Sixty-two funds saw partial turnover in their management teams but no high profile manager stalked off or was shown the door, and no rising star was awarded a new charge. Actually there were rather more than 62, since we don’t track boring bond funds (the value added by the third manager on a Massachusetts muni fund is modest enough that we don’t track those teams; sorry, guys) and, this month only, we’re boycotting changes in the Dreyfus funds. Frankly, Dreyfus got annoying. Their announcements show up in the SEC filings under a bunch of labels (including dozens of Dreyfus series, CitizensSelect, Advantage Funds and Strategic Funds) and were poorly written. We ended up with a headache and the decision to share the following announcement: “about a dozen Dreyfus funds shifted teams this month; if you invest with them, you might want to Continue reading →

Category Archives: Manager changes

Manager changes, January 2018

Ahh … it’s a quiet month on the manager change front. Forty-eight funds saw partial turnover in their management teams but no high profile manager stalked off or was shown the door, and no rising star was awarded a new charge. Despite the pressure for cost containment, 11 of the funds were simply adding to the size of the management team. The month’s sole highlight occurred when Chip encountered Harding Loevner manager Ferrill Roll, declared it “feral” and began wondering about whether he might be a candidate for managing a fund in Westeros. (Note in passing: don’t succumb to the temptation, the penalties for underperforming your benchmark there involve Continue reading →

Manager changes, December 2017

Sixty funds saw complete or partial manager changes, which is right in line with our long-term average. Most months see between 50-70 changes. Just as was the case in September, the most consequential changes are coming from the Third Avenue funds. Michael Winer, manager of Third Avenue Real Estate Value and the firm’s sole remaining star, is retiring after 20 years. His co-managers will need to step up. Just a bit later, the merger of Third Avenue International Value will Continue reading →

Manager changes, November 2017

It’s never a good sign when the guy whose name is on the door is also the guy handed the pink slip. And yet such was the fate this month of the founder of Caldwell & Orkin Market Opportunity. Happily that wasn’t the fate of any of the other 45 funds seeing partial or total manager changes this month. Continue reading →

Manager changes, October 2017

It’s a strange month. At one level, several exceedingly capable managers have been shown the door but at another level, almost no managers have been shown the door. We recorded fewer than 40 partial or complete manager changes this month, about 40% below what’s “normal.” At the same time, fund liquidations are at a multi-year low. Only 23 traditional mutual funds left us, one third of which came from a single firm. The quiet is curious. It might signal a bottoming-out in the industry, or might simply be an anomalous stay of execution for dozens of funds and managers. We’ll keep an eye out. Continue reading →

Manager changes, September 2017

Thirty funds saw complete or partial manager changes, which is a very modest talent. Most months see between 50-70 changes. The most consequential are the changes coming to the Third Avenue funds. The best description we have is that a bunch of the guys hired by founder Marty Whitman were purged during the Barse years. With Mr. Barse’s unceremonious departure, a number of his acolytes have now been shown the door, including “Chip” Rewey, the amiable soul hired to right the ship three years ago. In place of the recent departees, some of the previously purged folks have returned. No word from Mr. Whitman, now 93 and described by Forbes as Continue reading →

Manager changes, August 2017

This month saw partial or complete manager changes at 57 funds. The most consequential occurred at American Beacon Holland Large Cap Growth Fund, following the decision by Holland Capital Management to close after a long and honorable run. That team’s departure occasions a change in the fund’s strategy as well as in its management.

As to the other 56 funds … meh. In the case of Cornerstone Advisors Global Public Equity, which saw the departure of one of 47 managers from one of 14 sub-advisers, the change doesn’t even rise to the level of “meh.” (Nice fund, though.) Continue reading →

Manager changes, July 2017

On July 27, 2017, Morningstar researchers confirmed what we’ve known for years: most manager changes are utterly inconsequential. Messrs. Hawkins and Cates have a combined 54 years at Longleaf Partners (LLPFX); the arrival of a young co-manager is unlikely to make a marked difference. Two interesting consequences that they did observe are that manager changes trigger fund outflows and that the outflows are greatest at large funds, perhaps because media coverage of those funds makes the changes more visible and portentous.

And yet there are times when we ought to note manager changes for entirely different reasons. This month Dowe Bynum, following the discovery of a brain tumor, stepped aside from management of The Cook & Bynum Fund (COBYX). Dowe is a good guy to talk with, funny and smart, a caring spouse and a dad with young children. We’re sanguine about the fund’s operation: there’s always been a contingency plan in place, they’ve recently added analytic support and they pursue a low turnover (9%) discipline. We know Dowe is receiving very good care and want to add our voice to the chorus of support and good wishes. Continue reading →

Manager changes, June 2017

It’s been a relatively unexciting month on the manager change front, perhaps with folks regrouping over the quiet summer months. Five of the departures were triggered by announced retirements, which is a bit higher than usual. FPA got bounced off the team at Litman Gregory Masters Smaller Companies (MSSFX). On the one hand, that’s not terribly surprising: the managers’ main charge, FPA Capital (FPPTX), has trailed 94% of its Morningstar peers over the decade that lead manager Dennis Bryan has been in place. On the other hand, it is surprising that they lasted so long: FPA has been managing a portion of the portfolio for a decade, while the average tenure of managers at MSSFX is two to three years. It’s worth pondering the implications of that turnover: Litman Gregory’s specialty is manager selection and they have a lot of resources to deploy in finding the best managers and still, within a very few years, the majority of them are no longer contributing enough to remain. It does highlight the Continue reading →

Manager changes, May 2016

Each month, many funds undertake partial or complete changes in their management teams. Most are inconsequential, because they involve marginal changes in teams or the substitution of one inoffensive MBA-holder for another. That pretty much describes this month’s changes; 41 funds saw partial or complete changes in their management teams, none earth-shattering. Because bond fund managers, traditionally, had made relatively modest impacts of their funds’ absolute returns, Manager Changes typically highlights changes in equity and hybrid funds. Continue reading →

Manager changes, April 2017

Each month, many funds under partial or complete changes in their management teams. Most are inconsequential, because they involve marginal changes in teams or the substitution of one inoffensive MBA-holder for another. Because bond fund managers, traditionally, had made relatively modest impacts of their funds’ absolute returns, Manager Changes typically highlights changes in equity and hybrid funds.

Out of this month’s 40 tracked changes, the switch to AMG Managers Fairpointe Focused Equity Fund – which places star manager Thyra Zerhusen solely in charge of a struggling small fund – is interesting and the announcement that Salim Hart and Sam Chamovitz are the managers of Fidelity Low-Priced Stock Fund was briefly terrifying (the announcement did not make clear that Mr. Tillinghast remained). Jamie Harmon, has, however, Continue reading →

Manager changes, March 2017

It’s really rare that the world’s largest investment firm stages a full-scale revolution, but the scope of BlackRock’s changes this month – including the dismissal of 30 investment professionals including seven lead managers and the shift of billions in assets to new quant-based disciplines – seems to have that feel. Not quite a whiff of desperation but certainly determination. And, oh yes, investing legend Mark Mobius has moved into the shadows and 70 other funds underwent less changes. Continue reading →

Manager changes, February 2017

It’s a quiet month on the manager change front. While nominally there’s a greater deal of management turnover in a given year, practically most of it is insignificant because the 27th member of a team leaves and is replaced by an equally adept newbie. This is one of those months. We’ve identified 35 manager changes this month, few involving the installation of an entire new team and only two or three affecting “household names.”

Because bond fund managers, traditionally, had made relatively modest impacts of their funds’ absolute returns, Manager Changes typically highlights changes in equity and hybrid funds. Continue reading →

Manager changes, January 2017

The good folks at Grandeur Peak worked hard in January to realign and rationalize the manager line-ups across all their funds, then Stewart Spencer left Emerging Opportunities (GPEOX) at month’s end to pursue other paths and an additional shuffle was in order. It’s worth watching. Meanwhile, founders Robert Gardiner and Blake Walker have resumed joint management of Global Opps and International Opp.

T. Rowe Price and Fidelity both had changes sufficiently consequential to trigger Morningstar reviews of their analyst ratings. Continue reading →

Manager changes

Each month, dozens of funds undergo changes to their management teams; sometimes those changes are minor (one of 13 co-managers has stepped aside) and sometimes they fundamentally change a fund’s prospects (Rajiv Jain’s departure from Virtus EM Opportunities triggered billions in outflows). Among this month’s three dozen changes is the baffling dismissal of two successful teams from BBH International Equity (BBHEX), the arrival of a co-manager for David Herro at Oakmark International (OAKIX) and the removal of the co-manager at two of Tom Marsico’s funds.

Because bond fund managers, traditionally, had made Continue reading →

Manager changes

Manager changes come in three varieties: the utterly inconsequential, the individually significant and the broadly worrisome. Inconsequential changes, the vast majority of them, represent the normal tweaking of management teams or the comings-and-goings of competent but undistinguished professionals. Individually significant changes are ones where the manager made a real difference to a fund’s success, and where his or her departure might well disrupt the fund’s prospects. The dismissal of Wellington Management from Voya International Core, for example, substantially changes the fund’s profile and diminishes its short-term attractiveness. Broadly worrisome changes occur when principled managers with distinguished long-term records are dismissed because they’re “out of step” with the market. Quite frequently at the tops of frothy markets, value managers find their services no longer required. GMO famously lost 40% of its assets just before the crash of 2000 vindicated what they’d been doing. This month, the removal of Continue reading →

Manager changes

Among the dozens of manager changes this month, one stands out. Greg McCrickard’s long career at a T. Rowe Price manager has drawn to a close, though he’ll remain a while longer as a mentor of the firm’s young analysts. McCrickard managed T. Rowe Price Small-Cap Stock Fund OTCFX for 24 years. He’s succeeded by Frank Alonso who became McCrickard’s associate portfolio manager in 2013 and who did a nice job Price US small cap fund that’s only available to foreign investors. In general, Price handles these transitions better than anyone.

Because bond fund managers, traditionally, had made relatively modest impacts of their funds’ absolute returns, Manager Changes typically highlights changes in equity and hybrid funds. Continue reading →

Manager Changes

DoubleLine picks up the pieces after Bonnie Baha’s tragic death, Scott Satterwhite retires at Artisan, some turnover at Osterweis, Miller/Howard resigns for the Miller/Howard fund, Giralda steps away from the Giralda Fund and 60 other changes.

Because bond fund managers, traditionally, had made relatively modest impacts of their funds’ absolute returns, Manager Changes typically highlights changes in equity and hybrid funds. Continue reading →

Manager changes, August 2016

In memoriam

With great sadness, we note the passing of two members of the investing community.

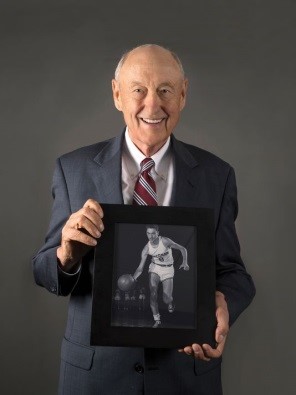

Albert “Ab” Nicholas, philanthropist and founder of the Nicholas Funds, died August 4, 2016, full of years and honors, at age 85. He earned his bachelor’s degree, in the early 1950s, from the University of Wisconsin-Madison. He was deeply grateful for the scholarship that made it possible for a poor kid from Rockford, Illinois, to attend college and he repaid that kindness a thousand times over through his gifts to the university. Continue reading →

Albert “Ab” Nicholas, philanthropist and founder of the Nicholas Funds, died August 4, 2016, full of years and honors, at age 85. He earned his bachelor’s degree, in the early 1950s, from the University of Wisconsin-Madison. He was deeply grateful for the scholarship that made it possible for a poor kid from Rockford, Illinois, to attend college and he repaid that kindness a thousand times over through his gifts to the university. Continue reading →

Manager changes, July 2016

Wow. Barely three dozen managers were subjected to the walk of shame (or, perhaps, the happy dance out the door) this month. There were two high profile changes.

Rob Taylor is retiring from management of Oakmark Global and Oakmark International, both of which are reopening to new investors. David Herro is being added as co-manager of the former and becomes sole manager of the latter. Since Mr. Herro is already managing $20 billion, the additional assignments either suggest that Oakmark is running out of talent or that Mr. Herro is feeling a bit megalomaniacal.

At we noted above, for reasons unexplained, Kumar Palghat has left Janus Unconstrained Global Bond (JUCAX) after one year.

In iconic changes, as we note below, West Shore is out at West Shore and Burnham is out at Burnham. Continue reading →