On June 23, 2023, Robert B. Bruce (1931-2023) passed away. It diminishes a rich life and generous soul to describe him merely as “one of the portfolio managers of the Bruce Fund.” A Wisconsin graduate, he had a long-time friendship with Ab Nicholas, another renowned investor, and namesake of the Nicholas Fund, with whom he created an endowment for Wisconsin athletics. His obituary celebrates “a model of hard work, generosity, and unpretentious success” who passed away “in the embrace of his family.” From 1965-1972, Bob helped manage the Mathers Fund (MATRX) to phenomenal success, then set out on his own in 1972. He eventually purchased a small mutual fund in 1983, brought on his eldest son, Jeff, as partner and co-manager, and crafted a 40-year record of distinction and success.

On June 23, 2023, Robert B. Bruce (1931-2023) passed away. It diminishes a rich life and generous soul to describe him merely as “one of the portfolio managers of the Bruce Fund.” A Wisconsin graduate, he had a long-time friendship with Ab Nicholas, another renowned investor, and namesake of the Nicholas Fund, with whom he created an endowment for Wisconsin athletics. His obituary celebrates “a model of hard work, generosity, and unpretentious success” who passed away “in the embrace of his family.” From 1965-1972, Bob helped manage the Mathers Fund (MATRX) to phenomenal success, then set out on his own in 1972. He eventually purchased a small mutual fund in 1983, brought on his eldest son, Jeff, as partner and co-manager, and crafted a 40-year record of distinction and success.

But what now? What’s to be made of Bruce (the fund) after Bruce (the founder)?

Good question! Our May 2020 profile of the fund offered this Bottom Line:

Bruce is an enigmatic fund because its managers choose for it to be so. They don’t explain themselves to the public, though they do answer calls from their investors. They don’t have “a formula,” don’t rely on rigorous quantitative analysis, and don’t have “a deep bench” behind them. They do, so far as I can tell, talk to lots of contacts and industry insiders to keep a clear view of where risks and opportunities lie. They do maintain consistently low portfolio turnover while still moving when the opportunity set arises.

The two cautions about the fund are (1) the elder Mr. Bruce’s age and the implication of moving from a two-person team to a single manager without a partner and (2) the insensitivity of the portfolio to the sustainability, in an ESG sense, of the portfolio’s holdings.

That said, it is hard to imagine why an independent-minded investor wouldn’t have the fund on their due-diligence list.

Now that the first has come to pass, what’s an investor in the $500 million fund to do? That stirred a healthy conversation on the MFO discussion board and a call to manager Jeff Bruce.

The worst-case outcome is a replay of the fate of the Mathers Fund. Thomas Mathers (1914-2007) was an acerbic “go-go growth manager with an iron stomach.” He launched Mathers Fund in 1965 with three co-managers. It had a slow start, then took off, excelling in both bull and bear markets. Mr. Bruce left in 1972, and Mr. Mathers, in a move he came to regret, handed the fund off to Henry Van der Eb in 1974 and sold the advisor to him in 1981. Mr. Van der Eb describes himself as “a dyed-in-the-wool value guy.” Others likely would have said, “perma-bear.” There’s little question that Mr. Mathers would have described him as “my biggest mistake.” Under Mr. Van der Eb, Mathers transformed into a stock-light bear fund that so infuriated Mr. Mathers that he demanded that his name be taken off the fund. Mr. Van der Eb refused. Assets withered. Gabelli/GAMCO bought the fund in 1999 after a decade in which the fund trailed the S&P 500 by 18% to 3% and also trailed the average money market. Mr. Van der Eb chose to close the fund in 2018. Chuck Jaffe offered this obituary:

According to Mathers’ own annual report at the end of 2017, a $10,000 investment in the fund made when it opened in 1965 was worth $195,153 by Dec. 31, 2017; the same amount invested in the S&P 500 was worth $1.48 million.

In short, on the five-decade scale from one to disaster, Mathers Fund is a financial Chernobyl, a nuclear wreck.

Chuck always had a way with words.

Mathers is the worst-case outcome: an exceptional fund reversing direction, becoming something entirely new (and alien), suffering collapsing returns and soaring expenses. But it is not the template for manager changes in eponymous funds; that is, funds bearing the name of their founding manager(s). In some cases, the transition is utterly seamless: the Mairs and Power funds, specialists in investing with exceptional care in the US Midwest, have managed four sets of manager successions without a hiccup; each of their four funds carries a four-star designation from Morningstar.

In other cases, the transition is clouded by external factors. The Fasciano Fund was the top small cap fund of the 1990s on both an absolute return and risk-adjusted return basis. It was Michael Fasciano’s vehicle, and he drove it well. The capsule is that Michael is the sort of manager that T. Rowe Price loves: the sensible, disciplined, consistent guy who wins by hitting for average rather than for power and who rarely strikes out. And yet, Fasciano is no more. We detailed the story of the rise and fall of one of our favorite small cap funds, but the short version is the fund soared, Michael partnered with Neuberger-Berman for support, Neuberger got bought by Lehman Brothers shortly before their cataclysmic failure, and in a desperate attempt to stay afloat, Lehman ordered thousands of layoffs. Mr. Fasciano was among them, and his fund was merged out of existence.

Our colleague Ed Studzinski’s question for such funds was always the same: “Yes, but what if the manager gets hit by a bus tomorrow? What are their shareholders to do?”

The short answer: absent an obvious red flag, chill out. You’ll be fine.

To reach that conclusion, we looked at the performance of a handful of famous eponymous funds following their founders’ departure, whether through retirement, death, or dismissal. In pretty much all cases, funds flourished – at least in terms of continuing their traditional risk-adjusted performance – in the years immediately following their founders’ departure. Here’s what we found.

Nicholas without Nicholas, seven years

Albert “Ab” Nicholas, an old friend of Robert Bruce’s, passed away in August 2016 at the age of 85. He was, with his son David, co-manager of Nicholas Fund until his last days. Nicholas Fund was launched in 1969, with son David Nicholas joining as co-manager in 2011. With Mr. Nicholas’ passing, Michael Shelton was elevated to co-manager. Jeff Strong joined the team last year.

Nicholas is a four-star fund with $3.6 billion in assets. It’s characterized as a large-growth fund with a smattering of mid-cap names. We spoke in July 2023 with Larry Pavelec, COO and Executive Vice President of the adviser, about their experience managing in Mr. Nicholas’ wake.

Every firm is different. Ab’s passing gave us the opportunity for a deep reset and self-analysis. Ab was skeptical of tech and preferred backdoor tech, whereas Dave Nicholas has grown up with a greater comfort level with technology as central to our lives, and he recognizes companies like Microsoft and Apple as free cash-flow machines. We’re also probably more cap conscious than before because our investors need it. Ab was a go-anywhere guy who might move the fund to value. And we’re a little more open to marketing, though we’re sensitive to the challenge of having too much noise in the system.

David has worked with Ab on this strategy for 30+ years. The one thing that did not change was the philosophy that we follow. We try to be disciplined. Believe in the philosophy. We put our clients first. We seek to invest in companies with sustainable advantages, but we do so with a strict valuation discipline. And we continue to look to improve, to adapt to the markets.

In the seven years since the elder Mr. Nicholas’ departure, the fund has modestly outperformed its peers in total returns. While its maximum drawdown and standard deviation match its peer group, it outperforms by measures of downside deviation, bear market deviation, and risk-adjusted returns.

Post Nicholas Performance

|

APR |

MAXDD |

STDEV |

DSDEV |

BMDEV |

Sharpe Ratio |

Ulcer Index |

|

|

Nicholas |

12.8 |

-24.4 |

16.1 |

10.5 |

10 |

0.71 |

7.4 |

|

Large-Cap Core Average |

12.4 |

-24.3 |

16.1 |

10.7 |

10.2 |

0.68 |

7.7 |

Source: MFO Premium. Green fill signals the outperformance of its benchmark for the period since the transition. MFO Premium uses a different color-coding system in its rankings. A fund’s Lipper peer group frequently differs from its Morningstar peer group, which may account for divergent relative performance.

Yacktman without Yacktman, seven years

There are days when it looks like the Yacktman funds are just toying with the rest of us. Yacktman appears in more articles about outstanding investments at MFO than any other fund or firm.

Don Yacktman plays a lot like a character out of “Leave It To Beaver.” Quiet, self-effacing family man. Boy Scout. Devout Mormon who sang in the choir. Quietly principled: he shrugged off the 1990s when the dot-com market nearly wrecked his firm, then shrugged off the 2000s when they effortlessly doubled the S&P 500. He left his previous firm, where his fund was performing brilliantly, because they were getting “sleazy” (Pat Regnier, “Don Yacktman’s Lonely Crusade,” Money, 4/1/1999, a great story there).

His explanation for how to win in investing is simple:

He waits to buy great companies when they’re down and rides them until they recover, which great companies almost always do. You don’t need to jump in and out of stocks, he tells them. “You just need to catch the wind enough times,” he says. “And you need to be very, very patient.” (“Don Yacktman: A fund manager’s faith produces results,” Fortune, 12/13/2012).

“Being patient” translates to a willingness to hold cash, sometimes quite a lot of cash, for quite a long time until the market presents – as it eventually does – suitable opportunities. That often means suffering terrible relative returns when the market is frothy (trailing 90% of their peers in 2019 and 2021 while still making 18% per year for their investors) and crushing when the markets turn choppy (as in 2018 and 2020).

Don Yacktman founded Yacktman Asset Management in 1992, the year he launched Yacktman Fund. Five years later, he added Yacktman Focused. Before founding the firm in 1992, he managed Selected American Shares (SLADX) for nearly a decade and was named Fund Manager of the Year by Morningstar in 1991. Don Yacktman stepped aside as CEO of Yacktman on August 1, 2013, and as portfolio manager in 2016. From launch through mid-2016, $10,000 in Yacktman grew to $104,000. The same investment in the S&P 500 grew to $81,000. Stephen Yacktman is now the lead manager of the Yacktman Funds. (Parenthetically, brother Brian Yacktman left in 2007 to launch the YCG Enhanced Fund (YCGEX), which has, over the past seven years, higher returns than both the Yacktman funds and its peer group.)

Post Yacktman Performance, 07/2016 – 06/2023

|

APR |

MAXDD |

STDEV |

DSDEV |

BMDEV |

Sharpe Ratio |

Ulcer Index |

|

|

AMG Yacktman |

10.6 |

-21.7 |

13.9 |

9.1 |

8.4 |

0.66 |

5.0 |

|

AMG Yacktman Focused |

10.9 |

-21.0 |

14.3 |

9.2 |

8.6 |

0.66 |

5.2 |

|

Multi-Cap Value Average |

9.5 |

-27.9 |

17.4 |

11.9 |

11.1 |

0.47 |

7.3 |

Source: MFO Premium. See the previous note concerning cell shading and peer groups.

Cook and Bynum without Bynum, five years

Messrs. Richard Cook and Dowe Bynum are concentrated value investors in the tradition of Buffett and Munger. They’ve been investing since before they were teens and even tried to start a mutual fund with $200,000 in seed money while they were in college. Within a few years after graduating college, they began managing money professionally, Cook with a hedge fund and Bynum at Goldman Sachs. By their mid-30s, they were managing an ultra-concentrated five-star fund headquartered in Birmingham, Alabama. Valuing their independence, they wanted to work far from the Wall Street crowd.

Dowe Bynum (1978-2020) passed away on Friday, July 17, 2020, at peace and surrounded by loved ones. Dowe, who eschewed his given first name, “Jasper,” was diagnosed with brain cancer about three years before. Richard Cook has been largely responsible for the day-to-day management of the portfolio since that time. Dowe’s illness deeply affected his family, his friend and partner, and their firm.

Dowe Bynum (1978-2020) passed away on Friday, July 17, 2020, at peace and surrounded by loved ones. Dowe, who eschewed his given first name, “Jasper,” was diagnosed with brain cancer about three years before. Richard Cook has been largely responsible for the day-to-day management of the portfolio since that time. Dowe’s illness deeply affected his family, his friend and partner, and their firm.

The fund, which often invested in just six or seven stocks, often concentrated in Latin America and among soft drink bottlers and distributors, is about impossible to benchmark. Lipper calls it a “global multi-cap value,” Morningstar had categorized it as a “world stock” before moving it to “emerging markets” recently. It is, as an EM equity fund, a five-star performer.

The effect of Dowe’s absence is impossible to gauge from the outside. The fund was a top-tier performer for its first five years, and money poured in; with no change in discipline but a substantial change in market conditions, it was a bottom-tier performer for the three years preceding and following Dowe’s diagnosis. Likely a misfit in its new “diversified EM” home, with 60% of its nine stock portfolio in Mexico and Chile, it has soared.

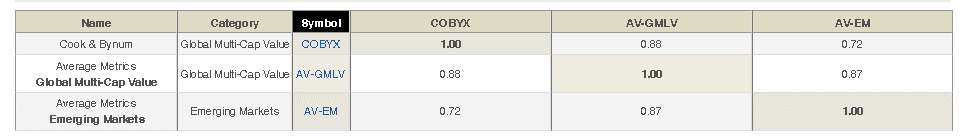

Morningstar categorizes COBYX as an emerging markets equity fund. Lipper places it in the global multi-cap value group, which is dominated by larger companies in developed markets.

We generated a five-year correlation matrix at MFO Premium, matching COBYX with its two possible peer groups.

The curious finding is not that COBYX correlates more with multi-cap value than with emerging markets (0.88 versus 0.72); it is that COBYX has a nearly identical correlation with multi-cap value as does the average emerging markets fund (0.88 versus 0.87).

The fund’s relative performance depends entirely on which of those groups strikes you as most plausible.

Post Bynum Performance, 07/ 2018 – 06 / 2023

|

APR |

MAXDD |

STDEV |

DSDEV |

BMDEV |

Sharpe Ratio |

Ulcer Index |

|

|

Cook & Bynum |

3.4 |

-26.9 |

16.6 |

11.8 |

11.1 |

0.11 |

11.2 |

|

Emerging Markets Equity |

0.3 |

-38.7 |

21.1 |

16.2 |

12.3 |

-0.02 |

16.8 |

|

Global Multi-Cap Value |

5.7 |

-27.4 |

18.7 |

13.1 |

12.2 |

0.22 |

9.8 |

Source: MFO Premium. See the previous note concerning cell shading and peer groups.

Muhlenkamp without Muhlenkamp, four years

Ron Muhlenkamp began his investing career in 1968, launched Muhlenkamp Fund in 1988, and managed it from just north of Pittsburgh, my hometown, which always made it a favorite. Ron was beloved by the CNBC-type talk shows for his clarity and unshakeable confidence. Through the 1990s and early years of this century, he clubbed the S&P 500, famously asking of the 2000-01 market collapse, “bear market? What bear market?” He would soon find an answer, as the fund trailed its Lipper peers in 11 of the next 14 years as Ron railed against Fed policy and interest rate insanity. I sold my own stake in the fund when I concluded that Ron had developed an unhealthy passion for reprinting his own old essays (“I told you this was going to happen!”) while the fund floundered. The fund was underwater for four years (2007, 2011, 2015, 2016), while the S&P 500 made money during that stretch.

He was joined by his son Jeff Muhlenkamp in November 2013. Son Todd serves as Muhlenkamp’s president. In February 2019, Ron handed over the day-to-day stock picking and portfolio management duties to Jeff. Ron remains engaged with the firm. Since the handover, the fund has rebounded. The most recent shareholder letter combines sensible market projections from Jeff with flat-out silly advice from Ron on how to get rich: “Just save 50% of all your money,” based on a decades-old reflection by Sir John Templeton on what worked for him after his graduation from Oxford (and assumption of a Wall Street job) in the 1930s.

Post Muhlenkamp Performance, o7/ 2019 – 06 / 2023

|

APR |

MAXDD |

STDEV |

DSDEV |

BMDEV |

Sharpe Ratio |

Ulcer Index |

|

|

Muhlenkamp |

14.6 |

-27 |

17.9 |

11.8 |

11.3 |

0.74 |

5.9 |

|

Multi-Cap Value |

8.8 |

-27.8 |

20.3 |

13.8 |

12.9 |

0.37 |

8.9 |

Source: MFO Premium. See the previous note concerning cell shading and peer groups.

Akre without Akre, 2.5 years

Akre Focus was born out of betrayal. Chuck Akre was the star manager of FBR Focus when FBR (Friedman, Billings, Ramsey & Co.) decided that he was being overpaid and offered a contract with a 50% fee reduction. Mr. Akre disagreed, said something like “poop on you,” left with his team of analysts, and launched Akre Focus in 2009. Only to discover, upon returning from an out-of-town trip, that FBR had bought his team away from him. Incensed, he hired and trained new analysts. In the years following, he clubbed the market and, measured by asset flows, clubbed FBR. Akre Focus reached $14 billion and five-star status.

Akre Focus was born out of betrayal. Chuck Akre was the star manager of FBR Focus when FBR (Friedman, Billings, Ramsey & Co.) decided that he was being overpaid and offered a contract with a 50% fee reduction. Mr. Akre disagreed, said something like “poop on you,” left with his team of analysts, and launched Akre Focus in 2009. Only to discover, upon returning from an out-of-town trip, that FBR had bought his team away from him. Incensed, he hired and trained new analysts. In the years following, he clubbed the market and, measured by asset flows, clubbed FBR. Akre Focus reached $14 billion and five-star status.

Mr. Akre stepped aside from day-to-day management in December 2020, though he remains active at the firm. His most recent activities surround the purchase of Eldon Farms as a “conservation purchase” in 2021. Akre Focus is now managed by John Neff and Chris Cerrone. Mr. Neff is a Partner at Akre Capital Management and has served as portfolio manager of the fund since August 2014, initially with founder Chuck Akre. Before joining Akre, he served for ten years as an equity analyst at William Blair & Company. Mr. Cerrone, a Partner at Akre Capital Management, has served as portfolio manager of the fund since January 2020. Before that, he served as an equity analyst for Goldman Sachs for two years.

The fund has seen substantial outflows following Mr. Akre’s departure. Performance in 2021 and 2022 was substantially above average, while 2023 (through July) is solid in absolute terms and lackluster in relative terms.

Post Akre Performance, o1/ 2021 – 06 / 2023

|

APR |

MAXDD |

STDEV |

DSDEV |

BMDEV |

Sharpe Ratio |

Ulcer Index |

|

|

Akre Focus |

4.2 |

-29.3 |

20.9 |

14.3 |

12.4 |

0.11 |

14.3 |

|

Multi-Cap Growth |

-2 |

-36.7 |

22.2 |

16.5 |

15.2 |

-0.13 |

21.5 |

Source: MFO Premium. See the previous note concerning cell shading and peer groups.

Walthausen without Walthausen, two years

Walthausen & Co., LLC. was an employee-owned investment adviser that John Walthausen founded in 2007 after running the Paradigm Value Fund. It specialized in small- and mid-cap value investing. In September 2007, he was joined by the entire investment team that had worked previously with him at Paradigm Capital Management, including an assistant portfolio manager, two analysts, and a head trader. John Walthausen retired on July 30, 2021, at age 75, after 14 years at the helm. Gerry Heffernan had co-managed the Fund since March 2018 and was joined by DeForest Hinman. Mr. Walthausen declared, “I am confident that Gerry, DeForest, and the rest of the team will carry the firm far into the future.”

Investors expressed less confidence. Assets in December 2021 were $100 million; assets in December 2022 dropped to $36 million, driven, so far as we can tell, by institutional redemption. The Board of Trustees concluded that they needed to sell the fund to North Star Investment Management Corporation in December 2022.

NorthStar installed the team that’s also responsible for NorthStar MicroCap. The fund was respectable in 2022 and has lagged 80% of its peers since the North Star transition (through July 30, 2023).

Post Walthausen Performance, o7/ 2021 – 06 / 2023

|

APR |

MAXDD |

STDEV |

DSDEV |

BMDEV |

Sharpe Ratio |

Ulcer Index |

|

|

North Star Small Cap Value |

-0.7 |

-20.1 |

21.2 |

13.3 |

11.7 |

-0.13 |

9.4 |

|

Small-Cap Core |

-2.9 |

-22.7 |

21 |

14.5 |

13.1 |

-0.24 |

11.6 |

Source: MFO Premium. See the previous note concerning cell shading and peer groups.

Bruce without Bruce, one month

And Bruce? The Younger Mr. Bruce will persevere, I suspect. His dad was more and more a voice in the background, I suspect. Our profile noted, “They don’t explain themselves to the public, though they do answer calls from their investors.” Literally, I called the fund (they don’t publish an email address); Jeff Bruce answered on the second ring, and I talked to Jeff Bruce for about 20 minutes. He’s very pleasant and agreeable but has spent 38 years with the mantra: we talk to our shareholders, not the outsiders.” No interviews with Morningstar since the early 80s, when Mr. Mansueto was a two-person operation and a newsletter. (The younger Mr. Bruce went to high school with Mr. Mansueto, but they seemed not to be in the same social circle.)

The takeaway is that Jeff anticipates no change. He and his dad worked together for 38 years. They talked about each idea. If one of them liked it, they bought a little. If both of them liked it, they bought a lot. And vice versa with sales. The support team remains in place, and confidence is unshaken.

He does know that we’ve commented favorably on the fund’s high cash stake. (Currently, 25% with substantial overweights in defensive stocks.) He seems to appreciate the understanding. The fund is underwater today, mostly because they had anticipated a hard market. It is, he reports, their fifth-worst performance since launch. He admits that there’s somewhat limited comfort in the observation, “well, we have done worse four other times and always bounced back by sticking with the plan.”

It’s entirely cool that the manager, in their 450 square-foot world headquarters, answers the phone himself on the second ring, and enjoys talking with shareholders. Since a one-month performance table is silly, we won’t waste your time.

Bottom Line

The evidence is consistent, though our survey is not encyclopedic. In almost all instances, funds perform credibly in the years (two to seven, in our survey) following the departure of their founding manager. They might or might not reach the heights of excellence seen under The Great Man’s guidance, but they do not betray their shareholders.

That’s a broad generalization. Your results might vary. If that prospect unnerves you, consider one of two alternate paths. One prudent course for active investors is usually a functional team or a firm (T Rowe Price, Mairs & Power) with a good record for manager replacement. The prudent course for skeptics might be a passive strategy that’s not purely market-cap or debt weighted.