I divide my investing strategy into the low cost, buy and hold philosophy following that of Vanguard, and its founder, John Bogle, along with Charles Ellis, and the more active business cycle approach of Fidelity, Benjamin Graham, Howard Marks, and Ed Easterling, with a touch of trend following from Gregory L. Morris using a risk-managed approach of Mutual Fund Observer, the bucket approach of Morningstar, and the tax strategy that I learned late in life. Whew! This article describes how I try to make sense of it all planning for retirement, and still focus on keeping it simple. I set a different strategy for different accounts to take advantage of the strengths of the financial institution, funds, and account type. Keep It Simple but Significant!

The amount of conflicting financial advice each of us is bombarded with never ceases to give me pause…

“How can you not invest in the future of America?” one guest will ask whole heartedly. While the next will state “US markets are all over-priced by every historical measure.” And, each provides passionate and convincing arguments.

Others argue for buy-and-hold strategies, while just as many others argue for trend following. Both camps devoted to their positions.

My colleague David Snowball offers one way of dealing with the conflict. Basically, nobody wants their funds (or the advice they follow) to suck…

So, David is constantly asking himself: Do the recommendations given, implicitly or not, by us or others, suck?

– How Well Do MFO Great Owls Perform?, MFO August 2019, Charles Boccadoro

I have been simplifying my accounts with one Vanguard traditional IRA described in this article that uses five buy and hold core funds, but with a tactical sleeve for 15% of the assets. It has a global focus with a tilt toward large-cap value. Next month’s article will describe a traditional IRA at Fidelity that follows the business cycle approach and is my attempt to “row instead of sail” using multi-asset, real return, and more tactical funds. These two accounts are conservative, with a stock and “other” ratio of about 45% to bonds, because taxes will have to be paid on them. I have set up a Roth IRA as a Fidelity Managed Account which is more aggressive, with about 75% stocks, because taxes have already been paid. Overall, including employer stock plans and a bucket for three years of living expenses, my portfolio is 55 percent stocks and “other” resembling a “balanced” portfolio with a large tilt away from technology toward core funds and a small tilt toward small and mid-cap funds.

Each investor’s situation is different and my intermediate objective is to keep income low until I begin drawing social security and required minimum distributions in order to convert traditional IRAs to Roth IRAs while income is low. This strategy works well for those with pensions and the cash to pay for the taxes on the conversions. One of my next quests is to work with a financial planner specializing in taxes to implement this strategy.

1. Vanguard Traditional IRA Strategy

Starting valuations matter. Global stocks this year have continued to rally from pandemic lows, and that will make further gains harder to come by. In fact, our 10-year annualized return forecasts for some developed markets are nearly 2 percentage points lower than they were at the end of 2020…

U.S. stocks: 2.4% to 4.4%; ex-U.S. stocks: 5.2% to 7.2%.

– Vanguard

I wanted to build a simple strategy for a traditional IRA using the Vanguard strategy and funds as much as possible. Taxes will have to be paid on this portfolio as required minimum distributions take effect so I want to be more conservative in this portfolio, and more aggressive in a Roth IRA. This portfolio is a candidate for at least a partial conversion to a Roth. Bear markets may be an ideal time to convert to a Roth and I will be watching for this opportunity.

What some people may not realize is that Vanguard manages $1.6 trillion in actively managed funds. They claim that over the past 10 years, 86% of their actively managed funds outperformed their peer groups. Another misconception about the Vanguard philosophy may be that you should blindly set an allocation and hold it or adjust it for the remaining years until retirement. In 1999, the founder of Vanguard, John Bogle, was “concerned about the (obviously) speculative level of stock prices.” Mr. Bogle reduced his equity exposure to about 35 percent of assets, which he held through the time of writing Enough: True Measures of Money, Business, and Life in 2010:

Clearly, investors would have been wise to set their expectation for future returns on the basis of the current sources of returns rather than fall into the trap of looking to past returns to set course. That dividend yield as 2000 began was at an all-time low of just 1 percent and the P/E at a near record high of 32 times earnings together explain why the average return on stocks in the current decade is at present running at an annual rate of less than 1 percent.

By comparison, the price-to-earnings ratio is currently estimated to be 29. One difference is that we are now in the mid-cycle stage of the business cycle where earning may have room to grow as opposed to the late stage of the business cycle in 2000. I also want to apply some form of Benjamin Graham’s (Warren Buffett’s mentor) guideline of investing no less than 25% in stocks and no more than 75% depending upon valuations:

As an alternative policy he [an investor] might choose to reduce his common-stock component to 25% ‘if he felt the market was dangerously high,’…

– The Intelligent Investor (1973), page 5, Benjamin Graham

Vanguard offers eleven sector ETFs from a total of 76, which can be used to tilt a portfolio according to one’s view of the investment environment.

I have finalized the strategy of this traditional IRA to own four Vanguard mixed funds and Columbia Thermostat (COTZX) to have five core funds with allocations that range between 10% and 25% that will make up 85% of the portfolio. The other 15% is a tactical sleeve of mostly Vanguard sector ETFs and trending funds to adjust according to the business cycle. The neutral stock to bond allocation for this portfolio is 45% where it is now, but at extremes in the business cycle, this may be as low as 30% or as high as 65% depending upon what I own in the tactical sleeve and Columbia Thermostat. This range is a gradual change over the business cycle and not an attempt for short-term timing of the market.

2. Best Funds Over Twenty Five Years

More than anything, we believe investors should be using all of the tools in their toolbox to meet goals and objectives. This means deploying an active investment approach with the ability to generate beyond passive benchmarks.

There is no such thing as ‘easy money,’ and lower returns should be expected. We know it may not be what investors want to hear, but this type of clear-eyed, realistic approach to risk management is the only way we know how.

– Cruising Through The Economic Cycle, Manning & Napier

For the Vanguard Portfolio, I want a portfolio with low turnover, and I look to the very short list of existing funds that consistently outperformed over the past twenty-five years. The funds below are the ones that I find most attractive, and Vanguard’s low-cost philosophy is a winning philosophy. For the next ten or more years, with high valuations in the US, stimulus wearing off, large debts and deficits, and the speculative nature of current markets with high margin leverage, we are likely to see lower domestic returns relative to international along with more volatility and with at least some “less than transitionary” inflation. The Wellington Management Fund has managed the Vanguard Wellington and Wellesley funds since inception and now manages two global versions of these funds.

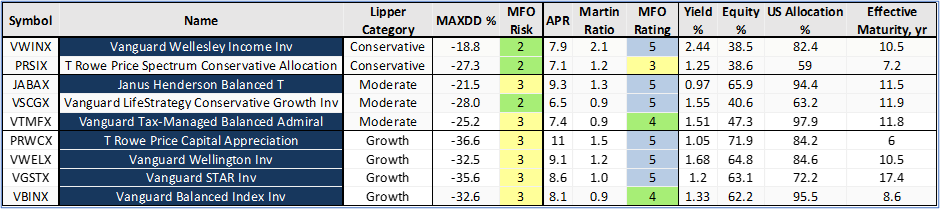

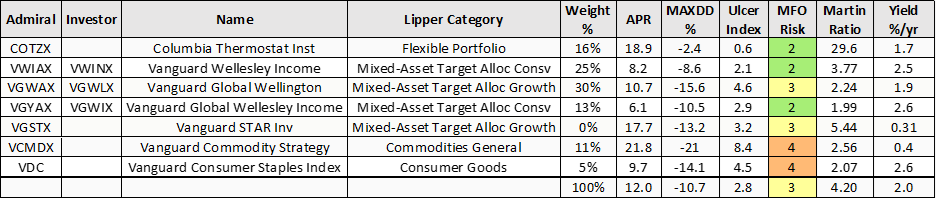

What the table points out is that the funds are conservative (MFO Risk =2) to moderate (MFO Risk =3) while the Lipper Category classifies them as conservative, moderate, and growth. The names in blue indicate the funds that have the MFO Great Owl Classification for high-risk adjusted performance. Martin Ratio is the risk-adjusted performance. I added the column for percent equity as another measure of risk (and returns), and percent domestic allocation to show that while many of these funds have done well, they have invested largely in the US which now has much higher valuations than many other markets. Vanguard Wellesley Income (VWIAX) is a great conservative fund that invests mostly domestically.

Table #1: Best Funds Over Twenty Five Years

For the more aggressive funds in the traditional IRA at Vanguard, I select the Wellington and STAR funds. For the more conservative fund, I like the Wellesley fund.

3. Vanguard Core Funds

Vanguard Global Wellington Admiral (VGWAX): The equity portfolio holds about 90 stocks and tilts to mega-caps. Key holdings since its November 2017 inception include Bank of America BAC, Microsoft MSFT, and Novartis NVS. Industrials have been overweight, anchored by defense companies such as Lockheed Martin LMT, which has a strong record of increasing dividends. A notable underweighting is technology, but the team likes semiconductor names, as they feel that after a period of consolidation, the top firms are now more effectively using technology as a source of competitive advantage. Non-U.S. names account for about half of the equity sleeve and include holdings like Taiwan Semiconductor TSM and AstraZeneca AZN.

– Morningstar, Patricia Oey

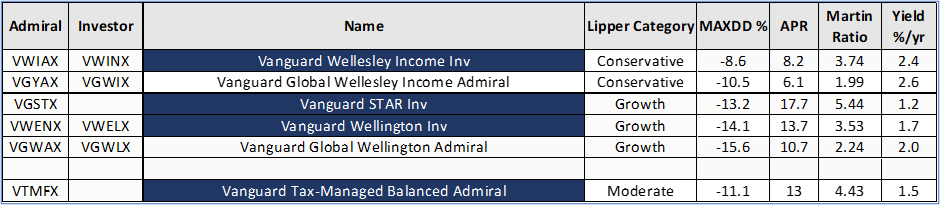

Table #2 shows my favorite Vanguard mixed-asset funds with metrics for the past two years. My expectation is that global funds, which have performed relatively poorly for the past few years, are likely set to outperform over the next five to ten years due to lower international valuations. The Global Wellesley and Global Wellington Funds have higher allocations (close to 45%) to international stocks with a strong tilt toward value. If you are interested in information about the Vanguard Funds in this article, I refer you to Vanguard Global 60/40 Funds.

The Vanguard Global Wellington has a price-to-earnings ratio of 18.6 compared to 25.5 for the Vanguard Wellington Fund. Investors are paying 37% more per dollar of earnings to own the Wellington instead of the Global Wellington fund. The global funds have been more volatile compared to domestic versions because of additional currency and country risks.

Table #2: Best Vanguard Core Fund Metrics – Two Years

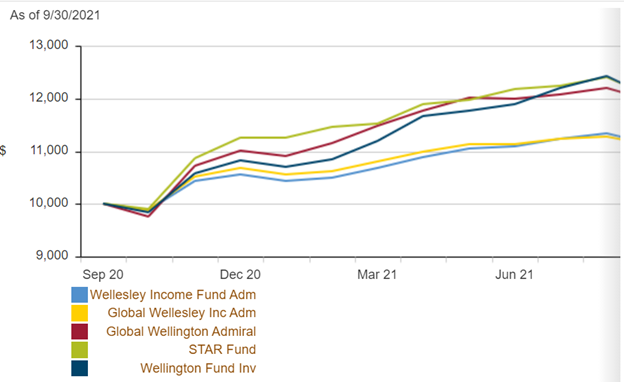

The one-year trends in Figure #1 show the funds in the Mixed-Asset Growth Category have performed similarly as we shift from the Recovery to the Middle Stage of the business cycle. Likewise, the Global Wellesley is performing about as well as the Wellesley Income Fund. This may represent an inflection point for performance from growth to value and domestic to international.

Figure #1: Best Vanguard Core Fund Metrics – One Year

I selected the Global Wellington and STAR Funds for the more aggressive side of the portfolio partly because they are more global, and the Wellesley Fund as the more conservative, domestic side of the portfolio. The Global Wellesley Fund is more of an unknown to me, and I selected it as a conservative global fund, but have a lower allocation to it.

4. Vanguard Sector Funds

Although we do not believe the pillars are yet in place to support a 1970s-style stagflation scenario, we are clearly in a weakening growth/high inflation era that appears less “transitory” every day…

Interdependencies, coupled with low inventories across global supply chains, have ushered in a brittle system that’s become more vulnerable to shocks and their ripple effects.

– The Beast of Burden of Inflation, Liz Ann Sonders from Charles Schwab

The tea leaves are difficult to read for sector funds because August to October has been volatile with a small dip. While valuations are high, we are in the middle stage of the business cycle which is typically the longest-running stage of the business cycle. The price-to-earnings ratio of the S&P 500 appears to be declining as earnings increase. With ample stimulus, there is probably more room to run before the next recession. Other risks include inflation, tapering on bond purchases by the Federal Reserve, volatility, and of course the “unknowns”. The past couple of months has been a good time to adjust allocations and pick up new funds.

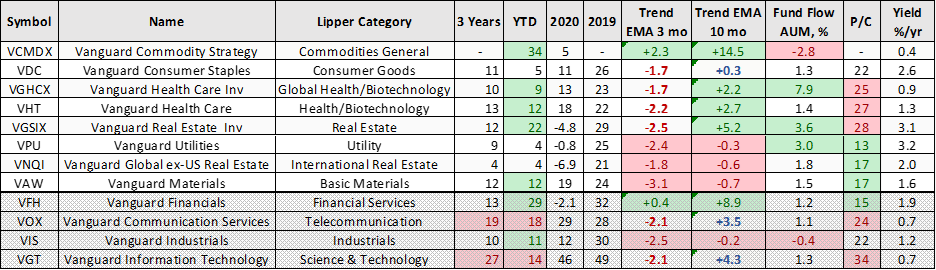

Table # 3 shows most of the Vanguard Sector Funds. Those in the top two sections (eight funds) typically do well in the late stage of the business cycle. Those in the top section (five funds) are trending higher and may be more favorable for the next year or two. Those in the bottom section are what I want to underweight as they do well in the Recovery stage, but may now be more over-valued. The Vanguard Commodity Strategy Fund has had strong trends but has seen some withdrawals recently. I am holding, but watching as I read some consumer staples such as food and natural gas for home heating continue the trend of higher prices.

Trend Exponential Moving Average (EMA) measures the price of the fund compared to its moving average which weight more recent months heavier. A positive value shows the fund is increasing in value compared to its trend. Price to Cash Flow (P/C) is the price relative to the cash the fund generates.

Table #3: Vanguard Sector Funds

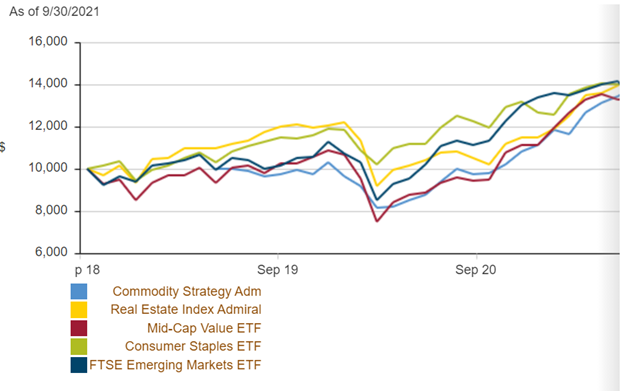

Investors should always have a Plan B for other funds. Figure #2 contains some Plan A tactical funds such as Commodity and Consumer Staples, along with Plan B funds such as real estate funds, mid-cap value funds, and emerging markets. When the Plan B funds are accelerating faster than the Plan A funds then it may be time to see if there is a storyline for making a change. I recently added the American Funds New World Fund Class (NWFFX) in another account because it underweights China and is more diversified including companies from developed countries that do business in emerging markets. Another interesting ETF that has performed well is the BlackRock iShares MSCI Emerging Markets ex-China (EMXC) which invests in emerging markets excluding China.

Figure #2: Trending Funds

I include the Vanguard Commodity Strategy Fund and the Consumer Staples ETF in the Tactical Sleeve but have added Health Care in the traditional IRA at Fidelity. These categories tend to do relatively well in the late stage of the business cycle. I have also added an emerging market and mid-cap value fund in the traditional IRA at Fidelity. For those wishing to hedge against inflation without buying commodities, I suggest that you look at Horizon Kinetics Inflation Beneficiaries ETF (INFL) which invests in companies that will benefit from inflation, but with a caution that like commodities it will likely be volatile.

5. Setting a Target Allocation (aka Cycle Inflection Points)

In my view, the greatest way to optimize the positioning of a portfolio at a given point in time is through deciding what balance it should strike between aggressiveness/defensiveness. And I believe the aggressiveness/ defensiveness should be adjusted over time in response to changes in the state of the investment environment and where a number of elements stand in their cycles.

– Mastering the Market Cycle: Getting the Odds on your Side, Howard Marks, co-founder of Oaktree Capital Management

You are driving along at 50 miles an hour and step on the accelerator. Your car speeds up. You let off the accelerator and the car slows down, but you are still moving. The same concept applies to the economy. Fidelity estimates that the economy has moved from the recovery stage to the middle cycle which means the economy is still growing, but at a slower rate (deceleration). Mutual Fund Observer Multi-Screen has a new tool called the Trend EMA for the exponential moving average for three- and ten-month periods. This can be applied to funds as I show in this article. The fund price may be growing at a faster rate (acceleration) or slower rate (deceleration). The point at which acceleration turns positive or negative is an inflection point where the fund may still be growing, but at a slower or faster rate than previously.

I believe that we are in secular and business cycle inflection points. Inflection points with high valuations, slower growth rates, and inflation are usually followed by secular bear markets where returns are lower than historical averages. Stocks may rise, but valuations often fall. Valuations are the best long-term determinant of returns, but not a short-term timing metric. For the business cycle, the middle stage is usually the longest. The economy is growing strongly but will grow slower than it did during the recovery stage.

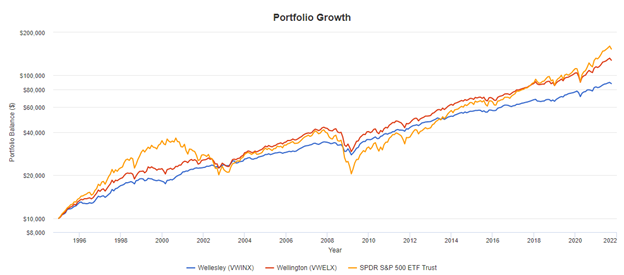

As an example of secular markets and business cycles, Figure #3 shows the conservative Vanguard Wellesley (VWINX) compared to the more aggressive Vanguard Wellington (VWELX) and S&P 500 since 1995. The Wellington and S&P500 did not consistently outperform the conservative Wellesley for the 20 year period containing the bursting of the Technology Bubble and Great Financial Crisis. For the past twenty-six years, the S&P500 has not significantly outperformed the Wellington fund. Entering retirement, my time horizon is likely less than 25 years. I expect lower than historical returns with high volatility. In this environment, I like an active approach rather than a passive one.

Figure #3: Secular Trends

We, as individual investors, can’t time the markets on a consistent basis but we can adjust the risk of our portfolios to match the investment environment. Because I believe that some underperforming funds such as international and small caps may be set to outperform, I did not choose funds to include in the portfolio based on historical performance. Instead, I chose funds that have performed relatively well in categories that I expect to outperform in the future. I want to have a target allocation but tilt toward growth in the recovery stage and defense in the later stages. Coincidently, my overall allocation is 55 percent. I would be comfortable with a 30 percent allocation to stocks in the late stage of a business cycle and 65 percent during the recovery stage.

Implementation is more difficult. This is one reason for building a multi-strategy portfolio. The goal is that each portfolio does well, but they and some of their funds will outperform at different times. Both the Vanguard and Fidelity Portfolios contain Columbia Thermostat (COTZX/CTFAX) which will allocate between 10 and 90 percent to stocks based on valuations using the philosophy of “buying low and selling high”. It is mostly in bonds now and will underperform many mixed-asset funds until the next correction. For more information about Columbia Thermostat, please read Tactical Sleeve for the Conservative Minded. There is always a bear market on the horizon, and I expect the next one in two to five years from now. This is not a forecast, just a historical reality…

“History doesn’t repeat itself, but it often rhymes.” – Mark Twain

6. Vanguard Traditional IRA Portfolio

The simplest form of adjusting portfolios to the business cycle is to own four to six funds and adjust allocations during regular quarterly or annual rebalancing. For those who want to be more active, you may add a few sector funds or rotate between growth and value funds. Portfolios should remain diversified in each stage of the business cycle.

– Business Cycle Portfolio Strategy, MFO December 2019, Charles Lynn Bolin

The above concept that I described in 2019 is what I am implementing with the traditional IRA at Vanguard. I am more heavily invested in Vanguard Global Wellington because it has a higher allocation to stocks, has a value orientation, is more global, and has the experience of the Wellington Management Team. I have a high allocation Vanguard Wellesley as a more conservative domestic fund. In other words, I set allocations based on gut feel where I believe we are in the business and secular cycles and will adjust the tilt based on trends.

The four Vanguard Funds that I am invested in are Vanguard Global Wellington (VGWAX), Global Wellesley (VGYAX), and Wellesley Fund (VWIAX). The Vanguard STAR Fund (VGSTX) is an excellent fund that I want to own more of during the recovery stage of the business cycle. It is a fund of funds including the venerable Windsor and PRIMECAP Funds, and overall has a tilt toward growth. I include the Columbia Thermostat Fund (COTZX) because it adjusts allocations according to cyclically adjusted price to earnings. Thermostat did not perform well following the Great Financial Crisis but has since changed its strategy to gradually change allocations instead of consisting of all stocks or bonds. It performed extremely well during the 2020 bear market.

I allocate 15% to a tactical sleeve based upon funds that do well in the coming stages of the business cycle, as well as momentum and valuations. In the tactical sleeve, I own the Vanguard Commodity Strategy Fund (VCMDX) which has exhibited lower risk than most commodity funds. I also recently bought the Vanguard Consumer Staples ETF (VDC). The tactical sleeve often consists of higher risk funds (MFO Risk = 4). The portfolio is moderate (MFO Risk = 3). The maximum drawdown of this portfolio would have been around 11 percent during the 2020 bear market, and the return would have been around 12 percent.

The allocation to stocks and commodities of this portfolio is 43%, of which just under a third is international. As per the strategy described in Section #1, I will be bringing the allocation to the STAR fund up to the minimum of 10% as I rebalance. I will also be looking to reduce the allocation of the Commodity Strategy Fund over time down to 5% as per the strategy of this portfolio.

Table #4: Vanguard Traditional IRA Portfolio (Two Years)

7. Closing

My wife and I built a relationship with a Fidelity Advisor which includes having a managed Roth IRA account. It is a comfort for my wife to know the financial plan and situation, and I want to know that she has someone to go to for advice in case something happens to me. He is a personal advisor, familiar with my situation and preferences. What I liked is that he asked my opinion and went along to rationalize decisions together. We will make adjustments as required going forward. I also like Vanguard for its great funds and like to diversify to some extent across financial institutions.

Just trying to keep it simple…

Just trying to keep it simple…

“Everything should be made as simple as possible, but no simpler.”

– Albert Einstein.

Best Wishes and Stay Safe!