Objective and strategy

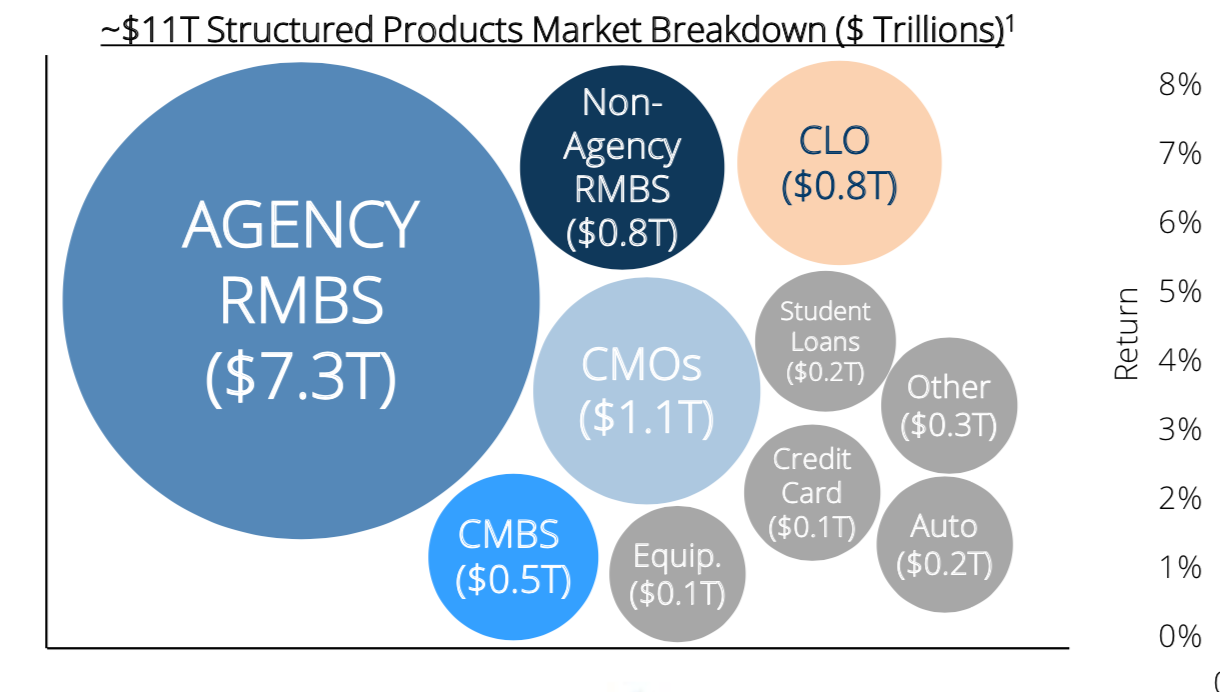

The fund seeks to maximize total return by investing across the structured credit sectors – RMBS, ABS, CMBS, CLO, and other non-traditional fixed income sectors. The fund must invest at least 60% of its assets in securities rated as investment grade. The balance of the fund will typically be invested in bonds rated below investment grade.

The management team seeks relative value across the breadth of structured credit sectors including Agency/Non-Agency RMBS, ABS, CLOs, Mortgage Derivatives, and more esoteric sectors such as mortgage servicing rights and aircraft leasing.

The securitization process is a relatively straightforward process by transforming heterogeneous, illiquid assets/loans into securities.

These securities issue debt to investors who in turn receive cash flows generated by the underlying collateral but structured to meet various investors’ needs. The collateral generates cash flows in the form of interest and principal payments, which then flow through the security structure to investors.

River Canyon’s PM team tracks, researches, and analyzes potential investments across the 40 sectors and 200 subsectors of the structured credit market.

The structured credit market takes homogenous loans/collateral, combines them into a pool, and then carves those interest and principal payments up into a variety of cash flows fitting a variety of investor needs. Mortgages are the largest category.

That’s probably the best way to view it for most investors.

In addition to the fund, River Canyon manages separately managed accounts focused primarily on structured credit.

The main difference between these accounts and RCTIX is that RCTIX has a higher quality bias, via its requirement to invest a minimum of 60% of its assets in investment grade securities and also has more direct exposure to Agency RMBS.

The fund’s benchmark is the Bloomberg Barclays U.S. Aggregate Bond Index.

Adviser

River Canyon Fund Management LLC, Los Angeles, CA., a subsidiary of Canyon Capital Advisors LLC.

River Canyon Fund Management LLC, Los Angeles, CA., a subsidiary of Canyon Capital Advisors LLC.

Canyon Partners, founded in 1990 by Joshua S. Friedman and Mitchell R. Julis, is a credit-oriented investment manager focused on distressed and event-driven strategies. It has been managing assets since 1990 and assets in the structured credit space since 2005.

In 2013, Canyon established River Canyon Fund Management as an investment advisor for its more liquid credit strategies. With an emphasis on structured products, River Canyon’s mandates include a comingled mutual fund as well as bespoke separately managed accounts designed to fit investor objectives.

These strategies bring to bear the full resources of the Canyon platform including the research team, trading, legal, and operations alongside the accumulated knowledge of 49 tenured investment managers.

Canyon Partners had firm-wide assets of $24.4B as of March 31, 2019.

Manager

George Jikovski, CFA and Partner.

His primary focus is on the mortgage-backed securities, structured credit, and credit derivatives sectors across all Canyon strategies. Before joining Canyon in 2007, he was at Trust Company of the West, where he focused on high grade MBS, including MBS derivatives, collateralized mortgage obligations (CMOs) and market value CDOs. Previously he was with the Financial Restructuring Group at Houlihan Lokey Howard & Zukin and was an investment banker in the Corporate Finance / M&A group at Bear, Stearns & Co, Inc. He’s a graduate of University of California, Los Angeles (B.A., Business Economics and a minor in accounting). With 20 years of experience and 12 years at Canyon Partners, he has managed RCTIX since inception.

Strategy capacity and closure

$20B is a reasonable estimate. The total structured credit market is $11 trillion.

Active share

Active share in fixed income funds is very different from that of equity funds.

Most passive fixed income funds and ETFs have a significant amount of active share because they cannot duplicate the fixed income benchmarks as easily as an equity manager can.

Furthermore, many active fixed income funds have significant active share because they also deviate from the benchmark with their active allocation decisions.

Over time the manager expects the fund’s overlap with the Barclays U.S. Aggregate Bond Index to be its holdings in Agency Mortgages.

Also, there’s no index for structured products. It’s a very heterogeneous market and not possible to create a reproducible index. But this heterogeneity in the market is what presents active managers a rich opportunity set to mine for potential investments.

Management’s stake in the fund

As of December 31, 2018, Canyon Partners entities and the funds PM team own approximately 45% of RCTIX. Of the five Trustees, two own $10,001 – $50,000, the other three none. As of December 31, 2018, all officers and Trustees as a group beneficially owned less than 1% of the Fund. Canyon employees and partners are collectively the largest investor across the various Canyon sponsored funds including RCTIX.

Opening date

December 30, 2014

Minimum investment

By prospectus: $100K.

Actual purchase availability:

Fidelity $100,000 TF

Schwab $1,000 TF

TD $2,500 TF

Vanguard $1,000 TF

Other platforms include Pershing, LPL Financial, and Hilltop Securities.

Expense ratio

0.66% on assets of $485 million, as of July 2023.

Multi-sector bond funds vs. structured credit products

The main difference is that a multi-sector bond fund would invest in a broader range of fixed income sectors including government, agency, emerging market, high yield, non-U.S. bonds, etc.

A structured credit fund would focus more on RMBS, CMBS, ABS, CLO, and other securitized bonds.

RCTIX is in the multi sector bond category at Morningstar because it’s benchmarked to the Bloomberg Barclays U.S. Aggregate Bond Index and its guidelines are broad enough to invest across a variety of sectors.

But it will always have a significant allocation to the structured credit markets. It’s an appropriate classification because as the fund grows, it will expand its investments across sectors and will implement some of the investment ideas from their hedge funds.

Lipper classifies the fund as a Core Bond Fund.

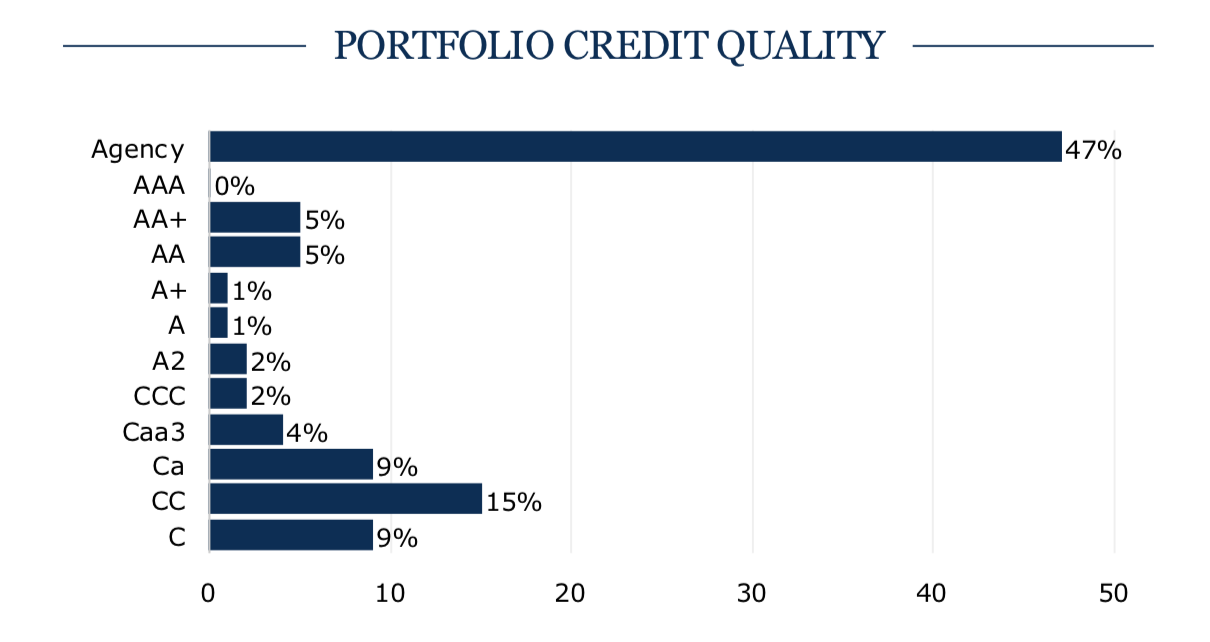

The above numbers do not include the 19% cash allocation.

The average credit quality of the fund is A-.

As of March 31, 2019, the fund’s average duration was 2.97 years.

Fund Origin

Canyon has been thoughtful in developing new products and investment vehicles. The firm has a long history of generating strong risk adjusted returns in the structured credit space.

RCTIX is a natural extension of their expertise and utilizes the resources they have built over the years to invest in the structured credit sector.

The fund was seeded with firm and partner capital. Canyon decided to incubate the funds track record until it hit the three-year point. During this time the fund was available to employees and fund board members to invest.

One of the reasons for incubating the fund was market feedback from advisors, consultants, and investors, which showed that they typically preferred to see a three-year track record before they considered researching or investing in a new fund.

Coming to market with a demonstrated successful track record across a variety of market scenarios and interest rate environments would provide further credibility to the fund’s value proposition and River Canyon.

They wanted to establish a stable, longer-term track record and proof-of-concept with their clients and potential investors.

By leveraging Canyon Partners extensive structured products expertise, it constructs diverse and resilient portfolios security by security, where no single risk factor dominates returns or volatility.

They believed that the fund needed to be fully integrated into Canyon’s entire investment research team and would benefit from the insights of the almost 75 investment team members working across their hedge funds, distressed vehicles, and real estate funds.

The RMBS market

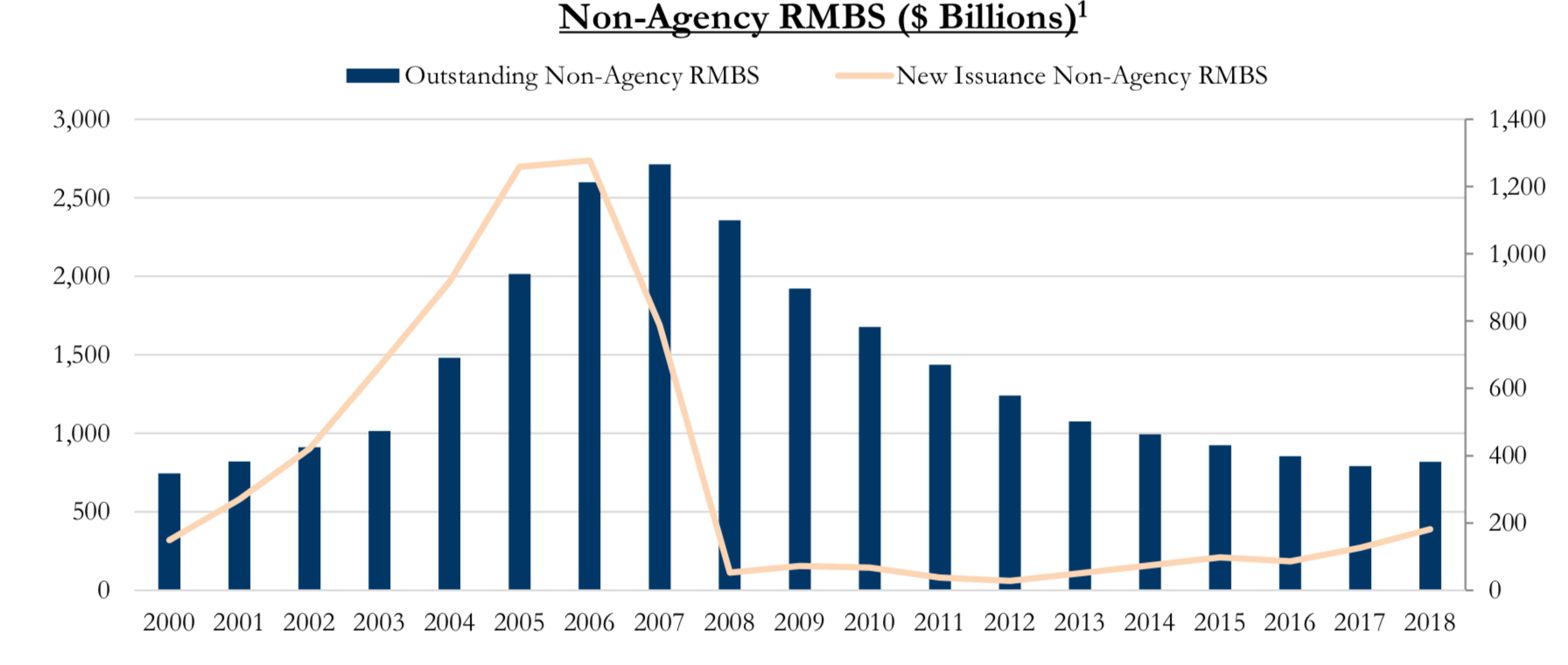

Canyon Partners began investing in RMBS on the short side in the mid-2000s, when the housing market was running wild and then pivoted to the long side after the crisis when the asset class was deeply distressed.

Over this period, Canyon became one of the largest alternative asset managers investing in the structured credit space.

As this asset class has gradually healed post the financial crisis, they believed they could leverage their existing analytical capabilities for use in a more liquid investment vehicle, namely a 1940 Act mutual fund.

So they targeted a distinct risk/reward profile that could serve the different needs of their clients and launched the fund.

Prior to the credit crisis, the outstanding legacy non-agency residential mortgage-backed securities (“non-agency RMBS”) market was approximately $2.7 trillion at its peak in 2007.

Now the non-agency RMBS market is approximately $550, positioning it under the radar of mega funds that typically invest in amounts greater than the average opportunity size in the current market.

So a trade that many believed to be over remains accessible to nimble investors, such as the fund, seeking idiosyncratic risk/reward outcomes.

At present, however, Mr. Jivoski notes that the non-RMBS legacy class market has been shrinking and becoming mature with collateral and price performance continuing to improve.

Most borrowers have substantial equity in their homes, fewer are delinquent, and defaults have slowed.

So it isn’t a source of distressed opportunities as it once was but still attractive for its resilient cash flows immune from economic volatility.

Risk management

The fund begins with a 60% minimum investment grade guideline.

In addition to the fund guidelines, Canyon Partners has invested significant capital in both public and proprietary databases as well as in the development of sophisticated proprietary risk management systems.

For RCTIX and their structured credit investments, they’ve also developed several proprietary systems specific to RMBS to knit together multiple sources of data starting at the individual loan level, sensitivity analyses of cash flow, return, and up/down scenarios.

These systems allow the team to stress test the portfolio for various scenarios across multiple inputs as well as monitor exposure and performance characteristics at the position and portfolio levels.

They stress test for changes in interest rates, equity markets, credit spreads, and volatility.

These resources are best in class and assist in the portfolio construction and risk management processes by allowing them to identify prospective opportunities quickly, analyze securities robustly and in detail, and stress test their mortgage book in various ways.

Comments

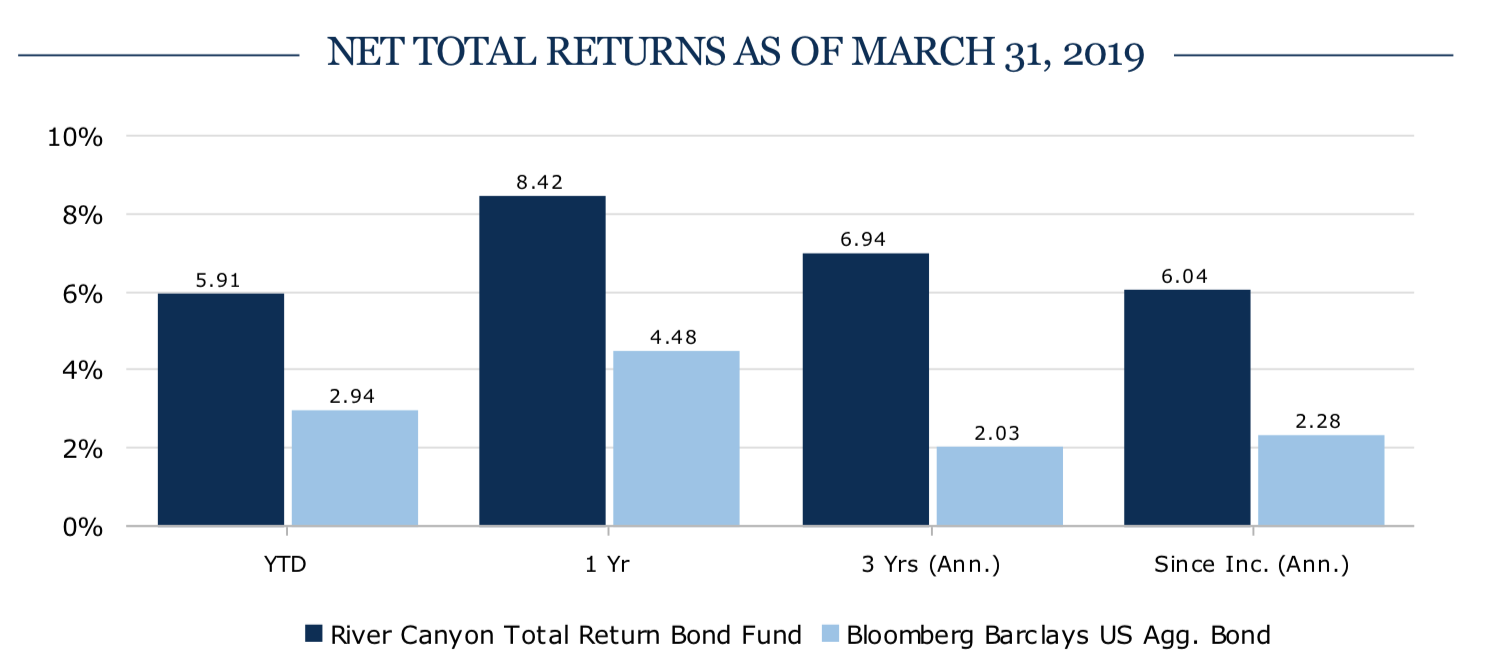

Since inception, RCTIX has demonstrated an impressive track record, outperforming its benchmark – the Barclays U.S. Aggregate Index and its Morningstar Multi-Sector Bond category.

Performance over peers, as indicated by our Lipper Global Data Feed (LGDF), reveal a lifetime APR spread of 4.1%, 3 year of 4.6%, and a 1 year of 4.2%.

It’s also an MFO Great Owl, and Morningstar gives it an overall 5-Star rating.

Here’s Morningstar’s risk-adjusted returns as of March 31, 2019, 4.6 years since inception.

| Category | Multi-Sector Bond |

| 1-Yr Category Rank | 1 of 306 |

| 3-Yr Category Rank | 6 of 270 |

MFOP Risk & Return Metrics for the fund show low drawdown, recovery, Ulcer, and Bear values and high risk-adjusted and excess returns as shown by the ratios here.

| Max DD | Recovery (months) | Ulcer Index | Bear rating | Sharpe ratio | Sortino ratio | Martin ratio | |

| Life | -1.6 | 4 | 0.5 | 1 | 1.47 | 4.54 | 10.60 |

| 3 Year | -1.6 | 4 | 0.5 | 1 | 1.49 | 4.60 | 10.73 |

| 1 Year | -1.6 | 5 | 0.6 | N/A | 1.17 | 4.90 | 11.00 |

The fund’s MFO Composite Rating – based on risk (as measured by its Martin Ratio), its MFO Rating, APR Rating, and Sharpe Ratio is 5 (Best).

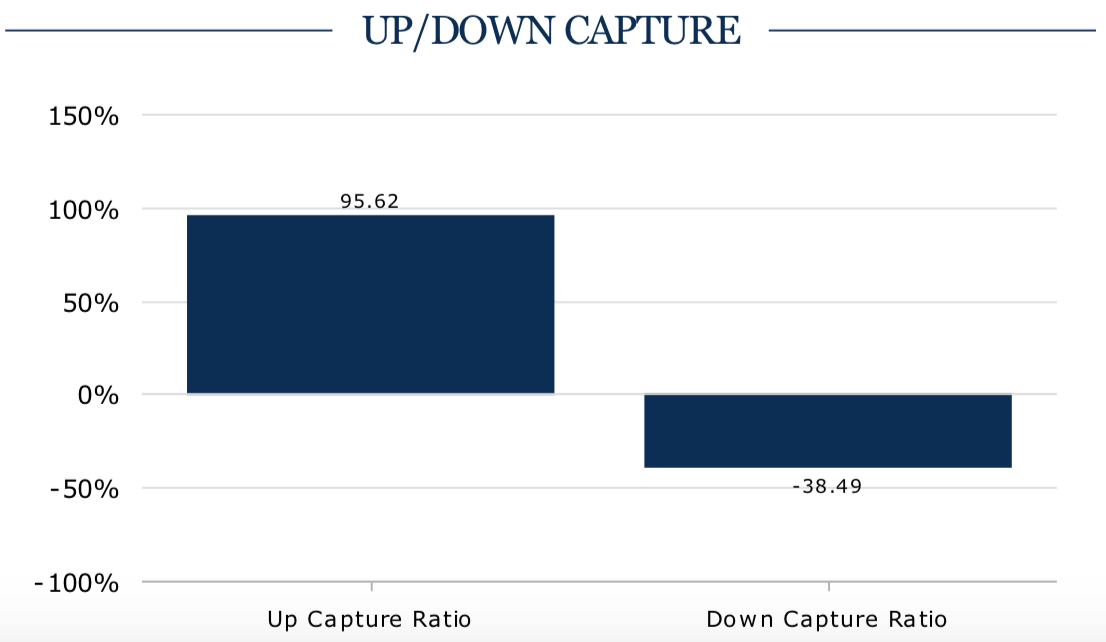

The fund’s upside and downside capture ratio is very strong and appeals to investors looking to capture more upside while limiting the downside.

Remember that the fund’s negative downside capture ratio means that it went up when its index went down – a good indicator of how the fund can provide diversification.

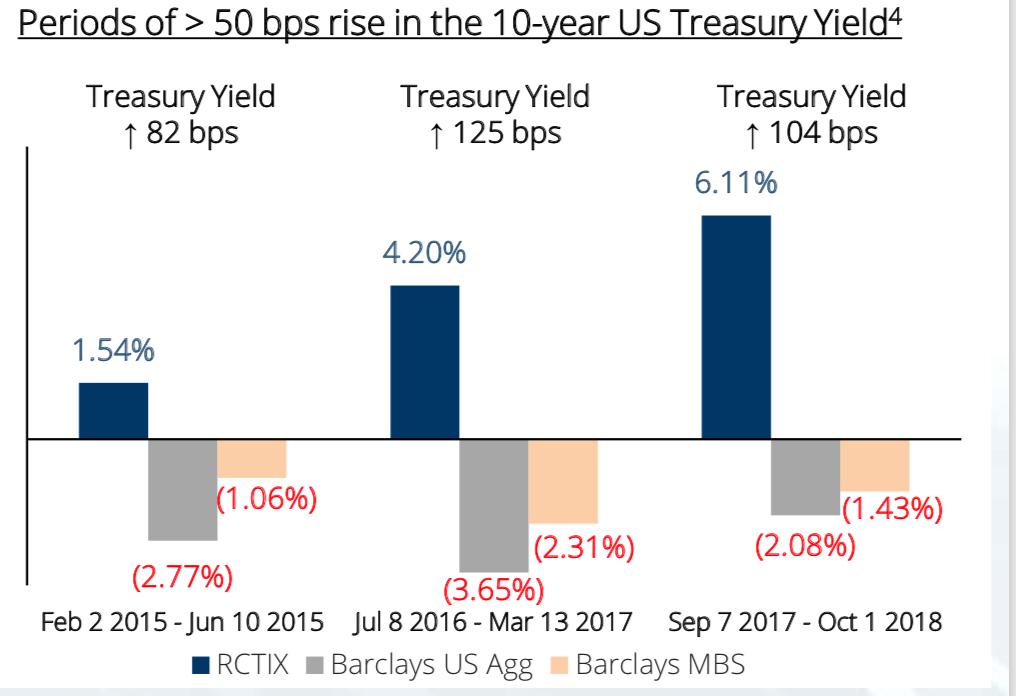

The fund has significantly outperformed in rising rate environments when rates have increased by 50 bps or more whereas the benchmarks have had negative performance.

The structured credit sector in general has a significant amount of floating rate debt which can act as a hedge during rising rate environments. Most fixed income sectors are primarily fixed rate, and the two risk factors that dominate bond markets are interest rate and credit risk.

Structured credit can mitigate some of the rate risk because its floating rate.

For example, the mortgage derivative sector of the market is composed primarily of Agency CMO’s. These securities have distinct interest rate sensitivity profiles and can be used to manage risk if rates are falling or rising. Since they are Agency securities, there is no credit risk, only interest rate risk.

By investing across this diverse structured credit market, a portfolio can be built to provide low correlated and attractive risk-adjusted total returns relative to many other fixed income sectors.

Rationality is one of the most important qualities that investors look for in a manager, especially when a market decline requires a proactive approach and protects investors from losses in the market.

While the fund isn’t immune to these challenges, it has outperformed vastly during those times. This has also meant playing offense while investing and reinvesting at more attractive valuations in a variety of securities, which has further enhanced returns.

The fund’s security selection has been the primary driver for the fund’s performance since inception when returns from the fixed income sectors were challenged from either rate increases and/or broad credit spread widening in several rising and falling rate environments.

That’s also because the fund isn’t levered to or dependent on specific outcomes of Fed policies or rates.

Key points show how the fund is distinctive among others in the securitized fund space.

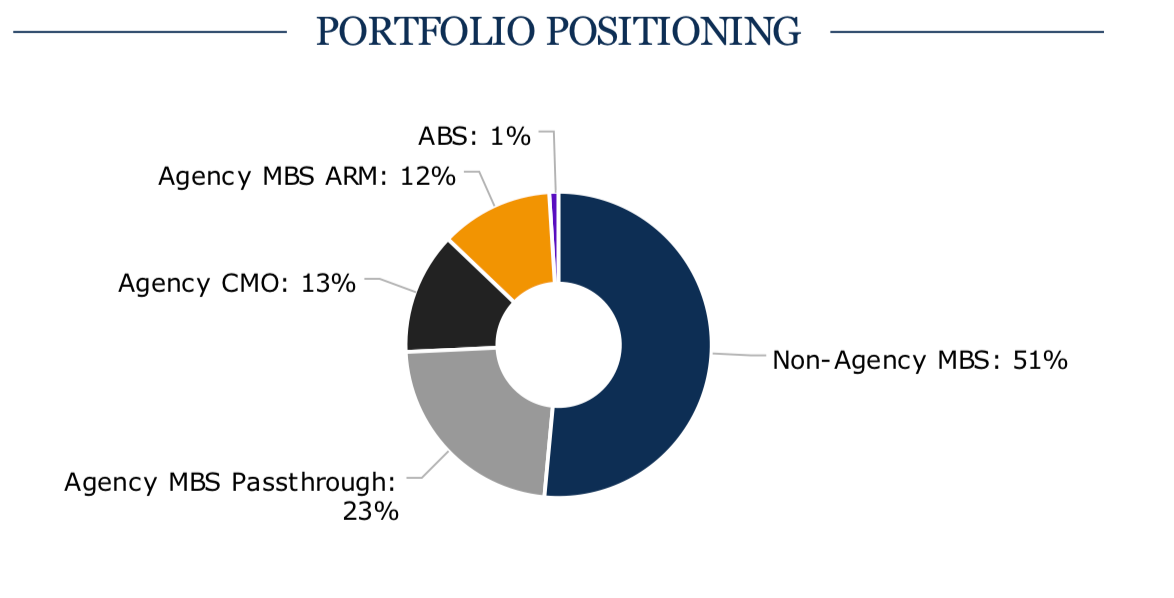

- The manager invests primarily in securitized mortgage sectors including agency and non-Agency RMBS, CMBS, CLOs, ABS, and Mortgage derivatives – Interest Only (IO), Principal Only (PO), and Inverse Interest Only (IIO, and others.

That’s pretty complete.

- RCTIX has a minimum 60% investment grade guideline. Other securitized funds may lack this quality.

- Some funds have as much as 100% legacy non-Agency RMBS exposure. RCTIX has typically had around a 50% allocation to legacy non-Agency RMBS.

- Regarding the legacy non-agency RMBS allocations, RCTIX has a higher allocation to more senior tranches while others are more invested in the junior/mezzanine tranches of these securities.

At this time in the cycle, the manager thinks it’s prudent to move up in the capital structure vs. being lower in the capital structure.

- Both Mr. Jivoski and Canyon Partners have broad experience and a long-term track record in securitized sectors, including the financial crisis and its effect on mortgages.

- Jivoski’s team covers each sector as it continues to evolve.

- He has a portfolio construction process to maximize the potential for diversification and risk-adjusted returns over time.

- He has a strategy that focuses on incorporating diverse sources of risk to build more resilient portfolios.

- He monitors the changing relative attractiveness of liquid alternative sectors over time.

- His investment process has remained consistent.

- His team believes that it can identify and invest in securities that can provide strong returns and exhibit resiliency in a deteriorating credit or spread widening scenario, particularly relative to corporate credit, which has seen an explosion in issuance at the BBB level over the past few years.

For investors concerned about a recession when rates would fall across the curve and spreads would widen, 40% of the fund is in Agency MBS. This high quality, highly liquid sector would perform quite well in this environment.

Here’s their portfolio turnover as of their fiscal year ending September 30.

| 2018 | 2017 | 2016 | 2015 |

| 47% | 48% | 19% | 41% |

RCTIX pays dividends quarterly, but they’re thinking about paying monthly.

Bottom Line

The manager has provided strong absolute and relative returns.

He’s produced a consistent track record over the past four-plus years that has outperformed its benchmark and almost every other fund in the category by a significant amount.

The structured credit sector presents compelling absolute and relative value and offers a diverse heterogeneous opportunity set for active portfolio management vs. traditional fixed-income strategies.

That means attractive, compelling, idiosyncratic value and income opportunities from often misunderstood, multifaceted, and complex securities combined with strong downside protection.

The fund is a hidden gem. The firm only began actively marketing RCTIX in the second half of 2018.

Limiting the fund’s distribution while building out its track record demonstrates the firm’s thoughtful approach to the mutual fund space.

I have confidence in RCTIX going forward.

Fund websites

RCTIX details the fund’s success in the structured credit market.

Canyon Partners provides a look at firm leadership and their five strategies.