Touchdowns and Turnovers: MFO’s All-Star Picks for the Best US Equity Funds of 2023

Who will be the NFL MVP? The money is on Lamar Jackson of the Baltimore Ravens, declared “undeniably one of the most electric players in the league.” The 27-year-old had a passer rating of 102.7 with 3,678 yards, 24 touchdowns against seven interceptions, and played in all 16 games. He was magical. (At least until he faced the Steelers against whom he sports a 1-3 record or got to the playoffs.) For his accomplishments, he earned a quarter-billion-dollar contract.

Who will be the NFL MVP? The money is on Lamar Jackson of the Baltimore Ravens, declared “undeniably one of the most electric players in the league.” The 27-year-old had a passer rating of 102.7 with 3,678 yards, 24 touchdowns against seven interceptions, and played in all 16 games. He was magical. (At least until he faced the Steelers against whom he sports a 1-3 record or got to the playoffs.) For his accomplishments, he earned a quarter-billion-dollar contract.

Sadly, Mr. Jackson isn’t making you any money. Happily, another MVP Jackson might: Jackson Square Large-Cap Growth, a fund whose TDs-to-turnovers ratio in 2023 was untouchable.

Likewise, C.J. Stroud was recognized as the league’s Rookie of the Year. But no rookie in the fund world put up more compelling numbers than American Funds Capital Group US Value ETF.

In the spirit of Awards Season, MFO is proud to present its US Equity Fund Awards for 2023. Lots of people offer fund awards, but they’re mostly boring and based on stuff you could discern at a glance: “highest one-year returns by an emerging markets equity fund, highest three-year returns by an emerging markets equity fund …” We will instead follow the NFL’s lead and award:

- Defensive Player of the Year

- Defensive Rookie of the Year

- Offensive Player of the Year

- Offensive Rookie of the Year

- Most Valuable Player of the Year

Finally, we will announce the rosters for the two Rookie All-Pro Teams.

Why offer awards?

These are not buy recommendations. These are funds that, in most cases, you’ve never heard of (though we have written about several). They represent an opportunity to learn about new strategies, discover new managers, and perhaps refresh your portfolio for 2024. Our selection criteria, detailed before each category, focused solely on 2023 performance. That’s the “of the Year” part. Some have faltered in the past, some might never see this level of performance again.

So two things: (1) it’s fun, people! Have some fun! And (2) it’s an excuse to learn something new. Embrace it!

Eligible funds included all US equity funds including OEF, ETF, and CEF investment funds; it excludes insurance products, funds with narrow sector focuses or reliance on cryptocurrencies, and funds made for trading or speculation. Finally, the funds had to be accessible to retail investors. That excluded funds with institutional minimums (GMO, for instance, has several promising new funds) or funds available only to a particular client group (for example, funds only available to a firm’s fund-of-funds).

MFO Rookie funds are those in existence for more than one year but less than two.

Defensive Player of the Year

Criteria: eligible funds placed in the lowest tier for 2023 maximum drawdown while scoring total returns of average to above. Among eligible funds, we looked for the highest return relative to peers.

Winner: Goodhaven Fund (GOODX)

GoodHaven Fund (GOODX) was launched in April 2011 by Larry Pitkowsky and Keith Trauner, two former associates of the iconoclastic Bruce Berkowitz, who manages Fairholme Fund. The fund had two good years, then a long stretch of lean ones. In 2020, they took a long hard look in the mirror and concluded that it wasn’t working. They concluded that they had been undercutting their own success, and their investors, with a series of misjudgments and rolled out a series of changes in late 2020. Manager Pitkowsky focuses more on quality than statistical value, on investing in “special situations” only when they were special, and exercising greater patience with good companies.

GoodHaven Fund (GOODX) was launched in April 2011 by Larry Pitkowsky and Keith Trauner, two former associates of the iconoclastic Bruce Berkowitz, who manages Fairholme Fund. The fund had two good years, then a long stretch of lean ones. In 2020, they took a long hard look in the mirror and concluded that it wasn’t working. They concluded that they had been undercutting their own success, and their investors, with a series of misjudgments and rolled out a series of changes in late 2020. Manager Pitkowsky focuses more on quality than statistical value, on investing in “special situations” only when they were special, and exercising greater patience with good companies.

By Morningstar’s assessment, GoodHaven’s portfolio is characterized by dramatically higher quality names with higher growth prospects than its peers. That has corresponded with a period of dramatic outperformance in terms of total returns, downside management, and risk-adjusted returns.

Comparison of 1-Year Performance, 1/2023 – 12/2023

| Name | 2023 Return | Maximum drawdown | Downside deviation | Ulcer Index |

Sharpe Ratio |

Sortino Ratio |

Martin Ratio |

| GoodHaven | 34.1 | -6.7 | 5.8 | 2.3 | 1.92 | 5.00 | 12.6 |

| Multi-cap value peers | 12.7 | -9.4 | 9.2 | 4.5 | 0.47 | 0.90 | 1.96 |

Defensive Rookie of the Year

Criteria: eligible rookie funds placed in the lowest tier for 2023 maximum drawdown while scoring total returns of average to above. Among eligible funds, we looked for the highest return relative to peers.

Winner: Distillate Small/Mid Cash Flow ETF (DSMC)

Distillate Small/Mid Cash Flow ETF launched in October 2022. DSMC is an actively managed exchange-traded fund that invests in small- and mid-capitalization companies. It is designed to offer investors exposure to an attractively valued portfolio of approximately 150 U.S. small- and mid-cap stocks that meet specific parameters involving reported and expected free cash flow and balance sheet quality.

Distillate Small/Mid Cash Flow ETF launched in October 2022. DSMC is an actively managed exchange-traded fund that invests in small- and mid-capitalization companies. It is designed to offer investors exposure to an attractively valued portfolio of approximately 150 U.S. small- and mid-cap stocks that meet specific parameters involving reported and expected free cash flow and balance sheet quality.

The goal, akin to Goodhaven’s, is to live in the interest of quality and value. The managers argue that accounting rules have not kept up with the evolution of the global economy, “rendering many traditional measures of value, quality, and risk unhelpful.” In response they developed customized measures of value and quality and, to an extent, reconsidered the nature of “risk.”

Managers Jay Beidle and Matthew Swanson, founding partners of Distillate, previously worked for 10 and 18 years, respectively, as analysts and managers at Institutional Capital, LLC (ICAP), a Chicago-based value investment boutique.

This small core fund returned 29.4%, besting its average peer by 13.5%. More importantly, its maximum 2023 drawdown was -10.8%, while its average peer dropped 14.3% in the same period. Distillate has gathered $48 million in assets. The fund posted a smaller downside (that is, “bad”) deviation and had a lower Ulcer Index than its peers, though its standard (that is, day-to-day) deviation was about two points higher. Its risk-adjusted metrics (Sharpe, Martin, and Sortino ratios) were three to four times greater than its peers.

Comparison of 1-Year Performance, 1/2023 – 12/2023

| Name | 2023 Return | Maximum drawdown | Downside deviation | Ulcer Index |

Sharpe Ratio |

Sortino Ratio |

Martin Ratio |

| Distillate Small/Mid | 29.4 | -10.8 | 9.9 | 5.2 | 1.02 | 2.46 | 4.69 |

| Small-cap core peers | 16.0 | -14.2 | 12.2 | 6.9 | 0.48 | 0.93 | 1.73 |

Offensive Player of the Year

Criteria: eligible funds placed in the highest tier for 2023 total returns while having a maximum drawdown no greater than average. Among eligible funds, we looked for the highest return relative to peers.

Winner: Value Line Larger Companies Focused (VALLX)

Value Line Larger Companies Focused launched in 1972. The manager invests in 25-50 large-cap ($10 billion and up) stocks. The distinguishing characteristic of the strategy is its use of the venerable Value Line Timeliness Ranking System to assist in selecting securities for purchase. The manager is “assisting by” but not “bound by” that system, so the highest-rated stocks might be excluded for other reasons.

Value Line Larger Companies Focused launched in 1972. The manager invests in 25-50 large-cap ($10 billion and up) stocks. The distinguishing characteristic of the strategy is its use of the venerable Value Line Timeliness Ranking System to assist in selecting securities for purchase. The manager is “assisting by” but not “bound by” that system, so the highest-rated stocks might be excluded for other reasons.

Manager Cindy Starke has been with the firm since May 2014 and is one of the longest-tenured managers in the fund’s history. Ms. Starke began her investment career as a portfolio manager for U.S. Trust Company. She moved on with that investment team to become a founding portfolio manager at NewBridge Partners, which was acquired by Victory Capital Management in 2003 where she was a co-portfolio manager of the Victory Focused Growth Mutual Fund.

Value Line’s 59% return, which placed it in the top 2% of its Morningstar peers, bested its peers by 2700 basis points with no greater volatility. The fund’s risk-adjusted return ratings – Sharpe, Sortino, Martin – are a multiple of its peers.

Comparison of 1-Year Performance, 1/2023 – 12/2023

| Name | 2023 Return | Maximum drawdown | Downside deviation | Ulcer Index |

Sharpe Ratio |

Sortino Ratio |

Martin Ratio |

| Value Line Larger Companies Focused | 59.1 | -11.7 | 9.2 | 4.2 | 2.17 | 5.88 | 12.9 |

| Multi-cap growth peers | 32.4 | -11.7 | 9.6 | 4.5 | 0.48 | 3.02 | 6.68 |

Offensive Rookie of the Year

Criteria: eligible rookie funds placed in the highest tier for 2023 total returns while having a maximum drawdown no greater than average. Among eligible funds, we looked for the highest return relative to peers.

Winner: American Funds Capital Group US Value ETF (CGDV)

American Funds Capital Group US Value ETF is an actively managed ETF that invests in dividend-paying stocks of larger established U.S. companies. One goal is to produce more income than its large-cap benchmark index. The portfolio currently holds about 50% with about 15% of the portfolio in small- to mid-cap stocks and 6% in international stocks.

American Funds Capital Group US Value ETF is an actively managed ETF that invests in dividend-paying stocks of larger established U.S. companies. One goal is to produce more income than its large-cap benchmark index. The portfolio currently holds about 50% with about 15% of the portfolio in small- to mid-cap stocks and 6% in international stocks.

The portfolio is focused on dividend-paying stocks but, in particular, on the stock of American companies “whose debt securities are rated at least investment grade … or unrated but determined to be of equivalent quality by the fund’s investment adviser.” That then serves as a marker of “established.”

The fund is managed, in the American Funds tradition, by a risk-conscious team of five who also share responsibility for some of American’s largest equity funds.

This equity income fund returned 28.8%, besting its average peer by 1,760 basis points. Its maximum drawdown was -7.35%, 21o bps better than its peers, and its Sharpe ratio was four times higher. The fund had lower risk scores (standard deviation, downside deviation, Ulcer Index and higher risk-adjusted returns (Sharpe ratio, Sortino ratio, Martin ratio) than its peers. The fund has not gone unnoticed, drawing $5.9 billion in assets since its February 2022 launch.

Comparison of 1-Year Performance, 1/2023 – 12/2023

| Name | 2023 Return | Maximum drawdown | Downside deviation | Ulcer Index |

Sharpe Ratio |

Sortino Ratio |

Martin Ratio |

| American Funds Capital Group US Value ETF | 28.8 | -7.4 | 6.0 | 2.8 | 1.70 | 3.94 | 8.44 |

| Equity income peers | 11.2 | -9.5 | 9.1 | 4.6 | 0.40 | 0.78 | 1.81 |

Most Valuable Fund

Criteria: eligible funds are those that simultaneously appeared in the top tier for total returns and the top tier for the lowest maximum drawdown. Among eligible funds, we looked for the highest Sharpe ratio.

Winner: Jackson Square Large-Cap Growth (JSPJX)

Jackson Square Large-Cap Growth launched in 1993 as Delaware US Growth. Jackson Square acquired the fund’s assets in April 2021. The fund invests in companies with an equity capitalization of more than $3 billion and describes itself as benchmark agnostic, holding a concentrated, conviction-weighted portfolio. That last part (“conviction weighted”) is significant in light of a recent Morningstar study that says most active managers fail, not because they can’t select good equities but because they cannot weigh in the portfolio in a way that allows the whole to make sense. They currently hold 26 stocks.

The Jackson Square team aspires to “a concentrated portfolio of companies that have superior business models, strong cash flows, and the opportunity to generate consistent, long-term growth of intrinsic business value.”

The fund is managed by William “Billy” Montana and Brian Tolles. Mr. Montana joined Jackson Square Partners as an analyst in September 2014. Mr. Tolles joined as an analyst in February 2016 and was promoted to portfolio manager in January 2019. The fund’s longer-term record is muddied by turnover in management; Mr. Montana was one member of a five-person team in 2020, four of whom have now left the fund. Mr. Tolles, contrarily, has been on board for half a year.

Jackson Squares’ splendid 2023 performance is reflected in 51.5% return, which exceeds its peers by 1000 basis points, but more importantly by the refusal of the fund to decline in value. Their maximum drawdown of 2% is one-quarter of what their peers experience and their Ulcer Index (a measure of how far a fund falls and how long it takes to recover) is on par with a short-term bond fund’s.

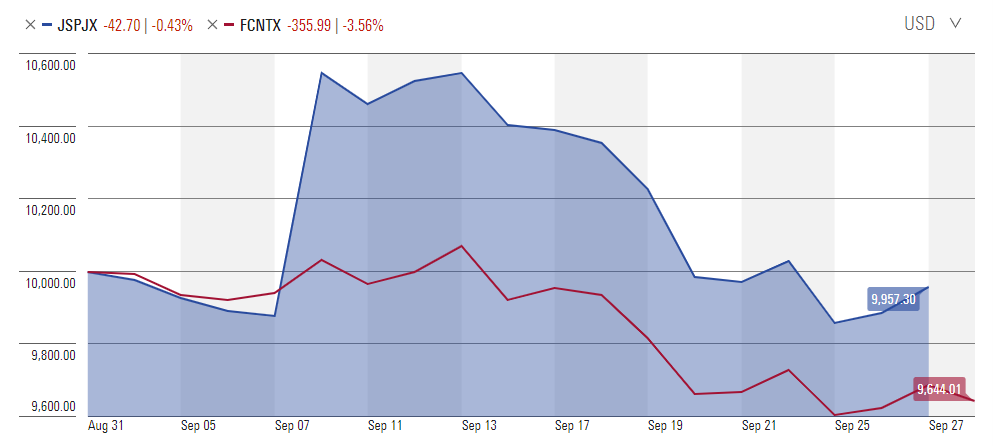

Here’s the flag: This performance is out of line with the fund’s long-term record. That improvement might have been attributable to Mr. Tolles’ arrival, which would make the improvement sustainable. Alternately, the driver of the fund’s win might have been “in the third quarter of 2023 the Jackson Square Large Cap Growth fund received proceeds from a class-action settlement from a company that it no longer owns. This settlement had a material impact on the fund’s investment performance. This is a one-time event that is not likely to be repeated.” How substantially? On September 8, the fund’s NAV was $17.45. It opened on 9/11 at $18.62, a 6.7% gain at a time when peers were largely flat.

Here’s what that looked like, in comparison to Fidelity Contrafund.

Comparison of 1-Year Performance (Since 202301)

| Name | 2023 Return | Maximum drawdown | Downside deviation | Ulcer Index |

Sharpe Ratio |

Sortino Ratio |

Martin Ratio |

| Jackson Square Large-Cap Growth | 51.5 | -2.1 | 2.8 | 0.8 | 3.14 | 16.7 | 57.9 |

| Large-cap growth peers | 41.2 | -8.1 | 7.3 | 3.1 | 2.06 | 5.04 | 12.1 |

The fund edged out a cohort of stars for the award, it was followed in the rankings by seven T. Rowe Price and Fidelity funds including TRP Blue Chip Growth ETF and Fidelity Contrafund. If you’re looking for an MVP with a better chance of repeating the feat, you should investigate runner-up T Rowe Price Blue Chip Growth ETF (TCHP).

| Name | 2023 Return | Maximum drawdown | Downside deviation | Ulcer Index |

Sharpe Ratio |

Sortino Ratio |

Martin Ratio |

| Jackson Square Large-Cap Growth | 51.5 | -2.1 | 2.8 | 0.8 | 3.14 | 16.7 | 57.9 |

| T Rowe Price Blue Chip Growth ETF | 50.1 | -6.3 | 6.4 | 2.5 | 2.62 | 6.98 | 17.8 |

| Large-cap growth peers | 41.2 | -8.1 | 7.3 | 3.1 | 2.06 | 5.04 | 12.1 |

TCHP is a non-transparent, active ETF run by the same manager, Paul Greene, responsible for the Blue Chip Growth Fund.

The Rookie All-Pro Team: The Top Rookie Equity and Allocation Funds of 2023

Finally, we searched MFO Premium for the complete roster of rookie stand-outs. Rookie funds are those with more than one year but less than two years in the league. We screened for rookies who earned their spot on the roster by combining top-tier risk-adjusted returns as well as peer-beating absolute returns. For the sake of simplicity, we separated equity from income funds.

Finally, we searched MFO Premium for the complete roster of rookie stand-outs. Rookie funds are those with more than one year but less than two years in the league. We screened for rookies who earned their spot on the roster by combining top-tier risk-adjusted returns as well as peer-beating absolute returns. For the sake of simplicity, we separated equity from income funds.

Selection criteria: Rookie All-Pro funds had to finish in the top tier MFO Rating (“MFO Rating is the principal performance ranking metric used in the MFO rating system and found across most of the MFO Premium pages. It ranks a fund’s performance based on risk-adjusted return, specifically Martin Ratio, relative to other funds in the same investment category over the same evaluation period”) and Sharpe Ratio Rating. The All-Pro starters also had to score in the lowest tier of Ulcer Ratings; that signaled that they were best at (a) limiting downside and (b) recovering quickly from it.

ETFs have three- or four-character symbols, open-ended funds have five characters ending with “X”.

| Symbol | Name | Lipper Category | 2023 return | APR vs Peer | Ulcer Rating |

| WCFEX | WCM Focused Emerging Markets ex China | Emerging Markets | 28.7 | 18.9 | 1 |

| WXCIX | William Blair Emerging Markets ex China Growth | Emerging Markets | 23.7 | 13.9 | 1 |

| JHFEX | John Hancock Fundamental Equity Income | Equity Income | 20.2 | 10.7 | 2 |

| STXD | Strive 1000 Dividend Growth | Equity Income | 15 | 5.4 | 1 |

| PBDC | Putnam BDC Income | Financial Services | 30.1 | 19.8 | 1 |

| BKGI | BNY Mellon Global Infrastructure Income | Global Infrastructure | 9.8 | 6.1 | 2 |

| VMAT | V-Shares MSCI World ESG Materiality and Carbon Transition | Global Multi-Cap Core | 28.8 | 12.6 | 2 |

| TRFK | Pacer Data and Digital Revolution | Global Science / Technology | 67 | 22.5 | 1 |

| MEDI | Harbor Health Care | Health / Biotechnology | 24.9 | 21.8 | 1 |

| HAPI | Harbor Human Capital Factor US Large Cap | Large-Cap Core | 30.3 | 7.3 | 2 |

| PJFG | Prudential PGIM Jennison Focused Growth | Large-Cap Growth | 54.1 | 14.1 | 1 |

| QGRW | WisdomTree US Quality Growth | Large-Cap Growth | 56 | 16 | 4 |

| PFPGX | Parnassus Growth Equity | Large-Cap Growth | 42.6 | 2.5 | 1 |

| PJFV | Prudential PGIM Jennison Focused Value | Large-Cap Value | 18.5 | 5.8 | 1 |

| HSMNX | Horizon Multi-Factor Small/Mid Cap | Mid-Cap Core | 23.4 | 9.8 | 1 |

| FDLS | Inspire Fidelis Multi Factor | Mid-Cap Core | 21.4 | 7.8 | 2 |

| AMID | Argent Mid Cap | Mid-Cap Growth | 31.1 | 11.2 | 1 |

| WGUSX | Wasatch US Select | Mid-Cap Growth | 30.9 | 10.9 | 2 |

| WCMAX | WCM Mid Cap Quality Value | Mid-Cap Growth | 28.7 | 8.7 | 1 |

| RVRB | Reverb | Multi-Cap Core | 26.8 | 7.3 | 2 |

| DSMC | Distillate Small/Mid Cash Flow | Small-Cap Core | 29.5 | 14.8 | 1 |

| GSBGX | GMO Small Cap Quality | Small-Cap Core | 32.5 | 17.8 | 1 |

The Rookie All-Pro Team: The Top Rookie Income and Alternatives Funds of 2023

Our last roster is the Income and Alts Rookie squad. Rookie funds are those with more than one year but less than two years in the league. We screened for rookies who earned their spot on the roster by combining top-tier risk-adjusted returns as well as peer-beating absolute returns. For the sake of simplicity, we separated equity from income funds

Our last roster is the Income and Alts Rookie squad. Rookie funds are those with more than one year but less than two years in the league. We screened for rookies who earned their spot on the roster by combining top-tier risk-adjusted returns as well as peer-beating absolute returns. For the sake of simplicity, we separated equity from income funds

Selection criteria: Rookie All-Pro funds had to finish in the top tier MFO Rating (“MFO Rating is the principal performance ranking metric used in the MFO rating system and found across most of the MFO Premium pages. It ranks a fund’s performance based on risk-adjusted return, specifically Martin Ratio, relative to other funds in the same investment category over the same evaluation period”) and Sharpe Ratio Rating. The All-Pro starters also had to score in the lowest tier of Ulcer Ratings; that signaled that they were best at (a) limiting downside and (b) recovering quickly from it.

| Symbol | Name | Lipper Category | 2023 return | APR vs Peer | Ulcer Rating |

| SPCZ | RiverNorth Enhanced Pre-Merger SPAC | Alternative Event Driven | 6.4 | 4.1 | 2 |

| COIDX | IDX Commodity Opportunities | Commodities | -4.5 | 3.4 | 1 |

| PIT | VanEck Commodity Strategy | Commodities | -3.4 | 4.5 | 1 |

| AGRH | BlackRock iShares Interest Rate Hedged US Aggregate Bond | Core Bond | 6.5 | 1.6 | 1 |

| TTRBX | Ambrus Core Bond | Core Bond | 5.8 | 0.9 | 1 |

| ACSIX | Arena Strategic Income | High Yield | 15.3 | 4.8 | 1 |

| PBKIX | Polen Bank Loan | High Yield | 14.5 | 4.1 | 1 |

| HYGI | BlackRock iShares Inflation Hedged High Yield Bond | Inflation Protected Bond | 11.8 | 9.3 | 2 |

| BRLN | BlackRock Floating Rate Loan | Loan Participation | 12.3 | 1.6 | 2 |

| LONZ | Allianz PIMCO Senior Loan Active | Loan Participation | 12.6 | 1.9 | 2 |

| CGMS | American Funds Capital Group U.S. Multi-Sector Income | Multi-Sector Income | 11.6 | 5.9 | 2 |

| CGMU | American Funds Capital Group Municipal Income | Municipal General & Insured Debt | 7 | 1.9 | 1 |

| BUFQ | First Trust FT CBOE Vest of Nasdaq-100 Buffer s | Options Arbitrage / Strategies | 35.4 | 18.3 | 1 |

| UYLD | Angel Oak UltraShort Income | Short IG Grade Debt | 7 | 2.1 | 1 |

| CSHI | NEOS Enhanced Income Cash Alternative | Specialty Fixed Income | 6.2 | -13 | 1 |

| CARY | Angel Oak Income | U.S. Mortgage | 8.9 | 4.4 | 1 |

| HIGH | Simplify Enhanced Income | U.S. Treasury General | 7.6 | 4.3 | 1 |

| BOXX | Alpha Architect 1-3 Month Box | U.S. Treasury Short | 5.1 | 0.9 | 3 |

| TBIL | F/m US Treasury 3 Month Bill | U.S. Treasury Short | 5.1 | 0.9 | 3 |

| TUSI | Touchstone Ultra Short Income | Ultra-Short Obligations | 6.5 | 1.3 | 2 |

| YEAR | AllianceBernstein AB Ultra Short Income | Ultra-Short Obligations | 6 | 0.9 | 2 |