The S&P 500 Index peaked at 4800 in December 2021. Thirteen months later, at the end of January 2023, the Index is down 16%, at a level of 4076. Suppose you did a Rip Van Winkle and woke up just in time for the New Year 2024 celebration… and found the S&P 500 index trading at 2400, putting the index 50% below its all-time peak. Would you buy the market, perhaps doze off again, or would you sell? The record is clear: most investors would do the latter.

In this article, I hope to make a small point about Taking Risk by visualizing scenarios. I find the art of engaging in imaginary market scenarios as a helpful mental model in the quest to become a better investor. This art has to be grounded in the science of proper asset allocation, or it may lead to capital destruction.

My experience during the COVID Crash and how I have changed my mindset

I sold stocks during the Covid crash in March 2020, not sure what lay ahead then. Fortunately, I have a strong partner in my wife, who thinks far more clearly than I do, and she reminded me why we invest in the first place: Without taking risks, there can never be an expectation of a return to be earned. You see, I knew this, and yet, I liquidated. It felt better at the moment to liquidate, to stop the pain, and to join others in doing the same. Even when I knew it was a mistake, I thought I was being smart. Even when I knew I ought to be buying, not selling stocks, I got out of a large chunk of equities.  A deep, thoughtful, in advance, scenario analysis might have protected me from making trading decisions that cost me a lot in taxes, if not in investment returns. I now do this kind of scenario analysis regularly across all my investments.

A deep, thoughtful, in advance, scenario analysis might have protected me from making trading decisions that cost me a lot in taxes, if not in investment returns. I now do this kind of scenario analysis regularly across all my investments.

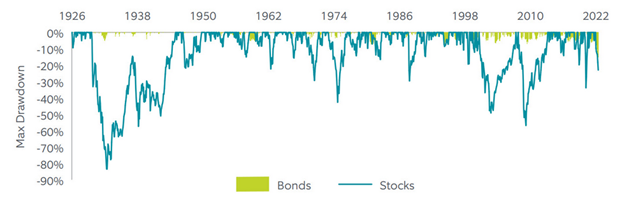

Starting the year 2000, there have been two instances: from March 2000 to March 2003 and from July 2007 to March 2009, when the S&P 500 Index went down about 50% from peak to trough. We know that US equities often crashed, sometimes crash a lot, but almost never crash by more than half. Twice in a century, actually, and in both cases, the markets bounced.

Depending on which long-term time period one uses, the S&P 500 Index has had a total return of between 9-12% annually. Most investors agree that US equities are a major asset class and that they belong in a portfolio. Even though I do not expect a 50% crash in stocks this time around, I ask myself every morning, “Devesh, what will you do when the market is at 2400?” I train my mind and body to answer, “I will sell bonds and buy stocks.”

Without this mental training, I know I am bound to make mistakes. Taking RISK is very important for making money but taking risks is scary for most of us.

Benefits of Scenario Analysis

Here are some benefits of visualizing a 50% crash scenario in the S&P 500 Index I have found along the way:

- I calculate the potential loss in my current portfolio and ask myself if I can live with that notional loss. An honest answer is a good guide to knowing the right amount of stocks for me to hold today.

- I might decide to alter my US equity index portfolio, reducing or adding as needed.

When that crash scenario ever arrives, I will be more prepared for it mentally. I will have run that number in my head hundreds of times and visualized it. It’s like imagining death. We know it’s going to come, and we know we are going to feel differently about it at that moment. The more we can visualize the scenario and prepare our minds, the more detached we become from the inevitable outcome. An acceptance of the outcome might free our minds to start living fully today.

When that crash scenario ever arrives, I will be more prepared for it mentally. I will have run that number in my head hundreds of times and visualized it. It’s like imagining death. We know it’s going to come, and we know we are going to feel differently about it at that moment. The more we can visualize the scenario and prepare our minds, the more detached we become from the inevitable outcome. An acceptance of the outcome might free our minds to start living fully today.- Once my emotions are well managed, I start processing them logically. If a 50% crash means I would want to be 100% invested in US stocks, what would a 40% crash mean? It would mean there is a risk of a further only 10% decline. This is where things get interesting. Knowing that an asset class can go down only 10% but historically can return up 10-12%, year after year, for long periods, makes this an interesting game theory question. Should I even wait for stocks to be down 50%? Why not buy them when they are down just 40% or 35% from the peak? A 35% sell-off from the recent S&P 500 peak would put the market at a level of 3100. Now my mind is on fire. David Snowball relates the story of Richard Cook, the fund manager so willing to charge into the crashing market in 2008 that his family even agreed to skip Christmas presents that year so they had more capital to allocate to the market. His investors (and, presumably, his children) were richly rewarded in the years that followed. Thus, slowly but surely, I can train the mind to move away from the fear of taking risks to embrace taking risks in US equities during a potential crash.

- I was able to use such an analysis to increase equity allocations substantially in the summer and fall of last year when equities were being liquidated heavily. As the markets bounced back, the same analysis helped me reduce my equity allocations.

Replicating Scenario Analysis across Other Major Asset Classes

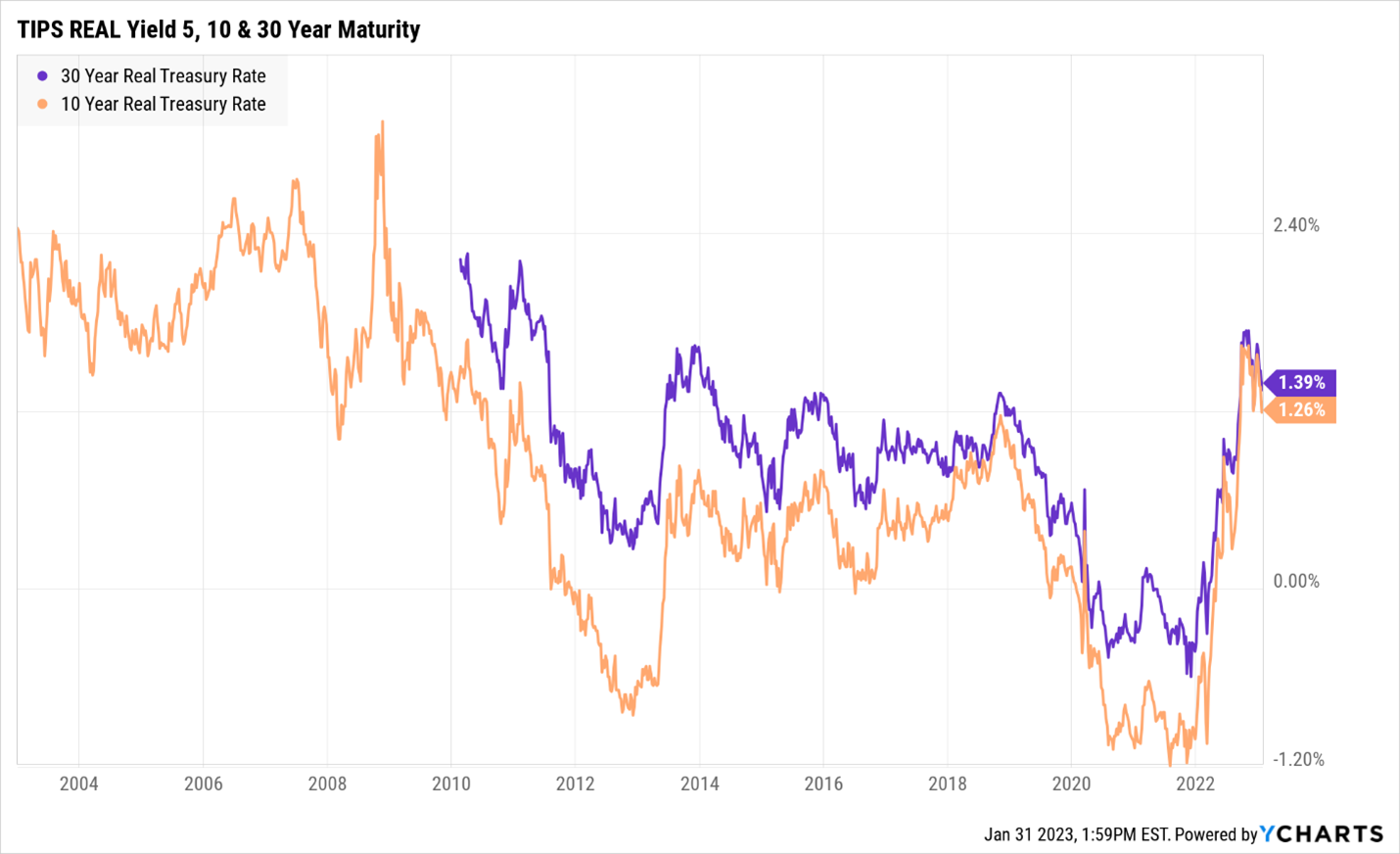

My January MFO article on 30-year TIPS was well received. Thank you for sending me the feedback. Many people felt this article, along with previous articles on TIPS, helped them get more comfortable with using TIPS as an inflation hedge. Others were candid enough to share that while they liked the article, they didn’t understand enough about TIPS to invest themselves. Up until two-three years ago, I didn’t know that much about TIPS either.

When rates were very low, when inflation looked inevitable, I felt I needed instruments to hedge against rising inflation. Reading David Swensen’s Unconventional Success (2005) clarified for me the importance of holding TIPS. I learn about Series I Bonds and then slowly educated myself on TIPS. When I knew enough and looked at the Real Yields embedded in TIPS, they felt like terrible investments at that time.

It’s only recently that the Real Yields have become high enough for me to get excited about longer-term TIPS. I have attached a chart of 10-year TIPS and 30-year TIPS Real Yields. You can see that the rise in yields has been one of the quickest and biggest on record. My scenario analysis mind is on fire. By buying TIPS now, surely, I take on risk, but I am willing to take that risk because the risk-reward scenario looks far more favorable now.

No one knows the future

Not me, not you, nobody knows the future. This much we know. As Captain Algren said in The Last Samurai, “I think a man does what he can until his destiny is revealed.” Whether I am right or wrong on TIPS or anything else, I do not know.

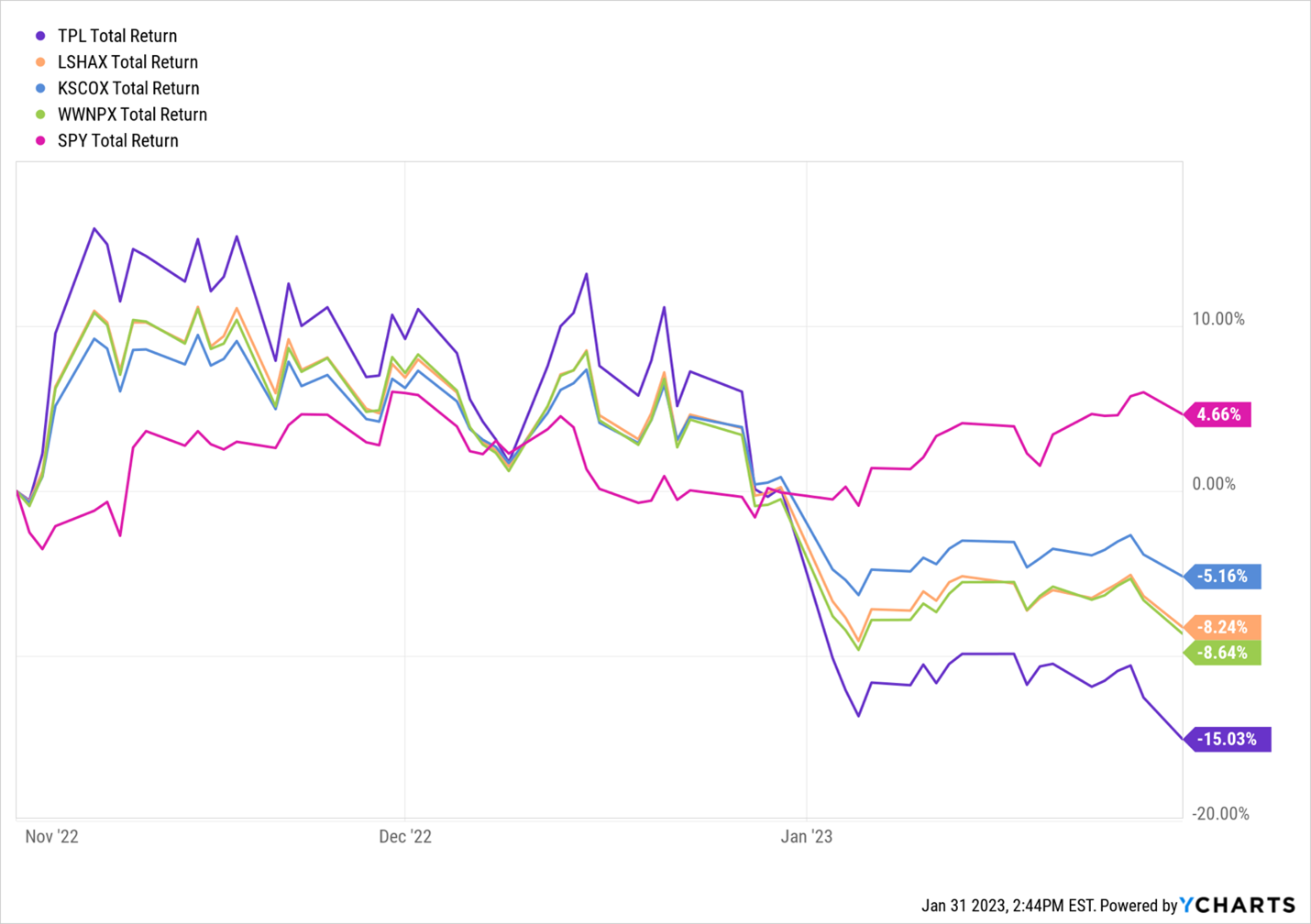

When I wrote in November about Texas Pacific Land being an unusually large weight in Kinetics mutual funds and the associated risk, I did not know that we would go on to see Texas Pacific down 15%, Kinetics Funds down between 5 and 8%, while the S&P 500 was up 5% in the three-month period starting Nov 1, 2022.

All any of us can do is make good decisions. If I can make decisions where the risk-reward is increasingly in my favor, where if I am wrong, I lose X, but if I am right, I can make multiples of X, then I am ahead of the game. This is all I can do. Scenario analysis helps to see the worst of the risks and also to visualize the potential rewards. In the case of TIPS, three things were important to me last month and even today:

- I can wait a long time for this investment because of the positive real rates and inflation protection. I am getting paid to hold these bonds.

- TIPS are a major asset class – a security issued by the US Government.

- I am adequately diversified across other asset classes.

Sometimes, we see investors using the correct mental models and framework for the wrong asset classes and investments. That will not do. That mental dishonesty or ineptitude will lead to complete capital destruction.

Does not work in all investments

Charles Boccadoro, who built and runs the MFO Premium search engine, and I tried to classify the 5900 ETFs and mutual funds in the market available to US investors. He is a meticulous man and erudite in his analysis. MFO is lucky to have someone with his expertise building a search engine that is as thorough and deep as MFO Premium.

In his classification process and after a lot of back and forth, we settled on 72 asset subclasses. Are investors supposed to invest in each one of them? Are there even 72 asset classes? In fact, many of these so-called “sub-asset classes” aren’t assets at all. Very few categories carry the weight of US Equities and US Treasuries. Developed market Stocks, yes. Emerging Markets, if done properly. Real Estate Trusts, maybe. But Precious Metals Stocks, Commodities, a single Emerging Market, and some levered Volatility products are not bona fide asset classes. Absolutely not. Those assets have no individual floor, or the floor is not as predictable as the 50% floor for the S&P 500 Index.

Buying the ARKK ETF or Bitcoin (because it’s down so much) could lead to a permanent loss of capital. This is also the reason why one shouldn’t have too much money in speculative stocks. Taking Risk in minor or speculative asset classes cannot be qualified as prudent risk-taking. This activity falls in the category of casino visits (without the free drinks).

Conclusion

It is important for investors to take risks, even a serious amount of risk, if they want their investments to generate strong returns. By being invested in major asset classes, and only in major asset classes, by studying these assets properly, by running scenario analysis in our minds, visualizing worst case scenarios, and preparing for them, we can strengthen our minds to face what is sometimes inevitable. In those moments of distress, we can then pursue serious risk taking, knowing that we have considered the worst-case scenarios and the risk-reward is in our favor.

As Mr. Swensen counseled, “investment success requires sticking with positions made uncomfortable by their variance with popular opinion. Casual commitments invite casual reversal … Only with the confidence created by a strong decision-making process can investors sell mania-induced excess and buy despair-driven value” (Pioneering Portfolio Management: An Unconventional Approach to Institutional Investment, 2009) Successful investing is not about making correct predictions; it is about the humble approach of taking serious risk when the odds are in our favor. I hope I’ve convinced you that a simple, uncomfortable exercise now might well create the confidence your family needs you to have when chaos and opportunity arrive together.