“Yearning for the good old days is not an investment strategy”

Objective and strategy

The strategy is to preserve capital and attain long-term total returns through a combination of current income and moderate capital appreciation. The managers invest in income-producing securities, primarily high-yield bonds, but will shift the allocation to managing a changing risk and opportunity set. Such changes might include shifting toward higher quality or shorter duration securities and increasing the fund’s cash stake. As of February 28, 2023, 77% of the portfolio is invested in high-yield bonds with an average duration of about 2.6, and 13% is held in cash. The 30-day yield is 6.9%.

Adviser

Osterweis Capital Management. Headquartered in San Francisco, the firm by founded in 1983 by John Osterweis. Their firm-wide ethos is “the avoidance of major losses in falling markets and the compounding of reasonable gains in rising markets.” They provide investment management for individuals, families, endowments, and institutions. In 2022, the Zeo Capital Advisors team joined Osterweis, bringing their two mutual funds under the Osterweis moniker after shareholder approval. The firm advises seven mutual funds, and as of 12/31/22, assets under management were $6.4 billion.

Managers

Carl Kaufman, Bradley Kane, and Craig Manchuck.

Carl Kaufman, Bradley Kane, and Craig Manchuck.

Mr. Kaufman is the co-president and co-CEO for Osterweis Capital, as well as the CIO for the strategic income strategy. He has managed the fund since 2002 and co-manages Osterweis Growth & Income.

Mr. Kane joined the team in 2013. Prior to joining Osterweis Capital Management, LLC in 2013, Mr. Kane was a Portfolio Manager and Analyst at Newfleet Asset Management, where he managed both high yield and leveraged loan portfolios.

And Mr. Manchuck came on board in 2017. Prior to joining Osterweis Capital Management in 2017, Mr. Manchuck was a Managing Director of Fixed Income at Stifel Nicolaus from 2013 to 2016 and Knight Capital from 2008-2013, where he was responsible for sales and origination of high yield bonds, leveraged loans, and post reorg equities.

Collectively the team has 100 years of investment experience and manages about $5 billion in fixed-income assets.

Strategy capacity and closure

Mr. Kaufman notes that $7.3 billion, the fund’s previous asset peak, “was not a strain,” and they’re billions below that. His recommendation is that we “ask again at $10 billion.”

Management’s stake in the fund

Mr. Kaufman has invested over $1 million in the fund, Mr. Kane is north of $500,000, and Mr. Manchuck has over $100,000. In total, eight of the firm’s managers and three of its trustees are invested in the fund. The source for all of that is the 3/31/2022 Statement of Additional Information.

Opening date

August 30, 2002.

Minimum investment

$5,000, reduced to $1,500 for IRAs and other tax-advantaged accounts. Individual brokerages, e.g. Schwab, can set other limits.

Expense ratio

0.84% on assets of $4.7 billion, as of July 2023.

Comments

Remember all the homely bits of the good old days? A roll of freshly churned butter and milk that had to be shaken to distribute the cream. The evening paper on the coffee table. Pa reading aloud from his favorite feature in the latest Reader’s Digest, “Laughter is the best medicine.” Ma working on the pan gravy that went with her fried chicken. Global admiration for America’s three greatest generals: General Electric, General Mills, and General Motors. Single-digit P/Es, 14% interest on passbook savings accounts, and interest rates just beginning to drift down from the stratosphere. To paraphrase Mr. Banks in Mary Poppins, “money is sound, credit rates are going up, up, up, and the American dollar is the admiration of the world!”

All of which are wonderful memories but dismal grounds for constructing an investment portfolio for 2023 and beyond. The cold reality is that the stock market remains near historic highs, making P/E contraction more likely than expansion, and interest rates seem on track for “higher for longer.” Both raise the prospect of dismal returns for traditional strategies using indexed or index-like approaches. Layered onto that is that non-zero prospect of politicians doing something staggeringly stupid in pursuit of political gain or a moment’s notoriety.

Osterweis has a three-part plan. It’s a clean, simple plan which reduces the risk of having it outsmart itself.

Part One: Avoid panic.

Most of today’s investors have never had to navigate markets marked by high inflation, rising interest rates, contracting P/E multiples, or the absence of “the Fed put.” If you grew up thinking that flat prices, zero interest rates, high P/E ratios, and Alan Greenspan were all your entitlements, it’s understandable that their sudden disappearance would be unsettling … and unsettled investors are prone to do stupid things.

As befitting guys who’ve seen many markets and styles and fads come and go, the Osterweis folks seem somewhere between sanguine and positively upbeat. In their early 2023 review, they write:

Once the markets have adjusted for the absence of free money (or in the case of Europe, “pay you to take it” money), what comes next? Barring a black swan event, life will continue, coping mechanisms will take hold, and markets for financial and real assets will find their equilibrium. Sometimes it helps to take a step back to have a broader view of what markets are offering today versus what we have gotten accustomed to in the past decade or so in order to find the right path to better returns.

The adjustments the markets have seen in the past year are painful, but they are presenting us with better opportunities for rational investing such as getting paid a decent return to lend money. What an old-fashioned concept! Selectivity and flexibility should be winning gambits.

Part Two: Maintain a long-term stock-bond balance.

They believe that long-term investors should maintain a 60/40 portfolio, though in individual cases, that might mean 50/50 or 65/35, but the goal is something in the direction of a stock-bond balance. The vexing question is, “what exactly goes into the 60? What’s the 40?” Their answer is 60% dividend-paying equities and 40% strategic income.

Dividend-paying stocks, in particular the stocks of companies growing their dividends, offer the prospect of capturing much of the stock market’s upside while adding a stream of income and some downside buffer.

The Strategic Income strategy focuses on investments in high-yield securities. Fixed-income investments face risk, a fact masked by 30 years of declining interest rates. For investment-grade fixed income, especially with passive strategies, the risk comes from rising interest rates that can lead to catastrophic mark-to-market losses. Osterweis believes that investors are better served by looking at securities that carry credit risk. “Credit risk” is the notion that an issuer might not be able to meet their debt payment obligations fully and promptly. That risk is controllable through a combination of good fundamental research (don’t invest in people who can’t pay their bills) and flexibility in choosing how to invest in companies:

Your readers need to understand we’re afraid of our own shadows. We don’t take a lot of risk. We look at each investment as if it were the only investment we’re going to make. One question forms our lens: “if you could only own one bond, is this the one?”

… we do a significant amount of work to determine the company’s business prospects as well as the positive and negative levers in its financial model, which influence the company’s ability to generate cash flow …our ideal investments are in companies that have great products, a competitive advantage that gives them pricing power in the market, a consistent operating history, and management that operate the company as if they own it. Finally, we determine what we believe to be the appreciation potential versus the downside risk to gauge the attractiveness of the security versus other available investment opportunities.

We’re invested in around 115 companies, far fewer than the 300-500 that are common in fund portfolios. We engage in rigorous testing, try to find the most attractive parts of the market then the least risky ways to play it. And we’re not afraid to keep cash, all of which means that the ride with us will be much smoother.

Part Three: Stay flexible.

Their research allows them to understand the risks each position poses. They have the freedom to mitigate those risks by shifting higher in the credit structure, shortening durations, shifting sector focus, or holding more cash.

… our research has shown that the various sectors of the bond market behave differently under different economic conditions.

We believe that by avoiding the “style box” trap and having the flexibility to invest in multiple classes of bonds, we can manage each portfolio in such a way as to emphasize the most attractive sector at any given time. By strategically shifting out of overvalued assets, we strive to minimize potential risk and produce better returns over time.

All of which has worked exceptionally well.

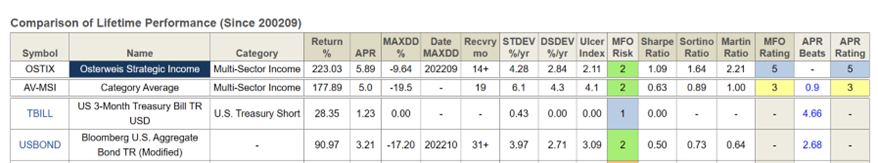

Since its inception, Osterweis Strategic Income has outperformed its Lipper peers by 90 basis points annually and the US bond aggregate by 268 basis points. Both their “normal” volatility (measured by standard deviation) and their “bad” volatility (measured by downside deviation) are far lower than the average multi-sector income fund and only marginally higher than an investment grade fund. In consequence, their risk-return metrics – the Ulcer Index plus Sharpe, Sortino, and Martin ratios – are all far higher.

Osterweis captures that same dynamic in a series of scatterplots, which we do not have a license to reproduce, that compare their fund’s 20-year returns and volatility against a series of Lipper peer groups: their native peer group, Multi-sector Income, plus High Yield Bond and Alternative Credit. In each case, the pattern is the same: OSTIX is one of the least volatile options with some of the highest returns. Another way of putting it: if you wanted somewhat better returns, you had to endure vastly higher volatility.

For those worried about bear markets: since inception, OSTIX has captured 14% of the S&P 500’s downside and 21% of the downside of a traditional 60/40 portfolio … and has a negative downside capture against the US bond market. That is, when traditional bonds have fallen, OSTIX has risen a bit (7.7%, to be exact).

Bottom Line

The record is clear. Osterweis is one of the two or three best strategic income funds available to investors. Over a period of decades, it has managed to nearly double the returns of the bond aggregate – even during a long, rate-driven bull market for investment grade bonds – with scarcely any greater volatility. Over the past decade, when the market has favored less prudent strategies, Osterweis has managed 4.0% annual returns as both their three-year and five-year rolling average. Over the long term, the fund’s three- and five-year rolling average has been around 5.8%. Mr. Kaufman believes that, with a macro environment more favorable to their style, returns of that higher magnitude remain plausible.

Investors who recognize that the era of easy, riskless returns in investment grade bonds has likely ended, at least for this generation, but who still need to prospect of steady income and ballast for a stock-heavy portfolio have an outstanding option here. They ought to explore it soon and carefully.