Dear friends,

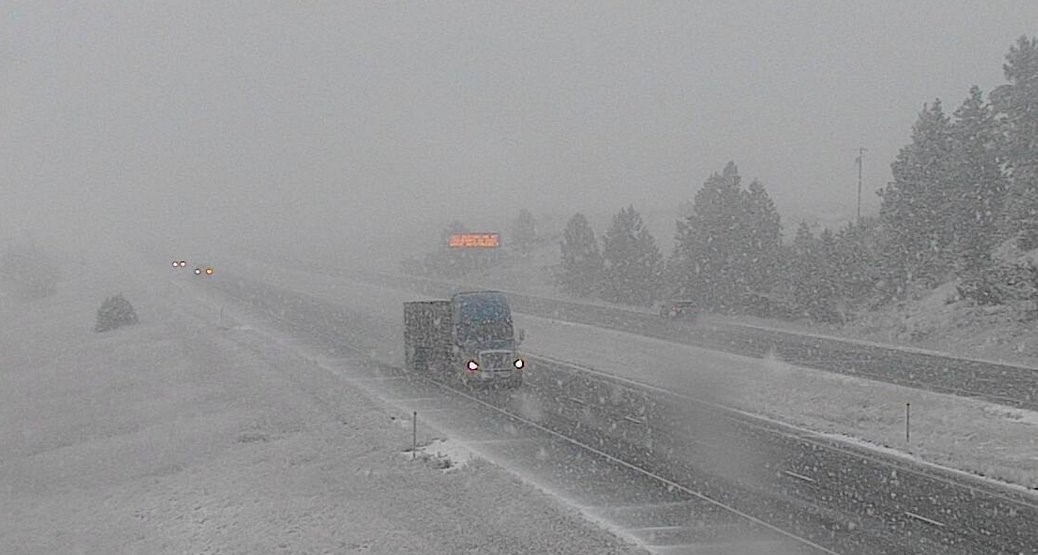

Welcome to autumn! The leaves are only hinting at the changes to come and my tomatoes tenaciously insist that it’s still August and they’re still going to ripen. But the 40 degree nights and yesterday’s pictures from Montana give lie to their obstinate optimism.

My optimism is fed by other springs: by the ripening of apples and the prospect of a long lovely drive up the Mississippi, by the chance this week to see my son at college and to celebrate his new friends. By the excuse to unpack the warm and bulky sweaters that have warmed me through, in a couple cases, nearly 30 winters … along with the plaid flannel shirts that my family rolls their eyes at. We’ll can some tomatoes and a bit of homemade apple sauce and, quite likely, invite my first-year students – from Vietnam and Pakistan, Nepal and Sweden, the UK and the PRC – over for homemade bread and soup, bits of pie and the chance to spend an evening away from campus. It is fed, finally, by the hope that the chaos of summer resolves into the quiet, predictable rhythms of fall.

We’ll see.

Those looking for a reason to renew their sense of the decency and extraordinary good of everyday folks might enjoy Charles’s essay this month, about the 110 members of the Alpha Architect team who participated in The March for The Fallen event. It offers, Charles notes, “proof positive that there is more to this group of money managers and financial advisors than their stereotypes hyping products, gathering assets, and pocketing high fees.” It’s a good tale.

This is our second issue of the Observer in two weeks, following the mid-month launch of our September issue. We know that many folks will have missed it. There was much cool stuff there, still timely. Dennis profiled the Conestoga SMID Cap Fund (CCSMX) while Charles shared a Launch Alert for a very promising Litman Gregory Masters High Income Alternatives Fund. I spent rather a lot of time with the managers of Seafarer Overseas Growth & Income, working to understand the recently unveiled changes in management team and portfolio strategy. Ed, as ever, stepped back from the day-to-day fray to take a longer look at the consequences of Amazon’s rise and the prospects of its fall. It was, on whole, a good collection and we commend it to you.

For folks who wondered what was up with the September issue and couldn’t find out, we urge you to confirm signing up for the MFO monthly email notification. About 7,000 of our 27,000 or so readers receive a monthly notice of the new issue’s launch and its highlights. We’ve also used that list to give folks a heads up in the rare occasions that we’ve had to delay release of an issue or we’ve offered folks the opportunity to participate in a conference call with an exceptional fund manager. We don’t share your email and we don’t send more than one email each month, except in extraordinary circumstances. Your choice. You can either click on the link above or complete the form at the bottom of MFO’s homepage.

Thanks, as ever, to our steady subscribers, Deborah and Greg, and to our newest monthly contributor, David, your faith in us is greatly appreciated. It’s easy to set up a regular, monthly contribution through our PayPal link. If you set a recurring contribution of $10 or more a month, it would (a) be ridiculously painless for you; (b) wonderfully helpful for us; and (c) earn you both a tax deduction and access to MFO Premium. Many thanks, too, to John, Paul, Mitchell, Marva, and Steve; we couldn’t do it without your help.

With luck, November will see us back on our normal rotation. (I say that just to hear God laugh at me.) We’ll do our best. You likewise!