The imminence of Halloween reveals itself in the deadened thud as the walking dead move toward the graveyard. Summer saw a curious lull in fund liquidations and manager changes both, but the end of summer is ending that reprieve. Our mid-September and October issues recount 70 obituaries, the vast majority of which were announced in the past 30 days. A precious few were high-performing funds that couldn’t attract attention. There seems to be a pattern in the remainder: lots of funds designed to hedge against market volatility, lots of funds designed to hedge against rising prices and a few more funds with exposure to emerging markets.

Updates

In our July issue, we profiled LS Opportunity Fund (LSOFX) which has been guided for the past three years by Prospector Partners. In its class, we found that LSOFX had the highest returns and some of the lowest risks for the period that Prospector has guided it. We concluded that Prospector’s risk-management takes the sharp edges off the market and “allows you to become a better, more committed long-term investor.” For those interested in a follow-up, Long Short Advisers just hosted a webinar on the fund’s performance and the managers’ outlook.

In our September issue, we reviewed – and endorsed – the evolution of Seafarer Overseas Growth & Income (SFGIX). The story, at base, is that both the management team and the portfolio strategy are evolving to become less centered on Andrew Foster and on the “steady Eddy” stocks that Andrew favors. Our argument was that the move was thoughtful, rational and well-designed to serve investors. Morningstar put Seafarer’s analyst rating “under review” for about three weeks. We’re pleased to report that they’re now reaffirmed Seafarer’s Silver rating. William Samuel Rocco, one of Morningstar’s longest-tenured analysts, writes that Seafarer’s “team and strategy remain solid after some modifications, and its other strengths are still intact… [it] remains an appealing emerging-markets vehicle for the long haul.” We agree.

Briefly Noted . . .

SMALL WINS FOR INVESTORS

As of October 31, 2018, Brown Advisory Global Leaders Fund (BAFLX) Institutional Shares of the Fund will be offered for sale to eligible purchasers.

Driehaus continues making substantial fee reductions. As of November 1, 2018, the management fee for Driehaus Emerging Markets Small Cap Growth Fund (DRESX) drops from 1.50 to 1.15% and expenses get capped at 1.45% overall.

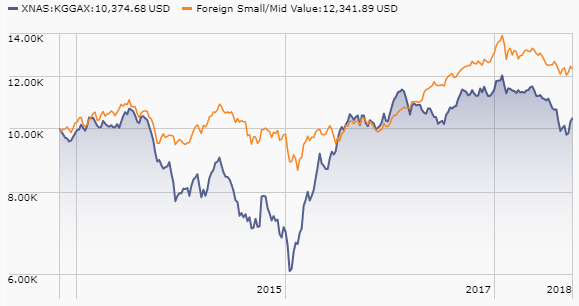

Something’s up at Kopernik. Kopernik Global, the company, is the shadow of a guy named David Iben. Mr. Iben is one of those fabulously successful guys (he managed Voya Global for six years) who struck out on his own. And, for a while, “struck out” seemed like a good choice of words. Over its first couple years, his flagship Global fund sort of looked like this:

The fund staged a furious rebound, though it never recovered the ground lost in its early crash:

In the midst of all that, Kopernik launched a second fund which is only open to Institutional investors, Kopernik International Fund (KGIIX). Morningstar designates it as a five-star fund, though with exceptionally high volatility.

According to a filing with the SEC, Kopernik is dropping the sales load from the “A” shares of its International Fund but maintaining them on the “A” shares of its Global Fund. Odd. Odder still is that there don’t appear to be “A” shares for the International fund. So I’m guessing that there’s a hypothetical, never-launched “A” which is now “Investor” which presumably will be available for sale. They’re also modifying their principal investment strategies to allow them to hold a lot of cash as a temporary defensive maneuver, just in case conditions call for it.

Effective September 28, 2018, Mairs & Power Small Cap Fund (MSCFX) re-opened to all investors.

Effective September 17, 2018, retail shares of the Marmont Redwood International Equity Fund (MRIDX) will be offered for purchase. The managers also run small cap growth portfolios for both John Hancock and Dreyfus.

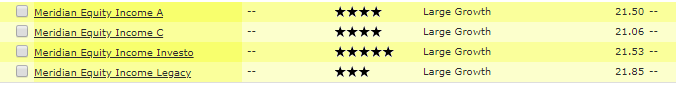

The low minimum, no-load “Legacy” share class of Meridian Equity Income (MEIFX) reopens on November 1 to those purchasing directly from the advisor.

Effective September 30, 2018, the Quaker funds stopped charging front-loads and renamed their “A” class shares as “Advisor” class. At the same time, they’re liquidating the “C” share class and moving those investors into the (cheaper!) Advisor shares. Sadly, they’re also merging away half their funds. You win some, you lose some. Details in the “Dustbin,” below.

CLOSINGS (and related inconveniences)

Upon the recommendation of Luther King Capital Management Corporation, the LKCM funds are liquidating the Adviser Class shares of LKCM Small Cap Equity Fund (LKSAX) on or about October 31, 2018 and have terminated the Adviser Class shares for LKCM Equity Fund (LKEAX) and LKCM Small-Mid Cap Equity Fund (LKSDX), which is less of an issue as they have not commenced operations and have no assets or shareholders. LKCM attributes the move to “changes in the marketplace for the distribution of mutual funds.”

Global X Iconic U.S. Brands ETF (LOGO), which is tiny and not growing, was liquidated on September 28, 2018. Somehow the fact that a collection of “iconic U.S. brands” couldn’t draw investor interests almost makes them seem less than iconic. Ironic?

OLD WINE, NEW BOTTLES

On February 15, 2019, Fidelity SAI International Minimum Volatility Index Fund (FSKLX) will be renamed Fidelity SAI International Low Volatility Index Fund and Fidelity SAI U.S. Minimum Volatility Index Fund (FSUVX) will be renamed Fidelity SAI U.S. Low Volatility Index Fund. I’m guessing “Low” is higher than “Minimum”?

Global X is switching index providers for its various China ETFs from Solactive to MSCI. In consequence, on December 5, 2018, Global X China Financials ETF (CHIX) will become Global X MSCI China Financials ETF and Global X China Industrials ETF (CHII) becomes Global X MSCI China Industrials ETF, the main consequence of which is that the number of portfolio holdings in each will double from about 40 to about 80. At the same, Global X NASDAQ China Technology ETF (QQQC) becomes Global X MSCI China Communication Services ETF and Global X China Energy ETF (CHIE) turns into Global X MSCI China Energy ETF, each with a 50% cut in portfolio holdings. Global X China Consumer ETF (CHIQ) becomes Global X MSCI China Consumer ETF and Global X China Materials ETF (CHIM) becomes Global X MSCI China Materials ETF, both with a modest broadening of the portfolio.

And, on November 19, 2018, Global X YieldCo Index ETF (YLCO) becomes Global X YieldCo & Renewable Energy Income ETF.

Finally, Global X is in the process of acquiring three Horizon ETFs. Following all of the legal niceties, Horizons DAX Germany ETF (DAX) will become Global X DAX Germany ETF, Horizons NASDAQ 100 Covered Call ETF (QYLD) becomes Global X NASDAQ 100 Covered Call ETF and Horizons S&P 500 Covered Call ETF (HSPX) morphs into Global X S&P 500 Covered Call ETF.

Invesco S&P SmallCap Utilities ETF (PSCU) was rechristened Invesco S&P SmallCap Utilities & Communication Services ETF in late September, 2018.

Alert! Alert! Alert! Effective on or around October 23, 2018, iShares MSCI Global Impact ETF will change its ticker symbol from MPCT (which made immediate sense) to SDG (which doesn’t). I’m sure there was a compelling argument – and likely an ad hoc task force, two reviews and a 150 slide PowerPoint deck – behind the change.

Meridian Equity Income Fund (MEIFX) is undergoing a makeover. Effective November 1, it gets rechristened as Meridian Enhanced Equity Fund and the current provision that it seeks “income as a component of total return” and that it focuses on “dividend-paying” equities both disappear. Morningstar rates it as a three-, four- and five-star fund currently.

All of the share classes have returned over 21% through the first three quarters of 2018, though volatility tends to be a third higher than its peers.

On November 30, 2018, Putnam Global Telecommunications Fund (PGBZX) is be rechristened Putnam Global Communications Fund. That’s triggered by a change in the GIC Standard for the field and it’s going to trigger “significant dispositions of certain portfolio holdings.” Just as a heads up, “significant dispositions” are generally taxable and, being unplanned, might well be painfully taxable.

The Tocqueville International Value Fund (TIVFX) is being adopted by American Beacon, with the fund’s current adviser becoming its new sub-adviser. No word on the date. I’m guessing the new fund’s name will be something like, oh, American Beacon Tocqueville International Value Fund.

The 14 Westcore funds have become the Segall Bryant & Hamill funds. The names are parallel (Westcore SCG is now SBH SCG) with a few inconsequential tweaks: Micro Cap (two words) becomes Micro-Cap Opportunity, Fundamental International Small Cap becomes International Small Cap, that sort of thing.

OFF TO THE DUSTBIN OF HISTORY

On September 20, 2018, the Board of Trustees authorized “an orderly liquidation” of the ALPS/Dorsey Wright Sector Momentum ETF (SWIN). From September 21, 2018 through October 22, 2018, the Fund will be in the process of closing down and liquidating its portfolio, and it will cease operation of October 22, 2018.

On September 20, 2018, the Board of Trustees authorized “an orderly liquidation” of the ALPS/Dorsey Wright Sector Momentum ETF (SWIN). From September 21, 2018 through October 22, 2018, the Fund will be in the process of closing down and liquidating its portfolio, and it will cease operation of October 22, 2018.

In what looks like a tiff and/or dust-up, the adviser to American Independence U.S. Inflation-Protected Fund (FFIHX) has advised the Board to liquidate the fund rather than try to re-organize it, has announced their decision to cease management of the fund on October 30, 2018, and to suspend their prior, voluntary cap on the fund’s fees and expenses immediately. The Board hasn’t responded, but that seems pretty much like a fatal wound.

AMG Managers Montag & Caldwell Balanced Fund (MOBAX) and AMG Managers Montag & Caldwell Mid Cap Growth Fund (AMCMX) disappear on October 26, 2018. MOBAX launched in 1994 and has been managed by Ron Canakaris the entire time. It’s a relatively low volatility balanced fund (59% downside capture) whose returns were too modest to maintain a viable investor base. Given Mr. Canakaris’s recent decision to step down as lead manager of Montag & Caldwell Growth, it might be that the fund’s sunset is linked to his.

The Board of Trustees of Professionally Managed Portfolios has approved the merger of Congress SMid Core Opportunity Fund (CACOX) into the Congress Mid Cap Growth Fund (CMIDX). I like their honesty: “the Acquired Fund has grown slowly since its inception, and as of August 31, 2018 the Acquired Fund had only approximately $25.6 million in assets. At the current asset size, the Acquired Fund is unable to support its own expenses without significant subsidy from the Advisor.”

Fidelity is merging away two of its Advisor funds. In each case, the Advisor will disappear into the retail version of the same fund on December 7, 2018. The affected funds are Fidelity Advisor High Income Fund (FHIAX), merging in Fidelity High Income Fund (SPHIX) and Fidelity Advisor Emerging Markets Income Fund (FMKAX), which is absorbed by Fidelity New Markets Income Fund (FNMIX).

FMC Select Fund (FMSLX), once a fabulously successful stealth fund that operated without marketing or even a ticker symbol, will liquidate on October 29, 2018.

Glenmede Mid Cap Equity Portfolio (GMQAX) will be liquidated on November 15, 2018.

Speaking of “distressed,” Guggenheim Event Driven and Distressed Strategies Fund (RYDOX) will, in recognition of “the Fund’s small asset base and low market demand,” liquidate on October 30, 2018.

John Hancock U.S. Growth (JHUAX) will probably merge into John Hancock Strategic Growth Fund (JSGAX) by March 2019. Right now they’re in the “call a shareholder meeting in December” stage of things.

Loomis Sayles Core Disciplined Alpha Bond Fund (LSABX) will liquidate on or about November 15, 2018.

LMCG Global Market Neutral Fund (GMNRX) is closed to new investments and will liquidate on or around the close of business on or about October 31, 2018.

Meeder Aggressive Allocation Fund (FLAGX) will merge into the Meeder Dynamic Allocation Fund (FLDGX), to be effective as of December 3, 2018.

Effective September 25, 2018, the MM Select Bond and Income Asset Fund (MSBJX) was dissolved. The MM in question is Massachusetts Mutual.

NorthPointe Small Cap Value Fund (NPSVX) will liquidate on or about October 26, 2018.

Oppenheimer International Growth and Income Fund (OIMAX) will liquidate on or about November 16, 2018.

PhaseCapital Dynamic Multi-Asset Growth Fund (PHDZX) was liquidated on or about September 27, 2018

Effective as of November 2, 2018, Putnam Emerging Markets Income Fund (PEMWX) will be closed to new purchases and will be liquidated on November 16, 2018.

Quaker Global Tactical Allocation Fund (QTRAX) will merge into the Quaker Impact Growth Fund (QUAGX, formerly the Quaker Strategic Growth Fund) and Quaker Mid-Cap Value Fund (QMCVX) disappears into the Quaker Small/Mid-Cap Impact Value Fund (QSVIX, formerly the Quaker Small-Cap Value Fund). Their target timeframe is “the Fall of 2018.”

Schwab GNMA Fund (SWGSX) will close on October 26, 2018 and will liquidate on November 7, 2018. Schwab notes that investors can continue making investments in the fund right up until the day of execution, but why would you?

Strategic Advisers Income Opportunities Fund of Funds (FPIOX), a Fidelity product, will liquidate on or about December 12, 2018.

Effective immediately, the Topturn OneEighty Fund (TTFOX) has closed to new investments and will discontinue its operations effective October 26, 2018. It was an expensive fund-of-funds that mostly did okay, wherein lay the problem. “Expensive” and “okay” are hard to market.

Virtus will be dragging 10 funds into the graveyard on Halloween this year, none will be returning. Virtus Conservative Allocation Strategy Fund (SVCAX), Virtus Growth Allocation Strategy Fund (SGIAX), Virtus DFA 2015 Target Date Retirement Income Fund, Virtus DFA 2020 Target Date Retirement Income Fund, Virtus DFA 2030 Target Date Retirement Income Fund, Virtus DFA 2035 Target Date Retirement Income Fund, Virtus DFA 2040 Target Date Retirement Income Fund, Virtus DFA 2045 Target Date Retirement Income Fund, Virtus DFA 2050 Target Date Retirement Income Fund, and Virtus DFA 2060 Target Date Retirement Income Fund will liquidate on October 30, 2018.

Westwood Global Equity Fund (WWGEX) will liquidate on October 12, 2018.