“Greenhushing” is greenwashing’s psychotic twin. “Greenwashing” is the practice of pretending to care about the environment; in fund terms, it occurs when marketers jam an inconsequential, mealy-mouthed sentence into a fund’s prospectus (“will consider ESG factors in all portfolio decisions to the extent they reflect financially material concerns”) and then marketing them as a sign of 21st-century sensibilities, notwithstanding the fund’s extensive coal holdings. DWS is in the spotlight currently as it tries to resolve charges from both the US SEC and German investigators that arose from claims by their former sustainability chief that the investor “made false statements” about sustainability actions.

“Greenhushing” is the newer phenomenon of running, as far and as fast as possible, from any accusations that your firm finds issues surrounding environmental sustainability, workforce equity, community engagement, or corporate boards that are not closed clubs at all relevant.

“Greenhushing” is the newer phenomenon of running, as far and as fast as possible, from any accusations that your firm finds issues surrounding environmental sustainability, workforce equity, community engagement, or corporate boards that are not closed clubs at all relevant.

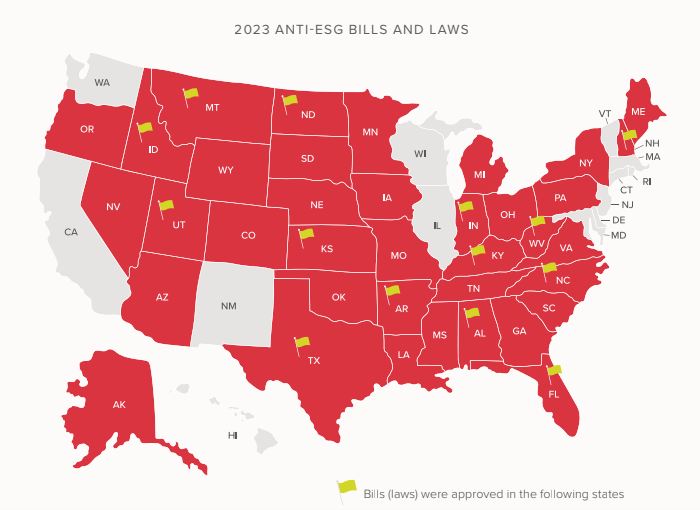

Greenhushing is driven by two concerns. First, they’re scared to death of the demagogues who attempt to fuel their political ascendance by demonizing the willingness of managers to consider some factors that they consider financially relevant. Thirty-seven states have seen anti-ESG bills introduced in the last legislative session.

To be clear: red in this map is not “Republican.” It is “at least one anti-ESG bill introduced.” The yellow flags signal the instances in which at least one bill became law. (Source: Pleiades 2023 Statehouse Report).

Second, their original ESG commitments were often an inch deep, to begin with. A 2022 survey by Deloitte revealed that most companies view ESG commitments through the lens of “brand recognition and reputation.” A separate review by the EU (2021) found that something like half of all “green claims” were “exaggerated, deceptive, or false.” Upon further review, MSCI downgraded 95 percent of the AAA ratings it had given European ESG ETFs.

And so, they flee. The most recent instance was the decision by Loomis Sayles to withdraw from the Climate 100, a coalition of large investors that had committed to pressure companies to reduce their carbon output. Loomis’s explanation of their decision is an epic word salad:

I can confirm that in June 2023 Loomis Sayles chose to withdraw as a signatory of the Climate Action 100+ initiative as a result of our routine evaluations to ensure that all our industry commitments continue to be aligned with the firm’s ESG philosophy,’ the spokesperson said. ‘Our ESG philosophy remains unchanged: we believe risks and opportunities associated with material ESG factors are inherent to investment decision-making and clients’ long-term financial success. In service of our fiduciary duty, we believe the best way to consider ESG is through integration that aims to identify the financial materiality of ESG factors. (“Loomis Sayles exits Climate Action 100, citing ‘fiduciary duty,” Citywire, July 31, 2023).

Other markers of anxious greenhushing:

S&P Global has stopped handing out scores to corporate borrowers on ESG criteria (“S&P drops ESG scores from debt ratings amid scrutiny,” Financial Times, 8/7/2023)

“ESG is perhaps the most glaringly absent term in this round of earnings transcripts.

-

-

- “The number of S&P 500 companies citing ‘ESG’ on earnings calls has declined (quarter over quarter) in four of the past five quarters,” according to a Fact Set study.

- “The term was cited by only 56 of the S&P 500 this quarter, down 24% (from 74 mentions) since last quarter and down roughly 64% (156 mentions) since its peak in Q4 of 2021.” (“Corporate America is rebranding ESG,” Axios, 8/10/2023, good article!)

-

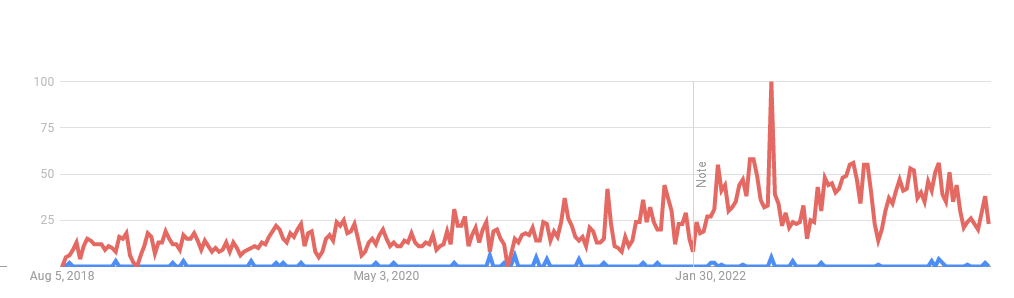

Perhaps fittingly, greenhushing (the blue line) receives far less attention than greenwashing (the red line):

All of this plays out, even while the public, across age and ideology, supports action at all levels to address global warming (“What the data says about Americans’ views of climate change,” Pew Research Center, 8/9/2023). And the public continues to demand evidence of corporate responsibility in both social and environmental arenas (Alan Murray, “Consumers are rejecting the anti-woke movement to demand CEOs speak out on important social issues,” Fortune, 8/11/2023). Even a majority of Republican voters want their candidates to leave corporations alone to make their own decisions. In a classic failure to communicate, most Americans do not support Biden’s climate initiatives (at least when you label them “the Inflation Reduction Act”), while simultaneously calling for more of the initiatives in … well, yes, the Inflation Reduction Act (“Most disapprove of Biden’s handling of climate change, Post-UMD poll finds,” Washington Post, 8/7/2023).

Bottom Line

The planet is in, so to speak, a world of hurt, from Canadian and Hawaiian wildfires to recording the warmest month and highest sea temperatures on record. We need to act with far more unity, speed, and force than we’ve shown any willingness to do if we’re to avert an epic catastrophe.

The reporting on greenhushing paints a pretty consistent picture: non-investment firms are extending their corporate sustainability initiatives as a matter of good business practice, though they’re not talking about them. Mid-sized investment firms are backtracking after one year of weak performance, redemptions, and political heat. Fund boutiques, which rarely get noticed in the national political furor, continue to plug along.

As the US enters the lunacy of a presidential election cycle, it might benefit all of us to issue, through our words and actions, a simple two-word message to the peddlers of overheated conspiracies and fearful rhetoric: “Cool it.”