USAA was founded in San Antonio, Texas, when 25 Army officers decided to insure each other’s automobiles. The year was 1922. Its original name: United States Army Automobile Association. Today, USAA stands for United Services Automobile Association – a Fortune 500 diversified financial services organization that caters to US military personnel and families. It has more than 11 million members. Its chairman is retired General Lester Lyles. Why choose to invest with USAA? “Military Values: Our disciplined approach stems from our military values of service, loyalty, honesty and integrity.”

One of its products is the USAA Managed Portfolios (aka UMP), which I learned about after a friend recently emailed, asking “Please take a look at my portfolio and possibly give me suggestions ….” As usual and sight unseen, I offered:

- Take advantage of any employer 401(k) plan to maximum extent possible, especially if they offer matching funds. At minimum, invest enough to maximize company match.

- If you’ve maxed out your 401(k) yearly contribution, you may still be able to invest more in an individual retirement account (IRA), so max that out too.

- You can easily open an IRA at places like Schwab, Fidelity, or Vanguard … probably even your bank or credit union. Most will offer different types of investments.

- On which investments you choose, it depends first and foremost on your risk tolerance. After that, on your investment timeline. Typical 401(k) plans will offer a variety of mutual funds. Your IRAs may allow broader options. In any case, look for low expenses, transparency, and shareholder friendliness.

My friend quickly responded:

- My employer offers no 401(k) plan.

- I already max out my IRA yearly but would like to invest more.

- I’m a long term investor and hardly ever look at my statements.

- My Traditional IRA is at USAA … one of the good guys.

- I signed up for their Moderately Aggressive fund … a mix between aggressive growth (65%), bond (33%) and cash (2%).

He sent me a link to USAA Mutual Funds, as well as his latest statement. In fact, my friend was not invested in one fund but an actively managed portfolio of funds, specifically a USAA Managed Portfolio (UMP) with a Moderately Aggressive risk allocation comprising funds available to USAA members across the mutual fund marketplace.

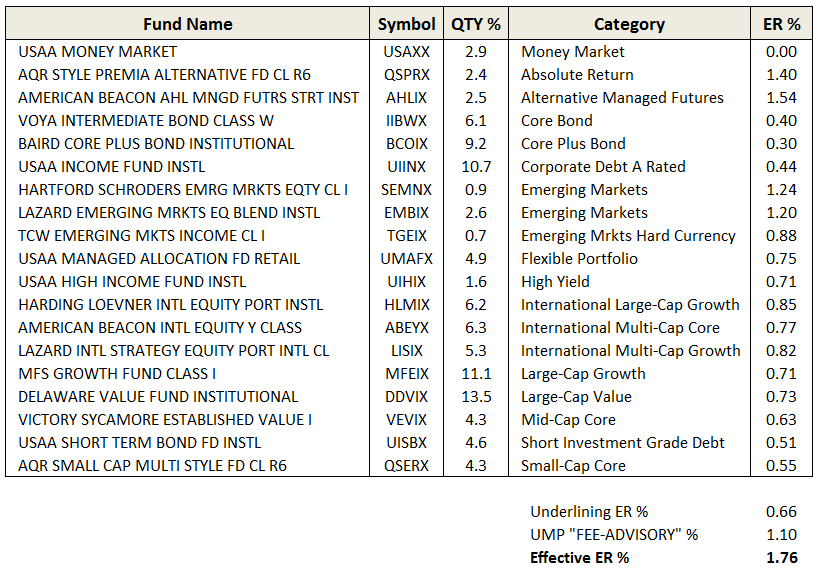

A closer look (see table below) shows his portfolio comprises 19 mutual funds, including three emerging market funds, three international funds, two large cap funds, three alternative funds, and seven fixed income funds.

The statement shows “TOTAL ACCOUNT FEES” for the month in dollars, not percentage, and did not reflect the fees of the underlining funds. Researching the UMP option, one finds the Wrap Fee Brochure, which specifies the 1.1% annual expense ratio (ER), after waivers. The brochure further explains the UMP product: “… a traditional managed account platform that offers model portfolios that may be comprised of mutual funds, money market funds, and/or ETFs …”

My friend provided limited back statements so it is hard to assess his UMP performance against benchmarks. USAA does provide quarterly commentaries on the UMP performance, but they seem top-level with expressions like “The UMP portfolios in general made a strong showing versus their benchmarks in the third quarter.”

I scratch my head though at the wisdom of holding 19 mutual funds, several in similar asset classes, charging a combined total of 1.8% per year, nominally. While it’s hard to say whether one fund or portfolio will outperform another over any given period, the portfolio charging higher fees will certainly face a greater headwind.

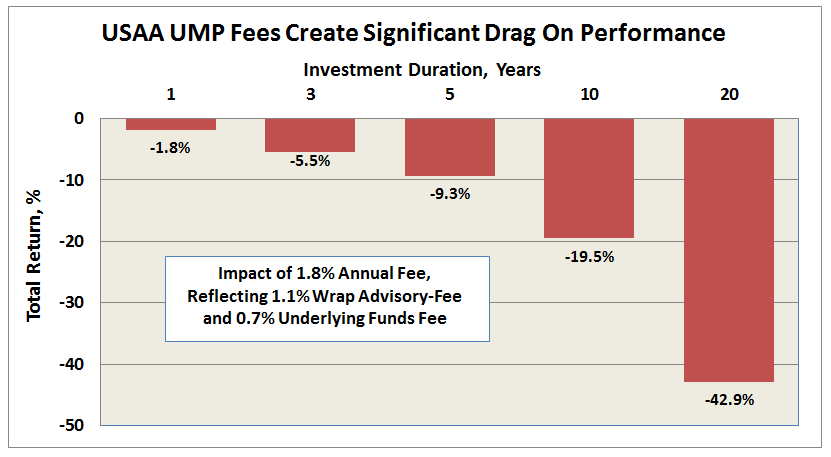

At 1.8% per year, the UMP portfolio results in a deduction in performance of significant levels over the long term (as is depicted below for an illustrative zero return portfolio), which must be overcome by manager skill if the investor is to come close to achieving benchmark performance. In this example, over 10 years, fees amount to nearly 20% of the retirement account and more than 40% over 20 years.

Curious, I called USAA to inquire about the benefits of a UMP account versus say one of the USAA Target Allocation funds, like USAA Target Retirement 2030 Fund (URTRX) or USAA Cornerstone Moderately Aggressive Fund (USCRX).

UMP is for people who “don’t have the time, desire or expertise to manage their portfolio,” an eager USAA representative explained. When I asked about some of the advantages, he added that UMP adjusts to market environment and has lower institutional class fees on underlying funds not available to individual investors. The problem is … so do funds like URTRX! When I complained about paying a 1.1% UMP wrap advisory-fee, he answered “You get what you pay for …”

When it comes to investing, the opposite is nearer to the truth: The less you pay, the more you get.

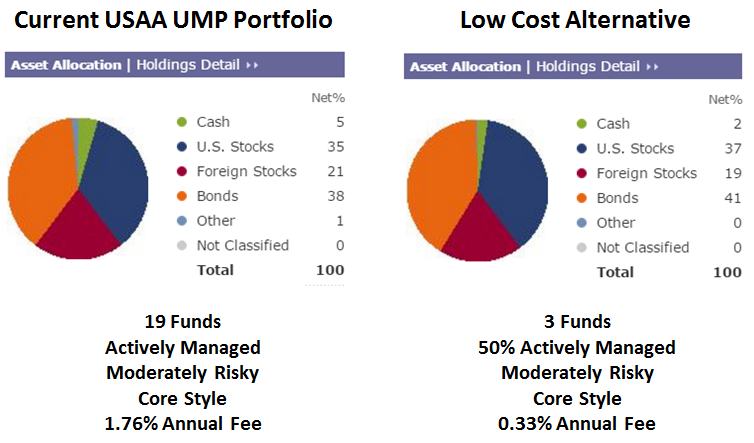

Wanting to offer my friend an alternative approach, I examined the many no load/no transaction fee funds available to USAA members. The goal: a simplified portfolio of 2 or 3 funds he could maintain with similar risk allocation but much lower fees.

To USAA’s credit, they offer a wide variety of interesting fund houses, including Artisan, AQR, T R Price, Fidelity, PIMCO, FMI, River North, Riverpark, Northern Trust, Leuthold, Guinness Atkinson, Oakmark, Oberweis, Osterweis, James, Intrepid, Matthews, Parnassus, and Greenspring.

I settled on a three fund portfolio, ironically with two fund-of-funds but with very low wrap fees: Fidelity Four-in-One Index Fund (FFNOX), Fidelity Total Bond Fund (FTBFX), and Northern Trust Global Tactical Asset Allocation Fund (BBALX) … split 50/25/25. FTBFX and BBALX are actively managed.

The two Fidelity funds receive Morningstar’s Gold Rating based on comparative Process, Parent, Performance, People, and Price. The latter BBALX was positively profiled by David last year.

Morningstar’s Portfolio Manager Tool indicates the USAA UMP allocation appears slightly defensive currently with a 60/40 tilt, as seen below. The Low Cost Alternative provides a very similar allocation.

Two even simpler alternatives would be a 50/50 split between FFNOX and BBALX, making the allocation somewhat more aggressive with a 70/30 stock/bond split, or a 50/50 split between FFNOX and FTBFX, making the allocation somewhat more conservative with a 40/60 stock/bond split. Both would also provide substantial fee reduction.

As for performance against the current USAA UMP portfolio? Some of its underlying funds only have a two year track record. That said, any of these low cost alternatives make “strong showings” (aka beat) the managed portfolio over the past 1 and 2 year periods. They crush the Target Risk USAA Cornerstone Moderately Aggressive Fund (USCRX), which carries a hefty 1.13% annual fee, over the past 1, 3, 5, and 10 year periods.

I recommended my friend call USAA soonest to reassign his current IRA away from UMP to a low cost alternative and redirect future contributions accordingly. I further recommended he open a regular non-tax deferred account for additional savings, while encouraging his employer to consider establishing something like a Simple IRA. (When I mentioned his situation to my local Fidelity representative, she offered to help his firm set it up.)