The eternal flaw of investment gurus, both on the web and elsewhere, is that they’re never held accountable for their bravado and bold recommendations. It is in the nature of the beast that one right guess lives on forever while an infinite number of horrendous recommendations vanish from the public mind. I think of Elaine Garzarelli, who made her fame from one right call – an impending market crash a week before the actual “Black Monday” crash in 1987 which saw the Dow drop 22% (7300 points in today’s terms) in a day – but somehow dodges rebuke for her Continue reading →

Author Archives: Devesh Shah

Artisan Developing World Fund interview

An interview with Lewis Kaufman, founding portfolio manager of the Artisan Developing World Fund

My primary investment biases are two-fold. First, in general, I invest in public markets through low-cost, low-turnover passive vehicles. Second, in general, I invest in US equities. Both of those biases were arrived at through a combination of (painful) experience and careful research. That said, none of us benefit from being held hostage by our beliefs. In many ways, humility and self-doubt, curiosity, and the determination to keep learning are the hallmarks of our wisest citizens. And I aspire to learn from them. In consequence, I’ve spent a huge amount of time over the past six months talking with a cadre of the industry’s best emerging markets managers.

Home Bias

Investors worldwide have a powerful bias Continue reading →

Interview with Amit Wadhwaney: Co-Founder and Portfolio Manager, Moerus Capital Management

Recently, I had a long chat with Amit Wadhwaney, the founder of Moerus Capital Management and the adviser to Moerus Worldwide Value Fund. He is a very thoughtful and seasoned investor. Here are some of his thoughts on his fund and his stock-picking style. I’ve presented a summary of my notes rather than an actual Q&A, but the flavor of their investing style will hopefully come through. Continue reading →

Just short of two cheers for active, international investing

Readers know that I long ago concluded that active management rarely adds value to an investor’s portfolio. There are too many managers fighting over the same stocks. Very few of them have a meaningful Edge over the others. Most of those who add some value rarely add enough to overcome the drag imposed by their expenses and higher tax burden. Some few add serious value, but they are almost impossible to reliably identify in advance.

That said, I am about to commit two heresies in one column: I will suggest that you consider Continue reading →

In Defense of Taking Risk

The S&P 500 Index peaked at 4800 in December 2021. Thirteen months later, at the end of January 2023, the Index is down 16%, at a level of 4076. Suppose you did a Rip Van Winkle and woke up just in time for the New Year 2024 celebration… and found the S&P 500 index trading at 2400, putting the index 50% below its all-time peak. Would you buy the market, perhaps doze off again, or would you sell? The record is clear: Continue reading →

Long-dated TIPS bonds: A margin of safety

Happy New Year to everyone. May there be peace in your home, on the planet, in the stars, and in all living beings. I am very glad to share that I have recently published a book of children’s stage plays.

Growing up in Mumbai, India, I studied at a school where theatre and drama were an important part of our education. Many of our school plays were then drawn from English literature. A few years ago, I was asked to take on a project to translate nine plays written in Gujarati, my first language, to English. Acclaimed playwright Prakash Lala wanted to make his stories available to young children everywhere. The average 10-12-year-old child in India has a different upbringing than the American kid. Family, grandparents, household help, and even neighbors play a much larger role in raising the kid than we see in society here. I’ve enjoyed translating the plays, working with my own kids on editing, and recently publishing the book on Amazon. Look for the title “Nine Children’s Plays.” I hope you will Continue reading →

What Really Matters…is that we are American investors

We are approaching the end of an extraordinary year, one that has left many of us – citizens, investors, employers, workers, and parents – feeling whipsawed, anxious and confused. Much of that comes from the sense that we can’t figure out what’s behind this year, so we don’t have much hope about managing, much less thriving in, the year ahead.

I entirely agree with your feelings, but I’m here to suggest that you take a deep, cleansing breath. We’re doing better than you know, and if we keep our wits about us, we’re going to do okay. Continue reading →

Kinetics Mutual Funds: Five Star funds with a Lone Star Risk

The great charm of traditional index funds is that they offer broad market exposure at a low cost. Critics deride their diversification as “diworsification,” where a portfolio automatically contains too little of the really great stuff and too much of the really poor stuff. Bold and confident managers have staked their careers – or at least their investors’ fortunes – on their ability to find one or two great (and greatly misunderstood) companies and then pour resources into them.

At its peak, the legendary Continue reading →

Rebalancing, Portfolio Restructuring, Tax Loss Harvesting

Down years in the financial markets are a heavy burden on asset holders. (We presume you’re noticed.) Holding assets through down years is the price we pay for earning long-term risk premia embedded in assets. Years like this are particularly challenging because the current downswing feels so very abnormal: it’s a correction in the financial markets (normal but painful) in which both investment grade bonds and speculative tech stocks are falling sharply and simultaneously (utterly abnormal and still painful), and the trajectory of the decline Continue reading →

Series I Bonds: A Ray of Hope

There are not many winners this year, but simplicity has taken the cake.

Series I Savings Bonds is one such winner. The current interest rate accrued on these bonds is 9.62% – in line with the CPI.

Like TIPS:

- Series I Bonds are backed by the full faith and credit of the US Government.

Unlike TIPS: Continue reading →

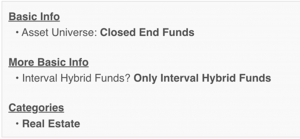

Closed-End Private Real Estate Interval Funds: A Job Well Done! Thank You and Bye-bye.

You cannot praise them enough. Don’t take my word. Look at the MFO Premium search engine:

Results sorted by AUM with Year-to-date Returns and other metrics: Continue reading →

Emerging Markets Investing in the Next Decade: The Players

Who, from a universe of 200+ emerging markets managers, did we choose to speak to … and how?

Good question! We decided to rely on insiders’ judgment, rather than mere notoriety or a strategy’s recent performance. We started by talking with Andrew Foster about his take on his investable universe and its evolution, then asked Andrew whose judgments he respected and who we ought to talk with. We asked those folks the same. Those recommendations, constrained by time and availability, led to conversations with the six worthies below. Continue reading →

Emerging Markets (EM) Investing in the Next Decade: The Game

Is it time to overweight EM stocks now? To answer this and many other questions, the Mutual Fund Observer reached out to six EM Equity Fund Managers. Our plan was to talk with each at length, sharing one manager’s insights with another and seeking their response. Our hope was to help you gain an insight deeper than “boy, EM valuations sure are low! Time to buy, right?”

I am deeply grateful to them for helping our readers further their understanding. This essay will walk you through their arguments and our reflections on what EM investors might Continue reading →

I wish I could give you some good TIPS on beating inflation

I’m not sure that I can. If I were to offer any tip, it might be to avoid TIPS.

The Problem: Inflation, TIPS, and Investment Frustration

Some investors (me included) bought Treasury Inflation Protected Securities (TIPS) to protect against rising inflation. Inflation has been raging in 2021-2022. Are you frustrated that shorter dated TIPS have made no money, while anyone who bought longer TIPS lost a bundle? All bonds lost money this year but TIPS were supposed to make money. And they didn’t. This very frustrating outcome is counterintuitive. In this article I take a look at Continue reading →

Confession is good for the soul, honest reflection is even better: My mid-year review

Irresponsibility might not be the gravest sin committed by internet pundits, but it’s surely one of the most widespread. We are forever regaled by advice from “the strategist who called the 2008 crash” has announced the 2022 recession will be worse than 2008, though we are spared the messy details about the source’s other 49 missed guesses. It’s the nature of the internet that Continue reading →

Having Faith in Sensible Investing

Retail investors or advisors serving retail investors can choose to keep it simple with portfolios that follow a handful of easy-to-grasp rules:

- Buy assets where there is a genuine underlying source of return (corporate earnings, interest income, and rental income).

- Diversify across asset classes so that you don’t depend on any one stream of returns.

- Choose asset weights that reflect the investor’s different needs: Income, Growth, Safety, Speculation

- Reduce unneeded fees

- Be strategic about the impulse to buy and, especially, to sell so that you can keep capital gains taxes reasonably low.

- Rebalance across the asset classes when one of the asset classes moves too much.

- Hold the portfolio of these diversified assets for decades.

An Investor’s Journeys, In Body and Mind

Hope your road is a long one.

May there be many summer mornings when,

with what pleasure, what joy,

you enter harbors you’re seeing for the first time;

may you stop at Phoenician trading stations

to buy fine things,

mother of pearl and coral, amber and ebony,

sensual perfume of every kind—

as many sensual perfumes as you can;

and may you visit many Egyptian cities

to learn and go on learning from their scholars.

To Win Today, Embrace Powerlessness and Dive Deep into the Portfolio

“Be careful what you wish for because it might come true” – someone wise

In this article, I lead by laying out the irony in today’s Federal Reserve behavior and the financial markets. Acknowledging a tough year for the 60/40 portfolio, I look at the worst of historical drawdowns in down market cycles. I benchmark my own expectations for the 60/40 in the current cycle and invite readers to do their own work. Finally, Continue reading →

To Win Tomorrow: Question Everything

There is a risk that 2022 is just the beginning of a treacherous investment decade. If so, it may be time to question what we know about conventional investment practices. In this article, I first highlight the so-called risk of a lost decade of real returns. Then, I raise 4 Questions we need to ask ourselves:

(1) what should be the mix between risky and riskless assets

(2) what about the active vs passive debate

(3) which assets work well during inflation

(4) which investment habits might we want to leave behind if the returns are slim.

After proposing some answers, I suggest Continue reading →

On Active vs Passive Equity Mutual Funds

When I came across a quote by Peter Lynch on how passive fund investors were making a mistake, I had two choices: to sweep his comments under the rug or evaluate the validity of them. In the article below, we will look at:

-

- Lynch’s argument

- My researched reasons for preferring passive investing.

- The role of confirmation bias and how it can hurt or help investors.

- The results of a careful analysis of the performance of Mr. Lynch’s preferred funds

- Finally, a few conclusions.

The takeaway: Outperforming MFs do exist but their taxable distributions are a larger drag than expected.

We’re inviting you to Continue reading →