“… over the long term the benefits offered by diversifying a portfolio of less correlated asset classes can be significant … investing in a diversified portfolio across equity and fixed income is the best option for most individuals,” wrote Jeremy Simpson in 2015, then director of Morningstar Investment Management in the article The Benefits of Diversification.

In Mebane Faber’s classic The Ivy Portfolio, he cites multiple sources on the benefits of diversification:

Harry Markowitz’s seminal 1952 paper “Portfolio Selection” explained the benefits of portfolio diversification. In addition to earning Markowitz a Nobel Prize in Economics, this Modern Portfolio Theory enabled managers to quantify with mathematics the benefits of not putting all of your eggs in one basket.

The Yale portfolio is constructed based on academic theory-namely namely a framework known as mean-variance analysis. The technique was originally developed by Harry Markowitz in concert with David Swensen’s mentor James Tobin, and eventually earned Markowitz a Nobel Prize in 1990 … You can put together a bunch of risky assets (stocks, real estate, commodities) and as long as they don’t all move together in a correlated fashion, the combined portfolio is less risky than the individual parts.

The most powerful tool an investor has working for him or her is diversification. True diversification allows you to build portfolios with higher returns for the same risk. Most investors, institutional and individual, are far less diversified than they should be.

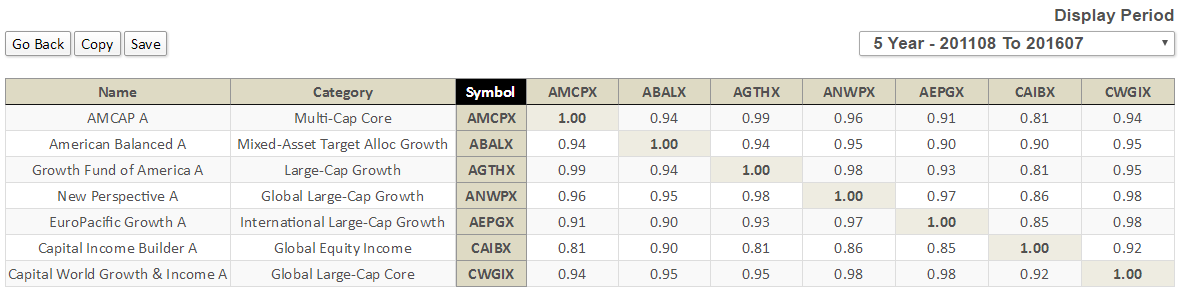

Recently, in the piece On Financial Planners, I wrote of a family friend whose “certified financial planner” had him in 34 funds across five tax deferred accounts. Adjusting for different share classes, he owned eight unique funds, which turned-out to be not all that unique. Amazon was held in six different funds. Ditto for Phillip Morris, Amgen, UnitedHealth Group, Home Depot, Broadcom, Microsoft, etc.

Below is the correlation matrix for the eight funds. (Click on image to enlarge.) Most are more than 90% correlated, while none are less than 80% correlated. In short, they are all strongly correlated! Why would a financial planner construct this portfolio?

While such a correlation matrix has its limitations, it remains a helpful tool for assessing portfolio concentration and diversification. It comprises correlation coefficients, often denoted “r”, which attempt to measure the tendency of two funds (their monthly total returns) to move together.

Values of r can range from -1.00 to 1.00. The closer to 1.00, the more two funds have behaved similarly. The closer to -1.00, the more two funds have behaved opposite to each other. Values closer to 0.00 mean the funds are uncorrelated and have behaved independent of each other. A more detailed description can be found here and here.

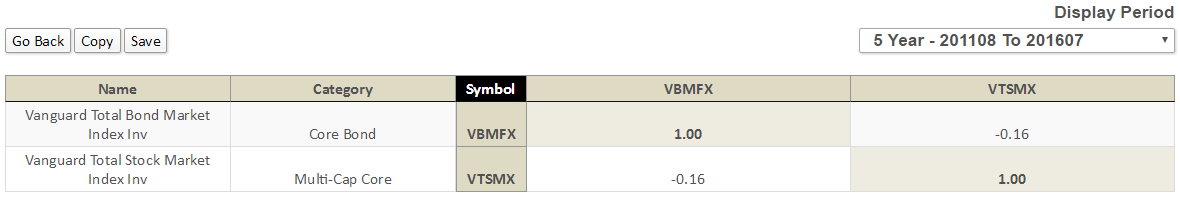

One of the simplest ways to be diversified is through Vanguard Balanced Index Fund (VBINX). Here is the correlation matrix for its basic components, essentially the Total Stock and Bond Index Funds (VTMSX and VBMFX).

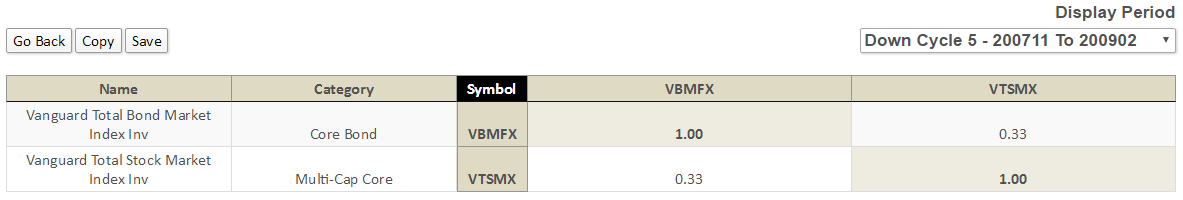

One of the shortcomings of correlation is that it is backward looking. Future correlation can change. While certain fund metrics, like volatility and even correlation, tend to be more persistent than say absolute return performance, correlation can change too with evaluation period, especially when markets dislocate. Even so, during the financial crisis bear market, VTMSX and VBMFX remained much more dissimilar than other asset pairs.

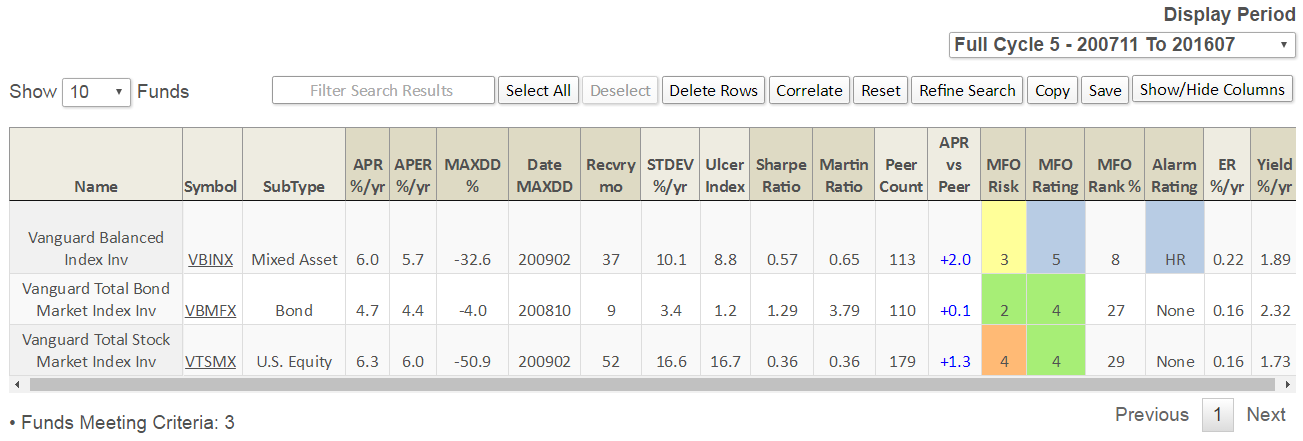

Here is the attendant performance comparison over the current market cycle (click on image to enlarge):

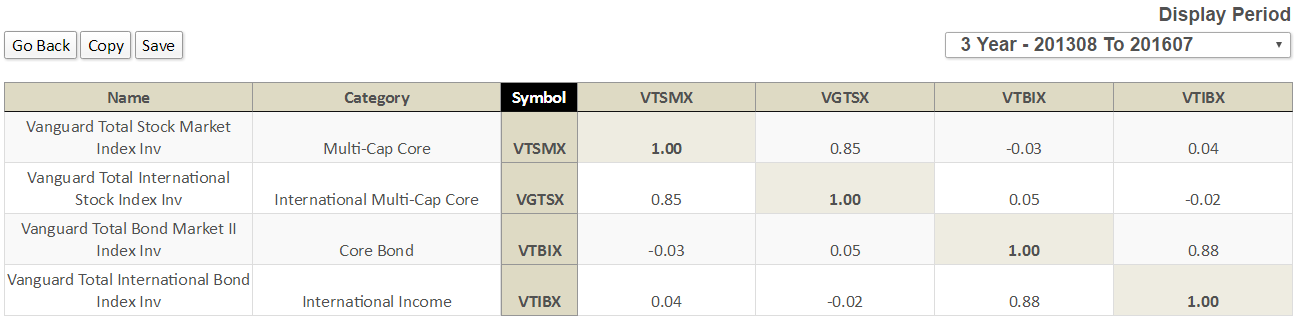

Another way to easily get diversification is through some of the so-called Target Date funds. Vanguard, for example, adds global exposure in its Target Retirement Series. Here is the correlation matrix of the underlying funds:

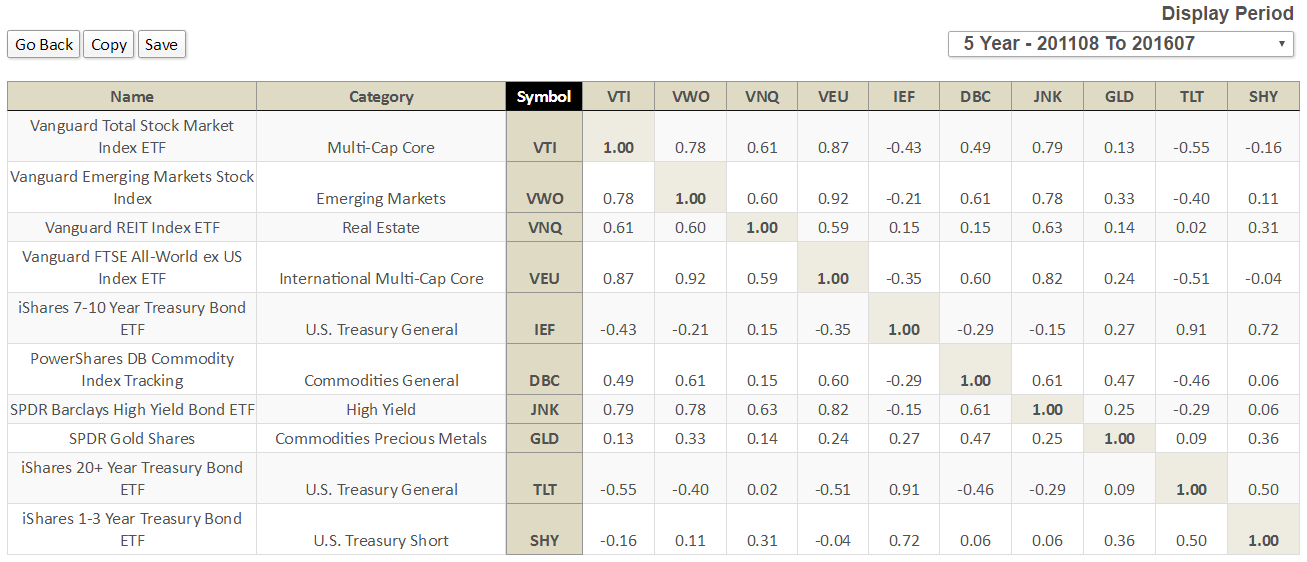

Finally, below find the correlation matrix for several ETFs representing various asset classes, including VTI, VEU, IEF, VNQ, DBC – the five comprising Faber’s “Ivy Portfolio … it is very simple but still reflects the general allocations of the top endowments without hedge funds and private equity.”

The MultiSearch Correlation Matrix can now be obtained for up to 12 funds across seven evaluation periods on the MFO Premium site. Just click “Correlate” button on the MultiSearch Results page.