Objective and strategy

This Fund seeks to invest in high-quality companies that are industry leaders with regards to their environmental, social, and governance practices. Their investable universe is mid- to large-cap US stocks excluding those companies involved in ESG controversies or those that violate global norms like the United Nations Global Compact. They also remove companies that do a poor job of managing their ESG risks and opportunities relative to their peers.

Having established the investable universe, the managers screen out firms that don’t meet their quality standards, which involves measures of profitability, management efficiency, and cash generation.

Finally, they use a portfolio optimization model to work through how to create the most attractive portfolio, accounting for factors like sector and style tilt, concentration, and so on. The current portfolio holds 185 stocks, about 25% mid-cap and 75% large-cap.

Adviser

Northern Trust Investments, a subsidiary of Northern Trust Corporation. As of December 30, 2020, Northern Trust Corporation, had assets under management of $1.4 trillion. Their fund complex had assets of $220 billion and they are the industry’s 12th largest ETF sponsor.

Manager

Jeffrey Sampson and Peter Zymali.

Jeff Sampson is a Senior Portfolio Manager on the Global Equity Team. He currently co-manages the Northern Income Equity Fund. He joined Northern in 1999, earned an MBA from the University of Chicago, and is an active CFA Charterholder. Mr. Sampson has specialized in working with high-net-worth families, family offices, and institutional investment teams. He manages over 50 portfolios valued in excess of $5 billion.

Peter Zymali is a Senior Portfolio Manager on the Global Equity Team with special expertise in ESG investments. Like Mr. Sampson, he earned his MBA at the University of Chicago. He’s earned the Certified Financial Planner designation. Mr. Zymali helps manage 84 other accounts but no other mutual funds.

Strategy capacity and closure

Effectively unlimited.

Management’s stake in the fund

The fund’s managers have de minimis personal investments in the fund, $1–$10,000 as of the latest Statement of Additional Information. Likewise, none of the fund’s eight trustees have chosen to invest in it.

Opening date

October 2, 2017

Minimum investment

$2,500 for direct purchase “K” shares

Expense ratio

0.39% for direct purchase “K” shares and 0.49% for purchases through third parties, on assets of $393 million (as of 7/18/23).

Comments

Many hundreds of billions, by some estimates tens of trillions, of dollars are being poured into socially responsible investment vehicles.

Nonetheless, there’s a vigorous debate about whether such investments make particular economic sense. Some believe that ESG-screened investments offer better risk-adjusted returns than do their peers; others believe that they tend to cost a bit in total returns without any offsetting risk reductions. Much brave and innocent data has been tortured on both sides.

The most recent research suggests that ESG investments are attractive only because they tend to be associated with higher quality companies, and high-quality companies represent attractive opportunities. Some research does confirm a correlation between ESG factors and the quality factor in investing.

What’s an investor to do? For investors who would prefer not to subsidize the destruction of the only planet they’ve got, finding a socially responsible fund that aligns with their interests makes a lot of practical and moral sense. If the skeptics turn out to be right, your portfolio might lag the broad market by a half percentage point a year which you might see as a perfectly reasonable outcome.

If you want to do better, to tilt the odds in your favor, the research we cited above suggests that you want to pair your intentional ESG focus with an equally intentional quality focus.

That’s where Northern US Quality ESG Fund comes in. Northern takes three actions on your behalf.

- They use ESG screens to eliminate one sort of bad actor. While the screens are proprietary and not discussed in great detail, we know that they avoid firms “with a material involvement in controversial business practices, including, but not limited to, tobacco and civilian firearms,” as well as those involved in ESG controversies or those that violate global norms. The result is a universe of good citizens (Apple, Microsoft, Google) but not do-gooders (First Solar, Brookfield Renewable Partners, NextEra Energy) per se.

- They use quality screens to eliminate challenged companies and inept managers. Their screens are quantitative: they look for the empirical evidence of good decision-making. That comes in the form of good capital allocation decisions which leads to high returns on equity, on invested capital, and so on.

By quality measures, Northern has one of the three highest-quality portfolios among all ESG screened funds in their Lipper peer group. We screened for large-cap core funds that are also socially screened, looking at their 3-year performance since that’s approximately the age of the Northern Fund. There are 34.

Return on Asset Capital Equity Investment Northern US Quality ESG 2nd of 34 4th 3rd 3rd As important, only one other fund has landed consistently in the top tier. That is, the other funds with great returns on assets tended to have much lower returns on equity, and vice versa.

Both Lipper and Morningstar confirm that Northern has a far higher return on equity than its respective peer groups; we can confirm through MFO Premium that the superiority is pretty much across the board.

- They use portfolio optimizers to help manage the risk-return trade-offs inherent in juggling hundreds of stocks without blundering into unforeseen sources of risk.

The result has been solid performance with no more than market-like risk.

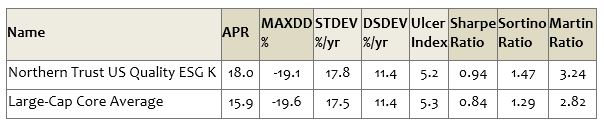

Comparison of Lifetime Performance (Since 201711)

So Northern returned 2.1% annually more than the average large core fund (both ESG and non-ESG) with comparable volatility, a smaller maximum drawdown, and better risk-return metrics.

Northern US Quality ESG has earned a five-star rating from Morningstar.

Bottom Line

Northern has a broad and enduring commitment to ESG investing, and the resources to do it really well. The combination of quality and ESG factors makes a world of sense. The solid early track record and the fund’s low expenses make it an attractive option for socially responsible investors who are not looking for an “impact” fund (that is, one dedicated to the higher-risk world of do-good actors).