On November 13, 2023, the Boston-based institutional investment firm GMO, founded in 1977 as Grantham, Mayo, and Van Otterloo, launched their first retail product: GMO US Quality Equity ETF (QLTY). The actively managed fund will invest in a focused portfolio of “companies with established track records of historical profitability and strong fundamentals – high quality companies – are able to outgrow the average company over time and are therefore worth a premium price.” Expect a portfolio of about 40 names, with a 75% weighting in large-cap stocks and 25% in mid-caps. At 0.5%, the ETF charges the same expenses as the $5 million share class of the Quality fund.

The fund will be managed by the three-person Focused Equity team: Tom Hancock, Ty Cobb, and Anthony Hene. All three joined GMO in the middle 1990s and boast 28 or 29 years of investment experience. Together, they manage the $7.5 billion GMO Quality Fund, which launched in 2004, and the $117 million GMO US Quality Strategy, which launched in June 2023. GMO Quality Fund is rated five-star / Gold by Morningstar and a Great Owl by MFO for its consistently top-tier risk-adjusted returns over the past 3-, 5-, 10-, and 20-year periods.

Why might you be interested?

GMO argues that investing in quality equity should be the core of any long-term investor’s portfolio. Their argument is that there’s “much gnashing of teeth” over the value/growth divide, which fails to recognize that both of those disciplines have innate weaknesses: growth investors tend to get trapped by short-term momentum plays, while value investors tend to get trapped in … well, value traps; companies that are achingly cheap, but for good reason.

The Focus Equity team’s contention is that by adding the third factor – quality – to a discipline that is both growth-centered and value conscious, they’re able to consistently thread the needle.

We believe the GMO Quality Strategy is an ideal core equity holding that has delivered strong returns, stability, and downside protection for investors for nearly 20 years and counting. By selecting stocks for their durable quality characteristics, it sits outside of the growth vs. value dilemma and avoids the pitfalls of those styles. Compared to similar approaches that employ more systematic commoditized processes but fail to consider valuation, the GMO Quality Strategy has delivered superior results and has earned the right to be called the real McCoy.

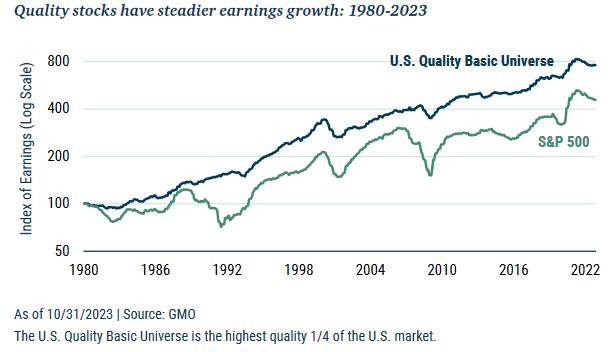

They illustrate the potential stability of the strategy by looking at the stability of the earnings of “quality” companies in comparison to the broader market.

GMO clearly intends to market this as an extension of the Quality Fund. The ETF factsheet advertises, for instance, “No minimum size required to invest in a 20-year institutional strategy.” GMO describes their process and competitive advantage this way:

In 2004, GMO launched the Quality Strategy with the mandate to own attractively valued stocks within the quality universe. The creation of the strategy was the culmination of decades of GMO research on quality business models. While the strategy’s origins date back to GMO’s earliest days, our process continues to evolve to ensure sustained relevance as well as our investment edge. We believe an increased emphasis on fundamental analysis in the last decade has given us a better chance to win and has further distinguished our approach from increasingly commoditized “factor” portfolios.

Investors in the strategy have always included a mix of tactical investors and those who consider the Quality Strategy to be a core, long-term allocation. It is worth mentioning that some of those earliest “tactical” investors still hold our strategy nearly 20 years later.

GMO is pretty openly dismissive of mechanical strategies that try to capture “quality” or “low volatility” through passive ETFs. Low-vol strategies simply focus on what was low volatility in the past, with no attempt to anticipate seismic change, so “they tend to exhibit significant time-varying style and sector exposures, often with abrupt turnover at inopportune times … For example, many levered financial services companies seemed relatively low volatility in 2007 until suddenly they weren’t.”

Smart beta quality strategies have a process that ends at the point that GMO’s begins. The smart beta funds run quant models and then buy the highest-rated stocks. GMO runs the quant models, then begins to query the outputs:

While we have a high degree of confidence in our own quant models, we recognize that the best quant models can produce false positives if, for example, a business model has exploited a niche that has eroded over time or if the perceived stability of profitability is merely a function of an unusually long cycle.

Similarly, sole reliance on quantitative screens can result in false negatives and exclude long-term, durable quality business models that may not meet one criterion of the screen or may not yet have enough financial history for the model to sort.

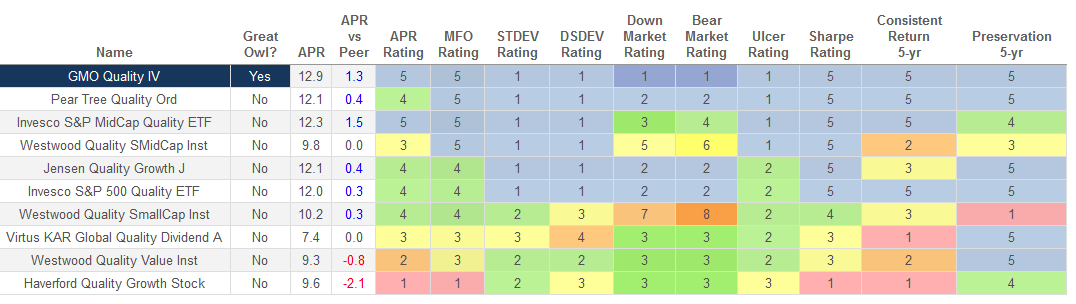

Dr. Hancock is the head of GMO’s Focus Equity team and has been with the strategy for 15 years, so we searched at MFO Premium for the 15-year performance of all equity funds with “Quality” in their name.

Color is the key to a quick reading of this graphic. Blue cells signal performance in the top 20% of one’s peer group, green in the next lower tier, then yellow, orange, and red. GMO Quality has the highest annual returns in the group and is the only fund to earn a place in the top tier by every measure we assessed: returns, volatility, down- and bear-market performance, risk-adjusted returns, and consistency of returns.

Bottom line

The US Quality ETF is not a clone of the Quality Fund because the latter owns some international stocks as well as US stocks. It does appear to clone the newer US Quality Strategy, which relies on the same team, the same logic, and the same discipline as the Quality Fund. GMO’s research library offers rather a lot of evidence by which to assess both the idea of “active quality” investing and the performance of the GMO Strategies over time.

It warrants your attention.