SMALL WINS FOR INVESTORS

Effective January 1, 2017, the management fee for AMG River Road Long-Short Fund (ARLSX, formerly ASTON/River Road Long-Short Fund) will be reduced from 1.10% to 0.85% . At the same time AMG River Road Select Value Fund (ARSMX, formerly ASTON/River Road Select Value Fund) drops from 0.9 to 0.75%. In both cases, the total e.r. then falls as well.

AQR Global (AQGNX) and International Equity Funds (AQINX) have reduced their expense ratios by 10 and 5 basis points, respectively.

Ariel has lowered fees on both International (AINTX) and Global (AGLOX) by 12 bps. The new e.r. for each is 1.13% on Investor shares and 0.88% on Institutional ones.

Effective February 24, 2017, BBH International Equity Fund (BBHEX) will eliminate its “N” class shares but lower the investment minimum for “I” class (BBHLX) down to $10,000 from $5 million. It will also lower the expense ratio for BBHLX from 0.89% to 0.70%. That’s all to the good. At the same time, though, BBH boots Walter Scott & Partners of Edinburgh after a successful 12 year run managing the fund and Mondrian Investment Partners after five years. They’re succeeded by Select Equity Group. No word on why, though the 20% reduction in their compensation might have contributed to it.

BNY Mellon Municipal Opportunities Fund (MOTIX) reopened to new investors on December 15, 2016.

Matthews Asia reduced the institutional share class minimums on all its funds from $3,000,000 to $100,000 on December 30, 2016.

CLOSINGS (and related inconveniences)

Balter Event-Driven (BEVRX) has closed to all investors. Technically, the Board “approved the indefinite suspension of all sales of Fund shares.” It’s a former hedge fund that hasn’t exactly caught fire since conversion to a ’40 Act fund, which suggests that this closure might be the fund’s first step into the darkness.

Effective at the close of business on January 27, 2017 Janus Enterprise Fund will close to new investors. The fund has more than doubled in size in a year, from $5 billion to $10 billion. The underlying strategy now holds more than $13 billion. Only two of 192 mid-cap growth funds are larger than Enterprise. I would be cautious about approaching it since it’s rare for funds that have closed after ballooning to thrive. That said, there is some reason for a final look. First, it has been a splendid midcap fund. With the exception of the 2000-2002 bear market, it has matched or outperformed its mid-cap growth peers. It has an experienced manager and a very low turnover strategy. Second, the two larger mid-cap growth funds, T. Rowe Price Mid Cap Growth (RPMGX) and Principal Midcap (PEMGX), are themselves excellent vehicles. Both are closed and both have continued doing well since closure. Closing a few billion ago would have been a nice touch. Contrarily, telegraphing the closure a month or more in advance is an open invitation for a final surge of performance chasers. Be cautious.

OLD WINE, NEW BOTTLES

Effective on or about February 15, 2017, BlackRock Disciplined Small Cap Core Fund (BDSAX) will be renamed BlackRock Advantage Small Cap Core Fund.

Good news for fans of Catalyst/Lyons Hedged Premium Return Fund (CLPAX): the fund was not liquidated on December 28, 2016. Woohoo! Instead, it rebooted as Catalyst Exceed Defined Risk Fund with the objective of pursuing capital appreciation and preserving of capital.

Good Harbor Tactical Equity Income Fund (GHTAX) is changing its name to the Leland Real Asset Opportunities Fund. No explanation for the “Leland” part since no one seems to be coming or going. My best guess is that it’s a change-of-distribution arrangement, since some of the other Good Harbor funds already trade under the Leland name.

Horizon Dynamic Dividend Fund (HNDDX) has become the Horizon Active Dividend Fund. The name change took place on December 28, the day the fund (now with almost $50,000 in assets) launched.

On February 28, 2017, MainStay Global High Income Fund (MGHAX) becomes MainStay Emerging Markets Debt fund with the predictable changes to its investment strategy. On the same day, MainStay Emerging Markets Opportunities Fund (MEOAX) will become MainStay Emerging Markets Equity Fund.

Pending shareholder approval, late in the first quarter of 2017, Mar Vista Strategic Growth Fund (MVSGX) will become Harbor Strategic Growth Fund.

On January 1, 2017, the T. Rowe Price International Growth & Income Fund (TRIGX) will change its name to the T. Rowe Price International Value Equity Fund.

At the end of December 2017, three Westcore funds were renamed. Westcore Growth Fund (WTMGX) became Westcore Large-Cap Dividend Fund, MIDCO Growth (WTEIX) became Mid Cap Value Dividend and Select (WTSLX) became Small Cap Growth Fund II.

OFF TO THE DUSTBIN OF HISTORY

The $3 million AllianzGI China Equity Fund (ALQAX) will liquidate on January 30, 2017. By design or not, the fund has been wildly volatile, even by the standards of China funds, which means that its modestly above-average returns have not won it many fans.

AMG Managers Anchor Capital Enhanced Equity Fund (AMBEX, formerly ASTON/Anchor Capital Enhanced Equity Fund) will pass into The Great Beyond on January 31, 2017.

American Independence Navellier Defensive Alpha Fund (IFCSX), a RiskX fund, will liquidate on January 31, 2017. Mr. Navellier was appointed co-manager in May 2016, presumably in a last-ditch attempt to salvage the long-time laggard. Things got marginally better (it went from a major laggard to a minor laggard) but not good, so it’s gone.

The folks behind ASG Global Macro Fund helpfully reported in December 27, 2016, that “The Fund no longer exists, and as a result, shares of the Fund are no longer available for purchase or exchange.”

Brown Advisory Value Equity Fund (BIAVX) merged into Brown Advisory Flexible Equity Fund on December 2, 2016.

Catalyst Hedged Insider Buying Fund (STVAX) merged into Catalyst Insider Long/Short Fund (CIAAX) on December 28, 2016. It’s not automatically a good sign when your fund is seen as less attractive than a volatile, $3 million, one-star fund.

Champlain Focused Large Cap Value Fund (CIPYX) will liquidate on January 27, 2017, shortly after its third anniversary.

Given “the unlikelihood that the Fund would experience any meaningful growth in the near future,” the $10 million FundX Flexible Total Return Fund (TOTLX) will liquidate on January 6, 2017. “Unlikelihood”? Who writes “unlikelihood”? Regardless, or “irregardless” if I’m following their lead, it might be that the unlikelihood was raised by the combination of an undistinguished strategy, high expenses and mediocre returns.

Hennessy Core Bond Fund (HCBFX), which has been consistently weak and expensive for the past decade, will liquidate on or about Friday, February 17, 2017.

Kimberlite Floating Rate Financial Services Capital Fund (CEFFX) liquidated on December 16. 2016.

Hancock Horizon Value Fund (HHGAX) will merge into Federated MDT Stock Trust (FSTRX) at the beginning of February. Likewise, Hancock Horizon Core Bond Fund (HHBAX) is slated to merge into Federated Total Return Bond Fund (TLRAX). That’s a clear win for existing HHGAX shareholders but less so for HHBAX where the expense reduction is smaller and the performance of the acquiring fund is less distinguished.

MassMutual Select Diversified International Fund (MMAAX) will be dissolved on or about April 28, 2017.

MFS Institutional Large Cap Value Fund has been liquidated. They shared a reminder rather after the event.

Mirae Asset Asia (MALAX) and Emerging Markets (MALGX) funds will liquidate on February 28, 2017. Both are solid performers that haven’t found a market niche.

PNC High Yield Bond Fund (PAHBX) will liquidate on January 31, 2017.

RX Tactical Rotation Fund (RXTAX) took its last spin on December 30, 2016. The advisor pulled the plug after 17 months of operation.

The flagship Schooner Fund (SCNAX) liquidated on December 30, 2016. The same team continues to manage Schooner Hedged Alternative Income (SHAAX).

On March 24, 2017, Victory CEMP Commodity Enhanced Volatility-Weighted Index Strategy Fund (CCNAX) will merge into Victory CEMP Commodity Volatility-Weighted Index Strategy Fund (CCOAX).

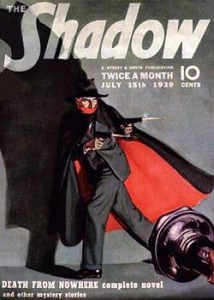

Thanks, as ever, to The Shadow for his yeoman’s work in reviewing SEC filings daily.