Dear friends,

Chip and I celebrated the start of Spring – or at least Augustana’s spring break – with a long sojourn to New Orleans. Our options were either a series of flights totaling about 10 hours or a 14-hour drive. For better and worse, we chose the latter, loaded the car with snacks, books, and music, and headed down the Mississippi from the Quad Cities to the Big Easy. The drive took us through seven states and one swath of utter destruction. The night before our passing, a tornado in Mississippi decapitated a forest adjacent to Interstate 55. Imagine, if you might, hundreds of mature trees either snapped off five feet above the ground or ripped up by their roots. It was spectacular and a sobering reminder of the price we’ll pay for a heating planet.

We ate well – she more adventurously than I, walked a lot, enjoyed live music, feral hogs, and wild alligators.

This issue of the Observer is richer than usual, but our late return from the drive means that this letter will be shorter.

In this issue of the Observer

Emerging Opportunities

There is a compelling argument to be made that there is an investment regime change underway, in Paul Espinosa’s phrase. We’ve come to expect that the right answer to the question “where and how should I invest” is captured in a single phrase: “passively, in US large growth stocks.” It is clear that phrase captures the past. It is less clear that it captures the future. Asset class researchers are increasingly assertive about the prospect that emerging markets might be vastly more profitable – and not necessarily more volatile – than the old US standbys. GMO currently projects a 5.5% annual return from EM and 8.3% for EM value over the remainder of this decade while it sees US large caps being underwater. Research Affiliates projects EM equities as the single highest returning asset, at 8.1% annually for a decade, with US large caps earning one-fourth as much. AQR, a firm once known as Applied Quantitative Research, estimated in March 2023 that EM stocks are now expected to generate about a 3% premium over developed market stocks, one of the highest levels in the past 25 years.

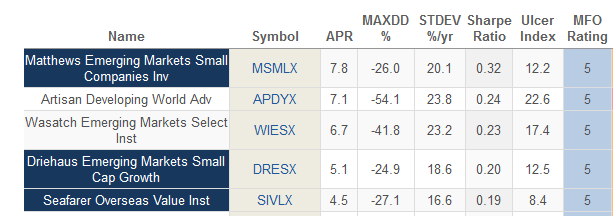

That optimism was hinted at in 2022 when everything went topsy-turvy, and EM stocks kept pace with the mighty S&P 500. In pursuit of the most compelling options, we screened for the diversified EM funds with the best risk-adjusted returns over the past five years. The top five, out of 225, are:

In this issue, I profile Seafarer Overseas Value, a Great Owl fund that was the best performer among all diversified EM funds in 2022. Devesh spent rather a lot of time interviewing Lewis Kaufman and his Artisan Developing World team. Devesh was struck by two stats: (1) the fund crashed in 2022, and (2) despite that, it maintains an almost 5:1 performance edge over its peers since inception.

Strategic Income

I noted in our March 2023 issue I am personally in search of additional fixed-income exposure, and I’ve resolved to find a fund whose performance is not tied to the fate of the broad fixed-income market. That reflects two facts:

- My long-term strategic allocation is out of whack – I’m too exposed to international stocks and too little exposed to fixed income, so more fixed income is good.

- I think most bond strategies are stupid. Or, at the very least, they are mostly dependent for their success on a very hospitable external environment, which I doubt will describe the remainder of this decade.

That led me to explore funds that bore the name “strategic income.” They were drawn from a half-dozen Lipper categories and used a dozen strategies, all with the goal of generating income independent of the broad investment grade bond market.

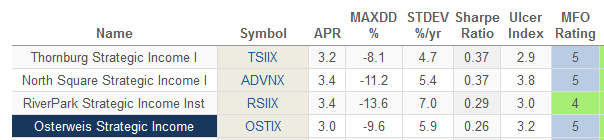

Four funds stood out for their risk-adjusted performance over the past five years.

In this issue, we profile two of them. RiverPark Strategic Income, which we first profiled in 2014, is managed by David Sherman of Cohanzick Management. David has a suite of distinguished, high-performing fixed-income funds, which he manages under both the RiverPark and CrossingBridge banners. Osterweis Strategic Income is managed by a team headed by Carl Kaufman, who has been with the fund since its launch. The three-member team boasts 100 years of experience and a very long record of thriving across markets.

North Square had a complete management team turnover in 2020. Thornburg will appear next month.

Preparing an all-weather bond portfolio

Lynn Bolin, reacting to some of the same forces that motivated me, has pursued the question: what fixed-income strategy succeeds, come hell or high water? He looks at the performance of funds across hostile environments to identify a cadre of durable veterans worth your consideration.

Reflecting on our own record

Devesh Shah takes a moment to go back over five sets of recommendations he’s made in the past year. His desire is both to cultivate a sense of ongoing transparency and shared inquiry and to give you a sense of how his long-term recommendations played in the short term.

And, as ever, Charles Boccadoro keeps us apprised of changes at MFO Premium – still, the best use for $120 investor dollars – and The Shadow shares word of the industry’s twists and turns in “Briefly Noted.”

In memoriam

Steve Leuthold (1937 – 2023) died at his home in California on March 7, 2023. Mr. Leuthold founded the Leuthold Group in 1981, which became famous for rigorous and exhaustive quantitative research into the dynamics of the stock market and surrounding economy. The depth of their insights led their clients to urge them to go beyond research into direct investment management. In 1995, he launched the quantitatively driven, multi-asset, benchmark agnostic Leuthold Core Fund (LCORX). It remains an excellent and distinctive option for investors looking for a one-stop answer to the question, “where can I leave my long-term money and get on with life?”

Steve Leuthold (1937 – 2023) died at his home in California on March 7, 2023. Mr. Leuthold founded the Leuthold Group in 1981, which became famous for rigorous and exhaustive quantitative research into the dynamics of the stock market and surrounding economy. The depth of their insights led their clients to urge them to go beyond research into direct investment management. In 1995, he launched the quantitatively driven, multi-asset, benchmark agnostic Leuthold Core Fund (LCORX). It remains an excellent and distinctive option for investors looking for a one-stop answer to the question, “where can I leave my long-term money and get on with life?”

Mr. Leuthold retired in 2011 and was succeeded by Doug Ramsey, who describes Steve as “a fry cook, law student, history major, Cargill commodities-trader trainee, bar- and dance-club proprietor, and singer/songwriter/guitar player in the rockabilly band Steve Carl & The Jags.” In addition to being a great colleague and fabulous investor.

And philanthropist. Mr. Leuthold donated most of his wealth to the Nature Conservancy and Salvation Army, as well as a number of other causes.

Mr. Leuthold is survived by his wife, sons, daughter, grandchildren, step-grandchildren, and one great-grandchild. They, and his colleagues at the Leuthold Group, are very much in our thoughts and prayers.

Thanks

This month, we thank “He who shall remain nameless” in addition to our indispensable regulars – Gregory, William, Brian, William, David, Doug, Wilson, and S &F Investment Advisors. We also thank you all.

As ever,