You may not know it. You may not want to admit it. But you’d certainly be running one.

How do I know? Because managed futures funds operate exactly the way you do. Managed futures funds are momentum investors; they choose some number of asset classes (US stocks, currencies, EM bonds, commodities, whatever) to include in their portfolios. They then invest in the asset classes that show the greatest upward momentum, avoid assets that are drifting, and short those that are falling. You could also imagine a control panel with eight toggle switches, one for each asset class, and three positions for each switch (positive, neutral, negative). Managers look at relative strength data and might flip Continue reading →

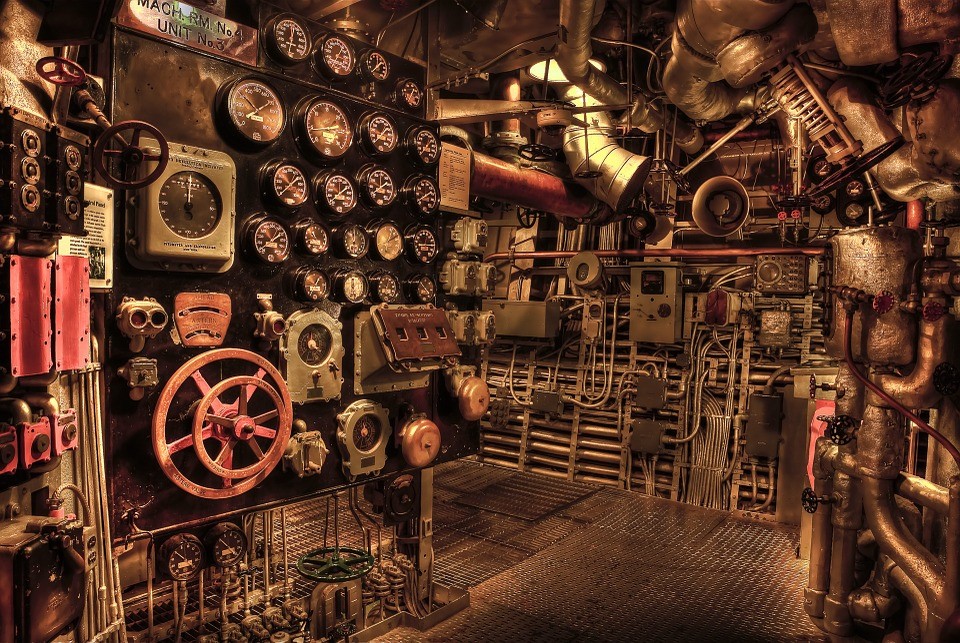

There’s something almost Biblical about this

There’s something almost Biblical about this