On May 31, 2019, Zeo Capital Advisors launched Zeo Sustainable Credit Fund (ZSRIX). The fund seeks to provide risk-adjusted total returns consisting of income and moderate capital appreciation. This marks the launch of Zeo’s second fund, after Zeo Short Duration Income (ZEOIX).

ZEOIX has performed exceedingly well over its eight years. The fund’s risk-adjusted returns have been best-in-class and its expenses have fallen. The limitation perceived by some of its major investors is that it is duration-constrained; that is, it doesn’t have the flexibility to pursue many attractive longer-duration opportunities. ZSRIX is designed to address those concerns.

“Sustainable Credit”

Sustainable: Investors view “sustainability” as offering one of two virtues. Some see sustainability as good, primarily, because it’s good for the planet. Others see sustainability as good because it’s good for the portfolio. Zeo falls in the latter camp. Firms pursuing sustainable practices (relatively sustainable practices, since some industries are more resource-intense by nature) are more credit-worthy. They’re giving evidence of making better long-term capital allocation decisions and they’re less subject to headline risk, policy risk or costly litigation.

Credit: Fixed income securities are subject to a combination of macro-level risks (the Federal Reserve or ECB acting to deal with an economic problem) or company-level risk (the management misallocating capital and being unable to pay their creditors). On whole, Zeo prefers dealing with the latter since it’s within management’s ability to control. So “credit” means that the portfolio is relatively interest-rate insensitive; that is, performance is driven primarily by corporate actions rather than macro-level ones.

The Process

The manager, humbly enough, understands that he cannot directly control his portfolio’s returns, but he can control its risk exposures and so that’s where he starts. He anticipates portfolio volatility, which some interpret as “risk,” at 150-250% of ZEOIX’s. “The market will,” he notes, “pay more or less of a premium for that portfolio compared to Short Duration’s.”

The fund will:

- Use the same investment discipline as ZEOIX.

- Be managed by Venkatesh Reddy, Zeo’s founder and ZEOIX’s manager.

- Invest primarily, and actively, in fixed income securities; they define that asset class pretty broadly.

- Target companies who are leaders among their peers in key areas of sustainable business practices.

- Typically be longer-dated than ZEOIX but shorter-dated than the total bond market.

The fund may:

- Invest internationally, including securities from emerging markets issuers.

- Invest a majority of its assets in high-yield bonds.

- Manage interest-rate risks by varying the duration of the portfolio or hedging.

The Case for Considering the Fund

The firm’s flagship fund offers reason for some optimism about the prospects of Sustainable Credit. Here’s the performance of Zeo Short Duration, since inception, against its Lipper “multisector income” peer group.

Comparison of Lifetime Performance (06/2011 – 04/2019)

| APR | Max DD | Std Dev | Down Dev | Bear market dev | Sharpe ratio | Sortino ratio | Martin ratio | Ulcer Index | |

| Zeo Short Duration Income | 3.1 | -1.5 | 1.2 | 0.6 | 0.2 | 2.05 | 4.41 | 9.21 | 0.3 |

| Multi-Sector Income Average | 3.8 | -5.7 | 3.8 | 2.3 | 1.2 | 0.91 | 1.57 | 2.40 | 1.7 |

How do you read that? Annual percentage returns (APR) measure the fund’s upside for the period mentioned, while the next four measure its downside: deepest decline during the period, normal volatility, downside or “bad” volatility and volatility in bear markets. The remaining four reflect the state of the balance between return and risk; Sharpe is the most widely-followed metric, Sortino is a bit more risk-averse and Martin is the most risk-averse of all. The Ulcer Index combines means of how far a fund falls and how long it takes to recover; funds that fall a lot and stay down tend to give their investors ulcers, hence the name.

ZEOIX has offered returns that are a bit lower than its peers with risks that are vastly lower; in consequence, its risk-return ratios are among the best in its peer group. Its Sharpe and Martin ratios are the second-best among its 53 peers, while its Ulcer index and Sortino ratio are the group’s best.

Morningstar places Zeo Short Duration in its high-yield peer group, which strikes us as misleading. Because Zeo is much more cautious than a high-yield fund – for example, its standard deviation is one-quarter of the average HY fund and its effective duration is one-fifth the average – its performance is wildly out-of-step with the group’s. In years when the group soars, Zeo has terrible relative performance and in years when the group tanks, Zeo has great relative performance. As a result, Zeo’s peer ranking and Morningstar rating tell you more about how the group has done lately than about whether Zeo continues to deliver on its promise: steady, positive absolute returns.

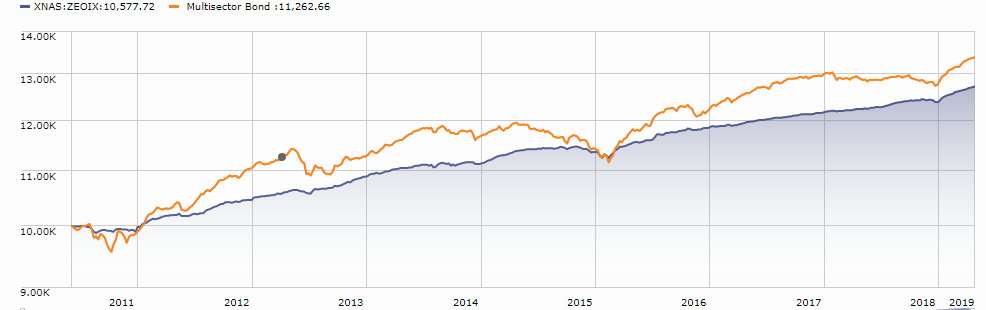

To get an idea of its steadiness, here’s a chart of ZEOIX against Morningstar’s equivalent to the Multi-Sector Income group:

In short, over time and with great consistency, Mr. Reddy has delivered what he promised. Mr. Reddy has a comparable goal for Short Duration: “best-in-class risk-adjusted returns measured by Sharpe ratio, among other ways.”

The fund carries a $5,000 minimum initial investment and expenses of 1.25% (after waivers for 2019). The Zeo Sustainable Credit Fund (ticker ZSRIX) should be open for investment Monday, June 3 on the following platforms:

- Direct through the transfer agent

- Charles Schwab

- Fidelity

- Pershing (within a week of launch)

Other custodial platforms added upon request. Given that ZEOIX is available for purchase on JPMorgan, Pershing, TD Ameritrade, and Vanguard, it’s likely this one will appear there, too.