By David Snowball

People bandy about the phrase “long/short fund” as if it had meaning. It does not. It is, instead, a catch-all term that includes funds with very different objectives and very different strategies, including some funds that do no shorting at all. Some short individual stocks, some short groups of stocks through ETFs and others short entire markets. Some are market-neutral, some are permanently defensive, some switch between defense and offense, others are always playing offense.

A 2013 analysis of all funds listed as “long/short” in Morningstar’s database by Long Short Advisors found “just 25 funds that are ‘real’ long/short equity funds that invest in individual stocks on both the long and short side of the portfolios and 12 strategies that only short using ETFs rather than individual stocks … The remaining funds are mix of totally miscategorized funds (multi-alternative, balanced, arbitrage, market neutral, global macro, etc.), quant funds and long/short sector funds that cannot be compared to broad market long/short funds.”

You can measure the jumble by looking at the correlations between the funds. If all long/short funds were doing roughly comparable things, you’d see consistently high correlations between members of the group. Instead, if you look at all long-short funds with at least a billion in assets, correlations range from negative 14 to positive 89. Twenty-three of 28 correlations are below 80, 14 of 28 are below 50. Similarly, if we look at the 10 funds with the highest annual returns over the past five years, the range is 42-87. Heck, a bunch of these funds have near-perfect correlations with the S&P 500 while others capture more than 100% of the S&P 500’s downside.

You can measure the jumble by looking at the correlations between the funds. If all long/short funds were doing roughly comparable things, you’d see consistently high correlations between members of the group. Instead, if you look at all long-short funds with at least a billion in assets, correlations range from negative 14 to positive 89. Twenty-three of 28 correlations are below 80, 14 of 28 are below 50. Similarly, if we look at the 10 funds with the highest annual returns over the past five years, the range is 42-87. Heck, a bunch of these funds have near-perfect correlations with the S&P 500 while others capture more than 100% of the S&P 500’s downside.

That’s not bad. It does, however, mean that the phrase “maybe I should consider a long/short fund” is incoherent.

That said, it is possible for individual long-short funds to make sense and to make a difference.

In particular, long/short strategies have the potential to buffer your portfolio in volatile markets where sharp downside movements are as likely as anything else. To help identify funds worth closer consideration, we started with a simple hurdle:

The fund had to outperform a simple 60/40 index in the Q4 downturn. Since “adding bonds” is a cheap, effective and time-tested strategy for dampening volatility, any alternative should be at least as effective. VBINX dropped 8.1% in the quarter, so we start with funds that did better.

There are 148 long-short equity funds in Lipper’s database. Sixty-two funds, 42.5% of the universe, met that requirement. Only one fund designated a Great Owl failed the test: Gotham Enhanced 500 (GENFX). All other Great Owls in the long/short group passed: Gotham Absolute 500 (GFIVX), JP Morgan Hedged Equity (JEHQX), PIMCO RAE Worldwide Long/Short Plus (PWLIX), Catalyst/Millburn Hedge Strategy (MBXIX), Hundredfold Select Alternative (SFHYX), MFS Managed Wealth (MNWIX), and Nuance Concentrated Value Long-Short (NCLSX).

The second hurdle is also simple: the funds had to have positive returns in the long-term. Why, after all, buy a fund that shines in one bad stretch but, otherwise, fails you year and year? That eliminated a dozen funds, including several of the top performers in the turbulent final quarter of 2018.

Below are all of the long-short funds that made it over our two hurdles: better than 60/40 in the short-run and better than zero in the long run. We’ve broken them into four groups for you:

Tier one: funds that made money in the short-term and in the long-term. Three. Huzzah!

Tier two: funds that were much better than 60/40 in the short-term (though that still meant losing some in Q4) and positive in the long-term. Seven.

Tier three: funds that were somewhat better than 60/40 in the short term and positive in the long-term. Twenty-three.

Promising newcomers: funds that are one-to-three years old which were better than 60/40 in the short term and positive since inception.

Only five of the 148 long/short funds tracked by Lipper were positive in both the short- and longer-term, three older funds and two newbies. Those funds are highlighted in green. We’ll provide a capsule of each after the data tables.

Some of these funds have very high investment minimums (Glenmede and Gotham, for example). Some of them are not “true” long-short funds but pursue other hedging strategies (FundX Tactical and Bridgeway Managed Volatility are examples). They share just three characteristics (in the Lipper peer group, Q4 performance, three-year performance) so you’d need to consider each separately on its merits.

| Tier One: Positive in both Q4 and 2016-18 |

| Symbol |

Name |

Q4 2018 |

3 year returns |

ER%/yr |

AUM$M |

| NCLSX |

Nuance Concentrated Value Long-Short |

8 |

6.6 |

2.59 |

26.8 |

| TACTX |

FundX Tactical Upgrader |

4.1 |

7.8 |

1.73 |

58.1 |

| BDMIX |

BlackRock Global Long/Short Equity |

1.3 |

2.4 |

1.64 |

633 |

| |

| Tier Two: Lost less than half of a balanced portfolio in Q4 and positive for 2016-18 |

| Symbol |

Name |

Q4 2018 |

3 year returns |

ER%/yr |

AUM$M |

| DIVA |

AGFiQ Hedged Dividend Income |

-1.2 |

6.3 |

0.75 |

3.5 |

| JOEQX |

JPMorgan Opportunistic Equity Long/Short |

-3.4 |

4.5 |

2.2 |

272 |

| PMHIX |

PIMCO EqS Long/Short |

-3.3 |

4.0 |

2.05 |

458 |

| JDIEX |

Saratoga James Alpha Managed Risk Domestic Equity |

-3.3 |

3.5 |

2.22 |

20.7 |

| DAMDX |

Dunham Monthly Distribution |

-1.9 |

2.7 |

2.94 |

254 |

| MNWIX |

MFS Managed Wealth |

-1.5 |

2.6 |

1.18 |

31.5 |

| ATQIX |

Arbitrage Tactical Equity |

-2.9 |

1.8 |

2.17 |

2.4 |

| |

| Tier Three: Lost less than a balanced portfolio in Q4 and positive for 2016-18 |

| Symbol |

Name |

Q4 2018 |

3 year returns |

ER%/yr |

AUM$M |

| MEQFX |

AMG FQ Long-Short Equity |

-6.6 |

11.1 |

0.76 |

95.2 |

| MBXIX |

Catalyst/Millburn Hedge Strategy |

-4.7 |

9.6 |

2 |

4,113 |

| GTRFX |

Gotham Total Return |

-7.4 |

9.2 |

3.51 |

29.2 |

| PWLIX |

PIMCO RAE Worldwide Long/Short PLUS |

-5.4 |

8.4 |

1.23 |

1,559 |

| GFIVX |

Gotham Absolute 500 |

-5.8 |

7.7 |

3.2 |

14 |

| JHEQX |

JPMorgan Hedged Equity |

-5.4 |

7.0 |

0.6 |

3,434 |

| LSOFX |

LS Opportunity |

-7.7 |

6.0 |

2.97 |

59.4 |

| SFHYX |

Hundredfold Select Alternative |

-4.5 |

4.9 |

2.84 |

50.6 |

| ACDJX |

American Century Alternatives Disciplined Long Short |

-6.5 |

4.8 |

2.39 |

46.6 |

| BGIQX |

BMO Global Long/Short Equity |

-8 |

4.4 |

1.41 |

7.2 |

| QLS |

IQ Hedge Long/Short Tracker ETF |

-7.7 |

3.6 |

1.04 |

3.9 |

| PLHZX |

PGIM QMA Long-Short Equity |

-7 |

3.6 |

2.01 |

482 |

| MAIPX |

MAI Managed Volatility |

-8 |

3.5 |

1.03 |

127 |

| ARLSX |

AMG River Road Long-Short |

-4.4 |

2.6 |

3.65 |

25.3 |

| SAOAX |

Guggenheim Alpha Opportunity |

-4.5 |

2.5 |

1.97 |

131 |

| CPIEX |

Counterpoint Tactical Equity |

-7 |

2.2 |

3.11 |

30.8 |

| BRBPX |

Bridgeway Managed Volatility |

-7.4 |

2.1 |

0.95 |

30 |

| GTAPX |

Glenmede Quantitative US Long/Short Equity Portfolio |

-7.9 |

1.9 |

2.42 |

311 |

| JSFDX |

John Hancock Seaport Long/Short |

-7.4 |

1.9 |

1.69 |

667 |

| SNAAX |

SEI Long/Short Alternative |

-7.3 |

1.9 |

1.44 |

31.4 |

| FVALX |

Forester Value |

-2.9 |

1.9 |

1.27 |

20.5 |

| HDG |

ProShares Hedge Replication ETF |

-5 |

1.1 |

0.95 |

37.8 |

| BGLSX |

Boston Partners Global Long/Short |

-7.7 |

0.0 |

2.64 |

873 |

| |

| Promising possibilities: Good (better than balanced in Q4 and positive lifetime-to-date) young (more than one year, less than three) long/short funds |

| Symbol |

Name |

Q4 2019 |

Since inception |

ER%/yr |

AUM$M |

| GDLFX |

Gotham Defensive Long 500 |

-7.9 |

11.5 |

3.8 |

11.1 |

| GHPLX |

Gotham Hedged Plus |

-7 |

8.1 |

3.1 |

2.8 |

| BIVIX |

Balter Invenomic |

1.7 |

7.8 |

2.63 |

93.2 |

| GACFX |

Gotham Absolute 500 Core |

-6.2 |

7.8 |

2.15 |

2.4 |

| GCHDX |

Gotham Hedged Core |

-7.5 |

7.8 |

1.4 |

2.4 |

| ATESX |

Anchor Tactical Equity Strategies |

-5.2 |

5.9 |

2.32 |

158 |

| CPLIX |

Calamos Phineus Long/Short |

-4 |

5.3 |

2.54 |

1,139 |

| BUIGX |

CBOE Vest S&P 500 Buffer Strategy |

-7.8 |

4.9 |

0.95 |

41.4 |

| GDLIX |

Gotham Defensive Long |

-7.6 |

4.8 |

3.62 |

2.2 |

| DFND |

Reality Shares DIVCON Dividend Defender ETF |

-6 |

4.5 |

1.38 |

4.7 |

| EIVPX |

Parametric Volatility Risk Premium – Defensive |

-7.9 |

2.7 |

0.55 |

376 |

| SHLDX |

USCA Premium Buy-Write |

-5.6 |

2.0 |

1.18 |

20.5 |

| GARD |

Reality Shares DIVCON Dividend Guard ETF |

-7.6 |

1.6 |

1.41 |

12.6 |

| VCRSX |

Voya CBRE Long/Short |

-4.6 |

1.1 |

2.35 |

44.8 |

| GSSFX |

Gotham Short Strategies |

11.5 |

0.5 |

1.35 |

2.2 |

| HMXIX |

AlphaCentric Hedged Market Opportunity |

1.9 |

0.2 |

2.47 |

8.3 |

Quick profiles of the five funds that were positive in both the short- and long-term

Nuance Concentrated Value Long-Short (NCLIX/NCLSX) invests in the stock of 15-35  companies that it deems to be industry leaders with strong and stable competitive positions. It then shorts the stock of up to 50 large companies with “more commoditized or structurally challenged competitive positions.” Up to 25% of the portfolio might be invested overseas.

companies that it deems to be industry leaders with strong and stable competitive positions. It then shorts the stock of up to 50 large companies with “more commoditized or structurally challenged competitive positions.” Up to 25% of the portfolio might be invested overseas.

Its managers remain pretty skeptical of the US market’s valuations. They write, “as of 12/31/18, the median company in the proprietary Nuance long universe, which consists of approximately 250 companies we view as industry leaders, was trading at around a 15% premium to what the Investment Team would consider to be fair value. Said another way, the universe appeared to be 15% over-valued on average, per our internal estimates. In addition, according to our company-by-company valuation work, this same universe had roughly 60% downside potential.” In response, the fund is just 6% net long; over the past couple years it has ranged from 23% net short to just 7% net long.

It has an R2 of just 13 against its peer group.

Morningstar rates this as a four-star fund. MFO has designated it as a Great Owl fund, which means that its risk-adjusted returns have been in the top 20% of its peer group. By any reasonable risk-sensitive measure, Nuance is a top-ten performer in its fund Lipper peer group.

Performance: 12th of 102 funds

Drawdown: 7th

Ulcer Index: 14th

Sharpe ratio: 11th

Martin ratio: 9th

Downside deviation: 11th

Bear-month deviation: 9th

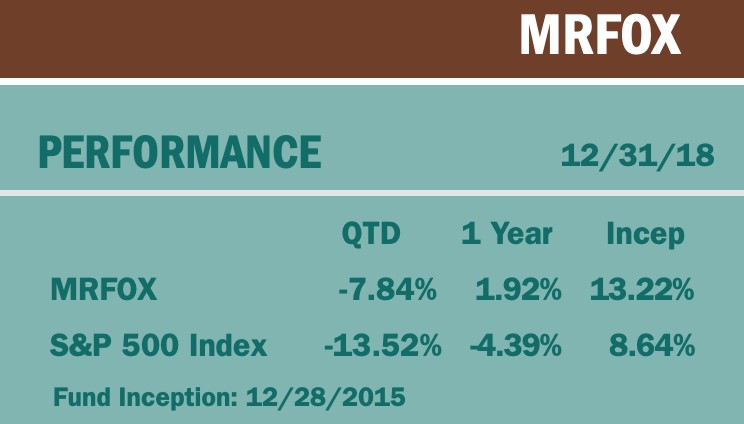

The fund launched in December 2015.It’s drawn $26 million since then. Expenses are 2.84% and the minimum initial investment is $2,500. It made 5% in 2018.

FundX Tactical Upgrader (TACTX) is not a true long-short fund. Like all of the FundX offerings,  it is a fund-of-funds that attempts to hold funds which are “in sync with current market leadership.” Then separately, the manager may deploy a number of options to buffer its stock market exposure: “raising cash, selling covered call or put options and/or buying put options or put spreads or call options or call spreads.”

it is a fund-of-funds that attempts to hold funds which are “in sync with current market leadership.” Then separately, the manager may deploy a number of options to buffer its stock market exposure: “raising cash, selling covered call or put options and/or buying put options or put spreads or call options or call spreads.”

Over the past three years, TACTX has performed reasonably well. Compared to all of the funds in its peer group, its three-year record:

Performance: 8th of 102 funds

Drawdown: 14th

Ulcer Index: 10th

Sharpe ratio: 4th

Martin ratio: 3rd

Downside deviation: 16th

Bear-month deviation: 19th

The fund had the misfortune of launching (and crashing) in the midst of the 2007-09 market crisis, which badly skews the “since inception” numbers. If we look at the 10-year picture, which mostly erases the effects of the financial crisis, you get a picture of a fund with slightly lower than average returns but noticeably lower than average risk. In particular, it has made money every year since launch and was up 7.5% in 2018

| |

Annual return |

MAX drawdown |

Recvry months |

Std dev |

Downside dev |

Sharpe ratio |

| FundX Tactical Upgrader |

5.2 |

-9.3 |

12 |

7.8 |

4.9 |

0.61 |

| Long/Short Equity Average |

5.8 |

-18.9 |

25 |

10.1 |

6.4 |

0.52 |

| S&P 500 Index |

13.1 |

-18.1 |

4 |

13.6 |

8.5 |

0.94 |

The fund launched in February, 2008. It’s drawn $72 million since then. Expenses are 1.73% and the minimum initial investment is $1,000.

BlackRock Global Long/Short Equity (BDMAX) is best considered a market-neutral fund; that  is, it tries to hedge out all market effects all of the time. That necessarily limits both upside and downside, since the decision to dodge headwinds also means that you can’t benefit from (more frequent) tailwinds. The fund’s distinctive strategy is its reliance on Big Data. Perhaps BIG DATA!!

is, it tries to hedge out all market effects all of the time. That necessarily limits both upside and downside, since the decision to dodge headwinds also means that you can’t benefit from (more frequent) tailwinds. The fund’s distinctive strategy is its reliance on Big Data. Perhaps BIG DATA!!

Their description is “The team’s powerful data capabilities help seek non-obvious opportunities others may miss.” Morningstar, which gives it a Bronze rating but only three-stars, explains it this way:

Management systematically ranks a universe of approximately 2,500 developed-markets stocks using a combination of traditional and nontraditional metrics …nontraditional metrics, which are often based on advanced computer techniques [include looking] at third-party data on online sales to get a sense of consumer sentiment in various markets.

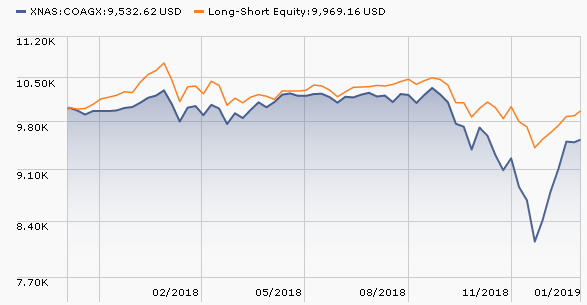

The team tracks 50 different metrics and has invested a lot to continually deepen their data analytic capabilities. One measure of their success is its nearly complete independence from the stock market: since inception, the R-squared (that is, measured correlation) with the stock market is just 0.04. They show almost identical independence from their peer group, with an R-squared of just 0.05.

Over the past three years, BDMAX has performed reasonably well. The fund makes about 2.5 – 4% per year. Because it has no correlation to its nominal peer group, it’s not much worth reporting its rankings within the group. In broad terms, it has had double-digit returns in two years but also negative returns in two years. Over the past five years it has returned about 1.5% annually, better than cash not trailing ultra-short bonds. In 2018, it was up 1.8%. The numbers since inception, which includes its great performance in 2013, are stronger (4.2% annually) but nothing to make my heart go pitter-pat. If the fund had evidence of consistent 4% returns and rare years in the red, it would be noticeably more compelling. Morningstar praises the team for continually revising and strengthening their data analytic regime, which might suggest a brighter future. We just haven’t seen it proven consistently.

The fund launched in December, 2012 .It’s drawn $640 million since then. Expenses are 1.89% and the minimum initial investment is $1,000. “A” shares carry a 5.25% sales load, though its available no-load and NTF through some brokerages.

Balter Invenomic (BIVIX) is a strictly quantitative fund. The managers stay as far as humanly  possible from the polished, sweet-tongued executives of the firms they might invest in. Instead, they generate a four page statistical profile of every stock in which they might invest. Currently, they have about 150 long and 150 short positions, which means that no one position has much potential to damage them.

possible from the polished, sweet-tongued executives of the firms they might invest in. Instead, they generate a four page statistical profile of every stock in which they might invest. Currently, they have about 150 long and 150 short positions, which means that no one position has much potential to damage them.

Invenomic’s key differentiator, from the lead manager’s perspective, is a successful short book. Manager Ali Motamed argues that most long/short managers fail on the short side. They maintain too few shorts, they put too much money into each, they maintain a large short book when market conditions don’t warrant it and they view themselves as on a crusade against the management teams. Each of those mistakes limits the power of the short portfolio to generate alpha rather than just limiting beta; that is, Mr. Motamed thinks a good short portfolio should make money rather than just hedge volatility. They target “story stocks,” firms with deteriorating fundamentals and firms artificially buoyed by one-time windfalls that investors are treating as structural advantages. Depending on market conditions, as little as 10% of the portfolio or as much as 75% of it might be in the short book.

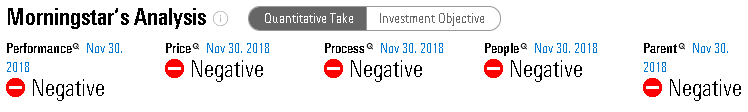

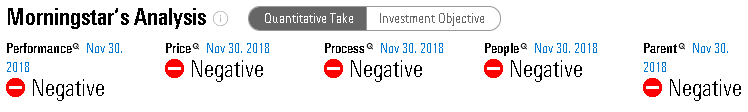

It is a fund about which Morningstar is uniformly negative.

I guess I mostly disagree. While the expenses are high, they’ve gotten a lot right. Since inception their beta (0.15) is far lower than the stock market’s, their Sharpe ratio (a measure of risk-adjusted returns) is far higher, they made solid money is 2018 (up 3.5%, 780 bps better than the market and 970 better than their peers) and a lot in January 2019 (up 6.8% in 30 days). BIVIX has higher Sharpe and Sortino ratios than any fund in the Morningstar Long-Short Equity category since inception (06/19/17) through 12/31/18. It’s an intriguing fund run by a manager with first-rate experience as one of the Boston Partners.

The fund launched in June, 2017. It’s drawn $117 million since then. Expenses are 2.93% and the minimum initial investment is $5,000.

Gotham Short Strategies (GSSFX) made a big pile of money (11.5%) in the fourth quarter of  2018 which pushed its lifetime annual rate of return to 0.5%. Morningstar categorizes it as a bear market fund, which is much more accurate than Lipper’s assignment to the long-short equity group. I’ve included it here just as a gesture of transparency: it technically passed the screens, so you deserve to know about it. The other thing to know is that it, like all of its black-box siblings at Gotham, requires a minimum initial investment of $250,000.

2018 which pushed its lifetime annual rate of return to 0.5%. Morningstar categorizes it as a bear market fund, which is much more accurate than Lipper’s assignment to the long-short equity group. I’ve included it here just as a gesture of transparency: it technically passed the screens, so you deserve to know about it. The other thing to know is that it, like all of its black-box siblings at Gotham, requires a minimum initial investment of $250,000.

Bottom line: both Nuance Concentrated Value Long-Short and Balter Invenomics warrant serious attention from investors looking to buffer part of their portfolio from the storm. They’re very different funds and both expensive by traditional standards, but both offer the prospect of dealing both with volatile markets and those which are hostile to traditional 60/40 balanced funds.

Nota bene: three of the four long-short funds we’ve profiled over the years – LS Opportunity, AMG RiverRoad Long-Short and Bridgeway Managed Volatility – passed our short-term / long-term screen and each ended up in Tier Three. All of them warrant close attention and we’ve linked, in the tables above, to our profiles of them. LS Opportunity, which has returned about 5.5% annually since launch might command the most attention. The only fund not passing the screen – RiverPark Long/Short Opportunity (RLSFX) – is a more aggressive fund that uses its short book as an offensive weapon rather than a defensive shield. As such, it’s not terribly surprising that it faltered in Q4 (down 12.5%). That said, it has top tier returns over the past quarter, year, three years and five years.

You can measure the jumble by looking at the correlations between the funds. If all long/short funds were doing roughly comparable things, you’d see consistently high correlations between members of the group. Instead, if you look at all long-short funds with at least a billion in assets, correlations range from negative 14 to positive 89. Twenty-three of 28 correlations are below 80, 14 of 28 are below 50. Similarly, if we look at the 10 funds with the highest annual returns over the past five years, the range is 42-87. Heck, a bunch of these funds have near-perfect correlations with the S&P 500 while others capture more than 100% of the S&P 500’s downside.

You can measure the jumble by looking at the correlations between the funds. If all long/short funds were doing roughly comparable things, you’d see consistently high correlations between members of the group. Instead, if you look at all long-short funds with at least a billion in assets, correlations range from negative 14 to positive 89. Twenty-three of 28 correlations are below 80, 14 of 28 are below 50. Similarly, if we look at the 10 funds with the highest annual returns over the past five years, the range is 42-87. Heck, a bunch of these funds have near-perfect correlations with the S&P 500 while others capture more than 100% of the S&P 500’s downside. companies that it deems to be industry leaders with strong and stable competitive positions. It then shorts the stock of up to 50 large companies with “more commoditized or structurally challenged competitive positions.” Up to 25% of the portfolio might be invested overseas.

companies that it deems to be industry leaders with strong and stable competitive positions. It then shorts the stock of up to 50 large companies with “more commoditized or structurally challenged competitive positions.” Up to 25% of the portfolio might be invested overseas. it is a fund-of-funds that attempts to hold funds which are “in sync with current market leadership.” Then separately, the manager may deploy a number of options to buffer its stock market exposure: “raising cash, selling covered call or put options and/or buying put options or put spreads or call options or call spreads.”

it is a fund-of-funds that attempts to hold funds which are “in sync with current market leadership.” Then separately, the manager may deploy a number of options to buffer its stock market exposure: “raising cash, selling covered call or put options and/or buying put options or put spreads or call options or call spreads.” possible from the polished, sweet-tongued executives of the firms they might invest in. Instead, they generate a four page statistical profile of every stock in which they might invest. Currently, they have about 150 long and 150 short positions, which means that no one position has much potential to damage them.

possible from the polished, sweet-tongued executives of the firms they might invest in. Instead, they generate a four page statistical profile of every stock in which they might invest. Currently, they have about 150 long and 150 short positions, which means that no one position has much potential to damage them.

2018 which pushed its lifetime annual rate of return to 0.5%. Morningstar categorizes it as a bear market fund, which is much more accurate than Lipper’s assignment to the long-short equity group. I’ve included it here just as a gesture of transparency: it technically passed the screens, so you deserve to know about it. The other thing to know is that it, like all of its black-box siblings at Gotham, requires a minimum initial investment of $250,000.

2018 which pushed its lifetime annual rate of return to 0.5%. Morningstar categorizes it as a bear market fund, which is much more accurate than Lipper’s assignment to the long-short equity group. I’ve included it here just as a gesture of transparency: it technically passed the screens, so you deserve to know about it. The other thing to know is that it, like all of its black-box siblings at Gotham, requires a minimum initial investment of $250,000.

Broadcast business media have discovered a gold mine of advertising resulting from scaring people on a daily basis. I suggest a simple solution:

Broadcast business media have discovered a gold mine of advertising resulting from scaring people on a daily basis. I suggest a simple solution:

Rondure Global Advisors

Rondure Global Advisors