I am selective in the analysts that I receive market commentary from. They are overwhelmingly cautious. The buzz word “FOMO or Fear Of Missing Out” is used to describe retail investors piling into markets. The quote that sums up my feelings best comes from Liz Ann Sonders of Charles Schwab in “High Hopes: S&P 500 Hits All Time High Amid Pandemic/Recession”, published on Advisor Perspectives.

I worry about the signs of froth in the market and among some behavioral measures of investor sentiment: not to mention traditional valuation metrics that are historically stretched. This is not an environment in which greed should dominate investment decisions; but instead one for discipline around diversification and periodic rebalancing…

This article looks at a brief history of global and alternative funds, two Model Portfolios created from these funds, and a summary of some of the best alternative and global funds available to individual investors, in my opinion. Readers that are only interested in a Short List of Funds including fund strategies may want to skip to the Summary Section. Those interested in why I chose these funds should wade through the rest of the article.

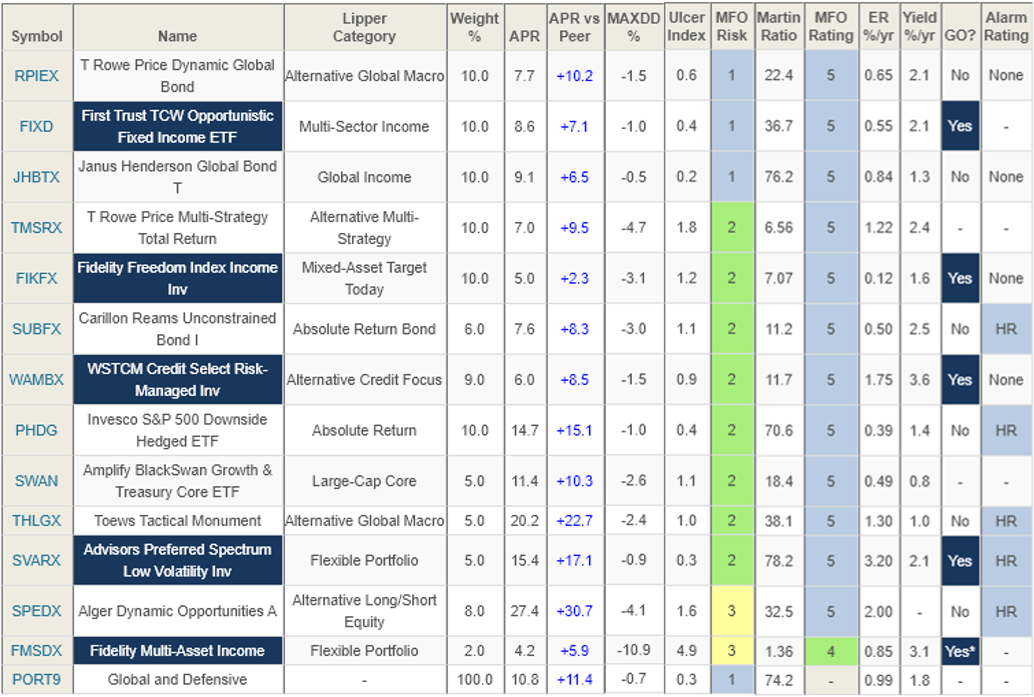

The Figure below shows some recent data on consumer spending, business and retail sales, employment, interest rates, inflation, and the value of the dollar. The trends are that inflation remains modest, interest rates are historically low, sales and spending have recovered to within a few percent of what they were in 2017. Employment recovery has slowed. The dollar strengthened during the early part of the recession and has been weakening since. Meanwhile, the S&P 500 has increased by 15% during the past 12 months.

Figure #1 Snapshot of the U.S. Economy

Source: Created by the Author using the St. Louis Federal Reserve FRED database

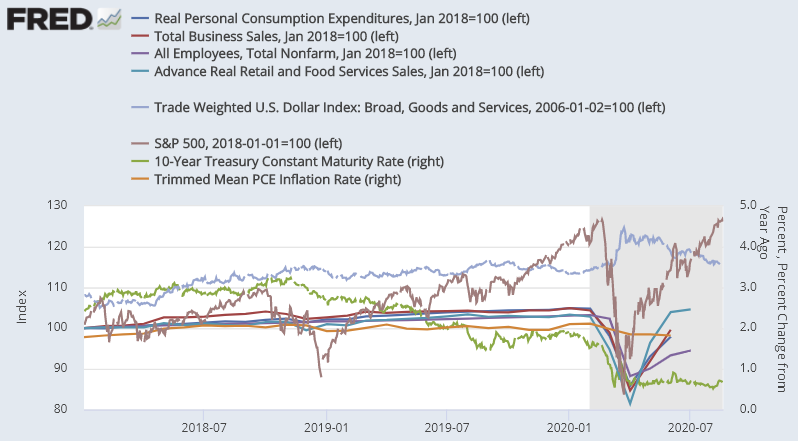

Meanwhile, commercial chapter 11 filings for the last four months are up 42% compared to the same four months in 2019. According to Challenger Gray & Christmas, “Companies announced nearly 1.6 million permanent job cuts in the first half of 2020…” The Conference Board Leading Indicators have been growing at a slower rate for the past two months. Tom Roseen at Lipper Alpha Insight points out that for the seventeenth week in a row, investors redeemed equity mutual funds, withdrawing $5.1 billion while equity ETFs had net outflows of $1.5 billion. Corporate profits are reflecting the realities of the recession as shown in Figure #2.

Figure #2: Impact on Corporate Profits

Source: Created by the Author using the St. Louis Federal Reserve FRED database

A Brief History of Global and Alternative Funds

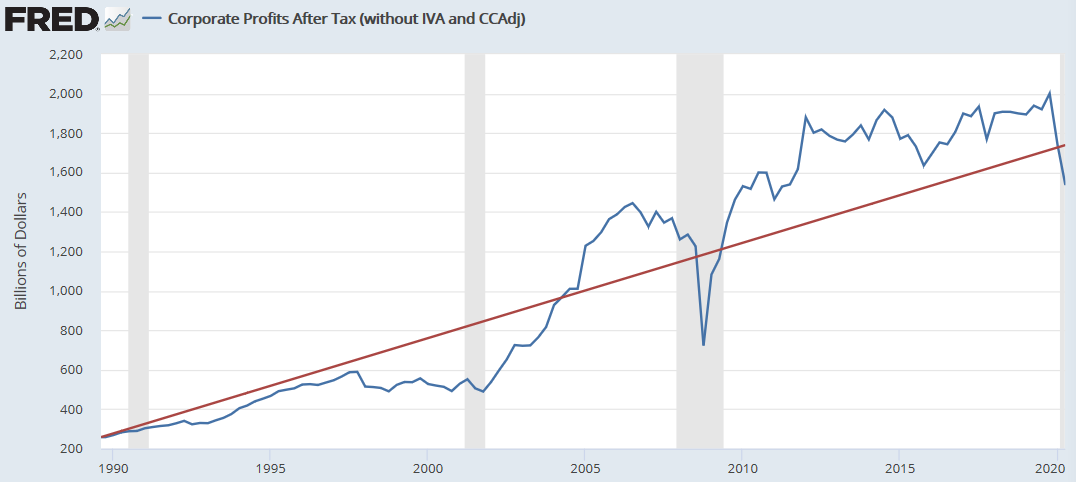

To look at the longer-term performance of global and alternative funds, I extracted 225 funds from the Mutual Fund Observer Premium screener that have been in existence for at least 15 years. What we can see in Table #1 is that Global and International Income Funds, Absolute Return Bonds, and Conservative Mixed Asset have done well in bull and bear markets and when interest rates are falling, but not well in a year (2005) when inflation was rising.

During bull markets and when interest rates are falling, Flexible Income and Portfolio, Global Macro, Long/short, and Multi-Strategy Funds have done well. All but Flexible Income did well in 2005 when inflation was rising. In a mild recession or bear market, these funds do well but are subject to larger losses during a financial crisis, but still lower than equity.

Table #1: Long Term Performance of Global and Alternative Funds

Source: Created by the Author using Lipper Global Datafeed and the MFO Premium screener

What the table above shows is that there are not many funds that have a long term history in these categories. They may be new to retail investors, suffer from survivor bias, or are new financial innovations. Descriptions of the Lipper Categories came from Refinitiv Lipper Classifications and Refinitiv Lipper U.S. Funds Classifications. A description of the categories follows:

-

- Global Income Funds: Funds that state in their prospectus that they invest primarily in U.S. dollar and non-U.S. dollar debt securities of issuers located in at least three countries, one of which may be the United States.

- International Income Funds: Funds that state in their prospectus that they invest primarily in U.S. dollar and non-U.S. dollar debt securities of issuers located in at least countries, excluding the United States, except in periods of market weakness.

- Absolute Return Bond Funds: Funds that aim for positive returns in all market conditions and invest primarily in debt securities. The funds are not benchmarked against a traditional long-only market index but rather have the aim of outperforming a cash or risk-free benchmark.

- Absolute Return Funds: Funds that aim for positive returns in all market conditions. The goal is not to benchmark against a traditional long-only market index, but rather to outperform a cash or risk-free benchmark.

- Flexible Portfolio Funds: Funds that allocate their investments to both domestic and foreign securities across traditional asset classes with a focus on total return. The traditional asset classes utilized are common stocks, bonds, and money market instruments.

- Alternative Multi-Strategy Funds: Funds that, by prospectus language, seek total returns through the management of several different hedge-like strategies. These funds are typically quantitatively driven to measure the existing relationship between instruments and in some cases to identify a position in which the risk adjusted spread between these instruments represents an opportunity for the investment manager.

- Alternative Global Macro Funds: Funds that, by prospectus language, invest around the world using economic theory to justify the decision-making process. The strategy is typically based on forecasts and analysis about interest rate trends, the general flow of funds, political changes, government policies, intergovernmental relations, and other broad systemic factors. These funds generally trade a wide range of markets and geographic regions, employing a broad range of trading ideas and instruments.

- Alternative Long/Short Equity Funds: Domestic or foreign funds that employ portfolio strategies combining long holdings of equities with short sales of equity, equity options, or equity index options. The funds may be either net long or net short, depending on the portfolio manager’s view of the market.

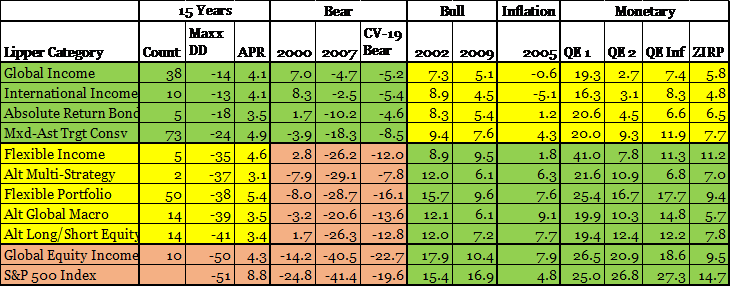

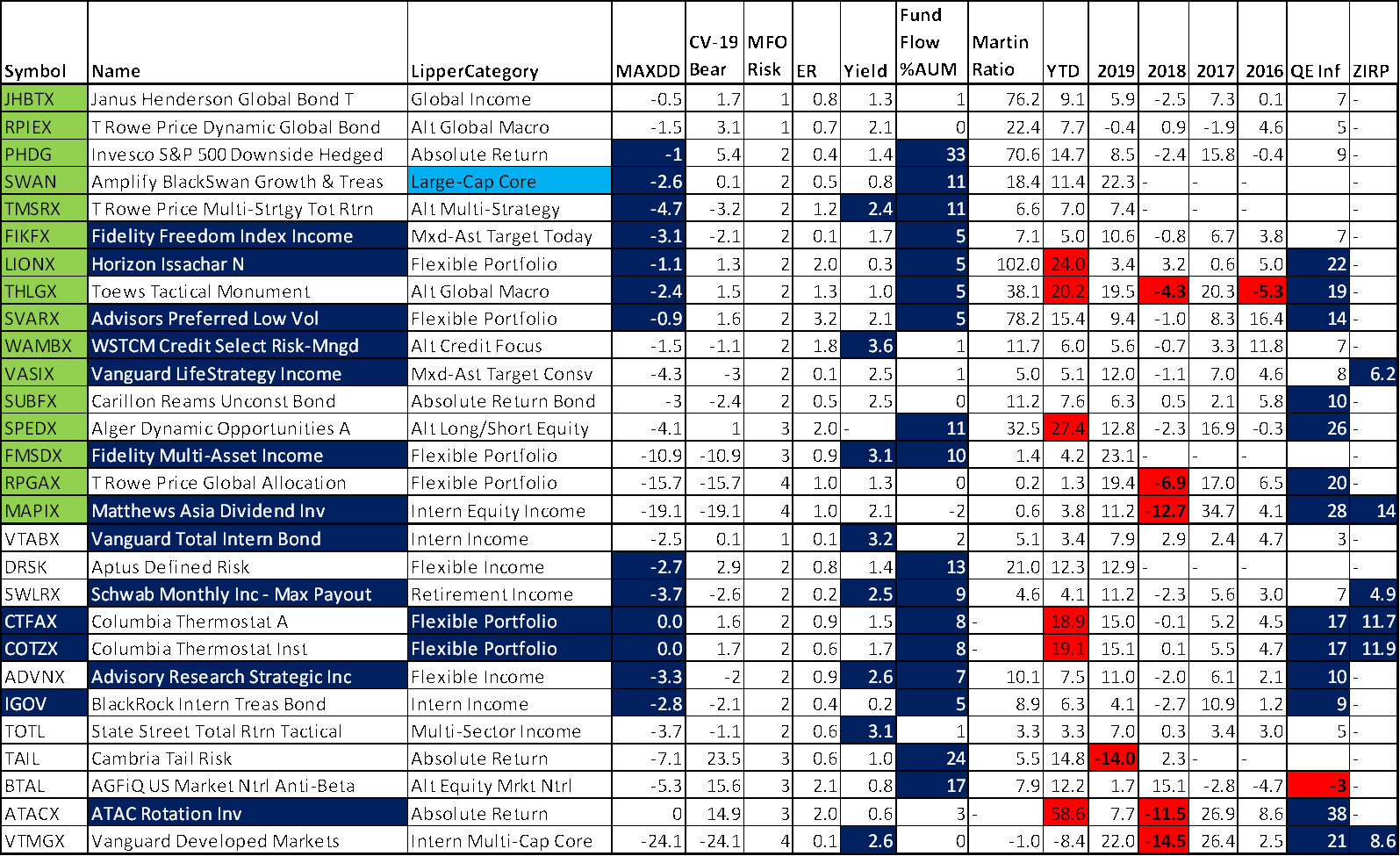

In this article, I screened over 50 funds, with several in each category, that have done well over the past five years but focusing on year to date performance. The following busy Figure below is the funds included in Model Portfolios and a few other interesting funds. In the Symbol column, the symbols highlighted in green are those included in the Model Portfolios in this article, and those in blue are ones that I found attractive. The table is sorted by those included in Model Portfolios, the MFO Risk Rank, and the Fund Flows. In the Name Column, the names highlighted in blue are Great Owl Funds. In the Lipper Category Column, the Large-Cap Core category for SWAN is misleading because it mostly invests in treasuries and uses options. The funds in the MAXDD column that are highlighted in blue have both low drawdowns and high fund flows. The funds that are highlighted in red in the YTD column raise the red flag that the fund has risen high quickly. The red cells in the years 2106 through 2019 highlight funds that have inconsistent returns. The last two columns highlight funds that do well with stimulus or in a low-interest-rate environment. What the table shows is that investors are currently seeking downside protection.

Table #2: Lower Risk, Higher Return Global and Alternative Funds

Source: Created by the Author using Lipper Global Datafeed and the MFO Premium screener

Overview of Model Portfolio Results

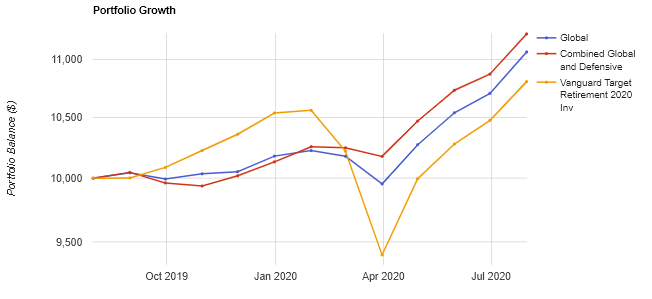

In this article, I build two portfolios selecting funds using Mutual Fund Observer Premium screens to the Lipper Global Database. These two portfolios are compared to the Vanguard Target Retirement 2020 Fund (VTWNX) in Figure #3 below. The link to Backtest Portfolio Asset Allocation is provided here. Interested readers can change funds and allocations. I like that the Combined Global and Defensive Portfolio had low drawdowns and decent returns.

Figure #3: Model Portfolios Compared to the Vanguard Target Retirement 2020 Fund

Source: Created by the Author using Portfolio Visualizer

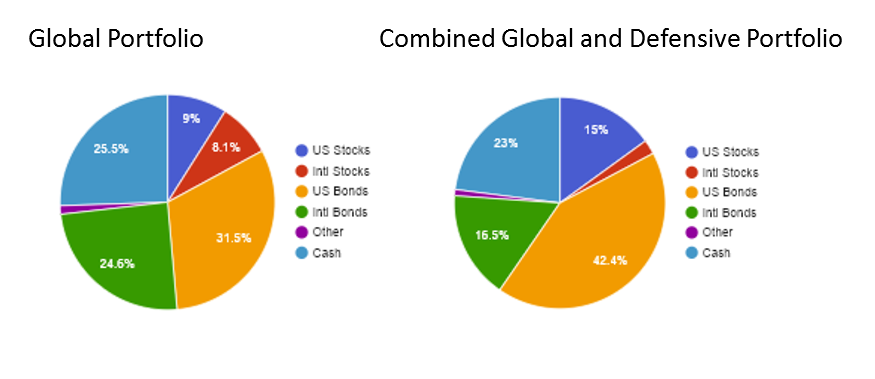

Both portfolios have close to 20% allocation to equities, 50 to 60 percent bonds, and 20 to 25% in cash. Some of these funds hedge and use leverage to manage risk.

Figure #4: Model Portfolio Allocations

Source: Created by the Author using Portfolio Visualizer

One criterion that I used for selecting global funds was that each fund had to have at least 30% of its assets outside of the United States. Portfolio Visualizer was used to reduce the original fifty funds into a Conservative Global Portfolio that had a drawdown of 2.6% this year with an annualized return through July of 9.5%. My last several articles on Seeking Alpha have looked at defensive funds. The second portfolio in this article combines the funds from the Conservative Global Portfolio with a Defensive Portfolio. Portfolio Visualizer is used to create a portfolio that maximizes the Sharpe Ratio over the 12 months. The link to Portfolio Optimization is here.

Global Portfolio

Each fund in the Global Portfolio has an age of 5 to 25 years except for the Fidelity Multi-Asset Income younger share class Fund (FMSDX). The portfolio had a maximum drawdown of 2.6 on a monthly basis and has an annualized return of 9.5 percent year to date.

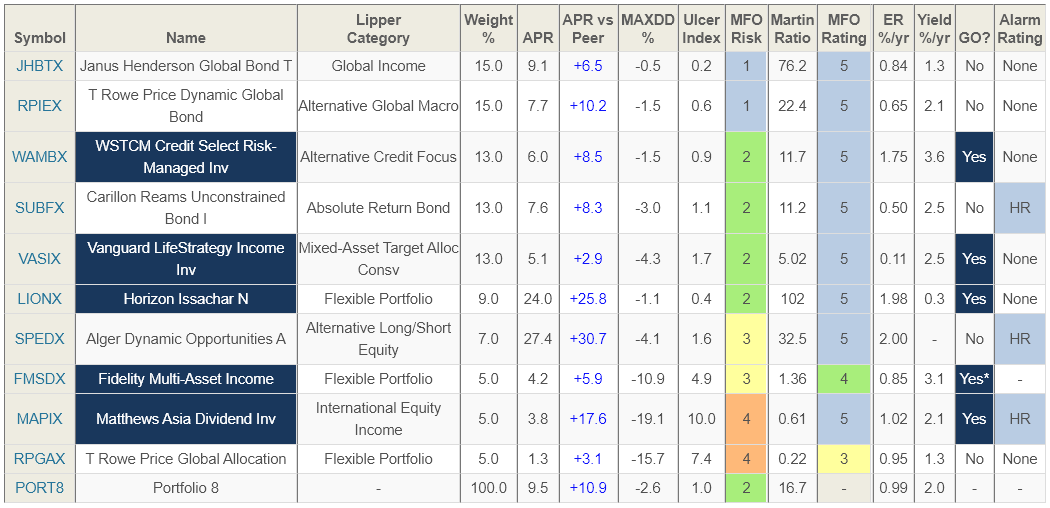

Table #3: Global Portfolio – Mutual Fund Observer Portfolio Tool

Source: Created by the Author using Lipper Global Datafeed and the MFO Premium screener

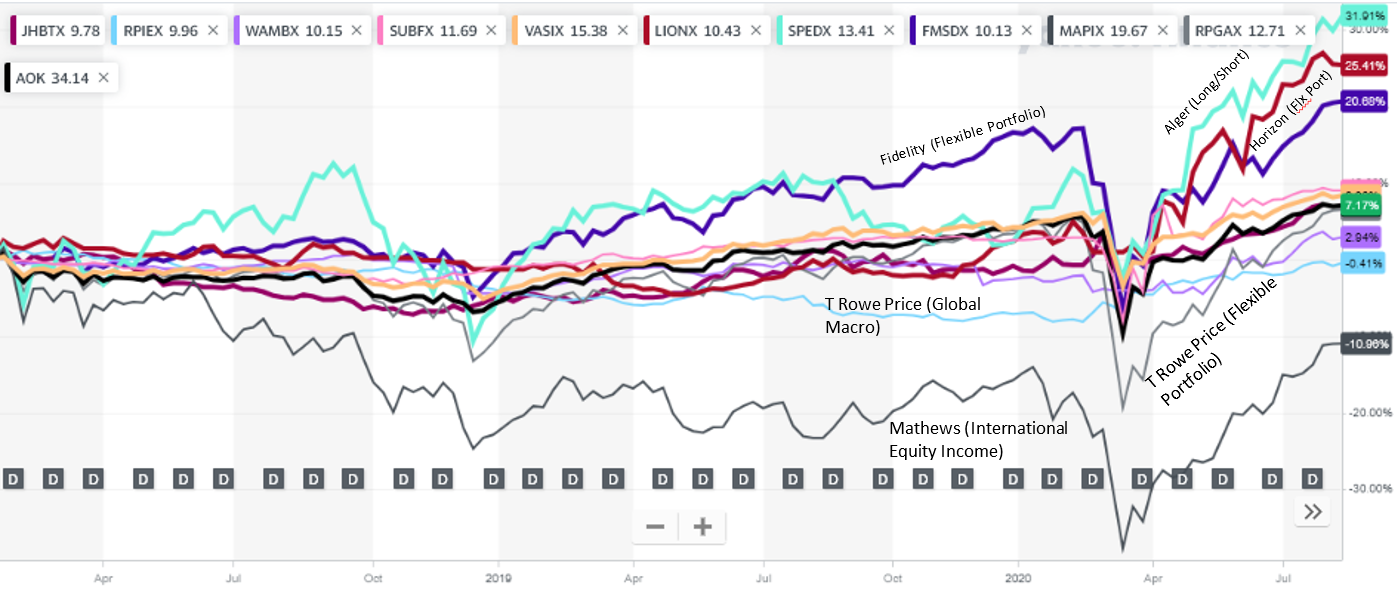

All of the funds outperformed the BlackRock iShares Core Conservative Allocation ETF (AOK) during the first seven months of the year. Alger Dynamic Opportunities (SPEDX) and Horizon Issachar (LIONX) have done well, but raise the question about how much they might fall if conditions changes. Matthews Asia Dividend (MAPIX) raises concerns about the impact of trade tensions if conditions worsen.

Figure #5: Global Portfolio Funds Year to Date

Created by the Author using Yahoo Finance

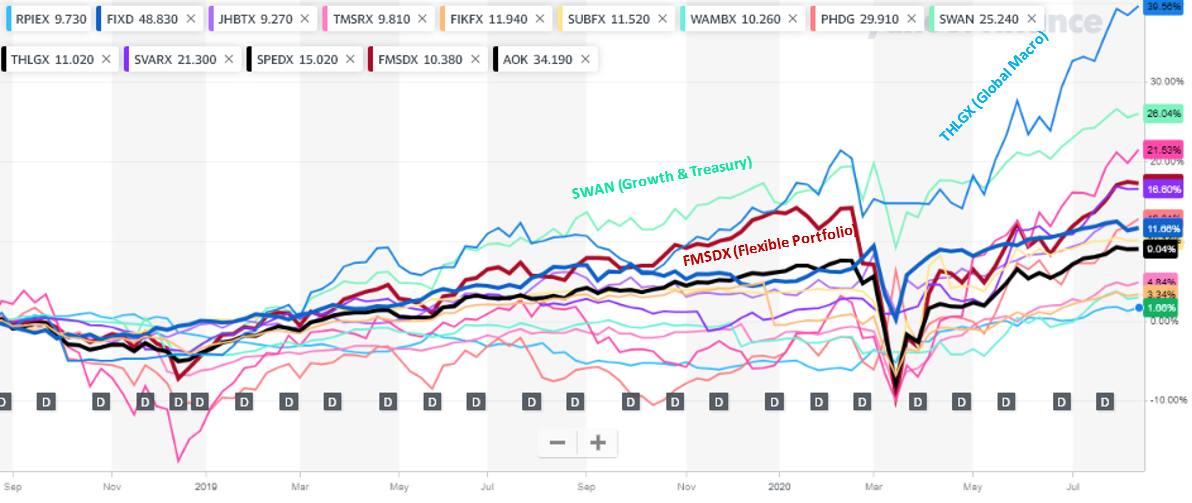

The next table shows how well the funds have done since January 2018. The future is guaranteed to be different than the past, but past performance does give a perspective of how the funds might behave in stressed conditions.

Figure #6: Global Portfolio Funds From January 2018

Created by the Author using Yahoo Finance

Combined Global and Defensive Portfolio

I wanted to see how a Model Portfolio would perform if I combined the Global Portfolio above with Defensive Funds that I had written about on Seeking Alpha. I combined the funds and used Portfolio Visualizer to maximize the Sharpe Ratio. The results are shown using the Portfolio Visualizer Portfolio Tool. One thing to note is that the recent trend is downward on many of the more defensive funds.

Table #4: Global and Defensive Portfolio – Mutual Fund Observer Portfolio Tool

Investors interested in Advisors Shares Spectrum Low Volatility (SVARX), but don’t like the high expense ratio also may want to evaluate Columbia Thermostat Flexible Portfolio (CTAFX and COTZX) which are available at Vanguard. The Prospectus highlights changes Columbia Thermostat implemented in May which increases the allocation to stocks.

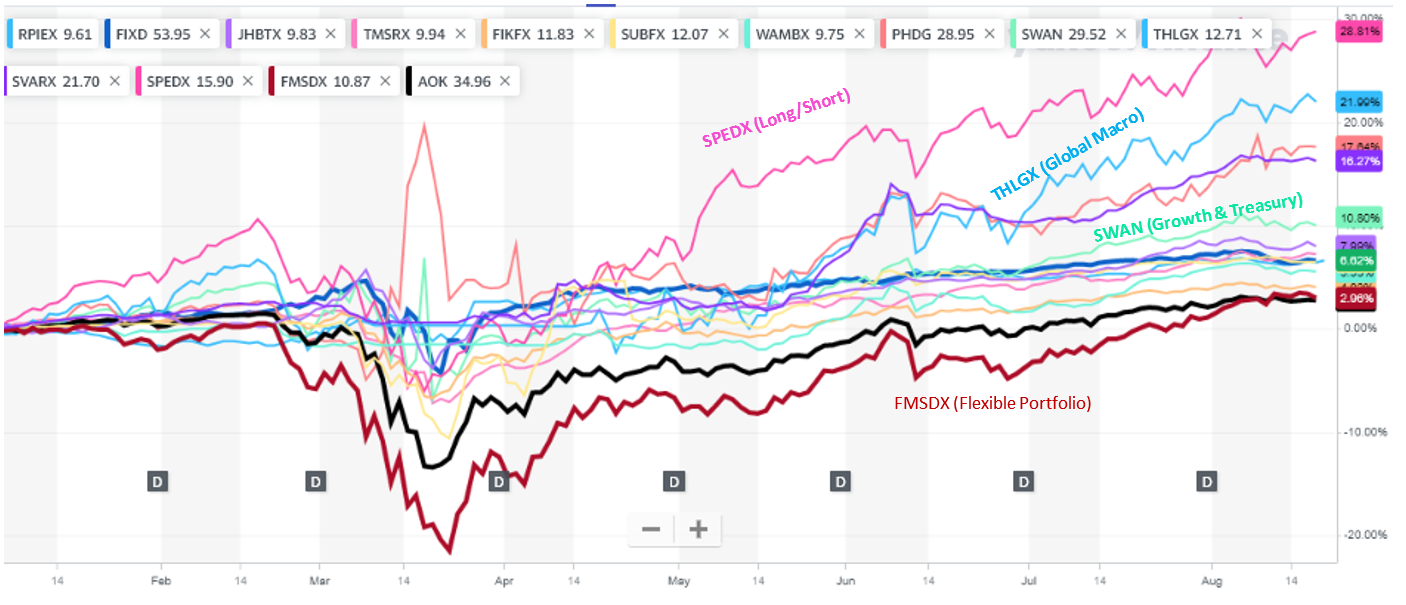

Figure #7: Global and Defensive Portfolio Funds Year to Date

Created by the Author using Yahoo Finance

Figure #8: Global and Defensive Portfolio Funds from January 2018

Created by the Author using Yahoo Finance

Summary – The Short List

After screening all global and alternative funds that are available to retail investors, reviewing the MFO metrics for short term and intermediate-term performance, using Portfolio Visualizer to narrow the list, and reviewing chart trends, I selected the following funds from 14 different Lipper Categories to look into their strategies. I have arranged them loosely starting with defensive funds, followed by safer bonds, mixed assets, and alternative funds, and ending with funds that focus more on equity. Investors should have diversified, balanced portfolios appropriate for their risk tolerance. As someone nearing retirement and with the current high-risk environment, I choose to focus more on managing risk. As a traditional bond and stock fund investor (who adjusts allocations according to the business cycle), I limit exposure to alternatives to 15% of my portfolio. The strategies are paraphrased below and investors are advised to read the prospectus before investing.

-

- Flexible Income Funds:

Aptus Defined Risk (DRSK) invests 90% or more in investment-grade bonds with maturities spread over the next 7 or 8 years. The Fund invests in Call Options in individual companies and ETFs with expirations of 1 to 6 months to gain exposure to security appreciation and Put Options on ETFs to protect from market declines. DRSK has too short of a history for an accurate comparison to the S&P 500. For the past year and a half, it has returned 14.75 compared to 15.8% for the S&P 500. During the recent bear market, it returned 2.9% compared to losing 19.5% for the S&P 500 on a monthly basis. I like DRSK for the downside protection.

ALTERNATIVE FUND: Advisory Research Strategic Income (ADVNX) has an 8-year performance record and is classified as a Great Owl.

-

- Mixed Asset Target Today: Fidelity Freedom Index Income (FIKFX) has done well this year. It is a fund of funds with 11% in domestic equities, 8% in international equities, 46% in investment-grade bonds, 3% in long term treasuries, 11% in inflation-protected treasuries, and 23% in short-term funds. That is a safe allocation for many conservative investors during this uncertain time. Over the next year or two, FIKFX will be stable, but won’t have the tailwinds of falling interest rates.

- Absolute Return Funds attempt to have positive returns in all markets and to outperform a cash or risk-free benchmark. I list four funds here and have written that I prefer investing in a basket of alternatives rather than having larger allocations to a single fund. The following four funds were effective in reducing volatility this year. The three Absolute Return Funds (ATACX, PHDG, TAIL) and SWAN returned 14.9%, 5.45, 23.5%, and 0.1% respectively during the recent bear market. On an annualized basis year to date, ATACX, PHDG, TAIL, and SWAN returned 33.6%, 14.0%, 5.2%, and 19.9% respectively. ATACX and PHDG have been in existence for over seven years with ATACX being classified as a Great Owl Fund and both are listed as Honor Roll. SWAN and TAIL are relatively new funds.

-

-

- ATAC Rotation (ATACX) invests in equity and bond ETFs and may also use inverse and leveraged exchange-traded products. ATAC uses quantitative analysis to allocate “primarily between equities and bonds depending on the potential for near-term stock market volatility as signaled through inter-market trends and relative prices.”

- Invesco S&P Downside Hedged (PHDG) is an actively managed ETF that uses quantitative analysis to invest primarily in equity ETFs, but also volatility funds and cash. The Fund invests such that a “greater portion of the Benchmark’s weight will be allocated to equity securities during periods of low volatility, and a greater portion of its weight will be allocated to the VIX Futures Index during periods of increased volatility.”

- Amplify BlackSwan Growth & Treasury (SWAN) invests using a rules-based, quantitative approach with least 80% primarily in U.S. Treasuries, and long-dated call options on the SPDR SYP 500 ETF. The goal is to preserve capital during “Black Swan Events” while attempting to capture 70% of the upside of the S&P 500 over a full market cycle. The Prospectus cautions that SWAN is not a substitute for a money market fund, nor does it attempt to replicate the returns of the S&P 500.

- Cambria Tail Risk (TAIL) is more like an Absolute Return Fund so I include it here. It invests “in cash and U.S. government bonds, and utilizing a put option strategy to manage the risk of a significant negative movement in the value of domestic equities”. Cambria spends about one percent of the fund’s assets each month buying put options.

-

4. Alternative Multi-Strategy Funds: Rowe Price Multi-Strategy Total Return (TMSRX) is a two-year fund that had a maximum drawdown of 5% on a monthly basis and has returned 8.2% on an annualized basis year to date. Its goal is to have returns that are attractive to cash while maintaining low volatility. The fund primarily seeks exposure to the following strategies: Macro and Absolute Return; Fixed Income Absolute Return; Equity Research Long/Short; Quantitative Equity Long/Short; Volatility Relative Value; Style Premia; Dynamic Global FX; Dynamic Credit; and Global Stock. For those investors who want reasonable returns, this single fund may be the basket of alternatives that I mentioned earlier.

ALTERNATIVE FUND: Grant Park Multi Alternative Strategies (GPANX) is a six-year-old fund with $294 million in assets under management. It is on Mutual Fund Observer’s Honor Roll. Its expenses are 1.9% with a yield of 10.8%. It had no drawdown on a monthly basis year to date and has an annualized return of 6.4% for the past year. It is available through Fidelity.

The Fund allocates its assets among four independent, underlying strategies. Each strategy seeks to identify profitable opportunities across multiple, liquid foreign, and domestic markets. The Fund invests primarily in (1) derivatives, (2) US equities, (3) open- and closed-end funds and exchange-traded funds, (4) American Depository Receipts, (5) currencies and (6) domestic and foreign investment grade fixed income instruments.

-

- International Income Funds: Vanguard International Bond (VTABX) invests in government, government agency, corporate, and securitized non-U.S. investment-grade fixed-income investments, all issued in currencies other than the U.S. dollar and with maturities of more than one year. It hedges against currency risk. The fund has been a consistent performer with a yield of over 3%. It won’t have the benefit of falling interest rates over the next year or two but may benefit if the dollar continues to weaken.

- Mixed Asset Target Conservative: Vanguard LifeStrategy Income (VASIX) is a fund of funds that has a target allocation of 56% to Vanguard Total Bond Market II Index Fund, 24% to Vanguard Total International Bond Index Fund, 12% to Vanguard Total Stock Market Index Fund, and 8% to Vanguard Total International Stock Index Fund. It is a good conservative fund that will not have the tailwind of falling interest rates but will benefit if the dollar continues to weaken. Some investors may want to invest in the Admiral shares of the component funds and rebalance themselves.

- Alternative Global Macro Funds: Rowe Price Dynamic Global Bond (RPIEX) normally invests at least 80% of its net assets in bonds, and seeks to offer some protection against rising interest rates and provide a low correlation with the equity markets. The fund normally invests at least 40% of its net assets in foreign securities, including securities of emerging market issuers, which may be denominated in U.S. dollars or non-U.S. dollar currencies.

- Global Income Funds: Janus Global Henderson Global Bond (JHBTX) invests at least 80% of its net assets in corporate bonds, government notes and bonds, convertible bonds, commercial and residential mortgage-backed securities, and zero-coupon bonds. The Fund invests in corporate debt securities of issuers in a number of different countries including emerging markets, which may include the United States. The Fund will not have the tailwind of falling interest rates.

- Alternative Credit Focus: WSTCM Credit Select Risk-Managed (WAMBX) uses a quantitative model to invest in a combination of U.S. high-yield debt securities, U.S. investment-grade debt securities, and U.S. Treasury debt obligations mostly within the U.S.

- Multi-Sector Income: State Street Total Return Tactical (TOTL) invests at least 80% of the Fund’s net assets primarily in securities issued or guaranteed by the U.S. government or its agencies, instrumentalities or sponsored corporations; inflation-protected public obligations of the U.S. Treasury; agency and non-agency residential mortgage-backed securities; agency and non-agency commercial mortgage-backed securities; agency and non-agency asset-backed securities; domestic corporate bonds; fixed income securities issued by foreign corporations and foreign governments including emerging markets; bank loans; municipal bonds; and other securities of any maturity. The fund has been a consistent performer and has a yield of over 3%.

- Absolute Return Bond Funds: Carillon Reams Unconstrained Bond (SUBFX, formerly Scout Unconstrained Bond) will invest at least 80% of its net assets in bonds, debt securities, mortgage- and asset-backed securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector entities. The Fund may invest in high yield bonds, options, and futures contracts.

- Flexible Portfolio Funds:

a. Fidelity Multi-Asset Income (FMSDX) invests in domestic and foreign issuers of equity and debt securities, including common and preferred stock, investment-grade debt securities, lower-quality debt securities, floating-rate securities, and convertible securities. The Managers analyze a security’s structural features and current pricing, its issuer’s potential for success, and the credit, currency, and economic risks of the security and its issuer to select investments.

b. ALTERNATIVE FUND: Columbia Thermostat (CTFAX, COTZX) invests such that when “the S&P 500® Index goes up in relation to trading range bands that are predetermined by the Investment Manager, the Fund sells a portion of its stock Portfolio Funds and invests more in the bond Portfolio Funds, and when the S&P 500® Index goes down in relation to the predetermined bands, the Fund increases its investment in the stock Portfolio Funds. I like the approach of CTFAX, but include it as an alternative fund because in May it changed its allocations to hold a higher percentage in stocks. These are available through Vanguard.

13. International Multi-Cap Core: Vanguard Developed Markets (VTMGX) “employs an indexing investment approach designed to track the performance of the FTSE Developed All Cap ex US Index, a market-capitalization-weighted index that is made up of approximately 3873 common stocks of large-, mid-, and small-cap companies located in Canada and the major markets of Europe and the Pacific region. If the dollar continues to weaken then Europe may be the beneficiary. I own two European equity funds, but like VTMGX as being more diversified and less volatile.

14. Alternative Long/Short Equity Funds have a low correlation to the stock market and can be used to lower volatility. After reviewing the available funds in this category, I am not inclined to invest in them. For a slightly different take, see David Snowball’s “The Long and Short of It” elsewhere in this month’s issue.

Alger Dynamic Opportunities (SPEDX) invests long in companies with rapidly growing demand or market dominance that may be benefitting from new regulations, new product innovation, or new management. The Fund may short companies that it believes will lag the market. The Fund has had an annualized return of 27.4 percent year to date with growth doing so well and is attracting new funds. I took profits in my growth funds over the past couple of months and will pass on SPEDX.

ALTERNATIVE FUND: Hussman Strategic Growth (HSGFX)

Disclaimer

I am not an economist nor an investment professional. I became interested in economic forecasting and modeling in 2007 when a mortgage loan officer told me that there was a huge financial crisis coming. There were signs of financial stress if you knew where to look. I have read dozens of books on business cycles since then. Discovering the rich database at the St. Louis Federal Reserve (FRED) provides most of the data to create an Investment Model. The tools at Mutual Fund Observer provide the means for implementing and validating the Investment Model.