*Zeo Capital Advisors, LLC ceased operations on 5/1/2022*

This fund is now Osterweis Short Duration Credit Fund.

“Perhaps time’s definition of coal is the diamond.”

Kahlil Gibran

Objective and Strategy

The Zeo Short Duration Income Fund (ZEOIX), previously known as the Zeo Strategic Income Fund, is a non-diversified, actively managed, total return, fixed-income fund that seeks …

- “ … to deliver low volatility, risk-managed solutions for the prudent investor.”

- “ … low volatility and absolute returns consisting of income and moderate capital appreciation.”

- “ … long-term capital preservation, income and moderate capital appreciation across market environments.”

- “ … low volatility, absolute returns in a long-only fixed income portfolio.”

- “ … to deliver a consistent, low-volatility risk profile suitable for both short and long time horizons.”

- “ … to deliver low volatility.”

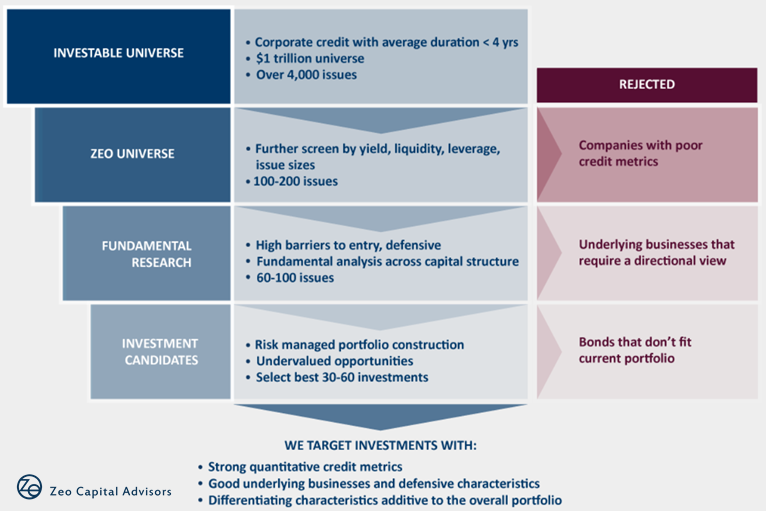

Clearly, ZEOIX’s focus is low volatility. To achieve its objective, the fund targets what its adviser assesses to be low-risk investments. Specifically, it focuses on under-valued short duration US corporate debt of defensive (boring but essential) companies with healthy underlying businesses resistant to cyclical trends.

While there is no target return goal, the strategy has delivered 2-4% annualized above risk-free return. Indeed, since the fund’s launch, ZEOIX has delivered 3% annualized return, mostly under an extended period of zero interest rate monetary policy. Dividend yield has been 2.5% this past year, comparable to AGG and todays’ newly resuscitated 1-year CD rate.

With risk being the paramount constraint, the fund seeks a steadily upward return, regardless of market cycle. In this regard, the fund seeks what many hedge fund strategies promise: absolute return.

Adviser

Zeo Capital Advisors, LLC located in San Francisco’s financial district. The firm was founded in February 2009, the nadir of the financial crisis, by Venk Reddy. The seed investor remains with Zeo and today, approaching the ten-year mark, the firm manages just over $300M. The preponderance is in ZEOIX. About 60% of the AUM comes from RIAs, while 15% is from family offices.

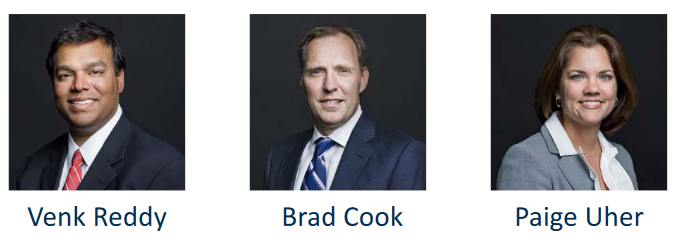

Zeo is a boutique adviser with a singular and niche fixed-income investment strategy. Its leadership team comprises just three individuals: Venk Reddy, Founder and CIO; Brad Cook, Portfolio Manager and Director of Credit Research; and Paige Uher, Director Investor Relations.

Together they articulate the Zeo mission statement: “We are committed, philosophically and structurally, to building a long-term business, aligning our mandate with specific and overlooked investment needs, and serving fiduciaries consistent with our existing investor base.”

In David Snowball’s July 2014 profile of ZEOIX, he noted the firm’s insistence on finding the right types of clients, consistent with the fund’s objective and strategy. That same principle applies today, only the firm has smartly expanded its website to better communicate its story, as well as initiated investor conference calls.

After meeting with the Zeo team twice in San Francisco and again at this month’s Morningstar Investment Conference in Chicago, here’s my impression of the team: Paige is the driving force behind getting the word out, the greatly improved website, and knowing each of Zeo’s clients. Brad is the inside, deep-dive corporate debt analyst, and experienced trader … slave to his Bloomberg trading terminal. Venk is the visionary who created the strategy that fills a void in the fixed income 40 Act world, establishing the firm to make it possible … and he knows a lot about the business of investing. So, one leader for each of the firm’s guiding principles focused on clients, portfolio, and business. They appear all together on the firm’s mission and all-in on their commitment to making Zeo successful.

The office itself is quite modest, even minimal, though the view of the Golden Gate is spectacular. The city’s financial district commands some of the highest rents on earth, but to date, Zeo shares the floor with another firm, also launched by the same seed investor and together they pay a very modest rent. Venk warns this could change going forward because of growth, but he believes staying in the heart of the city’s financial district benefits the firm, its employees, and ultimately its shareholders. For the record, rent is covered under the management fee portion of er.

I counted three Bloomberg terminals … and Brad’s terminal, whose was kind enough to walk me through some of his trading process, was lit-up like a Christmas tree. Black-and-white pictures showcasing products of the firms Brad likes to invest in hung throughout the office, like engine nacelles from Spirit Aerosystems.

Managers

Prior to Zeo, Venk was a co-founder of Laurel Ridge Asset Management LP, a $400m multi-strategy hedge fund, where he managed the credit, distressed and event-driven portfolios. In that role, Venk specialized in asset valuation and identifying opportunities at the intersection of quantitative and fundamental analysis. In addition to his portfolio and investment committee responsibilities, he managed both the credit and technology teams and built the infrastructure underlying the fund’s scalable risk and analysis systems. His previous positions include portfolio manager within Bank of America’s Equity Financial Products group (EFP), investments manager at Pine River Capital Management LP and HBK Investments LP, where he started his career. Venk earned a BA in Computer Science with Honors from Harvard University. He currently serves as a trustee for the Katherine Delmar Burke School with roles on the finance, audit and technology committees. He was recently featured in an efc article, entitled “Why this former bank trader and hedge fund manager feels he’s best off in long-only asset management.”

Brad joined Zeo in 2012. He began his career with PricewaterhouseCoopers in Vancouver where he qualified as a Canadian Chartered Accountant with a focus on audit and bankruptcy before joining their London-based corporate finance group. He then served as a vice president and high yield credit analyst at Oaktree Capital Management Ltd, a top-tier European high yield bond fund in London. He also served as a Director and senior credit analyst at Descartes Capital LLC, a $300m hedge fund focused on high yield and convertible debt based in San Francisco. Immediately prior to joining Zeo, he was head of convertible strategies at Sterne Agee Group, Inc. and head of credit research in the convertible bond group at Thomas Weisel Partners LLC. In both roles, Brad focused on fundamental investments in corporate debt with an emphasis on company value and capital structure. Brad earned a BComm from the University of Calgary.

Strategy Capacity and Closure

In 2014, David’s assessment was that the fund pursues “capacity constrained” strategies; that is, by its nature the fund’s strategy will never accommodate multiple billions of dollars. The advisor doesn’t have a predefined bright line because the capacity changes with market conditions. In general, the strategy might accommodate $500M – $1B.

As of May 2018, ZEOIX has $290M in AUM.

Management’s Stake in the Fund

Per last August’s SAI filing, Venk maintains $100 – 500K in the fund, and Brad maintains between $50 – 100K. These levels are much improved from those published in 2014. My initial inclination was that they remain low for managers of their tenure, experience, and leadership positions. That said the nature of the fund is very conservative. Since Venk and Brad do not appear close to retirement, the inclination to overallocate to ZEOIX may be misplaced.

They are partners and in addition to salary, may be eligible for a performance-based bonus and a share of the profits, if any. So, they each have a vested interest in the success of the firm and the fund. Venk adds “a substantial portion of our net worth for each of us as owners comes from a combination of our ownership in Zeo and our holdings in ZEOIX. In addition, all members of our management team are invested in the fund, as well as members of our families.”

The fund is one of a series of many funds registered with the SEC under the Northern Lights Trust. Gemini Fund Services, LLC is the trust’s administrator, transfer agent and fund accountant. All the trustees of the fund appear to be affiliated with Gemini and the SAI shows that none hold any stake in ZEOIX, which in the case of this trust is more the norm.

Opening Date

May 31, 2011. ZEOIX is the firm’s singular fund and for all intents and purposes the firm’s singular strategy. Commendably, ZOEIX is a single share-class fund.

Minimum Investment

The minimum initial investment (verified at Fidelity and Schwab) is $5,000 for all accounts except IRAs, which have a $1,500 minimum. Subsequent purchases for all accounts can be as low as $1,000.

Expense Ratio

August 2023 update:

0.85% on assets of $95 million. No redemption fee.

The fund recently reduced its management fee to from 1.00 to 0.75% per year. And, in the newly filed prospectus, its “Other Expenses” are reduced 2 bps. These reductions brings its net expense ratio to 1.04, slightly above the 1.00 er average for high yield funds (all share classes), where Morningstar categorizes ZEOIX, and in-line with the 1.03 er for multi-sector income funds, where Lipper categorizes the fund.

The reduction in er is a very positive step for this small firm and it speaks well of its commitment to shareholders.

The fund charges no loads and no 12b-1 fee. There is a 1% redemption fee if sold before holding for 30 days, which the adviser believes is consistent with the stable nature of the strategy and discourages trading.

It is available at brokerage houses, like Fidelity and Schwab, but not on their no transaction fee (NTF) platforms. The former charges a $49.95 transaction fee to buy, while the latter charges $76 (ouch!). There is no fee to sell.

Venk argues NTF hurts investors, because it typically costs 0.25% annually. I agree with him and applaud Zeo’s single share class.

On the topic of “soft dollars,” which is a hidden fee that allows advisers to pay higher commissions to broker-dealers to execute trades in exchange for things like research databases: It is the Firm’s policy to not enter into “soft dollar” relationships with any brokerage firms.

Besides, Venk explains, “we don’t really use third party research anyway. We are a fundamental manager that does our own credit research to determine what we want to buy. We don’t outsource that to anyone, so third party research is of limited value to us and is never the reason we make an investment decision.”

Interestingly, Zeo’s annual report shows no commissions paid, which is because dealers get paid by the spread.

Comments

When Zeo originally named the fund “Strategic Income,” it did not realize that by “Strategic” the industry really means “Tactical.” But the strategy is not tactical at all. Zeo uses short duration and fundamental analysis to create a portfolio of say 50 positions it believes will be resistant to interest rate change and are undervalued. Once established, it is happy to hold to duration. “We’re a lender to these companies and are not trading for profit,” Venk insists. Nor does Zeo move in and out of bonds in tactical fashion in response to some destabilizing market event, like their name came to imply. So, the name changed.

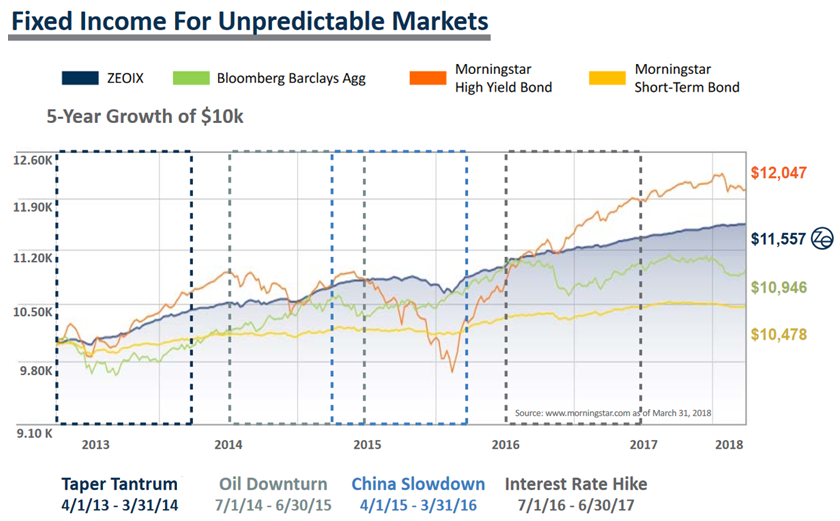

Below is an example of the resiliency of the fund’s performance given various potentially destabilizing market events. The data presented is through March 2018.

The average effective duration of its current portfolio is about 1 year, which is six times shorter than AGG. A year ago, it was half that. Its high yield relative to its short duration (the so-called “Sherman Ratio”), enables Zeo to mitigate interest rate risk while redeploying maturing bonds to those with higher yield.

The turnover metric appears high (152% as of April 2018) because of short duration. Venk argues that “for a portfolio where bonds are being called by issuers or maturing, or where a bond is within two weeks of such an event, the reinvestment of the proceeds artificially inflates the turnover calculation … ” Furthermore, the distributions ZEOIX makes are almost entirely driven by dividend income, not capital gains.

Brad spends considerable time understanding the companies Zeo holds in its portfolio. Companies that have a “reason to exist” and often have a high barrier to entry. Here’s background he provided on three typical holdings:

Arctic Glacier, LLC

Arctic Glacier (AGUCAN) produces and distributes packaged ice. What makes Arctic Glacier interesting to us is the monopolistic market structure when analyzed by region. The company has the #1 market share in its local markets and is often 10x the size of the next largest competitor. Our analysis gives us confidence that its scale and cost advantage of ice distribution leads to stable cash flows to service debt payments even through market cycles.

FTI Consulting Inc

FTI Consulting (FCN) is a professional consulting services company. FTI’s largest focus area is debt restructuring advisory services, which are typically most in demand in times of economic downturn. When the economy is growing, they provide technology and other financial consulting. This can result in an earnings profile that is somewhat countercyclical. We first invested in FTI in early 2014 when the debt was rated BB-. The company was rationalizing underperforming areas and focusing on debt reduction. Since then, the credit rating has been upgraded to BB+ (one level short of investment grade).

Cott Corporation

Cott (BCBCN) produces carbonated drinks and juices traditionally focusing on private label products to be sold at grocers. The carbonated drinks market has been in slow decline, which is typically not an attractive situation for equity investors. However, as a debt investor, we believe Cott gets overlooked as a strong credit investment supported by their strict focus on cash flows and debt reduction. Additionally, Cott purchased DS Services (DSWATE) to expand into direct-to-consumer bottled water and coffee distribution to spur growth and diversity.

Zeo is one of the firms whose depictions of fund performance and volatility regularly align with metrics we endorse on the MFO Premium site. Metrics like max drawdown, up versus down capture, and rolling averages.

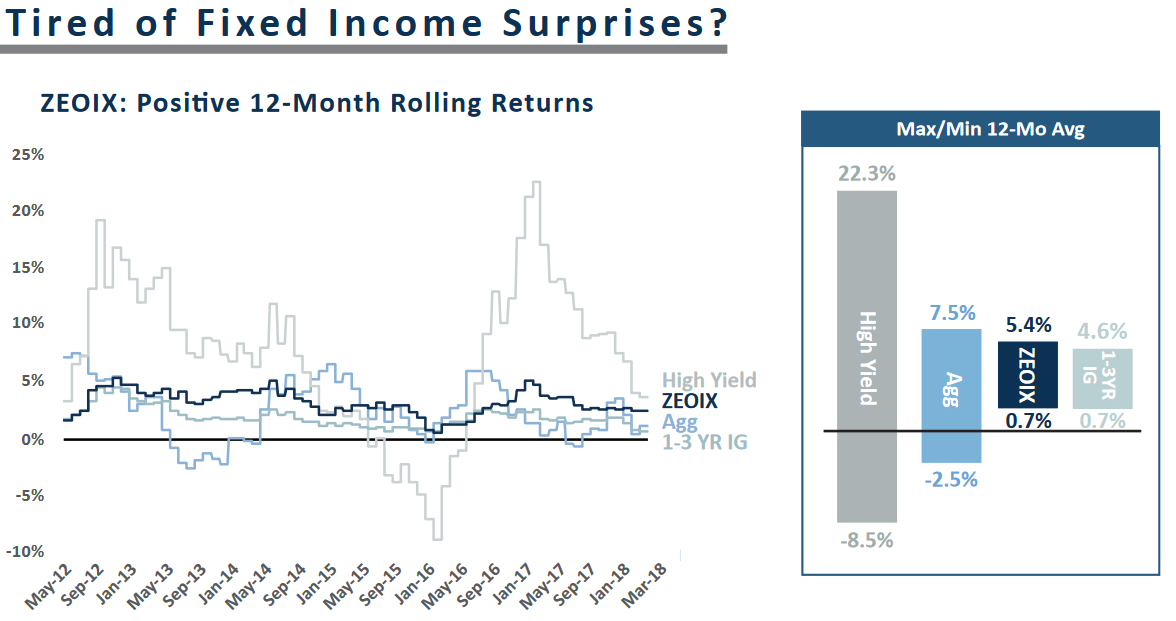

Here’s an example:

The chart depicts 1-year rolling returns since ZEOIX launch through March 2018. It demonstrates consistently positive rolling returns with tight deviation, compared to the Bloomberg Barclays US Aggregate Index and even more so when compared to the BAML High Yield Master II Index.

I find the fund’s 3- and 5-year rolling returns even more impressive. In the 49 3-year rolling returns since launch through May 2018, ZEOIX has never delivered less than 2.4% per year versus 1.1% for the Aggregate Index and in the 25 5-year rolling returns, it has never delivered less than 2.9% versus 1.5%.

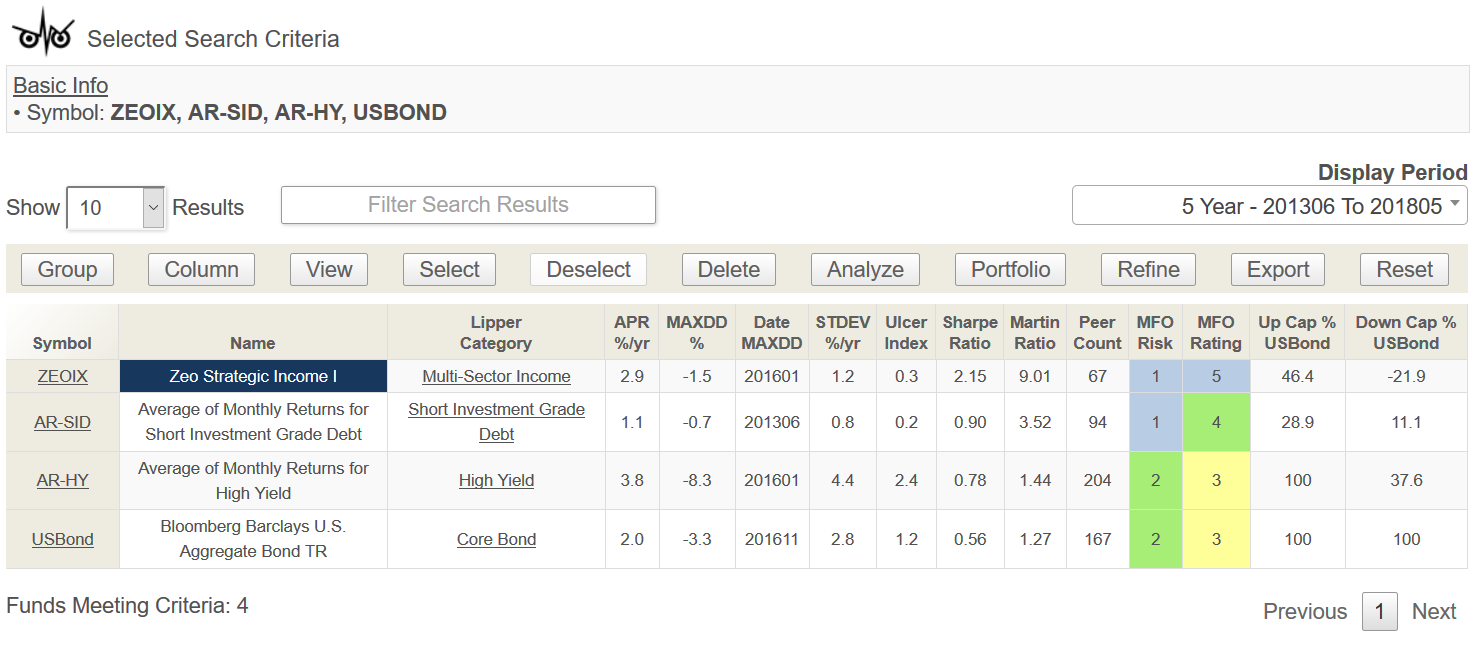

ZEOIX has been a perennial MFO Great Owl because the MFO ratings system is based on Martin Ratio, which rewards funds with high excess return and low drawdown. The table below highlights the fund’s performance the past five years versus the Aggregate Index and versus the high yield and short duration categories. The fund is a top quintile performer among the 67 peers Lipper has in the Multi-Sector Income category, but ZEOIX would be top quintile in any of these categories.

It also consistently receives the “Very Conservative” MFO Risk score of 1, which means its volatility is less the 20% of the S&P 500. Through May, there are 707 funds (mutual funds, ETFs, CEFs, and insurance funds) at least 5-years old with a MFO Risk of score 1, regardless of category. Nearly half of those are money market funds. ZEOIX is ranked number 13 out of 707 in the “Very Conservative” MFO Risk group, based on absolute return. It returned 15.5% cumulatively over the past 5 years versus 3.3% for the average Very Conservative fund (and 1.6% for the median).

Interestingly, ZEOIX has captured nearly 50% of the upside Aggregate Index, which is return across the months when the index was positive, while avoiding all of its downside. It delivered positive return across the months when the Aggregate Index was negative (there were 25 such months in the past 5 years), producing negative downside capture.

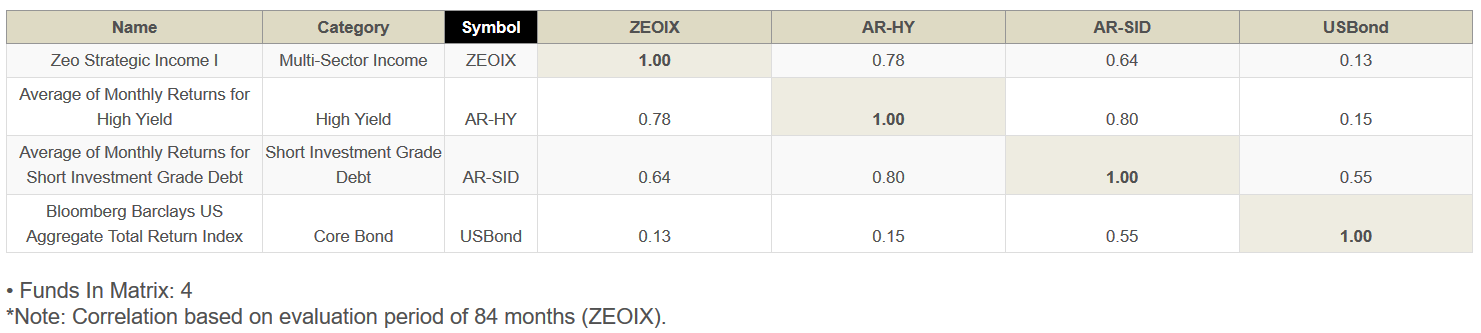

ZEOIX actually correlates more with high yield and short duration than it does with the Aggregate Index, as seen in the table below.

Bottom Line

Since our 2014 profile, the folks at Zeo have continued to do many of the right things David first praised and more. They’ve successfully executed their strategy of low volatility with modest return through several potentially destabilizing catalysts. They’ve reduced their er from 1.50% to 1.04%. They’re increased their personal stake in the fund. They’ve communicated well their message, as evidenced by an informative website and initiating investor teleconferences. AUM has tripled from $100M to nearly $300M and I expect it will continue to grow steadily, especially as interest rates increase.

ZEOIX does indeed fill a void in the fixed-income investment space. Venk identified it and founded the firm to fill it. The firm is approaching its tenth year and together with Brad and Paige, this leadership trio is prosecuting their strategy like a well-oiled machine.

Given the current interest rate environment and the continued maturity of this fund, there has never been a better time for very conservative investors to consider owning ZEOIX or for ZEOIX to occupy at least a portion of the low volatility allocation in more diversified portfolios.

Fund Website

Osterweis Short Duration Credit Fund (Formerly Zero Short Duration Income Fund).

Disclosure

I decided to invest in ZEOIX recently while researching this profile and after the firm reduced its er … for the more conservative and buy-and-forget portion of my retirement portfolio. The more I looked, the more I liked.