There’s so much we can’t explain:

What’s the universe made of? (Hint: it doesn’t actually seem to be “matter and energy”)

What lives in the ocean’s “twilight zone”? (“It’s remote. It’s deep. It’s dark. It’s elusive. It’s temperamental,” according to Woods Hole … perhaps the most mysterious and vital space on the planet)

What killed Venus? (The planet, not the goddess. Best guess is that it once had a water ocean and now has a 900-degree surface temp … almost hot enough for Florida to grant heat breaks to workers!)

Who thought it was a good idea to cast John Wayne as … Genghis Khan? (The Conqueror, 1956, was filmed on a fallout-contaminated set near a nuclear bomb testing range and featured lines like “I feel this Tartar woman is for me, and my blood says, take her. There are moments for wisdom and moments when I listen to my blood; my blood says, take this Tartar woman.”)

Who thought it was a good idea to cast John Wayne as … Genghis Khan? (The Conqueror, 1956, was filmed on a fallout-contaminated set near a nuclear bomb testing range and featured lines like “I feel this Tartar woman is for me, and my blood says, take her. There are moments for wisdom and moments when I listen to my blood; my blood says, take this Tartar woman.”)

Why do humans have such big butts? (No other mammal managed the feat.)

How does Tylenol kill pain? (And why does it induce crazy risk-taking behavior?)

Why do investors prefer low-return / high-volatility stocks to their opposites?

The Quality Anomaly

In dissecting the drivers of investment performance, researchers point to a set of six or seven factors that explain what’s happening. Momentum. Value/growth. High/low volatility. Small cap/large cap.

By far the most powerful and puzzling of the factors is Quality. Morningstar’s Ben Johnson (2019) described it as “the fuzziest factor you will find in the investing world.” Ben Inker, head of asset allocation at GMO (2023) called it “the weirdest market inefficiency in the world.”

The broadest sense of a quality company is one that uses its resources prudently: quality companies tend to have little or no debt, substantial free cash flows, steady and predictable earnings, and perhaps high returns on equity. Passive strategies and many active ones have a strong backward focus: they limit themselves to firms that have bright pasts, without actively inquiring about their future prospects.

Nonetheless, the evidence is compelling that high-quality stocks purchased at reasonable prices (Mr. Buffett’s “wonderful companies at fair prices” ideal) are about the closest thing to a free lunch in the investing world. In general, you have to pay for your lunch one way or another. The only rationale for buying crazy-volatile investments (IPOs, for instance) is the prospect of crazy-high returns. The only rationale for buying modest returns (three-month T-bills) is the promise of low volatility.

With quality stocks purchased at a reasonable price (call it QARP), that tradeoff does not occur. QARP stocks offer both higher long-term returns and lower volatility than run-of-the-mill equities. GMO’s research bears this out across a span of three decades:

- High-quality stocks offer 60% higher returns and 30% lower volatility than low-quality stocks.

- High-quality cyclical stocks offer 200% of the returns with 30% lower volatility than low-quality cyclicals.

- High-quality small-cap stocks offer 150% of the return of low-quality ones with 30% less volatility.

- High-quality value stocks offer 150% of the returns of low-quality ones with 30% less volatility.

- High-quality (BB) junk bonds offer 300% of the returns and 50% lower volatility than low-quality (CCC) junk bonds.

(Source: GMO, “The Quality Anomaly,”2023, exhibits 1-3, 5 and 6. In each case we approximated percentage values from their graphs)

Other researchers find an identical pattern in emerging Europe and in emerging markets generally: “The quality basket generated a compounded annual return of 15.0% as compared to 8.4% for MSCI EFM Standard index. What is more, annualized standard deviations of monthly returns were lower for the quality basket at 14.2% as compared to 23.4% for the benchmark index” (Ramraika and Trivedi, “High Quality Stocks in Emerging Markets,” 2015). In “most [world] regions and dimensions … our quality factor delivers a statistically significant alpha that cannot be explained by loadings on conventional equity factors such as market, value, size, and momentum (Amundi Institute research team, “Revisiting Quality Investing,” 2024).

There is no clear explanation for why quality is so widely, badly, and consistently mispriced. Some people claim that “quality” wins just because it’s a characteristic of the tech sector (not true: since it also holds in the old school cyclical companies, too) or that it wins because of the power of mega-cap monopolies (not true: since it also holds in small caps) or that it wins because growth companies are all shiny (likewise, not true: the relationship holds among value companies, too). In short, pretty much everywhere we look quality wins but sketchy stocks draw attention. The best that GMO’s Tom Hancock and Lucas White could come up with is, “investors routinely overpay for the exciting lottery ticket prospects of speculative, junky business models while neglecting the tangible but boring attributes of Quality” (“The Quality Spectrum,” 2023). Mr. Inker laments, “I have trouble coming up with anything at all plausible that doesn’t come to down ‘investors are weirdly stupid.’”

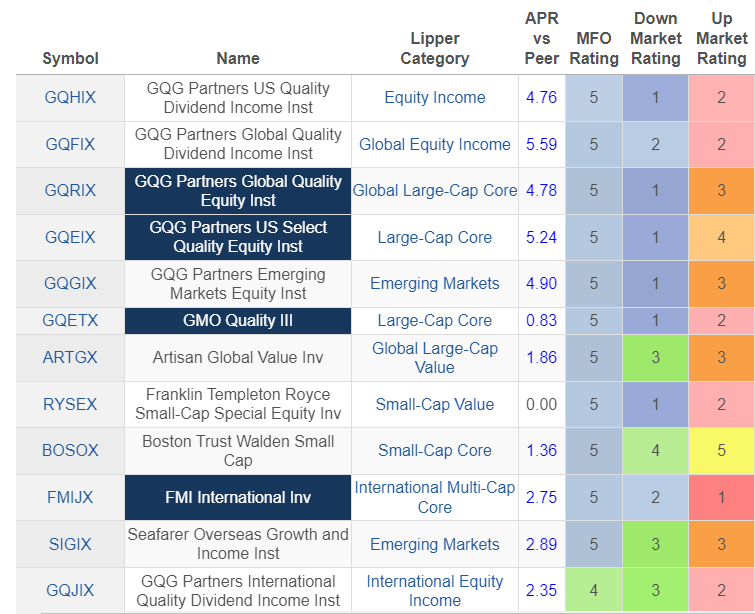

But not always. Quality tends to lag, however, during the mid-to-late phases of a bull market as investors (bless their hearts) start treating low-quality / high-beta stocks as lottery tickets. For visual learners, here’s the performance of a variety of funds that hold high-quality stocks. We’re charting performance since inception. The first data column shows how they’ve performed against their peers (+2% means, for instance, that the fund has outperformed its peers by 200 bps/year). The next three columns illustrate how the fund performed in the long-term (MFO rating), during months when the market was falling (down capture rating), and during months when the market was rising (up capture rating). Here’s the key: blue/green = good, red/pink/orange = bad.

Lifetime performance for select quality funds, through March 2024

Without exception, these high-quality portfolios crushed their peers in the long term and crushed their peers when markets were at their worst. In rising markets, they made strong absolute gains while still trailing the vast majority of their quality-agnostic peers.

Quality wins over complete market cycles, in part by crushing the performance of low-quality stocks when the bad times hit. GMO’s Ben Inker notes “high-quality stocks outperform low-quality stocks in down months by over three times the amount they underperform in up months!” Indeed, high-quality companies use crises to their advantage: they tend to be debt-free and cash-rich, so that they can move opportunistically in crises when lesser companies are folding.

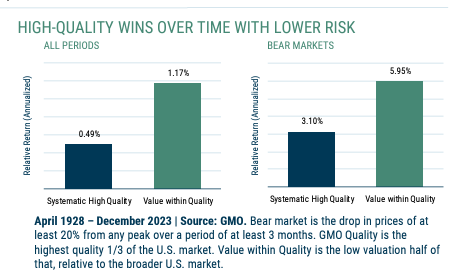

Finally, price matters. Overpaying for a quality company cuts your returns and reduces your margin of safety. GMO has tracked the relative outperformance of quality stocks against the broader market back to 1928, then pulled out the performance of the cheapest half of the quality universe for the same period. The difference is dramatic.

The short version: quality wins. Quality at a reasonable price wins by a lot.

Options for Adding Quality to your portfolio

MFO identified several exceptional high-quality funds that might allow you to take advantage of this investing anomaly. We focused on two of the most distinguished families whose work combined commitments to both quality and value. (We also partnered with the folks at Morningstar to seek their help in identifying funds in a variety of niches that might help diversify your portfolio.)

MFO commends:

GMO US Quality Equity ETF (QLTY), a newly launched, actively managed ETF, that operates with the same discipline and same management team as the $10 billion, five-star Great Owl GMO Quality (QGETX) fund. GMO grounds its Quality Strategy in the work done by its founders in the 1970s and formalized in 2004.

In 2004, GMO launched the Quality Strategy with the mandate to own attractively valued stocks within the quality universe. The creation of the strategy was the culmination of decades of GMO research on quality business models. While the strategy’s origins date back to GMO’s earliest days, our process continues to evolve to ensure sustained relevance as well as our investment edge.

Since its launch in November 2023, the ETF has actually outperformed its elder sibling, returning 17.0% to QGETX’s 15.3%. The ETF, which charges 0.50% for its services, has quickly gathered $600 million in assets, a win that portends additional GMO ETF launches. (Full disclosure: Chip, MFO’s cofounder, added QLTY to her personal portfolio shortly after its launch.)

GQG Partners US Select Quality Equity (GQEPX), which launched in 2018, is managed by the GQG team headed by Rajiv Jain. Mr. Jain is among the world’s most successful equity investors, having built a huge following at Vontobel before moving to found GQG: Global Quality Growth. The core discipline is the same across all of their strategies:

GQG’s investment philosophy is rooted in the belief that earnings drive stock prices.

The pursuit of durable earnings ignores the idea of traditional growth and value investing and instead focuses on finding companies we believe have the highest probability of compounding capital over the next five years. This investment style focused on high-quality, durable businesses, is considered by GQG to be more suitably named as “Forward-Looking Quality”.

The firm launched its now-$20 billion Emerging Markets Equity fund initially then added US Select Quality Equity and Global Select Quality Equity about five years ago. All have consistently earned five-star ratings from Morningstar, all have finished in the top 1-2% for total returns in their Morningstar peer groups over the past five years, and all outperformed their Lipper peer groups by an average of 500 bps per year. Both US Select and Global Select earned MFO’s Great Owl designation for consistently top-tier risk-adjusted performance. Those have been complemented by three quality + dividend funds launched just under three years ago, each of which has also easily outpaced their peers. In short, GQG gets it right consistently, over time and across global markets.

GMO and GQG might represent a rock-solid core for an investor’s portfolio. We reached out to Morningstar, asking for their take on the highest quality equity funds that a quality-sensitive investor might add to such a portfolio. Robby Greengold, a Morningstar strategist, offered a dozen possibilities. He explained his strategy this way:

I selected these funds for the relatively high-quality metrics of their portfolios (e.g., high-profit margins, low debt) and Morningstar Medalist Ratings (one of the fund’s share classes must receive either a Bronze, Silver, or Gold Morningstar Medalist Rating, which express our conviction in the fund’s ability to outperform on a risk-adjusted basis over a full market cycle). The funds needed to be covered by one of Morningstar’s analysts, and the analysts needed to explicitly point out that the fund deliberately targets high-quality stocks.

Herewith are a dozen quality funds with Morningstar’s take on them and our occasional asides.

|

|

Morningstar’s take |

MFO’s gloss |

|

Boston Trust Walden Small Cap Fund (BOSOX), small cap blend |

This team focuses on identifying well-managed small-cap firms with sustainable and predictable earnings profiles that also have reasonable valuations. This strategy also has a sustainability mandate, screening out firms deriving significant revenue from alcohol, coal mining, gaming, factory farming, weapons, tobacco, and prison operations (though not fossil fuels). 70-100 names in the portfolio. Where the approach really shines is in risk management. The team has a quality focus and is valuation-conscious … to a portfolio that consistently ranks among the least-volatile options in the small-blend category, an impressive feat considering its minimal cash stakes. |

It’s a great small-cap core fund with a ticker celebrated by readers in New England. It also closed to new investors in March 2023. |

|

Royce Small-Cap Special Equity Fund (RYSEX), small cap value |

This strategy has a conservative, risk-aware approach. Managers Charlie Dreifus and Steven McBoyle rely on research and a healthy dose of accounting cynicism to find small caps whose financial reports are free from earnings manipulation. Dreifus and McBoyle hunt for clean balance sheets, low debt, high returns on invested capital, and growing free cash flow that exceeds earnings. The managers will sit on cash, which often reaches double digits, creating a buffer in downturns but a drag when stocks rise. 35-55 names, low turnover. the fund often has a lot in micro-caps. |

The lead manager, Mr. Dreifus, has been investing for 55 years, is 80 years old, and has no plans for retiring. Mr. McBoyle is about 20 years his junior and has a long tenure with Royce. Still … |

|

MFS International Equity Fund (MIEIX), large blend. |

The managers rely on broad and thorough bottom-up research and a disciplined focus on moderately growing, established companies with shares trading at decent prices. The managers rely on their own research and that of MFS’ big and experienced fundamental research team to find growing companies with competitive advantages and management teams that encourage predictable earnings and cash flows, healthy balance sheets, and strong returns on capital. The managers concentrate further up the market-cap ladder than most foreign large-blend and large-growth peers, so the portfolio’s average market cap is typically higher than the category norm. |

$20 billion in AUM with major inflows in 2023-24. Stable two-person management team. About 75 large cap stocks with really low turnover. |

|

John Hancock Funds International Growth Fund (GOIOX), large growth |

Lead manager John Boselli and his team focus on companies with high organic growth rates, low share prices relative to free cash flow, and most importantly, quality business models. They also like companies that return capital to shareholders via share repurchases and dividends and shun those with the worst earnings revisions. They emphasize industry fundamentals, growth and stability, free cash flow generation, capital allocation, incentive compensation, and valuation surprises. |

The fund continues to be managed by Wellington Management, but long-time lead manager John Boselli retired at the end of 2023. He was, by all accounts, a superstar and recipient of several “Manager of the Year” awards. His two co-managers, who were added in August 2021, now have sole responsibility. |

|

Artisan Global Value Fund (ARTGX), large value |

This team is composed of value investors who emphasize quality firms with financial strength and shareholder-oriented management. They leverage qualitative and quantitative screens to narrow the investment universe to a manageable level [and] shun firms with poor accounting and corporate governance standards, as well as those operating in markets with inadequate laws and regulations. It invests in firms of all sizes that trade at discounts to their intrinsic value estimates, although the focus is overwhelmingly on large-cap stocks. 40–60 stocks, with position sizes weighted by conviction. Commensurate with management’s long-term mindset, portfolio turnover is typically below 30%. When the managers can’t find opportunities that meet their strict standards, cash can build up to 15% of assets. |

Our last profile update was a decade ago, reflecting a downside of our focus on newer, smaller distinctive funds. We reviewed the fund repeatedly when it fell within our ambit and concluded, in our last review, “We reiterate our conclusion from 2008, 2011 and 2012: ‘there are few better offerings in the global fund realm.’” This fund and its sibling International Value were originally managed by David Samra and Daniel O’Keefe. In 2018, they decided to divide their charges with Mr. Samra leading International Value and Mr. O’Keefe leading this fund. Over the past six years, International Value has handily outperformed its peers while Global Value has barely kept pace with them.

|

|

FMI International Fund (FMIJX), large blend |

FMI International isn’t your typical foreign large-blend Morningstar Category offering, but it is top-notch. It looks for companies with durable business models and strong management that generate superior profitability through a full economic cycle. The fund’s policy of hedging non-U.S. currency exposure highlights management’s focus on underlying business fundamentals. They typically shy away from firms with high debt levels but will buy those whose steady cash flows can support their leverage. Annual portfolio turnover has been below most foreign large-blend Morningstar Category peers. The team’s pickiness and valuation sensitivity show in the strategy’s high-conviction portfolio, which also stands out. It currently holds only 40 stocks, which is less than half the roughly 100-stock peer median. |

We profiled this fund shortly after launch, predicting “All the evidence available suggests that FMI International is a star in the making. It’s headed by a cautious and consistent team that’s been together for a long while. Expenses are low, the minimum is low, and FMI’s portfolio of high-quality multinational stocks is likely to produce a smoother, more profitable ride than the vast majority of its competitors.” Ten years later the only thing to add is “Yep, nailed it.” |

|

JPMorgan Emerging Markets Equity Fund (JMIEX), emerging markets |

The approach favors quality growth companies. The team seeks firms that boast quality franchises, consistent earnings streams, and solid returns on equity. They conduct in-depth fundamental research on prospective ideas and assign five-year expected return targets. Analysts also classify stocks on their coverage lists as premium, quality, or standard, according to the firm’s strategic classification framework, which is based on a 98-point questionnaire. Premium and quality names operate in attractive industries with limited external risks and possess strong balance sheets, good management teams, and solid cash-flow-generation prospects while trading names lack sustainable competitive advantages. The vast majority of assets are allocated to premium and quality names, with trading names making up only a small portion. The team’s valuation framework helps to ensure managers pay the right price for the opportunity, although they are prepared to pay up for quality and growth. |

The fund’s performance has been no better than “okay” for a long while, perhaps reflecting a willingness to pay more for stocks and to stress valuations less. Relative to its peers and benchmark, the portfolio has stronger growth but also – by virtually every measure – higher valuations. One-, three- and five-year returns are relatively weak, and you need to go out to the 10- and 15-year windows to see strong performance. |

|

GQG Partners Emerging Markets Equity Fund (GQGRX), emerging markets |

Lead manager Rajiv Jain continues to rely on the same creative and successful “quality growth” approach here that he has used since the late 1990s. He wants reliably growing companies, but only if they’re on solid financial footing and have demonstrated the ability to weather slow economies. Sectors or countries can be heavily overweight or underweight. Though Jain typically has held stocks for many years, he’ll change direction quickly and decisively if he considers it appropriate. A few years ago he sharply reduced his stake in the consumer staples sector when he saw conditions becoming more challenging, and then increased it again in the past couple of years as the metrics changed. And from early 2021 to late 2022, the fund’s energy stake soared, while the technology stake plummeted. Jain and his team focus on big companies and look for high returns on equity and assets and low to moderate leverage. Then they use fundamental analysis to research future growth opportunities, estimate risks, analyze the accounting to ensure its accuracy and transparency, and then estimate a reasonable price. Four former journalists use their investigative skills to seek information or trends that might not be apparent in the numbers. The strategy is moderately concentrated, with 50-70 holdings and substantial (4% to 8%) weightings in the top stocks. |

In the seven years since its launch, GQGRX has been one of the top ten EM funds or ETFs in existence. It has the fourth-highest returns of any diversified EM fund (5.4% APR) but, more importantly, the best Sharpe ratio (a measure of risk-adjusted returns). Across a variety of risk measures, including downside deviation and bear market deviation, It’s clearly a top 10 performer. This reflects Mr. Jain’s discipline: forward-looking quality is the first screen, valuation is the second, and everything else trails. |

|

T. Rowe Price International Discovery Fund (PRIDX), small/mid growth |

The managers focus on companies with market caps between $500 million and $5 billion with compelling business models and the ability to generate returns above the cost of capital. They seek shareholder-oriented management teams with good capital allocation skills. They favor firms in industries that are growing faster than the overall economy, that are addressing unmet needs and adding value for customers, and that have rational competitive structures. The managers employ this discipline with an appealing mix of bolder and tamer traits. On the bolder side, they readily invest in stocks in the developing world that meet their criteria and regularly build moderate country and sector overweightings. On the reserved side, they pay a lot of attention to valuations, spread the portfolio across 200-250 names, and move at a measured pace. This approach provides ample upside potential without assuming excessive risk, and it has earned good long-term results at a European smaller-cap offering for non-U.S. investors as well as this strategy. |

Snowball holds about 2% of his retirement portfolio in PRIDX, a position built decades ago under manager Justin Thomson who guided the fund for 22 years. T Rowe Price does an exceptional job in managing manager turnover, in part because they have a strong, team-oriented culture. New manager Ben Griffiths has been with the firm since 2006 and has managed a small cap fund for European investors since 2016. The fund has not been a disappointment under his watch, but neither has it been compelling. Over the past four years, the fund has outperformed its Lipper peer group by 0.1% per year with precisely the same Sharpe ratio (0.46). |

|

Fidelity International Discovery (FDKFX), large growth |

Manager Bill Kennedy wants to own growing companies, but he isn’t going to pay any price for them. He looks for companies with strong three- to five-year earnings prospects, responsible management teams, solid balance sheets, and large potential markets. But he wants to own firms that are trading at attractive valuations. While a lot of category rivals got swept up in the market euphoria of 2020 and 2021, buying up high-multiple, low-quality names, Kennedy stayed true to his approach. In fact, during those two years, his portfolio looked cheaper versus peers than ever before, as he did not follow the crowd into the more-speculative waters. |

Mr. Kennedy has managed the fund since its inception (2006) and has invested more than a million of his own money in it. |

|

Fidelity Diversified International (FKIDX) |

Manager Bill Bower’s investment process has several strengths. He looks for stocks with long-term earnings growth potential, durable business models, and deep competitive advantages. Bower is willing to pay a modest premium for these desired characteristics, but not as much as many foreign large-growth category peers, highlighting his valuation sensitivity. He will also allocate a small portion of assets to shorter-term, opportunistic ideas that may not have durable growth prospects but are still compelling. |

Mr. Bower has been managing the fund since 2001 and has invested more than a million of his own money in it. The portfolio holds about 140 names with modest turnover. The fund tends to have returns in the top third of its peers |

|

Fidelity Overseas Fund (FOSFX), large growth |

Manager Vince Montemaggiore employs a sensible approach with a dual focus on quality and valuation, though quality comes first. Without it, he won’t own a company, no matter how cheap it may seem. To him, quality means having a unique edge, like, among others, high barriers to entry, a low-cost advantage, or high switching costs. Ideally, the company has high recurring revenues and low debt levels. He wants to own those stocks that are trading at 15% or more discounts to his estimated intrinsic value. |

|

|

Seafarer Overseas Growth and Income Fund (SIGIX), emerging markets |

The team has always focused on firms with durable growth prospects and reliable income streams while considering cash flows, balance sheets, operating histories, liquidity, and valuations. The process is risk-conscious, distinctive, and attractive. The team still pursues companies with durable growth prospects and reliable income streams, invests broadly across the market-cap spectrum, and readily permits its security selection to result in atypical country and sector weightings. |

One of the core holdings in Snowball’s portfolio, with FPA Crescent. Manager Andrew Foster’s hope is to outperform his benchmark (the MSCI EM index) “slowly but steadily over time.” His strategy is grounded in the structural realities of the emerging markets. A defining characteristic of emerging markets is that their capital markets (including banks, brokerages, and bond and stock exchanges) cannot be counted on to operate. In consequence, you’re best off with firms who won’t need to turn to those markets for capital needs. Seafarer targets (1) firms that can grow their top line steadily in the 7-15% per annum range and (2) those that can finance their growth internally. Seafarer tries to marry that focus on sustainable moderate growth “with some current income, which is a key tool to understanding quality and valuation of growth.” We have profiled SIGIX but would also commend the younger Seafarer Overseas Value for your consideration. |