Dear friends,

Welcome to the New Year!

And to an odd question: why is it a New Year? That is, why January 1? Most calendrical events correspond to something: cycles of the moon and stars, movement of the seasons, conclusions of wars or deaths of Great Men.

But why January 1? It corresponds with nothing.

Here’s the short answer: your recent hangover and binge of bowl watching were occasioned by the scheming of some ancient Roman high priest, named a pontifex, and the political backlash to his overreach. Millennia ago, the Romans had a year that started sensibly enough, at the beginning of spring when new life began appearing. But the year also ended with the winter solstice and a year-end party that could stretch on for weeks. December, remember? Translates as “the tenth month” out of ten.

So what happened in between the party and the planting? The usual stuff, I suppose: sex, lies, lies about sex, dinner and work. What didn’t happen was politics: new governments, elected in the preceding year, weren’t in power until the new year began. And who decided exactly when the new year began? The pontifex. And how did the pontifex decide? Oracles, goat entrails and auguries, mostly. And also a keen sense of whether he liked the incoming government more than the outgoing one. If the incoming government promised to be a pain in the butt, the new year might start a bit later.  If the new government was full of friends, the new year might start dramatically earlier. And if the existing government promised to be an annoyance in the meanwhile, the pontifex could declare an extended religious holiday during which time the government could not convene.

If the new government was full of friends, the new year might start dramatically earlier. And if the existing government promised to be an annoyance in the meanwhile, the pontifex could declare an extended religious holiday during which time the government could not convene.

Eventually Julius Caesar and the astronomer Sosigenes got together to create a twelve month calendar whose new year commenced just after the hangover from the year-end parties faded. Oddly, the post-Roman Christian world didn’t adopt January 1 (pagan!) as the standard start date for another 1600 years. Pope Gregory tried to fiat the new start day. Protestant countries flipped him off. In England and the early US, New Year’s Day was March 25th, for example. Eventually the Brits standardized it in their domains in 1750.

Pagan priest examining the gall bladder of a goat. Ancient politics and hefty campaign contributions.

So, why exactly does it make sense for you to worry about how your portfolio did in 2014? The end date of the year is arbitrary. It corresponds neither to the market’s annual flux nor to the longer seven(ish) year cycles in which the market rises and falls, much less your own financial needs and resources.

I got no clue. You?

I’d hoped to start the year by sharing My Profound Insights into the year ahead, so I wandered over to the Drawer of Clues. Empty. Nuts. The Change Jar of Market Changes? Nothing except some candy wrappers that my son stuffed in there. The white board listing The Four Funds You Must Own for 2015? Carried off by some red-suited vagrant who snuck in on Christmas Eve. (Also snagged my sugar cookies and my bottle of Drambuie. Hope he got pulled over for impaired flying.)

Oddly, I seem to be the only person who doesn’t know where things are going. The Financial Times reports that “the ‘divergence’ between the economies of the US and the rest of the world … features in almost every 2015 outlook from Wall Street strategists.” Yves Kuhn, an investment strategist from Luxembourg, notes the “the biggest consensus by any margin is to be long dollar, short euro … I have never seen such a consensus in the market.” Barron’s December survey of economists and strategists: “the consensus is ‘stick with the bull.’” James Paulsen, allowed that “There’s some really, really strong Wall Street consensus themes right now” in favor of US stocks, the dollar and low interest rates.

Of course, the equally universal consensus in January 2014 was for rising interest rates, soaring energy prices and a crash in the bond market.

Me? I got no clue. Here’s the best I got:

- Check to see if you’ve got a plan. If not, get one. Fund an emergency account. Start investing in a conservative fund for medium time horizon needs. Work through a sensible asset allocation plan for the long-term. It’s not as hard as you want to imagine it is.

- Pursue it with some discipline. Find a sustainable monthly contribution. Set your investments on auto-pilot. Move any windfalls – whether it’s a bonus or a birthday check – into your savings. If you get a raise (I’m cheering for you!), increase your savings to match.

- Try not to screw yourself. Again. Don’t second guess yourself. Don’t obsess about your portfolio. Don’t buy because it’s been going up and you’re feeling left out. Don’t sell because your manager is being patient and you aren’t.

- Try not to let other people screw you. Really, if your fund has a letter after its name, figure out why. It means you’re paying extra. Be sure you know what exactly you’re paying and why.

- Make yourself useful, ‘cause then you’ll also make yourself happy. Get in the habit of reading again. Books. You know: the dead tree things. There’s pretty good research suggesting that the e-versions disrupt sleep and addle your mind. Try just 30 minutes in the evening with the electronics shut down, perusing Sarah Bakewell’s How to Live: A Life of Montaigne in One Question and Twenty Attempts at an Answer (2011) or Sherry Turkle’s Alone Together: Why We Expect More from Technology and Less from Each Other (2012). Read it with someone you enjoy hugging. Upgrade your news consumption: listen to the Marketplace podcasts or programs. Swear you’ll never again watch a “news program” that has a ticker constantly distracting you with unexplained 10 word snippets that pretend to explain global events. Set up a recurring contribution to your local food bank (I’ll give you the link to mine if you can’t find your own), shelter (animal or otherwise), or cause. They need you and you need to get outside yourself, to reconnect to something more important than YouTube, your portfolio or your gripes.

For those irked by sermonettes, my senior colleague has been reflecting on the question of what lessons we might draw from the markets of 2014 and offers a far more nuanced take in …

Reflections – 2014

Reflections – 2014

By Edward Studzinski

The Mountains are High, and the Emperor is Far, Far Away

Chinese Aphorism

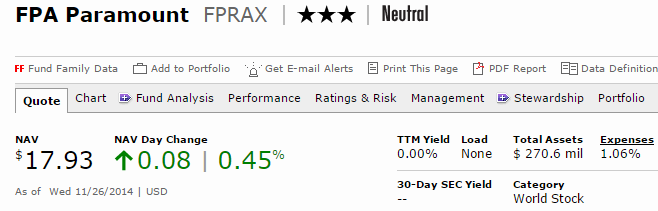

Year-end 2014 presents investors with a number of interesting conundrums. For a U.S. dollar investor, the domestic market, as represented by the S&P 500, provided a total return of 13.6%, at least for those invested in it by the proxy of Vanguard’s S&P 500 Index Fund Admiral Shares. Just before Christmas, John Authers of the Financial Times, in a piece entitled “Investment: Loser’s Game” argued that this year, with more than 90% of active managers on track to underperform their benchmarks, a tipping point may have finally been reached. The exodus of money from actively managed funds has accelerated. Vanguard is on track to take in close to $200B (yes, billion) into its passive funds this year.

And yet, I have to ask if it really matters. As I watch the postings on the Mutual Fund Observer’s discussion board, I suspect that achieving better than average investment performance is not what motivates many of our readers. Rather, there is a Walter Mittyesque desire to live vicariously through their portfolios. And every bon mot that Bill (take your pick, there are a multitude of them) or Steve or Michael or Bob drops in a print or televised interview is latched on to as a reaffirmation the genius and insight to invest early on with one of The Anointed. The disease exists in a related form at the Berkshire Hathaway Annual Circus in Omaha. Sooner or later, in an elevator or restaurant, you will hear a discussion of when that person started investing with Warren and how much money they have made. The reality is usually less that we would like to know or admit, as my friend Charles has pointed out in his recent piece about the long-term performance of his investments.

Rather than continuing to curse the darkness, let me light a few candles.

- When are index funds appropriate for an investment program? For most of middle America, I am hard pressed to think of when they are not. They are particularly important for those individuals who are not immortal. You may have constructed a wonderful portfolio of actively-managed funds. Unfortunately, if you pass away suddenly, your spouse or family may find that they have neither the time nor the interest to devote to those investments that you did. And that assumes a static environment (no personnel changes) in the funds you are invested in, and that the advisors you have selected, if any, will follow your lead. But surprise – if you are dead, often not at the time of your choice, you cannot control things from the hereafter. Sit in trust investment committee meetings as I did for many years, and what you will most likely hear is – “I don’t care what old George wanted – that fund is not on our approved list and to protect ourselves, we should sell it, regardless of its performance or the tax consequences.”

- How many mutual funds should one own? The interplay here is diversification and taxes. I suspect this year will prove a watershed event as investors find that their actively-managed fund has generated a huge tax bill for them while not beating its respective benchmark, or perhaps even losing money. The goal should probably be to own fewer than ten in a family unit, including individual and retirement investments. The right question to ask is why you invested in a particular fund to begin with. If you can’t remember, or the reason no longer applies, move on. In particular, retirement and 401(k) assets should be consolidated down to a smaller number of funds as you get older. Ideally they should be low cost, low expense funds. This can be done relatively easily by use of trustee to trustee transfers. And forget target date funds – they are a marketing gimmick, predicated on life expectancies not changing.

- Don’t actively managed funds make sense in some circumstances? Yes, but you really have to do a lot of due diligence, probably more than most investment firms will let you do. Just reading the Morningstar write-ups will not cut it. I think there will be a time when actively-managed value funds will be the place to be, but we need a massive flush-out of the industry to occur first, followed by fear overcoming greed in the investing public. At that point we will probably get more regulation (oh for the days of Franklin Roosevelt putting Joe Kennedy in charge of the SEC, figuring that sometimes it makes sense to have the fox guarding the hen house).

- Passive funds are attractive because of low expenses, and the fact that you don’t need to worry about managers departing or becoming ill. What should one look for in actively-managed funds? The simple answer is redundancy. Dodge and Cox is an ideal example, with all of their funds managed by reasonably-sized committees of very experienced investment personnel. And while smaller shops can argue that they have back-up and succession planning, often that is marketing hype and illusion rather than reality. I still remember a fund manager more than ten years ago telling me of a situation where a co-manager had been named to a fund in his organization. The CIO told him that it was to make the Trustees happy, giving the appearance of succession planning. But the CIO went on to say that if something ever happened to lead manager X, co-manager Y would be off the fund by sundown since Y had no portfolio management experience. Since learning such things is difficult from the outside, stick to the organizations where process and redundancy are obvious. Tweedy, Browne strikes me as another organization that fits the bill. Those are not meant as recommendations but rather are intended to give you some idea of what to look for in kicking tires and asking questions.

… look for organizations without self-promotion, where individuals do not seek out to be the new “It Girl” and where the organizations focus on attracting curious people with inquiring but disciplined minds …

A few final thoughts – a lot of hedge funds folded in 2014, mainly for reasons of performance. I expect that trend to spread to mutual funds in 2015, especially those that are at best marginally profitable. Some of this is a function of having the usual acquiring firms (or stooges, as one investment banker friend calls them) – the Europeans – absent from the merger and acquisition trail. Given the present relationship of the dollar and the Euro, I don’t expect that trend to change soon. But I also expect funds to close just because the difficulty of outperforming in a world where events, to paraphrase Senator Warren, are increasingly rigged, is almost impossible. In a world of instant gratification, that successful active management is as much an art as a science should be self-evident. There is something in the process of human interaction which I used to refer to as complementary organizational dysfunction that produces extraordinary results, not easily replicable. And it involves more than just investment selection on the basis of reversion to the mean.

One example of genius would be Thomas Jefferson, dining alone, or Warren Buffet, sitting in his office, reading annual reports. A different example would be the 1927 Yankees or the Fidelity organization of the 1980’s. In retrospect what made them great is easy to see. My advice to people looking for great active management today – look for organizations without self-promotion, where individuals do not seek out to be the new “It Girl” and where the organizations focus on attracting curious people with inquiring but disciplined minds, so that there ends up being a creative, dynamic tension. Avoid organizations that emphasize collegiality and consensus. In closing, let me remind you of that wonderful scene where Orson Welles, playing Harry Lime in The Third Man says,

… in Italy for 30 years under the Borgias they had warfare, terror, murder, and bloodshed, but they produced Michelangelo, Leonardo da Vinci, and the Renaissance. In Switzerland they had brotherly love – they had 500 years of democracy and peace, and what did they produce? The cuckoo clock.

Where In The World Is Your Fund Adviser?

Where In The World Is Your Fund Adviser?

When our esteemed colleague Ed Studzinski shares his views on an adviser or fund house, he invariably mentions location.

I’ve started to take notice.

Any place but Wall Street

Some fund advisers seem to identify themselves with their location. Smead Capital Management, Inc., which manages Smead Value Fund (SMVLX), states: ”Our compass bearings are slightly Northwest of Wall Street…” The firm is headquartered in Seattle.

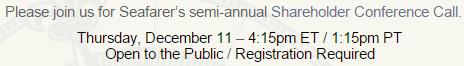

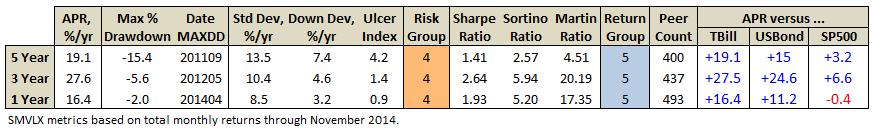

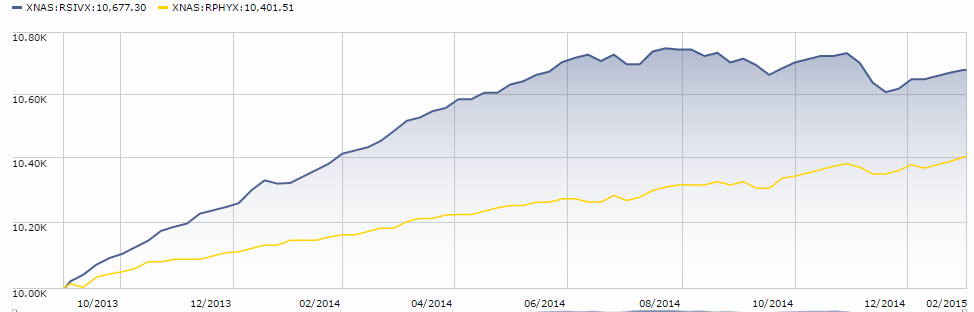

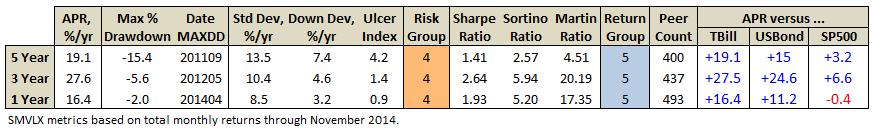

SMVLX is a 5-year Great Owl sporting top quintile performance over the past 5-, 3-, and even 1-year periods (ref. Ratings Definitions):

Bill Smead believes the separation from Wall Street gives his firm an edge.

Legendary value investor Bruce Berkowitz, founder of Fairholme Capital Management, LLC seems to agree. Fortune reported that he moved the firm from New Jersey to Florida in 2006 in order to … ”put some space between himself and Wall Street … no matter where he went in town, he was in danger of running into know-it-all investors who might pollute his thinking. ’I had to get away,’ he says.”

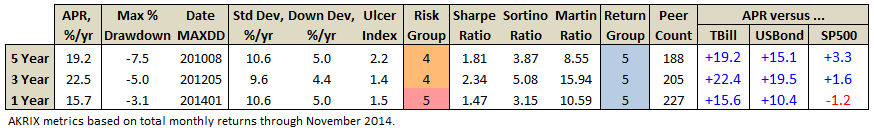

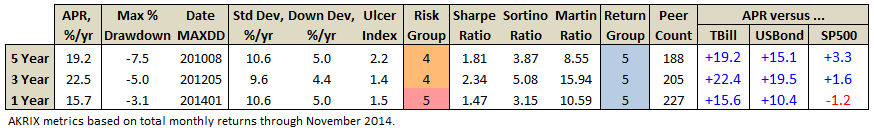

In 2002, Charles Akre of Akre Capital Management, LLC, located his firm in Middleburg, Virginia. At that time, he was sub-advising Friedman, Billings, Ramsey & Co.’s FBR Focus Fund, an enormously successful fund. The picturesque town is in horse country. Since 2009, the firm’s Akre Focus Fund (AKREX/AKRIX) is a top-quintile performer and another 5-year Great Owl:

Perhaps location does matter?

Tales of intrigue and woe

Unfortunately, determining an adviser’s actual work location is not always so apparent. Sometimes it appears downright labyrinthine, if not Byzantine.

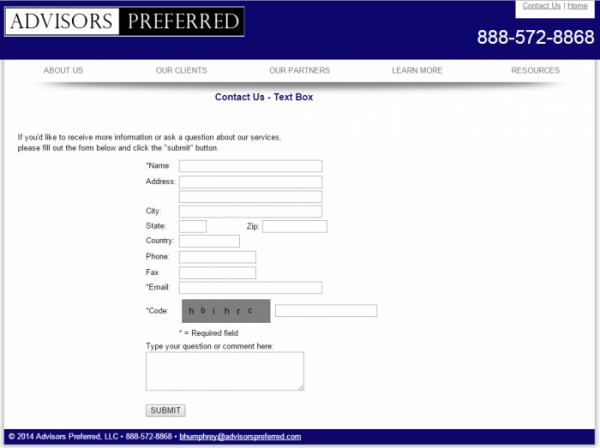

Take Advisors Preferred, LLC. Below is a snapshot of the firm’s contact page. There is no physical address. No discernable area code. Yet, it is the named adviser for several funds with assets under management (AUM) totaling half a billion dollars, including Hundredfold Select Alternative (SFHYX) and OnTrack Core Fund (OTRFX).

Advisors Preferred turns out to be a legal entity that provides services for sub-advisers who actually manage client money without having to hassle with administrative stuff … an “adviser” if you will by name only … an “Adviser for Hire.” To find addresses of the sub-advisers to these funds you must look to the SEC required fund documents, the prospectus or the statement of additional information (SAI).

Hunderfold Funds is sub-advised by Hunderfold Funds, LLC, which gives its sub-advisory fees to the Simply Distribute Charitable Foundation. Actually, the charity appears to own the sub-adviser. Who controls the charity? The people that control Spectrum Financial Inc., which is located, alas, in Virginia.

The SAI also reveals that the fund’s statutory trust is not administered by the adviser, Advisors Preferred, but by Gemini Funds Services, LLC. The trust itself is a so-called shared or “series trust” comprised of independent funds. Its name is Northern Lights Fund Trust II. (Ref. SEC summary.) The trust is incorporated in Delaware, like many statutory trusts, while Gemini is headquartered in New York.

Why use a series trust? According to Gemini, it’s cheaper. “Rising business costs along with the increased level of regulatory compliance … have magnified the benefits of joining a shared trust in contrast to the expenses associated with registering a standalone trust.”

How does Hundredfold pass this cost savings on to investors? SFHYX’s latest fact sheet shows a 3.80% expense ratio. This fee is not a one-time load or performance based; it is an annual expense.

OnTrack Funds is sub-advised by Price Capital Management, Inc, which is located in Florida. Per the SEC Filing, it actually is run out of a residence. Its latest fact sheet has the expense ratio for OTRFX at 2.95%, annually. With $130M AUM, this expense translates to $3.85M per year paid by investors the people at Price Capital (sub adviser), Gemini Funds (administrator), Advisors Preferred (adviser), Ceros Financial (distributer), and others.

What about the adviser itself, Advisors Preferred? It’s actually controlled by Ceros Financial Services, LLC, which is headquartered in Maryland. Ceros is wholly-owned by Ceros Holding AG, which is 95% owned by Copiaholding AG, which is wholly-owned by Franz Winklbauer. Mr. Winklbauer is deemed to indirectly control the adviser. In 2012, Franz Winklbauer resigned as vice president of the administrative board from Ceros Holding AG. Copiaholding AG was formed in Switzerland.

Which is to say … who are all these people?

Where do they really work?

And, what do they really do?

Maybe these are related questions.

If it’s hard to figure out where advisers work, it’s probably hard to figure out what they actually do for the investors that pay them.

Guilty by affiliation

Further obfuscating adviser physical location is industry trend toward affiliation, if not outright consolidation. Take Affiliated Managers Group, or more specifically AMG Funds LLC, whose main office location is Connecticut, as registered with the SEC. It currently is the named adviser to more than 40 mutual funds with assets under management (AUM) totaling $42B, including:

- Managers Intermediate Duration Govt (MGIDX), sub advised by Amundi Smith Breeden LLC, located in North Carolina,

- Yacktman Service (YACKX), sub advised by Yacktman Asset Management, L.P. of Texas, and

- Brandywine Blue (BLUEX), sub advised by Friess Associates of Delaware, LLC, located in Delaware (fortunately) and Friess Associates LLC, located in Wyoming.

All of these funds are in process of being rebranded with the AMG name. No good deed goes unpunished?

AMG, Inc., the corporation that controls AMG Funds and is headquartered in Massachusetts, has minority or majority ownership in many other asset managers, both in the US and aboard. Below is a snapshot of US firms now “affiliated” with AMG. Note that some are themselves named advisers with multiple sub-advisers, like Aston.

AMG describes its operation as follows: “While providing our Affiliates with continued operational autonomy, we also help them to leverage the benefits of AMG’s scale in U.S. retail and global product distribution, operations and technology to enhance their growth and capabilities.”

Collectively, AMG boasts more than $600B in AUM. Time will tell whether its affiliates become controlled outright and re-branded, and more importantly, whether such affiliation ultimately benefits investors. It currently showcases full contact information of its affiliates, and affiliates like Aston showcase contact information of its sub-advisers.

Bottom line

Is Bill Smead correct when he claims separation from Wall Street gives his firm an edge? Does location matter to performance? Whether location influences fund performance remains an interesting question, but as part of your due diligence, there should be no confusion about knowing where your fund adviser (and sub-adviser) works.

Closing the capital gains season and thinking ahead

This fall Mark Wilson has launched Cap Gains Valet to help investors track and understand capital gains distributions. In addition to being Chief Valet, Mark is chief investment officer for The Tarbox Group in Newport Beach, CA. He is, they report, “one of only four people in the nation that has both the Certified Financial Planner® and Accredited Pension Administrator (APA) designations.” As the capital gains season winds down, we asked Mark if he’d put on his CIO hat for a minute and tell us what sense an investor should make of it all. Yeah, lots of folks got hammered in 2014 but that’s past. What, we asked, about 2015 and how we act in the year ahead? Here are Mark’s valedictory comments:

This fall Mark Wilson has launched Cap Gains Valet to help investors track and understand capital gains distributions. In addition to being Chief Valet, Mark is chief investment officer for The Tarbox Group in Newport Beach, CA. He is, they report, “one of only four people in the nation that has both the Certified Financial Planner® and Accredited Pension Administrator (APA) designations.” As the capital gains season winds down, we asked Mark if he’d put on his CIO hat for a minute and tell us what sense an investor should make of it all. Yeah, lots of folks got hammered in 2014 but that’s past. What, we asked, about 2015 and how we act in the year ahead? Here are Mark’s valedictory comments:

As 2014 comes to a close, so does capital gains season. After two straight months thinking about capital gains distributions for CapGainsValet.com, it is a great time for me to reflect on the website’s inaugural year.

At The Tarbox Group (my real job), our firm has been formally gathering capital gains estimates for the mutual funds and ETFs we use in client accounts for over 20 years. Strategizing around these distributions has been part of our year-end activities for so long I did not expect to learn much from gathering and making this information available. I was wrong. Here are some of the things I learned (or learned again) from this project:

- Checking capital gains estimates more than once is a good idea. I’m sure this has happened before, but this year we saw a number of funds “up” their estimates a more than once before their actual distribution date. Given that a handful of distributions doubled from their initial estimates, it is possible that having this more up-to-date information might necessitate a different strategy.

- Many mutual fund websites are terrible. Given the dollars managed and fees fund companies are collecting, there is no reason to have a website that looks like a bad elementary school project. Not having easily accessible capital gains estimates is excusable, but not having timely commentary, performance information, or contact information is not.

- Be wary of funds that have a shrinking asset base. This year I counted over 50 funds that distributed more than 20% of their NAV. The most common reason for the large distributions… funds that have fallen out of favor and have had huge redemptions. Unfortunately, shareholders that stick around often get stuck with the tax bill.

- Asset location is important. We found ourselves saying “good thing we own that in an IRA!” more than once this year. Owning actively managed funds in tax deferred accounts reduces stress, extra work and tax bills. Deciding which account to hold your fund can be as important a decision as which fund to hold.

CapGainsValet is “going dark” this week. Be on the lookout for our return in October or November. In the meantime, have a profitable 2015!

Fund companies explain their massive taxable distributions to us

Well, actually, most of them don’t.

I had the opportunity to chat with Jason Zweig as he prepared his year end story on how to make sense out of the recent state of huge capital gains distributions. In preparing in advance of my talk with Jason, I spent a little time gettin’ granular. I used Mark Wilson’s site to track down the funds with the most extraordinary distributions.

Cap Gains Valet identified a sort of “dirty dozen” of funds that paid out 30% or more of their NAV as taxable distributions. “Why on earth,” we innocently asked ourselves, “would they do that?” So we started calling and asking. In general, we discovered that fund advisers reacted to the question about the same way that you react to the discovery of curdled half-and-half in your coffee: with a wrinkled nose and irritated expression.

For those of you who haven’t been following the action, here’s our cap gains primer:

Capital gains are profits that result from the sales of appreciated securities in a portfolio. They come in two flavors: long-term capital gains, which result from the sale of stocks the fund has held for a while, and short-term gain gains, which usually result for the bad practice of churning the portfolio.

Even funds which have lost a lot of money can hit you with a capital gains tax bill. A fund might be down 40% year-to-date and if the only shares it sold were the Google shares it wangled at Google’s 2004 IPO, you could be hit with a tax bill for a large gain.

Two things trigger large taxable distributions: a new portfolio manager or portfolio strategy which requires cleaning out the old portfolio or forced redemptions because shareholders are bolting and the manager needs to sell stuff – often his best and most liquid stuff – to meet redemptions.

So, how did this Dirty Dozen make the list?

Neuberger Berman Large Cap Disciplined Growth (NBCIX, 53% distribution). I had a nice conversation with Neil Groom for Neuberger Berman. He was pretty clear about the problem: “we’ve struggled with performance,” and over 75% of the fund shares have been redeemed. The manager liquidates shares pro rata – that is, he sells them all down evenly – and “there are just no losses to offset those sales.” Neuberger is now underwriting the fund’s expenses to the tune of $300,000/year but remains committed to it for a couple reasons. One is that they see it as a core investment product. And the other is that the fund has had long winning streaks and long losing streaks in the past, both of which they view as a product of their discipline rather than as a failing by their manager.

We reached out to the folks at Russell LifePoints 2040 Strategy (RXLAX, 35% distribution) and Russell LifePoints 2050 Strategy (RYLRX, 33% distribution): after getting past the “what does it matter? These funds are held in tax-deferred retirement accounts” response – why is true but still doesn’t answer the question “why did this happen to you and not all target-date funds?” Russell’s Kate Stouffer reported that the funds “realized capital gains in 2014 predominantly as a result of the underlying fund reallocation that took place in August 2014.” The accompanying link showed Russell punting two weak Russell funds for two newly-launched Russell funds overseen by the same managers.

Turner Emerging Growth (TMCGX, 48% distribution), Midcap Growth (TMGFX, 42% distribution) and Small Cap Growth (TSCEX, 54% distribution): I called Turner directly and bounced around a bit before being told that “we don’t speak to the media. You’ll need to contact our media relations firm.” Suh-weet! I did. They promised to make some inquiries. Two weeks later, still no word. Two of the three funds have changed managers in the past year and Turner has seen a fair amount of asset outflows, which together might explain the problem.

Janus Forty (JDCAX, 33% distribution): about a half billion in outflows, a net loss in assets of about 75% from its peak plus a new manager in mid-2013 who might be reshaping the portfolio.

Eaton Vance Large-Cap Value (EHSTX, 29% distribution): new lead manager in mid-2014 plus an 80% decline in assets since 2010 led to it.

Nationwide HighMark Large Cap Growth (NWGLX, 42% distribution): another tale of mass redemption. The fund had $73 million in assets as of July 2013 when a new co-manager was added. The fund rose since then, but a lot less than its peers or its benchmark, investors decamped and the fund ended up with $40 million in December 2014.

Nuveen NWQ Large-Cap Value (NQCAX, 47% distribution) has been suffering mass redemptions – assets were $1.3 billion in mid-2013, $700 million in mid-2014, and $275 million at year’s end. The fund also had weak and inconsistent returns: bottom 10% of its peer group for the past 1, 3 and 5 years and far below average – about a 20% return over the current market cycle as compared to 38% for its large cap value peers – despite a couple good years.

Wells Fargo Small Cap Opportunities (NVSOX, 41% distribution) has a splendid record, low volatility, a track record for reasonably low payouts, a stable management team … and crashing assets. The fund held $700 million in October 2013, $470 million in March 2014 and $330 million in December 2014. With investment minimums of $1 million (Administrative share class) and $5 million (Institutional), the best we can say is that it’s nice to see rich people being stupid, too.

A couple of these funds are, frankly, bad. Most are mediocre. And a couple are really good but, seemingly, really unlucky. For investors in taxable accounts, their fate highlights an ugly reality: your success can be undermined by the behavior of your funds’ other investors. You really don’t want to be the last one out the door, which means you need to understand when others are heading out.

Hear “it’s a stock-pickers market”? Run quick … away

Not from the market necessarily, but from any dim bulb whose insight is limited not only by the need to repeat what others have said, but to repeat the dumbest things that others have said.

“Active management is oversold.” Run!

“Passive investing makes no sense to us or to our investors.” Run faster!

Ted, the discussion board’s indefatigable Linkster, pointed us at Henry Blodget’s recent essay “14 Meaningless Phrases That Will Make You Sound Like A Stock-Market Wizard” at his Business Insider site. Yes, that Henry Blodget: the poster child for duplicitous stock “analysis” who was banned for life from the securities industry. He also had to “disgorge” $2 million in profits, a process that might or might not have involved a large bucket. In any case, he knows whereof he speaks.) He pokes fun at “the trend is your friend” (phrased differently it would be “follow the herd, that’s always a wise course”) and “it’s a stockpicker’s market,” among other canards.

Chip, the Observer’s tech-crazed tech director, appreciated Blodget’s attempt but recommends an earlier essay: “Stupid Things Finance People Say” by Morgan Housel of Motley Fool. Why? “They cover the same ground. The difference is the he’s actually funny.”

Hmmm …

Blodget: “It’s not a stock market. It’s a market of stocks.” It sounds deeply profound — the sort of wisdom that can be achieved only through decades of hard work and experience. It suggests the speaker understands the market in a way that the average schmo doesn’t. It suggests that the speaker, who gets that the stock market is a “market of stocks,” will coin money while the average schmo loses his or her shirt.

Housel: “Earnings were positive before one-time charges.” This is Wall Street’s equivalent of, “Other than that, Mrs. Lincoln, how was the play?”

Blodget: “I’m cautiously optimistic.” A classic. Can be used in almost all circumstances and market conditions … It implies wise, prudent caution, but also a sunny outlook, which most people like.

Housel: “We’re cautiously optimistic.” You’re also an oxymoron.

Blodget: “Stocks are down on ‘profit taking.” …It sounds like you know what professional traders are doing, which makes you sound smart and plugged in. It doesn’t commit you to a specific recommendation or prediction. If the stock or market goes down again tomorrow, you can still have been right about the “profit taking.” If the stock or market goes up tomorrow, you can explain that traders are now “bargain hunting” (the corollary). Whether the seller is “taking a profit” — and you have no way of knowing — the buyer is at the same time placing a new bet on the stock. So collectively describing market activity as “profit taking” is ridiculous.

Housel: “The Dow is down 50 points as investors react to news of [X].” Stop it, you’re just making stuff up. “Stocks are down and no one knows why” is the only honest headline in this category.

Your pick. Or try both for the same price!

Alternately, if you’re looking to pick up hot chicks as well as hot picks at your next Wall Street soiree, The Financial Times helpfully offered up “Strategist’s icebreakers serve up the season’s party from hell” (12/27/2014). They recommend chucking out the occasional “What’s all the fuss about the central banks?” Or you might try the cryptic, “Inflation isn’t keeping me up at night — for now.”

Top developments in fund industry litigation

Fundfox, launched in 2012, is the mutual fund industry’s only litigation intelligence service, delivering exclusive litigation information and real-time case documents neatly organized and filtered as never before. For a complete list of developments last month, and for information and court documents in any case, log in at www.fundfox.com and navigate to Fundfox Insider.

Fundfox, launched in 2012, is the mutual fund industry’s only litigation intelligence service, delivering exclusive litigation information and real-time case documents neatly organized and filtered as never before. For a complete list of developments last month, and for information and court documents in any case, log in at www.fundfox.com and navigate to Fundfox Insider.

New Lawsuit

- The plaintiff in existing fee litigation regarding ten Russell funds filed a new complaint, covering a different damages period, that additionally adds a new section 36(b) claim for excessive administrative fees. (McClure v. Russell Inv. Mgmt. Co.)

Orders

- The court consolidated ERISA lawsuits regarding “stable value funds” offered by J.P. Morgan to 401(k) plan participants. (In re J.P. Morgan Stable Value Fund ERISA Litig.)

- The court preliminarily approved a $9.475 million settlement of an ERISA class action that challenged MassMutual‘s receipt of revenue-sharing payments from unaffiliated mutual funds. (Golden Star, Inc. v. Mass Mut. Life Ins. Co.)

- The court gave its final approval to the $22.5 million settlement of Regions Morgan Keegan ERISA litigation. Plaintiffs had alleged that defendants imprudently caused and permitted retirement plans to invest in (1) Regions common stock (“despite the dire financial problems facing the Company”), (2) certain bond funds (“heavily and imprudently concentrated and invested in high-risk structured finance products”), and (3) the RMK Select Funds (“despite the fact that they incurred unreasonably expensive fees and were selected . . . solely to benefit Regions”). (In re Regions Morgan Keegan ERISA Litig.)

Briefs

- The plaintiff filed a reply brief in her appeal to the Eighth Circuit regarding gambling-related securities held by the American Century Ultra Fund. Defendants include independent directors. (Seidl v. Am. Century Cos.)

- In the ERISA class action alleging that TIAA-CREF failed to honor redemption and transfer requests in a timely fashion, the plaintiff filed her opposition to TIAA-CREF’s motion to dismiss. (Cummings v. TIAA-CREF.)

Amended Complaints

- Plaintiffs filed an amended complaint in the consolidated fee litigation regarding the Davis N.Y. Venture Fund: “The investment advisory fee rate charged to the Fund is as much as 96% higher than the rates negotiated at arm’s length by Davis with other clients for the same or substantially the same investment advisory services.” (In re Davis N.Y. Venture Fund Fee Litig.)

- Plaintiffs filed an amended complaint in the consolidated fee litigation regarding the Harbor International and and High-Yield Bond Funds: “Defendant charges investment advisory fees to each of the Funds that include a mark-up of more than 80% over the fees paid by Defendant to the Subadvisers who provide substantially all of the investment advisory services required by the Funds.” (Zehrer v. Harbor Capital Advisors, Inc.)

The Alt Perspective: Commentary and news from DailyAlts.

By Brian Haskins, editor of DailyAlts.com

By Brian Haskins, editor of DailyAlts.com

As they say out here in Hollywood, that’s a wrap. Now we can close the books on 2014 and take a look at some of the trends that emerged over the year, and make a few projections about what might be in store for 2015. So let’s jump in.

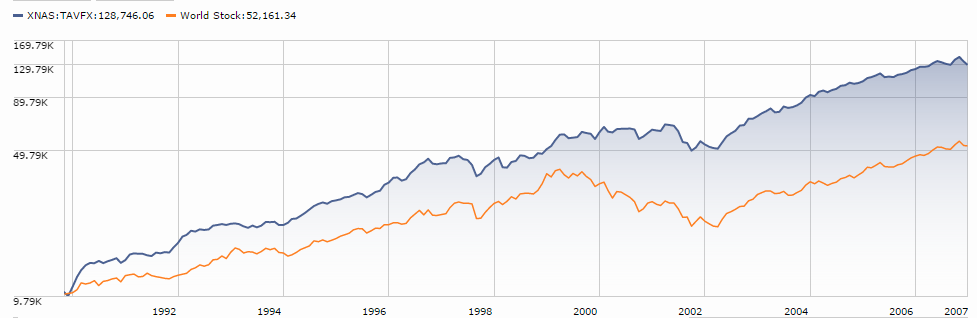

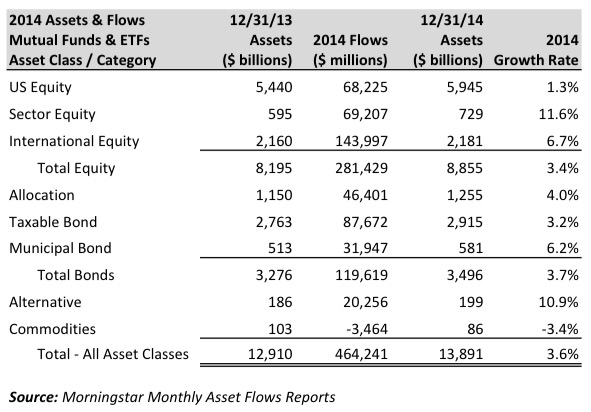

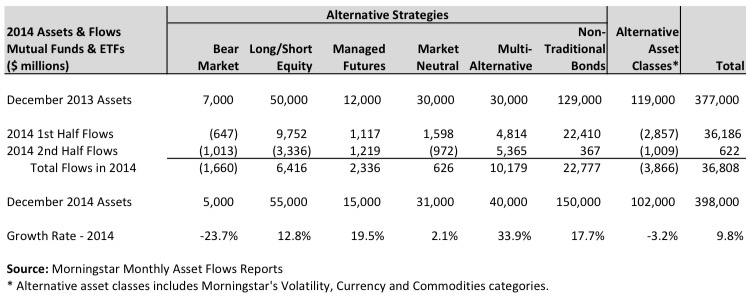

Early in 2014, it was clear that assets were flowing strongly into liquid alternatives, with twelve-month growth rates hovering around 40% for most of the first half of the year. While the growth rates declined as the year went on, it was clear that 2014 was a real turning point in both asset growth and new fund launches. In total, more than $26 billion of net new assets flowed into the category over the past twelve months.

Three of the categories that garnered the most new asset flows were non-traditional bonds, long/short equity and multi-alternative strategies. Each of these makes sense, as follows:

- Non-traditional bonds provide a hedge against a rise in interest rates, so investors naturally were looking for a way to avoid what was initially thought to be a sure thing in 2014 – rising rates. As we know, that turned not to be the case, and instead we saw a fairly steady decline in rates over the year. Nonetheless, investors who flowed into these funds should be well positioned should rates rise in 2015.

- On the equity side, long/short equity provides a hedge against a decline in the equity markets, and here again investors looked to position their portfolios more conservatively given the long bull run. As a result, long/short equity funds saw strong inflows for most of the year with the exception of the $11.9 billion MainStay Marketfield Fund (MFLDX) which experienced more than $5 billion of outflows over eight straight months on the back of a difficult performance period. As my old boss would say, they have gone from the penthouse to the doghouse. But with nearly $12 billion remaining in the fund and a 1.39% management fee, their doghouse probably isn’t too bad.

- Finally, investors favored multi-alternative funds steadily during the year. These funds provide an easy one-stop-shop for making an allocation to alternatives, and for many investors and financial advisors, these funds are a solid solution since they package multiple alternative investment strategies into one fund. I would expect to see multi-alternative funds continue to play a dominant role in portfolios over the next few years while the industry becomes more comfortable with evaluating and allocating to single strategy funds.

Now that the year has come to a close, we can take a step back and look at 2014 from a big picture perspective. Here are five key trends that I saw emerge over the year:

- The conversion of hedge funds into mutual funds – This is an interesting trend that will likely continue, and gain even more momentum in 2015. There are a few reasons why this is likely. First, raising assets in hedge funds has become more difficult over the past five years. Institutional investors allocate a bulk of their assets to well-known hedge fund managers, and performance isn’t the top criteria for making the allocations. Second, investing in hedge funds involves the review of a lot of non-standard paperwork, including fee agreements and other terms. This creates a high barrier to entry for smaller investors. Thus, the mutual fund vehicle is a much easier product to use for gathering assets with smaller investors in both the retail and institutional channels. As a result, we will see many more hedge fund conversions in the coming years. Third, the track record and the assets of a hedge fund are portable over to a mutual fund. This gives new mutual funds that convert from a hedge fund a head start over all other new funds.

- The re-emergence of managed futures funds – A divergence in global economic policies among central banks created more opportunities for managers that look for asset prices that move in opposite directions. Managed futures managers do just that, and 2014 proved to be the first year in many where they were able to put positive, double digit returns on the board. It is likely that 2015 will be another solid year for these strategies as strong price trends will likely continue with global interest rates, currencies, commodity prices and other assets over the year.

- More well-known hedge fund managers are getting into the liquid alternatives business – It’s hard to resist strong asset flows if you are an asset manager, and as discussed above, the asset flows into liquid alternatives have been strong. And expectations are that they will continue to be strong. So why wouldn’t a decent hedge fund manager want to get in the game and diversify their business away from institutional and high net worth assets. Some of the top hedge fund managers are recognizing this and getting into the space, and as more do, it will become even more acceptable for those who haven’t.

- A continued increase in the use of alternative beta strategies, and the introduction of more complex alternative beta funds – Alternative beta (or smart beta) strategies give investors exposure to specific “factors” that have otherwise not been easy to obtain historically. With the introduction of alternative beta funds, investors can now fine tune their portfolio with specific allocations to low or high volatility stocks, high yielding stocks, high momentum stocks, high or low quality stocks, etc. A little known secret is that factor exposures have historically explained more of an active manager’s excess returns (returns above a benchmark) than individual stock selection. With the advent of alternative beta funds in both the mutual fund and ETF format, investors have the ability to build more risk efficient portfolios or turn the knobs in ways they haven’t been able to in the past.

- An increase in the number of alternative ETFs – While mutual funds have a lower barrier to entry for investors than hedge funds, ETFs are even more ubiquitous. Nearly every ETF can be purchased in nearly every brokerage account. Not so for mutual funds. The biggest barrier to seeing more alternative ETFs has historically been the fact that most alternative strategies are actively managed. This is slowly changing as more systematic “hedge fund” approaches are being developed, along with alternative ETFs that invest in other ETFs to gain their underlying long and short market exposures. Expect to see this trend continue in 2015.

There is no doubt that 2015 will bring some surprises, but by definition we don’t know what those are today. We will keep you posted as the year progresses, and in the meantime, Happy New Year and all the best for a prosperous 2015!

Observer Fund Profiles:

Each month the Observer provides in-depth profiles of between two and four funds. Our “Most Intriguing New Funds” are funds launched within the past couple years that most frequently feature experienced managers leading innovative newer funds. “Stars in the Shadows” are older funds that have attracted far less attention than they deserve.

RiverPark Large Growth (RPXFX/RPXIX): it’s a discipline that works. Find the forces that will consistently drive growth in the years ahead. Do intense research to identify great firms that are best positioned to reap enduring gains from them. Wait. Wait. Wait. Then buy them when they’re cheap. It’s worked well, except for that pesky “get investors to notice” piece.

River Park Large Growth Conference Call Highlights

On December 17th we spoke for an hour with Mitch Rubin, manager of RiverPark Large Growth (RPXFX/RPXIX), Conrad van Tienhoven, his long-time associate, and Morty Schaja, CEO of RiverPark Funds. About 20 readers joined us on the call.

Here’s a brief recap of the highlights:

- The managers have 20 years’ experience running growth portfolios, originally with Baron Asset Management and now with RiverPark. That includes eight mutual funds and a couple hedge funds.

- Across their portfolios, the strategy has been the same: identify long-term secular trends that are likely to be enduring growth drivers, do really extensive fundamental research on the firm and its environment, and be patient before buying (the target is paying less than 15-times earnings for companies growing by 20% or more) or selling (which is mostly just rebalancing within the portfolio rather than eliminating names from the portfolio).

- In the long term, the strategy works well. In the short term, sometimes less so. They argue for time arbitrage. Investors tend to underreact to changes which are strengthening firms. They’ll discount several quarters of improved performance before putting a stock on their radar screen, then may hesitate for a while longer before convincing themselves to act. By then, the stock may already have priced-in much of the potential gains. Rubin & co. try to track firms and industries long enough that they can identify the long-term winners and buy during their lulls in performance.

In the long term, the system works. The fund has returned 20% annually over the past three years. It’s four years old and had top decile performance in the large cap growth category after the first three years.

Then we spent rather a lot of time on the ugly part.

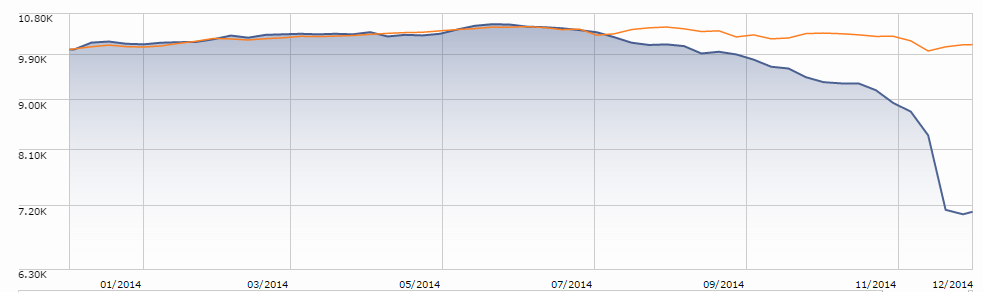

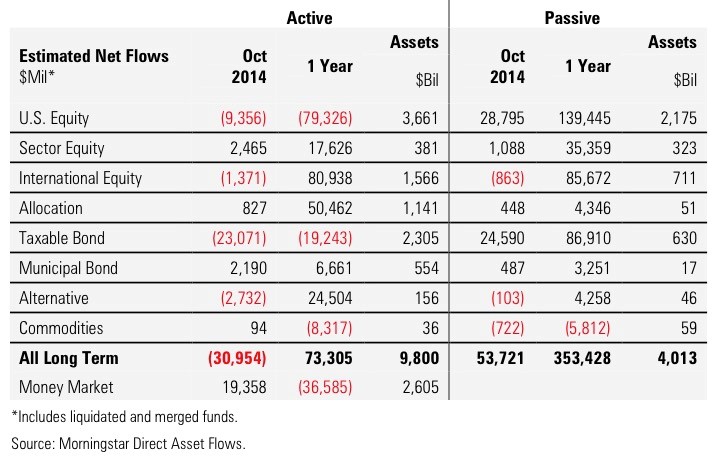

In relative terms, 2014 was wretched for the fund. The fund returned about 5.5% for the year, which meant it trailed 93% of its peers. It started the year with a spiffy five-star rating and ended with three. So, the question was, what happened?

Mitch’s answer was presented with, hmmm … great energy and conviction. There was a long stretch in there where I suspect he didn’t take a breath and I got the sense that he might have heard this question before. Still, his answer struck me as solid and well-grounded. In the short term, the time arbitrage discipline can leave them in the dust. In 2014, the fund was overweight in a number of underperforming arenas: energy E&P companies, gaming companies and interest rate victims.

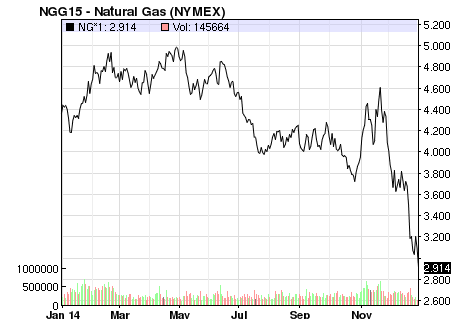

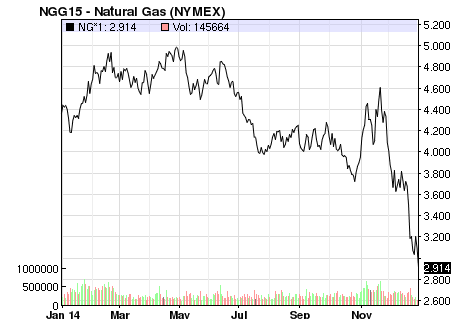

- Energy firms: 13% of the portfolio, about a 2:1 overweight. Four high-quality names with underlevered balance sheets and exposure to the Marcellus shale deposits. Fortunately for consumers and unfortunately for producers, rising production, difficulties in selling US natural gas on the world market and weakening demand linked to a spillover from Russia’s travails have caused prices to crater.

The fundamental story of rising demand for natural gas, abetted by better US access to the world energy market, is unchanged. In the interim, the portfolio companies are using their strong balance sheets to acquire assets on the cheap.

- Gaming firms: gaming in the US, with regards to Ol’ Blue Eyes and The Rat Pack, is the past. Gaming in Asia, they argue, is the future. The Chinese central government has committed to spending nearly a half trillion dollars on infrastructure projects, including $100 billion/year on access, in and around the gambling enclave of Macau. Chinese gaming (like hedge fund investing here) has traditionally been dominated by the ultra-rich, but gambling is culturally entrenched and the government is working to make it available to the mass affluent in China (much like liquid alt investing here). About 200 million Chinese travel abroad on vacation each year. On average, Chinese tourists spend a lot more in the casinos and a lot more in attendant high-end retail than do Western tourists. In the short term, President Xi’s anti-corruption campaign has precipitated “a vast purge” among his political opponents and other suspiciously-wealthy individuals. Until “the urge to purge” passes, high-rolling gamblers will be few and discreet. Middle class gamblers, not subject to such concerns, will eventually dominate. Just not yet.

- Interest rate victims: everyone knew, in January 2014, that interest rates were going to rise. Oops. Those continuingly low rates punish firms that hold vast cash stakes (think “Google” with its $50 billion bank account or Schwab with its huge network of money market accounts). While Visa and MasterCard’s stock is in the black for 2014, gains are muted by the lower rates they can charge on accounts and the lower returns on their cash flow.

Three questions came up:

- Dan Schein asked about the apparent tension between the managers’ commitment to a low turnover discipline and the reported 33-40% turnover rate. Morty noted that you need to distinguish between “name turnover” (that is, firms getting chucked out of the portfolio) and rebalancing. The majority of the fund’s turnover is simple internal rebalancing as the managers trim richly appreciated positions and add to underperforming ones. Name turnover is limited to two or three positions a year, with 70% of the names in the current portfolio having been there since inception.

- I asked about the extent of international exposure in the portfolio, which Morningstar reports at under 2%. Mitch noted that they far preferred to invest in firms operating under US accounting requirements (Generally Accepted Accounting Principles) and U.S. securities regulations, which made them far more reliable and transparent. On the other hand, the secular themes which the managers pursue (e.g., the rise of mobile computing) are global and so they favor U.S.-based firms with strong global presence. By their estimate, two thirds of the portfolio firms derive at least half of their earnings growth from outside the US and most of their firms derived 40-50% of earnings internationally; Priceline is about 75%, Google and eBay around 60%. Direct exposure to the emerging markets comes mainly from Visa and MasterCard, plus Schlumberger’s energy holdings.

- Finally I asked what concern they had about volatility in the portfolio. Their answer was that they couldn’t predict and didn’t worry about stock price volatility. They were concerned about what they referred to as “business case volatility,” which came down to the extent to which a firm could consistently generate free cash from recurring revenue streams (e.g., the fee MasterCard assesses on every point-of-sale transaction) without resorting to debt or leverage.

For folks interested but unable to join us, here’s the complete audio of the hour-long conversation.

The RPXFX Conference Call

As with all of these funds, we’ve created a new Featured Funds page for RiverPark Large Growth Fund, pulling together all of the best resources we have for the fund.

Conference Calls Upcoming

We anticipate three conference calls in the next three months and we would be delighted by your company on each of them. We’re still negotiating dates with the managers, so for now we’ll limit ourselves to a brief overview and a window of time.

At base, we only do conference calls when we think we’ve found really interesting people for you to talk with. That’s one of the reasons we do only a few a year.

Here’s the prospective line-up for winter.

Bernard Horn is manager of Polaris Global Value (PGVFX) and sub-adviser to a half dozen larger funds. Mr. Horn is president of Polaris Capital Management, LLC, a Boston-based global and international value equity firm. Mr. Horn founded Polaris in 1995 and launched the Global Value Fund in 1998. Today, Polaris manages more than $5 billion for 30 clients include rich folks, institutions and mutual and hedge funds. There’s a nice bio of Mr. Horn at the Polaris Capital site.

Bernard Horn is manager of Polaris Global Value (PGVFX) and sub-adviser to a half dozen larger funds. Mr. Horn is president of Polaris Capital Management, LLC, a Boston-based global and international value equity firm. Mr. Horn founded Polaris in 1995 and launched the Global Value Fund in 1998. Today, Polaris manages more than $5 billion for 30 clients include rich folks, institutions and mutual and hedge funds. There’s a nice bio of Mr. Horn at the Polaris Capital site.

Why talk with Mr. Horn? Three things led us to it. First, Polaris Global is really good and really small. After 16 years, it’s a four- to five-star fund with just $280 million in assets. He seems just a bit abashed by that (“we’re kind of bad at marketing”) but also intent on doing right for his shareholders rather than getting rich. Second, his small cap international fund (Pear Tree Polaris Foreign Value Small Cap QUSOX) is, if anything, better and it trawls the waters where active management actually has the greatest success. Finally, Ed and I have a great conversation with him in November. Ed and I are reasonably judgmental, reasonably well-educated and reasonably cranky. And still we came away from the conversation deeply impressed, as much by Mr. Horn’s reflections on his failures as much as by his successes. There’s a motto often misattributed to the 87 year old Michelangelo: Ancora imparo, “I am still learning.” We came away from the conversation with a sense that you might say the same about Mr. Horn.

Matthew Page and Ian Mortimer are co-managers of Guinness Atkinson Global Innovators (IWIRX) and Guinness Atkinson Dividend Builder (GAINX), both of which we’ve profiled in the past year. Dr. Mortimer is trained as a physicist, with a doctorate from Oxford. He began at Guinness as an analyst in 2006 and became a portfolio manager in 2011. Mr. Page (the friendly looking one over there->) earned a master’s degree in physics from Oxford and somehow convinced the faculty to let him do his thesis on finance: “Financial Markets as Complex Dynamical Systems.” Nice trick! He spent a year with Goldman Sachs, joined Guinness in 2005 and became a portfolio co-manager in 2006.

Matthew Page and Ian Mortimer are co-managers of Guinness Atkinson Global Innovators (IWIRX) and Guinness Atkinson Dividend Builder (GAINX), both of which we’ve profiled in the past year. Dr. Mortimer is trained as a physicist, with a doctorate from Oxford. He began at Guinness as an analyst in 2006 and became a portfolio manager in 2011. Mr. Page (the friendly looking one over there->) earned a master’s degree in physics from Oxford and somehow convinced the faculty to let him do his thesis on finance: “Financial Markets as Complex Dynamical Systems.” Nice trick! He spent a year with Goldman Sachs, joined Guinness in 2005 and became a portfolio co-manager in 2006.

Why might you want to hear from the guys? At one level, they’re really successful. Five star rating on IWIRX, great performance in 2014 (also 2012 and 2013), laughably low downside capture over those three years (almost all of their volatility is to the upside), and a solid, articulated portfolio discipline. In 2014, Lipper recognized IWIRX has the best global equity fund of the preceding 15 years and they still can’t attract investors. It’s sort of maddening. Part of the problem might be the fact that they’re based in London, which makes relationship-building with US investors a bit tough. At another level, like Mr. Horn, I’ve had great conversations with the guys. They’re good listeners, sharp and sometimes witty. I enjoyed the talks and learned from them.

David Berkowitz will manage the new RiverPark Focused Value Fund once it launches at the end of March. Mr. Berkowitz earned both a bachelor’s and master’s degree in chemical engineering at MIT before getting an MBA at that other school in Cambridge. In 1992, Mr. Berkowitz and his Harvard classmate William Ackman set up the Gotham Partners hedge fund, which drew investments from legendary investors such as Seth Klarman, Michael Steinhardt and Whitney Tilson. Berkowitz helped manage the fund until 2002, when they decided to close the fund, and subsequently managed money for a New York family office, the Festina Lente hedge fund (hmmm … “Make haste slowly,” the family motto of the Medicis among others) and for Ziff Brother Investments, where he was a Partner as well as the Chief Risk and Strategy Officer. He’s had an interesting, diverse career and Mr. Schaja speaks glowingly of him. We’re hopeful of speaking with Mr. Berkowitz in March.

David Berkowitz will manage the new RiverPark Focused Value Fund once it launches at the end of March. Mr. Berkowitz earned both a bachelor’s and master’s degree in chemical engineering at MIT before getting an MBA at that other school in Cambridge. In 1992, Mr. Berkowitz and his Harvard classmate William Ackman set up the Gotham Partners hedge fund, which drew investments from legendary investors such as Seth Klarman, Michael Steinhardt and Whitney Tilson. Berkowitz helped manage the fund until 2002, when they decided to close the fund, and subsequently managed money for a New York family office, the Festina Lente hedge fund (hmmm … “Make haste slowly,” the family motto of the Medicis among others) and for Ziff Brother Investments, where he was a Partner as well as the Chief Risk and Strategy Officer. He’s had an interesting, diverse career and Mr. Schaja speaks glowingly of him. We’re hopeful of speaking with Mr. Berkowitz in March.

Would you like to join in?

It’s very simple. In February we’ll post exact details about the time and date plus a registration link for each call. The calls cost you nothing, last exactly one hour and will give you the chance to ask the managers a question if you’re so moved. It’s a simple phone call with no need to have access to a tablet, wifi or anything.

Alternately, you can join the conference call notification list. One week ahead of each call we’ll email you a reminder and a registration link.

Launch Alert: Cambria Global Momentum & Global Asset Allocation

Cambria Funds recently launched two ETFs, as promised by its CIO Mebane Faber, who wants to “disrupt the traditional high fee mutual fund and hedge fund business, mostly through launching ETFs.” The line-up is now five funds with assets under management totaling more than $350M:

- Cambria Shareholder Yield ETF (SYLD)

- Cambria Foreign Shareholder Yield ETF (FYLD)

- Cambria Global Value ETF (GVAL)

- Cambria Global Momentum ETF (GMOM)

- Cambria Global Asset Allocation ETF (GAA)

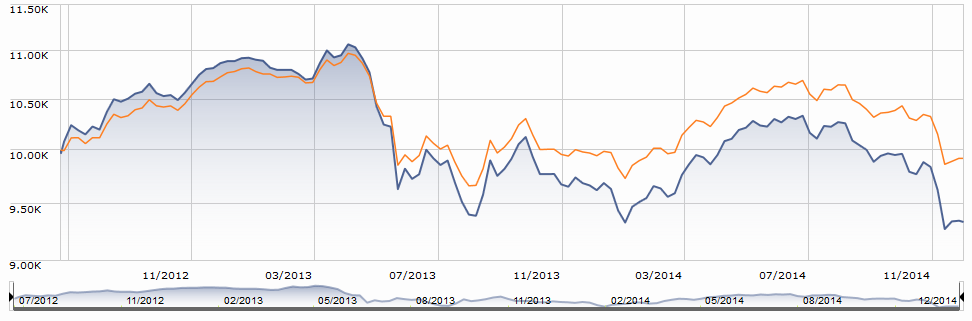

We wrote about the first three in “The Existential Pleasures of Engineering Beta” this past May. SYLD is now the largest actively managed ETF among the nine categories in Morningstar’s equity fund style box (small value to large growth). It’s up 12% this year and 32% since its inception May 2013.

GMOM and GAA are the two newest ETFs. Both are fund of funds.

GMOM is based on Mebane’s definitive paper “A Quantitative Approach To Tactical Asset Allocation” and popular book “The Ivy Portfolio: How to Invest Like the Top Endowments and Avoid Bear Markets.” It appears to be an in-house version of AdvisorShares Cambria Global Tactical ETF (GTAA), which Cambria stopped sub-advising this past June. Scott, a frequent and often profound contributor to our discussion board, describes GTAA in one word: “underwhelming.” (You can find follow some of the debate here.) The new version GMOM sports a much lower expense ratio, which can only help. Here is link to fact sheet.

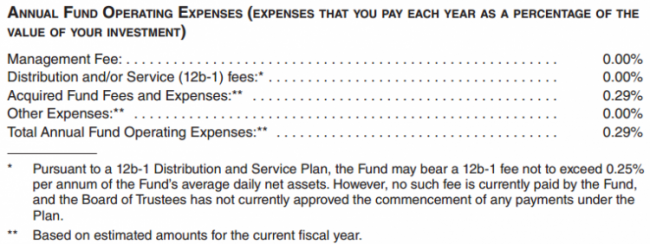

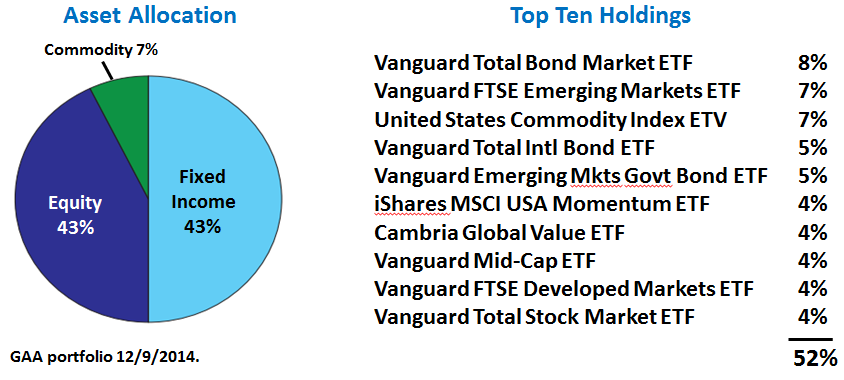

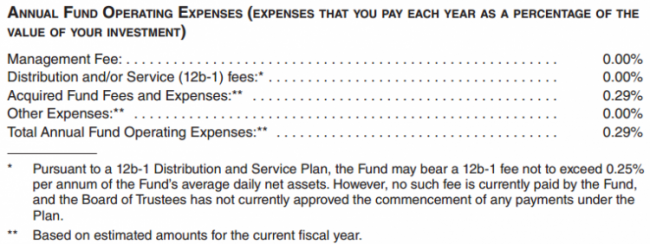

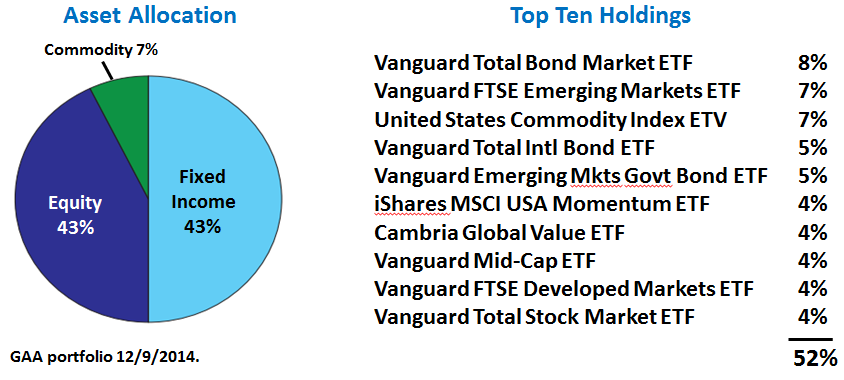

GAA is something pretty cool. It is an all-weather strategic asset allocation fund constructed for global exposure across diverse asset classes, but with lower volatility than your typical long term target allocation fund. It is a “one fund for a lifetime” offering. (See DailyAlts “Meb Faber on the Genesis of Cambria’s Global Tactical ETF.”) It is the first ETF to have a permanent 0% management fee. Its annual expense ratio is 0.29%. From its prospectus:

Here’s is link to fact sheet, and below is snapshot of current holdings:

In keeping with the theme that no good deed goes unpunished. Chuck Jaffe referenced GAA in his annual “Lump of Coal Awards” series. Mr. Jaffe warned “investors should pay attention to the total expense ratio, because that’s what they actually pay to own a fund or ETF.” Apparently, he was irked that the media focused on the zero management fee. We agree that it was pretty silly of reporters, members of Mr. Jaffe’s brotherhood, to focus so narrowly on a single feature of the fund and at the same time celebrate the fact that Mr. Faber’s move lowers the expenses that investors would otherwise bear.

Launch Alert: ValueShares International Quantitative Value

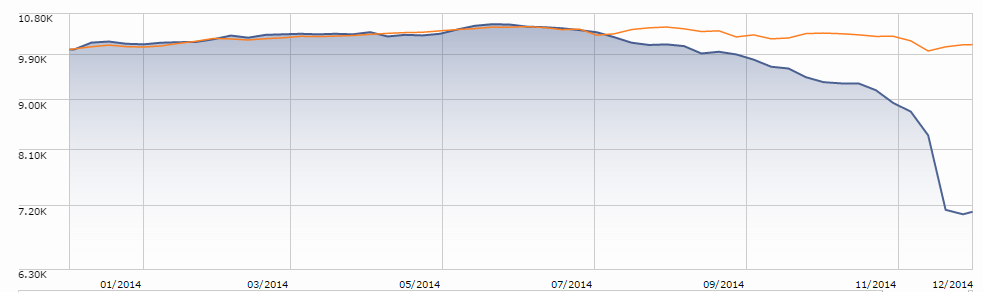

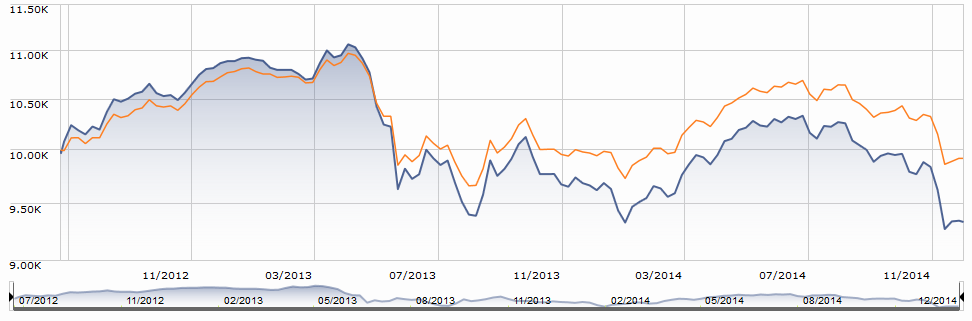

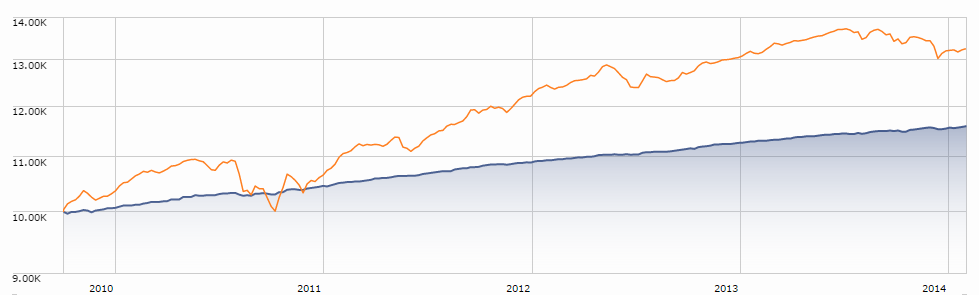

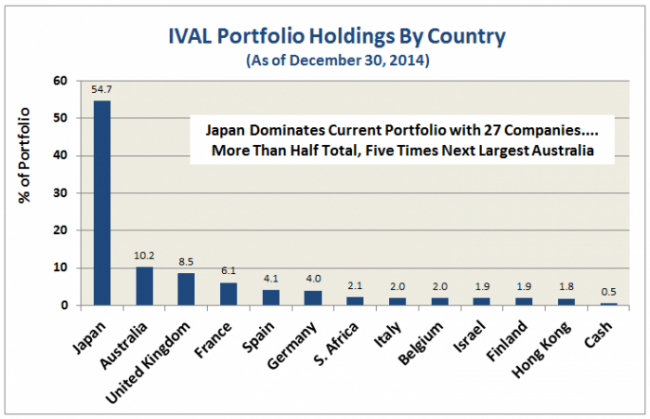

Wesley Gray announced the launch of ValueShares International Quantitative Value ETF (IVAL) on 19 December, his firm’s second active ETF. IVAL is the international sister to ValueShares Quantitative Value ETF (QVAL), which MFO profiled in December. Like QVAL, IVAL seeks the cheapest, highest quality value stocks … within the International domain. These stocks are selected in quant fashion based on value and quality criteria grounded in investing principles first outlined by Ben Graham and validated empirically through academic research.

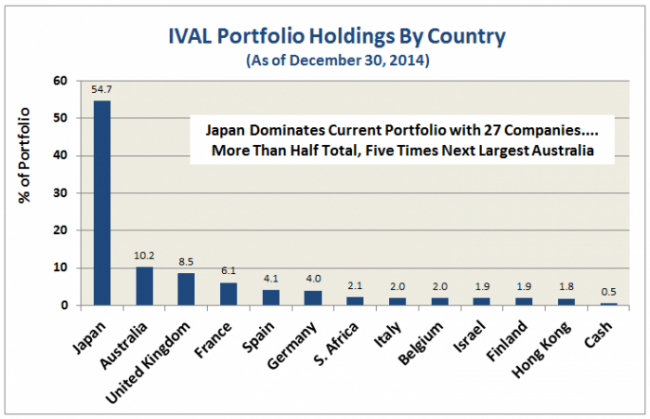

The concentrated portfolio currently invests in 50 companies across 14 countries. Here’s breakout:

As with QVAL, there is no sector diversification constraint or, in this case, country constraint. Japan dominates current portfolio. Once candidate stocks pass the capitalization, liquidity, and quality screens, value is king.

Notice too no Russia or Brazil.

Wesley explains: “We only trade in liquid tradeable names where front-running issues are minimized. We also look at the custodian costs. Russia and Brazil are insane on both the custodial costs and the frontrunning risks so we don’t trade ’em. In the end, we’re trading in developed/developing markets. Frontier/emerging don’t meet our criteria.”

Here is link to IVAL overview. Dr. Gray informs us that the new fund’s expense ratio has just been reduced by 20bps to 0.79%.

Launch Alert: Pear Tree Polaris Small Cap Fund (USBNX/QBNAX)

On January 1, a team from Polaris Capital assumed control of the former Pear Tree Columbia Small Cap Fund, which has now been rechristened. For the foreseeable future, the fund’s performance record will bear the imprint of the departed Columbia team. The Columbia team had been in place since the middle 1990s and the fund has, for years, been a study in mediocrity. We mean that in the best possible way: it rarely cratered, it rarely soared and it mostly trailed the pack by a bit. By Morningstar’s calculation, the compounding effect of almost always losing by a little ended up being monumental: the fund trailed more than 90% of its peers for the past 1, 3, 5, and 10 year periods while trailing two-thirds over them over the past 15 years.

Which is to say, your statistical screens are not going to capture the fund’s potential going forward.

We think you should look at the fund, and hope to ask Mr. Horn about it on a conference call with him. Here are the three things you need to know about USNBX if you’re in the market for a small cap fund:

- The management team here also runs Pear Tree Polaris Foreign Value Small Cap Fund (QUSOX / QUSIX) which has earned both five stars from Morningstar and a Great Owl designation from the Observer.

- The new subadvisory agreement pays Polaris 20 basis points less than Columbia received, which will translate into lower expenses that investors pay.

- The portfolio will be mostly small cap ($100 million – $5 billion) US stocks but they’ve got a global watch-list of 500 names which are candidates for inclusion and they have the ability to hedge the portfolio. The foreign version of the fund has been remarkable in its ability to manage risk: they typically capture one-third as much downside risk as their peers while capturing virtually all of the upside.

The projected expense ratio is 1.44%. The minimum initial investment is $2500, reduced to $1000 for tax-advantaged accounts and for those set up with an automatic investing plan. Pear Tree has not, as of January 1, updated the fund’s webpage is reflect the change but you should consider visiting Pear Tree’s homepage next week to see what they have to say about the upgrade. We’ll plan profiles of both funds in the months ahead.

Funds in Registration

Yikes. We’ve never before had a month like this: there’s only one new, no-load retail fund on file with the SEC. Even if we expand the search to loaded funds, we only get to four or five. Hmmm …

The one fund is RiverPark Focused Value Fund. It will be primarily a large cap domestic equity fund whose manager has a particular interest in “special situations” such as spin-offs or reorganizations and on firms whose share prices might have cratered. They’ll buy if it’s a high quality firm and if the stock trades at a substantial discount to intrinsic value. It will be managed by a well-known member of the hedge fund community, David Berkowitz.

Manager Changes

This month also saw an uptick in manager turnover; 73 funds reported changes, about 50% more than the month before. The most immediately noticeable of which was Bill Frels’ departure from Mairs & Power Growth (MPGFX) and Mairs & Power Balanced (MAPOX) after 15 and 20 years, respectively. They’re both remarkable funds: Balanced has earned five stars from Morningstar for the past 3, 5, 10 and since inception periods while Growth has either four or five stars for all those periods. Both invest primarily in firms located in the upper Midwest and both have negligible turnover.

Mr. Frels’ appointment occasioned considerable anxiety years ago because he was an unknown guy replacing an investing legend, George Mairs. At the time, we counseled calm because Mairs & Power had themselves calmly and deliberately planned for the handout. I suppose we’ll do the same today, though we might use this as an excuse for calling M&P to update our 2011 profile of the fund. That profile, written just as M&P appointed a co-manager in what we said was evidence of succession planning, concluded “If you’re looking for a core holding, especially for a smaller portfolio where the reduced minimum will help, this has to be on the short-list of the most attractive balanced funds in existence.” We were right and we don’t see any reason to alter that conclusion now.

Updates

Andrew Foster and the folks at Seafarer Partners really are consistently better communicators than almost any of their peers. In addition to a richly informative website and portfolio metrics that almost no one else thinks to share, they have just published a semi-annual report with substantial content.

Andrew Foster and the folks at Seafarer Partners really are consistently better communicators than almost any of their peers. In addition to a richly informative website and portfolio metrics that almost no one else thinks to share, they have just published a semi-annual report with substantial content.

Two arguments struck me. First, the fund’s performance was hampered by their decision to avoid bad companies:

the Fund’s lack of exposure to small and mid-size technology companies – mostly located in Taiwan – caused it to lag the benchmark during the market’s run-up. While interesting investments occasionally surface among the sea of smaller technology firms located in and around Taipei, this group of companies in general is not distinguished by sustainable growth. Most companies make components for consumer electronics or computers, and while some grow quickly for a while, often their good fortune is not sustainable, as their products are rapidly commoditized, or as technological evolution renders their products obsolete. Their share prices can jump rapidly higher for a time when their products are in vogue. Nevertheless, I rarely find much that is worthwhile or sustainable in this segment of the market, though there are sometimes exceptions.

As a shareholder in the fund, I really do applaud a discipline that avoids those iffy but easy short-term bets.

The second argument is more interesting and a lot more important for the investing community. Andrew argues that “value investing” might finally be coming to the emerging markets.

Yet even as the near-term is murky, I believe the longer-term outlook has recently come into sharper focus. A very important structural change – one that I think has been a long time in coming – has just begun to reshape the investment landscape within the developing world. I think the consequence of this change will play out over the next decade, at a minimum.

For the past sixteen years, I have subscribed to an investment philosophy that stresses “growth” over “value.” By “value,” I mean an investment approach that places its primary emphasis on the inherent cheapness of a company’s balance sheet, and which places secondary weight on the growth prospect of the company’s income statement..

In the past, I have had substantial doubts as to whether a classic “value” strategy could be effectively implemented within the developing world – “value” seemed destined to become a “value trap.” … In order to realize the value embedded in a cheap balance sheet, a minority investor must often invest patiently for an extended period, awaiting the catalyst that will ultimately unlock the value.

The problem with waiting in the developing world is that most countries lack sufficient legal, financial, accounting and regulatory standards to protect minority investors from abuse by “control parties.” A control party is the dominant owner of a given company. Without appropriate safeguards, minorities have little hope of avoiding exploitation while they wait; nor do they have sufficient legal clout to exert pressure on the control party to accelerate the realization of value. Thus in the past, a prospective “value” investment was more likely to be a “trap” than a source of long-term return.

Andrew’s letter outlines a series of legal and structural changes which seem to be changing that parlous state and he talks about the implications for his portfolio and, by extension, for yours. You should go read the letter.

Seafarer Growth & Income (SFGIX) is closing in on its third anniversary (February 15, 2015) with $122 million in assets and a splendid record, both in terms of returns and risk-management. The fund finished 2014 with a tiny loss but a record better than 75% of its peers. We’re hopeful of speaking with Andrew and his team as they celebrate that third anniversary.

Speaking of third anniversaries, Grandeur Peak funds have just celebrated theirs.  Their success has been amazing, at least to the folks who weren’t paying attention to their record in their preceding decade. Eric Heufner, the firm’s president, shared some of the highlights in a December email:

Their success has been amazing, at least to the folks who weren’t paying attention to their record in their preceding decade. Eric Heufner, the firm’s president, shared some of the highlights in a December email:

… our initial Funds have reached the three-year milestone. Both Funds ranked in the Top 1% of their respective Morningstar peer groups for the 3 years ending 10/31/14, and each delivered an annualized return of more than 20% over the period. The Grandeur Peak Global Opportunities Fund was the #1 fund in the Morningstar World Stock category and the Grandeur Peak International Opportunities Fund was the #2 fund in the Morningstar Foreign Small/Mid Growth category. We also added two new strategies over the past year 18 months. [He shared a performance table which comes down to this: all of the funds are top 10% or better for the available measurement periods.]

Our original team of 7 has now grown to a team of 30 (16 full-time & 14 part-time). Our assets under management have grown to $2.4 billion, and all four of our strategies are closed to additional investment—we remain totally committed to keeping our portfolios nimble. We still plan to launch other Funds, but nothing is imminent.

And, too, their discipline strikes me as entirely admirable: all four of their funds have now been hard-closed in accordance with plans that they announced early and clearly. 2015 should see the launch of their last three funds, each of which was also built-in early to the firm’s planning and capacity calculations.

Finally, Matthews Asia Strategic Income (MAINX) celebrated its third anniversary and first Morningstar rating in December, 2014. The fund received a four-star rating against a “world bond” peer group. For what interest it holds, that rating is mostly meaningless since the fund’s mandate (Asia! Mostly emerging) and portfolio (just 70% bonds plus income-producing equities and convertibles) are utterly distant from what you see in the average world bond fund. The fund has crushed the one or two legitimate competitors in the space, its returns have been strong and its manager, Teresa Kong, comes across a particularly smart and articulate.

Briefly Noted . . .

Investors have, as predicted, chucked rather more than a billion dollars into Bill Gross’s new charge, Janus Unconstrained Bond (JUCAX) fund. Despite holding 75% of that in cash, Gross has managed both to lose money and underperform his peers in these opening months. Both are silly observations, of course, though not nearly so silly as the desperate desire to rush a billion into Gross’s hands.

SMALL WINS FOR INVESTORS

Effective January 1, 2015, Perkins Small Cap Value Fund (JDSAX) reopened to new investors. I’m a bit ambivalent here. The fund looks sluggish when measured by the usual trailing periods (it has trailed about 90% of its peers over the past 3 and 5 year periods) but I continue to think that those stats mislead as often as they inform since they capture a fund’s behavior in a very limited set of market conditions. If you look at the fund’s performance over the current market cycle – from October 1 2007 to now – it has returned 78% which handily leads its peers’ 61% gain. Nonetheless the team is making adjustments which include spending down their cash (from 15% to 5%), which is a durned odd for a value discipline focused on high quality firms to do. They’re also dropping the number of names and adding staff. It has been a very fine fund over the long term but this feels just a bit twitchy.

CLOSINGS (and related inconveniences)

A couple unusual cases here.

Aegis High Yield Fund (AHYAX/AHYFX) closed to new investors in mid-December and has “assumed a temporary defensive position.” (The imagery is disturbing.) As we note below, this might well signal an end to the fund.

The more striking closure is GL Beyond Income Fund (GLBFX). While the fund is tiny, the mess is huge. It appears that Beyond Income’s manager, Daniel Thibeault (pronounced “tee-bow”), has been inventing non-existent securities then investing in them. Such invented securities might constitute a third of the fund’s portfolio. In addition, he’s been investing in illiquid securities – that is, stuff that might exist but whose value cannot be objectively determined and which cannot be easily sold. In response to the fraud, the manager has been arrested and charged with one count of fraud. More counts are certainly pending but conviction just on the one original charge could carry a 20-year prison sentence. Since the board has no earthly idea of what the fund’s portfolio is worth, they’ve suspended all redemptions in the fund as well as all purchased.

GL Beyond Income (it’s certainly sounding awfully ironic right now, isn’t it?) was one of two funds that Mr. Thibeault ran. The first fund, GL Macro Performance Fund (GLMPX), liquidated in July after booking a loss of nearly 50%. Like Beyond Income, it invested in a potpourri of “alternative investments” including private placements and loans to other organizations controlled by the manager.

There have been two pieces of really thoughtful writing on the crime. Investment News dug up a lot of the relevant information and background in a very solid story by Mason Braswell on December 30th. Chuck Jaffe approached the story as an illustration of the unrecognized risks that retail investors take as they move toward “liquid alts” funds which combine unusual corporate structures (the GL funds were interval funds, meaning that you could not freely redeem your shares) and opaque investments.

Morningstar, meanwhile, remains thoughtfully silent. They seem to have reprinted Jaffe’s story but their own coverage of the fraud and its implications has been limited to two one-sentence notes on their Advisor site.

OLD WINE, NEW BOTTLES

Effective January 1, 2015, the name of the AIT Global Emerging Markets Opportunities Fund (VTGIX) changed to the Vontobel Global Emerging Markets Equity Institutional Fund.

American Century One Choice 2015 Portfolio has reached the end of its glidepath and is combining with One Choice In Retirement. That’s not really a liquidation, more like a long-planned transition.

Effective January 30, 2015, the name of the Brandes Emerging Markets Fund (BEMAX) will be changed to the Brandes Emerging Markets Value Fund.