I have a deep distrust of managed futures funds. The logic is simple: isolate asset classes that are uncorrelated, invest only in the uptrending assets, ignore (or short) the losing classes, and you get a long, smooth ride to prosperity.

The research behind them is so beautiful and compelling. Various backtests suggest that a managed futures strategy would have returned 13.5% annually for the period 1972-2010. During that same period, the equity market would have returned 9.8% annually. On top of it, the managed futures strategy would have been less volatile.

Their performance, on whole, is so wretched and bewildering. Over the past five years, the average (surviving) managed futures fund returned 0.7% a year with a maximum drawdown of 17.7% and a negative Sharpe ratio. A well-run lemonade stand would have made you more money with less heartache. There is no group that was more frequently featured in the “Dustbin of History” column than managed futures, a trend that was diminished only when we started running out of managed futures funds to liquidate.

Standpoint Multi-Asset (REMIX / BLNDX) might force me to reconsider my biases.

The fund is managed by Eric Crittenden, who co-founded Longboard Asset Management in 2010 and launched the Longboard Managed Futures Fund (now Longboard Alternative Growth LONGX) in 2012, eventually building the firm’s assets to $500 million. He was Co-CIO and Co-Portfolio Manager for Longboard from August 2011 to August 2018, launching Standpoint Asset Management in August 2019.

Mr. Crittenden and I chatted over the summer, and we’ve been following the fund since then. It was an interesting conversation and, really, he had me at

I hate managed futures. I sold them for years at a 3% fee, driven by the argument that all portfolio optimizers agree that you should have 30-50% managed futures all the time. It’s like the advice, take your vitamins. That’s great if you can get them in the form of Gummi Bears but it can be horrible otherwise.

You’ve got to drill down to individual models, especially commodity-heavy ones. Commodities should be able to add valuable diversification to a portfolio but long-only commodities as a whole are money losers over time, in part because they’ve got a 12-30% cost to carry (for storage, insurance, etc.).

The strategy seems sensible and straightforward. The fund provides exposure to equities (which help in times of economic growth or inflation), fixed income (which buffers deflationary periods and stock market declines), and commodities (which are uncorrelated with the first two, making it possible to minimize the effects of both sustained price changes and of an equity market decline). Half of the portfolio is invested in low-cost ETFs to give exposure to the global equity market. The argument is simple: over time, equities make serious money, especially if you don’t overpay for them. The fund holds eight equity ETFs charging between 3 and 7 basis points.

The other half of the portfolio is managed futures positions. The positions can be in stocks and fixed income, as well as currencies and commodities. “Once a year we pull down the information on all the future contracts in the world, arrayed from most liquid to least liquid. We exclude the untradeable, then select the 75 most liquid in six sectors which includes equity index futures, bond futures, currencies, metals, energy, and agricultural commodities.” Using a market following strategy, the futures contracts allow the portfolio’s exposure to equity markets to be increased beyond its 50% base (it was at 65% in mid-summer) or decreased to near zero.

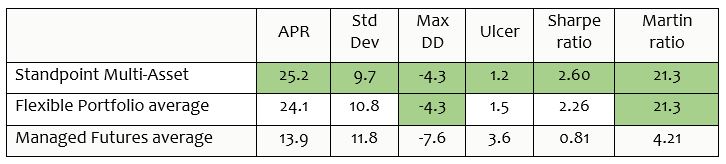

We compared Standpoint against its two plausible peer groups for the longest standard period available, 18 months. In each metric, the best value is signaled by green highlighting.

Performance from April 2020 – October 2021

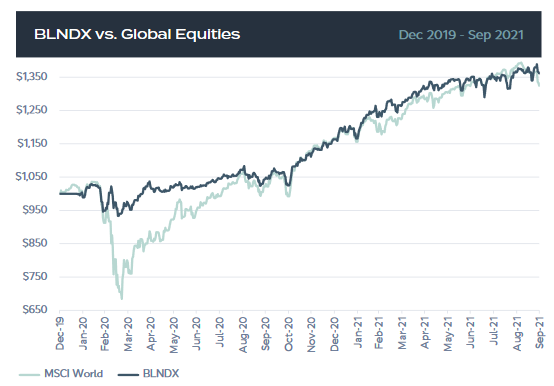

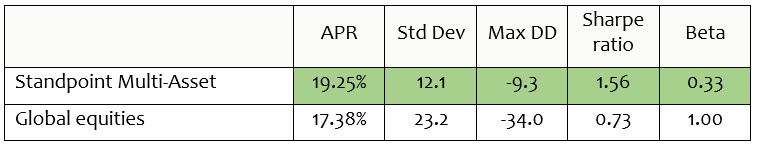

The performance of the strategy, since inception, against a global equity portfolio, is pretty striking. The same color scheme applies.

Source: Morningstar Direct, 12/30/19 – 9/30/21, from Standpoint

Much of that advantage comes from the one thing you most want in an all-weather portfolio: protecting you from the storm.

Ultimately, the fund should provide three sources of gain. The equity risk premium, the risk-free gains from T-bills and TIPS, and a risk-transfer premium that comes from providing liquidity to hedgers. That’s allowed them to generate a negative beta in bear markets.

The argument for Standpoint is much like the old argument for managed futures: it can provide absolute positive returns with muted volatility even when the equity markets correct or the fixed-income markets are priced to return less than zero in the immediate future.

“Our edge,” he says, “is that we know how to build a good macro program without the traditional 2 & 20.” It is designed to be a permanent piece of your portfolio: simple, durable, and resilient.

It’s worth investigating. The fund’s website is pretty low flash but has a fair amount of information and several video interviews. The fund charges 1.53% (after waivers) for Investor shares whose minimum purchase is $2,500.