At the time of publication, this fund was named Index Funds S&P 500® Equal Weight.

Objective and strategy

The fund equally weights all of the stocks in the S&P 500 index and rebalances its portfolio quarterly.

Adviser

The Index Group, LLC, headquartered in Colorado Springs, Colorado. While they are legally permitted to provide other advisory services, managing their mutual fund is their only current activity.

Manager

Michael Willis. Mr. Willis has been president of Index Funds since 2006. His earlier stints included serving as a senior vice president of UBS Financial Services (2003 to 2004), senior vice president-investment of PaineWebber (1999-2003) and first vice president of Smith Barney (1994-1999). This is the only vehicle he’s managing.

Strategy capacity and closure

$200-300 billion. Capacity constraints are normally imposed by starting with (1) the desired size of the lowest market cap fund in the portfolio or (2) by the need to be able to unwind positions with limited liquidity quickly and quietly. Neither of those is a meaningful constraint here: their tiniest firm has a $2 billion market cap and it will never get more than 0.22% of the portfolio and positions would change only as the composition of the underlying index does.

Management’s stake in the fund

Neither the manager nor the trustees has a direct investment in the fund. That having been said, the manager and his partner (aka The Index Boys) are pouring all of their money into running the fund which is reflected in the fact that they only charge investors 0.25% for a fund that costs them nearly 2% to operate. The trustees accept only $79/year for their services.

Opening date

April 30, 2015.

Minimum investment

$1,000

Expense ratio

0.25%, after waivers, on assets of $102.8 million, as of July 2023.

Comments

This is an update to our fund profile of June, 2018. For a complete discussion of the fund’s rationale and structure, please check the original profile. This update provides a short synopsis of the full argument and will provide updated performance information.

Thanks!

Standard and Poor’s compiles several versions of their famous S&P 500 index. The most famous is designated SPX. It is the cap-weighted version of the index. That means that the percentage weight each stock has in the index is directly tied to their market cap; a stock that represents 4% of the cumulative value of all the S&P stocks gets a 4% weighting in the index. As of April 2019, the top ten firms in the index comprise almost 25% of its entire weight. Over $3.4 trillion is invested in SPX index funds.

Another version of the index, designated Equal Weight Index or EWI, takes the exact same stocks but weights them differently. It gives every stock an equal weight in the index, 0.2% for everybody. Microsoft, which occupies 4% of the SPX is only 0.2% of EWI. The same 10 names that are almost 25% of SPX are just 2% of EWI. Once a quarter, the index is rebalanced to sell the winners back down to 0.2% and buy more of the losers to restore them to 0.2%. About $22.5 billion is invested in EWI index funds.

That simple difference in weighting creates significant differences in the biases embedded in the indexes:

- SPX is a large cap index, EWI acts like a midcap one. The average market cap for SPX is $110 billion, while EWI clocks in at $23 billion. 90% of the money in SPX, but only 57% of the money in EWI, is in large and mega-cap stocks.

- SPX is momentum-driven, EWI is a bit contrarian. The mantra for a cap-weighted index is “buy more of your winners.” To a limited extent, the discipline of an equal-weighted index is to sell down your winners and buy into your losers.

- SPX tilts more to growth, EWI tilts more to value. The “story stocks” from growth darlings (often the FAANGs) become a larger slice of the index as more investors pile up, increasing their size and the index’s valuations.

- SPX tilts more toward tech and telecomm, EWI has more exposure to the real world. Some of the greatest EWI overweights are in industrials, materials, real estate, utilities and energy.

The argument for investing in the S&P 500 Equal Weight Index is simple: you’re troubled by the fundamental flaw in the original S&P 500, which is its cap-weighting. It rewards, and becomes dependent on, the market’s largest and most overvalued stocks. And the sheer popularity of S&P 500 indexing (over $9.9 trillion indexed or benchmarked to the index, with indexed assets comprising approximately $3.4 trillion of this total) means that more money is automatically poured into those stocks, driving them to even higher valuations.

Two points worth knowing.

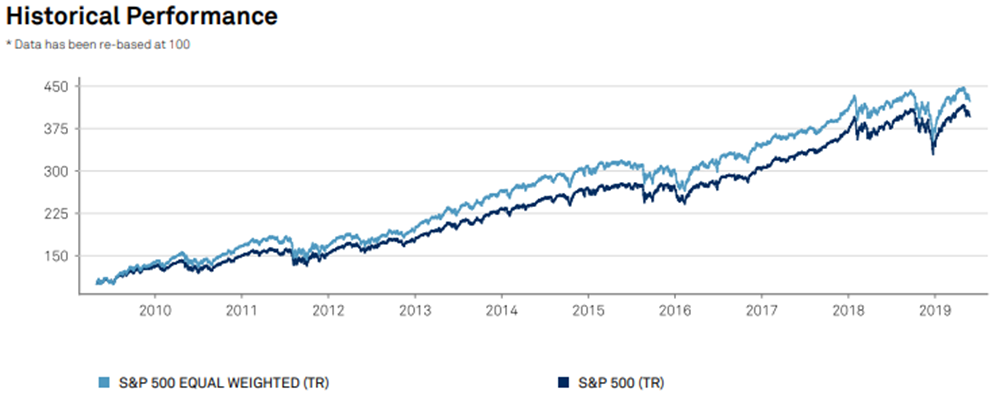

Over time, EWI beats SPX.

This chart of the 10-year performance comes from Standard and Poor’s itself.

Over the past decade, the conventional SPX index has beaten 85% of all large cap core funds. The unconventional EWI index has beaten 95% of them. Over 15 years, SPX leads 92% and EWI leads 98%. But, more centrally, EWI leads SPX.

Over time, INDEX has been your single best option for accessing EWI.

There are three vehicles that track EWI: two funds and one ETF. INDEX has been the best of them over its four-year lifetime. The other two options are huge: Invesco Equally-Weighted S&P 500 Fund (VADDX) holds $7.3 billion and charges 28 bps while Invesco S&P 500® Equal Weight ETF (RSP) has $15.2 billion and charges 20 bps.

Despite the popularity of the two older products, INDEX has since inception outperformed both on pure return and risk-adjusted returns.

| Four year | Three year | Two year | One year | AUM | |||||

| Annual Returns | Sharpe | Annual Returns | Sharpe | Annual Returns | Sharpe | Annual Returns | Sharpe | Millions | |

| INDEX | 9.4% | 0.68 | 12.68 | 0.98 | 10.8 | 0.68 | 10.42 | 0.47 | 42 |

| RSP | 9.1 | 0.66 | 12.57 | 0.97 | 10.8 | 0.68 | 10.44 | 0.47 | 16,100 |

| VADDX | 9.2 | 0.66 | 12.58 | 0.97 | 10.7 | 0.67 | 10.35 | 0.46 | 7,700 |

All data as of 4/30/2019, from the Lipper Global Data Feed and Morningstar. Thanks to my colleague Charles Boccadoro for adding the four-year performance metrics to the MFO Premium screener.

Those are very small performance differences, but they compound over time. A $10,000 investment in each of the three funds on the day INDEX launched would, four years later, have grown by 40.8 – 43.4%.

| INDEX | $14,340 |

| Invesco ETF RSP | 14,076 |

| Invesco Fund VADDX | 14,083 |

Calculation from Morningstar for the period 04/30/2015-05/01/2019.

The INDEX manager attributes their long-term success to tiny daily gains they have from intelligent cash management. By way of example, since prices in the first few and last few minutes of the market each day are highly volatile, they choose not to execute trades then which gains them an advantage that’s small but that more than offsets the ETF’s small price advantage.

On whole, you’d be silly not to pocket the extra money given that all three vehicles do exactly the same thing.

If you would like to reap those higher rewards, INDEX has proven to be a worthy option. With expenses of just 0.25%, it’s very affordable especially when you combine it with a low $1000 minimum investment. Mr. Willis has been managing the fund for four years and he’s signaled his commitment to his investors by pouring substantial amounts of his own money into creating and maintaining an accessible, low-cost vehicle.

Bottom Line

In the long-term, biases toward value, smallness and diversification have paid off handsomely. One attempt to calculate the returns of the equal-weight and cap-weight versions of the S&P 500 back to 1926 estimate that the equal-weight version outperforms the cap weighted version by 281 basis points per year; another, calculating from 1958, can EWI a nearly 350 bps year advantage. Skeptics of this approach, including our colleague Sam Lee, note that “there’s no such thing as a free lunch.” The higher returns come at the price of higher volatility, higher taxes as a result of more frequent portfolio rebalancing and the prospect of lagging badly during periods where mega-caps soar. All of which is true, though modestly so. For investors looking to de-FAANG their portfolios while maintaining exposure to the S&P 500 companies, INDEX offers a sensible, affordable option.

In the long-term, biases toward value, smallness and diversification have paid off handsomely. One attempt to calculate the returns of the equal-weight and cap-weight versions of the S&P 500 back to 1926 estimate that the equal-weight version outperforms the cap weighted version by 281 basis points per year; another, calculating from 1958, can EWI a nearly 350 bps year advantage. Skeptics of this approach, including our colleague Sam Lee, note that “there’s no such thing as a free lunch.” The higher returns come at the price of higher volatility, higher taxes as a result of more frequent portfolio rebalancing and the prospect of lagging badly during periods where mega-caps soar. All of which is true, though modestly so. For investors looking to de-FAANG their portfolios while maintaining exposure to the S&P 500 companies, INDEX offers a sensible, affordable option.