Missed Opportunity in Brazilian Interest Rates sowed the seeds of finding the right fund

Earlier this year, one of my friends, a doyenne of Currencies and Interest Rate trading, told me there was money to be made in Brazilian Real Local Government Bonds and interest rate products. In 2022, the Brazilian interest rate rose from 9.25% to a cycle high of 13.75%. Inflation was soaring there as in the rest of the world. A lot of traders lost money calling the highs in the rate high cycle and threw in the towel. Losses multiplied. But by the turn of the year, things were looking different. Inflation was coming down, the Central Bank had stopped raising rates in Sao Paulo and had stopped sounding hawkish. Since the market had been wrongfooted in 2022, interest rates seemed too high at the beginning of 2023.

“Devesh, you have to get involved in Brazilian local rates,” she pleaded. “This is a great trade.”

“But how?” I responded with frustration. “No mutual fund or ETF allows an individual investor based out of the USA to invest in local Brazilian Government bonds in Reais. There has never been a way to participate.”

She has always been liberal with her market calls and is almost always right. But trading Thailand vs. Malaysia or Aussie rates vs. Mexican rates is not my forte. I twiddled my thumbs until I determined to find an answer to the problem. I have enough background in these products to understand their complexity and the opportunity set.

My personal career history in EM showed opportunities and risks.

Right out of college, my first job was to trade Latin American currencies and local interest rates. From 1997 to 2000, I called banks and brokers in Venezuela, Argentina, Colombia, Chile, Brazil, and Mexico to buy and sell currencies and bonds for Merrill Lynch’s customers and for the bank’s own capital. Once, we took down an entire Colombian bond auction at 32% interest rates. But I also saw the Argentine and Venezuelan devaluation, and there is nothing uglier than seeing money evaporate. Debt instruments in Emerging Markets are fascinating because there are so many countries and so many products.

Exciting and educational it may be, but perhaps it is a blessing in disguise that simple fund products don’t exist to speculate on the future path of these Emerging Market (EM) debt assets. At a bank, one could be a specialist. Not from home. I kept looking for an intelligent way to harness the opportunity set in Emerging markets debt.

Does the answer lie in a Passive ETF?

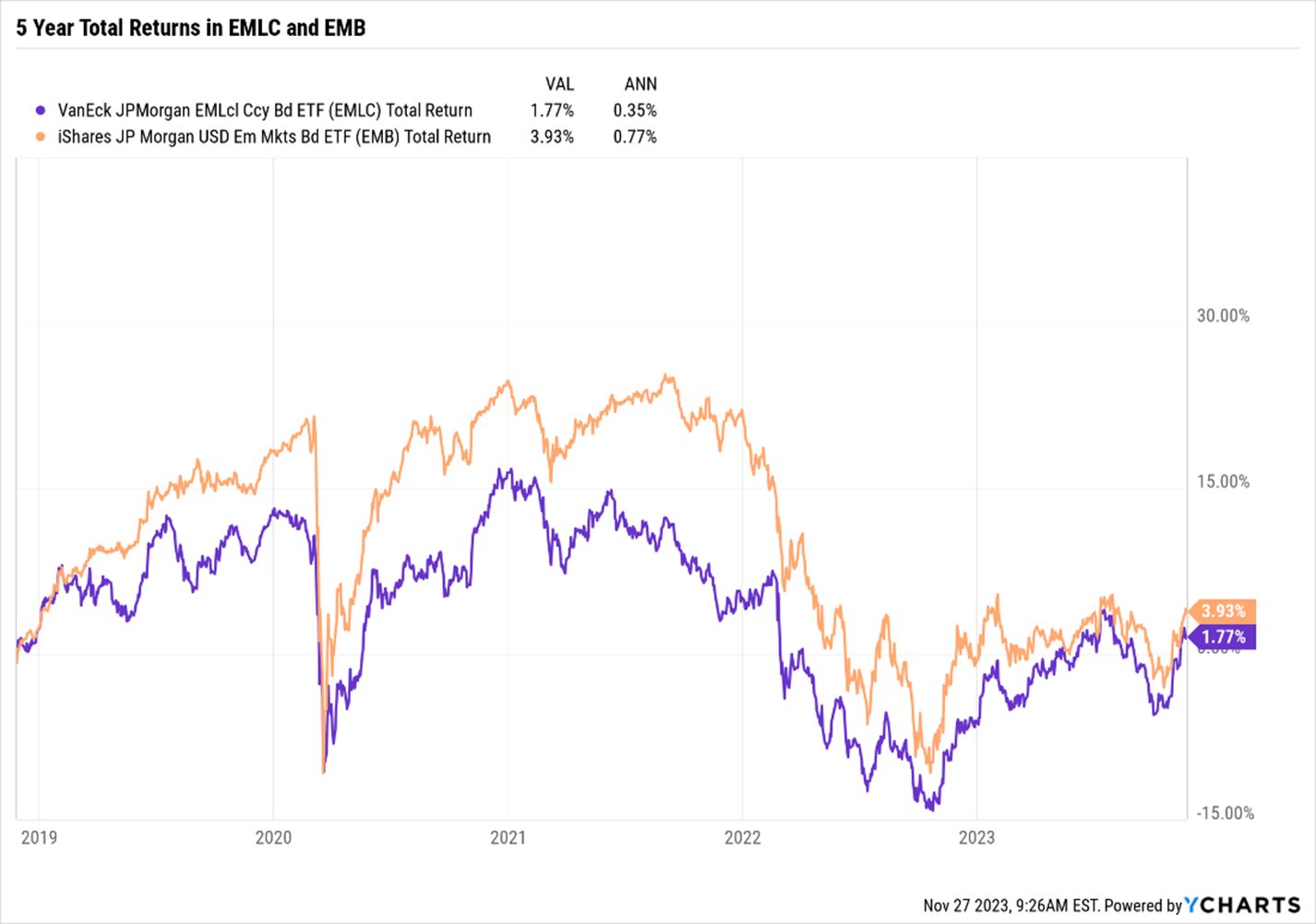

For local currency investments, the Van Eck JP Morgan EM Local Currency Bond ETF (EMLC) has almost $3 Billion in AUM. For hard currency investments, The iShares JP Morgan USD EM Bond ETF (EMB) is the go-to vehicle with almost $14 Billion in Assets. Unfortunately, neither of them inspires despite the billions invested in them. The 5-year Total Return for both are in the low single digits. There are many reasons for the poor record, but I am not looking for losers to turn around. I want to talk to winners who know how to make money.

PS: One wonders who these investors are with $17 Billion in these sorry ETFs. And why do they continue to be involved in it?

The Active Choice: Artisan EMsights Capital Group Emerging Market Debt Funds

I kept looking for active funds that would fit the shoe for EM debt and beat the pants out of the passive. With the help of the MFO Premium search engine, I found what I think is a good fund for the purpose and the portfolio.

Michael Cirami is a fund manager of three EM Debt funds at Artisan Partners. I spoke to him in mid-November to understand better what he does and why his funds might work for those in search of an adept manager in EM debt. I’d like to add that David Snowball has a companion piece that readers should read. If a reader wants a greater appreciation of what the fund tries to accomplish, there is a fantastic interview by The Wall Street Transcript. I wanted to take a slightly different approach. As an asset allocator, it matters less whether the fund chooses or avoids Nigeria or Guyana. The important thing for investors in our seats is to understand what this fund does and how it fits into our overall portfolio.

Michael Cirami is a fund manager of three EM Debt funds at Artisan Partners. I spoke to him in mid-November to understand better what he does and why his funds might work for those in search of an adept manager in EM debt. I’d like to add that David Snowball has a companion piece that readers should read. If a reader wants a greater appreciation of what the fund tries to accomplish, there is a fantastic interview by The Wall Street Transcript. I wanted to take a slightly different approach. As an asset allocator, it matters less whether the fund chooses or avoids Nigeria or Guyana. The important thing for investors in our seats is to understand what this fund does and how it fits into our overall portfolio.

Can we start with why the passive investment approach does not work well in EM Debt?

Passive ETFs generally follow Benchmarks. In EM Debt, there are four benchmarks:

Benchmarks are riddled with problems: Countries which issue the most debt tend to have the biggest positions in the index. Just because a country is highly indebted does not make them more investment-worthy. Perhaps, quite the opposite. Benchmarks may assign very low weights to some countries or all together ignore other countries while still keeping defaulted countries in the benchmark. There are arbitrary rules on minimum size and maturities included in the index. Bonds in the benchmark also have a lot of risk to non-EM factors: like US interest rates of the Euro currency rate. Finally, the benchmark carries many bonds with low spreads to US treasuries which do not offer attractive yields to debt investors.

These are some of the reasons why Passive ETFs have not performed well in EM.

What do you do that’s different?

We are benchmark agnostic. We start with a blank piece of paper and determine the best investments in EM across sovereign hard currency bonds, local currency bonds, corporate bonds, and derivatives which allows us to hedge or add to FX risk, Credit risk, or interest rate risk. Our investment universe is around 130 countries. Furthermore, we hedge out the US Interest rate risk across all our investments (more about this later).

We manage three different investment strategies:

- Artisan Global Unconstrained (“Unconstrained”)

- Artisan Emerging Markets Debt Opportunities (“EMDO”)

- Artisan Emerging Markets Local Opportunities (“Local”).

As of October 2023, the assets under management (AUM) are: Unconstrained $301 million, EMDO $82 million, and Local $412 million. We manage mutual funds, separate accounts, and European UCITS.

Only Global Unconstrained and EMDO are available to US Mutual Fund investors.

The EMDO fund is a long only fund in the EM debt asset class. It’s 100% EM alpha and beta.

The Global Unconstrained fund is a long-short fund across EM and Developing Markets (DM). This fund can be a mix 80% EM and 20% DM. Because it’s Long Short it carries less beta risk than the EMDO fund. It also allows us to capture alpha on both sides of the market as our analysts are focused on country by country and security by security research.

We believe that investing in mid-size countries like Brazil and Mexico might set up every now and then. But these tend to be generally more efficient. Our sweet spot is in the highly inefficient countries, tens of smaller countries, which can offer true diversification to a portfolio, and where the chances of over and undervalued securities are highest.

How big is your investible universe set for this asset class?

We believe the Sovereign Hard Currency market is about $1 Trillion dollars. Local currency bonds ex-China is about $2 Trillion, and perhaps $3 Trillion if we include India. The size of the asset class is not relevant to what we do as we try and find the best opportunities in EM.

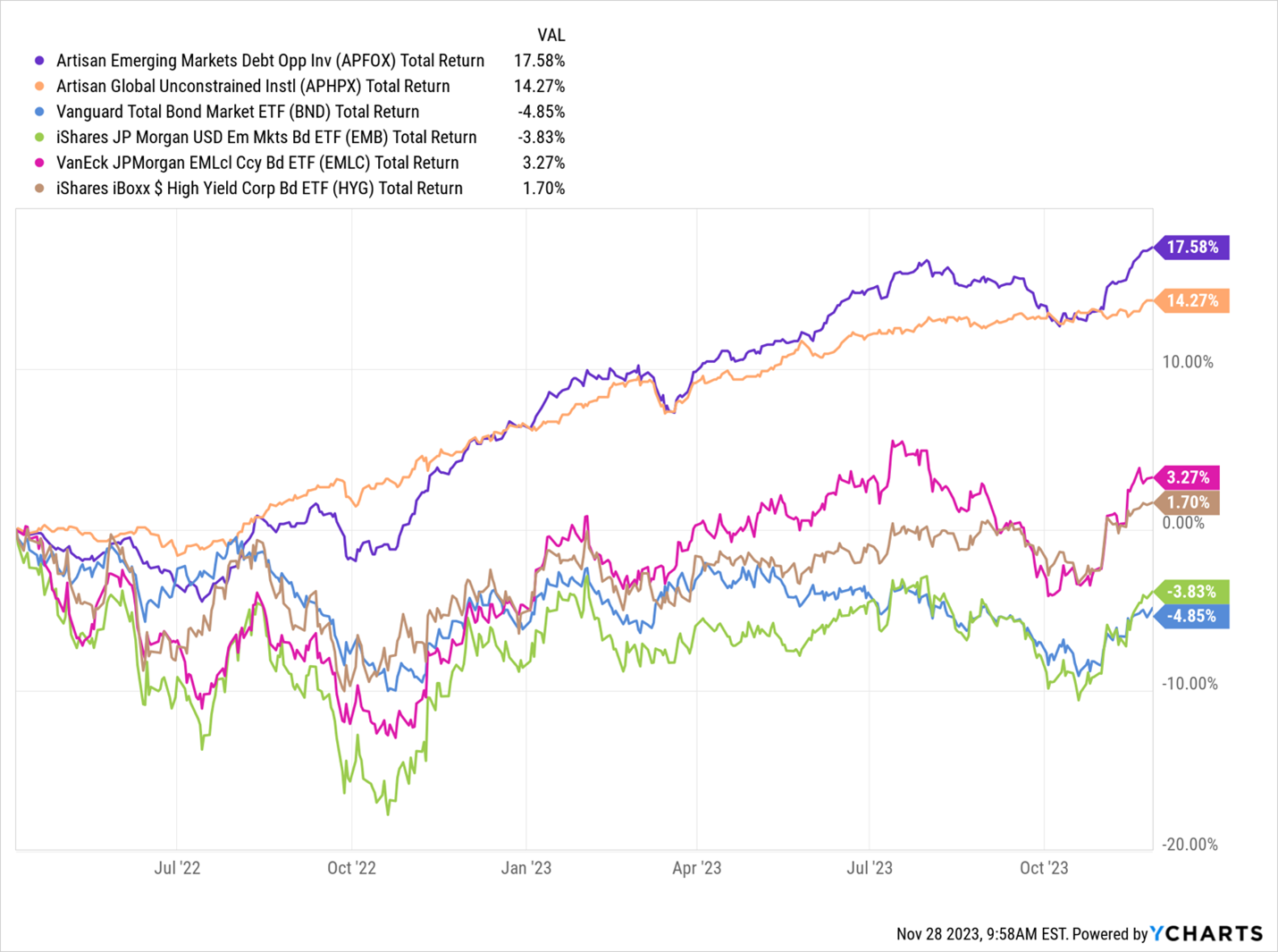

You started the funds in March and April 2022. Let’s take a look at the returns of the two funds and compare them with a few passive ETFs.

The EMDO and Global Unconstrained have fared substantially better in a hostile broader environment for bonds. Tell us something we should learn from this observation.

Over the last ten years, the EMBI (which is 90% in hard currency sovereigns and 10% in corporates) generated a total return of 24%. A hard currency bond is priced on a spread to US Treasuries. Over this period, about 44% of the return generated in the EMBI came from US interest rates. The passive is heavily exposed to the movements in US interest rates and thus is a confusing barometer with EM-specific performance.

Take the example of a new 10-year Turkish bond in US Dollars. It may be issued at a spread of over 4% (400 basis points) to the US 10-year, which has a current interest rate of 4.5%. The combined yield or interest earned would be 4 + 4.5% = 8.5%.

The EMBI would invest in a bond like this. So, a lot of the yield of the Turkish bond is coming from the level of the US 10-year interest rates. If US interest rates risk, and US bonds fall, so will the Turkish bond, even if the fundamentals might improve in Turkey on the margin.

In our funds, we hedge out our interest rate risk. If we bought the Turkish bond, we would short the 10-year US Treasury bond against it and mostly, but not fully insulate ourselves from the long-dated US Bond market.

We would then invest the proceeds generated from the sale of the 10-year US Treasury into short-term US Money market funds. This way we reduce the duration risk of all the positions.

We can still earn the 4% spread, and we could earn 5.25% from the current overnight cash rate, or a total of 9.25% now. We thus convert a fixed rate bond portfolio to a floating rate portfolio.

By choosing our countries based on opportunity set and not market cap weight, and by hedging duration risk from our investments, our funds behave differently from the passive ETFs.

What returns can be expected for an investor willing to invest in the fund for 5-7 years?

We understand that investors expect to meet a certain hurdle rate to step out of their comfort zone and invest in EM debt.

There are two components to our funds: Hard currency bonds and local bonds. Both have a wide dispersion between countries.

First, Sovereign & Corporate hard currency bonds trade from 300-400 bps over US Treasuries to as wide as 1000 bps. We think a blended rate is about 500 bps.

Second, local interest rates may be as low as 2% and as high as 9-10%. Additionally, there would be some FX movements on our investments. We see the Excess return to US Treasuries there to be between 300 to 500 bps.

Blending the two, we hope to earn an excess return over Treasuries with a spread duration of about 2.2 years. In a very good year, that could lead to mid-teens in returns. In a poor year, given the high yield, it might be in the small single-digit negative territory.

Returns are generally not going to be as extreme as Emerging Market Equities.

Besides the difference in volatility between Bonds and Equities, is there a difference in composition?

Compared to EM Equities, EM Debt is less volatile and also not as concentrated in Asia. Here is a chart with Top 10 country exposures:

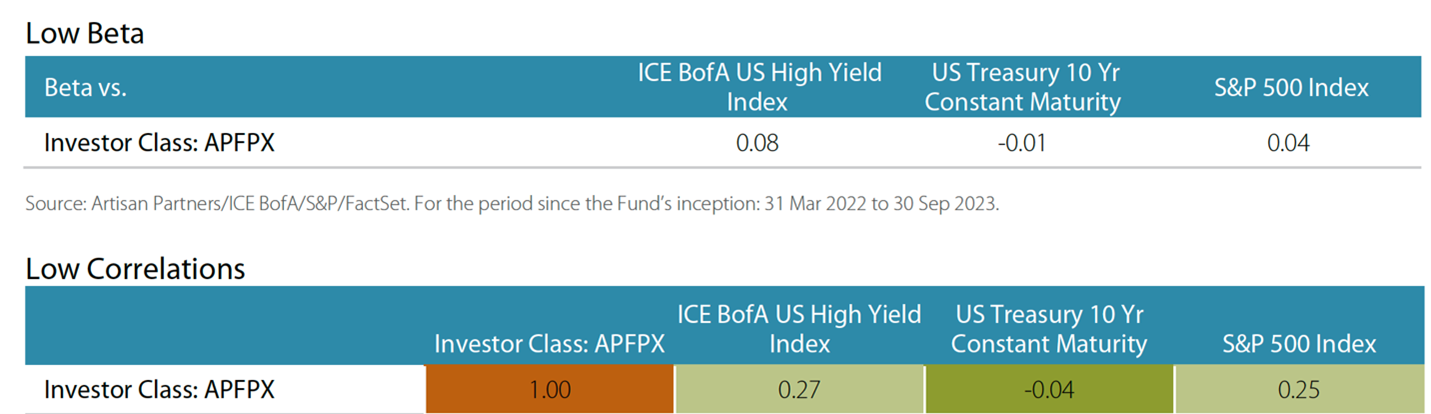

How correlated are the funds with other large asset classes?

The Global Unconstrained fund has a low beta and low correlation to US assets like the HY Index, the 10-year Treasury, and the S&P 500 Index.

Depending on the existing portfolio structure of investors, our EM debt funds can be a good diversifier. They can be a low duration, low beta, low correlation, high Sharpe ratio asset to own.

We believe that active management wins by not losing. We hope to protect the downside and compound capital over the years.

Note to reader: Since I was looking for a way to allocate to local and sovereign debt positions in Emerging Markets on a long-only basis, I am an investor in EMDO.

When I asked Michael where he is invested, he said, “I have been a fixed-income investor in my career. We tend to be a bearish breed, but I have money in both of the funds.”

How does he plan to deal with a large institutional investor deciding to pull the sell trigger on the portfolio given the highly illiquid and geographically diverse nature of the EM debt investments? Portfolio distribution in kind only works in theory. I am sure that’s not an option.

We invest in sovereign/corporate bonds and derivatives that span the liquidity spectrum. Many of these markets are highly liquid. I have managed in this style for nearly two decades in all different market conditions, and EM markets can be more liquid than some other traditional credit markets. Having said this, we would not have difficulty managing a large sell in the portfolio.

Conclusion

My journey started with the quest for a public market fund that offered intelligent exposure to EM Debt. The Artisan EMDO and Unconstrained seem to be the solution in the right direction. There might be other funds too, but I would be watching both funds very closely as a current investor. With Debt funds, there is less hyperbole. We are never going to have really great years. The hope is to compound capital outside of equities in a steady and solid manner. Michael Cirami and the team seem to have a handle on that process.