This fund has been liquidated.

Objective and strategy

Matthews Asia Value pursues long-term capital growth by investing in a diversified portfolio of securities of undervalued companies from the Asian region. The target is firms that are high quality, undervalued with strong balance sheets, focused on their shareholders, and well-positioned to take advantage of Asia’s economic and financial evolution. The goal is to buy shares at a discount of 30% or more to their calculation of intrinsic value.

It is an all-cap portfolio, which translates to an exceptional weighting in small- and mid-cap names. At the most recent portfolio report, 65% of the portfolio was in mid-cap and smaller names with 12% in micro-cap stocks. That’s double the peer average. While the manager would prefer to be fully invested, as he was in 2015 and 2016, he is willing to hold cash when there aren’t rich opportunities. The cash stake currently is above 15%.

Adviser

Matthews International Capital Management, more commonly known as Matthews Asia. Matthews Asia is the largest dedicated Asia-only investment specialist in the United States. They were founded in 1991 by Paul Matthews and launched their first funds in 1994. As of May 31, 2019, Matthews Asia had US$28.9 billion in assets under management. They advise the 17 Matthews Asia mutual funds, which range from “risk-conscious and pretty good” to “risk-conscious and outstanding.” As a firm they pursue a bottom-up, fundamental investment philosophy with a focus on long-term investment performance.

Manager

Beini Zhou, with the assistance of Michael Han. Mr. Zhou manages the firm’s Asia Value Strategy and co-manages the Asia Small Companies Strategy. Prior to joining Matthews in 2013, he was a Research Analyst with Artisan Partners on the Global Value Team. He earned an M.S. in Computer Science and a B.A. in Applied Mathematics, both from Harvard and both relevant to his investing discipline. Mr. Han is the fund’s co-manager and the primary answer to the question, “what happens if Beini Zhou gets hit by a bus?” Before joining Matthews in 2007, he worked at Luxor Capital Group and Crystal Investment Group. He has earned an MBA from Columbia. Both have been with the fund since launch.

Strategy capacity and closure

The capacity is about $5 billion. Matthews has an excellent track record of closing funds in order to manage inflows and protect existing investors. That said, with assets currently at 1% of capacity, this might remain a hypothetical protection for a bit.

Management’s stake in the fund

Mr. Zhou has invested between $50,000 – 100,000 in the fund; Mr. Han has not invested in it. One of Matthews other portfolio managers, Tiffany Hsiao, also had invested in the fund. As of December 2018, none of Matthews’s independent or interested trustees had invested in the fund. That’s rarely reassuring.

Opening date

November 30, 2015

Minimum investment

$2,500 for retail shares, $100,000 for institutional shares.

Expense ratio

1.5%, after waivers, for investor shares and 1.25% for institutional shares, on assets of $26 million.

Comments

Matthews Asia Value is an exceptional fund. It possesses three characteristics that make it well worth your consideration.

It is a Matthews fund.

Matthews is the industry’s top Asia specialist. It’s been their focus for nearly 30 years. While the largest firms might offer a few Asia-focused funds (Vanguard, one; T. Rowe Price, three; Fidelity, four), Matthews has seventeen. They’ve had “boots on the ground” for decades, they have operations based in Asia and their investment team is rooted in the region and its cultures. Matthews notes:

The 48 members of our investment team each have deep experience in Asia and share a commitment to helping you understand and leverage Asia’s long-term growth potential. They bring to that effort a range of skills, experiences, and backgrounds, with 35 team members hailing from Asia, speaking 15 different Asian languages and dialects.

Matthews funds are, across the board, solid, disciplined and risk conscious.

It is a value fund.

The story about investing in Asia has always been the growth story. Louise Kavanagh, a Hong Kong-based managing director for Nuveen notes:

Over the next few decades, the weight of economic power and structural megatrends will lean heavily towards the Asia-Pacific region. By 2030, Asia-Pacific, led by China, will account for nearly half of the world’s output, more than 50% of the world’s urban population growth and almost all of the top 50 global cities, with the largest forecasted change in wealthy households.

Matthews themselves strike the same chord: “Asia is the fastest-growing, most dynamic region in the world, currently representing one-third of global GDP and more than half of the world’s annual growth.” In JPMorgan’s “10 Reasons to Invest in Asia” (2019), the word “growth” occurs five times and “value” not at all. That growth bias once made sense, but Asia’s markets are now evolving in ways that will finally reward value investors.

The same growth bias manifests itself in the structure and portfolios of mutual funds. The only diversified Asian fund or ETF that even has “value” in its name is this one. Eight diversified Asia funds and ETFs– that is, ones focused neither on the emerging markets or a single country – have value-tilted portfolios. Several are, frankly, tiny and bad.

In international markets over the past 1-, 3- and 5-year periods, large has beaten small and growth has beaten value by about 300 bps. And still Matthews Asia Value, whose portfolio is tilted toward “small” and “value”, has been beating the larger-and-growthier pack since inception.

Three year performance, through 05/2019

| Value | Rank among all diversified Pacific region funds and ETFs | |

| Annual return | 9.9% | 4th |

| Standard deviation | 11.3 | 5th |

| Sharpe ratio | 0.75 | 2nd |

| Downside deviation | 11.3 | 5th |

| Sortino ratio | 1.10 | 3rd |

Among the Asian value options, Matthews has the second-highest returns and the highest Sharpe ratio.

It has Beini Zhou.

I’ve spoken twice, at length, with Mr. Zhou at the Morningstar Investment Conference. I talk with lots of managers each year. He is among the most impressive I’ve met in terms of clarity and precision of thought and expression. He was, at our last conversation, in the midst of taking courses on artificial intelligence and teaching himself a new programming language with the intent of designing a program that could scrape qualitative data, not just statistical data, from conference calls and other corporate documents.

Mr. Zhou made two arguments: that Asian markets were evolving in a way that will benefit value investors and that most of the folks attempting value investing in Asia don’t “get it.” Doctrinaire thinking, or an over-dependence on quantitative measures, leads most investors into value traps.

The Asia ex-Japan market has an abundance of undervalued stocks. Many, however, are undervalued for good reasons. It could be the business has not been growing and has no prospects for growth; corporate governance could be poor; management could include questionable characters or a shady past; business quality could be mediocre; or its financial numbers may seem too good to be true. A few years ago, we passed on a sizable Chinese specialty chemicals company at a single-digit price-to-earning (P/E) ratio even though all our checks, qualitative and quantitative, came back fine. We passed simply because we did not feel comfortable with the company’s operating margin of almost 60%. The stock was subsequently suspended by the local stock exchange due to concerns of potential fraud.

With its less-developed economies and markets, Asia is full of such landmines if one blindly invests in statistically cheap companies. (“Value Investing in the Digital Age,” 2019)

He attempts to avoid those landmines using two, complementary strategies. First, he spends a lot of face-to-face time with management, deciding whether or not they’re the sort of people with whom he could invest. “The jockey,” he argues, “is often as important as the horse. When we meet with a founder in Asia, numbers are secondary and we use our initial first-hour meeting to inquire about the history, culture and DNA of the organization.” That’s the point at which individual intellect partners with deep linguistic and cultural knowledge to produce clues that others might miss.

Second, he tries to connect the dots in ways that others don’t. He sees great value in tech stocks despite the fact that “value orthodoxy avoids tech.” Ten of the hundred firms on his immediate watchlist, those that meet his quality criteria but don’t yet represent good value, are tech firms.

Two key conditions are now in place for a value-oriented investing strategy in Asia. First, the slowdown in Asia in recent years has led to a compression of earnings multiples in the valuation of many companies in the region. Many of these same stocks used to be growth darlings trading at a highflying multiple that is the bane of value investors. But many now trade at no higher than a mid-teen P/E ratio while still generating double-digit profit growth, albeit not growing as fast as before. This presents opportunities to value investors that were not as readily available earlier. Case for Asian value investing (2017)

With luck, and skill, he identifies 30-40 “quality businesses where bad things have happened” that are actively changing their fate and that sell for $.70 on the dollar (“I want to buy a dollar for $.70 so long as it’s soon going to be worth more than a dollar”).

Bottom Line

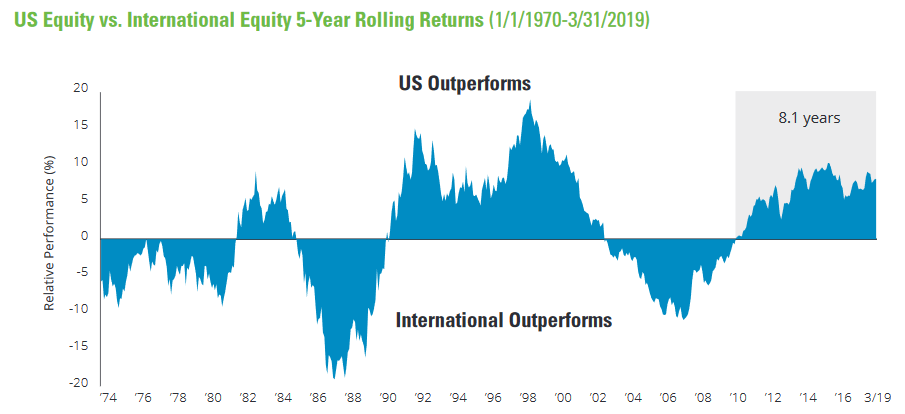

American investors have long been underexposed to international markets (foreign stocks represent 60% of global market cap but under 20% of US equity portfolios) and that problem has been getting worse (Fidelity estimates that international exposure has fallen 3-8% this decade, with young investors having the least international exposure). Even in perfectly normal markets, that’s bad because an undiversified portfolio tends toward both lower returns and higher volatility than one with a substantial global balance.

The problem is especially pressing now. The US stock market has the highest valuations in the world and the second-highest in US stock market history. Sober folks – Vanguard, Research Affiliates, GMO – all project the US to underperform in the decade ahead. It happens. Really.

(source: The Hartford Funds, US & International Markets Move in Cycles, 2019)

Sober but more alarmed folks are a bit more emphatic. “The Case for Avoiding U.S. and Buying Asia Instead” (Barron’s, 03/08/19) draws on the work of Chris Wood, a very well-respected analyst, to conclude that the financial engineering that’s been propping up the US market leaves us in a singularly fragile space.

For those interested in looking beyond, this is both an exceptional fund and an exceptional manager. While Mr. Zhou is risk-conscious in his decisions, though, it is not a “conservative” fund per se. You should not invest in it expecting low volatility or a downside hedge against either US or global market declines. The argument, instead, is that it offers a distinctive take on a dynamic region; Mr. Zhou has been finding value in ways, and in places, that others miss. In doing so, he’s been serving his investors in ways that other vehicles – both active and passive – have not been able to do.

For investors looking to re-establish their domestic / international balance, this is a first tier option.

Fund website

Matthews Asia Value. The Matthews site, in general, is chock-a-block with information on developments in Asia and their investment implications. Mr. Zhou has also authored a short, clear piece entitled “Value Investing in the Digital Age” (2019) which you’d benefit from reading.