It’s a good practice to take a thorough review annually of investment performance including fees and taxes. A dual-income household may accumulate a half dozen or more accounts because of tax characteristics, ownership, and goals. A good way to start is to list the accounts in order of planned withdrawals. The next step is to make sure that each account has the appropriate amount of risk and that the assets within are tax-efficient for the type of account. I am in the process of converting Traditional IRAs to Roth IRAs and the conversion is taxed as ordinary income. Municipal Bonds are included in Modified Adjusted Gross Income and may impact Medicare Premiums (IRMAA). In after-tax accounts, income is taxed while stock appreciation is not until sold and then often at lower capital gains rates. This is known as the Bucket Approach.

Our review found that we were paying over one percent of assets to have one special purpose, after-tax account managed with a 50% Stock to 50% Municipal Bond Ratio. It is a relatively small, but significant account that I had set up during uncertain times to be tax efficient. In the hierarchy of withdrawals, it will be the last account tapped. The appropriate goal for this account is for capital appreciation and simplicity while minimizing taxes. I use Fidelity and Vanguard wealth management services for some of our investments, and in the context of overall portfolio management, I am looking for a single tax-efficient equity fund to “buy and hold” for this account.

This article is divided into the following sections:

- Section 1, Investment Objective

- Section 2, Search Criteria

- Section 3, Summary of Lipper Categories

- Section 4, Short List of Tax-Efficient Funds

- Section 5, Final List of Tax-Efficient Funds

- Section 6, Vanguard Tax-Managed Capital Appreciation Admiral Fund (VTCLX)

Investment Objective

Collectively, my investments resemble a 60% stock/40% bond diversified portfolio, in part because I have pensions and Social Security to cover most living expenses and can withstand down markets. I concentrate Bucket #1 (Living Expenses) on short-term cash equivalents such as municipal money markets and bonds. Bucket #2 is mostly Traditional IRAs where taxes are yet to be paid and which have higher allocations to taxable bonds. Long-Term Bucket #3 consists of Roth IRAs and After-Tax Accounts which are concentrated in equities that are tax-efficient if held for the long term or using tax loss harvesting.

My goals for this one fund are 1) to have high after-tax returns, 2) to minimize income and taxes, and 3) to have respectable risk-adjusted returns as measured by the MFO Rating. This typically means an equity fund that pays low dividends and has low turnover.

Search Criteria

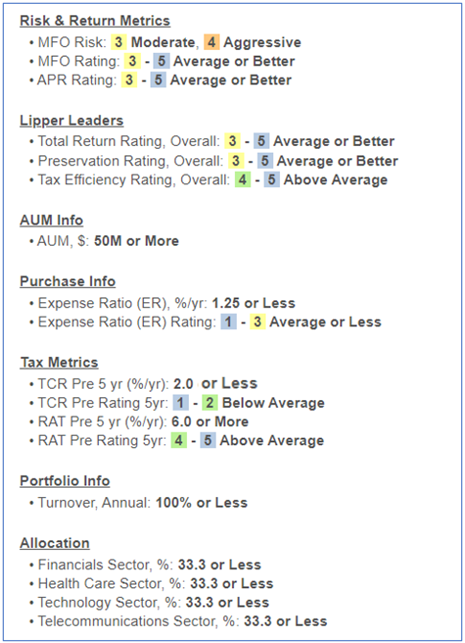

Table #1 shows the criteria that I used for the initial search. I restricted the mutual funds to Fidelity and Vanguard. While volatility is not a major consideration for this fund, I wanted to eliminate the most volatile funds.

Table #1: Search Criteria For Tax-Efficient Funds

Summary Of Lipper Categories

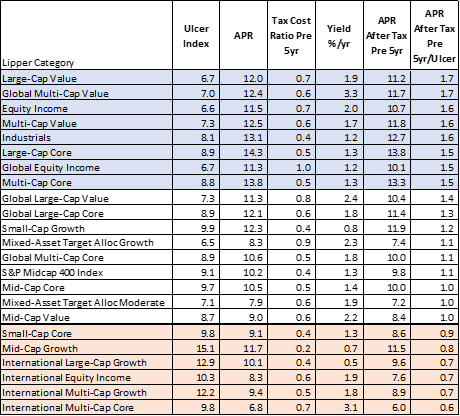

After a process of elimination, the search resulted in 32 mutual funds, and eighty-four exchange-traded funds in twenty-three Lipper Categories as shown in Table #2. The categories are sorted from the highest five-year After-Tax Annualized Return/Ulcer Index. The Ulcer Index is a measure of the depth and duration of drawdowns. The top section shaded in blue contains the Lipper Categories that I am most interested in, but I also want to consider global funds from the middle section.

Table #2: Tax-efficient Lipper Categories

Short List of Tax-Efficient Funds – Five-Year View

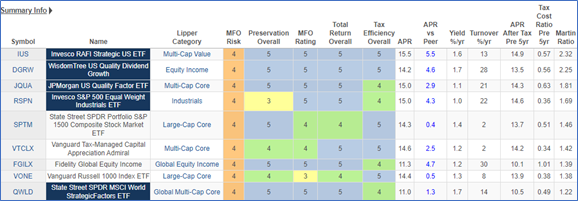

I then went through the funds in each of the Lipper Categories and selected one or two based on after-tax return, fund family rating, and tax efficiency, among other criteria. The nine funds in Table #3 are outstanding tax-efficient funds.

Table #3: Short List of Tax-efficient Funds – Five Years

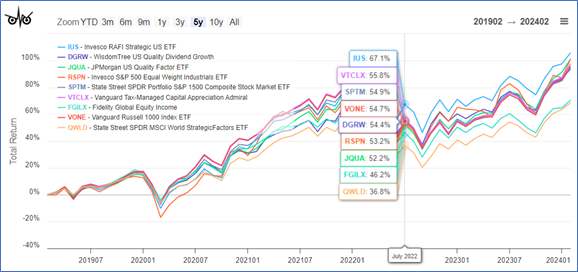

Figure #1 shows the five-year performance of these funds. The two global funds have underperformed, but this doesn’t concern me because of stretched valuations in the US.

Figure #1: Performance of Short List of Tax-efficient Funds – Five Years

Final List of Tax-Efficient Funds – Ten-Year View

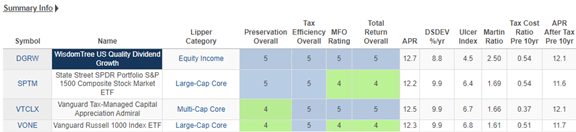

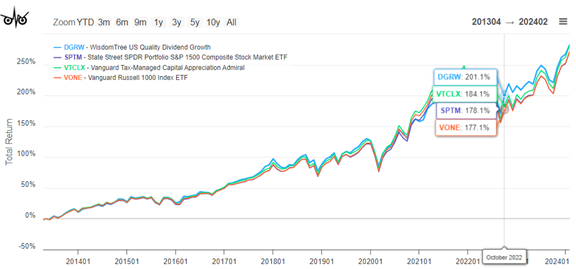

I then looked at the funds over a ten-year period. All of the funds in Table #4 are outstanding, but I favor Vanguard Tax-Managed Capital Appreciation (VTCLX) and WisdomTree US Quality Dividend Growth (DGRW). Figure #2 shows the ten-year performance of these funds.

Table #4: Final List of Tax-efficient Funds – Ten Years

Figure #2: Performance of Final List of Tax-efficient Funds – Ten Years

Vanguard Tax-Managed Capital Appreciation (VTCLX)

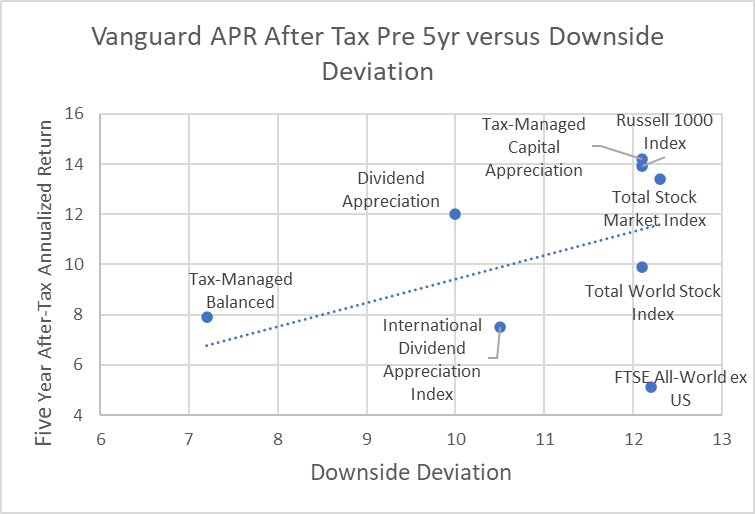

I decided to invest in the Vanguard Tax-Managed Capital Appreciation Admiral Fund (VTCLX). The link to the documentation is here. Figure #3 shows how VTCLX compares to other Vanguard funds for After-Tax Returns versus Downside Deviation. It has high after-tax returns but roughly matches the total market for volatility.

Figure #3: APR After-Tax Pre-5Year Versus Downside Deviation

Product Summary

“As part of Vanguard’s series of tax-managed investments, this fund offers investors exposure to the mid- and large-capitalization segments of the U.S. stock market. Its unique index-oriented approach attempts to track the benchmark while minimizing taxable gains and dividend income by purchasing index securities that pay lower dividends. One of the fund’s risks is its exposure to the mid-cap segment of the stock market, which tends to be more volatile than the large-cap market. Investors in a higher tax bracket who have an investment time horizon of five years or longer and a high tolerance for risk may wish to consider this fund complementary to a well-balanced portfolio.”

Fund Management

Vanguard Tax-Managed Capital Appreciation Fund seeks a tax-efficient total return consisting of long-term capital appreciation and nominal current income. The fund tracks the performance of the Russell 1000 Index—an unmanaged benchmark representing large- and mid-capitalization U.S. stocks. The advisor uses portfolio optimization techniques to select a sample of stocks that, in the aggregate, reflect the characteristics of the benchmark index. The technique emphasizes stocks with low dividend yields to minimize taxable dividend distributions. In addition, a disciplined sell process minimizes the realization of net capital gains and may include the realization of losses to offset unavoidable gains. The experience and stability of Vanguard’s Equity Index Group have permitted continuous refinement of indexing techniques designed to minimize tracking error and provide tax-efficient returns.

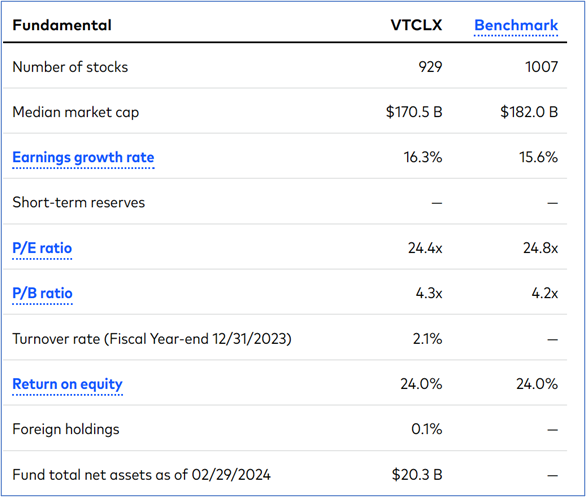

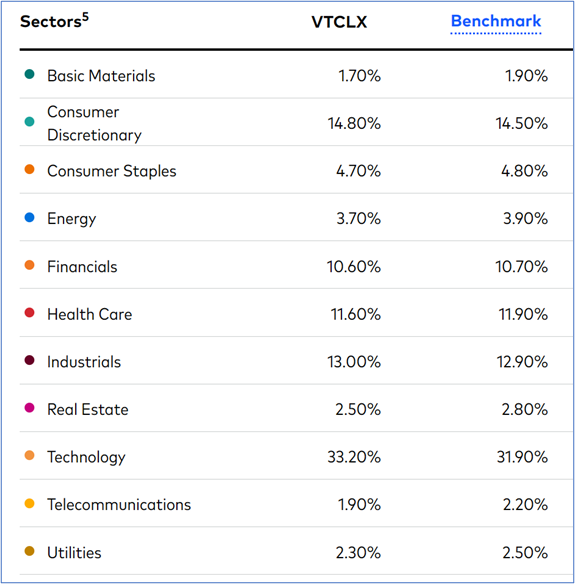

Table #5 contains the fundamentals for VTCLX and Table #6 contains the sector allocations.

Table #5: VTCLX Fundamentals

Table #6: VTCLX Sector Allocation

Closing

Over the next ten years, converting this 50% Stock/50% Bond account to DIY with one equity fund should result in saving thousands of dollars in fees, increase returns, and reduce taxes. It fits into an overall balanced portfolio and meets my objectives of keeping it simple. Currently, this account has a mixture of quality ETFs. I will gradually convert them over to the Vanguard Tax-Managed Capital Appreciation (VTCLX) when market conditions are favorable.