We’ve scheduled our year-end review webinar for Tuesday, 6 January at 9 am Pacific (noon Eastern). We will use MultiSearch Screens and other site tools to highlight performance of funds across different market segments, as described in our latest post A Good Year. Please join us by registering here.

Monthly Archives: January 2026

January 1, 2026

Welcome to the New Year’s issue of the Mutual Fund Observer. We’re glad you’re here.

Heraclitus, the famously elusive Greek philosopher, reminded his students that you cannot step into the same river twice. Both we and the river will have changed. According to legend, one of those students – snarky little barstid – replied: “I don’t think you can step into the same river once.” Even as we step, the river flows and changes.

As do we.

Heraclitus was speaking of a physical river. Centuries later, we have extended his insights to allow us to consider the River of Time itself: the continuous flow in which change happens, meaning accumulates, and our lives—and markets—actually unfold.

January has that fluid quality. We think of ourselves standing on the bank of the River, looking backward and forward at once—convinced that the past can be measured and the future mapped, even as the present slips by almost unnoticed. The river does not pause for our resolutions.

In reality, we don’t just get to watch time rush past; we are not on the bank, we are in the river. We may think we resolutely face the future, eyes upstream, scrying risk and opportunity. We may turn our back to the torrent, knowing that we can only know what has already passed and contemplating the dark sea into which it must eventually empty. We might be still and resolute, like a stone, or moving along with the flow. The young might experience a mere ankle-deep flow while some of us experience … the deeper currents pulling toward that wine-dark sea.

Perspective matters.

And metaphors matter because they teach us what to look for. From the riverbank, all motion feels alarming. From within the river, we begin to notice that not all movement means change, not all froth is consequential, and not all change arrives with noise. Some of what most shapes our lives—technological shifts, medical progress, environmental repair—moves steadily, almost invisibly, beneath the surface.

In this month’s Observer …

This January issue of the Observer lingers over a stretch of the river that many hurried past. Amid the noise and anxiety of 2025, extraordinary things went quietly right: a vast expansion of green energy in China, meaningful progress against several endemic diseases, and other developments that rarely commanded headlines but may shape lives for decades to come.

Uncertain times require clear thinking, and clear thinking requires … well, a functioning brain. In “New Year’s Resolution #1: Avoid lobotomies” we look at the threat that AI seductively poses to brains … yours, your alma mater’s, and your investment advisor’s. A short sidebar piece, “What Five AI Told Me About Investing in 2026, and what their answers tell you,” highlights the problematic patterns in AI’s response to an (admittedly unfair) question about what’s going to win in the year ahead.

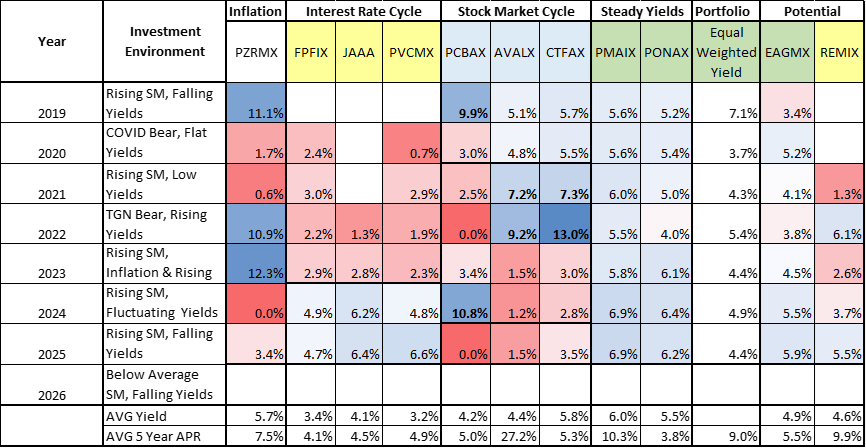

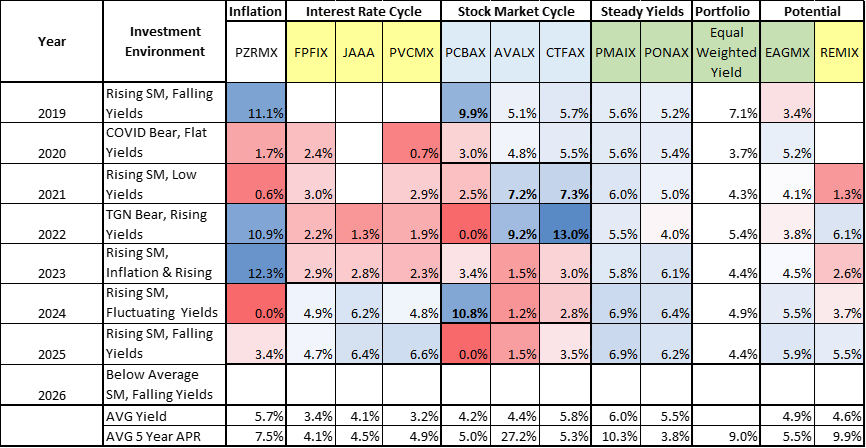

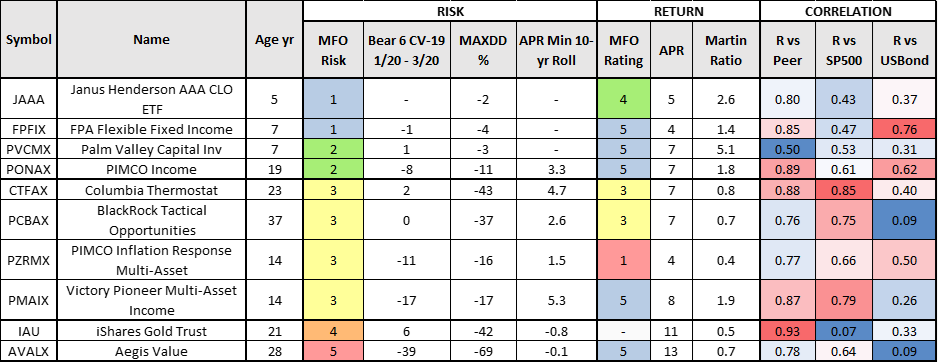

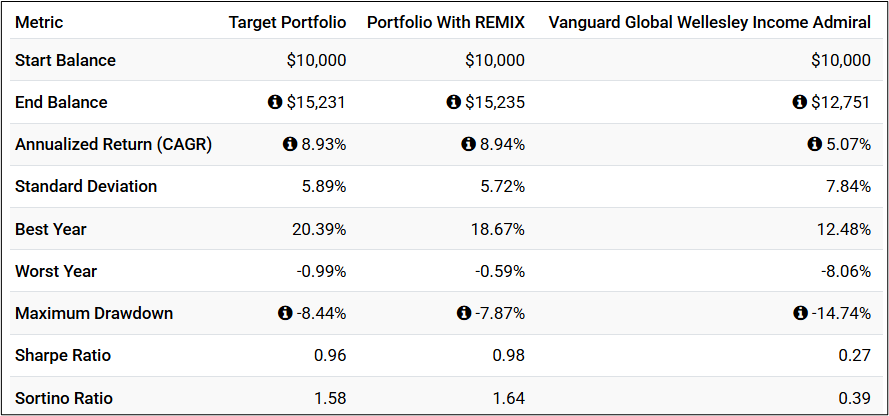

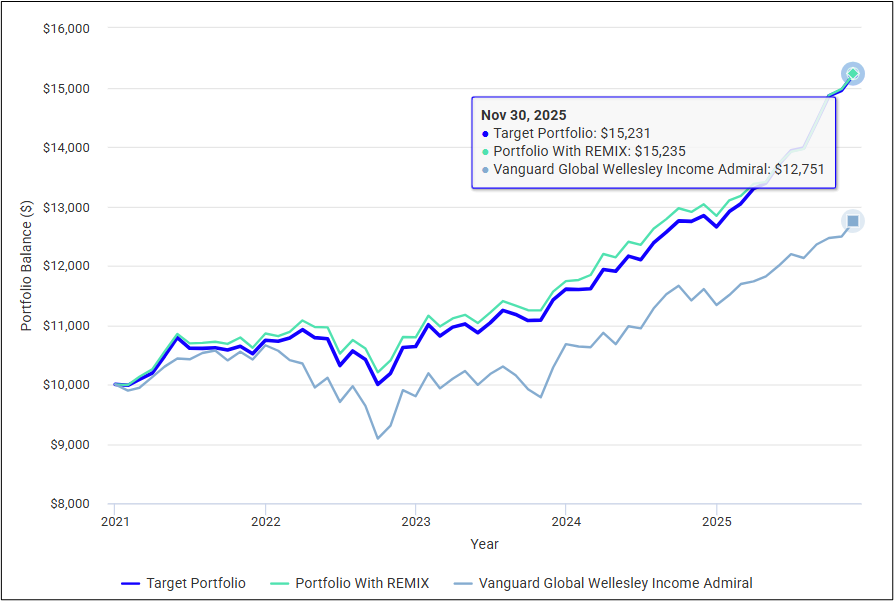

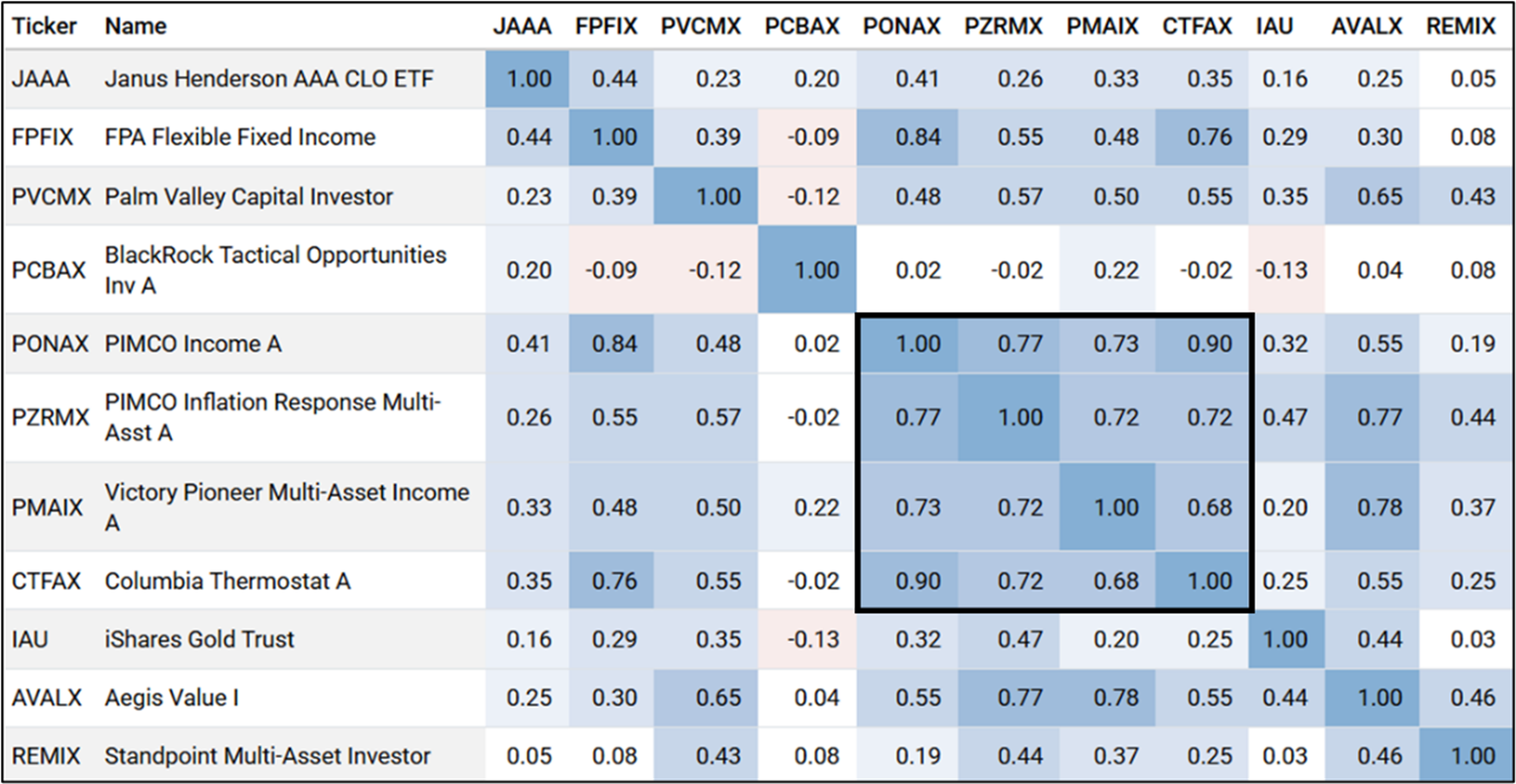

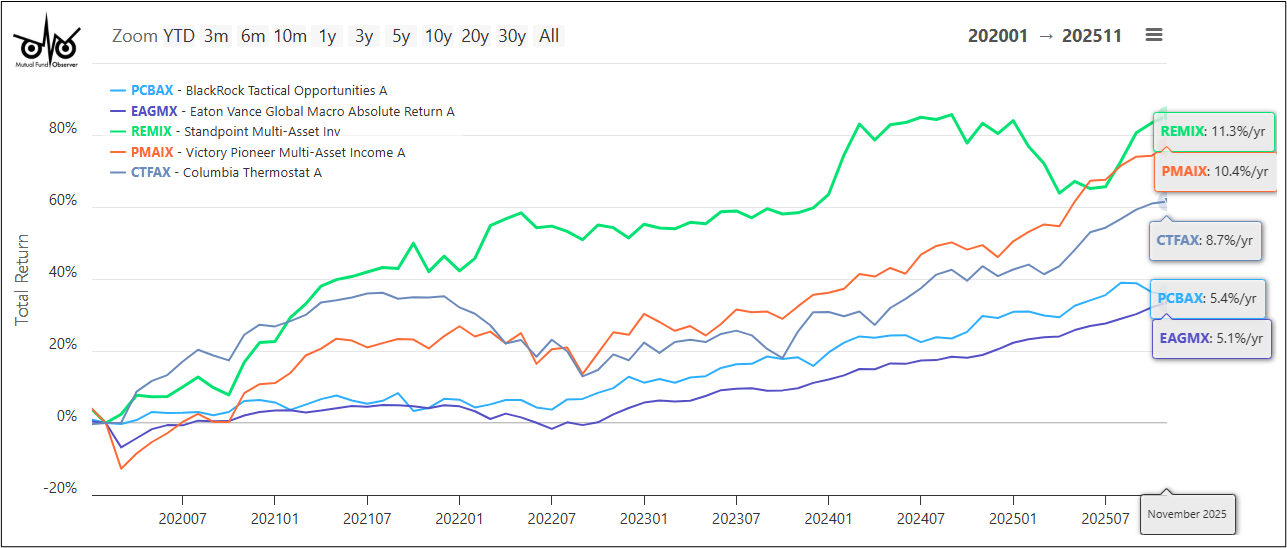

Our colleague Lynn Bolin contributes two complementary pieces exploring income-focused investing for the uncertain years ahead. In “My 2026 Investment Plan,” Lynn walks through the construction of his conservative Core TIRA portfolio – a traditional IRA designed to generate a steady income of at least 4% while limiting drawdowns to -15% during severe bear markets. He demonstrates how different funds yield differently depending on whether they’re responding to interest rate cycles or stock market cycles, and evaluates adding Standpoint Multi-Asset (REMIX) to improve diversification. Particularly valuable: Lynn’s analysis of how his portfolio performed through both the COVID bear market and the Great Normalization’s rising rates, and his discussion of why he’s moved from a 65% stock allocation to 50% as forecasts from the OECD, Federal Reserve, and Conference Board all point to slowing growth ahead. Vanguard’s own time-varying model now recommends a 40/60 stocks-to-bonds allocation – a near-revolutionary flip from the traditional 60/40.

In “A Closer Look at Income Strategy,” Lynn drills deeper into the mechanics of generating steady income in an environment where short and intermediate Treasury yields are falling while long-term rates rise. Working from 30,000 feet (which Lipper categories produce income in low-yield environments) down to ground level (specific fund recommendations), he identifies funds that maintained consistent yields through multiple market cycles. His analysis reveals that some funds distribute more when stock market opportunities appear limited, while others fluctuate with interest rates – and a select few provide genuinely steady income regardless of market conditions. The payoff: an example portfolio that achieved 7.7% annual returns with a maximum drawdown of just -9.8% over the past six years while yielding 5.2%.

The Shadow, as ever, surveys the month’s most consequential changes in the fund and ETF world in “Briefly Noted.”

We also pause, briefly and with gratitude, to acknowledge those who have sustained the Observer—financially, intellectually, and through simple acts of encouragement. And then, before the current carries us onward, we raise a glass to what has been, to what is, and to what may yet emerge from upstream.

The Good News You Scrolled Past

Pessimism is easy.

Way too easy, frankly.

If I were to construct the Pessimism Industrial Complex, it would have three pillars:

-

The federal government is controlled by toddlers, a bunch famous for tantrums when their irrational, I-am-the-universe demands are not met. And so we get the Trump Kennedy Center, chaired by Donald J. Trump and the Donald J. Trump US Institute for Peace. The Trump-class battleships that will populate The Golden Fleet. The Trump dollar coin. The Trump accounts for infants. The decision to make access to the national parks free on Trump’s birthday, which, I think, is somewhere in the month of Trumpruary.

There are no adults left in the room. Interviews with three departing US senators made two points: (1) every member of the US Senate is appalled and (2) they’re all waiting “for the right time” to, you know, develop a spine, remember their oath of office, or something (“Why Won’t Senators Stand Up to Trump? We Asked 3 Who Called It Quits,” New York Times, 12/13/2025). Until then, the federal response to a global climate crisis is “don’t wanna and you can’t make me!”

When you’re dealing with a creature named “The Doomsday Glacier,” it’s easy to foresee Bad Things Aplenty.

-

The media loves reporting bad news. We don’t know where the newsroom adage “if it bleeds, it leads” originated – the confident online assertions about Hearst in the 1890s is unattributed and a random New York Magazine article in 1989 is laughably wrong – but it does express a well-documented truth. Bad news sells, terrible news sells more. A 20-year study of German media found a “significant, positive correlations between explicitly negative cover pages and the magazines’ sales” (Arango-Kure and Marcel Garz, “Bad News Sells,” Journal of Media Economics, 2014). Globally, every additional negative word added to a story’s title increases readership (Robertson, et al, “Negativity drives online news consumption,” Nature: Human Behavior, 2023; btw, their study of 105,000 online news stories also found that positive words in titles drove down readership) and the more negative a story is, the more frequently and widely it’s shared on social media (Watson, et al, “Negative online news articles are shared more to social media,” Scientific Reports, 2024).

-

You love to doom-scroll. Doom‑scrolling, for the three of you who didn’t know, is the practiced art of dragging your thumb down an endless feed of bad news long after you have stopped learning anything new. It is not just “reading the news online”; it is staying locked in the loop of crisis headlines, live‑updated horrors, and algorithm-driven outrage until your mood and sense of the world are thoroughly saturated. Some psychologists speculate that it’s a hard-wired behavior; within evolutionary time-frames, our survival depends on obsessively locating and assessing all potential threats in our neighborhood (“is that a nice kitty or a creature whose nickname for me is ‘niblet’?”), and doom-scrolling is just the latest iteration of the impulse.

Surveys and behavioral studies suggest that a substantial minority of adults, and a flat‑out majority of younger users, now report doom‑scrolling regularly (“Gen Z has a doomscrolling problem,” Newsweek, 5/11/2025). In those same studies, heavier doom‑scrolling is consistently associated with higher levels of stress, depression, anxiety, sleep problems, and even secondary trauma symptoms, a joy of witnessing wave after wave of misery through a four‑inch screen (Satici, et al, “Doomscrolling Scale: its Association with Personality Traits, Psychological Distress, Social Media Use, and Wellbeing,” Applied Research in the Quality of Life, 2022).

And, boy howdy, is there a fair number of regrettable developments in the world. Andrew Winston’s curiously optimistic essay in Forbes (“2025: the year sustainability didn’t die,” 12/21/2025) began with a fairly bracing list of negatives:

… the harsh reality is the world’s greatest challenges [are] getting worse. Inequality grew, especially at the very top, where individuals amassed unfathomable wealth (hundreds of billions of dollars) and some corporate valuations hit unreal heights ($4 trillion to $5 trillion).

Meanwhile, climate impacts escalated; political winds don’t change actual winds. For example, part of Los Angeles burned to the ground (at an estimated cost of up to $250 billion) during unprecedented wildfires, historic heat baked India, Pakistan, and the EU, and devastating floods in Texas killed dozens of children. Scientists told us that climate change is “beyond scientific dispute,” at “tipping points,” and “extremely dangerous” (and that the world will blow past the 1.5C warming target). Insurer Allianz issued an eye-popping report that climate change could “destroy capitalism.”

In addition, the world got less democratic and pulled to the right and generally away from the sustainability agenda, making collective action even harder. This puts more pressure on businesses. And even facing headwinds, sustainability didn’t die. That’s the top story of the year. Let’s look at that and some other big themes.

Well … yeah. But if pessimism feels effortless at the end of 2025, that is not just because the news is bad; it is because you are mainlining it, in real time, on an interface designed never to run out.

Much of our success as a species is driven by two factors: a good plan and resilience in executing it. The media’s business model tends to emphasize doom because, well, doom sells. But 2025 offered remarkable evidence that when we commit to sustained action—plugging ozone holes, protecting beaches, installing solar panels, developing breakthrough medicines, restoring ecosystems—we can achieve transformations that once seemed impossible.

In our draft letter, what follows are eleven pages of incredibly consequential, positive developments. Chip’s anguished plea, “have mercy on their eyes!” led us to share the news in two forms: a dozen bullet points here and a dozen pages of detail in a sidebar story entitled, “The Big Box of Delights.”

So here’s what happened while doom was scrolling:

- Renewables overtook coal as the world’s largest source of electricity, and solar alone grew by 306 terawatt hours.

- China emerged as “the green giant,” adding twice as much solar as the rest of the world combined, including a single solar farm twice the size of Washington DC, and sold $180 billion in “green tech” to the rest of the world.

- India crossed an emissions inflection point, with their power sector carbon emissions actually falling as renewables surged.

- Clean energy investment surged, driven in part by AI’s power needs and tens of billions of private investments in batteries, nuclear, and solar.

- Green energy stocks outperformed traditional markets with the S&P Global Clean Energy Index up 46% by Christmas, beating the S&P 500, Nasdaq 100, and MSCI World Index.

- Corporate sustainability investments accelerated … quietly. As it turns out, sustainability makes sense, and an Accenture survey of global CEOs found 99% planned to maintain or expand sustainability while avoiding the press conferences that send the clown cars crashing in their direction.

- Economies have decoupled growth from emissions at scale; that is, there is no longer a correlation between economic growth and carbon growth because of, well, all that stuff above.

- Ireland ended coal power generation, which makes me smile. There’s a growing cadre of European nations on the same path.

- Lenacapavir, a revolutionary HIV prevention drug, reached Africa in record time. As in 2,000,000 doses of a drug that has 100% efficacy in preventing infections among women and 96% efficacy among others.

- Disease elimination victories multiply (except apparently in the US, where we wiped out measles in 2020, then decided that a Healthy America needed mass disease outbreaks). Three more countries eliminated malaria. A half dozen eliminated trachoma, which causes blindness. Special note to readers in Dallas: Cabo Verde, Mauritius, and Seychelles eliminated both measles and rubella. Check with the state health department about how they managed the feat with measles in Texas spiked.

- Cervical cancer vaccination reaches 86 million girls.

- Brain-machine interfaces – a combination of sound decoders and AI – restored speech to an ALS (“Lou Gehrig’s disease”) patient, offering hope for thousands. Hmmm … what else?

- Shades of “Finding Nemo,” green sea turtles have returned from the brink of extinction, and 20 other species were “downlisted” from threatened status by the International Union for the Conservation of Nature.

- High Seas Treaty, which the US signed but the titans in the US Senate refuse to vote on, enters force and provides a framework for preserving global biodiversity.

- Marriage equality advanced in Asia and Europe, baby steps admittedly, Poland abolished its last “LGBT-free” zones, and Kazakhstan criminalized bride kidnapping. No, literally. “Alyp qashu.” Brides were abducted and abused ‘cause … traditional values?

- Agrivoltaics, the practice of combining agriculture with solar arrays, is booming. It turns out that crops and cattle both thrive when they get protection from the summer sun.

- And, too, there was the drunk raccoon that united a nation.

In November, a liquor store employee in Virginia discovered broken bottles and an apparently intoxicated raccoon sleeping on the store’s bathroom floor. An animal control officer noted that he fell through a ceiling tile, “went on a rampage, drinking everything,” with a special fondness for … umm, whisky. The animal showed no signs of injury, according to local animal protection services, though they guessed the raccoon might be grappling with “a hangover” and regret over “poor life choices.”

The story delighted readers across the political spectrum—a rare moment of shared laughter in a divided time. But it became more than a viral moment when merchandise commemorating the raccoon’s night of debauchery raised a quarter of a million dollars for the local animal shelter that housed him. The Hanover County animal protection service teamed up with apparel maker Bonfire to create shirts, sweatshirts, cups, and stickers featuring the now-infamous image of a raccoon spreadeagled next to a spilled booze bottle, along with the words “Trashed Panda.” Through 12/22, they’ve sold 19,764 against a goal of 20,000.

The drunk raccoon reminds us that hope sometimes arrives in unexpected forms: in a hungover raccoon that brings people together, in merchandise that funds animal care, in our capacity to find joy and meaning in the absurd.

On Christmas Day, Pope Leo made his traditional papal “Urbi et Orbi” address, Latin for “To the City and to the World,” which summarizes the bad news (see above, plus your danged doomscroll) and prescribes a response: put aside indifference, stop scrolling and start acting, stand with the oppressed rather than the oppressive. “There will be peace when our monologues are interrupted and, enriched by listening, we fall to our knees before the humanity of the other.”

Stop wasting our time demonizing one another? Dreamer.

Progress is rarely dramatic. It’s built day by day through the determined efforts of scientists, healthcare workers, conservationists, educators, and ordinary citizens working to solve problems both great and small. While 2025’s headlines often focused on conflict and crisis, millions of people worldwide continued humanity’s long tradition of quietly building a better world.

They dreamt of better, and acted.

The answer to “what’s there to be optimistic about?” is the same as it was in 2025, and will be in 2027: enormous things happened because millions of good people rejected the counsel of despair, and that you probably didn’t hear about because doom sells better than progress. The choice isn’t between naive optimism and realistic despair. It’s between staying informed about what’s actually happening—the turtle populations recovering, the emissions curves bending, the diseases being eliminated, the hungover raccoons raising money for animal shelters—and letting a curated feed of catastrophe convince you that nothing good is possible.

Step away from the mediated world and step into the immediate one. Put your phones away. Hug someone today. Smile at a stranger. Do a good deed. Read a book. We recommend Always Remember (2025), a singularly beautiful little 30-minute read that reminds you of important things you already know but need to hear. Subscribe to Nautilus, a site (and magazine) that reminds you that science is cool … and important. Consider joining The Conversation, a site that has actual researchers write clear articles about important topics (“Deepfakes leveled up in 2025. Here’s what’s coming next.”)

Be like Jimmy the President. Be like Leo the Pope. Be like the Drunken Raccoon.

Make a difference where you are.

(Want cool pictures, more detail, and a couple more stories? Open “The Big Box o’ Delights.” Or, if you’re in the long-scroll version, just keep scrolling!)

What would you do if you had no idea of what’s coming?

The question’s not hypothetical, at least for investors. In truth, you have no idea of what’s coming. If you knew, you’d be richer than Croesus.

Two things are true when we stand in the river of time: we can see neither the river’s bottom nor what’s coming at us from just around the bend. The bottom might fall out. The torrent might be nearly upon us. We cannot know, but we’ve still got to act.

In general, the guides that professionals use are called “capital market assumptions” – data-driven estimates of the range of likely outcomes given current inputs. “Given a CAPE of 40 and capex spending of X, the likeliest range of US equity returns over the next 3-5 years falls between…” The recommendations that flow from those assumptions are called “strategic asset allocations,” statements that say broadly “a prudent investor with an intermediate time horizon should plan on holding X% in equities, with the possibility of some adjustments as markets evolve.”

The problem is that there are a million factors weighing on markets, but not all million – birth rates in Nigeria? thawing permafrost in Siberia? financial nihilism in Gen Z? – can be incorporated into the models. Different trillion-dollar advisors reach very different trillion-dollar conclusions about what course to chart.

Two of the largest firms – BlackRock and Vanguard – seem to have reached starkly different conclusions about prudent investor behavior. Given Vanguard’s intrinsic conservativeness, their new recommendation seems particularly tectonic.

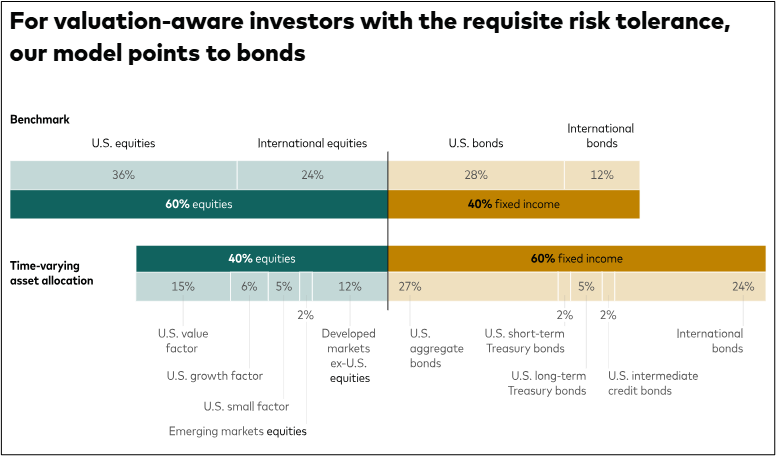

Vanguard’s call: For investors with a medium-term outlook (3-5 years), flip the traditional 60% stocks/40% bonds allocation to 40/60. Same expected returns as 60/40, but with substantially less risk. Why? The S&P 500’s CAPE ratio sits at 40.40 – rivaling the dot-com bubble peak. Vanguard projects US equities will return just 3.5% to 5.5% annually over the next decade, while growth stocks (including the Magnificent Seven) may deliver only 2.3% to 4.3%. Meanwhile, bonds now offer 3.8% to 4.8% with far less volatility. Roger Aliaga-Díaz, Vanguard’s global head of portfolio construction: “We see that overvaluation of equity markets more as a risk to the investor than as opportunity.”

This isn’t panic or market timing. In a December podcast, Vanguard’s chief economists explained that “stay the course” never meant “never adjust your allocation.” It meant stay invested, avoid emotional decisions, but use evidence-based risk management. Their Time-Varying Asset Allocation model – driven by the Vanguard Capital Markets Model that processes decades of data on risk factors and returns – now suggests this is a moment for conservative asset allocation. They estimate a 25-30% probability that AI disappoints and fails to deliver on current expectations.

Goldman Sachs concurs on muted US prospects, forecasting just 6.5% annual S&P 500 returns through 2035 – driven by earnings, not the multiple expansion that powered the last decade. They see better opportunities elsewhere: Emerging Markets (+10.9%), Asia ex-Japan (+10.3%), Japan (+8.2%). The “multiple expansion era” is over, they argue. Profit margins already jumped from 5% in 1990 to 13% today and can’t expand further.

BlackRock takes the opposite view: Stay pro-risk, overweight US stocks on the AI theme. Yes, valuations are stretched, and concentration is concerning, but AI capital spending is transforming the economy at an unprecedented scale. The challenge isn’t whether to reduce equity exposure – it’s identifying which companies beyond the current winners will capture AI revenues as they spread across sectors. Their 2026 outlook emphasizes “the diversification mirage” – that traditional diversifiers like long-term Treasuries now offer diminished cushion, so seek idiosyncratic returns in private markets and active strategies instead.

T. Rowe Price splits the difference: Neutral on equities overall but underweight US large-cap (-2.0%) while overweight small-cap, international, and emerging markets. They’re concerned about “the narrowness of AI trends” and prefer to position for market broadening. Like Vanguard, they’re underweight long-term bonds, worried about fiscal deficits keeping upward pressure on rates.

What’s an investor to make of this? The honest answer is that nobody knows what’s upstream. Vanguard’s systematic approach says: when you can’t see around the bend, measure what you can – valuations, yields, historical risk/return relationships – and position defensively. BlackRock’s view: the AI build-out is real, the momentum is powerful, stay engaged but stay nimble. Both might be right over different time horizons.

The shift isn’t just theoretical. Our colleague Lynn Bolin has reduced his overall stock allocation from 65% to 50% over the past year, positioning his conservative Core TIRA portfolio to weather what he expects will be a more turbulent second half of the decade. My own long-term allocation, which we discuss each February along with my portfolio, is 50/50.

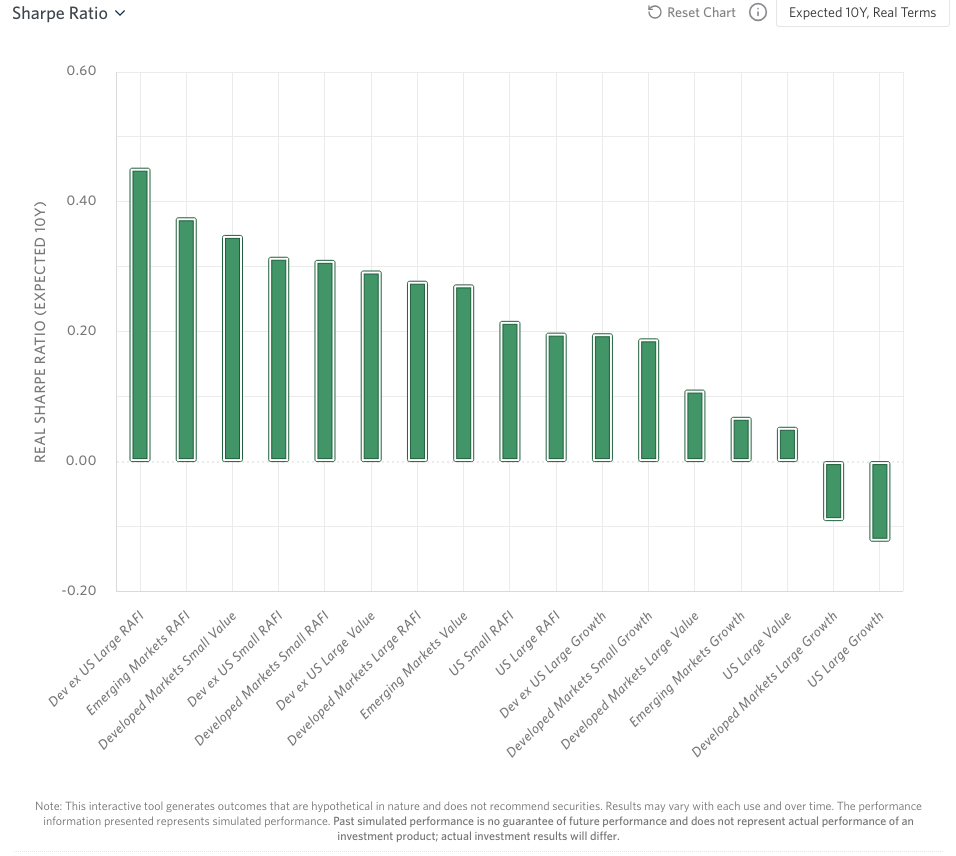

Research Affiliates, whose long-term asset allocation system has been broadly validated, offers striking support for the defensive shift. Their models project that a global 60/40 portfolio will deliver just 2.5% real returns over the next decade with a Sharpe ratio of 0.16. Their conservative model portfolio – shifting to 40% equity/60% bonds with commodities and inflation-linked assets – projects 3.5% real returns with a Sharpe ratio of 0.44. The more defensive portfolio projects higher returns with better risk-adjusted performance.

Their analysis also reinforces Goldman’s geographic thesis: looking across asset classes globally, US large-cap growth shows near-zero risk-adjusted returns (Sharpe ratio of -0.01), while developed ex-US large-cap value, emerging markets, and smaller international stocks all show meaningfully better prospects. The message is consistent: lighten on US growth, reduce overall equity exposure, look globally.

The takeaway isn’t that one firm has discovered the answer. It’s that even trillion-dollar asset managers using sophisticated models reach honestly different conclusions from the same data. Vanguard says reduce equity risk because valuations are stretched and bonds are finally paying again. BlackRock says stay engaged because AI momentum is real and traditional diversifiers don’t work like they used to. Goldman says look elsewhere entirely – emerging markets and Asia offer better prospects than US equities. Research Affiliates’ models strongly favor the defensive positioning.

Which suggests that broad diversification driven by your needs – not by greed or fear or the confident pronouncements of any single adviser – remains the most prudent course when standing in a river whose depths and currents we cannot fully know. The evidence from multiple independent sources supports a more conservative stance than the traditional 60/40 for those with intermediate time horizons. Whether that means 50/50, 40/60, or some other mix depends on your own circumstances, goals, and capacity to weather volatility.

But the days of assuming that 60/40 will automatically deliver double-digit returns through multiple expansion and tech dominance? Those have already flowed past us.

Thanks, as ever …

To the good folks we’ve met along the way, and with whom we chat too rarely. To Andrew and Michelle Foster of Seafarer Capital Partners for their vision of a better kind of fund company, and their enduring success. To Mark and Tina Oelschlager, the folks behind the small and excellent Towpath Focus Fund, for thoughtful talks and cheerful humanity … and enduring success. To Amit Wadhwaney of Moerus Worldwide, one of those remarkable people who make you feel like you become wiser, perhaps better, just talking to him. To Dave Sherman, founder of Cohanzick / CrossingBridge, whose formidable intellect and Tigger-like energy has translated into a bunch of funds that consistently honor the credo, “return of investment is more important than return on investment.” To the inestimably talented Charles, maestro of MFO Premium, whose tools deserve about ten times the attention – and financial support – that they receive. To Chuck Jaffe, aka “Hurricane Chuck,” who’s still at it after all these years, and to Dan Wiener, who our colleague Ed Studzinski denominated as Dan Dan the Vanguard Man, who has had the sense to take a step back and enjoy life. To our colleague Lynn Bolin, who has done likewise and yet writes better than ever, and to The Shadow, who might yet find cause to slow down. To Victoria Odinotska of Kanter Public Relations, a bright spirit and humane voice who toils bravely while under the burden of the ongoing assault on her beloved homeland. To the good folks at Long/Short Advisors and Cook & Bynum for keeping in touch, thoughtfully and consistently, over the years.

Finally, to our faithful subscribers and readers, thanks!

You have all made a difference.

L’Chaim!

The Big Box o’ Delights: What Went Right in 2025

Sections: Climate and energy / Public health / Conservation & wildlife recovery / Social progress / Innovation & technology

CLIMATE & ENERGY TRANSITION

Renewables overtake coal as the world’s largest source of electricity

For the first time in the industrial era, renewable energy generated more of the world’s electricity than coal did. In the first half of 2025, renewables supplied 34.3% of global electricity while coal fell to 33.1%, according to the energy think tank Ember. Solar and wind generation grew fast enough to outpace rising global electricity demand, meaning clean energy didn’t just keep up with growth, it began actively displacing fossil fuels. Solar alone grew by 306 terawatt hours (about what Italy uses in a year), covering 83% of the world’s increased electricity demand. The milestone arrived earlier than even optimists predicted; the International Energy Agency had forecasted it for eight to sixteen months later.

China emerges as “the green giant”

Science magazine’s description of China as “the green giant” captures both the scale and global impact of the country’s energy transformation. In 2024 alone, China installed new solar and wind generation equivalent to roughly 100 nuclear power plants; the pace accelerated in 2025. By May, China became the first country to surpass 1 terawatt of installed solar capacity. In just the first six months of 2025, China added 256 gigawatts of new solar systems—twice as much as the rest of the world combined. One solar farm on the Tibetan Plateau now spans more than 400 square kilometers, an area twice the size of Washington, D.C. Wind turbines have grown ever larger, with blades reaching 150 meters long.

The transformation has reshaped China’s landscape. Science notes that “vistas of smog, smokestacks, and coal heaps still exist, but glinting silicon panels now cover hills, deserts, and lakes.”

China’s build-out has global implications beyond emissions reductions. The country created an export industry worth nearly $180 billion in 2024, filling shipping containers with electric cars, solar cells, and wind turbine blades. By building up its own green energy system at unprecedented scale, China has made low-cost renewable energy technology accessible to much of the rest of the world.

India crosses an emissions inflection point

India’s trajectory offers a different kind of hope. After decades of relentless coal expansion—consumption jumped 42% between 2015 and 2024—something remarkable happened in 2025: for only the second time in half a century, India’s power sector emissions actually declined. They fell 1% in the first half of the year, even as the economy grew robustly and total electricity generation increased. The pivot came from record renewable additions: 22 gigawatts in just six months, a 57% jump from the previous year. By July, renewables reached 50% of India’s installed power capacity, hitting a 2030 target five years early.

This isn’t a full energy transition (India still plans new coal plants), but it marks a fundamental shift from “renewables can’t keep up with our growth” to “renewables are starting to displace our fossil fuels.” For a rapidly industrializing nation to reach this inflection point suggests that the clean energy transition may be arriving faster than even optimists predicted.

The conservative argument against US climate initiatives was always: “but what about China and India? They’re the real problem, without them we’re just wasting our time.” Well, dudes, they’re on the right side of history on this issue. Where are you?

Clean energy investment surges past expectations

Global investment in green technology rebounded dramatically in 2025 after several years of decline. By September, investors poured $56 billion into clean businesses across sectors, including renewable energy, battery storage, and electric vehicles, exceeding 2024’s full-year total. Nuclear energy alone attracted about one-fifth of global venture capital funding in 2025, largely driven by AI’s appetite for reliable power. Major players moved aggressively: Brookfield Asset Management announced a $20 billion fund to support the clean energy transition, while JPMorgan Chase committed up to $10 billion in direct equity and venture capital for batteries, nuclear, and solar power.

Green energy stocks outperform traditional markets

For much of 2025, the S&P Global Clean Energy Index beat the S&P 500, Nasdaq 100, and MSCI World Index, up 46% by Christmas 2025. Jefferies’ analysts called these “the glory days” for green tech. The reversal came despite rollbacks of environmental regulations in some countries, as energy demand and falling technology costs made clean energy increasingly competitive. BloombergNEF, Bloomberg’s primary research service, noted that “in 2015, solar power seemed far from overtaking coal, constrained both by scale and economics. Yet, within a decade, solar costs have fallen so dramatically that the dynamic has entirely reversed. Solar is now two times cheaper than fossil fuel.”

Corporate sustainability investments accelerate quietly

Corporate America’s commitment to sustainability strengthened in 2025 even as public rhetoric cooled. Major consulting firms tracking actual spending and commitments found a striking disconnect between headlines and behavior. Accenture and the UN Global Compact surveyed global CEOs and found 99% planned to maintain or expand sustainability efforts, with nearly 90% saying the business case had grown stronger over the past five years. Deloitte reported that more than 80% of companies increased sustainability investments during the year, while CapGemini found similar percentages planning further increases for 2026.

The shift reflects sustainability’s evolution from performative reporting to operational integration. Europe’s mandatory disclosure rules (the Corporate Sustainability Reporting Directive) are forcing companies to report genuine progress rather than aspirational goals, killing off green-washing in the process. At MIT, researchers studying sustainable supply chains found 85% of companies maintaining or accelerating their practices despite political headwinds. The pattern that emerged: companies are embedding sustainability into executive compensation, supply chain decisions, and capital allocation—they’re just talking about it less. As one sustainability professional put it, the era of “bold slogans and grand promises” has ended; the era of quiet, measurable integration into core business operations has begun.

Economies decouple growth from emissions at scale

Countries responsible for 92% of the global economy are now “decoupling” emissions from economic growth, a trend that has accelerated since the Paris Agreement was signed in 2015. The most pronounced decouplings occurred in Norway, Switzerland, and the UK, which grew their economies while shrinking emissions. Many emerging economies also achieved decoupling, including Brazil, Colombia, Egypt, Jordan, and Mozambique. China’s CO2 emissions have been flat for 18 months and may have peaked. While global emissions continue to rise, they’re growing far more slowly than economic output; the structural shift from “growth requires more carbon” to “growth despite less carbon” is unmistakable.

Ireland ends coal power generation

Ireland joined a small but growing group of European countries that have completely ended coal-fired electricity generation. Several others, including Greece and Italy, are set to follow in the coming years, continuing Europe’s rapid phase-out of its dirtiest fossil fuel.

Ireland is also rewetting its peatland; peat is an organic material that’s about halfway to being a fossil fuel. A traditional heat source, especially among the rural poor, peat bogs were drained, then the peat was cut, dried, and burned. Incredibly iconic smell that lingers in the air everywhere. Also, an environmental disaster that Ireland, both the Republic and Northern Ireland, is reversing. “[M]aintaining and enhancing the resilience of intact, natural peatlands may be the best and most cost-effective defense against climate change. Going one step further on the mitigation ladder, re-wetting and restoration of degraded peatlands has been named a “low-hanging fruit, and among the most cost-effective options for mitigating climate change” by Achim Steiner, UN Under-Secretary General and Executive Director UN Environment Programme. (Society for Ecological Restoration, Peatland Restoration in Ireland & Globally, 2025)

PUBLIC HEALTH BREAKTHROUGHS

A revolutionary HIV prevention drug reaches Africa

Lenacapavir represents a genuine breakthrough in HIV prevention: a twice-yearly injection that showed 100% efficacy in preventing infections among women in clinical trials and 96% efficacy among men, transgender individuals, and non-binary people. The U.S. FDA approved it in June 2025. Then something unprecedented happened: the first doses arrived in Eswatini and Zambia in November, the same year as U.S. approval. This shattered the typical pattern where new treatments take years or even decades to reach the countries with the highest HIV burden.

The speed resulted from coordinated action by the U.S. State Department, Gilead Sciences, and the Global Fund, which committed to provide at least 2 million doses at cost to high-burden countries. Gilead also struck deals to make the drug available in low- and middle-income countries for $40 per year, the same cost as current daily pills, but with the convenience and adherence advantages of just two shots annually. As one public health official noted, “For the first time, a new HIV medicine is reaching communities in sub-Saharan Africa in the same year as its U.S. approval.” By World AIDS Day 2025, clinics in Eswatini were administering the first injections.

Disease elimination victories multiply (except in Red States)

The year brought a cascade of disease elimination certifications. Georgia, Suriname, and Timor-Leste were certified malaria-free. Mauritania, Papua New Guinea, Burundi, Senegal, Fiji, and Egypt eliminated trachoma, a neglected tropical disease that causes blindness. Guinea and Kenya eliminated sleeping sickness, a parasitic disease spread by the tsetse fly.

Most remarkably, Cabo Verde, Mauritius, and Seychelles eliminated both measles and rubella, becoming the first sub-Saharan African countries to achieve this milestone. These successes demonstrate that sustained vaccination campaigns and public health infrastructure can eradicate diseases even in resource-limited settings.

Across much of the US, contrarily, communicable diseases that we thought we’d wiped out have surged. Measles cases went from zero in 2020 to 1800 (and climbing) in 2025. Some combination of social media disinformation (“vaccines contain toxic chemicals … and nanobots!”) and political convenience (“science is socialism”) has empowered a rising tide of “vaccine hesitancy” and a resultant tide of illness and death. (A child from west Texas who died of measles in 2025 was the first child death in the US in over 20 years.)

Cervical cancer vaccination reaches 86 million girls

Ambitious targets to vaccinate 86 million girls against cervical cancer in the countries where incidence is highest were reached early in 2025, preventing an estimated 1.4 million deaths. The achievement came from coordinated efforts across dozens of countries to expand vaccination programs and overcome logistical barriers to reaching remote populations.

Gene therapy achieves a breakthrough year

Scientists called 2025 “a breakthrough year for gene editing,” with multiple medical milestones achieved. A first-of-its-kind gene therapy for Huntington’s disease slowed the rate of cognitive decline by 75% in a small trial, giving patients decades more of “good quality life.” Another trial using base-editing technology showed promise for treating T-cell acute lymphoblastic leukemia, with the majority of participants entering remission. Researchers also conducted the first use of a CRISPR technology tailored to an individual patient, and successful trials began for treating chronic granulomatous disease and lung damage from genetic mutations. These advances demonstrated that collaboration between academia and industry can develop mutation-specific strategies for rare diseases once considered untreatable.

Brain-machine interfaces restore lost speech

An ALS patient regained the ability to speak to his daughter through revolutionary sound decoders and AI software—part of a new wave of brain-machine interfaces that could transform life for paralyzed individuals. The technology represents years of refinement in understanding neural patterns and translating them into intelligible speech, offering hope to thousands living with conditions that have robbed them of their voices.

CONSERVATION & WILDLIFE RECOVERY

Green sea turtles: from endangered to thriving

Green sea turtles: from endangered to thriving

The green sea turtle’s journey from the brink of extinction to “least concern” status represents one of the most dramatic conservation comebacks on record. In October 2025, the International Union for Conservation of Nature reclassified the species, which had been listed as endangered since 1982. The global population has increased by roughly 28% since the 1970s, following decades of sustained conservation efforts: legal protections against international trade and hunting, beach patrols protecting nesting females and their eggs, turtle excluder devices in fishing nets, and community-based initiatives to reduce egg harvesting.

The recovery was so robust that the species skipped intermediate categories like “vulnerable” and “near threatened” entirely. Notable success stories include Hawaii, where nesting females increased from under 100 in the 1970s to more than 800 annually, and Australia’s Raine Island, where surveys in 2025 recorded 20,000 nesting turtles in a single season, a 50% increase since 2014. The Seychelles witnessed a tenfold population surge after banning turtle hunting in 1968. The comeback demonstrates that when nations, scientists, and communities coordinate efforts over decades, even species hunted nearly to extinction can recover.

Twenty species downlisted from threatened status

The latest IUCN Red List update recorded at least 20 species moved from higher-risk categories to lower-risk ones, thanks to habitat restoration, invasive species control, and targeted conservation efforts. The ampurta, a rat-sized Australian marsupial, moved from near-extinction to “least concern” as its territory expanded by more than 48,000 square kilometers despite dry conditions and food shortages. Multiple bird species showed notable recovery, including the Rodrigues Warbler and Rodrigues Fody in Mauritius, and the Guadalupe Junco in Mexico. Conservation works—when sustained.

Rhinoceros populations continue recovery

Both black and greater one-horned rhinoceros populations showed meaningful increases in 2025. The global black rhinoceros population rose from 6,195 to 6,788 individuals, while the greater one-horned rhinoceros reached around 4,075 across India and Nepal. Mozambique reintroduced 10 black rhinos into Zinave National Park, creating the first founder population there in decades. While rhinos remain heavily threatened by poaching and habitat loss, even modest increases represent significant victories given the species’ slow reproduction rates and the continued demand for their horns.

High Seas Treaty enters force

The world ratified the first treaty to protect the high seas, the vast areas of ocean beyond any nation’s jurisdiction. The agreement, which becomes legally binding in January 2026 after ratification by more than 60 countries, provides an international framework for preserving biodiversity in international waters and commits nations to conserving at least 30% of land and sea areas. The treaty fills a critical gap in ocean governance, as nearly half of Earth’s surface had previously lacked comprehensive protection.

French Polynesia establishes world’s largest marine protected area

French Polynesia is committed to protecting 100% of its marine territory through the Blue Nature Alliance, creating the world’s largest marine protected area. The designation safeguards vast stretches of coral reefs, critical fish spawning grounds, and migration routes for whales, sharks, and sea turtles across millions of square kilometers of the South Pacific.

Eurasian beavers return to England

Eurasian beavers return to England

England authorized licensed wild releases of beavers for the first time in centuries. (A certain Victorian hat fashion was hard on the beaver population, which was hunted to extinction.) In March, the first beavers were released into a lake in Purbeck, Dorset. Later in the year, a wild beaver was spotted in Norfolk—the county’s first in over 500 years. Beavers are ecosystem engineers whose wetlands support biodiversity, improve water quality, and help mitigate flooding. Their return signals the success of rewilding efforts and marks a milestone in restoring native British fauna.

SOCIAL PROGRESS

Marriage equality advances in Asia and Europe

Legalization of same-sex marriage took effect in Thailand and Liechtenstein, expanding the number of countries recognizing marriage equality. Thailand became the first Southeast Asian nation to legalize same-sex marriage, representing a significant shift in a region where LGBTQ rights have faced considerable resistance.

Poland abolishes its last “LGBT-free” zones

Poland eliminated its final remaining “LGBT Ideology Free” zones. These zones had been established in recent years during the administration of the ruling Law and Justice party, which was voted out in 2024. The abolition represents a reversal of discriminatory local policies and a step toward greater inclusion.

Kazakhstan criminalizes bride kidnapping

The kidnapping of girls for forced marriage became a crime in Kazakhstan, the largest country in central Asia, under new rules that prohibit alyp qashu, a long-running tradition in which brides are abducted and subjected to physical and psychological abuse. The historic version was a form of elopement used when the parents disapproved of a match. Some freakish perversion in recent decades converted it to a quasi-criminal assault that sometimes involves ransom for the woman’s return. The criminalization represents a significant protection for women’s rights and bodily autonomy.

Cell phone bans expand in schools worldwide

Countries as disparate as South Korea and Sweden banned the use of cell phones in schools, joining a movement that now encompasses more than 40% of the world’s education systems. The restrictions reflect growing concern about phones’ impact on learning, attention, and social development, as well as emerging research on the mental health effects of constant connectivity during school hours.

Nota bene: it’s a start. Here’s the ugly reality: laptops are worse, by far, than cellphones in the classroom. Researchers note that between 40 – 60% of a student’s in-class time on laptops are spent on non-class activities, and it’s clear that note-taking on laptops is vastly inferior to notes taken by hand (Ravizza, et al, “Logged In and Zoned Out: How Laptop Internet Use Relates to Classroom Learning,” Psychological Science, 2017; Mueller, et al, “The Pen Is Mightier Than the Keyboard: Advantages of Longhand Over Laptop Note Taking,” Psychological Science, 2014; Eagan, et al, “Unregulated use of laptops over time in large lecture classes,” Computers & Education, 2010). Collectively, these three articles have been cited nearly 3000 times by other researchers.

Just fyi.

INNOVATION & TECHNOLOGY

Agrivoltaics demonstrate dual-use potential

At Jack’s Solar Garden in Longmont, Colorado, more than 3,000 solar panels glint in the sun, powering some 300 homes in the community while providing shade to the fruits, vegetables, and herbs growing below. The practice, known as “agrivoltaics,” combines agriculture and solar power generation on the same land, demonstrating that food production and clean energy need not compete for space. The approach is expanding across the United States – with about 600 sites so far – and globally as farmers discover that some crops actually thrive in the partial shade of solar panels, which can reduce water needs and protect plants from heat stress. Sheep grazing is the most common animal use so far.

Japan builds world’s first 3D-printed train station

Japan constructed the world’s first 3D-printed train station building at Hatsushima. The structure’s parts took a week to print and reinforce with concrete, then a team assembled them in less than six hours—demonstrating how additive manufacturing could revolutionize construction speed and efficiency while reducing material waste.

A Closer Look at Income Strategy

For most accounts, my primary investing objective is risk-adjusted return with dividends reinvested. I have set up automated withdrawals to transfer money from a conservative Traditional IRA (Core TIRA) in the Intermediate Investment Bucket to the Short-Term Investment Bucket. Having a steady income just took on a higher priority.

In this article, I look at how historical distributions fluctuate according to either the interest rate cycle or the stock market cycle, along with four funds that have the potential to produce steady yields. The Coming Decade section shows that yields on short and intermediate term Treasuries are falling while long-term rates are rising.

From a 30,000-foot view, Corporate Debt BBB-Rated, Multi-Sector Income, Short High Yield, and Loan Participation Lipper Categories have the potential to produce income in an environment with low yields on short-and intermediate Treasuries. From a 10,000-foot level, I identify funds that have consistent, high-risk-adjusted returns with respectable yields over the past twelve months (TTM), including capital gains. Arriving at the Ground Level, I create an example portfolio that would have achieved an APR of 7.7% for the past 5.9 years with a maximum drawdown of -9.8% and yield (TTM) of 5.2%.

Understanding Yields

As the Federal Reserve lowers the rate that banks charge each other for short-term loans, known as the federal funds rate, the yields on some funds will also fall. The key takeaway from this section is that yields on many funds will fluctuate according to either interest rate or stock market cycles, while a few funds have consistent distribution yields.

Morningstar has concise information for the past five years, including price at distribution and the type of distribution (income, short-term and long-term capital gains, and return of capital). Dividend.com and Seeking Alpha have longer histories of distributions, but without the price at distribution. NASDAQ has historical prices. For this exercise, I calculated the average total distribution as a percent of the average price of the fund for each of the past seven years.

Table #1 shows the distribution yield per year for each of the funds in my Core TIRA, with red shading indicating the lowest yield and blue the highest. All of the funds averaged a yield of at least 3.2% over the past six years, with PAIMX averaging 6.0%. Those whose inception date is after 2019 have the symbol shaded yellow. Three funds (FPFIX, JAAA, PVCMX) have higher yields when interest rates are high, but may have downward pressure as interest rates fall. Those whose yield fluctuates more with the stock market cycle (PCBAX, AVALX, CTFAX) tend to distribute capital gains when opportunities in the stock market appear to be lower. From the standpoint of steady income, PMAIX and PONAX are the clear winners, with PMAIX having the potential for higher total return.

Table #1: Historical Distributions Yields (Dividends, Capital Gains, Special)

The Core TIRA, excluding iShares Gold Trust (IAU), would have yielded more than 4% in every year except for 2020 during the COVID bear market with low yields on Treasuries. Of the two funds that I am considering adding in my mid-2026 review, EAGMX has high, steady yields, while REMIX has a low correlation to the S&P 500 and bonds, and higher potential for total return.

The Great Normalization (starting in 2022), with rising rates and a bear market in stocks, influenced me to develop a portion of my portfolio covering basic withdrawal needs that would do well during an extended severe bear market. When rates went over 4%, I began locking in yields by creating a bond ladder to lock in high yields. I plan to keep a rolling ten-year rolling ladder as long as yields are favorable.

The Coming Decade

My view of the next decade is that initially, short and intermediate term Treasury yields will fall because of the weakening labor market. High deficits and national debt will lead to efforts to lower the cost of financing the debt. The Federal Reserve is expected to continue lowering short-term rates, while the Treasury is pressuring longer-term rates lower by issuing short-term Treasury Bills and its buyback program.

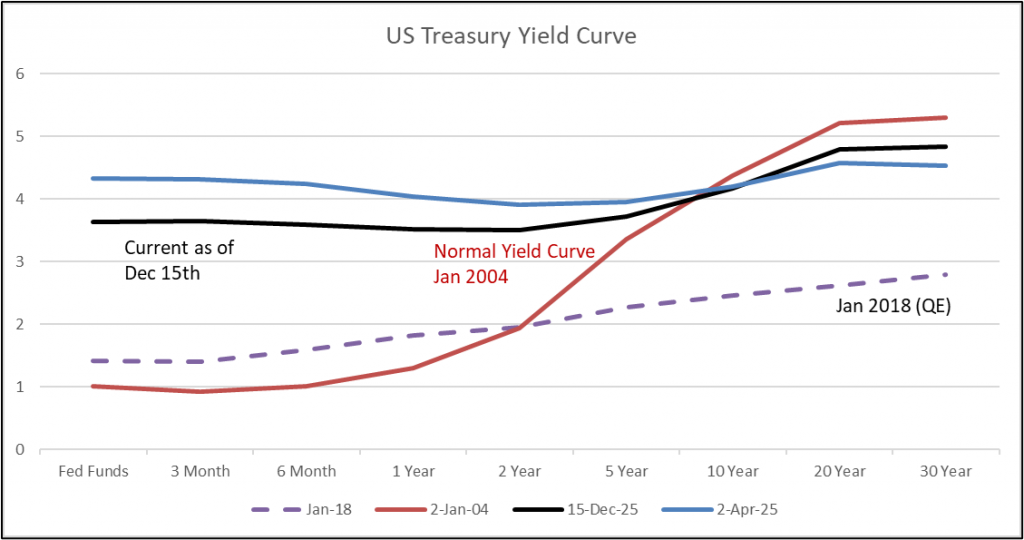

Figure #1 shows the current yield curve for Treasuries compared to when tariffs were announced, as well as a somewhat normal yield curve from January 2024. Yields on short and intermediate Treasuries are falling. The risk of rising national debt and inflation is pushing longer-term rates higher. Quantitative Easing pushed long-term rates lower in the decade following the Great Financial Crisis, as shown for 2018.

Figure #1: Treasury Yield Curves

30,000 Foot View

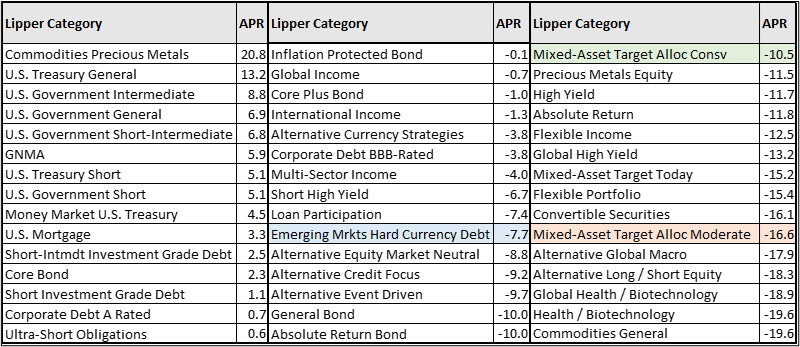

Table #2 shows how nearly 1,500 funds performed across seven bear markets, sorted by returns. On the left are the Lipper Categories with positive returns. There are no surprises here – gold, government bonds, and short-term investment-grade debt provided positive returns on average. During periods of low yields on government debt, most of these funds have not had high returns, and I am seeking income elsewhere. During the decade from 2010 through 2019, the average yield on a 10-year Treasury was 2.4% compared to 4.4% for the previous decade.

Table #2: Lipper Category Performance During Bear Markets

The categories on the right generally fare better than the S&P 500 during a bear market. Conservative mixed-asset funds had a drawdown of about one-third of the S&P 500 (-34%) while moderate mixed-asset funds lost about half. The middle column is interesting because it has the potential to produce income with relatively low drawdowns. Emerging market debt fell to about a quarter of that of the S&P 500.

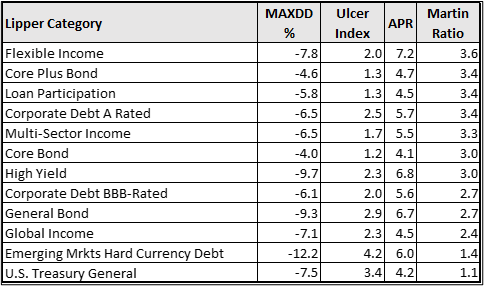

Table #3 shows some of the Lipper Categories where an investor had the potential to make at least 4% annualized in the decade beginning in 2010, and with relatively low drawdown. They are sorted from the highest risk-adjusted return (Martin Ratio) to the lowest.

Table #3: Lipper Category Performance During 2010 Through 2019

10,000 Foot View of Risk, Reward, and Income

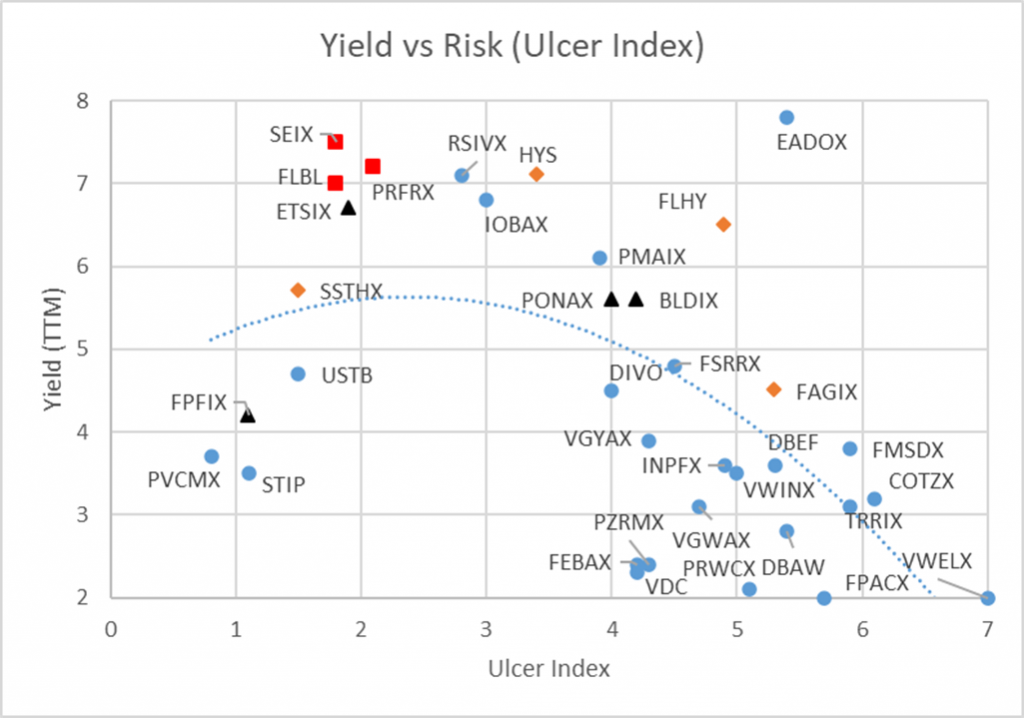

This past month, I set up twenty “pass or fail” tests for nearly seven hundred funds that I track, and identified around seventy funds that passed at least seventeen of these tests. For example, one test is that in periods of low yields, during which the fund was in existence, it had returns of at least three percent. Other tests were for risk, consistency, returns, yields, and so on. These sixty-seven funds now make up my 2026 Watch List.

Figure #2 shows yield (TTM) versus risk as measured by the Ulcer Index for thirty-five funds in my 2026 watch list. The red squares are Loan Participation funds. Multi-sector funds (black triangle) have more diverse performance. Performance of high-yield funds (gold diamonds) is also very diverse. Those in the lower right-hand corner are mostly in the mixed-asset and flexible portfolio Lipper Categories. As pointed out earlier, funds with a lower risk of drawdown have yields that tend to fluctuate with the interest rate cycle, while higher risk funds have yields that tend to fluctuate with the stock market cycle. Those in between may have the potential to provide a steady income.

Figure #2: Yield (TTM) vs Risk (Since January 2020)

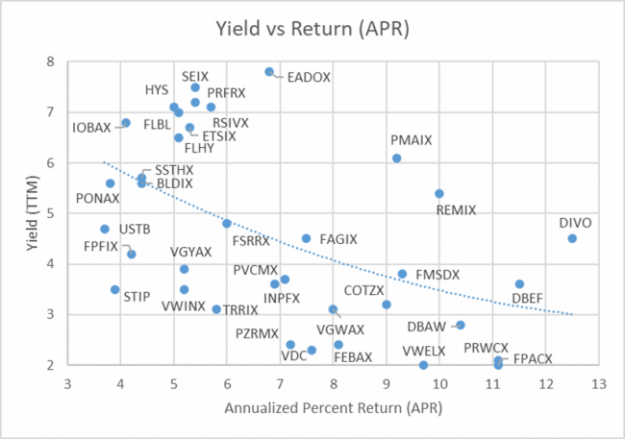

Figure #3 shows the yield (TTM) versus return of some of the funds in my 2026 Watch List. If yield is a consideration when designing a portfolio, moderately risky funds can be identified that pay a decent dividend. Standpoint Multi-Asset (REMIX), Amplify CWP Enhanced Dividend Income ETF (DIVO), Victory Pioneer Multi-Asset Income (PMAIX), and Eaton Vance Emerging Markets Debt Opportunities (EADOX) stand out for having both high returns and a higher yield (TTM).

Figure #3: Yield vs Return – Since January 2020

Ground Level View of Income Funds

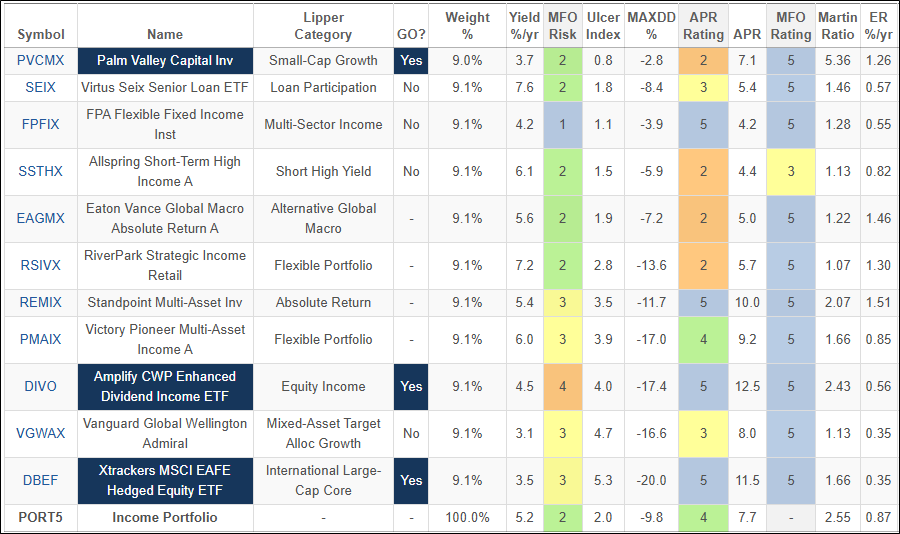

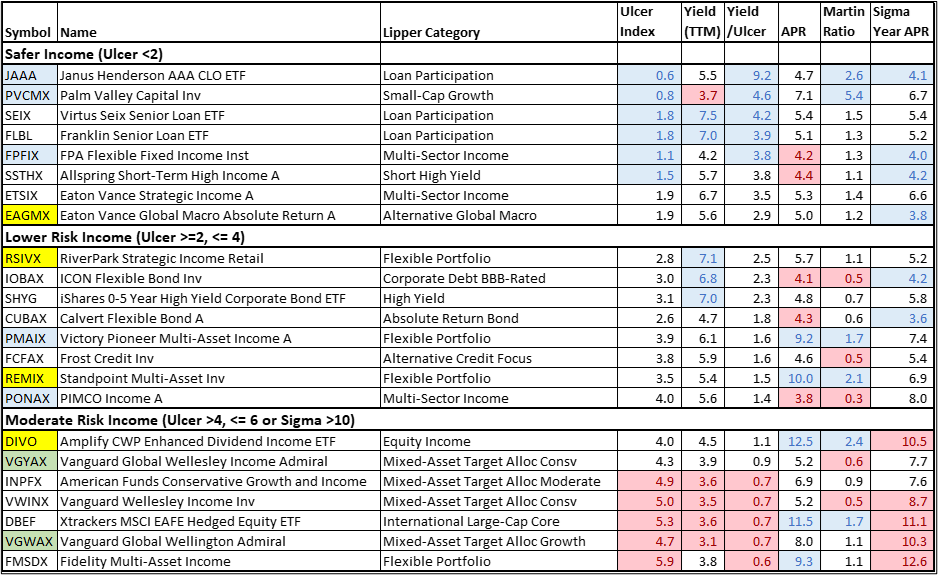

Table #4 is my short-list of income-producing funds. The five funds shaded blue are in my conservative Core TIRA. I own shares in the two green shaded funds in other accounts. I find the four funds that are shaded yellow to be potential buy candidates for the Core TIRA. “Sigma Year APR” is the “typical year-to-year variation in return APR since fund inception”.

Table #4: Funds with High Yields by Risk Level – Since January 2020

Source: Author Using MFO Premium fund screener and Lipper global dataset.

NOTE: Metrics for JAAA are life of fund, which is less than the others.

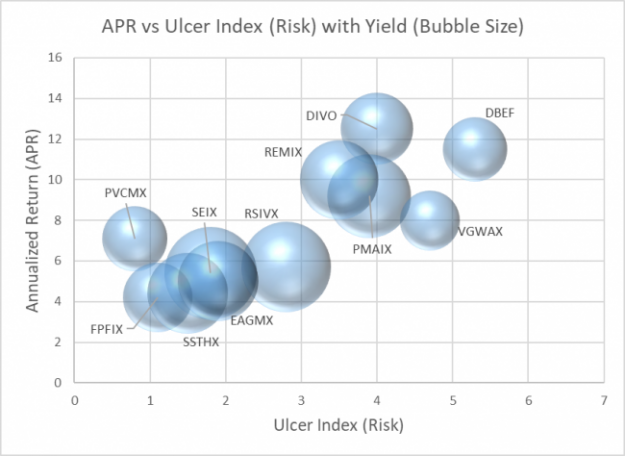

In Figure #4, I selected funds with consistent risk-adjusted returns that pay a high yield (TTM). The bubble is proportional to the yield.

Figure #4: APR vs Risk with Yield

Table #5 is an equal weighted portfolio of the high-income funds shown in Figure #4 above. The yield is 5.2% with an APR of 7.7% and a maximum drawdown of -9.8% for the past 5.9 years.

Table #5: Portfolio of High TTM Yield Funds – Metrics 5.9 Years

SHARE CLASSES

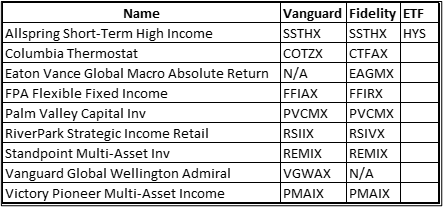

As a general practice, I use share classes of funds that are available at Fidelity without a load or transaction fee. Fidelity has been offering more funds with no load and no transaction fee, so I have expanded my universe of funds tracked. Table #6 shows the share classes available at Vanguard and Fidelity, along with a highly rated ETF in the same Lipper Category if it is in my watch list.

Table #6: Share Classes Available at Fidelity and Vanguard

Closing

Over the years, I have dabbled in income-producing funds, including closed-end funds, but was disappointed with the high volatility and drawdowns. I began using the “Yield/Ulcer Index” as part of my rating system, but historical yields tell a more complete picture. Before my 2026-midyear review, I plan to calculate the historical distribution yields for a select group of about forty funds in my watch list to help make informed decisions.

New Year’s Resolution #1: Don’t underwrite lobotomies

Ninety years ago, emergent science and a self-assured entrepreneur came together to offer a quick and cheap solution to an intractable problem.

The press loved it. The public became enamored, and demanded more and more of it. The Nobel committee awarded a Prize for it.

It seemed like a good idea at the time.

It always does.

The magic wand in 1936 was the lobotomy, executed with an ice pick thrust into the eye socket, in front of adoring crowds, by Dr. Walter Freeman.

The story of Walter Freeman’s “ice pick” lobotomy tour is horrifying in its own right, but it’s also an interesting reminder of why we can become enamored with a new technology even when the evidence of its effects is literally staring us in the face.

Understanding loboto-mania in 1936 perhaps offers a window on Chat-mania in 2026.

The lobotomist as miracle worker

In the decade after 1936, Walter Freeman turned lobotomy from an exotic neurosurgical experiment into a mass‑market “solution” for overcrowded asylums and distressed families. He championed a simplified transorbital technique that used an ice‑pick‑like orbitoclast hammered through the eye socket, often with only electroshock to knock patients out, so that he and other psychiatrists could operate outside surgical theaters and without neurosurgical training. (Right: he was not a surgeon; his training was in neurology and psychiatry.)

The effects of gouging a hole in the front of the brain were, let’s say, reasonably predictable. Freeman’s lobotomies sometimes reduced severe agitation but frequently caused profound emotional numbing, cognitive damage, lifelong disability, and a notable risk of death (10-15% in some estimations), making the overall effects devastating for many patients.

You would think the bloody horror of it would dent the procedure’s popularity. You would be incorrect. The fact that the procedure was crude, irreversible, and only loosely tied to scientific understanding of the brain did not stop its spread; if anything, the simplicity of the story, one quick intervention to quiet disorder, was part of the appeal.

Freeman became a showman and salesman. He crisscrossed the United States in a van named the Lobotomobile, barnstorming more than 50 state hospitals, performing or supervising thousands of lobotomies—sometimes dozens in a single day—under headlines that celebrated a miracle cure for intractable mental illness. Media coverage highlighted grateful families and quick discharges. He continued operating into the late 1960s until a patient died during her third lobotomy.

Freeman became a showman and salesman. He crisscrossed the United States in a van named the Lobotomobile, barnstorming more than 50 state hospitals, performing or supervising thousands of lobotomies—sometimes dozens in a single day—under headlines that celebrated a miracle cure for intractable mental illness. Media coverage highlighted grateful families and quick discharges. He continued operating into the late 1960s until a patient died during her third lobotomy.

Lobotomy flourished because it promised to solve real institutional crises: underfunded, overcrowded mental hospitals, limited therapies, and public pressure for visible action. The procedure was cheap, fast, and scalable; administrators could “empty the back wards” far more easily than they could fund staff, long‑term psychotherapy, or community care. Professional legitimacy followed: Egas Moniz received the 1949 Nobel Prize for the leucotomy, lending an aura of scientific inevitability to a technique that many neurosurgeons already viewed as reckless.

The rhetoric around lobotomy echoed that aura of inevitability. Advocates described it as cutting‑edge psychosurgery, a humane, scientifically grounded intervention that would free patients from torment and relieve overburdened families and institutions. Its harms were re-framed as acceptable side effects: people reduced to near catatonic dependency were cheerily described as calmer, more manageable, less anxious.

cutting‑edge psychosurgery, a humane, scientifically grounded intervention that would free patients from torment and relieve overburdened families and institutions. Its harms were re-framed as acceptable side effects: people reduced to near catatonic dependency were cheerily described as calmer, more manageable, less anxious.

We offer this historic vignette because we’re yet again being offered the opportunity to deal with serious challenges via lobotomy, though this time the procedure involves algorithms rather than an ice pick. They are being sold, with familiar confidence, as solutions to everything from student success to research productivity to investment performance. Let’s check in quickly on three possible sites for modern lobotomies: your house, your alma mater, and your portfolio. We’ll offer the humble suggestion that perhaps, just perhaps, Resolution #1 for 2026 should be: do not underwrite lobotomies, even the frictionless digital kind.

Your home lobotomy kit

Human beings are cognitive misers. Thinking hard is metabolically expensive (even at idle, our brains consume 20% of all the energy we use), effortful, and slow, so we habitually reach for shortcuts whenever we can get away with them. Rules of thumb substitute for calculation, to-do lists or written notes substitute for memorization, and purchased flowers substitute for expressed emotion.

Human beings are cognitive misers. Thinking hard is metabolically expensive (even at idle, our brains consume 20% of all the energy we use), effortful, and slow, so we habitually reach for shortcuts whenever we can get away with them. Rules of thumb substitute for calculation, to-do lists or written notes substitute for memorization, and purchased flowers substitute for expressed emotion.

Psychologists call this “cognitive offloading”: the use of external tools and actions to reduce the load on internal memory and attention. Offloading is not inherently bad; writing a shopping list is better than trying to juggle 17 items in working memory, and structured note‑taking can deepen learning rather than weaken it. But the same mechanisms that make offloading efficient also make it dangerous: when a tool makes it easy to skip the work of understanding, the brain, true to form, will often take the deal.

The healthy question “what options should I consider?” is supplanted by “what should I do?” Students, especially in courses they’ve been “forced” to take, can upload a course reading (or direct AI to an online version) plus a course assignment, and hit “complete this assignment for me.” Lawyers, including those representing the federal Department of Justice, have repeatedly been caught submitting arguments they’ve neither written nor read, containing court decisions that never occurred. Scientists are submitting AI-written research to AI-edited journals read mostly by AI-bots, citing findings that never occurred in the physical world … but that become part of the next generation of AI training data.

A growing body of work shows the trade‑offs. Experiments in which people can store information externally find that they perform better in the moment, yet remember less later if they treat the tool as a substitute for learning rather than as a support. Reviews of digital technology use link heavy, habitual reliance on devices to reductions in sustained attention and self‑initiated effort, raising concerns about a slow drift from “I don’t need to think here” to “I’m not sure I can think here without my tools.” When generative AI is used as an answer machine, it accelerates that drift by offloading not only memory but whole sequences of reasoning, evaluation, and revision.

If the first lobotomy was physical and irreversible, the new risk is a kind of voluntary, distributed cognitive atrophy: a gradual outsourcing of curiosity, interpretation, and judgment until our own muscles for those tasks weaken from disuse. That is not inevitable, but it is the path of least resistance.

Three New Year’s rules for using AI

To resist that path, you might adopt three simple rules for the year ahead:

- Never accept the first answer: Treat every AI output as a draft or provocation, not a conclusion: ask for counterarguments (“I believe the US stock market is historically overvalued and prone to catastrophic collapse, what are the contrary arguments best supported by credible sources?”), alternative framings, and missing objections, and then decide which are actually persuasive.

- Use it to amplify, not replace, your reasoning. Ask a dumb question, get a dumb answer, so don’t ask dumb questions. Instead, imagine yourself with a partner (I talk with my students about talking with an over-eager intern on their first day) who does good work if and only if they fully understand what’s up and what you need. Use a three-part approach to AI collaboration: (1) explain what challenge you’re facing – whether it’s a vegan friend coming to a barbecue or a family budget that’s crushed under the weight of energy costs. Don’t just name the challenge, explain it. The richer the explanation, the more prospect of a sensible rejoinder. (2) explain what help you’re looking for – “I need three options, rank-ordered from least to most costly, with verifiable sourcing that you share” – rather than vaguely requesting “a fix.” (3) empower rejoinder. Ask the AI “what else do you need to know? What questions do you have? What factors haven’t I considered?” rather than assuming that you’ve been clear, complete, encyclopedic.

- Force yourself to write and revise without it, at least some of the time.

Deliberately set aside projects or phases (first passes at an argument, key analytic moves) where you think on paper without machine assistance, so that the skills of structuring, connecting, and clarifying ideas remain practiced rather than vestigial.

These are not purity tests. They are reminders that your mind, like your body, adapts to the demands placed on it; tools that constantly invite under-use will reshape the user.

Your alma mater’s lobotomy kit: branding the “AI-ready” graduate

If individual users are tempted to let AI think for them, institutions may be even more tempted to let AI solve problems they have never been willing to face directly. Universities embrace fads with a ferocious passion that would appall most 13-year-old girls. In the 30 years since I acquired the sweater I’m wearing as I write this, universities have embraced more “revolutions” cooked up by marketers than I can count:

“Flipped classrooms” promised to turn professors from “the sage on the stage to the guide by the side” in the early 2000s.

An embrace of “learning styles,” as is “I’m a visual learner,” became common just after the start of the 21st century despite the utter absence of evidence that they, well, exist. (Here’s one hint about the evidence: researchers have identified no fewer than 71 different “learning styles” in the higher ed literature.)

MOOCs, massive open online courses, were heralded in the early 2010s as an existential disruptor of higher education, with universities racing to launch courses and partnerships that promised global reach but ultimately produced modest completion rates and limited revenue and collapsed into “the institutional sediment.”

“Green campus” campaigns packaged sustainability as a marketing asset long before many institutions made costly, less visible changes in energy systems or land use.

Laptop‑for‑all programs and “classroom of the future” initiatives similarly promised transformation, yet observational work has found that students spend a substantial share of in‑class device time on non‑course websites, with corresponding hits to attention and performance.

Universal design for learning, initially framed as a deep pedagogical shift “that anticipates student differences rather than reacting to them,” is supported by … hmm, let’s call it “modest” evidence of effectiveness, and is often implemented at the level of slogan and compliance checklist rather than as a thoroughly resourced redesign of curricula and assessment.

Almost all of these initiatives share two characteristics: the commitment to them maxed out at an inch deep, and the evidence for them was mostly marketing hype. (To be clear, environmentally sustainable practices: good; big green banners declaring The Center for Sustainability Initiatives: bad.)

Universities are rushing to brand themselves as “AI‑forward,” “AI‑enhanced,” or “AI‑powered,” often with vague promises of personalization, efficiency, and “innovation at scale.” The University of Florida brands itself as “the nation’s first AI university” and promises “AI everywhere,” the Cal State system as “Nation’s first and largest AI-empowered university system,” the Ohio State University promises to make every student “bilingual” in their major and AI applications, the Council of Independent Colleges runs a program literally titled “AI Ready” to boost AI adoption and a bunch of schools have taken to building and deploying their own chatbots.

In many cases, the technology is a thin layer over unchanged structures: the same classes, the same incentive systems, the same support gaps, now described in more futuristic language.

The risk in the current wave is that AI is framed as a painless cure‑all for deep structural issues: chronic underfunding, over-reliance on contingent labor, escalating student needs, political interference, and weak advising and mentoring systems. The more AI is sold as a substitute for time, attention, and genuine human relationships, the closer it comes to a digital lobotomy: a way to quiet disorder without addressing its sources.

Three rules for intelligent giving

If you are a donor, alumnus, or foundation considering support for “AI in education” this year, a few tests may help:

- Follow the labor: Prefer projects that invest in faculty time, advising capacity, and student support, those using AI as a tool inside those relationships, over projects that promise savings by replacing human contact with automated nudges and chatbots.

- Demand real evaluation, not dashboards: insist on evidence that proposed AI initiatives actually improve learning, retention, or equity, and treat glossy dashboards and prediction scores as marketing, not proof.

- Ask what happens if the fad fades: the sustainability challenge. Support efforts that build durable skills and infrastructure – data literacy, transparent pedagogy, open materials – rather than brittle dependency on some quickly assembled office or newly hired administrator, both of which will be quietly abandoned when the next wave of hype arrives. (If they say “that will never happen!” ask them for a report of the state of diversity and inclusion efforts on campus. An awkward silence will follow.)

The question, always, is whether AI is being used to deepen the slow work of teaching and learning, or to avoid it.

Your portfolio’s lobotomy: the invisible intrusion

The pattern is not confined to campuses. Recent industry surveys suggest that a large majority of investment advisors—on the order of 90 percent—are adopting AI tools for research, portfolio construction, and client communication. Some of this use is healthy: automating routine screening, flagging anomalies, and stress‑testing portfolios under different scenarios. But the same temptations that haunt individuals and universities appear here as well: overconfidence in opaque models, pressure to appear “cutting‑edge,” and a willingness to let black‑box systems propose or even select portfolios that few humans fully understand.

If you want to avoid underwriting lobotomies in your own financial life, it is worth asking your advisors simple, concrete questions:

- Which parts of your process are automated, and why? Where does human judgment overrule the model, and on what basis?

- How will you know if the AI‑driven system is failing, and who is accountable when it does?

The goal is not to reject algorithmic help, but to refuse the story that it absolves anyone of thinking. MFO conducted a test of AI-generated investment advice. The results are instructive, and we report them separately in “What five AIs told me about 2026’s best investment.”

Technologies that deserve trust tend to make experts more careful, not less. They reward patience. They sharpen judgment. They do not promise to remove the hard parts of thinking, only to support them.

Lobotomy promised relief by subtraction. AI sometimes makes the same offer.

So a modest resolution for the year ahead: don’t underwrite lobotomies. Resist tools—personal or institutional—that trade understanding for efficiency, judgment for fluency, or struggle for speed. The hardest intellectual work has always been inefficient. That inefficiency is not a flaw. It is the price of having a mind worth trusting.

What Five AIs Told Me About 2026’s Best Investment

And what their answers tell you.

In mid-December 2025, I asked five AI systems – ChatGPT, Claude, DeepSeek, Grok, Perplexity – the same deliberately unfair question: “given current market condition and historic patterns, what is likely to be the highest returning asset class available to US investors in 2026?” The question is unfair because nobody can know that until 2027, and because it ignores all of the important stuff, information about the investor’s horizon, needs, and temperament, which is vastly more important than raw returns information.

Every system rushed to answer rather than challenge the (dangerous, stupid) premise. They marshaled citations, built confidence through length, and buried disclaimers after pages of analysis. DeepSeek: 1,200 words of scenario planning. Grok: comparative tables. ChatGPT: implementation steps.

The consensus answer? All confidently predicted U.S. equities would lead, particularly AI-driven tech. The runner-up consensus favored international and emerging market equities (citing extreme valuation discounts to U.S. markets), with private equity and long-duration Treasury bonds appearing as high-conviction contrarian plays depending on whether the economy achieved a soft landing or tipped into recession.

Only Claude in incognito mode – stripped of context about who was asking – pushed back meaningfully: “Here’s what concerns me about your question: asking ‘what is likely to be the highest returning asset class’ suggests a search for a single answer when the evidence points to profound uncertainty.” Then it asked the questions that actually matter: “What’s your situation? Time horizon? Current allocation? Risk tolerance?”

Only Claude in incognito mode – stripped of context about who was asking – pushed back meaningfully: “Here’s what concerns me about your question: asking ‘what is likely to be the highest returning asset class’ suggests a search for a single answer when the evidence points to profound uncertainty.” Then it asked the questions that actually matter: “What’s your situation? Time horizon? Current allocation? Risk tolerance?”

But you would note the hedge words that followed every forecast: “if earnings materialize,” “assuming soft landing,” “barring geopolitical shock.” These weren’t uncertainty disclaimers; they were reminders that the confident frameworks were built on unknowable conditionals.

This is cognitive offloading weaponized. An advisor doing this face-to-face reads body language, probes anxiety, and discovers what’s really being asked. The algorithm just answers – fluently manufacturing certainty from insufficient information. It doesn’t know it’s performing a lobotomy. It’s just following the affordances of the technology: you ask, it responds, everyone’s satisfied with having done something.