Reducing my risk profile for accounts that Fidelity manages allows more flexibility in what I manage. In other words, the intermediate investment bucket aggressive sub portfolio that Fidelity manages became more conservative, while I added a little risk to the conservative sub portfolio that I manage.

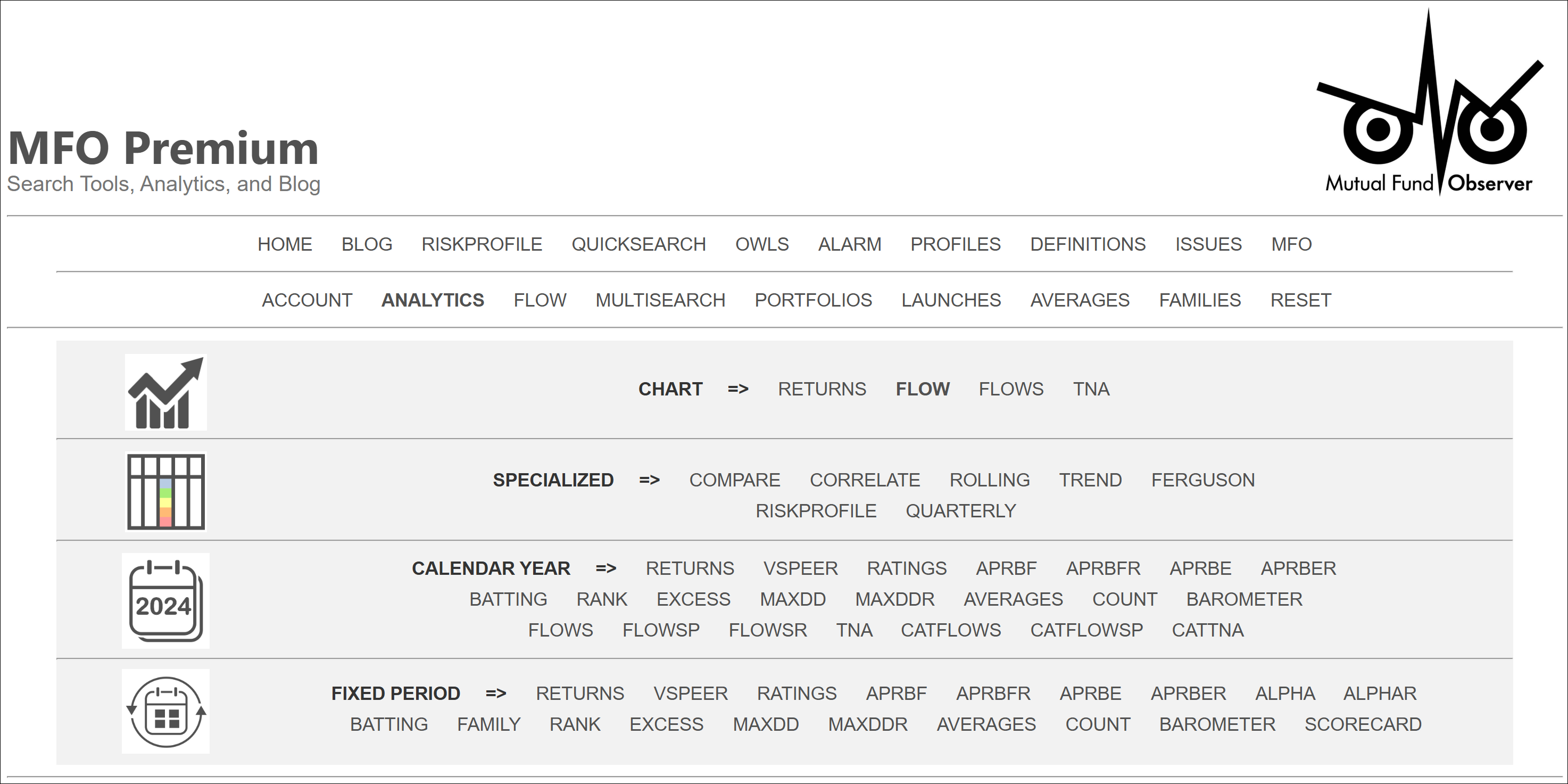

I would like to design a low-risk sub-portfolio that has a low correlation to stocks and bonds, returns about 5%, and has some inflation protection. The objective is to always have at least one fund that is up while still having decent returns. I began with the MFO Premium fund screener and Lipper global dataset, limited by correlations to the S&P 500 and bonds, low losses for the minimum rolling three-year period, and an MFO Risk rating of average or lower. I trimmed Continue reading →

In December 2020, Chuck Akre (1941 – today) stepped away from managing the Akre Focus fund, though he remains chairman of Akre Capital Management. During much of his 50+ year investing career, he built an unassailable reputation for discipline, independence, and excellence. The core of his investment strategy was captured by “the three-legged stool.” He looked for (1) extraordinary

In December 2020, Chuck Akre (1941 – today) stepped away from managing the Akre Focus fund, though he remains chairman of Akre Capital Management. During much of his 50+ year investing career, he built an unassailable reputation for discipline, independence, and excellence. The core of his investment strategy was captured by “the three-legged stool.” He looked for (1) extraordinary