January 2019 will be remembered by mutual fund and Vanguard investors for a few things. Besides the stock market recovery that largely reversed the year-end 2018 selloff, the following two things occurred:

- On January 16th, John Bogle, age 89, died in his home in Pennsylvania. Mr. Bogle’s efforts on behalf of indexing and individual investors were widely honored and remembered.

- On January 22nd, Vanguard created the PDF for the Wellington Fund Annual Report, dated November 30, 2018. The US Postal Service distributed paper copies of this report during the first week of February.

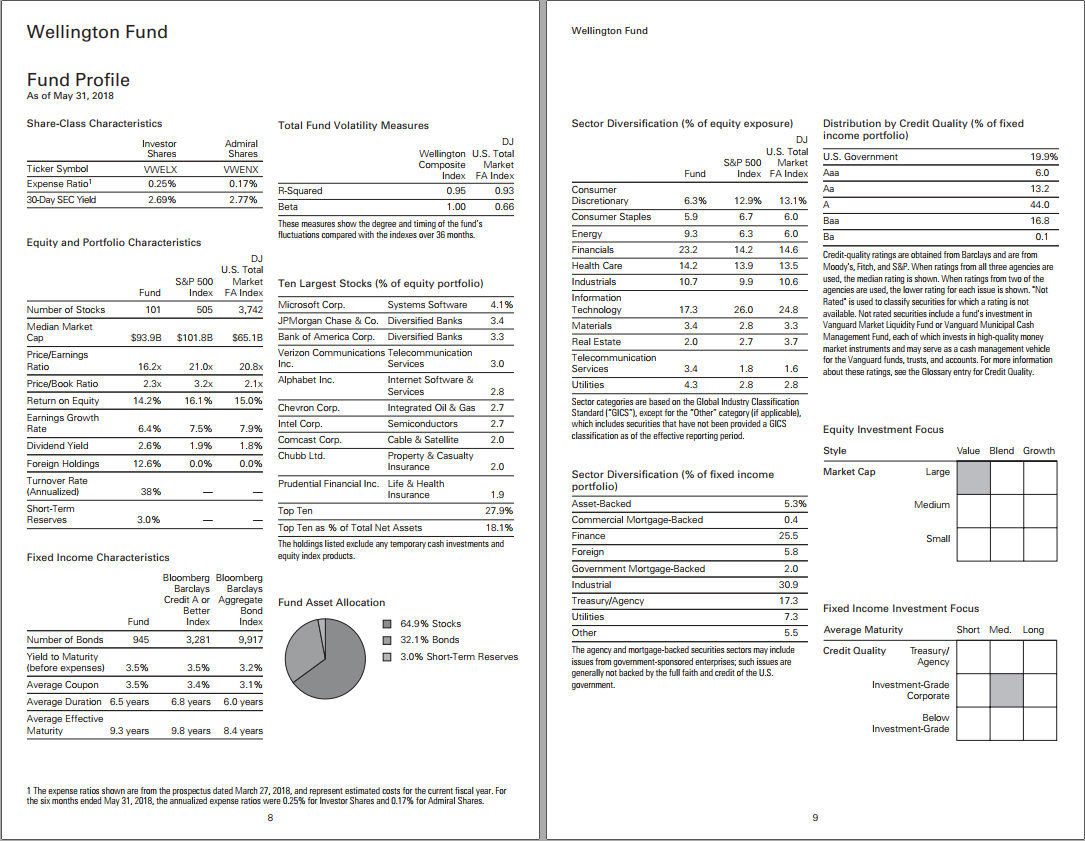

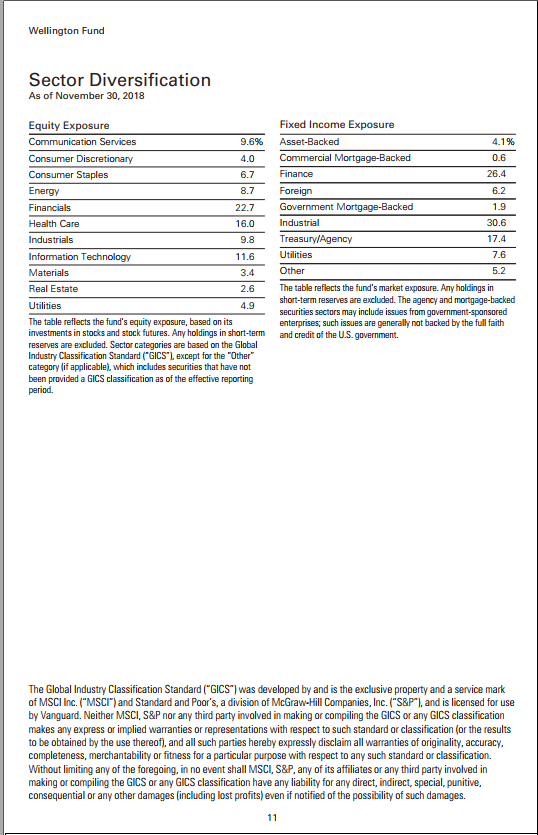

Compare, for example, the Fund Profile for Wellington Fund that was included with the May 31 2018 Semi-Annual Report, with the information included in the November 30 2018 Annual Report.

You will notice something peculiar – Vanguard has eliminated virtually all of the Fund Profile information from the Annual Report.

Gone, for example, are the Wellington Fund’s stock market symbols (VWELX or VWENX, for Investor and Admiral share classes, respectively), numerous stock portfolio metrics, including: number of stocks held, market cap, P/E and P/B ratios, return-on-equity, dividend yield, foreign holdings percentage, ten largest stocks, fund R2 and beta.

Gone as well are fixed income metrics including the number of bonds held, yield-to-maturity, average coupon, duration, and average effective maturity. Also missing are summary statistics on the bonds’ credit quality.

Long-time Vanguard experts and observers have remarked upon other recent changes in Vanguard’s disclosures and statements.

Daniel P. Wiener, editor of The Independent Adviser for Vanguard Investors and co-founder of Adviser Investments in Newton, MA, believes the changes may be related to Vanguard’s efforts to push folks to the web, in Vanguard’s continuing effort to cut costs. He notes that the second page of the new Wellington Fund annual report includes the following message:

Important information about access to shareholder reports

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of your fund’s annual and semiannual shareholder reports will no longer be sent to you by mail, unless you specifically request them. Instead, you will be notified by mail each time a report is posted on the website and will be provided with a link to access the report.

You may elect to receive paper copies of all future shareholder reports free of charge. If you invest through a financial intermediary, you can contact the intermediary to request that you continue to receive paper copies. If you invest directly with the fund, you can call Vanguard at one of the phone numbers on the back cover of this report or log on to vanguard.com. Your election to receive paper copies will apply to all the funds you hold through an intermediary or directly with Vanguard.

Wiener states that “the idea, of course, is that if folks don’t receive dead-tree [paper] reports, or they find them inadequate, they’ll go to the web… Vanguard, having shaved costs to the bone, and with service issues continuing to plague them, needs to find ways to continue to cut costs and at the same time redirect spending to the web. They’re well behind the competition in that regard so now they’ve gotta catch up.”

David Snowball points to Joseph DiStefano’s February 7 2019 column on Philly.com –

Vanguard SEC filings drop ‘at-cost,’ ‘no profit’ claims that were dear to late founder John Bogle.

DiStefano writes that Vanguard’s most recent statements to the Security and Exchange Commision (SEC) and investors no longer claim, as they once did, that:

The Vanguard Group is truly a mutual mutual fund company. It is owned jointly by the funds it oversees and thus indirectly by the shareholders in those funds. Most other mutual funds are operated by management companies that may be owned by one person, by a private group of individuals, or by public investors.

Nor do Vanguard’s recent statements claim (as they once did) that:

Vanguard operates “on an at-cost basis,” as if the funds charge the affiliated management company only what it costs for fund services, without the usual business overhead and profit margins.

As far as I can tell, Mr. Bogle never said “Know what you own, and know why you own it.” Those wise words were written by former Magellan Fund manager Peter Lynch, in his 1989 book One Up On Wall Street.

But it is not 1989 anymore, it is 30 years later – it is 2019. The year that John Bogle died. The year that Vanguard decided that you did not need to know what you own.

FIGURE 3: Going, Going, Gone!