I recently automated withdrawals from one conservative Traditional IRA (Core TIRA) into my short-term investment bucket for basic spending needs and emergencies. Previously, I automated withdrawals from a more aggressive Traditional IRA for longer-term discretionary spending needs. This exercise increased my focus on income. I just added Janus Henderson AAA CLO ETF (JAAA) to my Core TIRA sub-portfolio as a lower-risk income fund rather than to pursue higher returns.

The Core TIRA is conservate Traditional IRA, within the Intermediate Investment Bucket, that is intended to have long-term returns of 7% or more on average, have maximum drawdowns of -15% or less during a severe bear market, and provide steady income of at least 4%. This sub-portfolio has an allocation to stocks of 25%, but utilizes six funds classified as “flexible portfolio” or “alternative”.

Now that I have completed the Core TIRA portfolio, I am preparing for a mid-2026 review when a bond matures and needs to be reinvested. In this article, I review historical distribution yields and look at the life-of-fund drawdowns and correlations. I evaluate the performance of the Core TIRA over the past five years with and without Standpoint Multi-Asset as a potential purchase, and compare the results against Vanguard Global Wellesley. I conclude with long-term views of the economy by the OECD, the Federal Reserve survey of professional forecasters, and a look at Vanguard’s time-varying portfolio.

The Perpetual Motion Income Machine

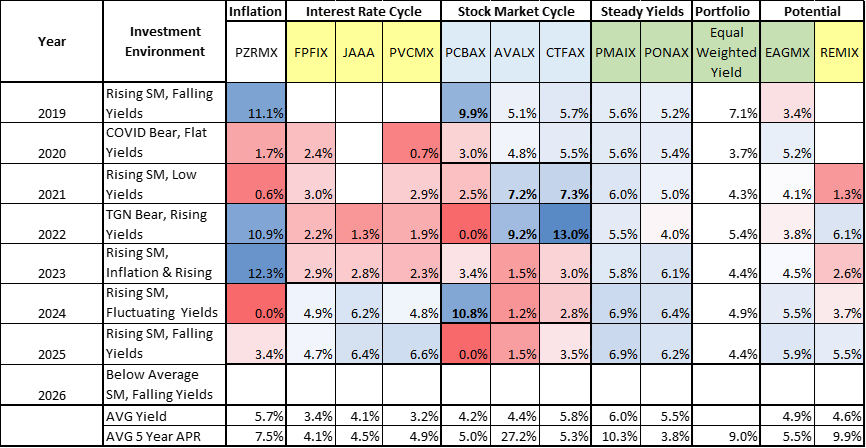

I wanted to understand the potential for the funds in my Core TIRA to produce a steady income of 4% per year. Some funds in the Core TIRA have yields, including capital gains, that fluctuate with the interest rate cycle, others that fluctuate according to the stock market cycle, and still others that provide a steady stream of income. I calculated the total distribution since 2019 by year from historical prices at the NASDAQ website and distribution history from Seeking Alpha. Yields for 2025 will change with end-of-year distributions.

Table #1 shows the yields per year for each of the funds in my Core TIRA, with red shading indicating the lowest yield and blue shading the highest. All of the funds yielded at least 3.2% over the past six years, with PAIMX yielding 6.0%. Those whose inception date is after 2019 have the symbol highlighted in yellow. Three funds (FPFIX, JAAA, PVCMX) have higher yields when interest rates are high, and may have downward pressure on yields as interest rates fall. Those whose yield fluctuates more with the stock market cycle (PCBAX, AVALX, CTFAX) appear to have larger distributions when opportunities in the stock market appear to be low. PMAIX and PONAX have the most consistent distributions, with PMAIX having the potential for a higher total return. Of the two funds that I am considering adding in my mid-2026 review, EAGMX has high steady yields, while REMIX has a low correlation to the S&P 500 and bonds, and a higher potential for total return.

Table #1: Historical Distribution Yield

2026 Core TIRA Life of Fund Perspective

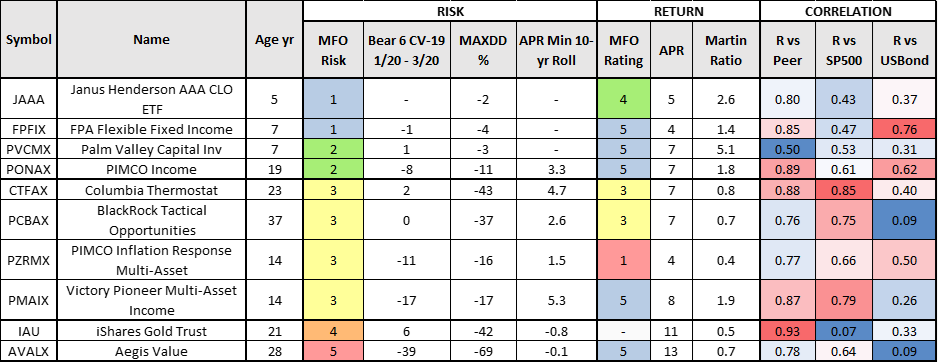

The objective of the Core TIRA portfolio, including the bond ladder, is to provide steady returns and cash flow that grow with inflation into my Investment Bucket #1 for spending even through a secular bear market. Table #2 shows how funds in my Core TIRA have performed over their lives, sorted from lowest risk to highest. All of the funds had an APR of almost 4% or higher during their lives. “APR Min 10-yr Roll” shows the return for the worst ten-year rolling period within the life of the fund. The purpose of finding uncorrelated funds is to ensure that funds are not moving down at the same time. For long-term stability, I like CTFAX and PMAIX, which had “APR Min 10-yr Roll” of 4.7% or more.

Table #2: Author’s Core TIRA Portfolio – Life of Fund Metrics

2026 Core TIRA Five-Year Perspective

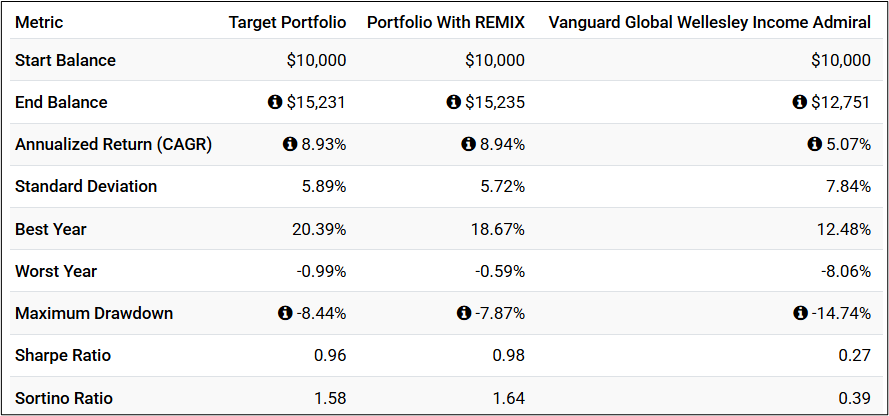

I used Portfolio Visualizer to further analyze the Core TIRA portfolio for the past five years, including adding REMIX as shown in Table #3. I compare it to Vanguard Global Wellesley (VGYAX, VGWIX), which I also own elsewhere. The link to Portfolio Visualizer Portfolio Backtesting is provided here.

Table #3: Analyzing Adding REMIX to the Core TIRA Sub-Portfolio

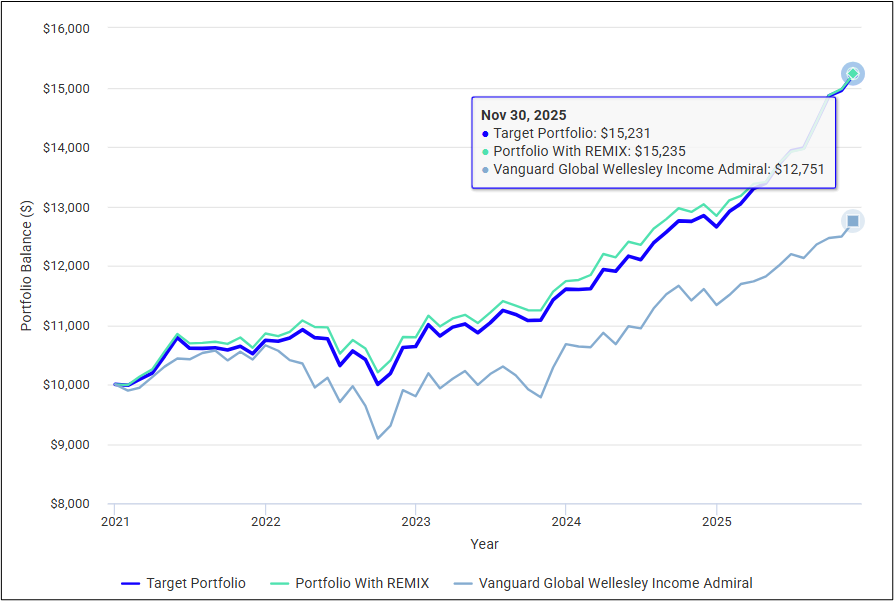

Figure #1 shows the growth of $10,000 invested in the Core TIRA with and without REMIX, and Vanguard Global Wellesley (VGYAX, VGWIX). I like how REMIX fits into the Core TIRA portfolio, and it increases income. I own Vanguard Global Wellesley in other accounts for its professional management and simplicity.

Figure #1: Analyzing Adding REMIX to the Core TIRA Sub-Portfolio

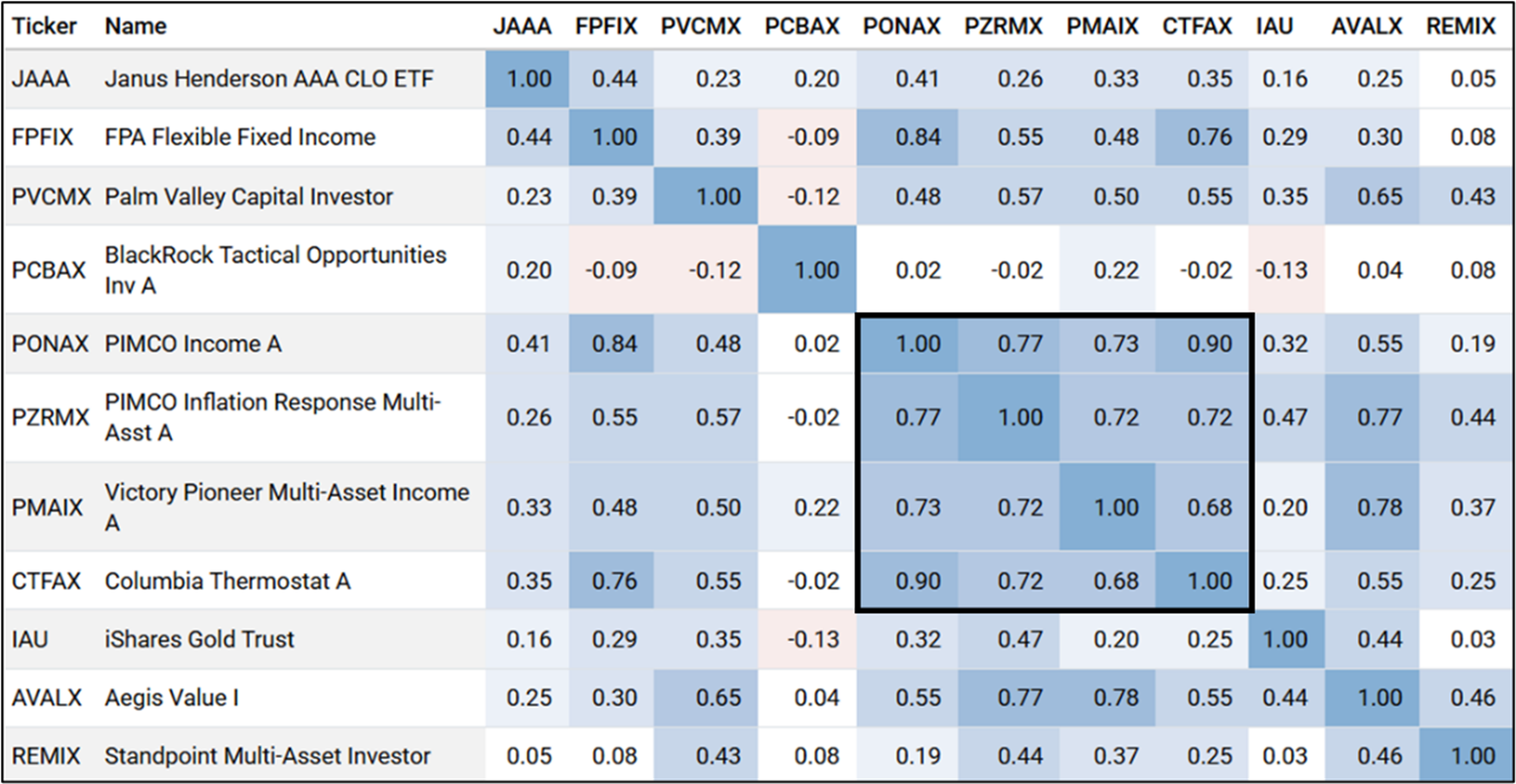

The funds can be loosely divided into three groups based on the past six years: 1) those that had low drawdowns (PVCMX, FPFIX, PCBAX, EAGMX), 2) those that had their maximum drawdown during The Great Normalization with rising rates (PONAX, PZRMX, CTFAX, and IAU), and 3) those that had their maximum drawdown during the COVID bear market (PMAIX, AVALX). Table #4 is the correlation matrix for the funds. They have low correlation with each other; however, PONAX, PZRMX, PMAIX, and CTFAX are moderately correlated.

Table #4: Correlation Matrix

Flexible Strategies

My conservative Core TIRA sub-portfolio consists of three funds classified as “alternatives”, three mixed asset funds in the “Flexible Portfolio” Lipper Category, and two in the “Multi-Sector Income” Category. I try to capture the objective and strategy of the funds below:

Alternative Global Macro:

- BlackRock Tactical Opportunities (PCBAX) – Objective: Total return.

- Eaton Vance Global Macro Absolute Return (EAGMX) – Objective: Total return. This is one of the high-performing funds listed in Thinking More Broadly: Bonds Beyond Vanilla by David Snowball.

Lipper Definition: Funds that, by prospectus language, invest around the world using economic theory to justify the decision-making process. The strategy is typically based on forecasts and analysis about interest rate trends, the general flow of funds, political changes, government policies, intergovernmental relations, and other broad systemic factors. These funds generally trade a wide range of markets and geographic regions, employing a broad range of trading ideas and instruments.

Morningstar classifies PCBAX as “Macro Trading”, but EAGMX as “Nontraditional Bond”.

Absolute Return:

- Standpoint Multi-Asset (REMIX) – Objective: Long-term capital appreciation.

Lipper Definition: Funds that aim for positive returns in all market conditions. The funds are not benchmarked against a traditional long-only market index but rather have the aim of outperforming a cash or risk-free benchmark.

David Snowball wrote Standpoint Multi-Asset Fund: Forcing Me to Reconsider in the November 2021 MFO Newsletter:

“The fund provides exposure to equities (which help in times of economic growth or inflation), fixed income (which buffers deflationary periods and stock market declines), and commodities (which are uncorrelated with the first two, making it possible to minimize the effects of both sustained price changes and of an equity market decline). Half of the portfolio is invested in low-cost ETFs to give exposure to the global equity market. The argument is simple: over time, equities make serious money, especially if you don’t overpay for them. The fund holds eight equity ETFs charging between 3 and 7 basis points.

The other half of the portfolio is managed futures positions. The positions can be in stocks and fixed income, as well as currencies and commodities. ‘Once a year we pull down the information on all the future contracts in the world, arrayed from most liquid to least liquid. We exclude the untradeable, then select the 75 most liquid in six sectors which includes equity index futures, bond futures, currencies, metals, energy, and agricultural commodities.’ Using a market following strategy, the futures contracts allow the portfolio’s exposure to equity markets to be increased beyond its 50% base (it was at 65% in mid-summer) or decreased to near zero.”

Flexible Portfolio:

- Columbia Thermostat (CTFAX) – Objective: Long-term capital appreciation.

- PIMCO Inflation Response Multi-Asset (PZRMX) – Objective: Total return which exceeds that of its benchmark.

- Victory Pioneer Multi-Asset Income (PMAIX) – Objective: High level of current income. Capital appreciation is a secondary objective.

Lipper Definition: Funds that allocate their investments to both domestic and foreign securities across traditional asset classes with a focus on total return. The traditional asset classes utilized are common stocks, bonds, and money market instruments.

Morningstar classifies PZRMX as “Global Conservative Allocation”, PMAIX as “Global Moderate Allocation”, and CTFAX as “Tactical Allocation”.

2026 Core TIRA – Evaluating Potential Buy Candidates

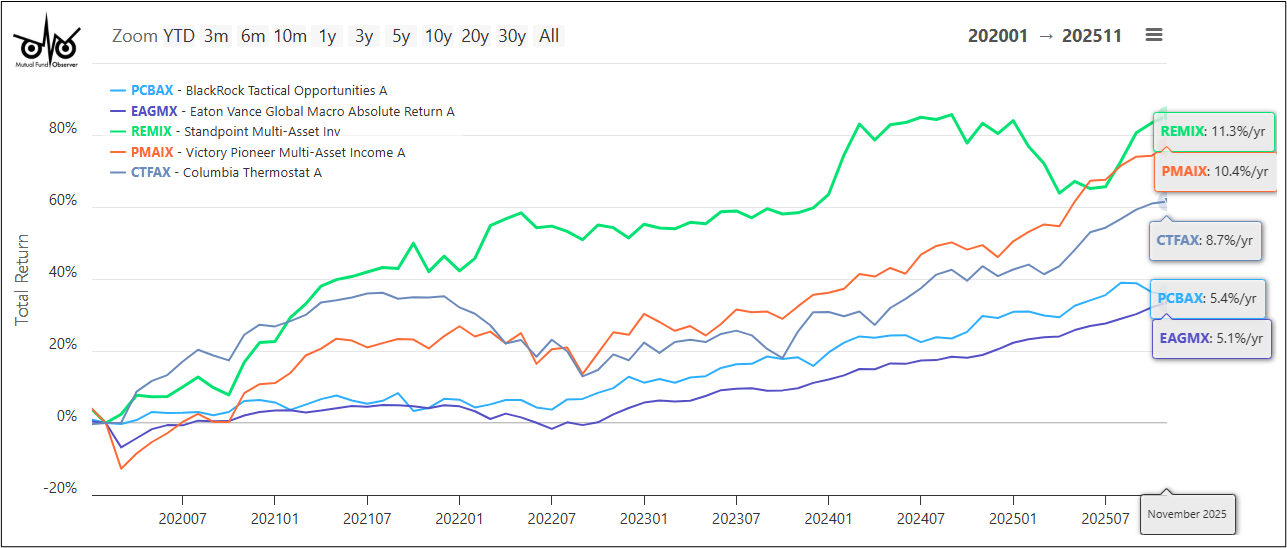

In Figure #2, I compare Standpoint Multi-Asset (REMIX) and Eaton Vance Global Macro Absolute Return (EAGMX) to PCBAX, PMAIX, and CTFAX. Eaton Vance Global Macro Absolute Return (EAGMX) has a smooth, low-risk profile and yields 5.6%. EAGMX had a maximum drawdown of -3% during the Great Financial Crisis, while PCBAX had a drawdown of -29%. I bought PCBAX because it has returned 4.9% annualized since 2010, while EAGMX returned 3.4%. I favor REMIX for its low correlation to other funds in the Core TIRA.

Figure #2: Comparison of Funds in Watch List to Core Funds in Portfolio

The Rest of the Decade

During the first half of this decade, the investment environment has experienced a lot of turbulence. I expect the second half to be more turbulent and have reduced risk accordingly.

I recently attended the Economy Watch webinar by The Conference Board. They estimate that global growth will moderate over the next 15 years, and long-term growth in the U.S. will slow to less than 2.0%. The Organisation for Economic Co-operation and Development (OECD) released its OECD Economic Outlook, Volume 2025 Issue 2, which shows its estimates of real GDP growth in the U.S. to be below 2.0% in 2026 and 2027. The Fourth Quarter 2025 Survey of Professional Forecasters by the Federal Reserve Bank of Philadelphia estimates that real GDP will be 1.8% in 2026, 2.1% in 2027, and 1.8% in 2028. In my opinion, the U.S. economy is experiencing slowing growth in the late stage of the business cycle.

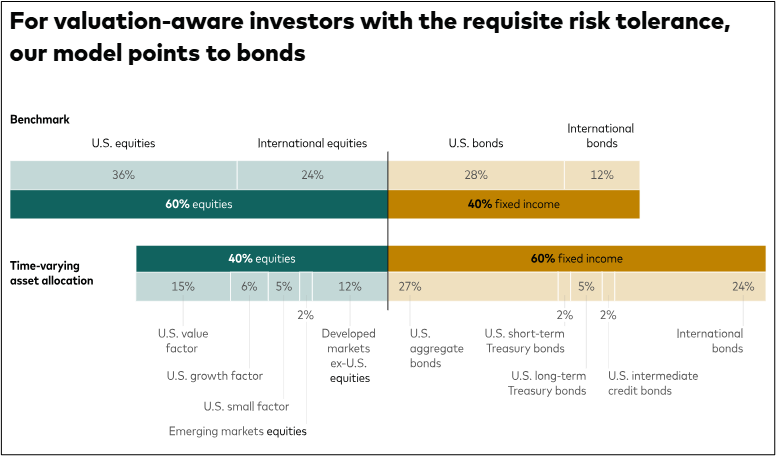

Vanguard updated its time-varying portfolio in Bonds Remain In Favor In Time-Varying Model Portfolio. They describe it as, “The TVAA strategy is built on the framework of the Vanguard Asset Allocation Model (VAAM), driven by forecasts generated by the Vanguard Capital Markets Model (VCMM).” Their TVAA model results in a globally diversified 40/60 portfolio tilted toward value, as shown in Figure #3. The TVAA has an expected annualized 10-year return of 5.7%.

Figure #3: Vanguard TVAA Model

I use financial advisors at Vanguard to manage a portion of my portfolio using both index and actively managed funds. The time-varying strategy is not one of the options available. Over the past year, I have lowered my overall stock-to-bond allocation from 65% to 50% with a below-average allocation to technology because I expect stocks to have below-average returns. I invest in Vanguard Global Wellesley in other accounts, which has a 40/60 allocation, but also in Vanguard Global Wellington, which has a 60/40 allocation.

Closing

I can sleep at night with the Bucket Approach and my Core TIRA account to meet essential spending needs and emergencies even in a secular bear market. During my mid-2026 review, I will ensure that sufficient funds are in place to meet 2027 withdrawals and confirm if I want to: 1) extend a rung in the bond ladder with iShares iBonds Dec 2034 Term Corporate ETF (IBDZ), 2) add Standpoint Multi-Asset (REMIX) to the Core TIRA, 3) increase the allocation to Victory Pioneer Multi-Asset Income (PMAIX) because of its focus on steady and high income, and 4) reduce investments in non-core bond funds. I don’t plan to sell any of the ten core funds in the Core TIRA.

I wish everyone a happy and prosperous 2026.