Warren Buffet once quipped: “Forecasts usually tell us more of the forecaster than of the forecast.” This is one reason I hesitate to forecast what we might see this year for capital gains distributions from mutual funds. Nonetheless, I’ll reveal a little about myself and will make an educated guess.

Looking Back

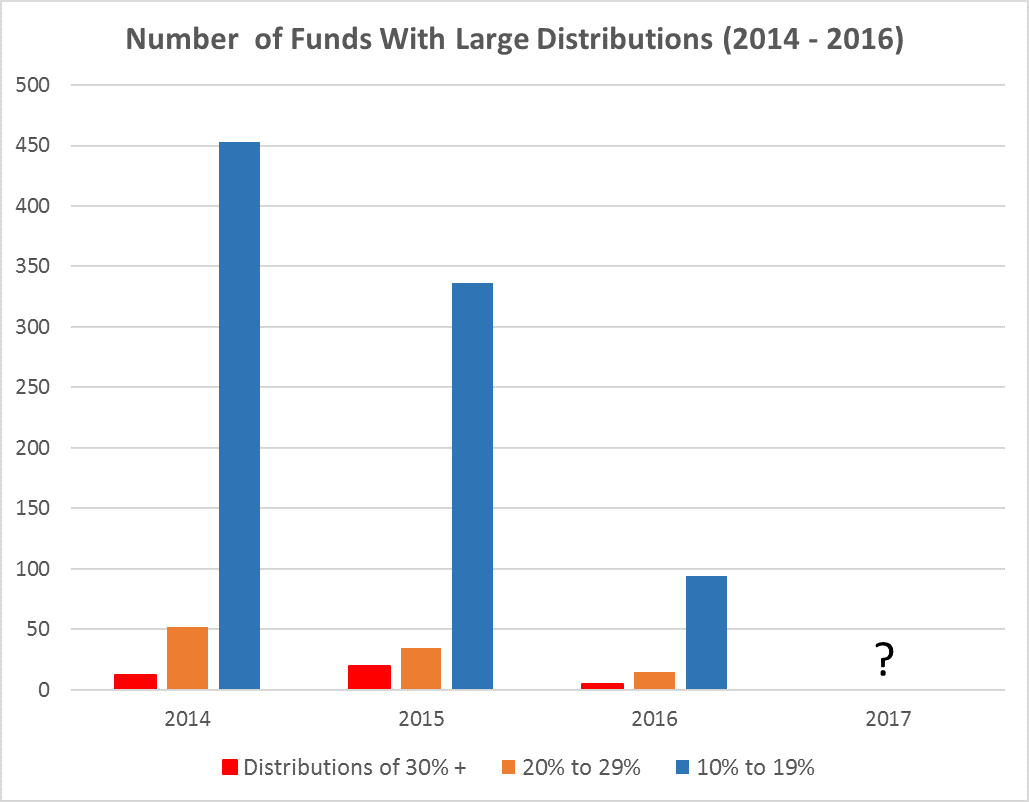

I don’t track absolute dollars of fund distributions, but for the last four years I have counted the number of funds that have “large” (more than 10%) capital gains distributions. As you can see from the chart below, the trend has been favorable to taxpayers. 2014 had over 500 funds that distributed more than 10% in gains. Last year, barely 100 funds were in that category.

Initial Thoughts

Larger than average fund distributions are generally driven by two factors:

- Gains – We’ve seen nine nice years of market gains, so it’s no surprise that funds (especially US equity funds) have gains on their books. As funds make trades to rebalance and take profits, they realize taxable gains that must be distributed to fund owners.

- Fund Liquidations – The last several years has seen a large move away from actively managed mutual funds and into index mutual funds and ETFs. Last year, active managers running US equity funds saw over $260 million in fund outflows and we are seeing similar numbers this year too. Managers in these funds have to raise cash, and that means selling holdings and realizing taxable gains. There is very little a fund manager can do to be tax efficient in this situation.

Given these two factors, I’d expect we will see a solid number of large fund distributions in 2017. My early thoughts were that we’d see numbers somewhere between what we saw in 2015 and 2016.

Where are we now?

As I write this, about one third of the fund firms in my extended database have released their capital gains estimates and the results are interesting. We have already surpassed last year’s totals and we are on pace towards 2014’s numbers. (You can find a running tally of Capital Gain Distribution Stats at http://www.capgainsvalet.com/cap-gains-stats-2017/.) We could end up this year with around 500 funds making 10%+ distributions.

Mark Wilson, APA, CFP® is President and Founder of MILE Wealth Management, a fee-only financial planning and investment management firm located in Irvine, CA. He’s been running CapGainsValet for the last four years to help mutual fund investors reduce the hassles of mutual fund capital gain distributions.