Updates

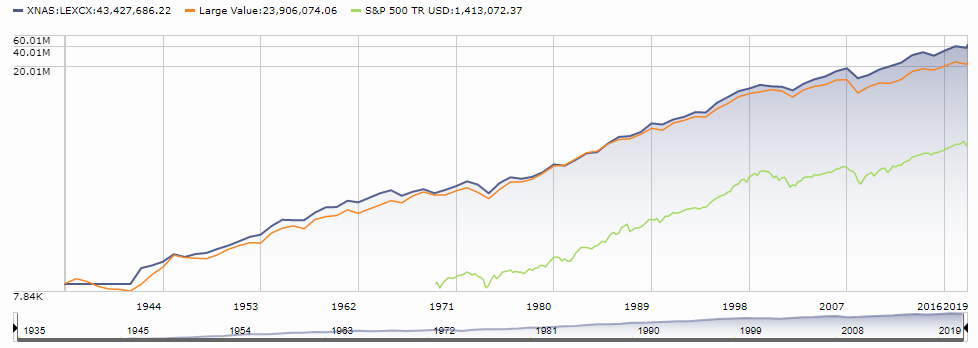

The Ghost Ship sails every onward. Voya Corporate Leaders (LEXCX, once Lexington Corporate Leaders) continues its skipperless voyage. The fund was launched in 1935 with a simple strategy (buy an equal number of shares of what were then America’s best companies, and never sell) and no manager. Right: no manager changes in more than 83 years ‘cause it’s had no manager in more than 83 years. How’s that working for you?

It’s turned an initial investment of $10,000 (admittedly, a nearly inconceivable amount in 1935 when a new car might be had for $600 and a new home for $6000, a lot less if you’d bought the high-end Vallonia from the Sears catalog) into $43.4 million while the average large cap value portfolio would have generated $23.9 million. The fund has outpaced 99% of its peers over the past 15 years and 97% in the tumultuous past 12 months.

Briefly Noted . . .

SMALL WINS FOR INVESTORS

Effective immediately, the minimum initial investment amount for iM Dolan McEniry Corporate Bond Fund (IDMIX) Institutional Shares has been lowered to $10,000. The fund launched in September 2018 and is performing well; it just hasn’t drawn investors.

The minimum initial investment for the institutional share class of Leader Total Return Fund (LCTIX) has dropped from $2 million to $100,000.

Effective March 29, 2019, the RMB Mendon Financial Services Fund (RMBKX) is open to investment by new investors.

The folks at Symons Value (SAVIX) want to reduce their fund’s expense ratio. Rather than, I don’t know, just reducing their fund’s expense ratio, they are creating a new share class (Class II) and moving all current investors into it. The net effect will be a drop of 0.25% in the expense ratio.

Vanguard FTSE All-World ex-US Small-Cap Index Fund, Vanguard FTSE Social Index Fund, Vanguard High Dividend Yield Index Fund, Vanguard Long-Term Bond Index Fund and Vanguard Total World Stock Index Fund now all offer low-cost Admiral Shares with an investment minimum of $3,000. Those trim a couple basis points off the comparable Investor shares. Vanguard has closed all of the Investor class shares to new investors and will begin moving their current investors automatically into the Admiral shares in April.

CLOSINGS (and related inconveniences)

Had you folks noticed anything? Other than funds liquidating, I hadn’t.

OLD WINE, NEW BOTTLES

Brown Advisory – Somerset Emerging Markets Fund (BIAQX) became Brown Advisory Emerging Markets Select Fund on February 22, 2019. The absence of “Somerset” in the name is consequent to the removal of “Somerset” (Capital Management) as the sub-adviser. Wellington and Pzena have replaced it. The Somerset managers were offering a fair trade: below average returns for much below-average risk.

Effective on or about May 1, 2019, DWS High Conviction Global Bond Fund (SZGAX) will be renamed DWS ESG Global Bond Fund. Thomas M. Farina will take over as manager for Ramhila Nadi and Bernhard Falk. SZGAX is amiably mediocre while Mr. Farina’s main charge is also amiably mediocre, so it’s hard to view the manager change as significant. The shift to an ESG focus feels like it’s marketing driven.

Effective as of February 15, 2019, EntrepreneurShares Global FundTM became ERShares Global FundTM (ENTRX). The same renaming occurred with the US Small Cap (IMPAX) and US Large Cap (IMPLX) funds.

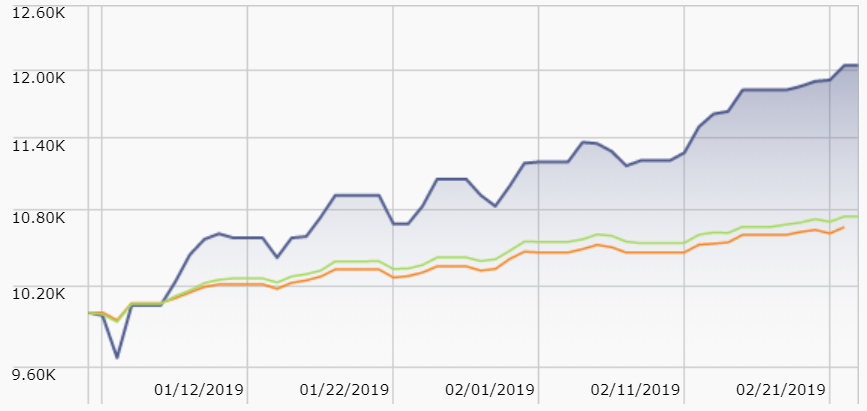

Effective March 1, 2019, William H. Gross, the Portfolio Manager for Janus Henderson Global Unconstrained Bond Fund (JUCAX) intends to retire. Here’s the tail of the tape on Mr. Gross’s adventure, from the date of his ascension to the fund:

| Annual return | Maximum drawdown | Volatility | Sharpe ratio | |

| JUCAX | 0.1% | -7.7% | 3.4% | -0.19 |

| Lipper peer group | 1.9 | -5.9 | 3.2 | 0.47 |

| 3 month T-bills, aka “cash” | 0.7 | 0.0 | 0.2 | 0.00 |

Which is to say, you could have had seven times Mr. Gross’s returns, with none of his fund’s volatility, by sticking your money in a credit union’s savings account.

In connection with Mr. Gross’ retirement, effective on or about February 15, 2019, Nick Maroutsos will become the new Portfolio Manager of the Fund, and the Fund will change its name to Janus Henderson Absolute Return Income Opportunities Fund.

Effective April 30, 2019, Thrivent Large Cap Stock Fund will change its name to Thrivent Global Stock Fund (AALGX).

Effective April 1, 2019, Wells Fargo Intrinsic Value Fund (EIVAX) becomes Wells Fargo Classic Value Fund.

Effective February 22, 2019, Xtrackers MSCI Asia Pacific ex Japan Hedged Equity ETF has changed its investment strategy and its name to Xtrackers International Real Estate ETF (HAUZ).

OFF TO THE DUSTBIN OF HISTORY

The Board of Trustees of the Trust approved a plan to liquidate and terminate the AMG Managers Value Partners Asia Dividend Fund (AVADX) which is expected to occur on or about April 12, 2019.

Summary execution: On February 7, 2019, the Aspen board of trustees announced their decision to immediately close to Aspen funds and to have them liquidated within three days. Aspen Managed Futures Strategy Fund and Aspen Portfolio Strategy Fund were thus dispatched on February 10, 2019.

Baron Energy and Resources Fund (BENFX) will liquidate on or before April 29, 2019. $10,000 invested at inception, December 2011, is now $6,200 which is substantially worse than its peers, who would have burned only 20% of your money.

BlackRock Emerging Markets Local Currency Bond Fund (BECIX) should have remembered the old warning: beware the Ides of March. Instead they, like Caesar, perish that day.

On February 6, 2019, the Board of Directors of BMO Funds approved a Plan of Liquidation for each of the ten funds in their BMO Target Retirement (Date) series. If the Plan is approved by shareholders, the Funds will be liquidated on June 28, 2019.

On February 4, 2019, the Board of Trustees of the ALPS ETF Trust authorized an orderly liquidation of the BUZZ US Sentiment Leaders ETF (BUZ). See what they did there … “investor sentiment” “buzz”. Except, ironically, after three years they were able to create no buzz of their own: $8 million in assets with comparable volatility but 30% lower returns than its Lipper science & tech peer group.

Cortina Small Cap Growth Fund (CRSGX) and the Cortina Small Cap Value Fund (CISVX) closed to new investments effective at the close of business on February 5, 2019 and will be liquidated effective as of the close of business on March 22, 2019.

Eaton Vance Focused International Opportunities Fund (EFIIX) will be liquidated around March 11, 2019. One star, no assets, trailed 75% of its peers …

“The Board of Trustees of the Funds has approved a Plan of Liquidation for [Gabelli Food of All Nations NextShares and Gabelli RBI Nextshares], pursuant to which each Fund will be liquidated on or about March 28, 2019.” We described these funds as “Gimmicky niche funds that seem more at home in the world of the Westcott Nothing But Net fund, the Golf Fund, the Chicken Little Growth fund, the StockCar Stocks Index fund or even … Gabelli Global Interactive Couch Potato Fund (GICPX, 1994-2000).” Two more remain.

Highmore Sustainable All-Cap Equity Fund (HMSQX) was liquidated on February 27, 2019. That was one day short of the fund’s first birthday.

Sometimes these filings speak for themselves: “The Board of Trustees has determined that it is in the best interest of shareholders to liquidate the Iron Equity Premium Income Fund (CALIX) as a result of receiving notice from the Fund’s adviser that it does not want to continue to manage the Fund. As of the date of this supplement, the Fund is no longer accepting purchase orders for its shares and it will close effective March 26, 2019.” It’s a four-star options-based fund with just $11 million in assets. The adviser had dropped its management fee from 1.0% to 0.65%, which looks great for investors until you realize that $71,500 isn’t nearly enough income to justify running the fund.

Legg Mason Developed ex-US Diversified Core ETF (DDBI), Legg Mason Emerging Markets Diversified Core ETF (EDBI) and Legg Mason US Diversified Core ETF (UDBI) will all be liquidated on March 22, 2019.

Miscalibrated? Lord Abbett Calibrated Mid Cap Value Fund merged into Lord Abbett Mid Cap Stock Fund (LAVLX) and Lord Abbett Calibrated Large Cap Value Fund was absorbed by Lord Abbett Fundamental Equity Fund (LDFVX), both on February 22, 2019. Each of the “surviving funds” carries a two-star rating from Morningstar and each has trailed 80% of its peers over the past decade.

Matthews Asia Focus Fund (MIFSX) will be liquidated on or about March 29, 2019. Tiny fund, mediocre record, no compelling focus.

Patriot Balanced Fund (ATBAX) will be liquidated on March 29, 2019. “Patriotism” meant not investing in companies that did business with Iran, Sudan and Syria. The fund lagged about 80% of its peers, though it’s hard to imagine that the difference is driven by the non-patriotic companies that everyone else chose to buy.

Principal Contrarian Value Index ETF and Principal International Multi-Factor Index ETF are at risk of extinction, following a NASDAQ compliance finding that they had too few shareholders (under 50) to remain as listed securities. Principal’s been given time to track down some additional shareholders but, really, why would they?

Spouting Rock Small Cap Growth Fund (SRSCX) has closed to new investments and will liquidate on March 20, 2019. Hmmm … if you got shares as a Christmas present this year, you’d be alternately delighted (by outperforming your peers by 3:1) and saddened (that you now own a liquidating investment).

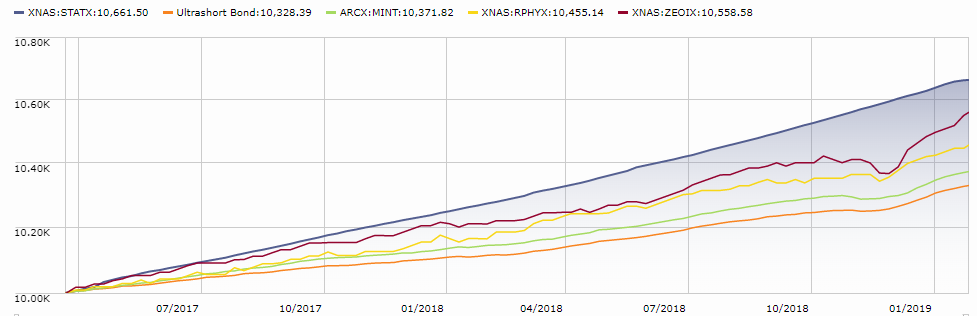

State Funds Enhanced Ultra Short Duration Mutual Fund (STATX) will liquidate on March 6, 2019. Uh-huh. That’s freakish. The fund has $90 million in assets, a 0.40% expense ratio, $100 minimum and a record so strong that it defied explanation. It outperformed its peers and its three best competitors, and did so with zero volatility.

A lively discussion of the fund alternated between excitement and deep suspicion of anything that smacked of “too good to be true.” And now it’s liquidating? Uh-huh. The Shadow, who is a senior member of our discussion board and remarkable observer of the developments in the industry, offers this passage as the only reason given: “Based on the recommendation of the adviser and given the Fund’s anticipated future expense, the Board has determined that liquidating the Fund would be in the best interests of the Fund and its shareholders.”

“Due to the Fund’s low asset levels, the high expense levels,” Stringer Moderate Growth Fund (SRQAX) is expected to liquidate at the close of business on March 31, 2019. That’s much more delicate than saying, “Due to the Fund’s high expenses, high sales load, bottom 5% returns, and tax inefficiency, investors have rationally chosen to avoid it and we have rationally chosen to terminate it.”

TETON Westwood Mid-Cap Equity Fund (WMCEX) will be liquidated on or about April 26, 2019.

Touchstone International Value Fund (FSIEX) is expected to be closed and liquidated on or about March 28, 2019.

Touchstone Merger Arbitrage Fund (TMGAX) is merging into Touchstone Arbitrage Fund (TMARX) around May 10, 2019. The funds have a correlation of 0.96 and identical (minimal) returns of 1.1% annually, so investors aren’t apt to notice the change.

Touchstone Controlled Growth with Income Fund (TSAAX) merges into the Touchstone Dynamic Diversified Income Fund (TBAAX) on about April 26, 2019. Similarly high five-year correlation, but the returns have been noticeably stronger for the surviving fund, so that’s good.

USCF Commodity Strategy Fund (USCFX) will liquidate on or around March 21, 2019.

USCF SummerHaven SHPEN Index Fund (BUYN) is in trouble ‘cause investors aren’t buyin’. NYSE’s compliance group has informed them that they’re at risk of de-listing because they don’t have at least 50 shareholders.

Western Asset Short Term Yield Fund (LGSTX), a $50,000 fund, all of whose shares are owned by a single person, will “terminate and wind up” on or about March 29, 2019.

On March 15, 2019, Wisdom will liquidate WisdomTree Australia Dividend Fund (AUSE), WisdomTree Japan Hedged Financials Fund (DXJF), WisdomTree Japan Hedged Quality Dividend Growth Fund (JHDG). WisdomTree Global SmallCap Dividend Fund (GSD), WisdomTree Global Hedged SmallCap Dividend Fund (HGSD), WisdomTree Europe Domestic Economy Fund (EDOM), WisdomTree Asia Local Debt Fund (ALD), and WisdomTree Brazilian Real Strategy Fund (BZF).