Risk is defined as “the possibility of loss or injury” by the Merriam-Webster Dictionary and volatility as “a tendency to change quickly and unpredictably.”

Risk refers to the possibility of loss, which is outcome focused. Volatility refers to a quick, unpredictable change, which isn’t centered on the outcome. To be a good investor, a person must be able to differentiate between these. Volatility acts as noise, while risk is worth paying attention to.

– The Difference Between Risk And Volatility, Investopedia, Judy Hulsey

I continue to expect a regime change from mid-cycle to late-cycle later this year and look for opportunities to reduce exposure to riskier assets from my current 55%. Fourth-quarter nominal gross domestic product is up 11.8% compared to a year ago with the consumer price index up 7.5% for a real (inflation-adjusted) gross domestic product of 5.6%. Inflation, valuations, geopolitical risks, and volatility are high. Normalizing of monetary policy (QE and rates) is likely to continue as planned, but perhaps at a slower pace.

This article looks at the recent trends in the two hundred quality funds that I track and a few that passed new screens looking for funds that may have higher risk-adjusted returns over the remainder of the year. A shift to defensive funds began late last year as consumer staples are down only 2% year to date compared to 7.8% for the S&P 500 and inflation protection funds such as commodities are up 10%. Technology, growth, and health care are down typically 10% to 13% year to date. Is it time to buy the dip or rotate to safety?

The model portfolios that I have written about on Mutual Fund Observer have lost 1.8% and 2.4% compared to the S&P 500 which has fallen 7.8% year to date. The portfolios are tilted to value, international, commodities, and funds that do well during the late stage of the business cycle such as consumer staples and utilities. In January, I sold a small amount of American New World Class (NWFFX) and in early February purchased more Parametric Commodity Strategic (EAPCX).

1. Top Performing Funds in 2022 (Ending February 25th)

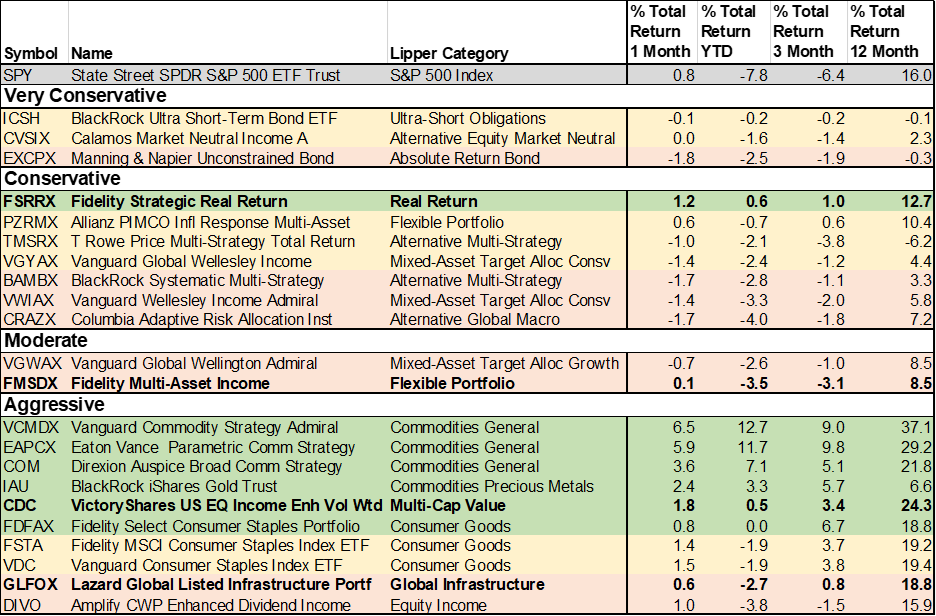

Below are the top-performing funds for 2022 that I track, plus a few that passed recent screens. They are selected based on relatively low drawdown and volatility. The grouping is based loosely on the MFO Risk Ranking over multiple time periods. In the Very Conservative category, most bonds will not do well in a rising rate environment. The Conservative and Moderate categories are of the most interest to me for buying and holding in an environment such as this. I own all of these except PZRMX and BAMBX which I view favorably. TMSRX has underperformed BAMBX over the past year but is outperforming slightly year to date.

I use the Aggressive Category to find funds in the recovery stages of the business cycle and to be in the tactical sleeve of portfolios. The aggressive category currently holds mostly commodities and consumer staples. It also holds CDC and DIVO which I have owned, but do not currently own. CDC: Three Layers Of Portfolio Protection by the Sunday Investor is an interesting article describing how CDC outperforms on a risk-adjusted basis. One other fund that has piqued my interest is Lazard Global Listed Infrastructure (GLFOX) which I recently purchased to test the waters. I profile it later in this article.

Table #1: Top Performing Quality Funds – Ending Feb 25, 2022

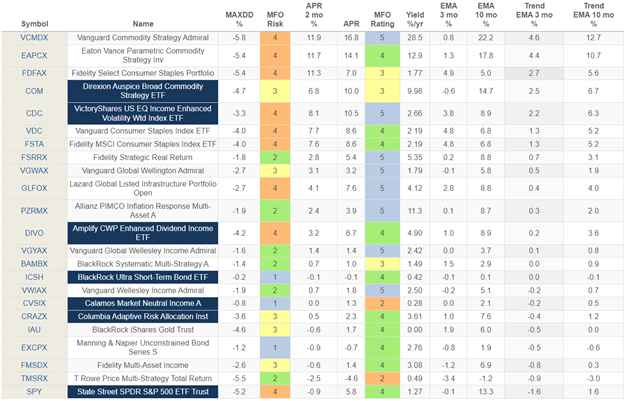

2. MFO Risk-Adjusted Returns and Trends

To look at recent trends I used Mutual Fund Observer Multi-Search for the Taper and Normalization Period from July 2021 to January 2022 sorted from highest two-month return ending January to lowest. The S&P500 (SPY) is included as a baseline fund. I like funds that have higher three and ten-month exponential moving averages (EMA), but also those that are trending higher compared to their EMAs. In other words, while I like all of the funds, I will favor increasing allocations (within reason) in the upper half of the table. I limit funds in the tactical sleeve to 25% of a portfolio while still maintaining diversity.

Table #2: Top Performing Quality Funds – Risk-Adjusted Returns and Trends (Jul 2021 -Jan 2022)

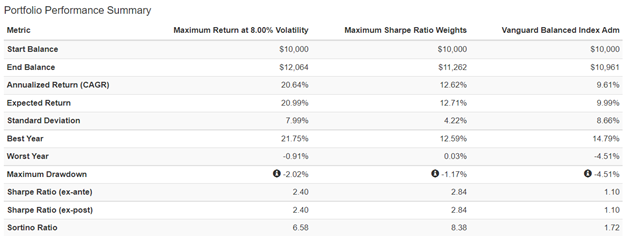

3. Portfolio Optimization

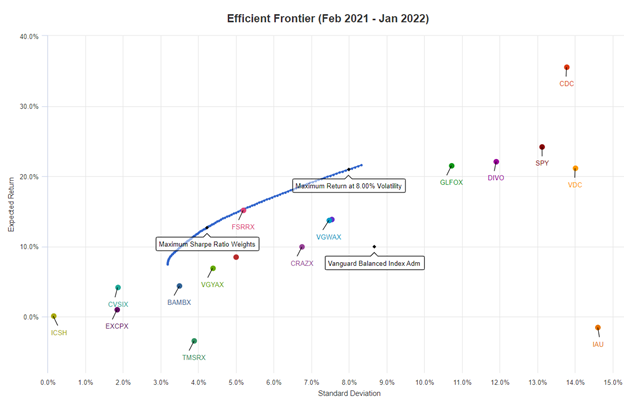

Future returns are guaranteed to be different than past returns, but I still like to see how Portfolio Optimization (portfoliovisualizer.com) would construct a portfolio to Maximize Return at 8% Volatility (blue) and to Maximize the Sharpe Ratio (red). I compared these two portfolios to the Vanguard Balanced Index Fund (orange).

Figure #1: Portfolio Optimization: Feb 2021 to Feb 2022

The risk-adjusted return (Sortino Ratio), as well as the volatility-adjusted return (Sharpe Ratio) of the two “Optimized” portfolios, are favorable compared to the Vanguard Balanced Index Fund.

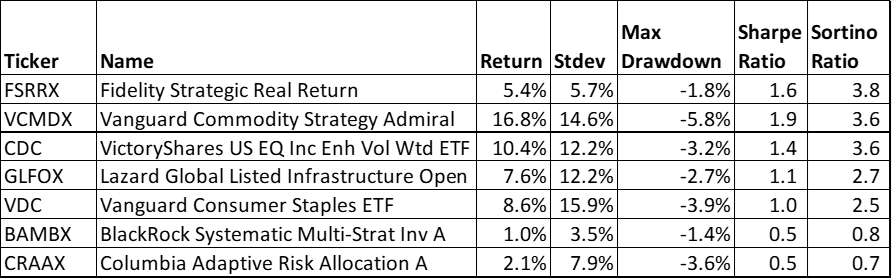

Table #3: Portfolio Performance

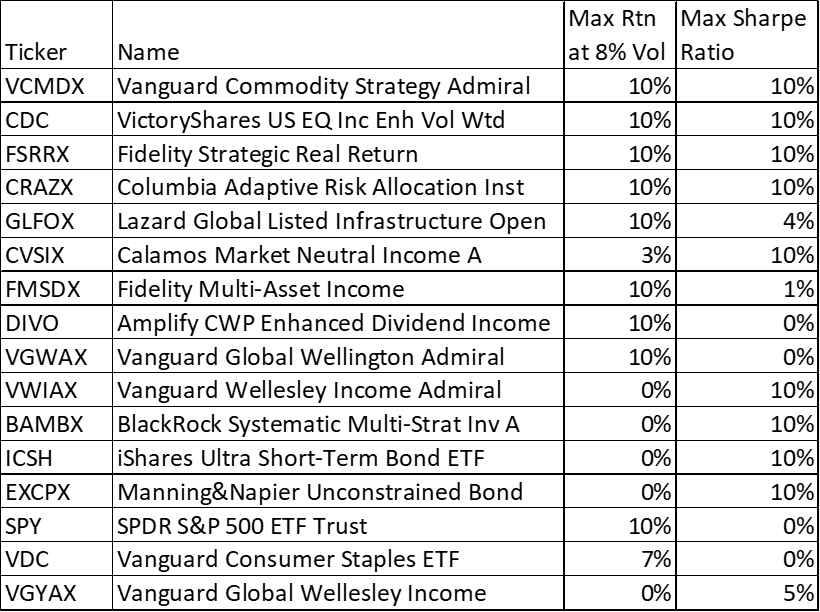

Table #4 contains the allocations to funds in both “Optimized” portfolios. Funds that have high allocations to both portfolios are an easier choice to own. Whether a fund is suitable for an investor that is higher in one portfolio and lower in the other depends upon an investor’s tolerance to risk as well as their outlook for 2022. I own VCMDX, FSRRX, CRAZX, GLFOX, FMSDX, VGWAX, VWIAX, VDC, and VGYAX. I like and am considering CDC and BAMBX.

Table #4: Portfolio Allocations

Figure #2 is a good visual representation of the returns of the funds versus standard deviation (volatility) for the past year. Standard deviation is the deviation from the mean which means that a fund that had a high return may also have had a high standard deviation and not necessarily large ups and downs. This is the case for CDC which had a return of 24% for the past twelve months.

Figure #2: Efficient Frontier (Return vs Volatility)

4. Finalist Funds

Finally, I looked at the drawdowns and graphs of returns to develop a final list of funds that I believe will do well on a risk-adjusted basis for 2022. I own all but CDC and BAMBX. The returns of these funds are dependent upon inflation, monetary policy, and geopolitical tensions. The Columbia Adaptive Risk Allocation Fund (CRAAX) is available at Fidelity.

Table #5: Finalist Funds: July 2021 – Jan 2022

5. Lazard Global Listed Infrastructure (GLFOX)

The Lazard Global Listed Infrastructure Portfolio seeks total return by investing in a select universe of “Preferred Infrastructure” companies. The team believes that these companies have the potential to achieve lower volatility returns that exceed inflation and that a portfolio of Preferred Infrastructure companies presents a potential diversification opportunity. The Portfolio may be a powerful complement to real assets, private equity infrastructure, and global equity allocations.

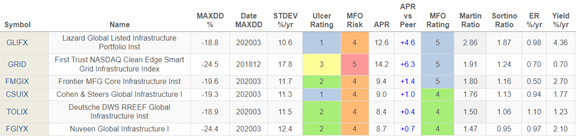

While developing my watchlist of two hundred quality funds, I did not find an infrastructure fund that I believed had solid risk to reward performance. They were just too volatile. I only recently researched Lazard Global Listed Infrastructure (GLFOX), and it is available with no load or transaction fee at Fidelity. Table #6 contains the no-load Global Infrastructure Funds with the highest risk-adjusted returns over the past 10 years. GLFOX is the investor share class and is available through Fidelity. It has a relatively lower risk (MaxxDD, Ulcer Rating) compared to other Global Infrastructure funds, and a high risk-adjusted return (Martin Ratio, Sortino Ratio). Many investors will find the yield (4.36%) attractive.

Table #6: Top Performing Global Infrastructure Funds – Ten Years

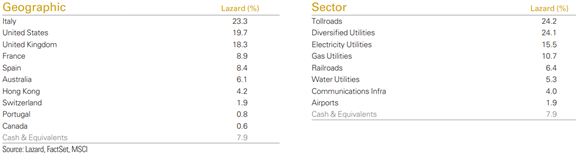

GLFOX is diversified across several countries and types of utilities.

Table #7: Lazard Global Listed Infrastructure Allocations

6. Short Term Bullish Funds

As I close out this article, I ran my ETF screen at Fidelity for ETFs with short-term bullish signals also using FactSet ratings of “A” or “B” and Morningstar Ratings of three or higher. I then used MFO to reduce the list to one or two per Lipper Category of three-year risk-adjusted-performance. Below are the short-term returns from Morningstar. The point of this exercise is that Consumer Defense is still making the list of short-term bullish funds. In addition, CDC continues to trend favorably. Finally, I have been considering buying a financial services fund and track Fidelity MSCI Financials ETF (FNCL) and Fidelity Dividend ETF for Rising Rates (FDRR) as possible defense against rising rates. Invesco S&P 500 Equal Weight Financials ETF (RYF) is another option to look at.

Table #8: Bullish ETFs With (Relatively) Higher YTD Returns

Closing

Prior to the Russian action, investors were largely focused on high inflation and imminent rising interest rates. Now the focus has shifted to the attack’s expected impact on energy, global growth, inflation, and central bank actions….

Market corrections driven by wars and oil market disruptions have historically been sharp but short-lived. As ever, volatility creates an urge among investors to do something, but our guide continues to be to stay invested and focused on long-term goals.

– Investors Confront Volatility As Russia Invades Ukraine, Columbia Threadneedle Investments

The invasion of Ukraine by Russia is a tragic event for world peace and a terrible loss of lives. On this last day of February, the war is still escalating along with the world’s reactions to it. Talks to diffuse the situation are starting.

The markets were oversold in February before the invasion, as measured by the relative strength index (RSI), and the markets recovered slightly last week. Is it time to buy the dip? Capital preservation is more important to me than a small gain from a dip when so much is unknown. I continue to focus on reducing risk according to the business cycle, and short-term volatility can be used to time these adjustments.