Updates

Chuck Jaffe has been named editor-in-chief of RagingBull.com. Do I even make jokes about Chuck and a site that highlights “bull”? No. No, I do not. Chuck’s appointment is part of a process to increase the stock-touting site’s journalistic integrity and transparency.

Chuck Jaffe has been named editor-in-chief of RagingBull.com. Do I even make jokes about Chuck and a site that highlights “bull”? No. No, I do not. Chuck’s appointment is part of a process to increase the stock-touting site’s journalistic integrity and transparency.

Briefly Noted . . .

In advance of its merger into Century Shares Trust (CENSX), the Congress Large Cap Growth Fund (CAMLX) is changing its investment objective from “long term capital appreciation” to “long-term capital growth.” Given that, as the Investopedia rightly notes, “capital growth … is also known as capital appreciation,” it’s not immediately clear why the adviser had to rush to get the word out.

A note to the Chinese: Your Wall cannot save you!

Vanguard received a “wholly foreign-owned enterprise” license from the China Securities Regulatory Commission last November and has now opened a subsidiary in Shanghai. A company representative says, “We look forward to introducing investors in China to our low-cost philosophy [which] could result in the so-called Vanguard effect – the tendency for our entrance into a market to drive down investment costs by encouraging other companies to lower their fees to compete with Vanguard.”

SMALL WINS FOR INVESTORS

Laudus Mondrian International Equity Fund (LIEIX) and Laudus Mondrian Emerging Markets Fund (LEMNX) have each opted for radical simplification: their Investor and Select share classes have been eliminated and the investment minimum on the remaining, Institutional, share class has been eliminated as well. The International Equity fund is exceptionally solid, run by the same folks who run the five star, really institutional Mondrian International Equity Fund (PIEPX). It’s well worth a look.

Beyond that, the industry continues to make widespread but shallow efforts at self-improvement: lots of minor fee reductions and some other share class simplifications that give more investors access to lower-cost shares.

CLOSINGS (and related inconveniences)

Longleaf Partners Fund (LLPFX) has been closed to new investors.

Effective June 9, 2017, the Oberweis International Opportunities Fund (OBIOX) hard closed for essentially all investors.

OLD WINE, NEW BOTTLES

Effective August 15, 2017, AMG FQ U.S. Equity Fund (FQUAX) becomes AMG FQ Long-Short Equity Fund and, presumably, starts shorting stocks. Since they haven’t been particularly distinguished as long-only investors (they’ve trailed 75% of their peers over the past five years with a 175% annual turnover), the desire to try something new is understandable.

AMG River Road Select Value Fund, formerly ASTON/River Road Select Value Fund, is now also formerly AMG River Road Select Value Fund. On June 30, 2017, the fund was rechristened as AMG River Road Small-Mid Cap Value Fund.

Ascendant Deep Value Convertibles Fund (AEQAX) has transformed into Ascendant Deep Value Bond Fund, with a new mandate to invest in … well, bonds rather than convertibles.

The BlackRock Mid Cap Value Opportunities Fund (MDRFX) has changed its name to BlackRock Mid Cap Dividend Fund.

In one of those moves that just cries out “hey! The marketing team just weighed-in,” Calamos High Income Fund (CHYDX) has been renamed Calamos High Income Opportunities Fund. The management team and strategy are unchanged, there’s a new benchmark index and it looks like expenses are being reduced by 8 bps to a well above-average 1.25%.

On June 29, 2017, the name of the Entrepreneur U.S. All Cap Fund (IMPAX) changed to Entrepreneur U.S. Small Cap Fund, which means that the fund’s mid- and large-cap holdings are getting trimmed away. One month later, July 31, 2017, they’re liquidating the fund’s Investor share class. While many funds, faced with that decision, move their Investors into Institutional shares, the Entrepreneurs are simply popping checks in the mail and bidding their Investors adieu.

At the end of August 2017, Exceed Defined Shield Index Fund (SHIEX) becomes the Catalyst/Exceed Defined Shield Fund. There’s already a Catalyst Exceed Defined Risk Fund (CLPAX), so the transition shouldn’t be jarring.

1st Source Monogram Income Equity Fund (FMIEX) begat Wasatch Large Cap Value Fund and in the third generation Wasatch Large Cap Value begat Wasatch Global Value Fund. The fund has been pretty mediocre since David Powers took over from the original management team in August 2013 and it has no real tradition of global investing (international stocks are a tenth of the portfolio), so it’s hard to get excited.

The one-star Horizon Spin-off & Corporate Restructuring (LSHAX) is being relaunched as Kinetics Spin-off and Corporate Restructuring with the same management team and an additional share class or two.

RidgeWorth Capital Innovations Global Resources and Infrastructure Fund (INNAX) has become the Oak Ridge Global Resources & Infrastructure Fund.

The Rainier funds are reorganizing into Hennessy funds sometime in the third quarter of 2017. Here’s the translation:

| Rainier Small/Mid Cap Equity | Hennessy Cornerstone Mid Cap 30 |

| Rainier Mid Cap Equity | Hennessy Cornerstone Mid Cap 30 |

| Rainier Large Cap Equity | Hennessy Cornerstone Large Cap Growth |

Similarly, the former Scout funds are all being rebranded as Carillon and Carillon Reams funds, the latter after the name of the long-time sub-adviser to the Scout bond funds. Ecce:

| Scout International | Carillon Scout International |

| Scout Mid Cap | Carillon Scout Mid Cap |

| Scout Small Cap | Carillon Scout Small Cap |

| Scout Low Duration Bond | Carillon Reams Low Duration Bond |

| Scout Core Bond | Carillon Reams Core Bond |

| Scout Core Plus Bond | Carillon Reams Core Plus Bond |

| Scout Unconstrained Bond | Carillon Reams Unconstrained Bond |

Somewhere during the 4th quarter, the Sentinel funds will all become Touchstone Funds, some by adoption and others by absorption.

| Sentinel Government Securities | Touchstone Active Bond * |

| Sentinel Low Duration Bond | Touchstone Ultra Short Duration Fixed Income * |

| Sentinel Multi-Asset Income | Touchstone Flexible Income * |

| Sentinel Sustainable Core Opportunities | Touchstone Sustainability and Impact Equity * |

| Sentinel Total Return Bond | Touchstone Active Bond * |

| Sentinel Balanced | Touchstone Balanced , new |

| Sentinel Common Stock | Touchstone Large Cap Focused, new |

| Sentinel International Equity | Touchstone International Equity, new |

| Sentinel Small Company | Touchstone Small Company, new |

*Existing Touchstone Fund.

Finally, WisdomTree has decided to add “U.S.” to the names of a bunch of its (presumably domestic) equity funds.

| WisdomTree Total Dividend | WisdomTree U.S. Total Dividend |

| WisdomTree LargeCap Dividend | WisdomTree U.S. LargeCap Dividend |

| WisdomTree MidCap Dividend | WisdomTree U.S. MidCap Dividend |

| WisdomTree SmallCap Dividend | WisdomTree U.S. SmallCap Dividend |

| WisdomTree High Dividend | WisdomTree U.S. High Dividend |

| WisdomTree Dividend ex-Financials | WisdomTree U.S. Dividend ex-Financials |

| WisdomTree Total Earnings | WisdomTree U.S. Total Earnings |

| WisdomTree Earnings 500 | WisdomTree U.S. Earnings 500 |

| WisdomTree MidCap Earnings | WisdomTree U.S. MidCap Earnings |

| WisdomTree SmallCap Earnings | WisdomTree U.S. SmallCap Earnings |

| WisdomTree LargeCap Value | WisdomTree U.S. LargeCap Value |

Effective June 19, 2017, the Tortoise North American Energy Independence Fund (TNPTX) was reorganized into the Tortoise Select Opportunity Fund.

OFF TO THE DUSTBIN OF HISTORY

ALPS/Sterling ETF Tactical Rotation Fund (ETRAX) disappeared at the close of business on June 26, 2017.

On June 22, 2017, the Board of Trustees “determined to terminate and wind up” the Alpine Emerging Markets Real Estate Fund (AEAMX). It’s about impossible to benchmark the fund’s performance since pretty much no one else operated in the space. No word on when that’s going to occur.

One of our weirder liquidations this month also comes from Alpine. I’ll quote without comment: “Effective June 22, 2017, the Board of Trustees of the Alpine Global Realty Growth & Income Fund approved the termination of the Fund. There were no shareholders on that date. As the Fund has ceased operations, shares of the Fund are no longer being offered.” Oooookay then.

AMG Managers High Yield Fund (MHHAX), a modestly above-average fund with a stable management team and manageable expenses (1.15%) will liquidate and terminate on or about August 31, 2017. The portfolio began transitioning to cash in June 12, 2017.

Arrow Commodity Strategy Fund (CSFFX) will liquidate on July 28, 2017.

Cozad Small Cap Value Fund (COZNX) is becoming Oberweis Small Cap Value, pending the (inevitable) approval of shareholders, which will be sought in July.

Credit Suisse Emerging Markets Equity Fund (CSNAX) – which managed to make about 1.2% over the course of 40 months – was liquidated on June 23, 2017.

Dhandho Junoon ETF (JUNE) – which specialized in investing in “Cannibals,” “Spin-off” and “Select Value Manager Holdings” — liquidated on June 30, 2017.

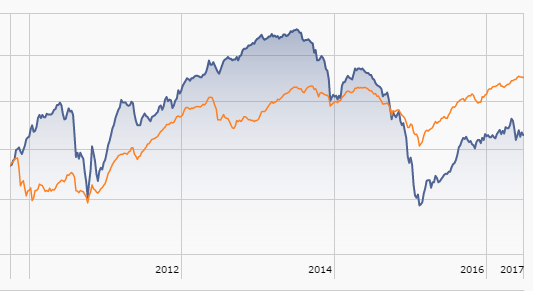

Driehaus Select Credit Fund (DRSLX) will liquidate on July 24, 2017. As you might expect of a Driehaus fund, DRSLX (the blue line) has been … uhhh, bold.

Franklin MidCap Value Fund (the “Fund”) is expected to merge into Franklin Small Cap Value Fund around the beginning of December, 2017.

Frontier Netols Small Cap Value Fund (FNVSX) essentially disappears on July 1, 2017. The principal at Netols is retiring and so Netols Asset Management is getting out of the business; the Board brought in Phocas Financial. The new manager “uses a different investment strategy than Netols … it is expected that most of the Fund’s existing holdings will be sold and replaced by new securities.” That likely signals a noticeable tax bill. On the upside, Phocas has done a nice job with Frontier Phocas Small Cap Value (FPVSX),

Glenmede U.S. Emerging Growth Portfolio (GTGSX) will close on August 31, 2017 and will liquidate on November 17, 2017.

The Grand Prix Investors Fund (no ticker symbol?) will close and liquidate on July 28, 2017. This offering, launched and managed by Autosport Fund Advisors, is bad but not nearly so bad as the other Grand Prix fund, a long-dead reminder of the foolishness of the 1990s and winner of a 2004 Booby Prize from Forbes.

GuideMark Opportunistic Equity Fund (GMOPX) liquidates on July 31, 2017.

JP Morgan is asking its shareholders to authorize the merger of JPMorgan Dynamic Growth Fund (DGAAX) into JPMorgan Large Cap Growth Fund (OLGAX).Both are four star funds with the same manager; OLGAX is about 30-times the size of its sibling. If approved, the merger would go through in the fourth quarter.

Mirae Asset Global Dynamic Bond Fund (MAGDX) will liquidate its assets “as soon as practicable” and will liquidate itself on August 4, 2017. It’s been a singularly strong fund since inception, despite rather higher fees than one might like.

Nationwide Portfolio Completion Fund (NWAAX) will liquidate on or about August 18, 2017, presumably leaving a lot of Nationwide portfolios incomplete.

All four of the New Century funds of funds – Alternative Strategies (NCHPX), Balanced (NCIPX), Capital (NCCPX) and International (NCFPX) – will liquidate, assuming shareholder approval, at the end of August, 2017.

PNC Target-Date Funds (2020-2050 and Retirement Income) will liquidate on or about August 7, 2017.

QS Dynamic Multi-Strategy Fund (LDFAX) “is expected to cease operations on or about August 25, 2017.”

State Street Global Advisors announced plans to liquidate nearly 20 ETFs, almost all of them international equity funds, by the end of July. They are:

- SPDR Bloomberg Barclays 0-5 Year TIPS ETF (SIPE)

- SPDR EURO STOXX 50® Currency Hedged ETF (HFEZ)

- SPDR MSCI Australia StrategicFactorsSM ETF (QAUS)

- SPDR MSCI Spain StrategicFactorsSM ETF (QESP)

- SPDR S&P® Emerging Europe ETF (GUR)

- SPDR S&P Emerging Latin America ETF (GML)

- SPDR S&P Emerging Middle East & Africa ETF (GAF)

- SPDR S&P International Consumer Discretionary Sector ETF (IPD)

- SPDR S&P International Consumer Staples Sector ETF (IPS)

- SPDR S&P International Dividend Currency Hedged ETF (HDWX)

- SPDR S&P International Energy Sector ETF (IPW)

- SPDR S&P International Financial Sector ETF (IPF)

- SPDR S&P International Health Care Sector ETF (IRY)

- SPDR S&P International Industrial Sector ETF (IPN)

- SPDR S&P International Materials Sector ETF (IRV)

- SPDR S&P International Technology Sector ETF (IPK)

- SPDR S&P International Telecommunications Sector ETF (IST)

- SPDR S&P International Utilities Sector ETF (IPU)

- SPDR S&P Russia ETF (RBL)

TCW International Growth Fund (TGIDX) was liquidated on June 30, 2017.

Triad Small Cap Value Fund (TSCVX) liquidated on June 23, 2017. The adviser laments “its inability to market the Fund.”

WisdomTree Strategic Corporate Bond Fund (CRDT), WisdomTree Western Asset Unconstrained Bond Fund (UBND) and WisdomTree Global Real Return Fund (RRF) will all liquidate on August 16, 2017. The advisor cites “limited future prospects of investor demand for the Funds.”