My last article on Seeking Alpha suggested that value, international, small caps, and emerging markets would outperform over the coming years. David Snowball wrote “The Investor’s Guide to 2023: Three Opportunities to Move Toward” last month along the same lines and offers his insight into these asset classes along with some excellent funds. I follow the Bucket Approach, where some Buckets have similarities to Dr. Snowball’s “Terrified Investor,” “Exhausted Investor,” or “Enterprising Investor.” A Reader on Seeking Alpha asked my opinion about American Century Avantis All Equity Markets ETF (AVGE) as a one-stop fund for these categories. This article represents my opinion of AVGE.

American Century Avantis All Equity Markets ETF (AVGE) is an actively managed exchange-traded fund in the Global Multi-Cap Core Lipper Category constructed of ten Avantis equity ETFs. AVGE is unique in that if you use the MFO Multi-Search Screen for the Global Multi-Cap Core Category with 20 or fewer holdings and over $50 million in assets, AVGE is the only fund. American Century now has eighteen Avantis ETFs, many with three years of history, so we can take a deeper dive.

With bonds now earning competitive yields, I have adapted my strategy to match withdrawal needs with individual CDs and bonds. The consequence is that I need to shift from multi-asset funds towards equity funds in order to increase allocations to equities. In this article, I explore how AVGE works and performs. While I do not view AVGE as a one-stop equity fund, it satisfies my desire to be the “Enterprising Investor” positioning some Buckets for “active, long-term” growth.

This article is divided into the following sections:

Section 1, What or Who is Avantis?

Section 2, Avantis All Equity Markets ETF (AVGE)

Section 3, Comparison to Global Multi-Cap Funds

What or Who is Avantis?

Professor Snowball covered the launch of Avantis and one of the Avantis funds in Launch Alert: Avantis International Small Cap Value (AVDV) in 2019. According to American Century in “Unthink ETFs, Rethink Possibilities,” the company was formed in 1958 by James E. Stowers Jr. and manages more than $200B in assets. Currently, over 40% of its annual profits go to funding the Stowers Institute for Medical Research.

Using the MFO Premium fund screener, American Century has 140 funds with $164B in assets under management. They have three funds that are more than fifty years old. The MFO Family Rating for the past three years is a respectable “Upper.” American Century has thirty-five ETFs with $19B in Assets under management.

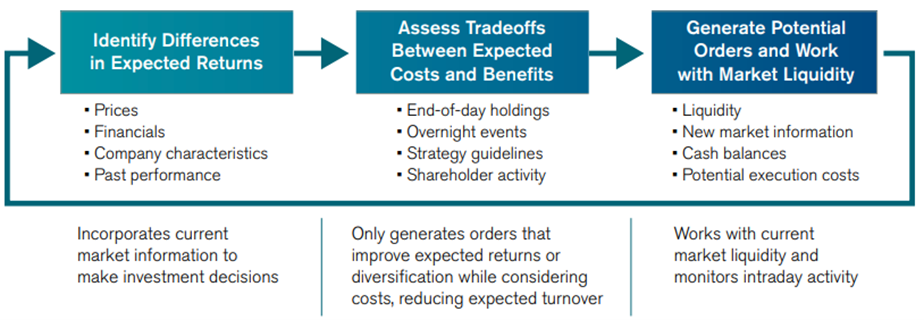

American Century Investments formed Avantis in 2018, and it manages eighteen ETFs with $17B in assets and nine mutual funds with $1.5B in assets. Eduardo Repetto (PhD) is the Chief Investment Officer at Avantis Investors. He was formerly the Co-Chief Executive Officer and Co-Chief Investment Officer at Dimensional Fund Advisers, a private investment firm well known for its active management approach. The Avantis website is located here. “Our Scientific Approach To Investing” by Avantis in April 2021 describes their approach based on valuation and profitability with a watchful eye on diversification, turnover, and costs, summarized as shown in Chart #1.

Chart #1: Avantis Process

Source: “Our Scientific Approach To Investing,” Avantis Investors, April 2021

Of the ten Avantis Funds that are three years old and older, the categories include international, small-cap, and emerging markets. Of these ten funds, six receive the MFO classification of “Great Owl” for high-risk adjusted performance, and seven had an MFO rating of above average or better (4 or 5). Eight of the ten funds had an MFO Risk Rating of 4 (similar to the S&P 500), and two had a rating of 5 for higher risk. Six had a Lipper Preservation rating of average or better (3 to 5). In other words, these funds carry much of the risk of their respective Lipper Categories but are better performers on a risk-adjusted basis.

Avantis All Equity Markets ETF (AVGE)

Morningstar rates the AVGE process as above average and gives All Equity Markets ETF (AVGE) a “Bronze Analyst Rating” based largely on the process:

The managers will strategically allocate to the underlying funds across geographies and investment styles to achieve the desired allocation. The underlying funds represent a broadly diversified basket of equity securities that seek to overweight securities that are expected to have higher returns or better risk characteristics than a passive and market-cap-weighted index.

The main disadvantage of the Avantis All Equity Markets ETF (AVGE) is its inception date of September 2022. However, investors have shown a belief in the fund by investing over $100M in this short time period. The Avantis All Equity Markets ETF (AVGE) is managed by Dr. Eduardo Repetto (CIO), Mitchell Firestein (Senior Portfolio Manager), Daniel Ong (CFA, Senior Portfolio Manager), Theodore Randall (Senior Portfolio Manager), and Matthew Dubin (Associate Portfolio Manager), collectively with eighteen years average experience. AVGE is leading a trend that I think will continue as an actively managed equity “fund of funds.” AVGE has a significant cost advantage over Global Multi-Cap Funds with an expense ratio of 0.23 compared to a median of 86 funds with an expense ratio of about 0.75.

From the Prospectus, a summary of the Principal Investment Strategies is:

Avantis All Equity Markets ETF is a “fund of funds,” meaning that it seeks to achieve its objective by investing in other Avantis exchange-traded funds (ETFs) (collectively, the underlying funds). The underlying funds represent a broadly diversified basket of equity securities that seek to overweight securities that are expected to have higher returns or better risk characteristics than a passive, market-cap weighted index…

To identify those securities with higher expected returns, the underlying funds generally place enhanced emphasis on securities of companies with smaller market capitalizations and securities of companies with higher profitability and value characteristics…

Under normal market conditions, the fund will invest at least 80% of its assets in equity ETFs. The managers will strategically allocate to the underlying funds across geographies and investment styles to achieve the desired allocation…

In the event of exceptional market or economic conditions, the fund may take temporary defensive positions that are inconsistent with the fund’s principal investment strategies…

Table #1 shows the fund’s target weight and range for allocation among the fund’s major asset classes and shows the underlying funds.

Table #1: Target Weights and Ranges

| Target Weight | Target Range | |

| U.S. Equity | 70% | 63% to 77% |

| Avantis U.S. Equity ETF | ||

| Avantis U.S. Small Cap Equity ETF | ||

| Avantis U.S. Large Cap Value ETF | ||

| Avantis U.S. Small Cap Value ETF | ||

| Non-U.S. Developed Markets | 17% | 10% to 24% |

| Avantis International Equity ETF | ||

| Avantis International Large Cap Value ETF | ||

| Avantis International Small Cap Value ETF | ||

| Emerging Markets | 10% | 3% to 17% |

| Avantis Emerging Markets Equity ETF | ||

| Avantis Emerging Markets Value ETF | ||

| Sector Equity | 3% | 1% to 6% |

| Avantis Real Estate ETF |

Source: Prospectus, Avantis Investors, January 2023)

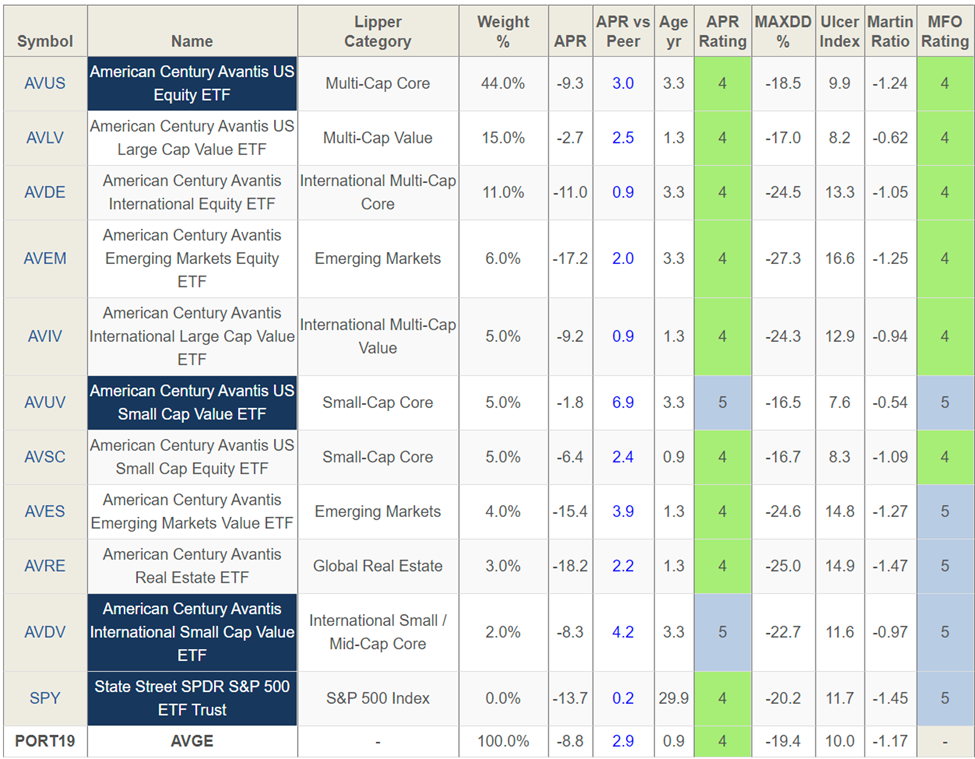

To partially overcome the short history of AVGE, I loaded the AVGE portfolio into the MFO premium portfolio tool. The results are shown in Table #2. The age of the youngest fund is approximately ten months old. During this ten-month period, all Avantis funds performed above average on a risk-adjusted return basis. I included SPY with no allocation for comparison purposes. The annualized return of AVGE, had the fund existed for the past ten months with the same allocation, would have been nearly -9% on a monthly basis compared to nearly -14% for the S&P 500. The drawdown and Ulcer Index are slightly lower than the S&P 500.

Table #2: MFO Portfolio Tool

A second possible drawback of AVGE is whether the allocation is appropriate for investors. Rob Berger, in the Financial Freedom Show, describes the use of Avantis All Equity Markets ETF (AVGE) as a one-stop equity fund. Mr. Berger describes both Avantis and AVGE. Mr. Berger’s conclusion is that he likes AVGE. However, he would not use it for all of an investor’s allocation to equity because it is so new.

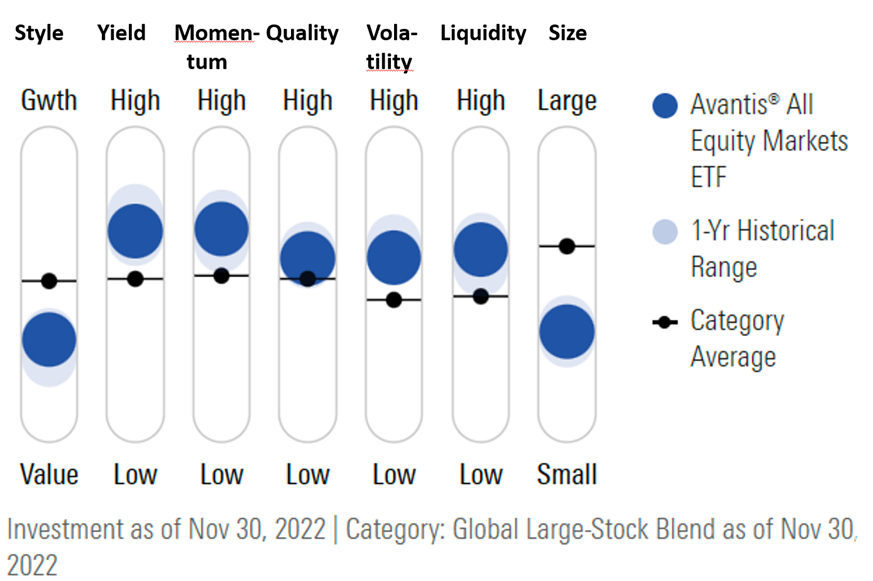

I used Morningstar to view their factor ratings AVGE shown in Chart #2.

Chart #2: Morningstar Factor Ratings

For regional allocation, AVGE currently has 73% allocated to North America and about 29% allocated to International Countries. Approximately 8 to 10% is allocated to diverse Developing Economies, with the majority allocated to Asia Emerging Markets. AVGE has a sector allocation consistent with the S&P 500 but with a tilt toward Basic Materials, Financial Services, Energy, and Industrials, and away from Technology, Consumer Defense, Healthcare, and Utilities.

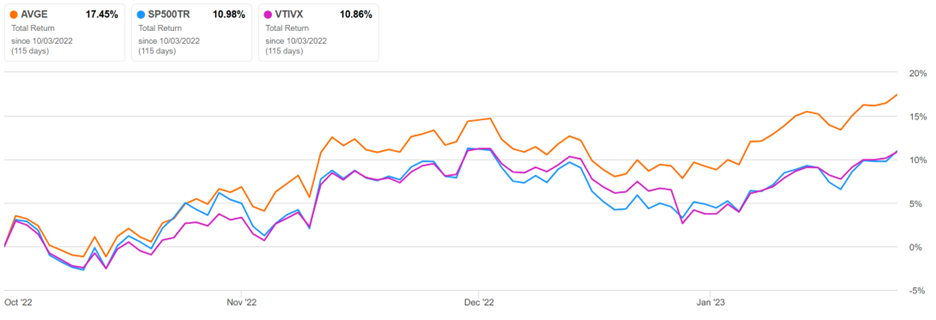

In some regards, a distant cousin to Avantis All Equity Markets ETF (AVGE) is mutual fund target retirement funds with a date older than 2045. These funds tend to invest using a passive, global multi-cap approach but include about 15% in bonds and get more conservative over time. Chart #3 shows the Total Return performance of AVGE compared to the S&P 500 and the Vanguard Target Retirement 2024 mutual fund. AVGE (orange line) performed well over the four-month period.

Chart #3: All Equity Markets (AVGE) Total Return vs Vanguard Target Retirement 2045 (VTIVX)

Comparison to Global Multi-Cap Funds

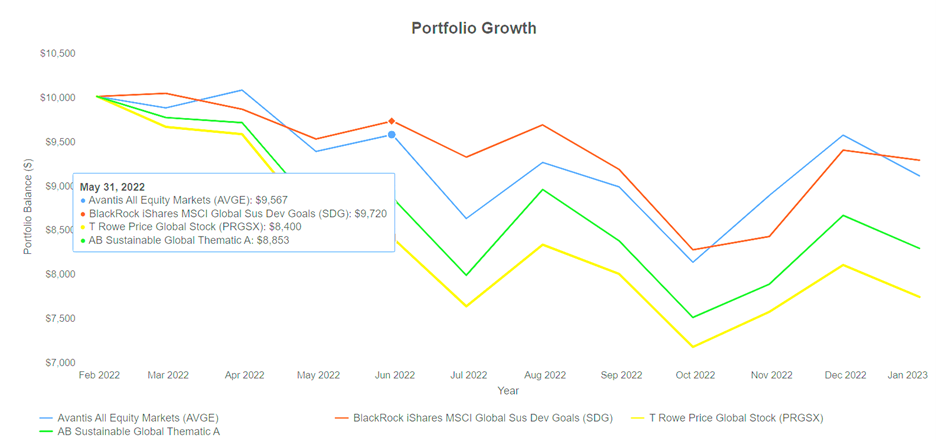

I used Portfolio Visualizer Backtest to compare the current allocation in AVGE to other quality Global Multi-Cap funds available to individual investors. There are few peers in this Lipper Category that are available to individual investors. This is a conceptual exercise because AVGE was not in existence for the full year. The AVGE portfolio would have done well.

Chart #4: Portfolio Visualizer of Current AVGE Allocation vs. Peers

Closing Thoughts

One should always consider risk first when making investments. I quote Ataman Ozyildirim (PhD), Senior Director, Economics, at The Conference Board, an organization with a long and respectable track record:

“There was widespread weakness among leading indicators in December, indicating deteriorating conditions for labor markets, manufacturing, housing construction, and financial markets in the months ahead. Meanwhile, the coincident economic index (CEI) has not weakened in the same fashion as the LEI because labor market related indicators (employment and personal income) remain robust. Nonetheless, industrial production— also a component of the CEI—fell for the third straight month. Overall economic activity is likely to turn negative in the coming quarters before picking up again in the final quarter of 2023.”

Source: The Conference Board, January 23, 2023

I favor Avantis All Equity Markets ETF (AVGE) for my Buckets that have intermediate Treasuries to meet withdrawal needs and need equity for longer term growth. AVGE invests in categories that I believe have growth potential over the next several years and has the flexibility to adjust. The short history of AVGE does not concern me because of the strength and performance of American Century and the strong Avantis management team with prior experience in this methodology.

I will watch the yield curve and other economic and financial indicators to show signs that economic risk is starting to decrease before buying a significant amount of AVGE. I do not see AVGE as a one-stop fund because I like diversification, but I do see it being a major holding in some of my Buckets over the course of the next few years.

My project this weekend is to re-organize the garage. It is a daunting but rewarding task after our move to Colorado.

Best wishes.