Dear friends,

“And they’re off!” signals both the start of a horse race and the end of a class’s years at college.

Augustana just launched 485 more grads in your direction. It’s our 157th assault on adult life, and one of our largest. I’m pleased that Mike Daniels was the student selected to speak at commencement but he’s so durn Augie. Mike’s a defensive lineman, but also a jazz musician. He’s an accountant, but also a first team NCAA Academic All-American. He’s been to Italy (with the football team), but also managed to sneak in three internships on his way to working for Deloitte & Touche. He’s a good man who overtly rejects “good enough” as a goal; that is not, he said, “the Augie way.”

They’re good kids. Be patient with them. They really do want to do right. They’re awfully bright. They learn fast. They work and play well together. They’re a lot more aware of the world around them than I was at their age. They’ll keep you young if you let them.

I’m not sure that they’re as relentlessly curious as we once were, but that’s mostly because they don’t have to wonder about the answers; they simply Google them. I’d grumble about their sense of entitlement, but every time I glance in the mirror I blush at the source of it. Their attention span is pretty short, I guess, and they seem incapable of focusing on one thing at a time. But I think that’s because they’re smart and they’ve learned the lesson we have chosen to teach them: do more and do it now! I’m not sure when it became common for 10th graders to have resumes – and concerns about building resumes – but we’re there now. And if we wonder why Facebook and Instagram creep into their daytime hours, we might think about the number of work emails and texts that creep into their nighttime hours.

Celebrating commencement: from peril to Pollyanna, and back

Such events are normally festooned by modestly gaseous speeches from distinguished adults. For better and worse, no one is listening; words may flow into their ears, but they’re not lodging in their brains. Given the day, how could they?

Bill Gates, perhaps sensing the problem, decided to try a different approach to a valedictory address. He tweeted it. Here is Gate’s May 15th address to The Classes of 2017:

- New college grads often ask me for career advice. At the risk of sounding like this guy…https://www.com/watch?v=Dug-G9xVdVs … [Snowball: it’s the “just one word: plastics” clip from The Graduate]

- [Artificial intelligence], energy, and biosciences are promising fields where you can make a huge impact. It’s what I would do if starting out today.

- Looking back on when I left college, there are some things I wish I had known.

- For example, intelligence takes many different forms. It is not one-dimensional. And not as important as I used to think.

- I also have one big regret: When I left school, I knew little about the world’s worst inequities. Took me decades to learn.

- You know more than I did when I was your age. You can start fighting inequity, whether down the street or around the world, sooner.

- Meanwhile, surround yourself with people who challenge you, teach you, and push you to be your best self. As @MelindaGates does for me.

- Like @WarrenBuffett I measure my happiness by whether people close to me are happy and love me, & by the difference I make for others.

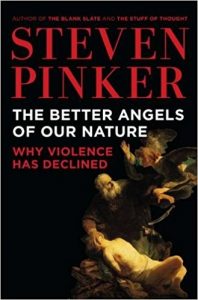

- If I could give each of you a graduation present, it would be this–the most inspiring book I’ve ever read.

- @SAPinker shows how the world is getting better. Sounds crazy, but it’s true. This is the most peaceful time in human history.

- That matters because if you think the world is getting better, you want to spread the progress to more people and places.

- It doesn’t mean you ignore the serious problems we face. It just means you believe they can be solved.

- This is the core of my worldview. It sustains me in tough times and is the reason I love my work. I think it can do same for you.

- This is an amazing time to be alive. I hope you make the most of it.

“It’s an amazing time … with serious problems … they can be solved.” It’s a call to action that Bernie Sanders echoed two weeks later: “In response to these very serious problems it seems to me that we have two choices. First we can throw up our hands in despair. We can moan and groan. We can withdraw from the public reality that we face. We can loudly proclaim that we can’t beat the system. That is one response. It is an understandable response but it is not an acceptable response” because the costs of despair are too high.

Gates’s endorsement of The Better Angels of our Nature drove sales of the book on Amazon through the roof, from about #12,000 to #2 in just a few days. For those of us reluctant to slog through an 832-page tome (inside every fat book there’s a thin book struggling to get out), here’s the short version:

- Almost all of human history has been a bloody horror, often in a literal “ankle-deep in blood” sense.

- But, century by century, it’s gotten better because we’re able to use our brains to make the world more secure and humane.

- Nonetheless, we insist on romanticizing the past and demonizing the present, mostly because the present is a pain in our butts and the past can’t hurt us anymore.

Pinker’s bottom line: there is no time machine to let us return there and, if there was, no one but a fool would step into it.

Setting aside the furor that the book engendered (and it was furious), there is a powerful warning embedded in Pinker’s Pollyanna prose: an attempt to return America to some rose-hued Golden Age is not only doomed from the start (it didn’t exist and we can’t get there), but it’s also powerfully destructive. Rather than celebrate the world we have and grapple with its problems, we’d sink into delusion and denial, letting manageable problems swell into horrific ones. Which, of course, just encourages more denial and nostalgia.

The administration’s obsession with the coal industry has that flavor. The coal industry as a whole employs, from miners to secretaries, just over 50,000 Americans. Those are hard, often dangerous (my grandfather’s work in the mines almost kept him from, well, becoming my grandfather), often high-paid (the industry average is $28/hour) jobs in towns that need them; still, it is a tiny pool, being dried up by private competition rather than government fiat. Even if we were to magically increase employment in coal by 50%, it would still employ far fewer people than my local Hy-Vee grocery chain.

And so, to our new graduates, welcome to the world! It’s a wonderful place. It’s a horrible place. It’s yours, and ours. Time to get working!

Had I mentioned that my Ph.D. is in a non-quantitative field?

I’m trained as a debate coach and a historian of rhetoric. I have a visceral attachment to words, stories and ideas and a modestly anxious acquaintance with number. I mention all this as part of an apology and a mea culpa.

In our June issue, we urged people to take a realistic look at the risks embedded in their portfolios. In particular, we suggested that you should quickly calculate the likely downside you face in the sort of powerful corrections we’ve recently seen, 2000-02 and 2007-09. One way to do that is to multiply the maximum drawdown for each fund in your portfolio by its weight in your portfolio, then add the products together. The sum you see is an approximation of the amount by which your portfolio might decline in a bear market.

All of which would have worked better if I’d been paying more attention to Mrs. Zimmermann in fifth-grade math, when she introduced percentages. I ended up miscalculating the drawdown impact of two funds, which overstated my portfolio’s likely loss. Our colleague and data demon Charles later went in and refined the drawdown calculation from funds that are too new to have experienced the 2007-09 downturn.

Bottom lines:

- My portfolio, which I think of as a conservative growth model, might well lose 30% in a sharp downturn, rather than the 33% I originally estimated. I might expect to take 3-5 years to recover those losses.

- I’m pleased with my manager’s risk sensitivity. I looked for the closest match ETFs for my core holdings, to compare the impact that my managers have on downside protection. For some funds (FPA Crescent), there are simply no substitutes. For others, the comparison of losses in 2007-09 is instructive:

As a substitute for

My MaxDD

ETF’s MaxDD

iShares Emerging Markets ETF

Seafarer

53%

60

PowerShares Emerging Markets Sovereign Debt Portfolio

Matthews Asian Strategic Income

20

26

iShares MSCI EAFE ETF

Artisan International Value

47

57

iShares Morningstar Small-Cap Value ETF

Intrepid Endurance

19

53

BLDRS Asia 50 ADR Index Fund

Matthews Asian Growth & Income

38

57

- I’m deeply grateful for all the folks who took the argument seriously to detect the error and share it with us. Those include Thom Pickett, a senior vice president at Wells Fargo Advisors, as well as bee, willmatt72 and Vintage Freak on MFO’s always lively discussion board. Thanks guys!

PARMX: no longer “left behind by Morningstar”

As Morningstar’s priorities have shifted, they’re dropped coverage of hundreds of exceptionally strong funds. Our standard for “exceptionally strong” is funds that have maintained a four- or five-star rating over every trailing time period.

On the flipside, we occasionally discover a fund that has been re-discovered by Morningstar. So, kudos to Parnassus Mid-Cap (PARMX). PARMX is a $2.4 billion, five-star mid-cap fund with a set of strong ESG screens. The fund was last covered six years ago (5/19/2011) when Kathryn Young concluded that you should “keep this fund on your radar, but give it time to mature.”

Apparently “time” translated to “about six years,” including five in which the fund handily beat its peers. On March 30, 2017, Wiley Green offered these highlights: “Parnassus Mid Cap has it all for environmental, social, and governance investors seeking mid-cap exposure … The team has executed well [and] the fund’s risk-adjusted performance shines, with lower volatility and better downside protection than the category and index during the same time frames.”

Morningstar prospects: Hope for the little guy

Morningstar publishes a quarterly list of “up-and-coming or under-the-radar investment strategies that Morningstar Manager Research thinks might be worthy of full coverage someday.”

The list is available only by subscription but we received permission to share highlights.

Two funds went from prospect to full coverage: ClearBridge Large Cap Growth (SBLGX), a 20 year old, $7.4 billion fund, was recognized as a Bronze medalist while Vanguard Tax-Exempt Bond Index (VTEBX), which is not yet two years old, has been awarded a Silver medal.

Columbia Acorn Emerging Markets (CEFZX) was dropped entirely from the Prospects list because of the departure of manager Fritz Kaegi and turmoil at Columbia Acorn funds.

New prospects include

- Tributary Small Company (FOSCX). Our December 2016 profile described it as “one of the best small cap funds available to you.”

- Westwood SmallCap (WHGSX), a 10-year old small- to micro-cap blend fund. Nominally institutional, it has a $5,000 minimum.

- Morgan Stanley Global Opportunities, led by a protégé of star manager Dennis Lynch.

- GQG Partners Emerging Markets Equities (GQGPX). It’s a new fund by a star manager Rajiv Jain. You can get some sense of Mr. Jain’s thinking from our February 2017 Elevator Talk with him.

- LJM Preservation & Growth (LJMAX), an options trading fund. I’ve sort of given up on options funds and managed futures funds, so I’ll mostly nod here.

- Oppenheimer Fundamental Alternatives (QVOPX), a 28-year-old multi-alternatives fund with a team that’s now been in place for five years.

Congratulations to the prospects, and thanks to Morningstar for sharing them.

Thanks, too, to you!

William, Patrick, and Jason – thanks so much for your contribution. It means a lot to us. And, as always, our trusty regulars Jonathan, Deb, Brian, and Greg. We couldn’t do it without you. For those who’d like to make a contribution, you can see your options on the “Support Us” page. We always appreciate your help.

As ever,