Objective and strategy

Harbor International Small Cap Fund pursues long-term growth by investing in a diversified portfolio of international small-cap stocks. They have three particular preferences:

- demonstrate traditional value metrics primarily on a price to book, price to earnings, and/or dividend yield basis;

- well-capitalized and transparent balance sheets and funding sources; and

- business models that are undervalued by the market.

Up to 15% of the fund’s total assets may be invested in emerging markets, though direct EM exposure is currently minimal. The portfolio held 60 stocks as of 6/30/2021.

Adviser

Harbor Capital Advisors. Harbor is headquartered in Chicago. In 2013 its corporate parent, Robeco Group NV, was acquired by ORIX Corporation, a Japanese financial services firm with a global presence. Harbor is now a wholly-owned subsidiary of ORIX. In May 2021, Harbor liquidated its five Harbor Robeco funds just two years after launch. Collectively, the 20 Harbor funds, almost all of which are externally managed, have $60 billion in assets.

Cedar Street Asset Management serves as the sub-advisor for Harbor International Small Cap Fund. It is an independent value-oriented investment management firm with ten employees and is also headquartered in Chicago. The firm is independent, owned by its employees, and manages approximately $290 million (as of 6/30/2021).

Managers

Jonathan Brodsky and Waldemar Mozes. Mr. Brodsky founded Cedar Street in 2016. Prior to that, he established the non-U.S. investment practice at Advisory Research. Mr. Brodsky began his investment career in 2000. He worked for the U.S. Securities and Exchanges Commission’s Office of International Affairs, focusing on cross-border regulatory, corporate governance, and enforcement matters. Mr. Brodsky holds a B.A. in political science and an M.A. in international relations from Syracuse University and an M.B.A. and J.D. from Northwestern University. He also studied at Fu Jen University in Taipei, Taiwan.

Mr. Mozes is a Partner and the Director of Investments for Cedar Street Asset Management. Prior to joining Cedar Street, Mr. Mozes developed and implemented the international investment strategy at TAMRO Capital Partners LLC and managed ASTON/TAMRO International Small Cap Fund (AROWX). It had a very promising launch, but the advisor pulled the plug after just one year because they had over $2 million AUM. Mr. Mozes, is a bright guy with experience at Artisan and Capital Group. He jokingly described himself as “the best fund manager ever to come from Transylvania.”

Strategy capacity and closure

$2 billion. The equivalent non-US small cap value strategy that Mr. Brodsky managed at Advisory Research reached around $1.5 billion and there were considerations at the time to move toward a soft close once they hit the $2 billion plateau.

Management’s stake in the fund

Each of the PMs has between $10-$50K invested directly in the mutual fund, and the senior investment team has over $2 million invested in a limited partnership on which the fund is based. Beyond that, the managers own the sub-advisor and have sort of dedicated their lives, fortunes, and sacred honor to making it work.

Opening date

Nominally, February 01, 2016. As a practical matter, the fund was reborn on May 23, 2019, when Cedar Street Asset Management brought a new team and new discipline to the fund. They succeeded the Barings team that had been in place at inception.

Minimum investment

$2,500 for the Investor class shares, $50,000 for Institutional shares.

Expense ratio

1.32% for Investor class shares and 0.96% on Institutional class shares, on assets for $60 million. The fund has seen steady inflows over the past year or so, often from investors who had worked with them on earlier funds.

Comments

Why international small caps?

There are four arguments for considering an investment in international small cap (ISC) stocks and one additional argument for considering it now.

- The ISC universe is huge. Depending on who’s doing the calculation, there are 6,000 – 11,000 publicly traded non-US small cap stocks. In comparison, there are about 3,000 international large cap companies and 2,100 US small cap stocks.

- It is the one area demonstrably ripe for active managers to add value. The average ISC stock is covered by fewer than five analysts, and it’s the only area where the data shows the majority of active managers consistently outperforming passive products. If we screen for the international small cap funds/ETFs with the highest Sharpe ratio over the past three- and five-year periods, only one of the top 20 was a passive product.

- International small is a more attractive asset class than international large. The managers noted that “most US investors fail to recognize that small caps outperform large caps outside the US. When people think of small caps, they think of extreme volatility, but that doesn’t hold up in the small cap space outside the US. Small caps tend to have comparatively lower volatility, better risk-adjusted returns, and a lower correlation to the US markets.” Over the past five- and ten-year periods, international small has posts better absolute and better risk-adjusted returns than international large.

- Most investors are underexposed to it. International index funds (e.g., BlackRock International Index MDIIX, Schwab International Index SWISX, Rowe Price International Index PIEQX or Vanguard Total International Stock Index VGTSX) typically commit somewhere between none of their portfolio (BlackRock, Price, Schwab) to up a tiny slice (Vanguard) to small caps. Of the ten largest actively managed international funds, only one has more than 2% in small caps.

Why now?

Because international small caps are substantially undervalued as a group. Steven Lipper, senior equity strategist for the Royce Funds, noted in August 2021 that small caps are “significantly undervalued” relative to large caps; in the past, gaps this large were typically followed by “very attractive [returns], averaging 19.2%” in the following year.

Why Cedar Street AM and Harbor International Small Cap?

Because they are really good at this stuff. The portfolio reflects three distinct preferences:

- it’s a small cap portfolio. Its Morningstar peers in the international small value group have, on average, 35% of their portfolios in large- and mega-cap names. Harbor has zero. At the other end of the scale, Harbor has 46% invested in small- and micro-cap stocks, about twice the peer average. That works out to a median market cap of $1.85 billion, compared to $7.7 billion for its peers.

- it’s a value portfolio. Many of its peers cheat toward growth.

- it’s a quality portfolio. The managers consciously pursue quality companies, and quality is one of the most powerful and consistent predictors of investment performance. In particular, they generally pursue firms with both high-quality management and pristine balance sheets.

In consequence, they’ve done exceptionally well. The Institutional share class has earned five stars from Morningstar, and the slightly more expensive Investor shares have earned four. And, over the past 2.5 years, the period roughly corresponding to Cedar Street’s management of the fund, it has been the best performing international small cap fund in existence.

Using the screeners at MFO Premium, which draw on the Lipper Global Data Feed, we examined the records of all international small cap value and core mutual funds and ETFs. In both absolute and risk-adjusted metrics, Harbor is the top-performing value fund.

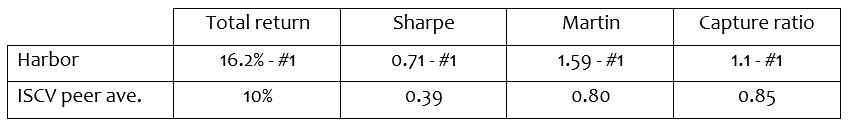

30-month record (through July 2021), international small value

Total return is a fund’s average annual return for the period; Harbor had the highest total return. Sharpe and Martin ratios are standard and conservative measures of risk-adjusted performance; Harbor was again first. And capture ratio is a sort of “how much bang for the buck” calculation; any score above 1.0 means that you’re winning. Relative to a standard international all-cap index, Harbor does a better job of capturing more of the index’s upside than downside than any of its peers.

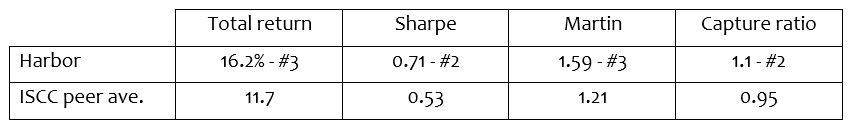

Even when we extend the comparison to the larger set of international small cap core funds, Harbor remains one of the top choices.

Bottom Line

It’s an experienced team and a sensible strategy with a rock-solid track record, both here and at their former Advisory Research and TAMRO funds. Equity investors interested in putting a bit of light between themselves and the high-priced US equity market would be well-advised to put Harbor International Small Cap Fund on their due diligence list.

Fund website

Harbor International Small Cap Fund. Readers interested in the general case for investing in international small cap stocks might find interest in one of several recent white papers. Those might include Artisan Partner’s “The Case for International Small Caps” (2021), Wells Fargo’s “International small-cap equities are underused and overlooked by most U.S. investors” (2020), which argues you might want 7% of your equities there, and Steve Lipper’s “Why Allocate to Non-U.S. Small-Caps?” (2021).