Since the number of funds we can cover in-depth is smaller than the number of funds worthy of in-depth coverage, we’ve decided to offer one or two managers each month the opportunity to make a 300 word pitch to you. That’s about the number of words a slightly-manic elevator companion could share in a minute and a half. In each case, I’ve promised to offer a quick capsule of the fund and a link back to the fund’s site. Other than that, they’ve got a few hundred words and precisely as much of your time and attention as you’re willing to share. These aren’t endorsements; they’re opportunities to learn more.

Sometimes relationships start in unexpected ways. Unbeknownst of us, our relationship with Hilton Tactical Income began with our long-ago Funds in Registration filing which reports on funds not yet available to the public. After puzzling through the Hilton prospectus, we offered this breezy description: “The managers start by making a macro-level assessment and then allocate to whatever’s going to work.” Manager Alex Oxenham admits that, “After reading your note I snarkily thought to myself, ‘you bet I plan on allocating to what will work!’”

The reason for our genial skepticism is that such funds promise the world, literally, but rarely deliver. Morningstar’s Adam McCullough recently noted:

Tactical-allocation funds aim to deliver better absolute or risk-adjusted returns than static allocation funds by deftly switching exposure among asset classes. Portfolio managers may evaluate the attractiveness of an asset class using signals such as relative valuations, price trends, economic indicators, sentiment analysis, or a combination of these metrics. Although this may seem like a fruitful area for active management, tactical allocation is hard, and most that try have failed. (Do Tactical-Allocation Funds Deliver? 04/03/2019)

Mr. McCullough’s findings were that such funds rarely outperformed a simple 60/40 index, that they weren’t particularly adept at offering downside protection, that their investors didn’t stick with them and that nearly 60 were shuttered in the past four years. As a rule, then, tactical allocation fails.

Hilton Tactical Allocation appears to be a singular exception to that rule. Let’s look quickly at (1) what the managers do and (2) how well they do it.

The goal is generating high levels of current income with some potential for capital appreciation. The fund provides monthly income distributions. The key on the “capital appreciation” piece is that the managers are intent on not losing money in bad markets; in consequence, they prefer stability, quality and predictability over the pursuit of maximum short-term gain. The managers have the freedom to look across the entire capital structure of high quality corporations to determine whether the most prudent investment come from the firm’s debt offerings or from the common or preferred stock shares.

The process of building the portfolio begins with founder Bill Garvey, Mr. Oxenham and the investment committee examining a variety of macro-level factors (from interest rates and monetary policy to geo-political risks and general business conditions) to construct the portfolio’s positioning framework. Depending on the macro-level analysis, they can be anywhere from 20-60% invested in equities though the actual five-year range has been from 38% (currently) to 50%. The remainder of the portfolio is allocated between cash and a potentially wide array of debt instruments including high-yield bonds, ETFs, closed-end funds, exchange-traded notes, REITs, Treasuries, muni bonds, master limited partnerships and various sorts of asset-backed securities.

The macro-level positioning has a 30-40 day shelf life and they often trade fixed-income securities opportunistically, looking to take advantage of short-lived market aberrations. The one thing that doesn’t ever change is the focus on minimizing absolute risk and volatility.

The results, in both absolute and risk-adjusted terms, have been consistently excellent. The Hilton strategy has been around since 2001, in the form of separately-managed accounts, and since 2013, in the form of a mutual fund.

Since inception, the fund has produced higher returns that its Lipper and Morningstar peer groups. The fund’s risk-profile, from MFO Premium, shows its strength in detail.

Comparison of Lifetime Performance (10/2013 – 3/2019)

| Annual Return | Max Draw-down | Std Dev | Down-side Dev | Ulcer Index |

Bear Market Dev | Sharpe Ratio |

Sortino Ratio |

|

| HCYIX | 5.9 | -5.6 | 5.3 | 3.2 | 1.7 | 2.6 | 0.99 | 1.62 |

| Flexible Portfolio Peers | 4.4 | -13.2 | 7.8 | 5.2 | 5.0 | 4.1 | 0.52 | 0.82 |

Returns (the fund’s APR or annual percentage return) is substantially higher than its peers. Its volatility (measured by maximum drawdown, standard deviation, downside – or “bad” – deviation and bear market deviation) are all substantially lower. It’s not surprising, then, that the risk-return metrics (Ulcer Index which measures how far a fund falls and how long it stays down, Sharpe, Sortino and Martin ratios) are all vastly superior.

The Morningstar peer comparison is a bit less detailed but still consistently positive.

Comparison of Five-year Performance (through 3/31/2019)

| Annual Return | Std Dev |

Alpha | Beta | Sharpe Ratio | Sortino Ratio | |

| HCYIX | 5.17 | 5.25 | 1.19 | 0.68 | 0.83 | 1.35 |

| Tactical Allocation Peers | 3.06 | 8.38 | -2.23 | 1.02 | 0.32 | 0.50 |

Hilton Tactical’s Institutional shares earned five stars from Morningstar while the Investor shares have a four-star rating (as of 4/23/2019). It also earned MFO’s “Great Owl” designation for having risk-adjusted returns in the top 20% of its peer group for every trailing measurement period longer than one year. By almost all measures, Hilton Tactical is one of the top 10 funds in its 139 fund peer group over the past five years. Since inception, it has earned the “Lipper Leader’ designation for total return, consistency of return, preservation of gains and expenses.

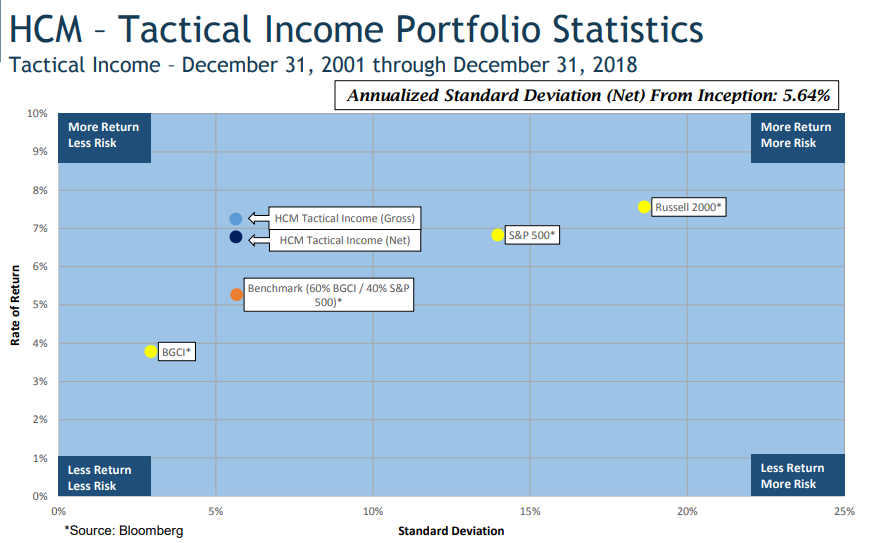

There’s some confirmation of the fund’s prospects in the longer-term performance of the underlying strategy. Hilton manages about $1.5 billion in assets using this strategy, with the fund accounting for less than 10% of the total. From December 2001 – December 2018, the firm’s separate account composite shows annual returns of 6.8% with a standard deviation of 5.6%. In visual terms, that looks like this:

Remember: that’s not the mutual fund though it is the strategy used in the mutual fund. The short version: the strategy can be described as having S&P 500-like returns with far lower volatility or benchmark-like volatility with far higher returns. It is, in either case, doing well.

Manager Alex Oxenham joined Hilton Capital in 2011 after a stint at HSBC Private Bank in New York as a Senior Portfolio Manager. Before that, he worked in portfolio management for Mercantile Bankshares, Bankers Trust Alex Brown / Brown Advisory and Bank of America. We asked manager Alex to share his reflections on what makes the Fund distinctive. Here are his 350 words of insight:

Hilton believes that an actively managed multi-asset portfolio of income producing securities can preserve capital, minimize volatility, and provide competitive total returns over a variety of market cycles. Our philosophy is born out of the original thesis at the launch of Hilton Capital in 2001 – that by adding other income generating assets to a portfolio of traditional fixed income holdings, a more attractive income stream can be developed, with the potential for capital appreciation, all while protecting on the downside while maintaining a low volatility experience for investors. Often individual investors panic sell during periods of extreme volatility. Our approach is predicated on creating wealth through compounding and trying to eliminate as much of the downside as possible which should help individual investors avoid the temptation of selling at the bottom. The resulting return profile over the eighteen plus years of performance has outperformed broad equity markets, with a volatility profile more in line with a fixed income portfolio.

The investment process begins with the investment committee’s top-down macro-economic evaluation, which is driven by extensive economic data-driven analysis, as well as the combined experience of the five-member investment team. We regularly share our economic outlook with our clients (www.hiltoncm.com). We believe it’s important for our investors to understand how and why we have the portfolio positioned at any given time. In constant evolution the investment committee adjusts their views on the asset allocation amongst cash, fixed income, and equities. Capital structure, sector and individual holdings decisions are driven by a hybrid of the global macro evaluation process, valuation metrics and fundamental analysis. Our tactical changes are very dissimilar to our peers. We are focused on the need to adjust our allocation over a complete market cycle versus more short-term trading strategies.

In our experience, the Tactical Income strategy can be utilized in four main ways 1) as a potentially volatility reducing complement to an equity portfolio 2) an alternative income generator for a fixed income portfolio 3) an enhancement to a balanced portfolio and 4) as a standalone portfolio delivering income, low volatility, and the potential for growth.

The Investor share class of Hilton Tactical Income (HCYAX) has a $2,500 minimum initial investment and a 1.68% expense ratio on assets of about $125 million. The Institutional share class is at $50,000 and 1.43%, but Ladder can waive that minimum. It is available through TD Ameritrade, Charles Schwab, Fidelity, Vanguard and most major wirehouses. The Fund’s homepage is odd. That likely reflects the fact that Hilton is the step-child in the Direxion family of funds and ETFs. At base, Direxion caters to traders with their Monthly 25+ Year Treasury Bear 1.35x Fund (DXSTX), the long/short Emerging Over Developed Markets ETF (RWED) and Daily Mid-Cap Bull 3X ETF (MIDU). Those are typical of Direxion’s offerings and they are not, on whole, vehicles that require thoughtful reflections on the managers’ discipline or perspective. As a result, the template leaves content on the Hilton fund pretty thin. Don’t blame them.