William Blair Emerging Markets Small Cap Growth (WESNX) is a purely outstanding offering. You might or might not be able to buy it.

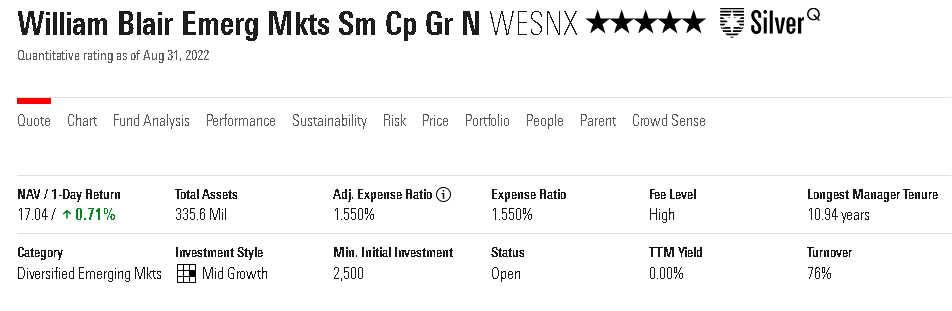

You might: Morningstar and Lipper both report that the fund is open to new investors.

The fund’s AUM has fallen but by a relatively small amount. The latest William Blair report on four- and five-star funds says that closed funds are flagged with an asterisk (*). WESNX is not flagged.

You might not: Both TD Ameritrade and Schwab have the fund available “for current investors only.” Re-opening the fund would be a “material change” and would have to be posted to the SEC; it has not been.

William Blair representatives, unhelpfully, have not responded to my request for clarification. The fund’s homepage is mute on the subject.

If you can, you should.

The EM team, led by Todd McClone, who spoke at length with Devesh Shah for his “Emerging Markets Investing for the Next Decade” (9/2022) essay, focuses exclusively on high-quality growth companies. They aim for “well-managed companies with superior business fundamentals,” which might include both IPOs and private placements. Their 25-person team covers a 1000-company universe, with EM companies comprising almost 50% of William Blair’s global high-quality growth universe. As Devesh noted, US investors might have systematically under judged the emerging strength of management teams in emerging market firms. Blair’s assessment – that 50% of all high-quality growth teams globally are in the EMs – supports that suspicion.

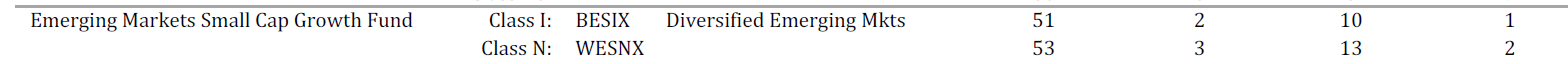

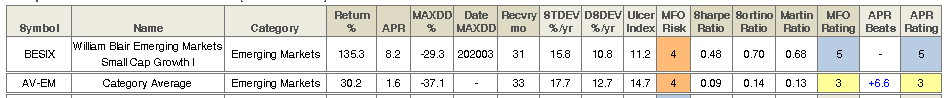

The discipline has performed brilliantly over the long term and well in the short term. The fund has earned a five-star rating for the past three- and ten-year overalls, as well as an overall five-star rating. (Its five-year rating is four stars.) Morningstar places its returns in the top 1% over the past decade.

Since its inception, it has outperformed the average EM fund by a margin of 5:1 with higher returns, lower standard deviation, and better risk-adjusted returns.

The fund underperformed in the second quarter of 2022, which the managers attribute to the broad flight from risk.

Underperformance during the quarter versus MSCI Emerging Markets Small Cap (net) was largely due to style headwinds amid strong outperformance of low-valuation stocks. The underperformance is highly correlated to the inflationary pressures and increase in interest rates, which has led to significant multiple contractions for growth companies in particular. Quality companies, which typically offer downside protection, didn’t help offset the underperformance amid the largely indiscriminate sell-off of high-growth, high-P/E stocks.

They argue that even if the move to value investing in the emerging markets persists, their portfolio might benefit because the valuations on their portfolio of high-quality names got compressed just as much as low-quality stocks did, which gives them the potential for a significant rebound when markets normalize.

Bottom line: we don’t know yet whether Blair has reopened, or will reopen, the fund. It’s not a pure small cap fund by Morningstar’s standards, but its average holding is dramatically smaller and dramatically higher quality than its average peer. For long-term investors interested in a growth style, there would be few better prospects.

We will follow up on your behalf.

William Blair Emerging Markets Small Cap Growth. Blair also shared a really useful process overview.