On September 12, 2017, American Beacon launched two funds using Shapiro Capital Management, an institutional, value-oriented firm, as its sub-advisor. This alert focuses on the Equity Opportunities Fund, its all-cap value product. The SMID fund applies the same strategy in the mid cap space.

Established in 1990, Shapiro is known for deep fundamental research and concentrated portfolios. As of 2017, its managers — Samuel Shapiro, Michael McCarthy, Louis Shapiro, and Harry Shapiro — have 141 years of collective investment experience and head a team without turnover for 27 years, a continuity that confirms their ability to outperform their peers and passive indices.

Shapiro provides investment management services to individuals, investment companies, foundations, endowments, pension and profit sharing plans, trusts, corporations, and estates. As of 3Q 2017, the firm managed approximately $4.5B in assets.

The Core: A vigorous contrarian strategy

Shapiro seeks capital appreciation and long-term outperformance following an absolute return mindset. They choose contrarian, misunderstood companies, those going through restructuring, spin-offs, reverse LBOs, having some presence of a catalyst, complex accounting, and material insider purchases — in other words– “complicated situations” in the most inefficient segments of the market while looking for stocks having a greater than 50% upside to intrinsic value based on an absolute target price.

The managers ask, “Where’s the pain in the market?” as they try to stay ahead of market sentiment.

Historically, four segments comprise the fund portfolios:

Contrarian 35-50%; Spin-Offs 25-35%; Reorganizations 15-20%; and Residual Assets 3-8%

They want companies with established operations having

- High returns on invested assets >= 20% pretax

- A product/service with minimal chances of obsolescence

- Franchise-like characteristics with significant barriers to entry

- Substantial operations – market leadership and

- Sound management with an equity interest

That means they will avoid high-risk businesses, e.g., computer hardware companies, airlines, biotechnology, fads, and start-ups. The funds will typically hold 25-30 securities with a relatively low turnover of their core positions between 30-40 percent.

During a holding period, they continue to concentrate on operations of their investments, not on their price fluctuations, i.e., a relatively long investment horizon because of their belief that the intrinsic value will be reflected in the stock.

Based on EBITDA, the highest percentage of these companies are underleveraged or normally leveraged –not fully leveraged — and often 1 or 2 in their industries.

Performance

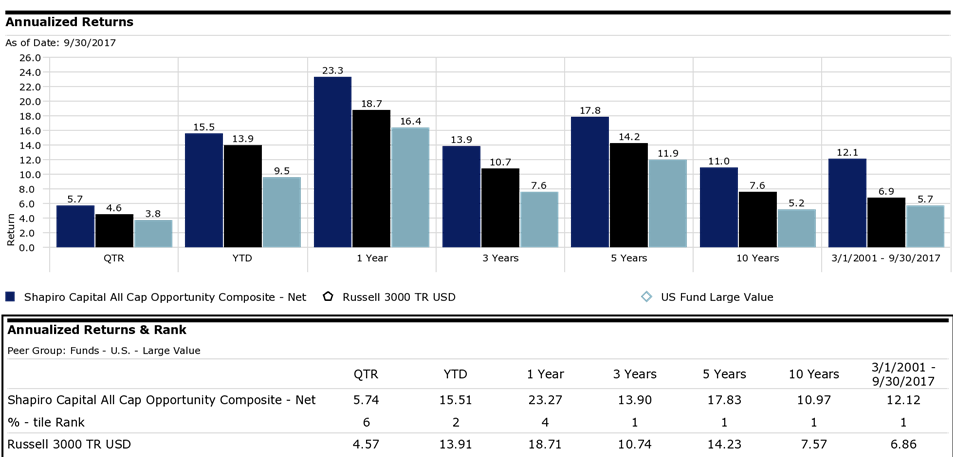

The Opportunities fund is an outgrowth of the All-Cap Composite beginning March 1, 2001.

Examining the detailed quarterly commentaries for the All-Cap Composite Strategy for 10.75 years (March 2007 through September 2017) shows the consistent application of the managers’ approach in finding value beyond traditional factors, e.g., value relative to the market, P/B, P/E., industry, or sector.

Their in-house, intensive research has produced historically robust returns independent of which value style is in favor and created a stronger investment experience across full market cycles.

The adviser’s compliance team asks us to mention: “The net of fee numbers reflects a 0.95% advisory fee representing the highest annual advisory fee Shapiro charged to accounts in the All Cap Opportunity Composite.” So we did.

- The Composite has been in the top decile in each measurement period since inception.

- On a rolling 3-year basis since inception through 3Q2017, the All-Cap Opportunity Strategy has outperformed the Russell 3000 Index approximately 88% of the time. (Source: Morningstar Direct)

- The Active Share for the All-Cap Composite vs. its benchmark calculated at quarter end from October 2007 to September 2017 is 93%. (Source: FactSet)

Back to their compliance folks for this reminder: “The performance of the Composite does not represent the historical performance of its corresponding Fund and should not be considered indicative of future performance of that Fund and is not subject to the same types of expenses as the Funds or other restrictions imposed by the 1940 Investment Company Act.”

Notably significant is that the managers have historically welcomed the increased shift to passive strategies because they improve their long-term potential by further reducing the active judgment necessary for market efficiency. From their 2Q2017 commentary:

Our recent experience supports this view as deal activity (the best barometer of inefficiency) is rising in step with increased passive adoption. Absent the possibility of greater short-term volatility, we see far more opportunity than risk for our economically justified value approach in an increasingly passive investment environment.

Conclusion

The firm’s consistent, time-tested strategy and collective management experience has produced superior returns.

Being different from active and passive strategies has made the difference and is emblematic of the Composite’s success.

Investors may wish to consider what this new prodigy can offer.

Administrative details for American Beacon Shapiro All-Cap Fund.

| Symbol | Expense Ratio | Minimum Purchase |

| SHXIX (I Class) | .80 | $250,000 |

| SHXYX (Y Class) | .90 | $100,000 |

| SHXPX (N Class) | 1.18 | $2500 |

The fund is available through TD, Schwab, Raymond James, and Pershing. They expect to add Fidelity to that list but don’t plan to go beyond that.

Shapiro and its principals have invested significantly in its strategies and hold the same securities that the company purchases or recommends for its clients. The initial SAI was dated before the fund’s first day of operation, so it necessarily reflects no insider ownership.

There’s relatively little information about the funds yet available. Both the American Beacon Shapiro Equity Opportunities and Shapiro Capital websites are essentially blank. In general the American Beacon pages are reasonably rich, so we just might need to be patient for a bit.