Traditionally, the job description for a core bond manager was numbing: (1) show up for work, (2) buy a bunch of Treasury bonds and some investment grade intermediate corporates, (3) celebrate the trading coup that allowed you to buy the same bond as everyone else but for a quarter basis point less – woohoo!, (4) go home and enjoy a fiber-rich dinner and small glass of red wine.

In reality, managers added negligible value. Over 10 years (through August 2025), the core bond fund trailing 75% of its peers returned 1.7% annually, the iShares Core US Aggregate Bond ETF (a proxy for “the market”) returned 1.8% annually, and a fund leading 75% of its peers returned 2.2%. Net difference between cellar and penthouse: 0.5% per year. (Source: MFOPremium calculations, Lipper Global Datafeed data.) And that’s pretty typical for other trailing periods. As a result, relative returns were highly dependent on efficiency: very large funds with very low expense ratios, able to place bids on very large lots of very efficiently priced bonds, had a nearly unbeatable structural advantage.

Cellar versus penthouse

10-year performance difference between

the top quartile and the bottom quartile

Core bond: 0.5% annually (per MFO Premium)

Core stock: 1.6% annually (per Morningstar)

In a world where US Treasury bonds are the world’s safest investment and among its most reliably profitable, it was an unbeatable recipe.

We might be leaving that world behind, which suggests we might need to consider possibilities where diversification and manager judgment might add substantial value.

That implies the possibility of considering an ongoing stake in credit rather than just investment grade, in international rather than just U.S., in special situations rather than just vanilla auctions, and in shorter durations.

The case for looking broadly

For intelligent investors—regardless of whether financial analysis is a daily habit or a distant interest—it’s becoming increasingly difficult to ignore the mounting alarm bells surrounding the United States’ fiscal outlook. In mid-2025, the national debt stands at over $37 trillion, a sum now greater than the entire American economy. This staggering figure reflects years of budget deficits and a political climate where policy decisions often appear driven more by ideology, self-interest and brinkmanship than any rational economic strategy. Even major investors, once reliant on U.S. Treasury bonds for security, are beginning to question how much longer the world’s largest borrower can sustainably fund its needs without consequence (Drew Desilver, “Key facts about the US national debt,” Pew Research, 8/12/2025).

| National debt before the Reagan Revolution (1980) | $900 billion 32% of GDP |

| National debt (2025) | $37.4 trillion 120% of GDP |

(Sources: Historical Debt Outstanding, US Treasury; Federal Reserve Bank of St Louis, 9/2025)

These fiscal realities are not happening in isolation. As the U.S. government takes on more debt, with rising costs just to pay interest, confidence in federal bonds has begun to erode. Recent episodes of political gridlock over spending caps and the debt limit have highlighted just how reactive and unpredictable U.S. fiscal policy has become. The practical effect is a new era of vulnerability for traditional income portfolios anchored almost solely on U.S. Treasuries and investment-grade corporates. Investors are seeing the value of home-country assets increasingly shaped by fiscal risk and short-term fixes rather than predictable economic fundamentals.

In contrast, a growing number of foreign markets not only boast more attractive valuations but also signal ripening opportunities as non-U.S. economies chart their own paths out of stagnation. Diversification, therefore, isn’t simply about chasing higher yields or speculating abroad—it’s emerging as a necessary hedge against the potential excesses of U.S.-centric fiscal and market dynamics.

One measure of that changed dynamic is Research Affiliates’ estimates of the risks and returns, given a series of uniform economic assumptions, of dozens of asset classes. The following table gives the 10 highest Sharpe assets plus the US bond aggregate. Categories in black are fixed income (seven of 11), and blue are equity.

By contrast, the three asset classes with negative expected 10-year Sharpe ratios are US Large-Cap stocks (-0.03), Developed Markets Large Growth stocks (-0.06), and US Large Growth stocks (-0.12).

Bottom line: investors need to consider looking for core exposure, not just 5% nibbles, in areas beyond the common.

Income beyond the ordinary

The bad news is that many of the most intriguing income investments are not easily accessible to most investors: closed-end interval funds such as RBC Blue Ray Destra International Event-Driven Credit (CEDIX) or Carlyle Tactical Private Credit (TAKNX), often have high minimums and limited brokerage access. Others, such as SEI Opportunistic Income (SIIT) Fund and GMO Emerging Country Debt, are institutional. Those structural quirks – the ability to use leverage and to lock large investments in place by denying investors the chance to redeem at will – give those managers exceptional advantages.

That said, there are intriguing options available to regular investors. We searched the MFO Premium database for funds that met six criteria:

- They had a record of five years or more.

- They were income-oriented.

- They could invest globally and across asset classes.

- They returned at least 4% annually. By comparison, the Vanguard Total Bond Market Index has lost 0.8% annually over the past five years.

- They moved independently of the US bond market (downside capture of less than 50%, correlation of less than 75%).

- They earned the MFO Great Owl designation (funds must have top 20% risk-adjusted returns for all the trailing measurement periods).

And, finally, they had to be purchasable.

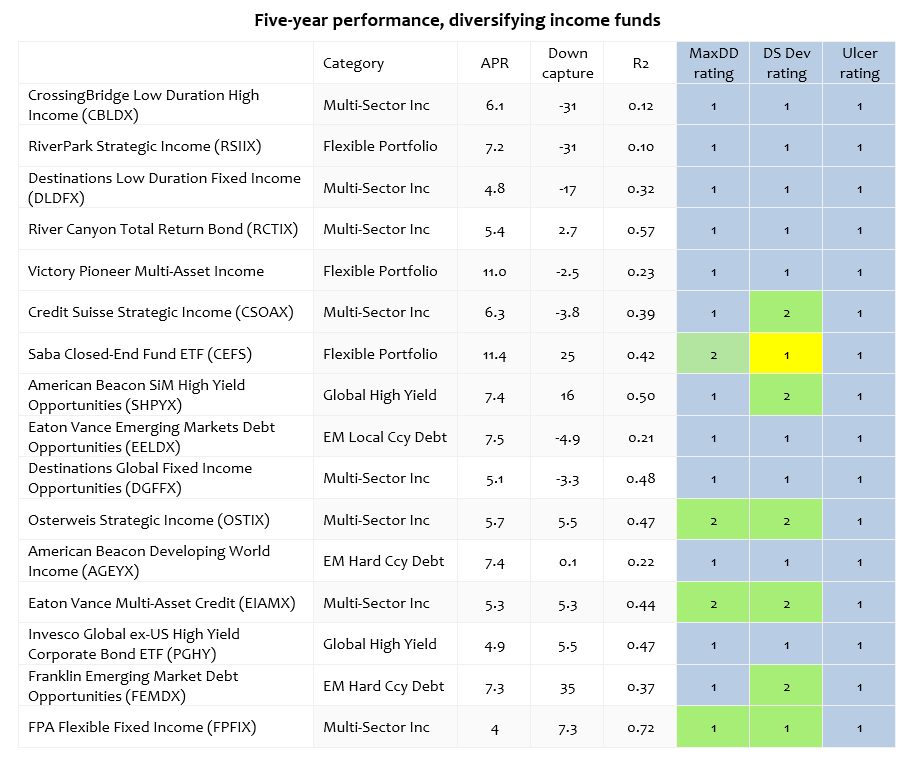

Sixteen funds survived the cut. The funds are sorted by Sharpe ratio.

How to read that chart: The first three columns are easy. Name, Lipper fund category, and average yearly return over the past four years. Down capture is the percentage of the US bond market’s downside that the fund captured. A negative down capture means the fund tended to rise when the US bond market fell. The R-squared (R2) measures the degree of correlation between the fund and the US bond market: 100 means that the fund marches in lockstep with the bond market; 0 means the fund is completely independent of it. Finally, visual represents of three performance metrics: a maximum drawdown rating (how far the fund fell relative to its peers), downside deviation rating (called “bad deviation,” it’s a measure of how much a fund routinely falls relative to its peers) and Ulcer rating (our favorite: a measure of how far a fund falls and how long it takes to recover; deep fall + long recovery = massive investor ulcers). In each case, a blue cell signals top 20% performance.

Snapshots of the winning funds

- CrossingBridge Low Duration High Income targets high current income and moderate capital appreciation by investing in short-maturity high yield debt, generally with maturity under three years, emphasizing principal protection and reducing credit and interest rate risks. The fund stands out for its active management in the short-duration segment and prioritizes risk mitigation over chasing yield, aiming for consistent income with lower volatility than typical high yield funds.

- RiverPark Strategic Income pursues income and preservation of capital through a flexible, bottom-up portfolio of investment-grade and high-yield corporate debt, preferreds, convertibles, bank loans, and income-producing equities, with average duration from 2.5-4 years. Its opportunistic approach allows shifting between higher-yielding and more defensive assets as market conditions dictate, and it is noted for its ability to invest in special situations for potential excess yield during periods of market stress. Nota bene: four of the 16 funds on this list rely, at least in part, on the skills of the CrossingBridge/Cohanzik management team. It’s in Snowball’s personal portfolio.

- Destinations Low Duration Fixed Income employs a multi-manager strategy, which currently includes CrossingBridge Advisors for event-driven high yield credit opportunities and DoubleLine Capital for low duration strategies. It’s focused on generating current income with low duration.

- River Canyon Total Return Bond employs a bottom-up credit selection process with a top-down overlay and aims to identify securities that exhibit upside optionality with downside protection, focusing on selecting securities with a likelihood of outperformance across a wide range of macroeconomic and market scenarios. It focuses on exposure to securities and sectors that have historically low correlation to traditional asset classes.

- Victory Pioneer Multi-Asset Income is a flexible, globally diversified fund investing across a wide spectrum of income-producing assets, including bonds, dividend-paying equities, and cash equivalents. Its strategic asset allocation balances income generation and long-term growth, making it suitable for moderate risk tolerance and dynamic market conditions. The managers are seeking to exploit low correlations of global fixed income and non-investment grade debt markets with US investment grade markets.

- Credit Suisse Strategic Income combines leveraged loans and high-yield corporate bonds in a distinguished high-yield strategy with the managers adjusting its portfolio’s exposure among various types of debt instruments based on market conditions and outlook, currently primarily investing in bonds issued by domestic and foreign companies, senior secured floating rate loans, and mortgage-backed securities, asset-backed securities, and CLOs.

- Saba Closed-End Fund ETF invests in closed-end funds trading at significant discounts to their net asset value, seeking to generate monthly income and capital appreciation. The fund distinguishes itself with an activist approach, aiming to narrow those discounts and unlock value, and utilizes hedging to mitigate interest rate risk; its diversified holdings provide exposure to both equity and fixed income closed-end funds.

- American Beacon SiM High Yield Opportunities offers a flexible approach and a willingness to invest in edgier segments of the high yield market, which leads to periods of elevated volatility in exchange for higher potential payouts.

- Eaton Vance Emerging Markets Debt Opportunities is a flexible emerging markets bond fund that invests across sovereign and corporate credits, local currencies, and off-benchmark opportunities in over 100 countries. Eaton Vance applies rigorous economic and political research to build a portfolio that captures diverse sources of emerging market debt income, often moving beyond conventional benchmarks for enhanced risk-adjusted returns and country-level diversification.

- Destinations Global Fixed Income Opportunities uses a multi-manager, multi-sector approach to invest in global investment-grade and high-yield bonds, sovereign debt, bank loans, preferred securities, and convertibles. The subs include DoubleLine, Numeric, Man Group, and Cohanzick.

- Osterweis Strategic Income pursues long-term capital preservation and moderate income by actively allocating across high-yield and investment-grade bonds, with frequent tactical shifts in response to market conditions. The fund is distinguished by an unconstrained, flexible approach from an experienced and lean management team, resulting in a strong historical record for risk-adjusted returns, albeit at a manageable volatility level.

- American Beacon Developing World Income pursues income through a globally diversified in sovereign and corporate bonds from emerging and frontier markets. It stands out for using 16 managers and several sub-advisers (Global Evolution A/S, abrdn, Sydbank…) specializing in lesser-known country and sector exposures.

- Eaton Vance Multi-Asset Credit invests across a broad spectrum of credit-related assets such as high-yield bonds, senior loans, structured credit, preferred and convertible securities, and emerging market debt. The fund’s core appeal lies in tactical allocation and an active focus on reduced downside and avoidance of permanent capital impairment.

- Invesco Global ex-US High Yield Corporate Bond ETF tracks an index of US dollar-denominated, high-yield bonds issued by corporations outside the United States. Its distinguishing features include broad global diversification with a monthly rebalance.

- Franklin Emerging Market Debt Opportunities invests predominantly in debt obligations from sovereign and sub-sovereign issuers in emerging countries, with a flexible approach that includes select corporate debt.

- FPA Flexible Fixed Income pursues positive absolute returns over any three-year period – it’s an FPA hallmark – and strong risk-adjusted returns by investing across the fixed income universe, unconstrained by benchmark or sector, with a strong emphasis on capital preservation. Unique for its willingness to hold cash and reduce risk when opportunities are limited, FPFIX is run by a seasoned team at First Pacific Advisors.

Bottom line

MFO does not make “sell now!” or “buy now!” calls, much less predictions about “the 10 funds you absolutely must own!” Those calls are easy to make, impossible to make reliably. Our argument is simpler: we are in the midst of a fiscal mess, which is likely to get messier and messier. It would be prudent, before any panic sets in, to examine the question: are there ways to reduce my exposure to emerging risks and still earn a decent return?

The funds above have made money over the past five years; the US bond market has not. Those funds uniformly aim to provide high current income with admirably low exposure to the traditional income markets. And it reminds us, again, of the consistent independence and excellence of the CrossingBridge folks who are responsible for the two highest-rated funds on the list (CrossingBridge Low Duration and RiverPark Strategic Income).

We will try to profile three of these funds each month during the last three months of 2025.