Dear friends,

It’s fall. We made it!

The leaves are still green and there are still tomatoes to be canned (yes, I do) but I saw one of my students pull on a sweater today. The Steelers announce their final roster this weekend. The sidewalks are littered with acorns. It’s 6:00 p.m. and the sun outside my window is noticeably low in the sky. I hear the distant song of ripening apples.

Life is good, if only you’ll take time to notice it.

We could spend time this month fretting about the obvious:

- A variety of stock indexes are at all-time highs and traders are placing bets that it will hit new highs

- By one measure, stock overvaluation is worse than in 1999; currently every S&P industry category is richly valued while three or four industries, left behind by the mad tech rush of the late 1990s, were substantially undervalued at the turn of the century (The Leuthold Group, Perception for the Professional, August 2016)

- A more freakish analysis suggest that the bond market valuations might be at a 5,000 year high

- The number of investors describing themselves as “bullish” is climbing while the number of bullish strategists is falling, and

- Investors as a group have become complacent; August was the least volatile month in 20 years.

But we won’t. (The paragraph above was brought to you by the rhetoric trope named paralipsis, the tactic of telling you things by telling you that we’re not going to tell you.) But that will wait. The Fed will keep its head down until after the election and 99% of politicians are anxiously trying to avoid generating headlines. I will, instead, celebrate the season by unveiling our all new Certificate in ETF Punditry.

Observer Fund Profiles:

Each month the Observer provides in-depth profiles of between two and four funds. Our “Most Intriguing New Funds” are funds launched within the past couple years that most frequently feature experienced managers leading innovative newer funds. “Stars in the Shadows” are older funds that have attracted far less attention than they deserve.

Mairs and Power Small Cap (MSCFX): Mairs and Power Small Cap has a surprising number of things in common with Seafarer Overseas Growth & Income. Both are consistently excellent funds with consistent, risk-conscious disciplines. Both have smart, experienced, self-effacing managers. Neither is a household name. And both are closing on September 30. We offer this updated profile for those who are considering their small cap exposure.

Updates

We noted in last month’s issue that Morningstar’s definition of “new” and “small,” when it comes to funds, is inching toward our definition of “old” and “bloated.” That is, funds with five year records and billions in assets still get described as “off the radar.” In “5 more under-the-radar and up-and-coming funds” (8/30/2016), Dan Culloton does a nice job of highlighting a handful of actually new-and-small funds that are either dirt cheap or whose management teams have long records of sustained success with the fund’s strategy. Those five are:

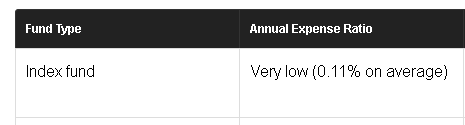

Vanguard Core Bond (VCORX) launched in March 2016. It falls into the not-very-actively managed camp; it targets high-quality bonds, makes modest bets and counts on the compounding advantage of a 0.25% expense ratio.

Hood River Small-Cap Growth (HRSRX) is a small-growth fund that we should have written about a year ago. A couple readers have called it to our attention, but it kept falling through the cracks. Apologies for that. Hood River is run by the former Columbia Small Cap Growth team and operated under the Roxbury name into the team spun themselves off as an independent adviser. It has about $150 million in assets and has been, over most trailing periods, modestly superior to its peers.

Mar Vista Strategic Growth (RMSIX) is a conservative large-growth fund, formerly in the Roxbury family. It invests in a reasonably compact portfolio of “wide moat” firms. As you might imagine, that means it’s okay in up-markets and strong in down ones. The team has been managing the strategy for more than 10 years.

Mondrian International Equity (DPIEX) is a defensive equity strategy that used to be called Delaware Pooled Trust International Equity. They were rebranded in March 2016. Morningstar reports that about 40% of the portfolio construction is driven by macro-economic calls, 60% by stock-specific stuff. The discipline focuses on avoiding big losses which has given them top quartile returns with below-average volatility.

WCM Focused International Growth (WCMRX) invests in a focused (30-35 stock) portfolio of high-quality firms. “Quality” is measured by factors like net margin and return on equity. Strong long-term returns, muted volatility.

Whistlerblower rewards: I have deeply mixed feelings about the SEC’s celebration of reaching the $100 million mark in payouts to whistleblowers, including individual awards of $22 million and $30 million. On the one hand it’s nice to have an incentive to root out large scale corruption. On the other hand, it’s appalling that there’s so much to be rooted.

In Closing . . .

The good folks at Amazon have been poring over the data, trying to discern what books might most interest you. From some combination of stuff that other readers have purchased and … you know, Big Data, they offer up the following reading recommendations:

|

|

|

| Boomerang: Travels in the New Third World | Liar’s Poker: Rising Through the Wreckage on Wall Street | The Quants: How a New Breed of Math Whizzes Conquered Wall Street and Nearly Destroyed It |

Thanks, as ever to Greg and to Deb. And, this month, thanks also to Brett from Cincinnati and Richard from the state of Washington. We appreciate your generosity.

Our colleague Charles Boccadoro will be attending Morningstar’s ETF Conference on our behalf this month. If you’ll be there and want to chat, please do let him know.

We’ll look for you.

In 2004 and 2005, I was involved in the interviewing process for hiring analysts. A believer in the Hyman Rickover School of interviewing, I was always trying to find intellectually curious people who would not be just like everyone else at the firm. I wanted them to be inquiring about life in general, and show it both in their professional and personal interests. One of my favorite questions was what people read for fun, if anything. I will leave it to you to imagine my response when the answer I got one day was, “My reading for fun is all of the quarterly reports written by the people at Longleaf, as well as Buffett’s annual letters, and what you all write.”

In 2004 and 2005, I was involved in the interviewing process for hiring analysts. A believer in the Hyman Rickover School of interviewing, I was always trying to find intellectually curious people who would not be just like everyone else at the firm. I wanted them to be inquiring about life in general, and show it both in their professional and personal interests. One of my favorite questions was what people read for fun, if anything. I will leave it to you to imagine my response when the answer I got one day was, “My reading for fun is all of the quarterly reports written by the people at Longleaf, as well as Buffett’s annual letters, and what you all write.”

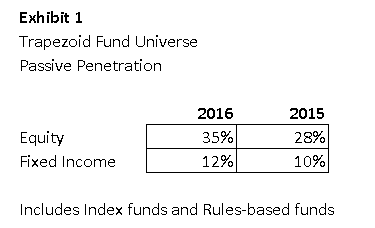

How far this trend will extend is up for debate. But the penetration rate actually steepened this year. The new DOL fiduciary rules, which take full effect at the end of 2017, may be a catalyst. If you believe in the classic S curve from Marketing 101, we are (to paraphrase Bon Jovi) only half way there.

How far this trend will extend is up for debate. But the penetration rate actually steepened this year. The new DOL fiduciary rules, which take full effect at the end of 2017, may be a catalyst. If you believe in the classic S curve from Marketing 101, we are (to paraphrase Bon Jovi) only half way there.

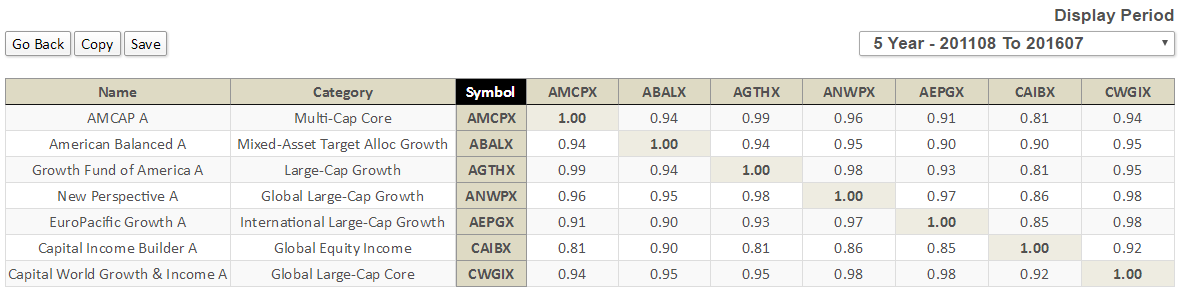

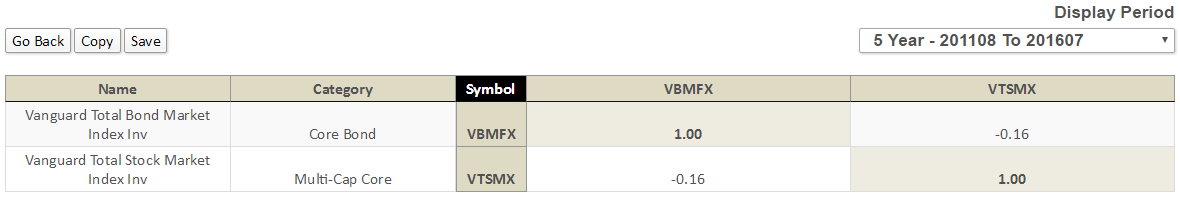

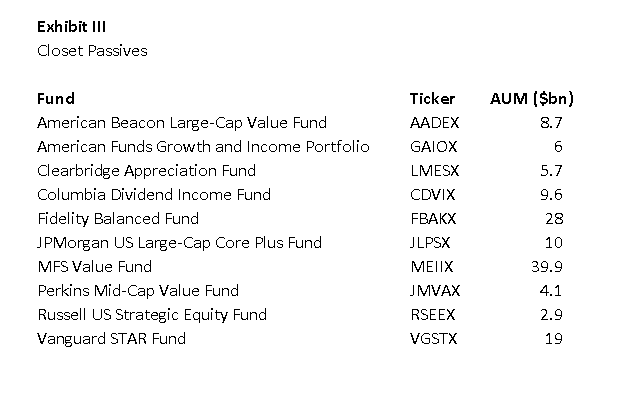

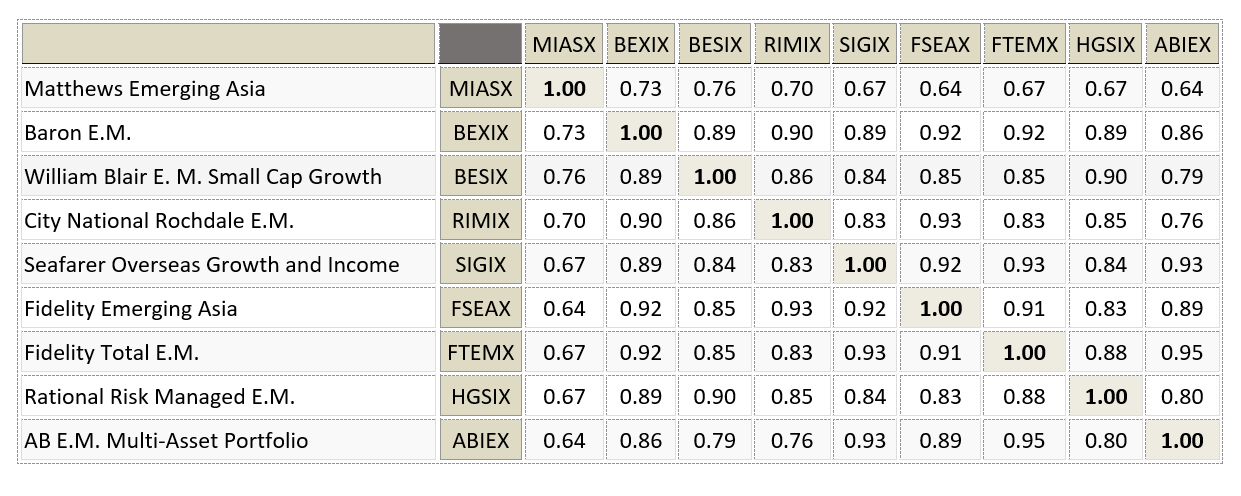

Here are some representative funds we found. These are not true passives. The portfolio holdings will not resemble their benchmarks. Performance will deviate a bit from year to year due to security selection. But the funds gross returns stay ~98% correlated to the Trapezoid “replication portfolio” at all times.

Here are some representative funds we found. These are not true passives. The portfolio holdings will not resemble their benchmarks. Performance will deviate a bit from year to year due to security selection. But the funds gross returns stay ~98% correlated to the Trapezoid “replication portfolio” at all times. What’s the Trapezoid story? Leigh Walzer has over 25 years of experience in the investment management industry as a portfolio manager and investment analyst. He’s worked with and for some frighteningly good folks. He holds an A.B. in Statistics from Princeton University and an M.B.A. from Harvard University. Leigh is the CEO and founder of Trapezoid, LLC, as well as the creator of the Orthogonal Attribution Engine. The Orthogonal Attribution Engine isolates the skill delivered by fund managers in excess of what is available through investable passive alternatives and other indices. The system aspires to, and already shows encouraging signs of, a fair degree of predictive validity.

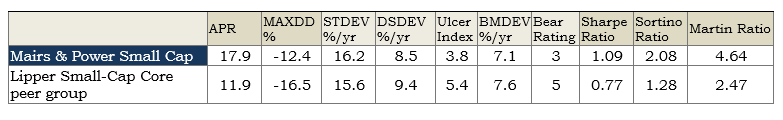

What’s the Trapezoid story? Leigh Walzer has over 25 years of experience in the investment management industry as a portfolio manager and investment analyst. He’s worked with and for some frighteningly good folks. He holds an A.B. in Statistics from Princeton University and an M.B.A. from Harvard University. Leigh is the CEO and founder of Trapezoid, LLC, as well as the creator of the Orthogonal Attribution Engine. The Orthogonal Attribution Engine isolates the skill delivered by fund managers in excess of what is available through investable passive alternatives and other indices. The system aspires to, and already shows encouraging signs of, a fair degree of predictive validity. Here’s how to read that table: since August 2011, Small Cap has generated 6% greater annual returns that its Lipper peers while exposing shareholders to less risk. Its maximum drawdown was significantly smaller, its downside volatility was lower, its performance in bear market months was better and the length and magnitude of its losses (which is what the Ulcer Index measures) was less. It follows then that all of the measures of risk-adjusted returns (the Sharpe, Sortino and Martin ratios) are higher. It’s particularly noteworthy that the measures which are most sensitive to downside risk (Sortino and Martin) show greater advantage than does the standard Sharpe ratio.

Here’s how to read that table: since August 2011, Small Cap has generated 6% greater annual returns that its Lipper peers while exposing shareholders to less risk. Its maximum drawdown was significantly smaller, its downside volatility was lower, its performance in bear market months was better and the length and magnitude of its losses (which is what the Ulcer Index measures) was less. It follows then that all of the measures of risk-adjusted returns (the Sharpe, Sortino and Martin ratios) are higher. It’s particularly noteworthy that the measures which are most sensitive to downside risk (Sortino and Martin) show greater advantage than does the standard Sharpe ratio. For those unfamiliar with the fund, Seafarer is a four year old diversified emerging markets fund; its manager, Andrew Foster, has a long and distinguished track record as manager and is incessantly committed to helping his shareholders. He’s been evangelical about lowering expenses whenever conditions permit and his shareholder communications are singularly clear and thoughtful. He believes that emerging market economies are characterized by unreliable capital markets; that is, firms cannot count on being able to raise capital quickly and efficiently when they need it. As a result, one of his strong preferences is for firms that generate sufficient free cash flow to cover their capital needs internally.

For those unfamiliar with the fund, Seafarer is a four year old diversified emerging markets fund; its manager, Andrew Foster, has a long and distinguished track record as manager and is incessantly committed to helping his shareholders. He’s been evangelical about lowering expenses whenever conditions permit and his shareholder communications are singularly clear and thoughtful. He believes that emerging market economies are characterized by unreliable capital markets; that is, firms cannot count on being able to raise capital quickly and efficiently when they need it. As a result, one of his strong preferences is for firms that generate sufficient free cash flow to cover their capital needs internally.

Mr. Willis ultimately reached two sets of conclusions.

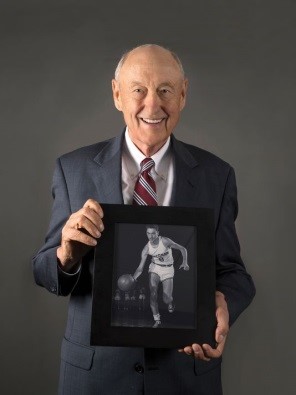

Mr. Willis ultimately reached two sets of conclusions. Albert “Ab” Nicholas, philanthropist and founder of the Nicholas Funds,

Albert “Ab” Nicholas, philanthropist and founder of the Nicholas Funds,  Bonnie Baha, director of global credit at the DoubleLine funds, died August 22, 2016, at age 56. Her family was in Charlotteville, Virginia, dropped her son off at the University of Virginia when she, her husband Mustapha and their daughter were struck by a car. Her husband and daughter were both treated for non-life-threatening injuries.

Bonnie Baha, director of global credit at the DoubleLine funds, died August 22, 2016, at age 56. Her family was in Charlotteville, Virginia, dropped her son off at the University of Virginia when she, her husband Mustapha and their daughter were struck by a car. Her husband and daughter were both treated for non-life-threatening injuries.

Thanks, as ever, to TheShadow who knows not only what evil lurks in the hearts of men but also what news lurks in the darkness of the SEC daily filings. His vigilance, and willingness to share timely finds on our discussion board, make this portion of our monthly issue easier for me to produce and more complete for our readers.

Thanks, as ever, to TheShadow who knows not only what evil lurks in the hearts of men but also what news lurks in the darkness of the SEC daily filings. His vigilance, and willingness to share timely finds on our discussion board, make this portion of our monthly issue easier for me to produce and more complete for our readers.