Dear friends,

Welcome to the August issue of the Mutual Fund Observer! We just completed one of the five rainiest Julys in the city’s history, with three torrential downpours (the garden celebrates) and roll expectantly into August.

For those of us who teach for a living, August is the season of watchful waiting, a phrase lifted from the Christian celebration of Advent. The faithful are waiting for … you know, Christ’s return and stuff. Professors are waiting for the first day of class. For a sea of hopeful, anxious faces. For the opportunity to explain that AI is not the answer to all questions. (A discussion that used to begin “the internet is not …” and then “Wikipedia is not …) For Augustana, the end of the month will see nearly 700 new first-year students, of whom over 200 are domestic students of color and … hmm, some number are international students. Which number? Good question! Maybe 15 or 20% of the class? We’re largely at the mercy of the federal government which has been, let’s say, measured in its willingness to issue student visas. So, we’ll see.

And, in the meantime, we wait.

In this month’s issue

In Trending Funds at Mid-2025: Lynn Bolin presents his systematic approach to identifying promising mutual funds using a rating system that emphasizes equity value and bond quality, driven by concerns about high market valuations and potential economic shocks from policy changes. He highlights trending funds across risk categories, noting that international and global equity funds have performed particularly well due to their lower valuations compared to the highly valued domestic market.

Lynn follows that us with his Portfolio Risk Assessment, a comprehensive risk audit of the current investment landscape, arguing for more conservative portfolio allocations (shifting from 65% to 50% stocks) due to concerns about market overvaluation, tariff impacts, rising national debt, and potential inflationary pressures. He advocates for active portfolio management during what he sees as an increasingly volatile period, drawing parallels to pre-1982 economic patterns and warning that the era of ultra-low interest rates may be ending.

Both pieces reflect Bolin’s cautious, value-oriented investment philosophy in response to what he views as significant structural economic risks ahead.

Charles Boccadoro, maestro of our data and screener site, MFO Premium, shares word of an updated navigation system there. (It’s still the web’s best value; for a tax-deductible donation of $120, you get access to several thousand datapoints on nearly 10,000 investments; unlike most sites that produce “canned” reports on one type of fund, MFO Premium is capable of running live, real-time calculations for you. Interested in the correlation between the funds in your portfolio over the last three years? No problem. Move it out to five years? Can do!)

We spoke with John Neff, manager of Akre Focus, on the cusp of the fund becoming the largest mutual fund ($12 billion) to convert to an ETF. Mr. Neff reflects on what’s changing at this iconic fund, and what isn’t.

As is our summer tradition, we looked back three years to an August 2022 article on funds for volatile markets. We recommended six funds to your attention, five of which turned in good-to-excellent performance. The other one lost its founding manager. This month we update the performance and prospects of all five and, as a late summer bonus, we tuck in some new research on investor delusions.

I also examine the apparent consensus that markets face a dramatic 15% move—with experts split on whether up or down—and suggest that multiple warning signals point toward significant US market vulnerability ahead. Drawing on everything from Warren Buffett’s massive cash position to deteriorating jobs data and geopolitical tensions, I encourage folks to consider the case for reducing US market exposure and embracing a more globally diversified, defensively positioned portfolio. The piece includes specific fund recommendations for investors seeking equity-like returns with lower correlation to increasingly overvalued US markets.

Speaking of changes, we share a quick Launch Alert for Rainwater Equity Fund. We spoke with manager Joe Shaposhnik in 2019 about the fund on which Rainwater builds: TCW New America Premier Equities. That fund finished the decade as the top performer in its category, then was merged away into an ETF. Its record of excellence in both up and down markets warrants some special attention to the prospects of Rainwater Equity. We’ll watch carefully for you.

And, as always, TheShadow helps keep us abreast of the industry’s many machinations, in Briefly Noted.

The View from 4400 Miles Away

They look down and they understand why it’s called Mother Earth. They all feel it from time to time. They all make an association between the earth and a mother, and this in turn makes them feel like children. In their clean-shaven, androgynous bobbing, their regulation shorts and spoonable food, the juice drunk through straws, the birthday bunting, the early nights, the enforced innocence of dutiful days, they all have moments up here of a sudden obliteration of their astronaut selves and a powerful sense of childhood and smallness. Their towering parent ever-present through the dome of glass.

Think the new thought, they sometimes tell themselves. The thoughts you have in orbit are so grandiose and old. Think a new one, a completely fresh unthought one. But there are no new thoughts. They’re just old thoughts born into new moments — and in these moments is the thought: without the earth we are all finished. We couldn’t survive a second without its grace, we are sailors on a ship in a deep, dark unswimmable sea. Samantha Harvey, Orbital: A Novel (2023), with thanks to Martha Barnette of A Way With Words for commending it to us.

We are struck by how very often those who’ve taken leave of the Earth, astronauts, real or fictional, are all drawn to the same vision and the same sense of wonder. Not the infinite cosmos around them, but instead “the little blue marble” before them. Not where they are, but whence they came. Astronaut Leland Melvin comments, “seeing our world from that vantage point changes you” (Chasing Space: An Astronaut’s Story of Grit, Grace and Second Chances, 2018).

We are struck by how very often those who’ve taken leave of the Earth, astronauts, real or fictional, are all drawn to the same vision and the same sense of wonder. Not the infinite cosmos around them, but instead “the little blue marble” before them. Not where they are, but whence they came. Astronaut Leland Melvin comments, “seeing our world from that vantage point changes you” (Chasing Space: An Astronaut’s Story of Grit, Grace and Second Chances, 2018).

Chip and I had nearly the same reaction as we viewed home from a distance of 4419 miles, the gap between our home in Davenport, Iowa, and our holiday start in Stockholm, Sweden. It’s easy to get mesmerized by the cosmos – fjords, waterfalls, funicular railroads, and Viking treasures – then miss answering the question, “What did we see?” And so, we slow down to give ourselves a chance to see and not merely to pass through, snapping and posting like fools. Our tendency is to settle in one spot, perhaps for four days or a week, so that we can start feeling settled. The world slows down enough for us to see, to think, and to enjoy. And so, we split two weeks between the two capital cities – Stockholm and Oslo – and Bergen, on Norway’s far west coast.

To start with the important stuff: it was splendid. English is spoken universally and with great beauty and grace. My grouchy countenance and rumpled clothing apparently convinced a fair number of shopkeepers that I was Swedish, so they would begin a conversation with me in Swedish, I’d answer in English (the context clues and a tiny vocabulary of Swedish words made that possible), and they’d transition to English in the next breath. The few signs that we’re bilingual were …well, really, really clear.

Of all the things that we saw, more below on that, we were most struck by two things we almost never saw: cars and sugar.

Stockholm is home to a million people. Oslo, with 20% of Norway’s population, is home to 700,000 or so. Neither had as much traffic as Davenport (100,000). Of the cars in the capital cities, 70% were electric or hybrid. In two weeks, Chip and I traveled by plane, train, electric tram, subway (the T-Bana or Tunnel Bana in Stockholm, literally “tunnel path”), funicular railroad, ferry, and taxi (once, a 4:00 a.m. airport run). We did not rent a car and did not need one.

That one factor had a bunch of implications. The cities were walkable and devoted huge amounts of other space to … you know, human rather than machines. No downtown parking lots. Rarely even parking garages. Small public parks are scattered by the dozens, and huge outdoor plazas for walking and relaxing.

There is a small grocery store every few blocks and, because the stores were small (close to an urban CVS or Walgreens), the selection was thoughtfully curated (the average American grocery carries 240 different cereal options, measured by SKU; the average Swedish store might have stocked 20). At least in cities, “food deserts” weren’t an issue.

There is a small grocery store every few blocks and, because the stores were small (close to an urban CVS or Walgreens), the selection was thoughtfully curated (the average American grocery carries 240 different cereal options, measured by SKU; the average Swedish store might have stocked 20). At least in cities, “food deserts” weren’t an issue.

Similarly, sugar was incredibly scarce. Coffee shops tended to offer sugar in half-teaspoon sachets. A slice of carrot cake (at the Espresso House near Haymarket in Stockholm) was the size of a Snickers bar. A hotel’s breakfast buffet might offer 10 kinds of bread – half crispy, all fresh-baked – but one tiny bowl of mini-muffins. The occasional doughnut shop was just a little stand with a deep fryer. Iced tea was very lightly sweetened. Bakery items, such as cardamon buns, had very little sugar in the dough but large, crunchy sugar crystals atop.

Ice cream, on the other hand, was quite popular and quite pricey, and licorice was nearly a fetish.

Yep. Licorice logs, with flavored centers, sold in the licorice store Lakrits Roten (Licorice Root).

Had I mentioned that the Swedes’ love of licorice extended to ice cream? The sign advertises a soft serve ice cream in salt licorice flavor – with licorice bits.

In the US, we mostly have to find time to walk; walking is not a necessity, it’s a sort of moral obligation. In Norway and Sweden, walking is universal and ongoing, an inescapable part of everyday life. Perhaps as a result of walkable cities and a diet oriented toward less processed foods and less sugar, very few people are noticeably overweight, and almost none are battling the sort of morbid obesity (BMI > 40) that afflicts nearly one in ten Americans.

You should consider visiting.

If you do, you might enjoy Midsommar. The Swedes have a 10-day holiday that brackets the summer solstice. As a practical matter, it does not get dark during the festival days; the most you experience is a sort of deep twilight between, say, midnight and 2:00 a.m. The view from our hotel in Oslo at 9:00 p.m. (top), 11:00 p.m., and 1:00 a.m.

Things that struck us in Stockholm

Wonderful people, temps in the mid-60s to mid-70s, phenomenal public transit – seriously, the best we’ve ever encountered – and consistently good food … except for the tendency to think of coffee as a late-morning beverage. (sigh)

The Vasa Museum is worth a visit. The Vasa is a sort of monument to kingly ego and the tendency of presi royal advisors to say “yes, Your Highness” first and “WTF?” after. The Vasa was designed to be the greatest warship of its age (1627), but the king wanted it even greater (“One Big Beautiful Boat”, he demanded!) and so the shipwrights added a palatial level on the stern, which made the ship disastrously top-heavy and unstable. Its maiden voyage was about … oh, 500 feet before it tipped over, drowned a bunch of people, and sank in about 100 feet of water in Stockholm’s harbor.

About 350 years later, they raised the Vasa, inched it to shore, and built a five-story-tall museum around it.

Skansen the world’s oldest open-air museum, on the island Djurgården in Stockholm. Folks familiar with Colonial Williamsburg or Old Sturbridge Village will know the vibe.

Gamla Stan simply translates to “Old Town,” and is. It dates to the 1400s. Cool shops, Belgian block streets, and the occasional palace.

Notes on a day trip to Uppsala

Uppsala is the home of Scandinavia’s oldest university (1477). Four hundred years later, some of Uppsala’s graduates became the founders of Augustana College (1860), my employer. A cool small city with a quiet canal through its center and a huge cathedral.

It’s one of the few places where the number of people buried just under the floor didn’t detract from a sense of calm and grandeur.

Norway in a Nutshell

“Norway in a Nutshell” describes a combined train, bus, and ferry trip from Oslo to Bergen, by way of the fjord-side hamlet of Flåm. Loath as we are to be packaged with tourists, we mostly followed the NiaN route but scheduled things on our own.

The most powerful sense of Norway came from its geography. As we ferried down the Sognefjord, the water beneath our keel was 4,200 feet deep, and the mountains immediately beside us were 5,250 feet high. Not surprisingly, waterfalls occurred every half mile or so throughout the trip.

There’s Flåm, the real village which we didn’t visit, and Flåm the ferry port, a couple of dozen buildings located on Aurlandsfjord, which is an arm of the larger Sognefjord.

An overnight stay in the small town of Flåm

provided an opportunity for a lovely dinner at Ægir BrewPub (the actual meal is in this letter’s conclusion),

and a relaxing morning staring out at the water, while sipping our coffee.

Bergen

Bergen is Norway’s “second city,” about 300,000 people, surrounded by seven mountains, is also its westernmost metropolis, just 350 miles from Aberdeen and 220 to the Shetland Islands, also part of the UK. That meant that, during the Second World War, Bergen was a center of Norwegian resistance … and of public executions by the Nazis. It was odd to wander the peaceful grounds of Bergenhus fortress and the historic Haakon’s Hall, stumbling upon the garden where – the signs assure – 215 people were publicly executed, including British commandos, members of the Norwegian resistance, collaborators and German soldiers who “undermined morale.” Dozens more civilians, male and female, were gunned down at waterside or in the Ulven concentration camp.

And today? Flowers and walkers.

High atop the city is a delightful park called Fløyen – or more formally Fløyfjellet – reachable by the Fløibanen funicular railroad. The railroad is part of the city’s public transit system, not just a tourist experience. There are two stops at neighborhoods along the way, should any passengers signal an interest in popping off.

The park is about 1000’ above the city.

There’s a walking trail for the adventurous. After due consideration, Chip and I decided to find our adventures elsewhere – and hopped the train.

Visited the Fisketorget, which, for folks who spend most of the time near the Mississippi River, was pretty stunning. It’s a combination of a fish market and food stalls.

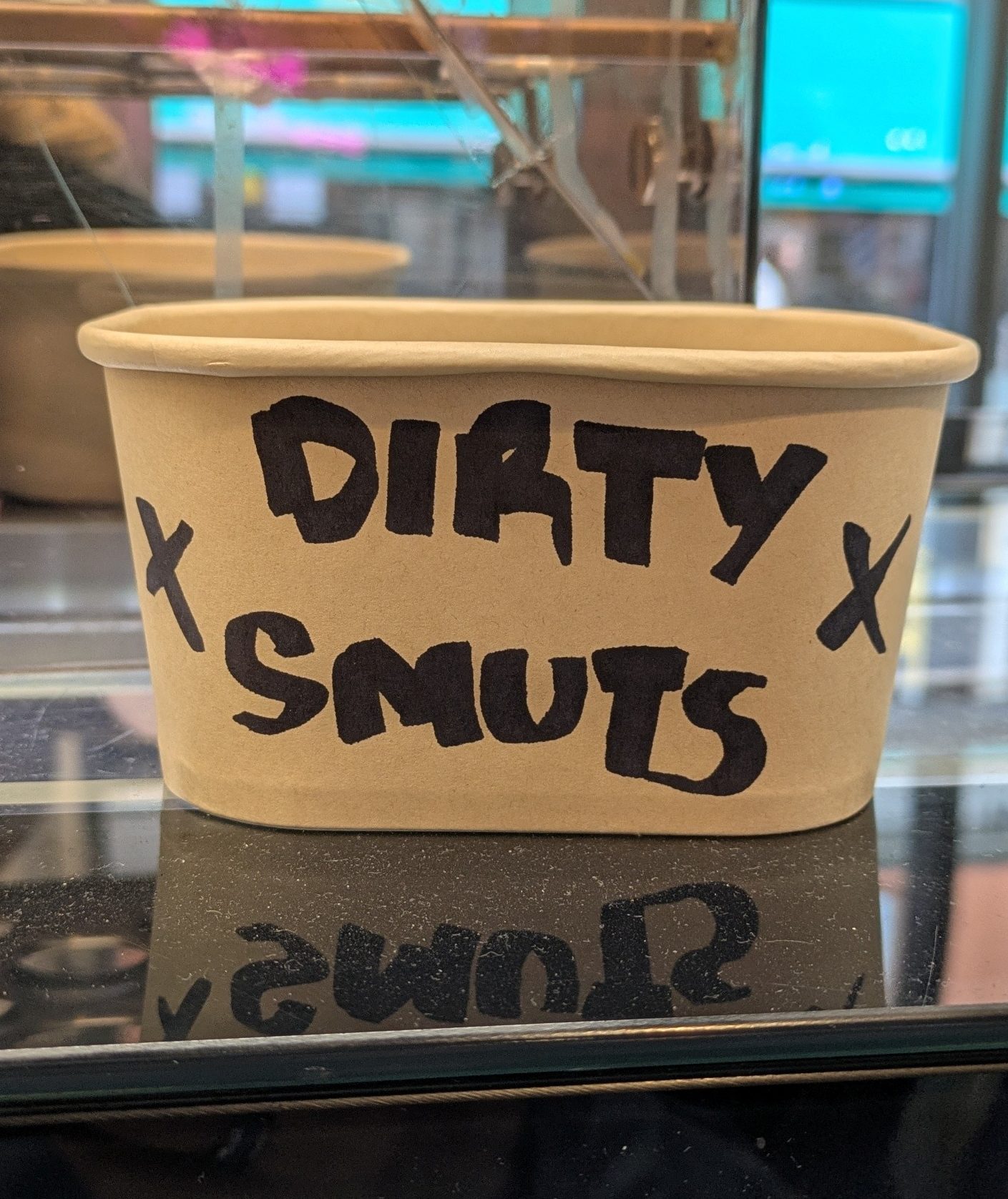

Finished the day with smut.

Well, okay, ice cream. “Smut” is Norwegian for “dirty” (I ponder etymology for a moment), and since Bergen is intensely bilingual, the ice cream shop’s bowl for used sampling spoons announces “Dirty Smuts.”

Oslo

Oslo, home to 20% of Norway’s population, was a delightful city. There seemed to be something stereotypically Norwegian about the fact that there’s a big honkin’ palace on the hill replete with a king and guards and all … which has been turned into a public park.

They have an incredible passion for parks and public spaces.

And sculptures. The presence of art everywhere is part of the city’s cultural identity, and part of the city’s construction budget is devoted to public art. One park alone has over 200 sculptures, many of which are realistic and sometimes voluptuous nudes. Which, as you think about it, might be a profoundly healthy message: people have bodies. Get over it already.

We spent part of our final night on a jazz dinner cruise. American jazz, followed by a sing-along of Norwegian folk songs, as we approached the dock. A jolly time, but one that revealed a singular obsession with shrimp.

The cruise was advertised as having “a shrimp dinner buffet,” which it did, sort of. The buffet, set up below decks, was (1) a thousand pieces of white bread, (2) dueling vats of butter and mayonnaise, (3) a pile of fresh dill fronds, and (4) a bathtub containing two small shovels and cooked shrimp. Intact. Heads, egg sacs, limbs, and all. Our shipmates scooped up shrimp by the shovelful, disassembled them, and piled them on white bread with … well, mayo and/or butter and/or dill.

Jan, one of the folks sitting with us, worked through rather more than 100 shrimp, one and a half bottles of wine and a beer. With gusto.

We enjoyed the company on a three hour evening jazz cruise on the Oslofjord, with a live jazz band and a shrimp buffet

On whole, we had fun and it (eventually) showed. We’d entirely endorse the adventure for anyone who loves being out and about and meeting fascinating folks who share a love of life.

Words You’ll Actually Use in Bergen (Norwegian) vs. Stockholm (Swedish)

| English | Norwegian | Swedish |

| thanks / thank you | takk / tusen takk | tack / tack så mycket |

| market (outdoors) | torget, fisketorget | torget, marknaden |

| market hall / food hall | mathallen | saluhallen |

| shop / store | butikk, butikken | affär |

| boutique (fashion) | boutique, klesbutikk | boutique, klädbutik |

| coffee | kaffe | kaffe |

| café spot | kafé | café |

| restroom / bathroom | toalett / do (pron. “doo”) | toalett / WC |

| bus | buss | buss |

| tram / streetcar | trikk | spårvagn |

| railroad / train | tog | tåg |

| Track | spor | spår |

| ticket | billett | biljett |

| what time…? | når …? | när …? |

| how much? | hvor mye? | hur mycket? |

| cash / card | kontant / kort | kontant / kort |

| enjoy! / cheers! | værsågod! / skål! | varsågod! / skål! |

Biblioclasm: the impulse to destroy knowledge

All censorship exists to prevent anyone from challenging current conceptions and existing institutions. George Bernard Shaw, Mrs Warren’s Profession (1895)

There is, in general, only one reason to suppress knowledge: the fear that if people possessed the knowledge, those in power would be screwed (aka out of a job).

That bubbled up in the context of President Trump’s recent decision to destroy two NASA satellites, which, apparently, were reporting back inconvenient climate data.

The data the two missions collect is widely used, including by scientists, oil and gas companies and farmers who need detailed information about carbon dioxide and crop health. They are the only two federal satellite missions that were designed and built specifically to monitor planet-warming greenhouse gases. (“Why a NASA satellite that scientists and farmers rely on may be destroyed on purpose,” NPR.com, 8/4/2025)

The administration also shut down a Department of Defense weather satellite program, in July (“Trump terminates satellite data considered crucial to storm forecasting,” E&E News, 6/27/2025). They’ve also begun the purge of federal climate databases, putting at risk “decades of health, climate change and extreme weather research” (“Inside the desperate rush to save decades of US scientific data from deletion,” BBC, 4/23/2025). The global climate website, GlobalChange.gov, has been shuttered (“Trump administration shuts down website on climate change,” LA Times, 7/1/2025) and the main federal climate data website (Climate.gov) is likely to follow (“Major US climate website likely to be shut down after almost all staff fired,” The Guardian, 6/11/2025). The four hundred scientists working on the Congressionally mandated National Climate Assessment have been fired (“Scientists aim to compile US climate report after Trump cuts,” Deutsche Welle, Germany’s official international broadcaster, 5/2/2025).

The coup de grace would be the imminent rescission of the 2009 “endangerment finding.” At base, the EPA reviewed the scientific evidence and in 2009 found that climate change endangers the public health and safety. That finding then allowed the agency to pursue regulations that controlled carbon pollution from cars and power plants. The Trump Administration has, in a pretty triumphalist tone, announced its plan to rescind the finding (7/29/2025).

Presumably, if you honestly thought that climate change was a hoax, you would continuously seek the data needed to prove your rightness. The decision to destroy the ability to collect data, contrarily, suggests that you know you’re wrong … and you don’t care.

Reliable federal climate data and transparent risk disclosures are essential for a functioning, well-informed financial market. The systematic destruction of these resources by the Trump administration is not simply a scientific or environmental issue—it’s a direct threat to investors’ ability to assess risk, price assets fairly, and make data-driven investment decisions. This rollback of data and disclosure increases financial market volatility, raises the cost of capital, and may lead to capital flight from sectors and regions most exposed to undetected or unreported climate risks. For anyone managing a portfolio, the absence of trustworthy climate information is a recipe for risk mispricing and unexpected losses.

You can act to protect the globe and your portfolio. EPA regulatory changes, including rescission proposals, require public comment periods. Citizen scientists can submit scientifically informed comments—supplemented with locally collected data—to the Federal Register or at public hearings announced for the rulemaking process. These comments become part of the legal record and can be referenced in lawsuits. The EPA has instructions for those interested in commenting on their decision.

Not interested in railing against the EPA? Fair enough. Still, you might want to get involved locally. Don’t try to fix the world. Try to get your city government to change the building code to encourage green roofs, support pocket parks, and plant city trees. Heck, for $1, you can get a tree planted yourself.

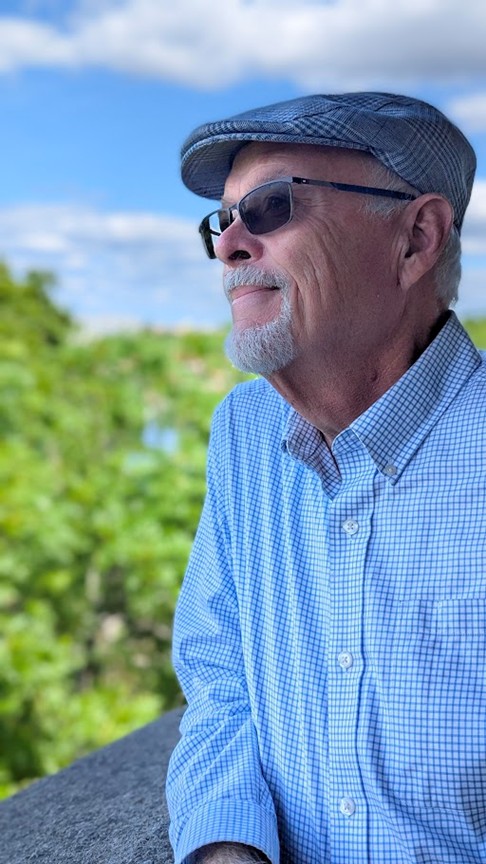

Greetings from a good guy

Davenport’s Bix 7 Race draws about 14,000 people to town every July. This year, one of them was Murray Rosenblith, a gentleman of roughly my vintage and co-manager of The New Alternatives Fund (NALFX). Founded in 1983 by two attorneys, father and son Maurice Schoenwald and David Schoenwald. New Alternatives was created in 1982 as a vehicle for the Schoenwalds and their friends to express their support for environmentally responsible and sustainable companies, leading them to be dubbed “the greenest fund in the United States” (The Economist, November 1989). It’s probably the oldest renewable energy (plus other sustainable stuff) fund in the US.

Davenport’s Bix 7 Race draws about 14,000 people to town every July. This year, one of them was Murray Rosenblith, a gentleman of roughly my vintage and co-manager of The New Alternatives Fund (NALFX). Founded in 1983 by two attorneys, father and son Maurice Schoenwald and David Schoenwald. New Alternatives was created in 1982 as a vehicle for the Schoenwalds and their friends to express their support for environmentally responsible and sustainable companies, leading them to be dubbed “the greenest fund in the United States” (The Economist, November 1989). It’s probably the oldest renewable energy (plus other sustainable stuff) fund in the US.

A fascinating bunch. Murray’s background is primarily as a social activist and writer who joined the fund’s board as a result of his work stewarding the investments of an activist non-profit. As the board considered the challenge of succession planning (Mr Schoenwald is now 75 or 76), they sought to tag an insider. Mr. Rosenblith fit the bill. Subsequently, they added Kate Don Angelo, who has an MS in Accounting, to the mix.

The managers have little patience for number crunching or traditional investment metrics; their intention is to direct money to companies that they believe have the greatest prospect for improving the world.

We have no commitment to a specific formula in selecting investments, such as favoring growth or value or any technical system. We select securities for purchase or sale by subjective concern to the areas of interest and concentration. Attention is given to the perceived prospects for the company selected and its industry, with concern for economic, political and social conditions at the time.

It has consistently marched to its own drummer (active share north of 99%) with an average holding period of 20 years. The fund has had more good years than bad, tends to be out-of-step and slightly more volatile than its global small- to mid-cap peers.

It has consistently marched to its own drummer (active share north of 99%) with an average holding period of 20 years. The fund has had more good years than bad, tends to be out-of-step and slightly more volatile than its global small- to mid-cap peers.

Given an interest in using their capital to make a difference, the team is having internal discussions on whether a social-impact bond ETF might be a logical next vehicle. Stay tuned.

On the passing of Nick Kaiser: Farewell to a great man

Nicholas (Nick) Kaiser, a pioneering investment strategist and founder of Saturna Capital Corporation, passed away peacefully on July 25th at his home in Ponte Vedra Beach, FL, surrounded by his family, after a courageous battle with cancer. He was 79.

In May 2020, Nicholas Kaiser called it a career as he stepped away from day-to-day responsibilities at the Amana, Sextant, and Saturna funds. They’re all advised by Saturna Capital, a firm Mr. Kaiser founded in 1989. At the time, we summarized his impact:

Mr. Kaiser is a monumental figure: an early champion of sustainable investing, the manager of the first funds accessible to faithful Muslim investors, a ten-time honoree on Morningstar’s Ultimate Stockpickers list, twice nominated for Morningstar’s Domestic Stock Portfolio Manager of the Year and twice named to Barron’s Top 100 Portfolio Managers. Mr. Kaiser remains as Saturna’s board chair and chief strategist. We offer our heartfelt thanks for the difference he’s chosen to make.

The folks at Saturna Capital offered some additional details:

Born in Bellingham, Washington, in 1946, Nick’s early academic and personal accomplishments reflected the passion, discipline, and curiosity that would define his life. He attended Shawnigan Lake School on Vancouver Island for high school, Yale College to study Economics (Class of 1966) and earned an MBA with dual majors in International Economics and Finance from the University of Chicago in 1968. He also served as a private in the U.S. Army at Fort Benjamin Harrison, Indiana.

Born in Bellingham, Washington, in 1946, Nick’s early academic and personal accomplishments reflected the passion, discipline, and curiosity that would define his life. He attended Shawnigan Lake School on Vancouver Island for high school, Yale College to study Economics (Class of 1966) and earned an MBA with dual majors in International Economics and Finance from the University of Chicago in 1968. He also served as a private in the U.S. Army at Fort Benjamin Harrison, Indiana.

In 1976, Nick and his first wife, Markell Foote Kaiser, acquired Unified Management Corporation in Indianapolis, Indiana. There, Nick applied his expertise in finance and computing to transform the company into a mid-sized investment management and brokerage firm. His success led to innovations in mutual fund operations and the creation of the world’s first Halal mutual funds, The Amana Mutual Funds Trust, pioneering values-based investing long before it became mainstream.

After selling Unified Management Corporation in 1986, Nick returned to Bellingham and in 1989 founded Saturna Capital Corporation. As Founder and Global Strategist, he led the firm with a vision grounded in principled, long-term investing and ethical service. His leadership helped Saturna grow into an internationally respected investment firm, which is still led today by his daughter, Jane Carten. He remained an active mentor and presence in the company, even after stepping down from portfolio management in 2020.

Nick’s contributions extended beyond finance. He served as a Governor of the Investment Company Institute, President of CFA and Financial Planning Association chapters, and National President of the No-Load Mutual Fund Association … [and] generously dedicated his time and expertise to civic and educational causes. He served on the boards of the Mt. Baker Foundation and Franklin Academy and supported Western Washington University, endowing the Kaiser Professorship in International Business. He held leadership roles with organizations including the Mt. Baker Council of the Boy Scouts of America (Executive Vice President), St. Paul’s Episcopal School (President), B.C.’s Island Trust Fund (Advisor), Fourth Corner Economics Club (Founder) and Bellingham Rotary.

Nick’s life outside of business was rich with adventure. The lifelong bonds forged with Shawnigan classmates assisted in his repatriation to the waters, islands, forests and ski hills of the Pacific Northwest. A licensed commercial pilot, ocean sailor, skier, and avid reader, his return saw him trade in Midwest small plane piloting for boat ownership and extended voyages around the San Juan and Gulf Islands, Desolation Sound and circumnavigating Vancouver Island.

Nick Kaiser’s legacy lives on in the lives he touched through his wisdom, generosity, and unwavering integrity.

Thanks …

To all of the folks who helped to make our Scandinavian sojourn amazing!

Thank you, Stuart. The Vasa Museum was remarkable! Hi, Leah. We tracked down Susan Foss in Bryggen, the old town section of Bergen. What beautiful, incredibly warm stuff. I ended up with a pullover sweater that I promise to share when the weather turns cold; I begin sweating just looking at it now. Regrets, DGH: we sailed past Bygdøy on our evening jazz cruise, but didn’t make landfall. Chip’s itinerary for the return visit (possibly after a trip to western Scotland), is already intimidating. Roger: Everything about the “Norway in a Nutshell” piece of the trip – trains, tiny trains, electric-powered ferries, waterfalls, the occasional dancing nymph, and an overnight in Flåm – was amazing. We had one of our favorite meals of the trip at Aegir’s microbrewery in Flåm. It included a beer flight matched with five dishes, including what I must say is some of the best smoked deer and pulled goat (with creamed potato and lingonberry) dishes we’ve ever eaten! (Those are numbers two and four on the plate.)

Thanks to you all for the guidance. We thought of you often.

And, many thanks, always, to the steady contributors who help us keep the lights on and our spirits up: the good folks at S&F Investment Advisors, RHG Advisors, Wilson, Greg, William, William, Stephen, Brian, David, Doug, and Altaf.

And a special note to Poody: thanks! Your trust, desire to learn, and to exercise some agency over your affairs are incredibly powerful drivers for all that we do. My own folks, as you might know, never finished high school, never sought financial guidance, and spent many nights whispering together on the front porch, often about the bills they couldn’t pay. A lot of what we try to do is to offer a simple message: take a deep breath, it’s not magic, with a bit of patience and planning, you’ve got this. We’ll help.

As ever,