Dear friends,

As I begin this essay the thermostat registers an attention-grabbing minus 18 degrees Fahrenheit. When I peer out of the window nearest my (windowless) office, I’m confronted with:

All of which are sure and certain signs that it’s what? Yes, Spring Break in the Midwest!

Which funds? “Not ours,” saith Fidelity!

If you had a mandate to assemble a portfolio of the stars and were given virtually unlimited resources with which to identify and select the country’s best funds and managers, who would you pick? And, more to the point, how cool would it be to look over the shoulders of those who actually had that mandate and those resources?

Welcome to the world of the Strategic Advisers funds, an arm of Fidelity Investments dedicated to providing personalized portfolios for affluent clients. The pitch is simple: “we can do a better job of finding and matching investment managers, some not accessible to regular people, than you possibly could.” The Strategic Advisers funds have broad mandates, with names like Core Fund (FCSAX) and Value Fund (FVSAX). Most are funds of funds, explicitly including Fidelity funds in their selection universe, or they’re hybrids between a fund-of-funds and a fund where other mutual fund managers contribute individual security names.

Welcome to the world of the Strategic Advisers funds, an arm of Fidelity Investments dedicated to providing personalized portfolios for affluent clients. The pitch is simple: “we can do a better job of finding and matching investment managers, some not accessible to regular people, than you possibly could.” The Strategic Advisers funds have broad mandates, with names like Core Fund (FCSAX) and Value Fund (FVSAX). Most are funds of funds, explicitly including Fidelity funds in their selection universe, or they’re hybrids between a fund-of-funds and a fund where other mutual fund managers contribute individual security names.

SA celebrates its manager research process in depth and in detail. The heart of it, though, is being able to see the future:

Yet all too often, yesterday’s star manager becomes tomorrow’s laggard. For this reason, Strategic Advisers’ investment selection process emphasizes looking forward rather than backward, and seeks consistency, not of performance per se, but of style and process.

They’re looking for transparent, disciplined, repeatable processes, stable management teams and substantial personal investment by the team members.

The Observer researched the top holdings of every Strategic Advisers fund, except for their target-date series since those funds just invest in the other SA funds. Here’s what we found:

A small handful of Fidelity funds found their way in. Only four of the eight domestic equity funds had any Fido fund in the sample and each of those featured just one fund. The net effect: Fidelity places something like 95-98% of their domestic equity money with managers other than their own. Fidelity funds dominate one international equity fund (FUSIX), while getting small slices of three others. Fidelity has little presence in core fixed-income funds but a larger presence in the two high-yield funds.

The Fidelity funds most preferred by the SA analysts are:

|

Blue Chip Growth (FBGRX), a five-star $19 billion fund whose manager arrived in 2009, just after the start of the current bull market. Not clear what happens in less hospitable climates. |

|

Capital & Income (FAGIX), five star, $10 billion high yield hybrid fund It’s classified as high-yield bond but holds 17% of its portfolio in the stock of companies that have issued high-yield debt. |

|

Emerging Markets (FEMKX), a $3 billion fund that improved dramatically with the arrival of manager Sammy Simnegar in October, 2012. |

|

Growth Company (FDGRX), a $40 billion beast that Steven Wymer has led since 1997. Slightly elevated volatility, substantially elevated returns. |

|

Advisor Stock Selector Mid Cap (FSSMX), which got new managers in 2011 and 2012, then recently moved from retail to Advisor class. The long term record is weak, the short term record is stronger. |

|

Conservative Income Bond (FCONX), a purely pedestrian ultra-short bond fund. |

|

Diversified International (FDIVX), a fund that had $60 billion in assets, hit a cold streak around the financial crisis, and is down to $26 billion despite strong returns again under its long-time manager. |

|

International Capital Appreciation (FIVFX), a small fund by Fido standards at $1.3 billion, which has been both bold and successful in the current upmarket. It’s run by the Emerging Markets guy. |

|

International Discovery (FIGRX), a $10 billion upmarket darling that’s stumbled badly in down markets and whose discipline seems to wander. Making it, well, not disciplined. |

|

Low-Priced Stock (FLPSX), Mr. Tillinghast has led the fund since 1989 and is likely one of the five best managers in Fidelity’s history. Which, at $50 billion, isn’t quite a secret. |

|

Short Term Bond (FSHBX), another perfectly pedestrian, low-risk, undistinguished return bond fund. Meh. |

Fidelity favors managers that are household names. No “undiscovered gems” here. The portfolios are studded with large, safe bets from BlackRock, JPMorgan, MetWest, PIMCO and T. Rowe.

DFA and Vanguard are missing. Utterly, though whether that’s Fidelity’s decision or not is unknown.

JPMorgan appears to be their favorite outside manager. Five different SA funds have invested in JPMorgan products including Core Bond, Equity Spectrum, Short Duration, US Core Plus Large Cap Select and Value Advantage.

The word “Focus” is notably absent. Core hold 550 positions, including funds and individual securities while Core Multi-Manager holds 360. Core Income holds a thousand while Core Income Multi-Managers holds 240 plus nine mutual funds. International owns two dozen funds and 400 stocks.

Some distinguished small funds do appear further down the portfolios. Pear Tree Polaris Foreign Value (QFVOX) is a 1% position in International. Wasatch Frontier Emerging Small Countries (WAFMX) was awarded a freakish 0.02% of Emerging Markets Fund of Funds (FLILX), as well as 0.6% in Emerging Markets (FSAMX). By and large, though, timidity rules!

Bottom Line: the tyranny of career risk rules! Most professional investors know that it’s better to be wrong with the crowd than wrong by yourself. That’s a rational response to the prospect of being fired, either by your investors or by your supervisor. That same pattern plays out in fund selection committees, including the college committee on which I sit. It’s much more important to be “not wrong” than to be “right.” We prefer choices that we can’t be blamed for. The SA teams have made just such choices: dozens of funds, mostly harmless, and hundreds of stocks, mostly mainstream, in serried ranks.

If you’ve got a full-time staff that’s paid to do nothing else, that might be manageable if not brilliant. For the rest of us, private and professional investors alike, it’s not.

One of the Observers’ hardest tasks is trying to insulate ourselves, and you, from blind adherence to that maxim. One of the reasons we’ll highlight one- and two-star funds, and one of the reasons I’ve invested in several, is to help illustrate the point that you need to look beyond the easy answers and obvious choices. With the steady evolution of our Multi-Search screener, we’re hoping to help folks approach that task more systematically. Details soon!

The Death of “Buy the unloved”

You know what Morningstar would say about a mutual fund that claimed a spiffy 20 year record but has switched managers, dramatically changed its investment strategy, went out of business for several years, and is now run by managers who are warning people not to buy the fund. You can just see the analysts’ soured, disbelieving expression and hear the incredulous “what is this cr…?”

Welcome to the world of Buy the Unloved, which used to be my favorite annual feature. Begun in 1993, the strategy drew up the indisputable observation that investors tend to be terrible at timing: over and over again they sell at the bottom and buy at the top. So here was the strategy: encourage people to buy what everyone else was selling and sell what everyone else was buying. The implementation was simple:

Identify the three fund categories that saw the greatest outflows, measured by percentage of assets, then buy good funds in each of those categories and prepare to hold them for three years. At the same time identify the three fund categories with the greatest inrush and sell them.

I liked it, it worked, then Morningstar stopped publishing it. Investment advisor Neil Stoloff provided an interesting history of the strategy, detailed on pages 12-16 of a 2011 essay he wrote. When they resumed, the strategy had a far more conservative take: buy the three sectors that saw the greatest outflows measured in total dollar volume and hold them, while selling the most popular sectors.

The problem with, and perhaps strength of, the newer version is that it means that you’ll mostly be limited to playing with your core sectors rather than volatile smaller ones. By way of example, large cap blend holds about $1.6 trillion – a 1% outflow there ($16 billion) would be an amount greater than the total assets in any of the 50 smallest fund categories. Large cap growth at $1.2 trillion is close behind.

Oh, by the way, they haven’t traditionally allowed bond funds to play. They track bond flows but, in a private exchange, Mr. Kinnel allowed that “Generally they are too dull to provide much of a signal.”

Morningstar now faces two problems:

- De facto, the system is rigged to provide “sell” signals on core fund groups.

- Morningstar is not willing to recommend that you ever sell core fund groups.

Katie Reichart’s 2013 presentation of the strategy (annoying video ahead) warned that “It can be used just on the margin…perhaps for a small percentage of their portfolio.” In 2014, it was “Add some to the unloved pile and trim from the loved” and by 2015 there was a flat-out dismissal of it: “I’m sharing the information for those who want to follow the strategy to the letter–but I wouldn’t do it.”

|

The headline: |

The bottom line: |

|

So, I’m sharing the information for those who want to follow the strategy to the letter–but I wouldn’t do it. R. Kinnel |

So what’s happened? Kinnel’s analysis seems odd but might well be consistent with the data:

But since 2008, performance and flows have decoupled on the asset-class level even though they continue to be linked on a fund level.

Now flows are more linked to headlines. Since 2008, some people have taken a pessimistic (albeit incorrect) view of America’s economy and looked to China as a superior bet. It hasn’t worked that way the past five years, and it leaves us in the odd position of seeing the nature of fund flows change.

I don’t actually know what that means.

Morningstar has released complete 2014 fund flow data, by fund family and fund category. (Thanks, Dan!) It reveals that investors fled from:

- US Large Growth (-41 billion)

- Bank Loans (-20 billion)

- High Yield Bonds (-16 billion).

Since two of the three areas are bonds, you’re not supposed to use those as a signal. And since the other is a core category buffeted by headline risk, really there’s nothing there, either. Further down the list, categories such as commodities and natural resources saw outflows of 10% or so. But those aren’t signals, either.

Whither goest investors?

- US Large Blend (+105 billion)

- International Large Blend (+92 billion)

- Intermediate Bonds (+34 billion)

- Non-traditional Bonds (+23 billion)

Two untouchable core categories, two irrelevant bond ones. Meanwhile, the Multialternative category saw an inrush of about 33% of its assets in a year. Too small in absolute terms to matter.

Bottom Line: Get serious or get rid of it. The underlying logic of the strategy is psychological: investors are too cowardly to do the right thing. On face, that’s afflicting Morningstar’s approach to the feature. If the data says it works, they need to screw up their courage and announce the unpopular fact that it might be time to back away from core stock categories. If the data says it doesn’t work, they need to screw up their courage, explain the data and end the game.

Bottom Line: Get serious or get rid of it. The underlying logic of the strategy is psychological: investors are too cowardly to do the right thing. On face, that’s afflicting Morningstar’s approach to the feature. If the data says it works, they need to screw up their courage and announce the unpopular fact that it might be time to back away from core stock categories. If the data says it doesn’t work, they need to screw up their courage, explain the data and end the game.

The current version, “for amusement only,” version serves no real purpose and no one’s interest.

Whitebox Tactical Opportunities 4Q14 Conference Call

Whitebox Tactical Opportunities 4Q14 Conference Call

Portfolio managers Andrew Redleaf and Dr. Jason Cross, along with Whitebox Funds’ President Bruce Nordin and Mike Coffey, Head of Mutual Fund Distribution, hosted the 4th quarter conference call for their Tactical Opportunities Fund (WBMIX) on February 26. Robert Vogel and Paul Twitchell, the fund’s third and fourth portfolio managers, did not participate.

Prolific MFO board contributor Scott first made us aware of the fund in August 2012 with the post “Somewhat Interesting Tiny Fund.” David profiled its more market neutral and less tactical (less directionally oriented) sibling WBLFX in April 2013. I discussed WBMIX in the October 2013 commentary, calling the fund proper “increasingly hard to ignore.” Although the fund proper was young, it possessed the potential to be “on the short list … for those who simply want to hold one all-weather fund.”

Prolific MFO board contributor Scott first made us aware of the fund in August 2012 with the post “Somewhat Interesting Tiny Fund.” David profiled its more market neutral and less tactical (less directionally oriented) sibling WBLFX in April 2013. I discussed WBMIX in the October 2013 commentary, calling the fund proper “increasingly hard to ignore.” Although the fund proper was young, it possessed the potential to be “on the short list … for those who simply want to hold one all-weather fund.”

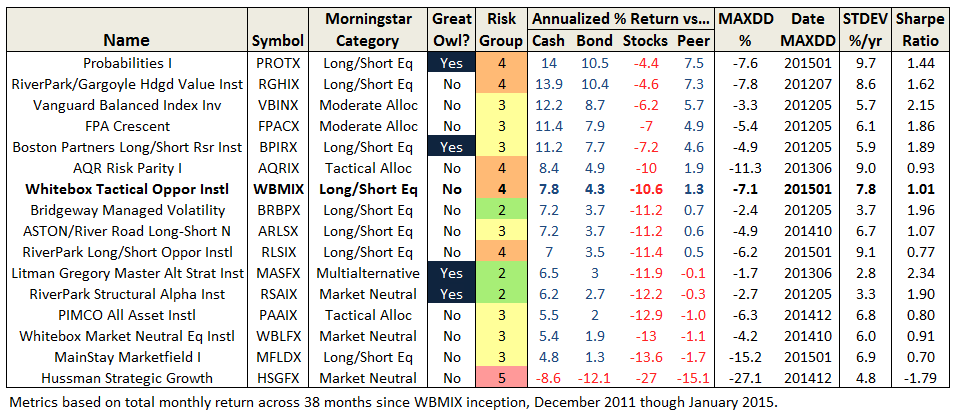

WBMIX recently pasted its three year mark and at $865M AUM is no longer tiny. Today’s question is whether it remains an interesting and compelling option for those investors looking for alternatives to the traditional 60/40 balanced fund at a time of interest rate uncertainty and given the two significant equity drawdowns since 2000.

Mr. Redleaf launched the call by summarizing two major convictions:

- The US equity market is “expensive by just about any measure.” He noted examples like market cap to GDP or Shiller CAPE, comparing certain valuations to pre great recession and even pre great depression. At such valuations, expected returns are small and do not warrant the downside risk they bear, believing there is a “real chance of 20-30-40 even 50% retraction.” In short, “great risk in hope of small gain.”

- The global markets are fraught with risk, still recovering from the great recession. He explained that we were in the “fourth phase of government action.” He called the current phase competitive currency devaluation, which he believes “cannot work.” It provides temporary relief at best and longer term does more harm than good. He seems to support only the initial phase of government stimulus, which “helped markets avert Armageddon.” The last two phases, which included the zero interest rate policy (ZIRP), have done little to increase top-line growth.

Consequently, toward middle of last year, Tactical Opportunities (TO) moved away from its long bias to market neutral. Mr. Redleaf explained the portfolio now looks to be long “reasonably priced” (since cheap is hard to find) quality companies and be short over-priced storybook companies (some coined “Never, Nevers”) that would take many years, like 17, of uninterrupted growth to justify current prices.

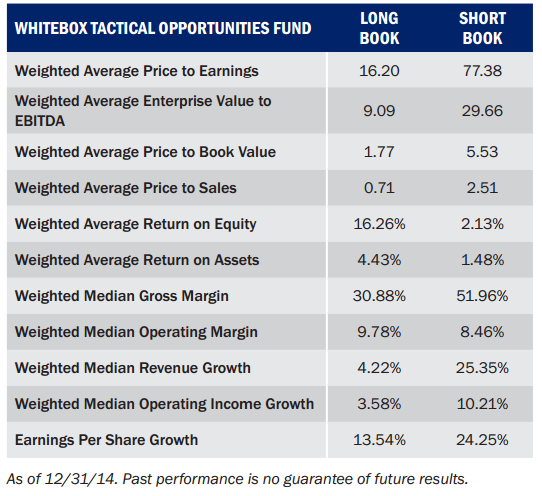

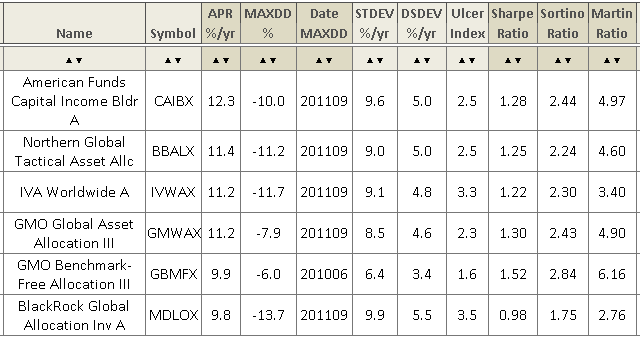

The following table from its recent quarterly commentary illustrates the rationale:

Mr. Redleaf holds a deep contrarian view of efficient market theory. He works to exploit market irrationalities, inefficiencies, and so-called dislocations, like “mispriced securities that have a relationship to each other,” or so-called “value arbitrage.” Consistently guarding against extreme risk, the firm would never put on a naked short. Its annual report reads “…a hedge is itself an investment in which we believe and one that adds, not sacrifices returns.”

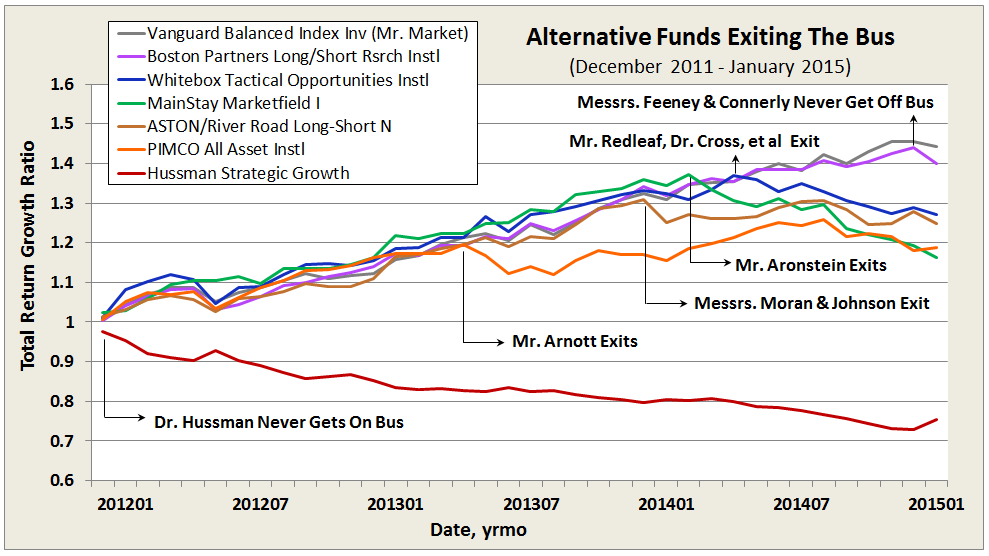

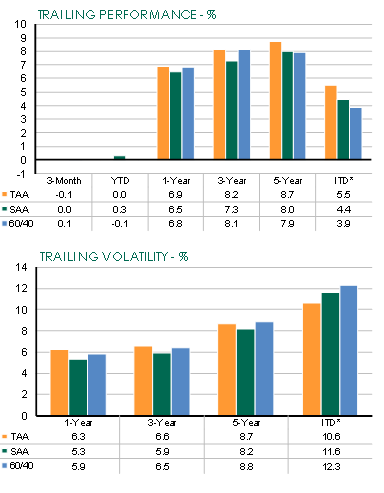

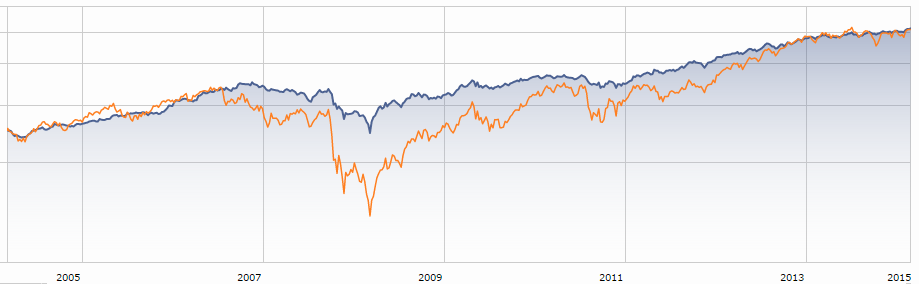

But that does not mean it will not have periods of underperformance and even drawdown. If the traditional 60/40 balanced fund performance represents the “Mr. Market Bus,” Whitebox chose to exit middle of last year. As can be seen in the graph of total return growth since WBMIX inception, Mr. Redleaf seems to be in good company.

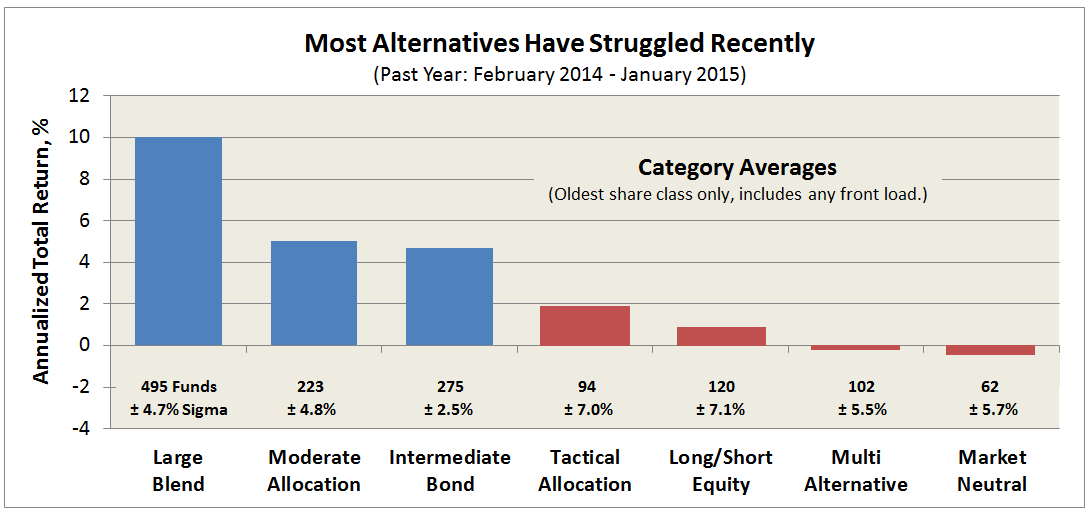

Whether the “exit” was a because of deliberate tactical moves, like a market-neutral stance, or because particular trades, especially long/short trades went wrong, or both … many alternative funds missed-out on much of the market’s gains this past year, as evidenced in following chart:

But TO did not just miss much of the upside, it’s actually retracted 8% through February, based on month ending total returns, the greatest amount since its inception in December 2011; in fact, it has been retracting for ten consecutive months. Their explanation:

Our view of current opportunity has been about 180 degrees opposite Mr. Market’s. Currently, we love what we’d call “intelligent value” while Mr. Market apparently seems infatuated with what we’d call “unsustainable growth.”

Put bluntly, the stocks we disfavored most (and were short) were among the stocks investors remained enamored with.

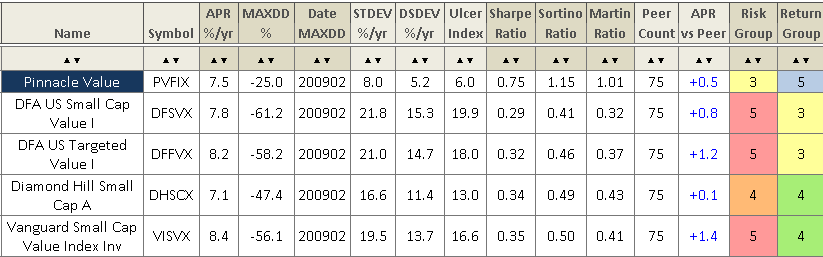

A more conservative strategy would call for moving assets to cash. (Funds like ASTON RiverRoad Independent Value, which has about 75% cash. Pinnacle Value at 50%. And, FPA Crescent at 44%.) But TO is more aggressive, with attendant volatilities above 75% of SP500, as it strives to “produce competitive returns under multiple scenarios.” This aspect of the fund is more evident now than back in October 2013.

Comparing its performance since launch against other long-short peers and some notable alternatives, WBMIX now falls in the middle of the pack, after a strong start in 2012/13 but disappointing 2014:

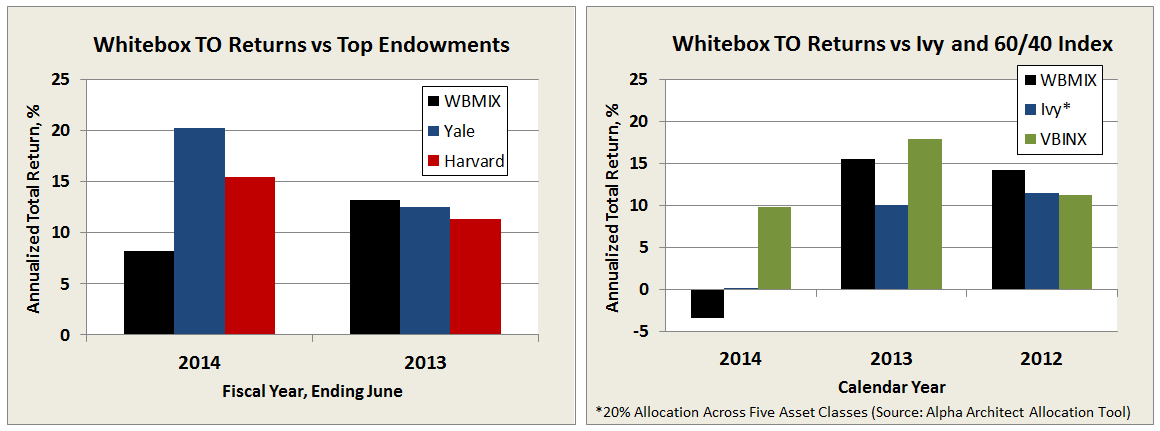

From the beginning, Mr. Redleaf has hoped TO would be judged in comparison to top endowments. Below are a couple comparisons, first against Yale and Harvard, which report on fiscal basis, and second against a simple Ivy asset allocation (computed using Alpha Architect’s Allocation Tool) and Vanguard’s 60/40 Balanced Index. Again, a strong showing in 2012/13, but 2014 was a tough year for TO (and Ivy).

Looking beyond strategy and performance, the folks at Whitebox continue to distinguish themselves as leaders in shareholder friendliness – a much welcomed and refreshing attribute, particularly with former hedge fund shops now offering the mutual funds and ETFs. Since last report:

- They maintain a “culture of transparency and integrity,” like their name suggests providing timely and thoughtful quarterly commentaries, published on their public website, not just for advisors. (In stark contrast to other firms, like AQR Funds, which in the past have stopped publishing commentaries during periods of underperformance, no longer make commentaries available without an account, and cater to Accredited Investors and Qualified Eligible Persons.)

- They now benchmark against SP500 total return, not just SPX.

- They eliminated the loaded advisor share class.

- Their expense ratio is well below peer average. Institutional shares, available at some brokerages for accounts with $100K minimum, have been running between 1.25-1.35%. They impose a voluntary cap of 1.35%, which must be approved by its board annually, but they have no intention of ever raising … just the opposite as AUM grows, says Mr. Coffey. (The cap is 1.6% for investor shares, symbol WBMAX.)

These ratios exclude the mandatory reporting of dividend and interest expense on short sales and acquired fund fees, which make all long/short funds inherently more expensive than long only equity funds. The former has been running about 1%, while the latter is minimal with selective index ETFs.

- They do not charge a short-term redemption fee.

All that said, they could do even better going forward:

- While Mr. Redleaf has over $1M invested directly with the fund, the most recent SAI dated 15 January 2015, indicates that the other three portfolio managers have zero stake. A spokesman for the fund defends “…as a smaller company, the partners’ investment is implicit rather than explicit. They have ‘Skin in the game,’ as a successful Tac Ops increases Whitebox’s profitability and on the other side of the coin, they stand to lose.”

David, of course, would argue that there is an important difference: Direct shareholders of a fund gain or lose based on fund performance, whereas firm owners gain or lose based on AUM.

Ed, author of two articles on “Skin in the Game” (Part I & Part II), would warn: “If you want to get rich, it’s easier to do so by investing the wealth of others than investing your own money.”

- Similarly, the SAI shows only one of its four trustees with any direct stake in the fund.

- They continue to impose a 12b-1 fee on their investor share class. A simpler and more equitable approach would be to maintain a single share class eliminating this fee and continue to charge lowest expenses possible.

- They continue to practice a so-called “soft money” policy, which means the fund “may pay higher commission rates than the lowest available” on broker transactions in exchange for research services. Unfortunately, this practice is widespread in the industry and investors end-up paying an expense that should be paid for by the adviser.

In conclusion, does the fund’s strategy remain interesting? Absolutely. Thoughtfulness, logic, and “arithmetic” are evident in each trade, in each hedge. Those trades can include broad asset classes, wherever Mr. Redleaf and team deem there are mispriced opportunities at acceptable risk.

Another example mentioned on the call is their longstanding large versus small theme. They believe that small caps are systematically overpriced, so they have been long on large caps while short on small caps. They have seen few opportunities in the credit markets, but given the recent fall in the energy sector, that may be changing. And, finally, first mentioned as a potential opportunity in 2013, a recent theme is their so-called “E-Trade … a three‐legged position in which we are short Italian and French sovereign debt, short the euro (currency) via put options, and long US debt.”

Does the fund’s strategy remain compelling enough to be a candidate for your one all-weather fund? If you share a macro-“market” view similar to the one articulated above by Mr. Redleaf, the answer to that may be yes, particularly if your risk temperament is aggressive and your timeline is say 7-10 years. But such contrarianism comes with a price, shorter-term at least.

During the call, Dr. Cross addressed the current drawdown, stating that “the fund would rather be down 8% than down 30% … so that it can be positioned to take advantage.” This “positioning” may turn out to be the right move, but when he said it, I could not help but think of a recent post by MFO board member Tampa Bay:

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.” – Peter Lynch

Mr. Redleaf is no ordinary investor, of course. His bet against mortgages in 2008 is legendary. Whitebox Advisers, LLC, which he founded in 1999 in Minneapolis, now manages more than $4B.

He concluded the call by stating the “path to victory” for the fund’s current “intelligent value” strategy is one of two ways: 1) a significant correction from current valuations, or 2) a fully recovered economy with genuine top-line growth.

Whitebox Tactical Opportunities is facing its first real test as a mutual fund. While investors may forgive not making money during an upward market, they are notoriously unforgiving losing money (eg., Fairholme 2011), perhaps unfairly and perhaps to their own detriment, but even over relatively short spans and even if done in pursuit of “efficient management of risk.”

We’ve Seen This Movie Before

We’ve Seen This Movie Before

By Edward Studzinski

“We do not have to visit a madhouse to find disordered minds; our planet is the mental institution of the universe.” Goethe

For students of the stock market, one of the better reads is John Brooks’, The Go-Go Years. It did a wonderful job of describing the rather manic era of the 60’s and 70’s (pre-1973). One of the arguments made then was that the older generation of money managers was out of touch with both technology and new investment ideas. This resulted in a youth movement on Wall Street, especially in the investment management firms. You needed to have a “kid” as a portfolio manager, which was taken to its logical conclusion in a cartoon which showed an approximately ten-year old sitting behind a desk, looking at a Quotron machine. Around 2000, a similar youth movement came along during the dot.com craze, where once again investment managers, especially value managers, were told that their era was over, that they didn’t understand the new way and new wave of investing. Each of those two eras ended badly for those who had entrusted their assets to what was in vogue at the time.

In 2008, we had a period of over-valuation in the markets that was pretty clear in terms of equities. We also had what appears in retrospect to have been the deliberate misrepresentation and marketing of certain categories of fixed income investments to those who should have known better and did not. This resulted in a market meltdown that caused substantial drawdowns in value for many equity mutual funds, in a range of forty to sixty per cent, causing many small investors to panic and suffer a permanent loss of capital which many of them could not afford nor replace. The argument of many fund managers who had invested in their own funds (and as David has often written about, many do not), was that they too had skin in the game, and suffered the losses alongside of their investors.

Let’s run some simple math. Assume a fund management firm that at 2/27/2015 has $100 billion in assets under management. Assets are equities, a mix of international and domestic, the international with fees and expenses of 1.30% and the domestic with fees and expenses of 0.90%. Let’s assume a 50/50 international/domestic split of assets, so $50 billion at 0.90% and $50 billion at 1.30%. This results in $1.1billion in fees and expenses to the management company. Assuming $300 million goes in expenses to non-investment personnel, overhead, and the other expenses that you read about in the prospectus, you could have $800 million to be divided amongst the equity owners of the management firm. In a world of Marxian simplicity, each partner is getting $40 million dollars a year. But, things are often not simple if we take the PIMCO example. Allianz as owners of the firm, having funded through their acquisitions the buy-out of the founders, may take 50% of profits or revenues off the top. So, each equal-weighted equity owner may only be getting paid $20 million a year. Assets under management may go down with the market sell-off so that fees going forward go down. But it should be obvious that average mutual fund investors are not at parity with the fund managers in risk exposure or tolerance.

Why am I beating this horse into the ground again? U.S. economic growth for the final quarter was revised down from the first reported estimate of 2.6% to 2.2%. More than 440 of the companies in the S&P 500 index had reported Q4 numbers by the end of last week showed revenue growth of 1.5% versus 4.1% in the previous quarter. Earnings increased at an annual rate that had slowed to 5.9% from 10.4% in the previous quarter. Earnings downgrades have become more frequent.

Why then has the market been rising – faith in the Federal Reserve’s QE policy of bond repurchases (now ended) and their policy of keeping rates low. Things on the economic front are not as good as we are being told. But my real concern is that we have become detached from thinking about the value of individual investments, the margin of safety or lack thereof, and our respective time horizons and risk tolerances. And I will not go into at this time, how much deflation and slowing economies are of concern in the rest of the world.

Look at the energy sector, where the price of oil has come down more than 50% since the 2014 high. Each time we see a movement in the price of oil, as well as in the futures, we see swings in the equity prices of energy companies. Should the valuations of those companies be moving in sync with energy prices, and are the balance sheets of each of those companies equal? No, what you are seeing is the algorithmic trading programs kicking in, with large institutional investors and hedge funds trying to grind out profits from the increased volatility. Most of the readers of this publication are not playing the same game. Indeed they are unable to play that game.

So I say again, focus upon your time horizons and risk tolerance. If your investment pool represents the accumulation of your life’s work and retirement savings, your focus should be not on how much you can make but rather how much you can afford to lose. As the U.S. equity market has continued to hit one record high after another, recognize that it is getting close to trading at nearly thirty times long-term, inflation-adjusted earnings. In 2014, the S&P 500 did not fall for more than three consecutive days.

We are in la-la land, and there is little margin for error in most investment opportunities. On January 15, 2015, when the Swiss National Bank eliminated its currency’s Euro-peg, the value of that currency moved 30% in minutes, wiping out many currency traders in what were thought to be low-risk arbitrage-like investments.

What should this mean for readers of this publication? We at MFO have been looking for absolute value investors. I can tell you that they are in short supply. Charlie Munger had some good advice recently, which others have quoted and I will paraphrase. Focus on doing the easy things. Investment decisions or choices that are complex, and by that I mean things that include shorting stocks, futures, and the like – leave that to others. One of the more brilliant value investors and a contemporary of Benjamin Graham, Irving Kahn, passed away last week. He did very well with 50% of his assets in cash and 50% of his assets in equities. For most of us, the cash serves as a buffer and as a reserve for when the real, once in a lifetime, opportunities arise. I will close now, as is my wont, with a quote from a book, The Last Supper, by one of the great, under-appreciated American authors, Charles McCarry. “Do you know what makes a man a genius? The ability to see the obvious. Practically nobody can do that.”

Top developments in fund industry litigation

Fundfox, launched in 2012, is the mutual fund industry’s only litigation intelligence service, delivering exclusive litigation information and real-time case documents neatly organized and filtered as never before. For a complete list of developments last month, and for information and court documents in any case, log in at www.fundfox.com and navigate to Fundfox Insider.

Fundfox, launched in 2012, is the mutual fund industry’s only litigation intelligence service, delivering exclusive litigation information and real-time case documents neatly organized and filtered as never before. For a complete list of developments last month, and for information and court documents in any case, log in at www.fundfox.com and navigate to Fundfox Insider.

New Lawsuits

The Calamos Growth Fund is the subject of a new section 36(b) lawsuit that alleges excessive advisory and 12b-1 fees. The complaint alleges that Calamos extracted higher investment advisory fees from the Growth Fund than from “third-party, arm’s length institutional clients,” even though advisory services were “similar” and “in some cases effectively identical.” (Chill v. Calamos Advisors LLC.)

A new lawsuit accuses T. Rowe Price of infringing several patents relating to management of its target-date funds. (GRQ Inv. Mgmt., LLC v. T. Rowe Price Group, Inc.)

New Appeal

Plaintiffs have appealed a district court’s dismissal of state-law claims against Vanguard regarding fund holdings of gambling-related securities. The district court held that the claims were time barred and, alternatively, that the fund board’s refusal to pursue plaintiffs’ litigation demand was protected by the business judgment rule. Defendants include independent directors. (Hartsel v. Vanguard Group, Inc.)

Settlements

ERISA class action plaintiffs filed an unopposed motion to settle their claims against Northern Trust for $36 million. The lawsuit alleged mismanagement of the securities lending program in which collective trust funds participated. (Diebold v. N. Trust Invs., N.A.)

In an interrelated class action against Northern Trust that asserts non-ERISA claims, plaintiffs filed an unopposed motion to partially settle the lawsuit for $24 million. The settlement covers plaintiffs who participated in the securities lending program indirectly (i.e., through investments in commingled investment funds); the litigation will continue with respect to plaintiffs who participated directly (i.e., through a securities lending agreement with Northern Trust). (La. Firefighters’ Ret. Sys. v. N. Trust Invs., N.A.)

The Alt Perspective: Commentary and news from DailyAlts.

By Brian Haskin, editor of DailyAlts.com

By Brian Haskin, editor of DailyAlts.com

February is in the books, and fortunately it ended with a significant decline in volatility, and a nice rally in the equity market. Bonds took it on the chin as rates rose over the month, but commodities rallied on the back of rising oil prices over the month. In the alternative mutual fund are, all of the major categories put up positive returns over the month, with long/short equity leading the way with a category return of 1.88%, according to Morningstar. Multi-alternative funds posted a category return of 0.98%, while non-traditional bonds ended the month 0.88% higher and managed futures funds added 0.47%.

Industry Evolution

The liquid alternatives industry continues to evolve in many ways, the most obvious of which is the continuous launch of new funds. However, we are now beginning to see more activity and consolidation of players at the company level. In December of 2014, we ended the year with New York Life’s MainStay arm purchasing IndexIQ, an alternative ETF provider. This acquisition gave MainStay immediate access to two of the hottest segments of the investment field, all in one package: active ETFs and liquid alternatives.

In February, we saw two more firms combine forces with Salient Partner’s purchase of Forward Management. Both firms have strong footholds in the liquid alternatives market, and the combination of the two firms will expend both their product platforms and distribution capabilities. Scale becomes more important as competition continues to grow. Expect more mergers over the year as firms jockey for position.

Waking Giants

Aside from merger activity, some firms just finally wake up and realize there is an opportunity passing them by. Columbia Management is one of them. The firm has been making some moves over the past few months with new hires and product filings, and finally put the pedal to the metal this month and launched a new alternative mutual fund in partnership with Blackstone. At the same time, Columbia rationalized some of their existing offerings and announced the termination terminated three alternative mutual funds that were launched more than three years ago.

In addition to Columbia, American Century has decided to formalize their liquid alternatives business with new branding (AC Alternatives) and three new alternative mutual funds. These new funds join a stable of two equity market neutral funds and two long/short “130-30” funds (these funds remain beta 1 funds but increase their long exposure to 130% of the portfolio’s value and offset that with 30% shorting, bringing the fund to a net long position of 100%). With at least five alternative mutual funds (the 130-30 funds are technically not liquid alternatives since they are beta 1 funds), American Century will have a solid stable of products to roll under their new AC Alternatives brand that has been created just for their liquid alternatives business.

Featured New Funds

February new fund activity picked up over January with a few notable new funds that hit the market. One theme that has emerged is the growth of globally focused long/short equity funds. Up until last year, a large majority of long/short equity funds were focused on US equities, however last year, firms began introducing funds that could invest in globally developed and emerging markets. The Boston Partners Global Long/Short Fund was one of note, and was launched after the firm had closed its first two long/short equity funds.

This increased diversity of funds is good for both asset managers and investors. Asset managers have a larger global pond in which to fish, thus creating more opportunities, while investors can diversify across both domestic and globally focused funds. Four new funds of note are as follows:

Meeder Spectrum Fund – This is the firm’s first alternative mutual fund, but not their first unconstrained fund. The fund will use a quantitative process to create a globally allocated long/short equity fund, and will use both stocks and other mutual funds or ETFs to implement its strategy. The fund’s management fee is a reasonable 0.75%.

Stone Toro Market Neutral Fund – While described as market neutral, the fund can move between -10% net short to +60% net long. This means that the fund will likely have some beta exposure, but it does allocate globally to both developed and emerging market stocks using an arbitrage approach that looks for structural imperfections related to investor behavior and corporate actions. This is different from the traditional valuation driven approach and could prove to add some value in ways other funds will not.

PIMCO Multi-Strategy Alternative Fund – This fund will allocate to a range of PIMCO alternative mutual funds, including alternative asset classes such as commodities and real assets. Research Affiliates will also sub-advise on the fund and assist in the allocation to funds advised by Research Affiliates.

Columbia Adaptive Alternatives Fund – launched in partnership with Blackstone, this fund invests across three different sleeves (one of which is managed by Blackstone), and allocates to twelve different investment strategies. Lots of complexity here – give it time to see what it can deliver.

While there is plenty more news and fund activity to discuss, let’s call it a wrap there. If you would like to receive daily or weekly updates on liquid alternatives, feel free to sign up for our free newsletter: http://dailyalts.com/mailinglist.php.

Observer Fund Profiles:

Each month the Observer provides in-depth profiles of between two and four funds. Our “Most Intriguing New Funds” are funds launched within the past couple years that most frequently feature experienced managers leading innovative newer funds. “Stars in the Shadows” are older funds that have attracted far less attention than they deserve.

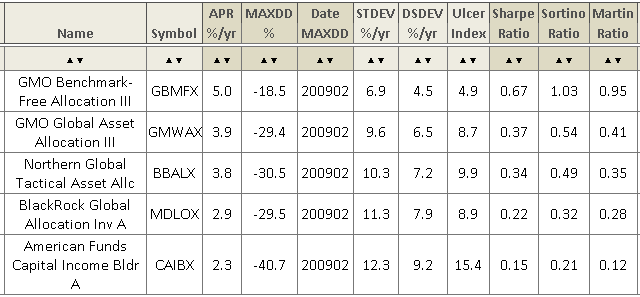

Northern Global Tactical Asset Allocation (BBALX): This fund is many things: broadly diversified, well designed, disciplined, low priced and successful. It is not, however, a typical “moderate allocation” fund. As such, it’s imperative to get past the misleading star rating (which has ranged from two to five) to understand the fund’s distinctive and considerable strengths.

Pinnacle Value (PVFIX): If they (accurately) rebranded this as Pinnacle Hedged Microcap Value, the liquid alts crowd would be pounding on the door (and Mr. Deysher would likely be bolting it). While it doesn’t bear the name, the effect is the same: hedged exposure to a volatile asset class with a risk-return profile that’s distinctly asymmetrical to the upside.

Elevator Talk: Waldemar Mozes, ASTON/TAMRO International Small Cap (AROWX/ATRWX)

Since the number of funds we can cover in-depth is smaller than the number of funds worthy of in-depth coverage, we’ve decided to offer one or two managers each month the opportunity to make a 200 word pitch to you. That’s about the number of words a slightly-manic elevator companion could share in a minute and a half. In each case, I’ve promised to offer a quick capsule of the fund and a link back to the fund’s site. Other than that, they’ve got 200 words and precisely as much of your time and attention as you’re willing to share. These aren’t endorsements; they’re opportunities to learn more.

Since the number of funds we can cover in-depth is smaller than the number of funds worthy of in-depth coverage, we’ve decided to offer one or two managers each month the opportunity to make a 200 word pitch to you. That’s about the number of words a slightly-manic elevator companion could share in a minute and a half. In each case, I’ve promised to offer a quick capsule of the fund and a link back to the fund’s site. Other than that, they’ve got 200 words and precisely as much of your time and attention as you’re willing to share. These aren’t endorsements; they’re opportunities to learn more.

Waldemar Mozes manages AROWX which launched at the end of December 2014. The underlying strategy, however, has a record that’s either a bit longer or a lot longer, depending on whether you’re looking at the launch of separately managed accounts in this style (from April 2013) or the launch of TAMRO’s investment strategy (2000), of which this is just a special application. Mr. Mozes joined TAMRO in 2008 after stints with Artisan Partners and The Capital Group, adviser to the American Funds.

TAMRO uses the same strategy in their private accounts and all three of the funds they sub-advise for Aston:

… we identify undervalued companies with a competitive advantage. We attempt to mitigate our investment risk by purchasing stocks where, by our calculation, the potential gain is at least three times the potential loss (an Upside reward-to-Downside risk ratio of 3:1 or greater). While our investments fall into three different categories – Leaders, Laggards and Innovators – all share the key characteristics of success:

-

Differentiated product or service offering

-

Capable and motivated leadership

-

Financial flexibility

As a business development matter, Mr. Mozes proposed extending the strategy to the international small cap arena. There are at least three reasons why that made sense:

- The ISC universe is huge. Depending on who’s doing the calculation, there are 10,000 – 25,000 stocks.

- It is the one area demonstrably ripe for active managers to add value. The average ISC stock is covered by fewer than five analysts and it’s the only area where the data shows the majority of active managers consistently outperforming passive products. Across standard trailing time periods, international small caps outperform international large caps with higher Sharpe and Sortino ratios.

- Most investors are underexposed to it. International index funds (e.g, BlackRock International Index MDIIX, Schwab International IndexSWISX, Rowe Price International Index PIEQX or Vanguard Total International Stock Index VGTSX) typically commit somewhere between none of their portfolio (BlackRock, Price, Schwab) to up a tiny slice (Vanguard) to small caps. Of the 10 largest actively managed international funds, only one has more than 2% in small caps.

There are very few true international small cap funds worth examining since most that claim to be small cap actually invest more in mid- and large-cap stocks than in actual small caps. Here are Waldemar’s 268 words on why you should add AROWX to your due-diligence list:

At TAMRO, our objective is to invest in high-quality companies trading below their intrinsic value due to market misperceptions. This philosophy has enabled our domestic small cap strategy to beat its benchmark, 10 of the past 14 calendar years. We’re confident, after 3+ years of rigorous testing and nearly a two-year composite performance track record, that it will work for international small cap too.

Here’s why:

Bigger Universe = Bigger Opportunity. The international equity universe is three times larger than the domestic universe and probably contains both three times as many high-quality and three times as many poorly-run companies. We exploit this weakness by focusing on quality: businesses that generate high and consistent ROIC/ROE, are run by skilled capital allocators, and produce enough free cash flow to self-fund growth without excessive leverage or dilution. But we also care deeply about downside risk, which is why our valuation mantra is: the price you pay dictates your return.

GDP Always Growing Somewhere. Smaller companies tend to be the engines of local economic growth and GDP is always growing somewhere. We use a proprietary screening tool that provides a timely list of potential research ideas based on fundamental and valuation characteristics. It’s not a black box, but it does flag companies, industries, or countries that might otherwise be overlooked.

Something Different. One reason international small-cap as an asset class has such great appeal is lower correlation. We strive to build on this advantage with a concentrated (40-60 positions), quality-biased portfolio. Ultimately, we care little about growth/value styles and focus on market-beating returns with high active share, low tracking error, and low turnover.

ASTON/TAMRO International Small Cap has a $2500 minimum initial investment which is reduced to $500 for IRAs and other types of tax-advantaged accounts. Expenses are capped at 1.50% on the investor shares and 1.25% for institutional shares, with a 2.0% redemption fee on shares sold within 90 days. The fund has about gathered about $1.3 million in assets since its December 2014 launch. Here’s the fund’s homepage. It’s understandably thin on content yet but there’s some fairly rich analysis on the TAMRO Capital page devoted to the underlying strategy.

Conference Call Highlights: Guinness Atkinson Global Innovators

Every month through the winter, the Observer conspires to give folks the opportunity to do something rare and valuable: to hear directly from managers, to put questions to them in-person and to listen to the quality of the unfiltered answers. A lot of funds sponsor quarterly conference calls, generally web-based. Of necessity, those are cautious affairs, with carefully screened questions and an acute awareness that the compliance folks are sitting there. Most of the ones I’ve attended are also plagued by something called a “slide deck,” which generally turns out to be a numbing array of superfluous PowerPoint slides. We try to do something simpler and more useful: find really interesting folks, let them talk for just a little while and then ask them intelligent questions – yours and mine – that they don’t get to rehearse the answers to. Why? Because the better you understand how a manager thinks and acts, the more likely you are to make a good decision about one.

Every month through the winter, the Observer conspires to give folks the opportunity to do something rare and valuable: to hear directly from managers, to put questions to them in-person and to listen to the quality of the unfiltered answers. A lot of funds sponsor quarterly conference calls, generally web-based. Of necessity, those are cautious affairs, with carefully screened questions and an acute awareness that the compliance folks are sitting there. Most of the ones I’ve attended are also plagued by something called a “slide deck,” which generally turns out to be a numbing array of superfluous PowerPoint slides. We try to do something simpler and more useful: find really interesting folks, let them talk for just a little while and then ask them intelligent questions – yours and mine – that they don’t get to rehearse the answers to. Why? Because the better you understand how a manager thinks and acts, the more likely you are to make a good decision about one.

In February with spoke with Matthew Page and Ian Mortimer of the Guinness Atkinson funds. Both of their funds have remarkable track records, we’ve profiled both and I’ve had good conversations with the team on several occasions. Here’s what we heard on the call.

The guys run two strategies for US investors. The older one, Global Innovators, is a growth strategy that Guinness has been pursuing for 15 years. The newer one, Dividend Builder, is a value strategy that the managers propounded on their own in response to a challenge from founder Tim Guinness. These strategies are manifested in “mirror funds” open to European investors. Curiously, American investors seem taken by the growth strategy ($180M in the US, $30M in the Euro version) while European investors are prone to value ($6M in the US, $120M in the Euro). Both managers have an ownership stake in Guinness Atkinson and hope to work there for 30 years, neither is legally permitted to invest in the US version of the strategy, both intend – following some paperwork – to invest their pensions in the Dublin-based version. The paperwork hang up seems to affect, primarily, the newer Dividend Builder (in Europe, “Global Equity Income”) strategy and I failed to ask directly about personal investment in the older strategy.

The growth strategy, Global Innovators IWIRX, starts by looking for firms “doing something smarter than the average company in their industry. Being smarter translates, over time, to higher return on capital, which is the key to all we do.” They then buy those companies when they’re underpriced. The fund holds 30 equally-weighted positions.

Innovators come in two flavors: disruptors – early stage growth companies, perhaps with recent IPOs, that have everyone excited and continuous improvers – firms with a long history of using innovation to maintain consistently high ROC. In general, the guys prefer the latter because the former tend to be wildly overpriced and haven’t proven their ability to translate excitement into growth.

The example they pointed to was the IPO market. Last year they looked at 180 IPOs. Only 60 of those were profitable firms and only 6 or 7 of the stocks were reasonably priced (p/e under 20). Of those six, exactly one had a good ROC profile but its debt/equity ratio was greater than 300%. So none of them ended up in the portfolio. Matthew observes that their portfolio is “not pure disruptors. Though those can make you look extremely clever when they go right, they also make you look extremely stupid when they go wrong. We would prefer to avoid that outcome.”

This also means that they are not looking for a portfolio of “the most innovative companies in the world.” A commitment to innovation provides a prism or lens through which to identify excellent growth companies. That’s illustrated in the separate paths into the portfolio taken by disruptors and continuous improvers. With early stage disruptors, the managers begin by looking for evidence that a firm is truly innovative (for example, by looking at industry coverage in Fast Company or MIT’s Technology Review) and then look at the prospect that innovation will produce consistent, affordable growth. For the established firms, the team starts with their quantitative screen that finds firms with top 25% return on capital scores in every one of the past ten years, then they pursue a “very subjective qualitative assessment of whether they’re innovative, how they might be and how those innovations drive growth.”

In both cases, they have a “watch list” of about 200-250 companies but their discipline tends to keep many of the disruptors out because of concerns about sustainability and price. Currently there might be one early stage firm in the portfolio and lots of Boeing, Intel, and Cisco.

They sell when price appreciates (they sold Shire pharmaceuticals after eight months because of an 80% share-price rise), fundamentals deteriorate (fairly rare – of the firms that pass the 10 year ROC screen, 80% will continue passing the screen for each of the subsequent five years) or the firm seems to have lost its way (shifting, for example, from organic growth to growth-through-acquisition).

The value strategy, Dividend Builder GAINX is a permutation of the growth strategy’s approach to well-established firms. The value strategy looks only at dividend-paying companies that have provided an inflation-adjusted cash flow return on investment of at least 10% in each of the last 10 years. The secondary screens require at least a moderate dividend yield, a history of rising dividends, low levels of debt and a low payout ratio. In general, they found a high dividend strategy to be a loser and a dividend growth one to be a winner.

In general, the guys are “keen to avoid getting sucked into exciting stories or areas of great media interest. We’re physicists, and we quite like numbers rather than stories.” They believe that’s a competitive advantage, in part because listening to the numbers rather than the stories and maintaining a compact, equal-weight portfolio both tends to distance them from the herd. The growth strategy’s active share, for instance, is 94. That’s extraordinarily high for a strategy with a de facto large cap emphasis.

Bottom line: I’m intrigued by the fact that this fund has consistently outperformed both as a passive product and as an active one and with three different sets of managers. The gain is likely a product of what their discipline consciously and uniquely excludes, firms that don’t invest in their futures, as what it includes. The managers’ training as physicists, guys avowedly wary of “compelling narratives” and charismatic CEOs, adds another layer of distinction.

We’ve gathered all of the information available on the two Guinness Atkinson funds, including an .mp3 of the conference call, into its new Featured Fund page. Feel free to visit!

Conference Call Upcoming: RiverPark Focused Value

We’d be delighted if you’d join us on Tuesday, March 17th, from 7:00 – 8:00 Eastern, for a conversation with David Berkowitz and Morty Schaja of the RiverPark Funds. Mr. Berkowitz has been appointed as RiverPark’s co-chief investment officer and is set to manage the newly-christened RiverPark Focused Value Fund (RFVIX/RFVFX) which will launch on March 31.

We’d be delighted if you’d join us on Tuesday, March 17th, from 7:00 – 8:00 Eastern, for a conversation with David Berkowitz and Morty Schaja of the RiverPark Funds. Mr. Berkowitz has been appointed as RiverPark’s co-chief investment officer and is set to manage the newly-christened RiverPark Focused Value Fund (RFVIX/RFVFX) which will launch on March 31.

It’s unprecedented for us to devote a conference call to a manager whose fund has not launched, much less one who also has no public performance record. So why did we?

Mr. Berkowitz seems to have had an eventful career. Morty describes it this way:

David’s investment career began in 1992, when, with a classmate from business school, he founded Gotham Partners, a value-oriented investment partnership. David co-managed Gotham from inception through 2002. In 2003, he joined the Jack Parker Corporation, a New York family office, as Chief Investment Officer; in 2006, he launched Festina Lente, a value-oriented investment partnership; and in 2009 joined Ziff Brothers Investments where he was a Partner and Chief Risk and Strategy Officer.

It will be interesting to talk about why a public fund for the merely affluent is a logical next step in his career and how he imagines the structural differences might translate to differences in his portfolio.

RiverPark’s record on identifying first-tier talent is really good. Pretty much all of the RiverPark funds have met or exceeded any reasonable expectation. In addition, they tend to be distinctive funds that don’t fit neatly into style boxes or fund categories. In general they represent thoughtful, distinctive strategies that have been well executed.

Good value investors are in increasingly short supply. When you reach the point that everyone’s a value investor, then no one is. It becomes just a sort of rhetorical flourish, devoid of substance. As the market ascends year after year, fewer managers take the career risk of holding out for deeply-discounted stocks. Mr. Berkowitz professes a commitment to a compact, high commitment portfolio aiming for “substantial discounts to conservative assessments of value.” As a corollary to a “high commitment” mindset, Mr. Berkowitz is committing $10 million of his own money to seed the fund, an amount supplemented by $2 million from the other RiverPark folk. It’s a promising gesture.

Andrew Foster of Seafarer Overseas Growth & Income (SFGIX) has agreed to join us on April 16. We’ll share details in our April issue.

HOW CAN YOU JOIN IN?

If you’d like to join in the RiverPark call, just click on register and you’ll be taken to the Chorus Call site. In exchange for your name and email, you’ll receive a toll-free number, a PIN and instructions on joining the call. If you register, I’ll send you a reminder email on the morning of the call.

If you’d like to join in the RiverPark call, just click on register and you’ll be taken to the Chorus Call site. In exchange for your name and email, you’ll receive a toll-free number, a PIN and instructions on joining the call. If you register, I’ll send you a reminder email on the morning of the call.

Remember: registering for one call does not automatically register you for another. You need to click each separately. Likewise, registering for the conference call mailing list doesn’t register you for a call; it just lets you know when an opportunity comes up.

WOULD AN ADDITIONAL HEADS UP HELP?

Over four hundred readers have signed up for a conference call mailing list. About a week ahead of each call, I write to everyone on the list to remind them of what might make the call special and how to register. If you’d like to be added to the conference call list, just drop me a line.

Launch Alert

At the end of January, T. Rowe Price launched their first two global bond funds. The more interesting of the two might be T. Rowe Price Global High Income Bond Fund (RPIHX). The fund will seek high income, with the prospect of some capital appreciation. The plan is to invest in a global portfolio of corporate and government high yield bonds and in floating rate bank loans. The portfolio sports a 5.86% dividend yield.

It’s interesting, primarily, because of the strength of its lead managers. It will be managed by Michael Della Vedova and Mark Vaselkiv. Mr. Della Vedova runs Price’s European high-yield fund, which Morningstar UK rates as a four-star fund with above average returns and just average risk. Before joining Price in 2009, he was a cofounder and partner of Four Quarter Capital, a credit hedge fund focusing on high-yield European corporate debt. There’s a video interview with Mr. Della Vedova on Morningstar’s UK site. (Warning: the video begins playing automatically and somewhat loudly.) Mr. Vaselkiv manages Price’s first-rate high yield bond fund which is closed to new investors. He’s been running the fund since 1996 and has beaten 80% of his peers by doing what Price is famous for: consistent, disciplined performance, lots of singles and no attempts to goose returns by swinging for the fences. His caution might be especially helpful now if he’s right that we’re “in the late innings of an amazing cycle.” With European beginning to experiment with negative interest rates on its investment grade debt, carefully casting a wider net might well be in order.

The opening expense ratio is 0.85%. The minimum initial investment is $2,500, reduced to $1,000 for IRAs.

Funds in Registration

After months of decline, the number of new no-load funds in the pipeline, those in registration with the SEC for April launch, has rebounded a bit. There are at least 16 new funds on the way. A couple make me just shake my head, though they certainly will have appeal to fans of Rube Goldberg’s work. There are also a couple niche funds – a luxury brands fund and an Asian sustainability one – that might have merit beyond their marketing value, though I’m dubious. That said, there are also a handful of intriguing possibilities:

American Century is launching a series of multi-manager alternative strategies funds.

Brown Advisory is launching a global leaders fund run by a former be head of Asian equities for HSBC.

Brown Capital Management is planning an international small cap fund run by the same team that manages their international large growth fund.

They’re all detailed on the Funds in Registration page.

Manager Changes

February was a month that saw a number of remarkable souls passing from this vale of tears. Irving Kahn, Benjamin Graham’s teaching assistant and Warren Buffett’s teacher, passed away at 109. All of his siblings also lived over 100 years. Jason Zweig published a nice remembrance of him, “Investor Irving Kahn, Disciple of Benjamin Graham, Dies at 109,” which you can read if you Google the title but which I can’t directly link to. Leonard Nimoy, whose first autobiography was entitled I Am Not Spock (1975), died of chronic obstructive pulmonary disease at age 83. He had a global following, not least among mixed-race youth who found solace in the character Spock’s mixed heritage. Of immediate relevance to this column, Don Hodges, founder of the Hodges Funds, passed away in late January at age 80. He’d been a professional investor for 50 years and was actively managing several of the Hodges Funds until a few weeks before his death.

You can see all of the comings and goings on our Manager Changes page.

Updates

![]() Bretton Fund (BRTNX) is a small, concentrated portfolio managed by Stephen Dodson. The fund launched in 2010 in an attempt to bring a Buffett-like approach to the world of funds. In thinking about his new firm and its discipline, he was struck by a paradox: almost all investment professionals worshipped Warren Buffett, but almost none attempted to invest like him. Stephen’s estimate is that there are “a ton” of concentrated long-term value hedge funds, but fewer than 20 mutual funds (Pinnacle Value PVFIX and The Cook and Bynum Fund COBYX, for example) that follow Buffett’s discipline: he invests in “a small number of good business he believes that he understands and that are trading at a significant discount to what they believe they’re worth.” Stephen seemed particularly struck by his interviews of managers who run successful, conventional equity funds: 50-100 stocks and a portfolio sensitive to the sector-weightings in some index.

Bretton Fund (BRTNX) is a small, concentrated portfolio managed by Stephen Dodson. The fund launched in 2010 in an attempt to bring a Buffett-like approach to the world of funds. In thinking about his new firm and its discipline, he was struck by a paradox: almost all investment professionals worshipped Warren Buffett, but almost none attempted to invest like him. Stephen’s estimate is that there are “a ton” of concentrated long-term value hedge funds, but fewer than 20 mutual funds (Pinnacle Value PVFIX and The Cook and Bynum Fund COBYX, for example) that follow Buffett’s discipline: he invests in “a small number of good business he believes that he understands and that are trading at a significant discount to what they believe they’re worth.” Stephen seemed particularly struck by his interviews of managers who run successful, conventional equity funds: 50-100 stocks and a portfolio sensitive to the sector-weightings in some index.

I asked each of them, “How would you invest if it was only your money and you never had to report to outside shareholders but you needed to sort of protect and grow this capital at an attractive rate for the rest of your life, how would you invest. Would you invest in the same approach, 50-100 stocks across all sectors.” And they said, “absolutely not. I’d only invest in my 10-20 best ideas.”

One element of Stephen’s discipline is that he only invests in companies and industries that he understands; that is, he invests within a self-defined “circle of competence.”

In February he moved to dramatically expand that circle by adding Raphael de Balmann as co-principal of the adviser and co-manager of BRTNX. Messrs. Dodson and de Balmann have known each other for a long time and talk regularly and he seems to have strengths complementary to Mr. Dodson’s. De Balmann has primarily been a private equity investor, where Dodson has been public equity. De Balmann is passionate about understanding the sources and sustainability of cash flows, Dodson is stronger on analyzing earnings. De Balmann understands a variety of industries, including industrials, which are beyond Dodson’s circle of competence.

Stephen anticipates a slight expansion of the number of portfolio holdings from the high teens to the low twenties, a fresh set of eyes finding value in places that he couldn’t and likely a broader set of industries. The underlying discipline remains unchanged.

We wish them both well.

Star gazing

Seafarer Overseas Growth & Income (SFGIX) celebrated its third anniversary on February 5th. By mid-March it should receive its first star rating from Morningstar. With a risk conscious strategy and three year returns in the top 3% of its emerging markets peer group, we’re hopeful that the fund will gain some well-earned recognition from investors.

Guinness Atkinson Dividend Builder (GAINX) will pass its three-year mark at the end of March, with a star rating to follow by about five. The fund has returned 49% since inception, against 38% for its world-stock peers.

A resource for readers

Our colleague Charles Boccadoro is in lively and continuing conversation with a bunch of folks whose investing disciplines have a strongly quantitative bent. He offers the following alert about a new book from one of his favorite correspodents.

Official publication date is tomorrow, March 2.

Like his last two books, Shareholder Yield and Global Value, reviewed in last year’s May commentary, Meb Faber’s new book “Global Asset Allocation: A Survey of the World’s Top Asset Allocation Strategies” is a self-published ebook, available on Amazon for just $2.99.

On his blog, Mr. Faber states “my goal was to keep it short enough to read in one sitting, evidence-based with a basic summary that is practical and easily implementable.”

That description is true of all Meb’s books, including his first published by Wiley in 2009, The Ivy Portfolio. To celebrate he’s making downloads of Shareholder Yield and Global Value available for free.

We will review his new book next time we check-in on Cambria’s ETF performance.

Here appears to be its Table of Contents:

INTRODUCTION

CHAPTER 1 – A History of Stocks, Bonds, and Bills

CHAPTER 2 – The Benchmark Portfolio: 60/40

CHAPTER 3 – Asset Class Building Blocks

CHAPTER 4 – The Risk Parity and All Seasons Portfolios

CHAPTER 5 – The Permanent Portfolio

CHAPTER 6 – The Global Market Portfolio

CHAPTER 7 – The Rob Arnott Portfolio

CHAPTER 8 – The Marc Faber Portfolio

CHAPTER 9 – The Endowment Portfolio: Swensen, El-Erian, and Ivy

CHAPTER 10 – The Warren Buffett Portfolio

CHAPTER 11 – Comparison of the Strategies

CHAPTER 12 – Implementation (ETFs, Fees, Taxes, Advisors)

CHAPTER 13 – Summary

APPENDIX A – FAQs

Briefly Noted . . .

Vanguard, probably to Jack Bogle’s utter disgust, is making a pretty dramatic reduction in their exposure to US stocks and bonds. According an SEC filing, the firm’s retirement-date products and Life Strategy Funds will maintain their stock/bond balance but, over “the coming months,” the domestic/international balance with the stock and bond portfolios will swing.

Vanguard, probably to Jack Bogle’s utter disgust, is making a pretty dramatic reduction in their exposure to US stocks and bonds. According an SEC filing, the firm’s retirement-date products and Life Strategy Funds will maintain their stock/bond balance but, over “the coming months,” the domestic/international balance with the stock and bond portfolios will swing.

For long-dated funds, those with target dates of 2040 or later, the US stock allocation will drop from 63% to 54% while international equities will rise from 27% to 36%. In shorter-date funds, there’s a 500 – 600 basis point reallocation from domestic to international. There’s a complementary hike in international body exposure, from 2% of long-dated portfolios up to 3% and uneven but substantial increases in all of the shorter-date funds as well.

SMALL WINS FOR INVESTORS

Okay, it might be stretching to call this a “win,” but you can now get into two one-star funds for a lot less money than before. Effective February 27, 2015, the minimum investment amount in the Class I Shares of both the CM Advisors Fund (CMAFX) and the CM Advisors Small Cap Value (CMOVX) was reduced from $250,000 to $2,500.

CLOSINGS (and related inconveniences)

None that we noticed.

OLD WINE, NEW BOTTLES

Around May 1, the $6 billion ClearBridge Equity Income Fund (SOPAX) becomes ClearBridge Dividend Strategy Fund. The strategy will be to invest in stocks and “other investments with similar economic characteristics that pay dividends or are expected to initiate their dividends over time.”

Effective May 1, 2015, European Equity Fund (VEEEX/VEECX) escapes Europe and equities. It gets renamed at the Global Strategic Income Fund and adds high-yield bonds to its list of investment options.

On April 30, Goldman Sachs U.S. Equity Fund (GAGVX) becomes Goldman Sachs Dynamic U.S. Equity Fund. The “dynamic” part is that the team that guided it to mediocre large cap performance will now guide it to … uh, dynamic all-cap performance.

Goldman Sachs Absolute Return Tracker Fund (GARTX) attempts to replicate the returns of a hedge fund index without, of course, investing in hedge funds. It’s not clear why you’d want to do that and the fund has been returning 1-3% annually. Effective April 30, the fund’s investment strategies will be broadened to allow them to invest in an even wider array of derivatives (e.g. master limited partnership indexes) in pursuit of their dubious goal.

Effective March 31, 2015, MFS Research Bond Fund will change to MFS® Total Return Bond Fund and MFS Bond Fund will change to MFS® Corporate Bond Fund.

OFF TO THE DUSTBIN OF HISTORY

Aberdeen Global Select Opportunities Fund was swallowed up by Aberdeen Global Equity Fund (GLLAX) on Friday, February 25, 2015. GLLAX is … performance-challenged.

As we predicted a couple months ago when the fund suddenly closed to new investors, Aegis High Yield Fund (AHYAX/AHYFX) is going the way of the wild goose. Its end will come on or before April 30, 2015.

Frontier RobecoSAM Global Equity Fund (FSGLX), a tiny institutional fund that was rarely worse than mediocre and occasionally a bit better, will be closed and liquidated on March 23, 2015.

Bad news for Chuck Jaffe. He won’t have the Giant 5 to kick around anymore. Giant 5 Total Investment System Fund received one of Jaffe’s “Lump of Coal” awards in 2014 for wasting time and money changing their ticker symbol from FIVEX to CASHX. Glancing at their returns, Jaffe suggested SUCKX as a better move. From here it starts to get a bit weird. The funds’ adviser changed its name from Willis Group to Index Asset Management, which somehow convinced them to spend more time and money changed the ticker on their other fund, Giant 5 Total Index System Fund, from INDEX to WILLX. So they decided to surrender a cool ticker that reflected their current name for a ticker that reminds them of the abandoned name of their firm. Uh-huh. At this point, cynics might suggest changing their URL from weareindex.com to the more descriptively accurate wearecharging2.21%andchurningtheportfolio.com. Doubtless sensing Chuck beginning to stock up on the slings and arrows of outrageous fortune, the adviser sprang into action on February 27 … and announced the liquidation of the funds, effective March 30th.

The $24 million Hatteras PE Intelligence Fund (HPEIX) will liquidate on March 13, 2015. The plan was to produce the returns of a Private Equity index without investing in private equity. The fund launched in November 2013, has neither made nor lost any meaningful money, so the adviser pulled the plug after 15 months.

JPMorgan Alternative Strategies Fund (JASAX), a fund mostly comprised of other Morgan funds, will liquidate on March 23, 2015.

Martin Focused Value Fund (MFVRX), a dogged little fund that held nine stocks and 70% cash, has decided that it’s not economically viable and that’s unlikely to change. As a result, it will cease operations by the end of March.

Old Westbury Real Return Fund (OWRRX), which has about a half billion in assets, is being liquidated in mid-March 2015. It was perfectly respectable as commodity funds go. Sadly, the fund’s performance charts had a lot of segments that looked like

and like

In consequence of which it finished down 9% since inception and down 24% over the past five years.

Parnassus Small Cap Fund (PARSX) is being merged into the smaller but far stronger Parnassus Mid Cap (PARMX) at the end of April, 2015. PARMX’s prospectus will be tweaked to make it SMID-ier.

The Board of Trustees of PIMCO approved a plan of liquidation for the PIMCO Convertible Fund (PACNX) which will occur on May 1, 2015. The fund has nearly a quarter billion in assets, so presumably the Board was discouraged by the fund’s relatively week three year record: 11% annually, which trailed about two-thirds of the funds in the tiny “convertibles” group.

The Board of Rainier Balanced Fund (RIMBX/RAIBX) has approved, the liquidation and termination of the fund. The liquidation is expected to occur as of the close of business on March 27, 2015. It’s been around, unobjectionable and unremarkable, since the mid-90s but has under $20 million in assets.

S1 (SONEX/SONRX), the Simple Alternatives fund, will liquidate in mid-March. We were never actually clear about what was “simple” about the fund: it was a high expense, high turnover, high manager turnover operation.

Salient Alternative Strategies Master Fund liquidated in mid-February, around the time they bought Forward Funds to get access to more alternative strategies.

In examples of an increasingly common move, Touchstone decided to liquidated both Touchstone Institutional Money Market Fund and Touchstone Money Market Fund, proceeds of the move will be rolled over into a Dreyfus money market.

In a sort of “snatching Victory from the jaws of defeat, then chucking some other Victory into the jaws” development, shareholders have learned that Victory Special Value (SSVSX) is not going to be merged out of existence into Victory Dividend Growth. Instead, Special Value has reopened to new investment while Dividend Growth has closed and replaced it on Death Row. Liquidation of Dividend Growth is slated for April 24, 2015. In the meantime, Victory Special Value got a whole new management team. The new managers don’t have a great record, but it does beat their predecessors’, so that’s a small win.

Wasatch Heritage Growth Fund (WAHGX) has closed to new investors and will be liquidated at the end of April, 2015. The initial plan was to invest in firms that had grown too large to remain in Wasatch’s many small cap portfolios; those “graduates” were the sort of the “heritage” of the title. The strategy generated neither compelling results nor investor interest.

In Closing . . .

The Observer celebrates its fourth anniversary on April 1st. We’re delighted (and slightly surprised) at being here four years later; the average lifespan of a new website is generally measured in weeks. We’re delighted and humbled by the realization that nearly 30,000 folks peek in each month to see what we’re up to. We’re grateful, especially to the folks who continue to support the Observer, both financially and with an ongoing stream of suggestions, leads, questions and corrections. I’m always anxious about thanking folks for their contributions because I’m paranoid about forgetting anyone (if so, many apologies) and equally concerned about botching your names (a monthly goof). To the folks who use our Paypal link (Lee – I like the fact that your firm lists its professionals alphabetically rather than by hierarchy, Jeffrey who seems to have gotten entirely past Twitter and William, most recently), remember that you’ve got the option to say “hi”, too. It’s always good to hear from you. One project for us in the month ahead will be to systematize access for subscribers to our steadily-evolved premium site.

We’d been planning a party with party hats, festive noisemakers, a round of pin-the-tail-on-the-overrated-manager and a cake. Chip and Charles were way into it.

Hmmm … apparently we might end up with something a bit more dignified instead. At the very least we’ll all be around the Morningstar conference in June and open to the prospect of a celebratory drink.

Spring impends. Keep a good thought and we’ll see you in a month!