An interview with Lewis Kaufman, founding portfolio manager of the Artisan Developing World Fund

My primary investment biases are two-fold. First, in general, I invest in public markets through low-cost, low-turnover passive vehicles. Second, in general, I invest in US equities. Both of those biases were arrived at through a combination of (painful) experience and careful research. That said, none of us benefit from being held hostage by our beliefs. In many ways, humility and self-doubt, curiosity, and the determination to keep learning are the hallmarks of our wisest citizens. And I aspire to learn from them. In consequence, I’ve spent a huge amount of time over the past six months talking with a cadre of the industry’s best emerging markets managers.

Home Bias

Investors worldwide have a powerful bias toward investing disproportionately in their home country. That’s true whether “home” is the US, India, or France. A June 2022 research paper by Martin Wallmeier and Christoph Iseli in the Journal of International Money and Finance titled “Home Bias and Expected Returns: A structural approach” shows the level of domestic securities owned by investors in various countries around the world. As of 2020, US investors held 81.63% of their assets in US equities. This resonates with me as 85% of my equity assets are in the US.

Most of us are aware of two important things – one, it would be nice to be geographically diversified outside the US for a greater percentage of our investments. And two, it’s been a complete waste of time to try, as the returns outside the US have simply not kept up with domestic returns. A lot of my columns on EM investing and funds (1), (2), (3), and (4) are my endeavor to unearth interesting fund managers and funds for me to diversify.

I’ve tried to share my discoveries over the months.

This month I’m delighted to continue that journey with you by reviewing my conversation with Artisan’s Lewis Kaufman, demonstrably one of the best of the best.

We’ll structure this travelogue around five topics:

- Who is the guy?

- What does he do when it comes to managing?

- How does he do?

- What does he believe about the current state of EM investing?

- Finally, what did I – and what might you – take away from the exchange?

Who should read this article?

Everyone.

Who should invest in Artisan Developing World?

Not everyone.

This is an actively managed fund with a 1.3% expense ratio, focuses on emerging markets, holds Chinese stocks, and despite its fantastic cumulative returns, suffered a brutal drawdown in the 2021-2022 bear market. Even if any or all of those things put you off, you should still read this article and follow the fund. You will walk away with lots of investment nuggets from understanding Kaufman’s perspective on emerging markets and equity investing in general. For the right investor with a solid risk appetite, this fund might be very interesting. I think Lewis Kaufman is an excellent investor with a solid investment process and demands a very close look.

Topic one: Who is this guy?

Artisan Partners and Lewis Kaufman

Artisan has a distinctive partnership model. It starts by adding partners, generally, entire management teams, that Artisan believes are phenomenally talented. MFO’s publisher, David Snowball, has been following Artisan for a quarter century and describes them as one of a tiny handful of consistently successful boutiques. Artisan conducts due diligence on dozens of management teams each year but might find only one team every two years that meets their standard. That standard is not that the team is very good; it’s that the team has the capacity to crush its category. They brought in 10 teams since their founding in 1994 and give each of them both support and autonomy. That means bringing in investment talent at a thoughtful pace. More information on their model can be found here.

Artisan has a distinctive partnership model. It starts by adding partners, generally, entire management teams, that Artisan believes are phenomenally talented. MFO’s publisher, David Snowball, has been following Artisan for a quarter century and describes them as one of a tiny handful of consistently successful boutiques. Artisan conducts due diligence on dozens of management teams each year but might find only one team every two years that meets their standard. That standard is not that the team is very good; it’s that the team has the capacity to crush its category. They brought in 10 teams since their founding in 1994 and give each of them both support and autonomy. That means bringing in investment talent at a thoughtful pace. More information on their model can be found here.

Lewis Kaufman is one of the most distinguished emerging market managers in the industry. He has been an investment professional for more than two decades. He made his name and came to Artisan’s attention as manager of Thornburg Developing World Fund from inception through early 2015. During that time, he amassed a remarkable record for risk-sensitive performance. A $10,000 investment at inception would have grown to $15,700 on the day of Mr. Kaufman’s departure, while his peers would have earned $11,300. Morningstar’s only Gold-rated emerging markets fund (American Funds New World Fund NEWFX) would have clocked in at $13,300, a gain about midway between mediocre and Mr. Kaufmann.

Lewis Kaufman is one of the most distinguished emerging market managers in the industry. He has been an investment professional for more than two decades. He made his name and came to Artisan’s attention as manager of Thornburg Developing World Fund from inception through early 2015. During that time, he amassed a remarkable record for risk-sensitive performance. A $10,000 investment at inception would have grown to $15,700 on the day of Mr. Kaufman’s departure, while his peers would have earned $11,300. Morningstar’s only Gold-rated emerging markets fund (American Funds New World Fund NEWFX) would have clocked in at $13,300, a gain about midway between mediocre and Mr. Kaufmann.

Lewis Kaufman has been an investor for 24 years, has traded many market cycles, is highly informed on macro and micro, speaks very fast, and ties in themes, stories, and stocks from all over the EM world. He graduated cum laude with a bachelor’s degree in English from Colgate University and holds a master’s degree in business administration from Duke. He has earned the ridiculously rigorous CFA Charterholder designation.

Topic Two: What does he do?

The Artisan Developing World Fund launched in June 2015 under Mr. Kaufman’s leadership. Mr. Kaufman pursues a compact, primarily large-cap portfolio. He’s willing to invest in firms tied to, but not domiciled in, the emerging markets. And he has a special interest in self-funding companies, that is, firms that generate free cash flow sufficient to cover their operating and capital needs. That allows the firms to insulate themselves from both the risk of international capital flight and dysfunctional capital markets, which are almost a defining feature of emerging markets. The fund currently has over $3 billion in assets.

The picking of stocks and the running of a portfolio is a highly complex process for even an individual. For an active manager, these challenges are compounded: which stocks to own, when to rebalance, when to exit, what makes a new stock worth owning, how to fund it, the external macro risks, portfolio drawdown considerations, and most importantly – PROCESS CONSISTENCY.

For experienced investors and for those who wish to become experienced, listening to Kaufman’s investor update would be a good way to understand the process.

“Process Consistency allows value creation in moments of chaos rather than impairing capital. It provides us staying power and a way to tackle a wide array of problems.”

The manager uses two main strategies: Flexion and Correlation.

Correlation is easier to understand. The fund looks for companies that have a return profile similar to the other stocks in the fund (that is, the possibility of extraordinary returns). However, they look for these stocks to be uncorrelated to the existing stocks in the portfolio. The idea is for these correlation stocks to provide a ballast to the rest of the portfolio and allow the ability to reduce capital in these Correlation stocks in order to add to the Scalable stocks. In effect, the better term is Uncorrelated Stocks, but we get the point.

What is Flexion? According to Kaufman, it is a way to preserve the integrity of outcomes.

Take this example he gives: “Suppose I have specific concerns about risk in China. I own a stock that is down 40% from the high. It is currently 3% of the portfolio. Suppose I blow out of the entire stock. I have 300 bps of capital to decide what to do with. I don’t want to abruptly blow out of a stock, or a region, only to then chase the stock on the way up. My instinct is contrarian, not momentum. Instead, I can be more gradual in my selling approach and wait for other, better businesses to become available at good prices. Then, when I trim my existing position, I can add to the other better business. And I also preserve the optionality that my existing position has a chance to reflate back. For example, SE was down 70% last year and is already up 65% in 2023.”

The fund wants to trim positions at moments of low reinvestment risk such that investor capital will not be impaired. This, by the way, does not mean there will not be volatility. This fund is not a money market or even a bond fund! It clearly has a lot more volatility than most funds. But it is thoughtful, preconceived, and expected volatility. It’s not like the ARKK fund that hopes to ride momentum or some macro theme. The manager is providing capital to companies that are trying to run an investment program where the process comes before everything else, and the goal is to generate disproportionate equity outcomes. This does not work well in all kinds of markets and economic environments. In an extremely bad economic scenario, these companies and the fund will be hurt. The period from 2019 to 2023 is instructive in the large rallies and sell-offs the fund endured. Kaufman’s faith and discipline in his process have kept him steering the ship, but not without stomach-churning periods.

Kaufman added, “In adverse periods, people tend to lose their process. Some managers went all into ESG, and then two years later, you look at the portfolio, and there is Exxon and BP in the fund. I am trying to be very consistent with my investment program. Historically, and I have invested for 24 years, the portfolio has a strong track record and emerged very well coming out of a crisis.”

Topic Three: How does he do?

Quite well. And for quite a long while.

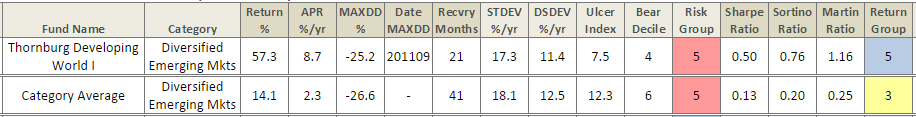

By all of the risk and risk/return measures we follow, he achieved those gains with lower volatility than his peers. Here’s Thornburg under his watch.

Mr. Kaufman’s performance at his previous charge is remarkable: he posted returns that were 370% of his average peers’ while having a lower maximum drawdown, a lower standard deviation, a lower downside deviation, and a vastly higher Sharpe ratio. We can compare that to the performance of his current charge.

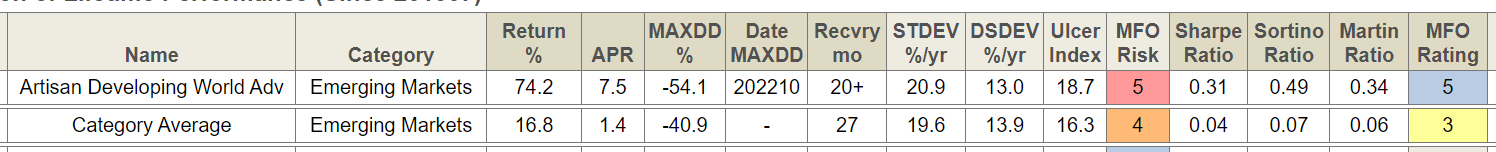

Since its inception, Artisan Developing World has had returns that are 570% of its average peers. The volatility advantage that Thornburg held over its peers has largely disappeared, but the difference in returns is so much greater that Artisan’s Sharpe ratio is almost eight times higher than his peers.

Let us be clear about this: Mr. Kaufman has a 5:1 return advantage over his peers after two purely disastrous years. In 2021 he lost 10% and trailed 90% of his peers, and fans might have asked, “how much worse can it get?” They got their answer in 2022 when he lost 41% and trailed 100% of them.

Yikes.

At this point, bad investors would declare, “well, he’s lost it,” and would bail after suffering enough. Good investors, contrarily, would ask, “how can we make sense of this? And how can it help us position our portfolios for the future rather than for the past?” Because we have faith in you and we try to help our readers become better investors, those are exactly the questions we explored on your behalf with Mr. Kaufman and his team.

We know investing internationally has been a tough neighborhood, but the Artisan fund has produced excellent absolute and relative results. But how has it managed to do so, and why should we spend time on it? To understand this, Mutual Fund Observer sat down with Lewis Kaufman and his team. Through our Q&A and his deeply insightful Q4 2022 Investor Update, I have learnt a lot. In this article, I hope to outline – Kaufman’s evolving thesis on emerging markets, his investment PROCESS, his understanding of relative risks in places he is NOT invested, and why he believes in his investment style and process.

Topic Four: What does he believe about the current state of EM investing?

Some of the questions from our extended interview follow.

Question: how would you place your discipline on the growth – value spectrum?

“My impulses are not momentum oriented. My impulses are contrarian in nature,” says Kaufman. “I am running an investment program with a very consistent process with a portfolio of securities which have the potential of delivering disproportionate equity outcomes. It baffles me that people think you can only be value oriented in value stocks. We have a high growth, high valuation set of assets that have experienced extreme valuation compression (ed. note: in 2021-2022). We don’t own companies that are ever going to be 10x earnings. Airbnb, Mercado libre, Crowdstrike, Nvidia, and Adyen are some of our top holdings. They trade at 45x next 12-month earnings vs. an average of 140x a year ago. The multiple compression came from prices going down but also because earnings are compounding. Is 45x the right multiple? I don’t know, but it’s a whole lot lower than 140. Because of our process (ed. note: described below), we have a history of coming out very strongly when the cycle turns.”

Returns of the Artisan Developing Fund selected years.

| Life | 2019 | 2020 | 2021 | 2022 | 2023 Q1 |

| 8.31% | 41.89% | 81.52% | -9.7% | -41.27% | 21% |

“Relative to the past, this bear market (2021-2022) has been concentrated in scalable assets that are most consistent with long term value creation. In the past, some of the best stocks were scalable stocks like Mercado Libre. In this market drawdown, they have been the worst stock. In previous market cycles, they behaved differently. But maybe in the future, these stocks will be more resilient,” says Kaufman.

Question: how have emerging markets as an asset class evolved?

Early on, Kaufman believed that the demographic dividend plus high productivity potential might lead to high potential GDP across EM countries. China’s entry into the WTO and the commodity boom of the first decade in the 21st century benefitted many EM countries.

“Many investors still think of EM as being a low penetration, high growth area, but since 2009, I have operated with a different thesis. Emerging Markets are not progressing in an optimal way, which is constraining the growth and demand opportunity. The countries want to grow, but they are unable to manifest this growth for many reasons.” Understanding those constraints has helped Kaufman decide what to invest in and what to avoid.

“Starting the year 2015, it was becoming obvious that potential GDP was falling. Instead of investing in human capital, many countries had engaged in fiscal transfers and caged themselves in the middle-income trap.”

“Large pools of skilled labor do not exist, except in China. Most emerging markets do not have enough pools of savings to encourage domestic capital formation (that is, allow companies to raise money from local investors). They depend on foreign capital. But to a large extent, foreign capital investments have slowed down. As productivity and output are slowing, with limited innovation happening there, capital is averse to entering emerging markets.”

“Brazil was once expected to grow at 4.5-5%, but now most economists put that number at 2.5%. India was expected to once grow at 9-10%, and now 6-6.5%.”

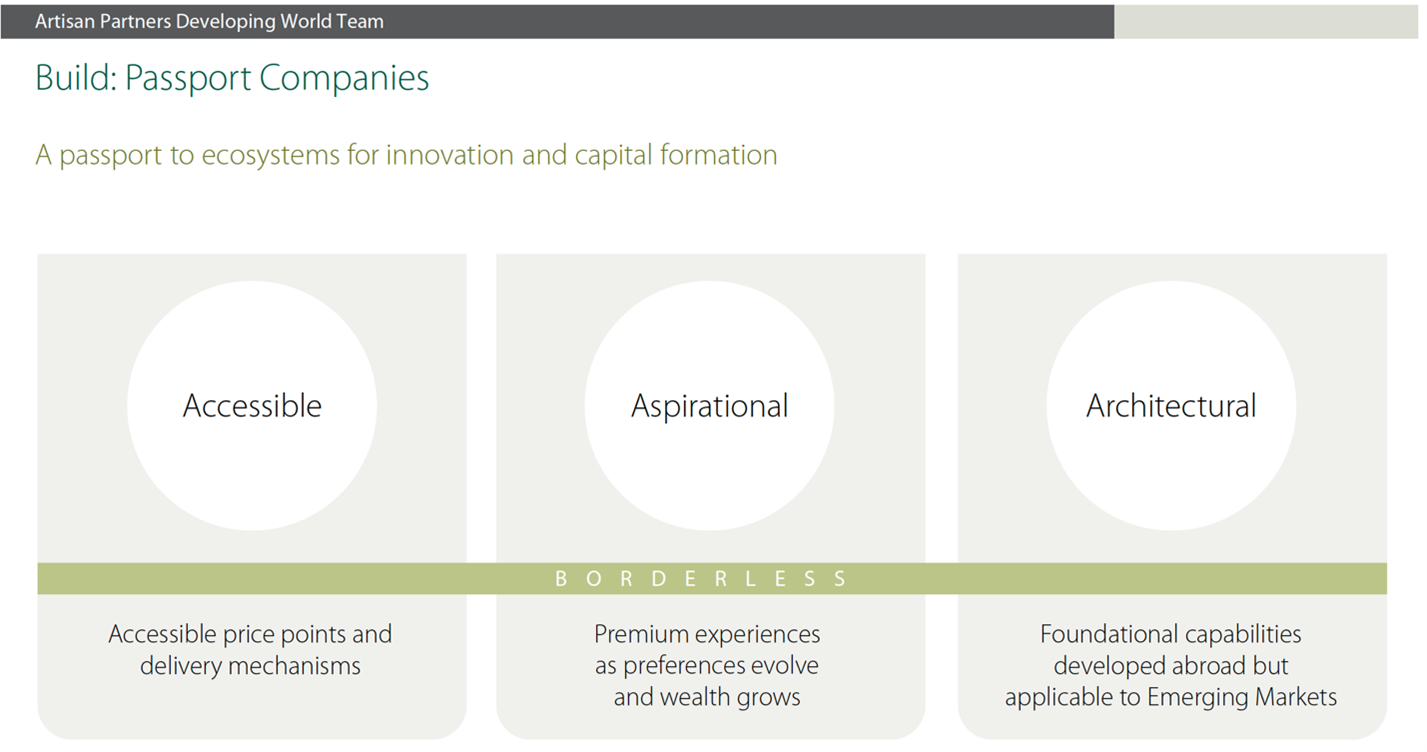

Kaufman does not see himself as a cheerleader for the emerging market asset class. Instead, he now sees Emerging Markets as large latent pools of domestic demand. He believes different tools are needed to invest in this EM world, and for him, those tools are to find Scalable Companies and Passport Companies. These companies have the “potential for disproportionate equity outcomes,” a phrase he keeps revisiting many times. Scalable companies are able to transcend the constraints, and Passport companies are able to cross borders easily to meet customer demand.

This thesis has led Kaufman to assemble a portfolio that looks very different than an MSCI EM Index or even the average EM actively managed fund. While the MSCI EM Index has 1375 securities, the fund has 33 stocks. 55% of the fund is invested in developed markets, in stocks such as Airbnb, NVIDIA, SEA Ltd, Visa, and Crowdstrike.

Help us understand why you have such a high percentage of stocks in developed markets, we asked: “The Passport companies (like Nvidia and Airbnb) are bringing the innovation and capital formation to the EM. Of course, in the case of Nvidia, they have a meaningful part of their business coming from the EM already. And Airbnb fits in the aspirational category as the EM population desires travel and experiences in the same way that the developed market population does. With the prevalence of the economic constraints in the EM, we find Passport Companies to be an important tool.

What about scalability and tapping large pools of latent demand? “We believe that businesses with scalability are uniquely able to transcend those constraints. So, in the case of Mercado Libre, Brazil and Argentina might not be progressing in an optimal way. However, MELI’s ability to generate revenues from multiple sources with favorable business economics is allowing them to extract value from that latent demand pool. Crowdstrike is a different case where it certainly has scalability, and it is passporting – crossing borders easily to meet demand. It is also providing a foundational capability to the emerging markets since security software simply is not as available or advanced in the emerging markets.”

Most investors know the general markets and some mutual funds or ETFs well. We certainly don’t know individual stocks at the level active fund managers and hedge fund managers would. I don’t drive myself crazy understanding the rationale on each position. Learning about individual investments made by a fund manager is part of the equation to investing in a fund but not the only reason to invest or avoid a fund. Stock positions should offer a window of transparency, not a prediction of the future.

Question: how do you see the role of China in an EM portfolio?

China: It is the one large country in EM unique in the level of income achieved and structural drivers. In 2022, despite Zero Covid, Social Finance grew by double digits in China. It has more capacity for domestic capital formation (that is, domestic companies can raise money from the locals) than any other EM country and is less dependent on foreign capital than others. Kaufman talks about his individual Chinese company picks in the Investor call. He talks through why he believes companies like Meituan are scalable. They have 100s of millions of wealthy users across Tier 1 and Tier 2 cities across China. When they order food through Meituan’s food delivery app, the ticket sizes are bigger, they order more frequently, and they order desserts. Meituan has a local service business that serves as a YELP function for its customers. They receive advertisements from the businesses. Thus, the company is able to monetize its fixed R&D in multiple revenue streams (much like Mercado Libre above).

Adds Kaufman, “Economically, for the reasons discussed (skilled labor and domestic capital formation), China is more attractive than the other EM countries. However, external risks have risen. Given this backdrop, we have allowed our weights to come down naturally, kept alignment to our highest conviction companies in China while using the China reduction to add to other opportunities (at periods of low reinvestment risk). Even with the lower weight, our alignment to what we see as the better opportunities has preserved the participation in the opportunity and the correlation advantage, yet we have reduced the risk.”

While they don’t measure their over/underweight to the benchmark, the fund is running about 10% underweight to China.

Related question: what, then, is the role of India?

With a country of over a billion people, India would seem like a natural place for the fund to invest. However, HDFC Bank is the only investment the fund has there.

“We know the companies well in India. We have invested in the past. All those companies are durable, not scalable. Not conducive to disproportionate equity outcomes. Define all of them by constraints of affordability. Define all of them as expensive due to demand by foreign direct investors and domestic mutual fund investors.”

I pressed him for his source of discomfort for getting bigger on India. He said he would like to provide capital to Indian companies, but the opportunity is not right. India needs to create more high value jobs outside of agriculture. Right now, investible India is a population closer to 200-300 million people for the services that can be sold and for the company in which he can invest that sell those services. India needs more capital formation and needs companies to invest in jobs, which can create consumption, which creates the ability to lever up. Apple and Foxconn are trying but mostly down the value chain. More capital formation needs to happen higher on the value chain.

“India is not China in the size of its wealthy consumers. Besides, the large mutual fund industry is captive for the stock market there. And valuations aren’t cheap. Ten years ago, I was invested in Asian Paints, Dabur, Titan. Revenues were growing mid-teens and P/E multiples were around 21-22 times. Today, the companies have matured. Revenues are growing high single digits and P/E are 45 times. Much of the total returns in India in these stocks has come from multiple expansion over the time period.”

For a specific stock investment he avoided, Kaufman gives the example of Zomato, which came public in 2021. In India, the customer base of users is closer to 75mm, much smaller than in China. Ticket sizes are smaller, and people order less frequently. The Indian restaurant business is unlikely to become formalized, which means less organized merchant partners with budgets to bring on for ad dollars.

Kaufman also stayed clear of Paytm, which had a public offering in 2021. “Turned out the business has been disrupted by Indian direct payment systems.” According to Kaufman, “India hasn’t been a trustworthy partner for foreign investors. Sometimes, the goalpost moves. Regulations change and are altered to be favorable to domestic players. We want to be involved in India, but we need stocks and capital formation, and we are not going to invest in India just to meet a benchmark number. We need companies to be aligned to what we are trying to do.”

As I mentioned last month, I have been invested in India through private equity and hedge fund, and they are both doing just fine. Not everyone is looking to invest in a scalable business the way the Artisan Developing fund is looking to do. There are many ways to skin a cat. Seafarer’s International Value fund, for example, a topic of David Snowball’s column this month, while not invested in India, is generally a vehicle where Paul Espinosa looks at traditional value, as opposed to Kaufman’s growth value.

Question: at the other end of the spectrum are the frontier markets countries. Do you have much interest in them? If not, why not?

In the Investor call, Kaufman lays out very clear reasons why he finds most of Africa uninvestable – the lack of an institutional framework for FX in Nigeria, and corruption in S. Africa. In Latin America, the fund has investments in Mercado Libre and Nu Bank but not much else. The shift to the political left as a form of populism is leaving much of Latin America unfavorable for equity investments. He doesn’t consider Mexico’s AMLO trustworthy for business, despite the potential for massive friend shoring there. Many Middle Eastern countries are too dependent on commodities. In South-East Asia, the fund is invested in SEA Limited, but not much else. Thailand cannot go up the value chain. The Philippines cannot create jobs. Vietnam is a small market. Indonesia is interesting but needs more companies. None of these can raise large domestic capital for their companies and are foreign-dependent. Even more dependent on foreign capital are countries which sporadically have huge returns and otherwise crash – Turkey, Egypt, Colombia, Peru, Chile, and Poland. There are a lot of external risks, weak institutions, and political considerations that make most of these countries uninvestable.

Perhaps I learnt the most from one sentence Lewis Kaufman said, “There is just not a lot going on.”

As investors, we have to pause and process that sentence. What are we doing when we are being passive investors in Emerging Markets or in International Markets? We are trying to extract risk premium because that’s what we’ve been told makes sense. But does it always?

If countries cannot raise domestic capital, if their institutions are broken, if they have large populations but low income, and if the customers have inconsistent and tenuous consumption habits, then the companies that are trying to build capacity there will not be able to use operating leverage to compound earnings. When there is not a lot going on, supplying capital as equity holders makes little sense for us to do. Especially if valuations are not super low, like in India.

Maybe there are other ways to invest in those markets. FX or Bonds could be interesting in Brazil and Mexico, but equities are a different kind of beast. The companies need to be fed a lot of customer transactions to monetize. It’s not easy to get repeat customer business. The Artisan Developing fund’s investment program is trying to find and stick consistently with such scalable and aspirational companies that can figure it out. Lewis Kaufman does not want to invest in companies unless they are aligned with his process.

Topic Five: What we’ve learned and what we might do

I now believe this Artisan fund will soon find its way into my portfolio, just as Seafarer and Moerus have been added in the last six months. William Blair’s EM funds, run by Todd McClone, is also on my very short list.

Every individual investor has their own risk parameters and personal situations. No fund is correct for every investor. No writer should recommend a fund for all investors. Therefore, here’s what I ask myself and encourage you to ask yourself:

Am I a good investor in the kind of companies this fund picks? I am not. I can’t keep up with so many companies. And I don’t know which ones are good and which are bad. Because I know this about myself, I want to complement my portfolio with the skills of someone who does.

Do I need to be in Emerging Markets and international stocks? Chinese stocks? Well, I’d rather just make a lot of money without doing anything too difficult in life, watch PBS, and play some tennis. But I am young, have a young family, and hope to stick around long enough that I consider both the holding of equities and the withstanding of volatility in equities an important part of my future experience and return set. Returns in stocks are not like earning income in money market funds. Stock returns are lumpy. And passive has not worked internationally and in EM. I look at the Artisan fund with great attention to what it’s done and to the seriousness of the process followed by the fund manager.

Does the Artisan fund represent the right manifestation of that international investment? I can’t predict the future. Not the future returns, nor the volatility, nor the macro environment which we are going into. I want a group of fund managers who are each believers in their investment style, are invested in their cooking, and are willing to wear the volatility of underperformance. More than anything, I pray for each one of them to be lucky.

The Artisan Developing World Fund warrants our attention. Lewis Kaufman and his team have generated substantial total returns in a complex market environment. When I listen to him, I find a rational, thoughtful, long-term investor who understands why people need to hold equities in their portfolios.