Dear friends,

It’s May, a sweet and anxious time at college. The End is tantalizingly close; just two weeks remain in the academic year and, for many, in their academic career. Both the trees on the Quad and summer wardrobes are bursting out. The days remaining and the brain cells remaining shrink to a precious few. We all wonder where another year (my 31st here) went, holding on to its black-robed closing days even as we long for the change of pace and breathing space that summer promises.

For investors too summer holds promise, for days away and for markets unhinged. Perhaps thinking a bit ahead while the hinges remain intact might be a prudent course and a helpful prologue to lazy, hazy and crazy.

The Dry Powder Crowd

A bunch of fundamentally solid funds have been hammered by their absolute value orientation; that is, their refusal to buy stocks when they believe that the stock’s valuations and the underlying corporation’s prospects simply do not offer a sufficient margin of safety for the risks they’re taking, much less compelling opportunities. The mere fact that a fund sports just one lonely star in the Morningstar system should not disqualify it from serious consideration. Many times a low star rating reflects the fact that a particular style or perspective is out-of-favor, but the managers were unwilling to surrender their discipline to play to what’s popular.

That strikes us as admirable.

Sometimes a fund ends up with a one-star rating simply because it’s too independent to fit into one of Morningstar’s or Lipper’s predetermined boxes.

We screened for one-star equity funds with over 20% cash. From that list we looked for solid, disciplined funds whose Morningstar ratings have taken a pounding. Those include:

|

|

Cash |

3 yr return |

Comment |

|

ASTON/River Road Independent Value (ARIVX) |

80% |

3.7 |

Brilliant run from 2006-2011 when even his lagging years saw double digit absolute returns. Performance since has been sad; his peers have been rising 15% annually while ARIVX has been under 4%. The manager’s response is unambiguous: “As the rise in small cap prices accelerates and measures of valuation approach or exceed past bubble peaks, we believe it is now fair to characterize the current small cap market as a bubble.” After decades of small cap investing, he’s simply unwilling to chase bubbles so the fund is 80% cash. |

|

Fairholme Allocation (FAAFX) |

29 |

10.9 |

Mr. Berkowitz is annoyed with you for fleeing his funds a couple years ago. In response he closed the funds then reopened them with dramatically raised minimums. His funds manage frequent, dramatic losses often followed by dramatic gains. Just not as often lately as leaders surge and contrarian bets falter. He and his associates have about $70 million in the fund. |

|

FPA Capital (FPPTX) |

25 |

7.6 |

The only Morningstar medalist (Silver) in the group, FPA manages this as an absolute value small- to mid-cap fund. The manager of this closed fund has been onboard since 2007 and like many like-minded investors is getting whacked by holding both undervalued energy stocks and cash. |

|

Intrepid Small Cap, soon to be Intrepid Endeavor (ICMAX) |

68 |

6.3 |

Same story as with FPA and Aston: in response to increasingly irrational activity in small cap investing (e.g., the numbers of firms being acquired at record high earnings levels), Intrepid is concentrated in a handful of undervalued sectors and cash. AUM has dropped from $760 million in September 2012 to $420 million now, of which 70% is cash. |

|

Linde Hansen Contrarian Value (LHVAX) |

21 |

13.5 |

Messrs. Linde and Hansen are long-term Lord Abbett managers. By their calculation, price to normalized earnings have, since 2014, been at levels last seen before the 2007-09 crash. That leaves them without many portfolio candidates and without a willingness to buy for the sake of buying: “We believe the worst investing mistakes happen when discipline is abandoned and criteria are stretched (usually in an effort to stay fully invested or chasing indexes). With that perspective in mind, expect us to be patient.” |

|

The Cook & Bynum Fund (COBYX) |

42 |

7.7 |

The phrase “global concentrated absolute value” does pretty much capture it: seven stocks, three sectors, huge Latin exposure and 40% cash. The guys have posted very respectable returns in four of their five years with the fund: double-digit absolute returns or top percentile relative ones. A charging market left them with fewer and fewer attractive options, despite long international field trips in pursuit of undiscovered gems. Like many of the other funds above, they have been, and likely will again be, a five star fund. |

Frankly, any one of the funds above has the potential to be the best performer in your portfolio over the next five years especially if interest rates and valuations begin to normalize.

The challenge of overcoming cash seems so titanic that it’s worth noting, especially, the funds whose managers have managed to marry substantial cash strong with ongoing strong absolute and relative returns. These funds all have at least 20% cash and four- or five-star ratings from Morningstar, as of April 2015.

|

|

Cash |

3 yr return |

Comment |

|

Diamond Hill Small Cap (DHSCX) |

20 |

17.2 |

The manager builds the portfolio one stock at a time, doing bottom-up research to find undervalued small caps that he can hold onto for 5-10 years. Mr. Schindler has been with the fund as manager or co-manager since inception. |

|

Eventide Gilead (ETGLX) |

20 |

26.1 |

Socially responsible stock fund with outrageous fees (1.55%) for a fund with a straightforward strategy and $1.6 billion in assets, but its returns are top 1-2% across most trailing time periods. Morningstar felt compelled to grump about the fund’s volatility despite the fact that, since inception, the fund has not been noticeably more volatile than its mid-cap growth peers. |

|

FMI International (FMIJX) |

20 |

16 |

In May 2012 we described this as “a star in the making … headed by a cautious and consistent team that’s been together for a long while.” We were right: highly independent, low turnover, low expense, team-managed. The fund has a lot of exposure to US multinationals and it’s the only open fund in the FMI family. |

|

Longleaf Partners Small Cap (LLSCX) |

23 |

23 |

Mason Hawkins and Staley Cates have been running this mid-cap growth fund for decades. It’s now closed to new investors. |

|

Pinnacle Value (PVFIX) |

44 |

11.3 |

Our March 2015 profile noted that Pinnacle had the best risk-return profile of any fund in our database, earning about 10% annually while subjecting investors to barely one-third of the market’s volatility. |

|

Putnam Capital Spectrum (PVSAX) |

29 |

19.3 |

At $10.7 billion in AUM, this is the largest fund in the group. It’s managed by David Glancy who established his record as the lead manager for Fidelity’s high yield bond funds and its leveraged stock fund. |

|

TETON Westwood Mighty Mites (WEMMX) |

24 |

16.8 |

There’s a curious balance here: huge numbers of stocks (500) and really low turnover in the portfolio (14%). That allows a $1.3 billion fund to remain almost exclusively invested in microcaps. The Gabelli and Laura Linehan have been on the fund since launch. |

|

Tweedy, Browne Global Value (TBGVX) |

22 |

12.6 |

I’m just endlessly impressed with the Tweedy funds. These folks get things right so often that it’s just remarkable. The fund is currency hedged with just 9% US exposure and 4% turnover. |

|

Weitz Partners III Opportunity (WPOPX) |

26 |

15.8 |

Morningstar likes it (see below), so who am I to question? |

Fans of large funds (or Goodhaven) might want to consult Morningstar’s recommended list of “Cash-Heavy Funds for the Cautious Investor” which includes five names:

|

|

Cash |

3 yr return |

Comment |

|

FPA Crescent (FPACX) |

38% |

11.2 |

The $20 billion “free range chicken” has been managed by Mr. Romick since 1993. Its cash stake reflects FPA’s institutional impulse toward absolute value investing. |

|

Weitz Partners Value (WPVLX) |

19 |

16.2 |

Perhaps Mr. Weitz was chastened by his 53% loss in the 2007-09 market crises, which he entered with a 10% cash buffer. |

|

Weitz Hickory (WEHIX) |

19 |

13.7 |

On the upside, WEHIX’s 56% drawdown does make its sibling look moderate by comparison. |

|

Third Avenue Real Estate Value (TAREX) |

16 |

15.7 |

This is an interesting contrast to Third Avenue’s other equity funds which remain fully invested; Small Cap, for example, reports under 1% cash. |

|

Goodhaven (GOODX) |

0 |

5.7 |

I don’t get it. Morningstar is enamored with this fund despite the fact that it trails 99% of its peers. Morningstar reported a 19% cash stake in March and a 0% stake now. I have no idea of what’s up and a marginal interest in finding out. |

It’s time for an upgrade

The story was all over the place on the morning of April 20th:

- Reuters: “Carlyle to shutter its two mutual funds”

- Bloomberg: “Carlyle to close two mutual funds in liquid alts setback”

- Ignites: “Carlyle pulls plug on two mutual funds”

- ValueWalk: “Carlyle to liquidate a pair of mutual funds”

- Barron’s: “Carlyle closing funds, gold slips”

- MFWire dutifully linked to three of them in its morning link list

Business Insider gets it closest to right: “Private equity giant Carlyle Group is shutting down the two mutual funds it launched just a year ago,” including Carlyle Global Core Allocation Fund.

What’s my beef?

- Carlyle doesn’t have two mutual funds, they have one. They have authorization to launch the second fund, but never have. It’s like shuttering an unbuilt house. Reuters, nonetheless, solemnly notes that the second fund “never took off [and] will also be wound down,” implying that – despite Carlyle’s best efforts, it was just an undistinguished performer.

- The fund they have isn’t the one named in the stories. There is no such fund as Carlyle Global Core Allocation Fund, a fund mentioned in every story. Its name is Carlyle Core Allocation Fund(CCAIX/CCANX). It’s rather like the Janus Global Unconstrained Bond Fund that, despite Janus’s insistence, didn’t exist at the point that Mr. Gross joined the team. “Global” is a description but not in the name.

- The Carlyle fund is not newsworthy. It’s less than one year old, it has a trivial asset base ($50 million) and has not yet made a penny ($10,000 at inception is now $9930).

If folks wanted to find a story here, a good title might be “Another big name private investor trawls the fund space for assets, doesn’t receive immediate gratification and almost immediately loses interest.” I detest the practice of tossing a fund into the market then shutting it in its first year; it really speaks poorly of the adviser’s planning, understanding and commitment but it seems distressingly common.

What’s my solution?

Upgrade. Most news outlets are no longer capable of doing that for you; they simply don’t have the resources to do a better job or to separate press release from self-serving bilge from news so you need to do it for yourself.

Switch to Bloomberg TV from, you know, the screechy guys. If it’s not universally lauded, it does seem broadly recognized as the most thoughtful of the financial television channels.

Develop the habit of listening to Marketplace, online or on public radio. It’s a service of American Public Media and I love listening to Kai Ryssdal and crew for their broad, intelligent, insightful reporting on a wide range of topics in finance and money.

Read the Saturday Wall Street Journal, which contains more sensible content per inch than any other paper that lands on my desk. Jason Zweig’s column alone is worth the price of admission. His most recent weekend piece, “A History of Mutual-Fund Doors Opening and Closing,” is outstanding, if only because it quotes me. About 90% of us would benefit from less saturation with the daily noise and more time to read pieces that offer a bit of perspective.

Reward yourself richly on any day when your child’s baseball score comes immediately to mind but you can honestly say you have no earthly clue what the score of the Dow Jones is. That’s not advice for casual investors, that’s advice for professionals: the last thing on earth that you want is a time horizon that’s measured in hours, days, weeks or months. On that scale the movement of markets is utterly unpredictable and focusing on those horizons will damage you more deeply and more consistently than any other bad habit you can develop.

Go read a good book and I don’t mean financial porn. If your competitive advantage is seeing things that other people (uhh, the herd) don’t see, then you’ve got to expose yourself to things other people don’t experience. In a world increasingly dominated by six inch screens, books – those things made from trees – fit the bill. Bill Gates recommends The Bully Pulpit, by Doris Kearns Goodwin. Goodwin “studies the lives of America’s 26th and 27th presidents to examine a question that fascinates me: How does social change happen?” That is, Teddy Roosevelt and William Taft. Power down your phone while you’re reading. The aforementioned Mr. Zweig fusses that “you can’t spend all day reading things that train your brain to twitch” and offers up Daniel Kahneman’s Thinking, Fast and Slow. Having something that you sip, rather than gulp, does help turn reading from an obligation to a calming ritual. Nina Kallen, a friend, insurance coverage lawyer in Boston and one of the sharpest people we know, declares Roger Fisher and William Ury’s Getting to Yes: Negotiating Agreement Without Giving In to be “life-changing.” In her judgment, it’s the one book that every 18-year-old should be handed as part of the process of becoming an adult. Chip and I have moved the book to the top of our joint reading list for the month ahead. Speaking of 18-year-olds, it wouldn’t hurt if your children actually saw you reading; perhaps if you tell them they wouldn’t like it, they’d insist on joining you.

How Good Is Your Fund Family? An Update…

How Good Is Your Fund Family? An Update…

Baseball season has started. MLB.TV actually plays more commercials than it used to, which sad to say I enjoy more than the silent “Commercial Break In Progress” screen, even if they are repetitive.

One commercial is for The Hartford Funds. The company launched a media campaign introducing a new tagline, “Our benchmark is the investor℠,” and its focus on “human-centric investing.”

Its website touts research they have done with MIT on aging, and its funds are actually sub-advised by Wellington Management.

A quick look shows 66 funds, each with some 6 share classes, and just under $100B AUM. Of the 66, most charge front loads up to 5.5% with an average annual expense ratio of just over 1%, including 12b-1 fee. And, 60 have been around for more than 3 years, averaging 15 years in fact.

How well have their funds performed over their lifetimes? Just average … a near even split between funds over-performing and under-performing their peers, including expenses.

We first started looking at fund family performance last year in the piece “How Good Is Your Fund Family?” Following much the same methodology, with all the same qualifications, below is a brief update. Shortly, we hope to publish an ongoing tally, or “Fund Family Score Card” if you will, because … during the next commercial break, while watching a fund family’s newest media campaign, we want to make it easier for you to gauge how well a fund family has performed against its peers.

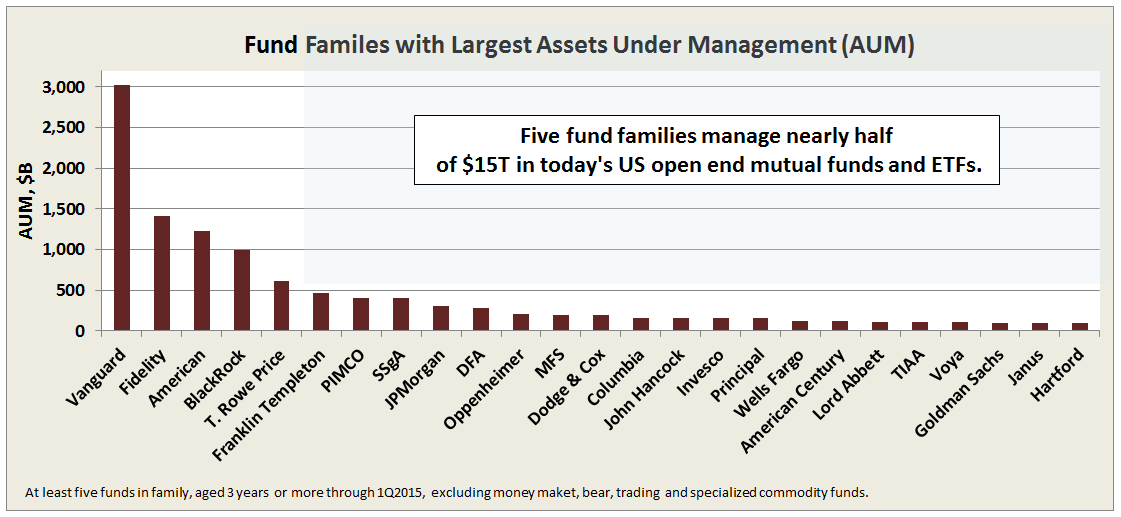

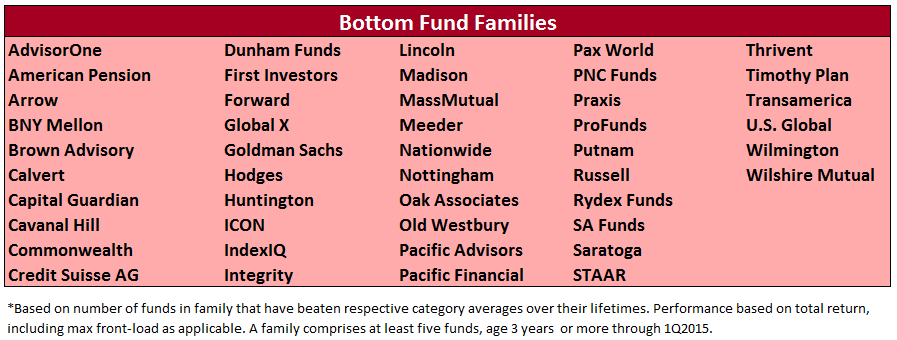

The current playing field has about 6200 US funds packaged and usually marketed in 225 families. For our tally, each family includes at least 5 funds with ages 3 years or more. Oldest share class only, excluding money market, bear, trading, and specialized commodity funds. Though the numbers sound high, the field is actually dominated by just five families, as shown below:

It is interesting that while Vanguard represents the largest family by AUM, with nearly twice its nearest competitor, its average annual ER of 0.22% is less than one third either Fidelity or American Funds, at 0.79% and 0.71%, respectively. So, even without front loads, which both the latter use to excess, they are likely raking in much more in fees than Vanguard.

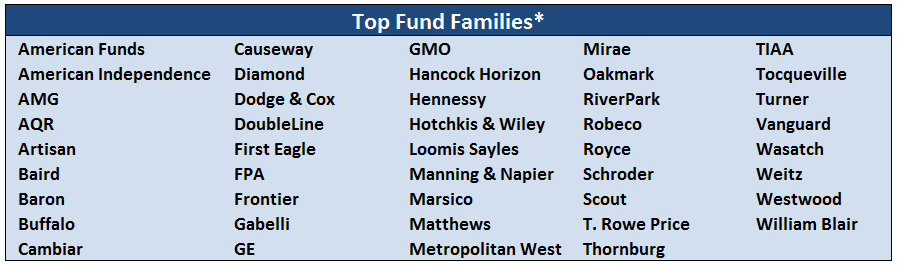

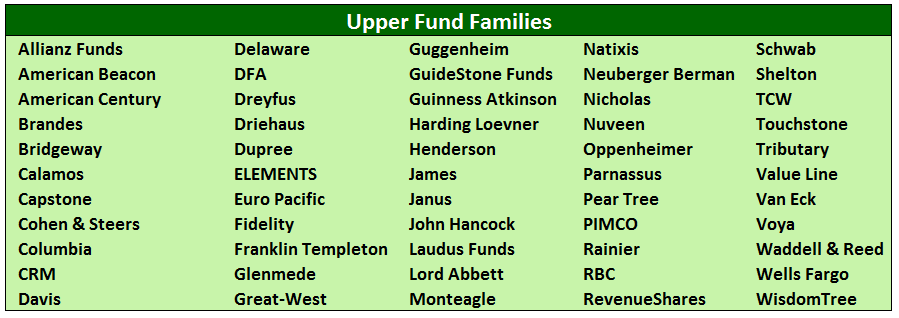

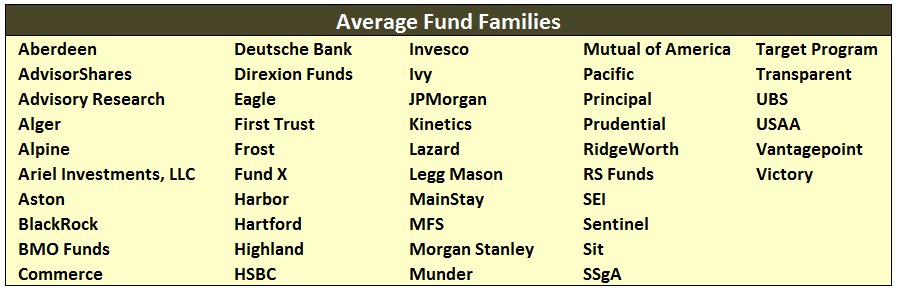

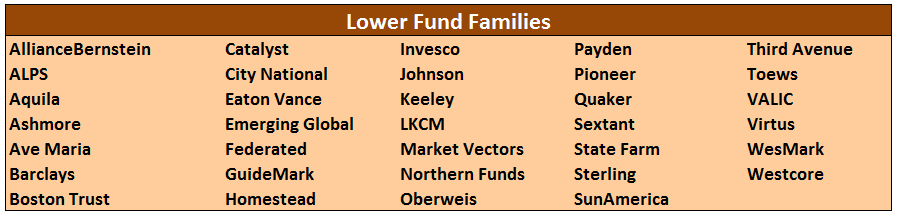

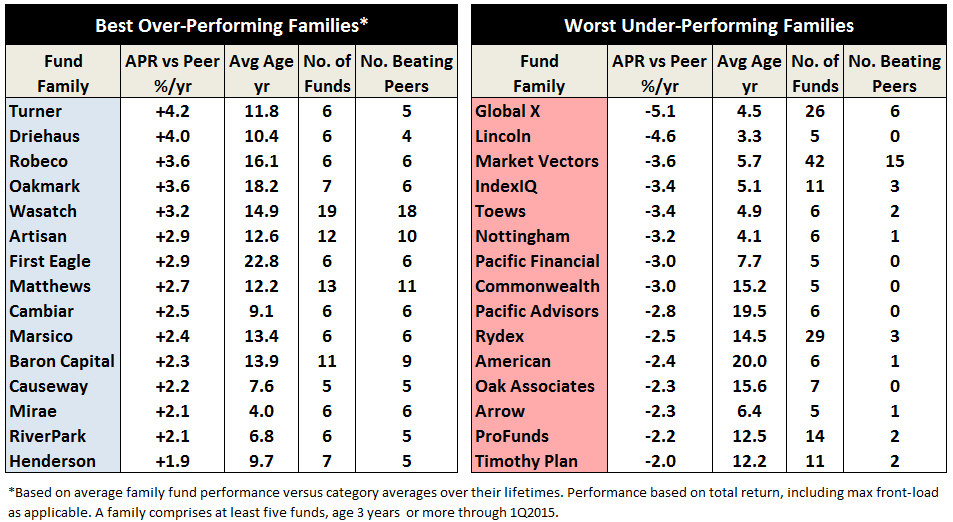

Ranking each of the 225 families based on number of funds that beat their category averages produces the following score card, by quintile, best to worst:

Of the five families, four are in top two quintiles: Vanguard, American Funds, Fidelity, and T. Rowe Price. In fact, of Vanguard’s 145 funds, 119 beat their peers. Extraordinary. But BlackRock is just average, like Hartford.

The difference in average total return between top and bottom fund families on score card is 3.1% per year!

The line-ups of some of the bottom quintile families include 100% under-performers, where every fund has returned less than its peers over their lifetimes: Commonwealth, Integrity, Lincoln, Oak Associates, Pacific Advisors, Pacific Financial, Praxis, STAAR. Do you think their investors know? Do the investors of Goldman Sachs know that their funds are bottom quintile … written-off to survivorship bias possibly?

Visiting the website of Oberweis, you don’t see that four of its six funds under-performed. Instead, you find: TWO FUNDS NAMED “BEST FUND” IN 2015 LIPPER AWARDS. Yes, its two over-performers.

While the line-ups of some top quintile families include 100% over-performers: Cambiar, Causeway, Dodge & Cox, First Eagle, Marsico, Mirae, Robeco, Tocqueville.

Here is a summary of some of the current best and worst:

While not meeting the “five funds” minimum, some other notables: Tweedy Browne has 4 of 4 over-performers, and Berwyn, FMI, Mairs & Power, Meridian, and PRIMECAP Odyssey all have 3 of 3.

(PRIMECAP is an interesting case. It actually advises 6 funds, but 3 are packaged as part of the Vanguard family. All 6 PRIMECAP advised funds are long-term overperformers … 3.4% per year across an average of 15 years! Similarly with OakTree. All four of its funds beat their peers, but only 2 under its own name.)

As well as younger families off to great starts: KP, 14 of 14 over-performers, Rothschild 7 of 7, Gotham 5 of 5, and Grandeur Peak 4 of 4. We will find a way to call attention to these funds too on the future “Fund Family Score Card.”

Ed is on assignment, staking out a possible roach motel

Our distinguished senior colleague Ed Studzinski is a deep-value investor; his impulse is to worry more about protecting his investors when times turn dark than in making them as rich as Croesus when the days are bright and sunny. He’s been meditating, of late, on the question of whether there’s anything a manager today might do that would reliably protect his investors in the case of a market crisis akin to 2008.

Ed is one of a growing number of investors who are fearful that we might be approaching a roach motel; that is, a situation where it’s easy to get into a particular security but where it might be impossible to get back out of it when you urgently want to.

Ed is one of a growing number of investors who are fearful that we might be approaching a roach motel; that is, a situation where it’s easy to get into a particular security but where it might be impossible to get back out of it when you urgently want to.

Structural changes in the market and market regulations have, some fear, put us at risk for a liquidity crisis. In a liquidity crisis, the ability of market makers to absorb the volume of securities offered for sale and to efficiently match buyers and sellers disappears. A manager under pressure to sell a million dollars’ worth of corporate bonds might well find that there’s only a market for two-thirds of that amount, the remaining third could swiftly become illiquid – that is, unmarketable – securities.

David Sherman, president of Cohanzick Asset Management and manager of two RiverPark’s non-traditional bond funds addressed the issue in his most recent shareholder letter. I came away from it with two strong impressions:

There may be emerging structural problems in the investment-grade fixed-income market. At base, the unintended consequences of well-intended reforms may be draining liquidity from the market (the market makers have dramatically less cash and less skin in the game than they once did) and making it hard to market large fixed-income sales. An immediate manifestation is the problem in getting large bond issuances sold.

Things might get noticeably worse for folks managing large fixed-income portfolios. His argument is that given the challenges facing large bond issues, you really want a fund that can benefit from small bond issues. That means a small fund with commitments to looking beyond the investment-grade universe and to closing before size becomes a hindrance.

Some of his concerns are echoed on a news site tailored for portfolio managers, ninetwentynine.com. An article entitled “Have managers lost sight of liquidity risk?” argues:

A liquidity drought in the bond space is a real concern if the Fed starts raising rates, but as the Fed pushes off the expected date of its first hike, some managers may be losing sight of that danger. That’s according to Fed officials, who argue that if a rate hike catches too many managers off their feet, the least they can expect is a taper tantrum similar to 2013, reports Reuters. The worst-case-scenario is a full-blown liquidity crisis.

The most recent investor letter from the managers of Driehaus Active Income Fund (LCMAX) warns that recent structural changes in the market have made it increasingly fragile:

Since the end of the credit crisis, there have been a number of structural changes in the credit markets, including new regulations, a reduced size of broker dealer trading desks, changes in fund flows, and significant growth of larger index-based mutual funds and ETFs. The “new” market environment and players have impacted nearly all aspects of the market, including trading liquidity. The transfer of risk is not nearly as orderly as it once was and is now more expensive and volatile … one thing nearly everyone can agree on is that liquidity in the credit markets has decreased materially since the credit crisis.

The federal Office of Financial Research concurs: “Markets have become more brittle because liquidity may be less available in a downturn.” Ben Inker, head of GMO’s asset allocation group, just observed that “the liquidity in [corporate credit] markets has become shockingly poor.”

More and more money is being stashed in a handful of enormous fixed income funds, active and passive. In general, those might be incredibly regrettable places to be when liquidity becomes constrained:

Generally speaking, you’re going to need liquidity in your bond fund when the market is stressed. When the market is falling apart, the ETFs are the worst place to be, as evidenced by their underperformance to the index in 2008, 2011 and 2013. So yes, you will have liquidity, but it will be in something that is cratering.

What does this mean for you?

- Formerly safe havens won’t necessarily remain safe.

- You need to know what strategy your portfolio manager has for getting ahead of a liquidity crunch and for managing during it. The Driehaus folks list seven or eight sensible steps they’ve taken and Mr. Sherman walks through the structural elements of his portfolio that mitigate such risks.

- If your manager pretend not to know what the concern is or suggests you shouldn’t worry your pretty little head about it, fire him.

In the interim, Mr. Studzinski is off worrying on your behalf, talking with other investors and looking for a safe(r) path forward. We’re hoping that he’ll return next month with word of what he’s found.

Top developments in fund industry litigation

Fundfox, launched in 2012, is the mutual fund industry’s only litigation intelligence service, delivering exclusive litigation information and real-time case documents neatly organized and filtered as never before. For the complete list of developments last month, and for information and court documents in any case, log in at www.fundfox.com and navigate to Fundfox Insider.

Fundfox, launched in 2012, is the mutual fund industry’s only litigation intelligence service, delivering exclusive litigation information and real-time case documents neatly organized and filtered as never before. For the complete list of developments last month, and for information and court documents in any case, log in at www.fundfox.com and navigate to Fundfox Insider.

Orders

- The SEC charged BlackRock Advisors with breaching its fiduciary duty by failing to disclose a conflict of interest created by the outside business activity of a top-performing portfolio manager. BlackRock agreed to settle the charges and pay a $12 million penalty.

- In a blow to Putnam, the Second Circuit reinstated fraud and negligence-based claims made by the insurer of a swap transaction. The insurer alleges that Putnam misrepresented the independence of its management of a collateralized debt obligation. (Fin. Guar. Ins. Co. v. Putnam Advisory Co.)

New Appeals

- Plaintiffs have appealed the lower court’s dismissal of an ERISA class action regarding Fidelity‘s practices with respect to the so-called “float income” generated from plan participants’ account transactions. (In re Fid. ERISA Float Litig.)

Briefs

- Plaintiffs filed their opposition to Davis‘s motion to dismiss excessive-fee litigation regarding the New York Venture Fund. Brief: “Defendants’ investment advisory fee arrangements with the Davis New York Venture Fund . . . epitomize the conflicts of interest and potential for abuse that led Congress to enact § 36(b). Unconstrained by competitive pressures, Defendants charge the Fund advisory fees that are as much as 96% higher than the fees negotiated at arm’s length by other, independent mutual funds . . . for Davis’s investment [sub-]advisory services.” (In re Davis N.Y. Venture Fund Fee Litig.)

- Plaintiffs filed their opposition to PIMCO‘s motion to dismiss excessive-fee litigation regarding the Total Return Fund. Brief: “In 2013 alone, the PIMCO Defendants charged the shareholders of the PIMCO Total Return Fund $1.5 billion in fees, awarded Ex-head of PIMCO, Bill Gross, a $290 million bonus and his second-in-command a whopping $230 million, and ousted a Board member who dared challenge Gross’s compensation—all this despite the Fund’s dismal performance that trailed 70% of its peers.” (Kenny v. Pac. Inv. Mgmt. Co.)

- In the purported class action regarding alleged deviations from two fundamental investment objectives by the Schwab Total Bond Market Fund, the Investment Company Institute and Independent Directors Council filed an amici brief in support of Schwab’s petition for rehearing (and rehearing en banc) of the Ninth Circuit’s 2-1 decision allowing the plaintiffs’ state-law claims to proceed. Brief: “The panel’s decision departs from long-standing law governing mutual funds and creates confusion and uncertainty nationwide.” Defendants include independent directors. (Northstar Fin. Advisors, Inc. v. Schwab Invs.)

Amended Complaint

- Plaintiffs filed a new complaint in the fee litigation against New York Life, adding a fourth fund to the case: the MainStay High Yield Opportunities Fund. (Redus-Tarchis v. N.Y. Life Inv. Mgmt., LLC.)

Answer

- P. Morgan filed an answer in an excessive-fee lawsuit regarding three of its bond funds. (Goodman v. J.P. Morgan Inv. Mgmt., Inc.)

The Alt Perspective: Commentary and News from Daily Alts

The spring has brought new life into the liquid alternatives market with both March and April seeing robust activity in terms of new fund launches and registrations, as well as fund flows. Touching on new fund flows first, March saw more than $2 billion of new asset flow into alternative mutual funds and ETFs, while US equity mutual funds and ETFs had combined outflows of nearly $6 billion.

The spring has brought new life into the liquid alternatives market with both March and April seeing robust activity in terms of new fund launches and registrations, as well as fund flows. Touching on new fund flows first, March saw more than $2 billion of new asset flow into alternative mutual funds and ETFs, while US equity mutual funds and ETFs had combined outflows of nearly $6 billion.

At the top of the inflow rankings were international equity and fixed income, which provides a clear indication that investors were seeking both potentially higher return equity markets (non-US equity) and shelter (fixed income and alternatives). With increased levels of volatility in the markets, I wouldn’t be surprised to see this cash flow trend continue on into April and May.

New Funds Launched in April

We logged eight new liquid alternative funds in April from firms such as Prudential, Waycross, PowerShares and LoCorr. No particular strategy stood out as being dominant among the eight funds as they ranged from long/short equity and alternative fixed income strategies, to global macro and multi-strategy. A couple highlights are as follows:

1) LoCorr Multi-Strategy Fund – To date, LoCorr has done a thoughtful job of brining high quality managers to the liquid alts market, and offers funds that cover managed futures, long/short commodities, long/short equity and alternative income strategies. In this new fund, they bring all of these together in a single offering, making it easier for investors to diversify with a single fund.

2) Exceed Structured Shield Index Strategies Fund – This is the first of three new mutual funds that provide investors with a structured product that is designed to protect downside volatility and provide a specific level of upside participation. The idea of a more defined outcome can be appealing to a lot of investors, and will also help advisors figure out where and how to use the fund in a portfolio.

New Funds Registered in April

Fund registrations are where we see what is coming a couple months down the road – a bit like going to the annual car show to see what the car manufacturers are going to be brining out in the new season. And at this point, it looks like June/July will be busy as we counted 9 new alternative fund registration in April. A couple interesting products are listed below:

1) Hatteras Market Neutral Fund – Hatteras has been around the liquid alts market for quite some time, and with this fund will be brining multiple managers in as sub-advisors. Market neutral strategies are appealing at times when investors are looking to take risk off the table yet generate returns that are better than cash. They can also serve as a fixed income substitute when the outlook is flat to negative for the fixed income market.

2) Franklin K2 Long Short Credit Fund – K2 is a leading fund of hedge fund manager that works with large institutional investors to invest in and manage portfolios of hedge funds. The firm was acquired by Franklin Templeton back in 2012 and has so far launched one alternative mutual fund. The fund will be managed by multiple sub-advisors and will allocate to several segments of the fixed income market.

Debunking Active Share

High active share does not equal high alpha. I’ll say that again. High active share does not equal high alpha. This is the finding in a new AQR white paper that essentially proves false two of the key tenents of a 2009 research paper (How Active is Your Fund Manager? A New Measure That Predicts Performance) by Martijn Cremers and Antti Petajisto. These two tenents are:

1) Active Share predicts fund performance: funds with the highest Active Share significantly outperform their benchmarks, both before and after expenses, and they exhibit strong performance persistence.

2) Non-index funds with the lowest Active Share underperform their benchmarks.

AQR explains that other factors are in play, and those other factors actually explain the outperformance that Cremers and Petajisto found in their work. You can read more here: AQR Deactivates Active Share in New White Paper.

And finally, for anyone considering the old “Sell in May and Go Away” strategy this month, be sure to have a read of this article, or watch this video. Or, better yet, just make a strategic allocation to a few solid alternative funds that have some downside protection built into them.

Feel free to stop by DailyAlts.com for more coverage of liquid alternatives.

Observer Fund Profiles:

Each month the Observer provides in-depth profiles of between two and four funds. Our “Most Intriguing New Funds” are funds launched within the past couple years that most frequently feature experienced managers leading innovative newer funds. “Stars in the Shadows” are older funds that have attracted far less attention than they deserve.

Seafarer Overseas Growth & Income (SFGIX/SIGIX): Our contention has always been that Seafarer represents one of the best possible options for investors interested in approaching the emerging markets. A steadily deepening record and list of accomplishments suggests that we’re right.

Towle Deep Value Fund (TDVFX): This fund positions itself a “an absolute value fund with a strong preference for staying fully invested.” For the past 33 years, Mr. Towle & Co. have been consistently successful at turning over more rock – in under covered small caps and international stocks alike – to find enough deeply undervalued stocks to populate the portfolio and produce eye-catching results.

Conference Call Highlights: Seafarer Overseas Growth & Income

Here are some quick highlights from our April 16th conversation with Andrew Foster of Seafarer.

Here are some quick highlights from our April 16th conversation with Andrew Foster of Seafarer.

Seafarer’s objective: Andrew’s hope is to outperform his benchmark (the MSCI EM index) “slowly but steadily over time.” He describes the approach as a “relative return strategy” which pursues growth that’s more sustainable than what’s typical in developing markets while remaining value conscious.

Here’s the strategy: you need to start by understanding that the capital markets in many EM nations are somewhere between “poorly developed” and “cruddy.” Both academics and professional investors assume that a country’s capital markets will function smoothly: banks will make loans to credit-worthy borrowers, corporations and governments will be able to access the bond market to finance longer-term projects and stocks will trade regularly, transparently and at rational expense.

None of that may safely be assumed in the case of emerging markets; indeed, that’s what might distinguish an “emerging” market from a developed one. The question becomes: what are the characteristics of companies that might thrive in such conditions.

The answer seems to be (1) firms that can grow their top line steadily in the 7-15% per annum range and (2) those that can finance their growth internally. The focus on the top line means looking for firms that can increase revenues by 7-15% without obsessing about similar growth in the bottom line. It’s almost inevitable that EM firms will have “stumbles” that might diminish earnings for one to three years; while you can’t ignore them, you also can’t let them drive your investing decisions. “If the top line grows,” Andrew argues, “the bottom line will follow.” The focus on internal financing means that the firms will be capable of funding their operations and plans without needing recourse to the unreliable external sources of capital.

Seafarer tries to marry that focus on sustainable moderate growth “with some current income, which is a key tool to understanding quality and valuation of growth.” Dividends are a means to an end; they don’t do anything magical all by themselves. Dividends have three functions. They are:

An essential albeit crude valuation tool – many valuation metrics cannot be meaningfully applied across borders and between regions; there’s simply too much complexity in the way different markets operate. Dividends are a universally applicable measure.

A way of identifying firms that will bounce less in adverse market conditions – firms with stable yields that are just “somewhat higher than average” tend to be resilient. Firms with very high dividend yields are often sending out distress signals.

A key and under-appreciated signal for the liquidity and solvency of a company – EMs are constantly beset by liquidity and credit shocks and unreliable capital markets compound the challenge. Companies don’t survive those shocks as easily as people imagine. The effects of liquidity and credit crunches range from firms that completely miss their revenue and earnings forecasts to those that drown themselves in debt or simply shutter. Against such challenges dividends provide a clear and useful signal of liquidity and solvency.

It’s certainly true that perhaps 70% of the dispersion of returns over a 5-to-10 year period are driven by macro-economic factors (Putin invades-> the EU sanctions-> economies falter-> the price of oil drops-> interest rates fall) but that fact is not useful because such events are unforecastable and their macro-level impacts are incalculably complex (try “what effect will European reaction to Putin’s missile transfer offer have on shadow interest rates in China?”).

Andrew believes he can make sense of the ways in which micro-economic factors, which drive the other 30% of dispersion, might impact individual firms. He tries to insulate his portfolio, and his investors, from excess volatility by diversifying away some of the risk, imagining a “three years to not quite forever” time horizon for his holdings and moving across a firm’s capital structure in pursuit of the best risk-return balance.

While Seafarer is classified as an emerging markets equity fund, common stocks have comprised between 70-85% of the portfolio. “There’s way too much attention given to whether a security is a stock or bond; all are cash flows from an issuer. They’re not completely different animals, they’re cousins. We sometimes find instruments trading with odd valuations, try to exploit that.” As of January 2015, 80% of the fund is invested directly in common stock; the remainder is invested in ADRs, hard- and local-currency convertibles, government bonds and cash. The cash stake is at a historic low of 1%.

Thinking about the fund’s performance: Seafarer is in the top 3% of EM stock funds since launch, returning a bit over 10% annually. With characteristic honesty and modesty, Andrew cautions against assuming that the fund’s top-tier rankings will persist in the next part of the cycle:

We’re proud of performance over the last few years. We have really benefited from the fact that our strategy was well-positioned for anemic growth environments. Three or four years ago a lot of people were buying the story of vibrant growth in the emerging markets, and many were willing to overpay for it. As we know, that growth did not materialize. There are signs that the deceleration of growth is over even if it’s not clear when the acceleration of growth might begin. A major source of return for our fund over 10 years is beta. We’re here to harness beta and hope for a little alpha.

That said, he does believe that flaws in the construction of EM indexes makes it more likely that passive strategies will underperform:

I’m actually a fan of passive investing if costs are low, churn is low, and the benchmark is soundly constructed. The main EM benchmark is disconnected from the market. The MSCI EM index imposes filters for scalability and replicability in pursuit of an index that’s easily tradable by major investors. That leads it to being not a really good benchmark. The emerging markets have $14 trillion in market capitalization; the MSCI Core index captures only $3.8 trillion of that amount and the Total Market index captures just $4.2 trillion. In the US, the Total Stock Market indexes capture 80% of the market. The comparable EM index captures barely 25%.

Highlights from the questions:

As a practical matter, a 4-5% position is “huge for us” though he has learned to let his winners run a little longer than he used to, so the occasional 6% position wouldn’t be surprising.

A focus on dividend payers does not imply a focus on large cap stocks. There are a lot of very stable dividend-payers in the mid- to small-cap range; Seafarer ranges about 15-20% small cap and 35-50% midcap.

The fundamental reason to consider investing in emerging markets is because “they are really in dismal shape, sometimes the horrible things you read about them are true but there’s an incredibly powerful drive to give your kids a better life and to improve your life. People will move mountains to make things better. I followed the story of one family who were able to move from a farmhouse with a dirt floor to a comfortable, modern townhouse in one lifetime. It’s incredibly inspiring, but it’s also incredibly powerful.”

With special reference to holdings in Eastern Europe, you need to avoid high-growth, high-expectation companies that are going to get shell-shocked by political turmoil and currency devaluation. It’s important to find companies that have already been hit and that have proved that they can survive the shock.

Bottom line: Andrew has a great track record built around winning by not losing. His funds have posted great relative returns in bad markets and very respectable absolute returns in frothy ones. While he is doubtless correct in saying that the fund was unique well-suited to the current market and that it won’t always be a market leader, it’s equally correct to say that this is one of the most consistently risk-conscious, more consistently shareholder-sensitive and most consistently rewarding EM funds available. Those are patterns that I’ve found compelling.

We’ve also updated our featured fund page for Seafarer.

Funds in Registration

New mutual funds must be registered with the Securities and Exchange Commission before they can be offered for sale to the public. The SEC has a 75-day window during which to call for revisions of a prospectus; fund companies sometimes use that same time to tweak a fund’s fee structure or operating details.

Funds in registration this month are eligible to launch in late June and some of the prospectuses do highlight that date.

This month our research associate David Welsch tracked down 14 no-load retail funds in registration, which represents our core interest. By far the most interest was stirred by the announcement of three new Grandeur Peak funds:

- Global Micro Cap

- International Stalwarts

- Global Stalwarts

The launch of Global Micro Cap has been anticipated for a long time. Grandeur Peak announced two things early on: (1) that they had a firm wide strategy capacity of around $3 billion, and (2) they had seven funds in the works, including Global Micro, which were each allocated a set part of that capacity. Two of the seven projected funds (US Opportunities and Global Value) remain on the drawing board. President Eric Huefner remarks that “Remaining nimble is critical for a small/micro cap manager to be world-class,” hence “we are terribly passionate about asset capping across the firm.”

The surprise comes with the launch of the two Stalwarts funds, whose existence was previously unanticipated. Folks on our discussion board reacted with (thoughtful) alarm. Many of them are GP investors and they raised two concerns: (1) this might signal a change in corporate culture with the business managers ascendant over the asset managers, and (2) a move into larger capitalizations might move GP away from their core area of competence.

Because they’re in a quiet period, Eric was not able to speak about these concerns though he did affirm that they’re entirely understandable and that he’d be able to address them directly after launch of the new funds.

Mr. Gardiner, Guardian Manager, at work

While I am mightily amused by the title GUARDIAN MANAGER given to Robert Gardiner to explain his role with the new funds, I’m not immediately distressed by these developments. “Stalwarts” has always been a designation for one of the three sorts of stocks that the firm invests in, so presumably these are stocks that the team has already researched and invested in. Many small cap managers find an attraction in these “alumni” stocks, which they know well and have confidence in but which have outgrown their original fund. Such funds also offer a firm the ability to increase its strategy capacity without compromising its investment discipline. I’ll be interested in hearing from Mr. Heufner later this summer and, perhaps, in getting to tap of Mr. Gardiner’s shield.

Manager Changes

A lot of funds were liquidated this month, which means that a lot of managers changed from “employed” to “highly motivated investment professional seeking to make a difference.” Beyond that group, 43 funds reported partial or complete changes in their management teams. The most striking were:

- The departure of Independence Capital Asset Partners from LS Opportunity Fund, about which there’s more below.

- The departure of Robert Mohn from both Columbia Acorn Fund (ACRNX) and Columbia Acorn USA (AUSAX) and from his position as their Domestic CIO. Mr. Mohn joined the fund in late 2003 shortly after the retirement of the legendary Ralph Wanger. He initially comanaged the fund with John Park (now of Oakseed Opportunity SEEDX) and Chuck McQuaid (now manager of Columbia Thermostat (CTFAX). Mr. Mohn is being succeeded by Zachary Egan, President of the adviser, and the estimable Fritz Kaegi, one of the managers of Columbia Acorn Emerging Markets (CAGAX). They’ll join David Frank who remained on the fund.

Updates

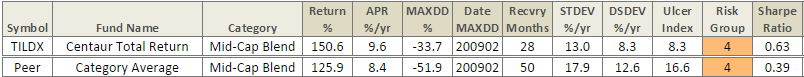

Centaur Total Return (TILDX) celebrated its 10-year anniversary in March, so I wish we’d reported the fact back then. It’s an interesting creature. Centaur started life as Tilson Dividend, though Whitney Tilson never had a role in its management. Mr. Tilson thought of himself (likely “thinks of himself”) as a great value investor, but that claim didn’t play out in his Tilson Focus Fund so he sort of gave up and headed to hedge fund land. (Lately he’s been making headlines by accusing Lumber Liquidators, a company his firm has shorted, of deceptive sales practices.) Mr. Tilson left and the fund was rechristened as Centaur.

Centaur’s record is worth puzzling over. Morningstar gives it a ten-year ranking of five stars, a three-year ranking of one star and three stars overall. Over its lifetime it has modestly better returns and vastly lower risks than its peers which give it a great risk-adjusted performance.

Mostly it has great down market protection and reasonable upmarket performance, which works well if the market has both ups and downs. When the market has a whole series of strong gains, conservative value investors end up looking bad … until they look prescient and brilliant all over again.

There’s an oddly contrarian indicator in the quick dismissal of funds like Centaur, whose managers have proven adept and disciplined. When the consensus is “one star, bunch of worthless cash in the portfolio, there’s nothing to see here,” there might well be reason to start thinking more seriously as folks with a bunch of …

In any case, best anniversary wishes to manager Zeke Ashton and his team.

Briefly Noted . . .

American Century Investments, adviser to the American Century Funds, has elected to support the America’s Best Communities competition, a $10 million project to stimulate economic revitalization in small towns and cities across the country. At this point, 50 communities have registered first round wins. The ultimate winner will receive a $3 million economic development grant from a consortium of American firms.

In the interim, American Century has “adopted” Wausau, Wisconsin, which styles itself “the Chicago of the north.” (I suspect many of you think of Chicago as “the Chicago of the north,” but that’s just because you’re winter wimps.) Wausau won $35,000 which will be used to develop a comprehensive plan for economic revival and cultural enrichment. American Century is voluntarily adding another $15,000 to Wausau’s award and will serve as a sort of consultant to the town as they work on preparing a plan. It’s a helpful gesture and worthy of recognition.

LS Opportunity Fund (LSOFX) is about to become … well, something else but we don’t know what. The fund has always been managed by Independence Capital Asset Partners in parallel with ICAP’s long/short hedge fund. On April 23, 2015, the fund’s board terminated ICAP’s contract because of “certain portfolio management changes expected to occur within the sub-adviser.” On April 30, the board named Prospector Partners LLC has the fund’s interim manager, presumably with the expectation that they’ll be confirmed in June as the permanent replacement for ICAP. Prospector is described as “an investment adviser registered with the Securities and Exchange Commission with its principal offices [in] Guilford, CT. Prospector currently provides investment advisory services to corporations, pooled investment vehicles, and retirement plans.” Though they don’t mention it, Prospector also serves as the adviser to two distinctly unexciting long-only mutual funds: Prospector Opportunity (POPFX) and Prospector Capital Appreciation (PCAFX). LSOFX is a rated by Morningstar as a four-star fund with $170 million in assets, which makes the change both consequential and perplexing. We’ll share more as soon as we can.

Northern Global Tactical Asset Allocation Fund (BBALX) has added hedging via derivatives to the list of its possible investments: “In addition, the Fund also may invest directly in derivatives, including but not limited to forward currency exchange contracts, futures contracts and options on futures contracts, for hedging purposes.”

Gargoyle is on the move. RiverPark Funds is in the process of transferring control of RiverPark Gargoyle Hedged Value Fund (RGHVX) to TCW where it will be renamed … wait for it … TCW/Gargoyle Hedged Value Fund. It’s a solid five star fund with $73 million in assets. That latter number is what has occasioned the proposed move which shareholders will still need to ratify.

RiverPark CEO Morty Schaja notes that the strategy has spectacular long-term performance (it was a hedge fund before becoming a mutual fund) but that it’s devilishly hard to market. The fund uses two distinct strategies: a quantitatively driven relative value strategy for its stock portfolio and a defensive options overlay. While the options provide income and some downside protection, the fund does not pretend to being heavily hedged much less market neutral. As a result, it has a lot more downside volatility than the average long-short fund (it was down 34% in 2008, for example, compared with 15% for its peers) but also a more explosive upside (gaining 42% in 2009 against 10% for its peers). That’s not a common combination and RiverPark’s small marketing team has been having trouble finding investors who understand and value the combination. TCW is interested in developing a presence in “the liquid alts space” and has a sales force that’s large enough to find the investors that Gargoyle is seeking.

Expenses will be essentially unchanged, though the retail minimum will be substantially higher.

Zacks Small-Cap Core Fund (ZSCCX) has raised its upper market cap limit to $10.3 billion, which hardly sounds small cap at all. That’s the range of stocks like Staples (SPLS) and L-3 Communications (LLL) which Morningstar classifies as mid-caps.

SMALL WINS FOR INVESTORS

Touchstone Merger Arbitrage Fund (TMGAX) has reopened to a select subset of investors: RIAs, family offices, institutional consulting firms, bank trust departments and the like. It’s fine as market-neutral funds go but they don’t go very far: TMGAX has returned under 2% annually over the past three years. On whole, I suspect that RiverPark Structural Alpha (RSAFX) remains the more-attractive choice.

CLOSINGS (and related inconveniences)

Effective May 15, 2015, Janus Triton (JGMAX) and Janus Venture (JVTAX) are soft closing, albeit with a bunch of exceptions. Triton fans might consider Meridian Small Cap Growth, run by the team that put together Triton’s excellent record.

Effective at the close of business on May 29, 2015, MFS International Value Fund (MGIAX) will be closed to new investors

Effective June 1, 2015, the T. Rowe Price Health Sciences Fund (PRHSX) will be closed to new investors.

Vulcan Value Partners (VVLPX) has closed to new investors. The firm closed its Small Cap strategy, including its small cap fund, in November of 2013, and closed its All Cap Program in early 2014. Vulcan closed, without advance notice, its Large Cap Programs – which include Large Cap, Focus and Focus Plus in late April. All five of Vulcan Value Partners’ investment strategies are ranked in the top 1% of their respective peer groups since inception.

OLD WINE, NEW BOTTLES

Effective April 30, 2015, American Independence Risk-Managed Allocation Fund (AARMX) was renamed the American Independence JAForlines Risk-Managed Allocation Fund. The objective, strategies and ticker remained the same. Just to make it unsearchable, Morningstar abbreviates it as American Indep JAFrl Risk-Mgd Allc A.

Effective on June 26, 2015 Intrepid Small Cap Fund (ICMAX) becomes Intrepid Endurance Fund and will no longer to restricted to small cap investing. It’s an understandable move: the fund has an absolute value focus, there are durned few deeply discounted small cap stocks currently and so cash has built up to become 60% of the portfolio. By eliminating the market cap restriction, the managers are free to move further afield in search of places to deploy their cash stash.

Effective June 15, 2015, Invesco China Fund (AACFX) will change its name to Invesco Greater China Fund.

Effective June 1, 2015, Pioneer Long/Short Global Bond Fund (LSGAX) becomes Pioneer Long/Short Bond Fund. Since it’s nominally not “global,” it’s no longer forced to place at least 40% outside of the U.S. At the same time Pioneer Multi-Asset Real Return Fund (PMARX) will be renamed Pioneer Flexible Opportunities.

As of May 1, 2015 Royce Opportunity Select Fund (ROSFX) became Royce Micro-Cap Opportunity Fund. For their purposes, micro-caps have capitalizations up to $1 billion. The Fund will invest, under normal circumstances, at least 80% of its net assets in equity securities of companies with stock market capitalizations up to $1 billion. In addition, the Fund’s operating policies will prohibit it from engaging in short sale transactions, writing call options, or borrowing money for investment purposes.

At the same time, Royce Value Fund (RVVHX) will be renamed Royce Small-Cap Value Fund and will target stocks with capitalizations under $3 billion. Royce Value Plus Fund (RVPHX) will be renamed Royce Smaller-Companies Growth Fund with a maximum market cap at time of purchase of $7.5 billion.

OFF TO THE DUSTBIN OF HISTORY

AlphaMark Small Cap Growth Fund (AMSCX) has been terminated; the gap between the announcement and the fund’s liquidation was three weeks. It wasn’t a bad fund at all, three stars from Morningstar, middling returns, modest risk, but wasn’t able to gain enough distinction to become economically viable. To their credit, the advisor stuck with the fund for nearly seven years before succumbing.

American Beacon Small Cap Value II Fund (ABBVX) will liquidate on May 12. The advisor cites a rare but not unique occurrence to explain the decision: “after a large redemption which is expected to occur in April 2015 that will substantially reduce the Fund’s asset size, it will no longer be practicable for the Manager to operate the Fund in an economically viable manner.”

Carlyle Core Allocation Fund (CCAIX) and Enhanced Commodity Real Return (no ticker) liquidate in mid-May.

The Citi Market Pilot 2030 (CFTYX) and 2040 (CFTWX) funds each liquidated on about one week’s notice in mid-April; the decision was announced April 9 and the portfolio was liquidated April 17. They lasted just about one year.

The Trustees have voted to liquidate and terminate Context Alternative Strategies Fund (CALTX) on May 18, 2015.

Contravisory Strategic Equity Fund (CSEFX), a tiny low risk/low return stock fund, will liquidate in mid-May.

Dreyfus TOBAM Emerging Markets Fund (DABQX) will be liquidated on or about June 30, 2015.

Franklin Templeton is thinning down. They merged away one of their closed-end funds in April. They plan to liquidate the $38 million Franklin Global Asset Allocation Fund (FGAAX) on June 30. Next the tiny Franklin Mutual Recovery Fund (FMRAX) is looking, with shareholder approval, to merge into the Franklin Mutual Quest Fund (TEQIX) likely around the end of August.

The Jordan Fund (JORDX) is merging into the Meridian Equity Income Fund (MRIEX), pending shareholder approval. The move is more sensible than it looks. Mr. Jordan has been running the fund for a decade but has little to show for it. He had five strong years followed by five lean ones and he still hasn’t accumulated enough assets to break even. Minyoung Sohn took over MRIEX last October but has only $26 million to invest; the JORDX acquisition will triple the fund’s size, move it toward financial equilibrium and will get JORDX investors a noticeable reduction in fees.

Leadsman Capital Strategic Income Fund (LEDRX) was liquidated on April 7, 2015, based on the advisor’s “representations of its inability to market the Fund and the Adviser’s indication that it does not desire to continue to support the Fund.” They lost interest in it? Okay, on the one hand there was only $400,005 in the fund. On the other hand, they launched it exactly six months before declaring failure and going home. I’m perpetually stunned by advisors who pull the plug after a few months or a year. I mean, really, what does that say about the quality of their business planning, much less their investment acumen?

I wonder if we should make advisers to new funds post bail? At launch the advisor must commit to running the fund for no less than a year (or two or three). They have to deposit some amount ($50,000? $100,000?) with an independent trustee. If they close early, they forfeit their bond to the fund’s investors. That might encourage more folks to invest in promising young funds by hedging against one of the risks they face and it might discourage “let’s toss it against the wall and see if anything sticks” fund launches.

Manning & Napier Inflation Focus Equity Series (MNIFX) will liquidate on May 11, 2015.

Merk Hard Currency ETF (formerly HRD) has liquidated. Hard currency funds are, at base, a bet against the falling value of the US dollar. Merk, for example, defines hard currencies as “currencies backed by sound monetary policy.” That’s really not been working out. Merk’s flagship no-load fund, Merk Hard Currency (MERKX), is still around but has been bleeding assets (from $280M to $160M in a year) and losing money (down 2.1% annually for the past five years). It’s been in the red in four of the past five years and five of the past ten. Here’s the three-year picture.

Presumably if investors stop fleeing to the safe haven of US Treasuries there will be a mighty reversal of fortunes. The question is whether investors can (or should) wait around until then. Can you say “Grexit”?

Effective May 1, 2015, Royce Select Fund I (RYSFX) will be closed to all purchases and all exchanges into the Fund in anticipation of the fund being absorbed into the one-star Royce 100 Fund (ROHHX). Mr. Royce co-manages both but it’s still odd that they buried a three-star small blend fund into a one-star one.

The Turner Funds will close and liquidate the Turner Titan Fund (TTLFX), effective on or about June 1, 2015. It’s a perfectly respectable long/short fund in which no one had any interest.

The two-star Voya Large Cap Growth Fund (ILCAX) is slated to be merged into the three-star Voya Growth Opportunities Fund (NLCAX). Same management team, same management fee, same performance: it’s pretty much a wash.

In Closing . . .

The first issue of the Observer appeared four years ago this month, May 2011. We resolved from the outset to try to build a thoughtful community here and to provide them with insights about opportunities and perspectives that they might never otherwise encounter. I’m not entirely sure of how well we did, but I can say that it’s been an adventure and a delight. We have a lot yet to accomplish and we’re deeply hopeful you’ll join us in the effort to help investors and independent managers alike. Each needs the other.

Thanks, as ever, to the folks – Linda, who celebrates our even temperament, Bill and James – who’ve clicked on our elegantly redesigned PayPal link. Thanks, most especially, to Deb and Greg who’ve been in it through thick and thin. It really helps.

A word of encouragement: if you haven’t already done so, please click now on our Amazon link and either bookmark it or set it as one of the start pages in your browser. We receive a rebate equivalent to 6-7% of the value of anything you purchase (books, music, used umbrellas, vitamins …) through that link. It costs you nothing since it’s part of Amazon’s marketing budget and if you bookmark it now, you’ll never have to think about it again.

We’re excited about the upcoming Morningstar conference. All four of us – Charles, Chip, Ed and I – will be around the conference and at least three of us will be there from beginning to end, and beyond. Highlights for me:

- The opportunity to dine with the other Observer folks at one of Ed’s carefully-vetted Chicago eateries.

- Two potentially excellent addresses – an opening talk by Jeremy Grantham and a colloquy between Bill Nygren and Steve Romick

- A panel presentation on what Morningstar considers off-the-radar funds: the five-star Mairs & Power Small Cap (MSCFX, which we profiled late in 2011), Meridian Small Cap Growth (MSGAX, which we profiled late in 2014) and the five-star Eventide Gilead Fund (ETAGX, which, at $1.6 billion, is a bit beyond our coverage universe).

- A frontier markets panel presented by some “A” list managers.

- The opportunity to meet and chat with you folks. If you’re going to be at Morningstar, as exhibitor or attendee, and would like a chance to chat with one or another of us, drop me a note and we’ll try hard to set something up. We’d love to see you.

As ever,