Dear friends,

Welcome to the darkest and brightest season of the year. Each year we share the reminder of a long and resolute human impulse: to stare into the gathering gloom, frozen fields, and biting winds and to declare, “we will not surrender to the darkness, within or without. Light the fires, summon the family, call our friends and set the table. Tonight, we rejoice together.”

The midwinter holidays ahead – not just Christmas but Saturnalia, Yul, St. Lucia’s Day, Dong Zhi, Yalda Night and a dozen other celebrations rooted in other cultures and other traditions – are, at the base, expressions of gratitude. They occur in the darkest, coldest, most threatening time of year. They occur at the moment when we most need others, and they most need us. No one thrives when they’re alone and each day brings 14 to 18 hours of darkness. And so we’ve chosen, from time immemorial, to open our hearts and our homes, our arms and our pantries, to friends and strangers alike.

Don’t talk yourself out of that impulse. Don’t worry about whether your gift is glittery (if people actually care about that, you’re sharing gifts with the wrong people) or your meal is perfect (I love Stouffer’s frozen mac and cheese, by the way). Take advice from Scrooged. Tell someone they make you smile, hug them if you dare, smile and go.

Oh, by the way, you make me smile. I’m endlessly humbled (and pleased) at the realization that you’re dropping by to see what we’ve been thinking. Thanks for that!

Managing this market, preparing for the next

In the month of November, Vanguard Total Stock Market Index (VTSMX) soared 8.3% and the guys whose livelihood depends on your willingness to invest ever larger amounts in the stock market have begun celebrating “a market bottom” and imaging a sharp rebound in 2023.

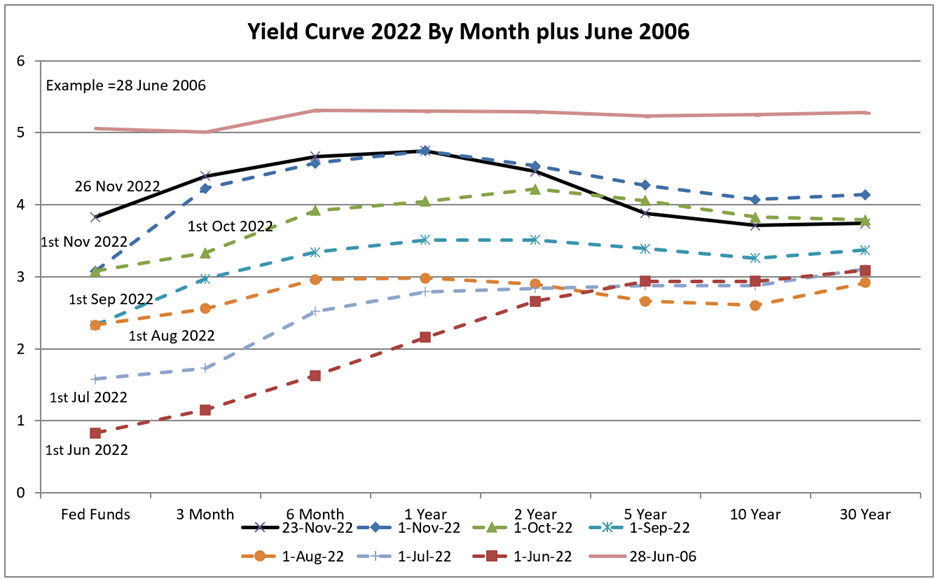

They might be right. We wouldn’t bet on it. Valuations remain historically high, and the recent bounce hasn’t helped matters. It is not clear – especially in light of November’s strong jobs report – that the Federal Reserve is ready to relent on its interest rate raising cycle. While there once was a “soft landing” at the end of a Fed tightening cycle, that happy outcome has occurred only once. Consumers are spending record amounts but mostly by drawing down savings and accumulating debt. Investors have lost a cumulative $22 trillion in 2022 (with the sole bright spot being that Elon Musk has personally lost over $100 billion).

Too, there is that issue of the party which assumes control of the House of Representatives in January. The St. Louis Post Dispatch (11/27/2022), likening them to toddlers, warns:

Anyone who might be offended by the comparison between unruly toddlers and a GOP House majority should consider the words of Rep. Jason Smith, R-Missouri, who is in line for a major budget post under the incoming GOP House majority: “The American people expect Congress to use every tool at its disposal” to press the Biden administration on issues like taxes, energy policy and the border, Smith said recently, “and the debt ceiling absolutely is one of those tools.”

Translation: Holding America’s full faith and credit hostage to an array of partisan issues — as Republicans did a decade ago, kneecapping the government’s credit rating for the first time ever — is something Smith and his cohorts are vowing to do again.

In 2011, the Republic-led refusal to raise the debt ceiling triggered the Black Monday sell-off where a trillion dollars in market value was lost in a single day.

In our 2022 year-end issue, we’ll develop four themes for you to consider. Our preview for them:

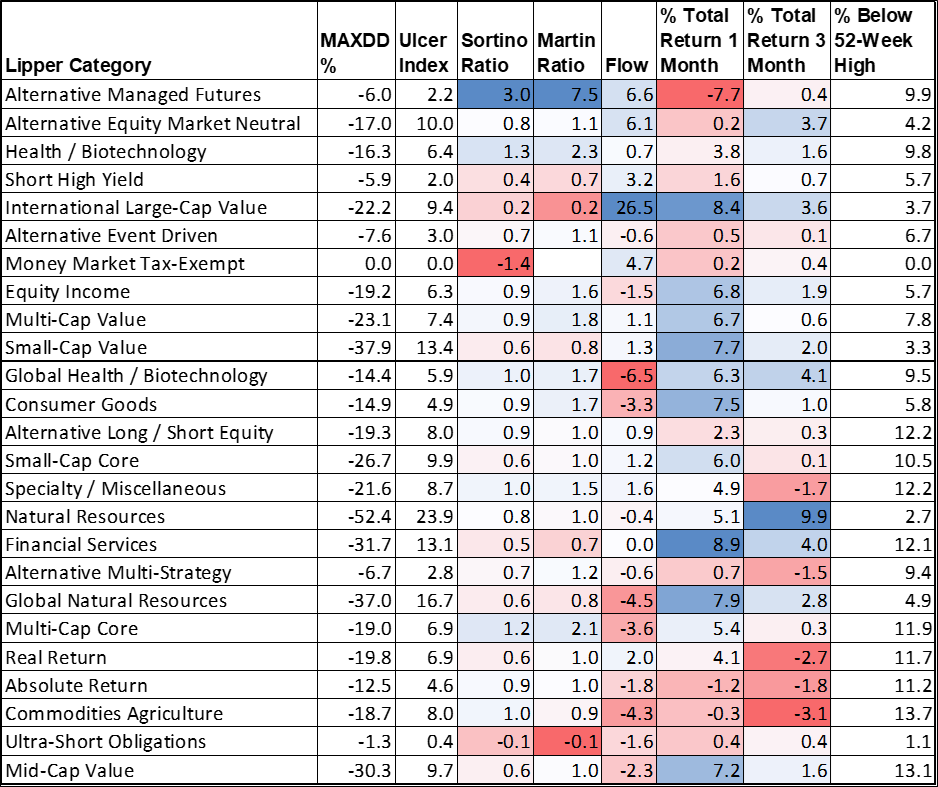

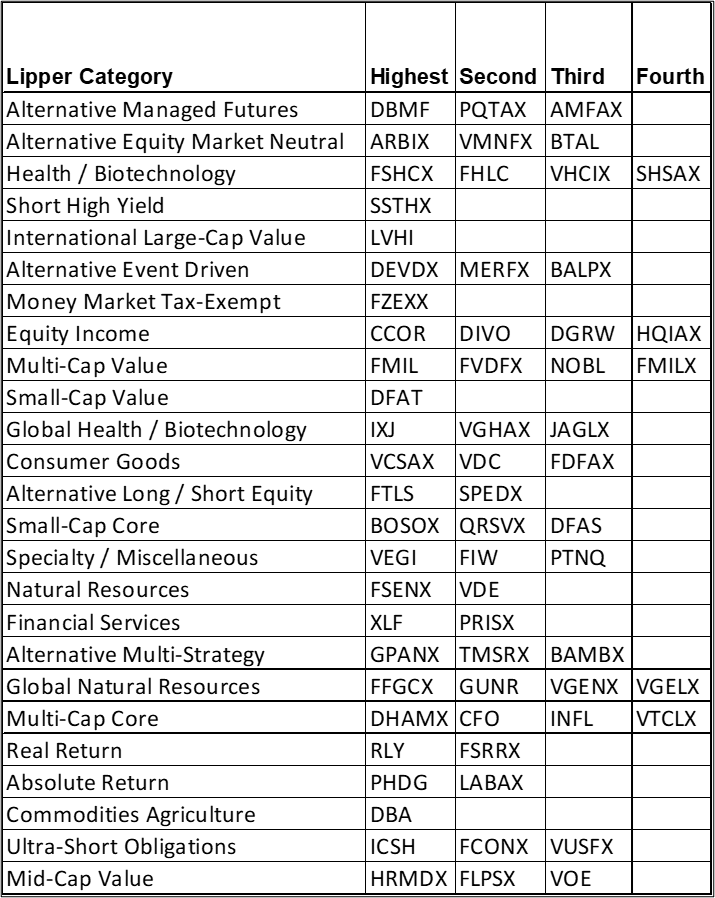

- Respect managers who have cash available to deploy: we’ve earlier described them as “the dry powder gang” and talk about them just below.

- Respect the ability of short and ultra-short fixed income investments to adapt quickly to rising interest rates.

- Favor high-quality over high momentum, stable growth over aggressive growth, and dividends over buybacks since all of those characteristics hold up better in markets where investors have grown fearful.

- Identify opportunities in small caps (especially small cap value) and emerging markets (especially emerging markets value) because those are widely regarded as the last pockets of reasonable risk-return balances on the planet.

We’ll share the receipts and name names. For now, the key is remembering that you can manage the current turmoil without hiding under a rock and missing out on the long-term gains still available to you.

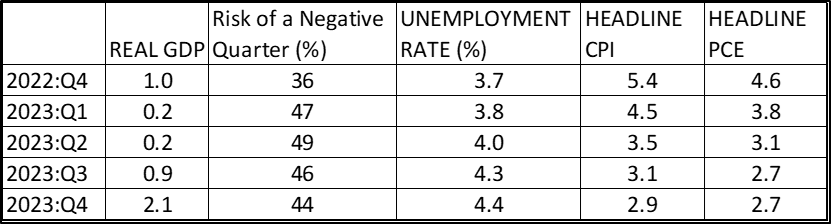

In this month’s issue, Lynn Bolin lays out the prospects of a 2023 recession and the tools for managing through it, Devesh Shah reflects on what to do if you can’t find the magical Manager G and on what you have to celebrate, while the Shadow lays out a record of the industry’s most significant changes in the past month. I profile Towpath Focus, a fund that’s off your radar but – perhaps – should be at the center of it and another newbie that you can, well, probably do without.

Checking in on The Dry Powder Gang

In 2017, we urged you to consider The Dry Powder Gang. These are experienced equity managers who embrace an absolute return mindset. That is, they recognize that stocks make money in the long term but can inflict absolute misery in the short term. As a result, they are managers willing to dial back their equity exposure when equity valuations become irrational, and the risk-return calculus turns sharply negative.

We described them this way:

They are, in a real sense, the individual investor’s best friends. They’re the people who are willing to obsess over stocks when you’d rather obsess over the NFL draft or the Cubs’ resurgence. And they’re willing, on your behalf, to walk away from the party, to turn away from the cliff, to say “no” and go. They are the professionals who might reasonably claim, “we got your back!”

In a world where interest rates fell steadily to, then below, zero and stocks had only two settings – high and higher – they were loathed by individuals and institutions. Some liquidated, most saw substantial outflows and many barely held on. Most offered reasonable absolute returns during the “no one is as smart of Cathie Woods” phase of the market, though their relative returns were often atrocious as otherwise rational managers started sneaking Bitcoin into their portfolios just to remain competitive.

If you think that the future is apt to be less driven by across-the-board market gains and more marked by periodic dislocations, you should consider whether it’s time to look more closely at absolute return and absolute value investors.

The Dry Powder Roster

| Style | Rating | 2022 peer rank | |

| Cook & Bynum COBYX | Global large-cap core | Five star | Top 1% |

| Hennessy Total Return HDOGX | Large-cap value, Dogs of the Dow | Three star | 2 |

| Pinnacle Value PVFIX | Small-cap core | Two star | 3 |

| Frank Value FRNKX | Mid-cap core | Three star | 4 |

| Palm Valley Capital, functionally an extension of Intrepid Endurance | Small-cap value | Five star, Great Owl | 8 |

| FMI Common Stock FMIMX | Small-cap core | Four star | 10 |

| Intrepid Small Cap, formerly Endurance ICMAX | Small-cap value | Two star | 14 |

| FPA Crescent FPACX | Flexible | Four star | 16 |

| Bruce BRUFX | Flexible | Five star | 18 |

| Castle Focus MOATX | Global multi-cap core | Two star | 26 |

| Shelton Equity Income, formerly Core Value EQTIX | Equity income | Four star | 50 |

| Weitz Partners III Opportunity WPOIX | Multi-cap growth | Three star | 92 |

| Centaur Total Return TILDX | Equity-income | Liquidated | |

| Intrepid Disciplined Value ICMCX | Mid-cap value | Liquidated | |

| Bread & Butter BABFX | Multi-cap value | Liquidated |

Full disclosure: Snowball owns shares of FPA Crescent and Palm Valley Capital; he had previously owned Intrepid Small Cap but moved that investment to Palm Valley when Intrepid’s managers launched the new firm.

Thanks, as ever …

New Year’s blessings to our indispensable regulars, from the good folks at S&F Investment Advisor in lovely Encino to Wilson, Gregory, William, the other William, Brian, David, and Doug.

Many thanks to Bruce & Silina (we’re so glad to hear that we’re making a difference for you, thanks!), Jonathan, Binod, Philip, Jeroen, John H, and Debbi Burnett in memory of our departed friend and the love of her life on the one-year anniversary of his passing. (Quick note: pick up the phone and call your friend. You know the one, the one you’ve been venting to and laughing with for years but never quite get around to calling much anymore. You won’t realize how much those calls mean until you can’t place them anyone.)

If you’re so disposed, please do consider contributing to MFO. Of our 18,000 readers, about 1% chip in. Making it 1% plus 1 would be a gain! It’s tax deductible, it lets us keep the lights on, and raises the prospect that we might be able to share a year-end gift with the folks who – without compensation – make this all possible.

Thanks!

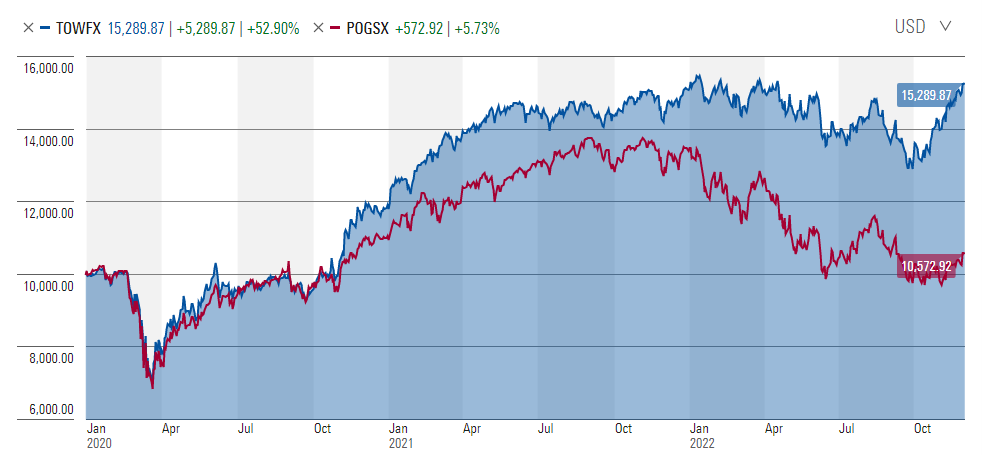

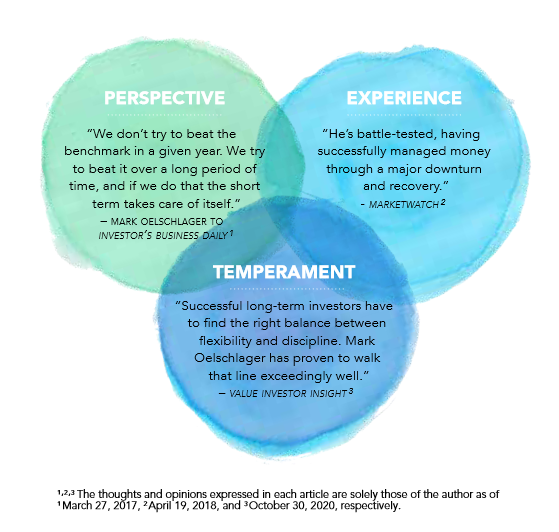

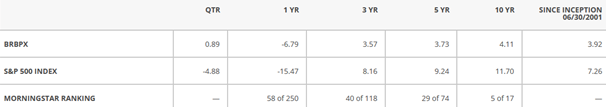

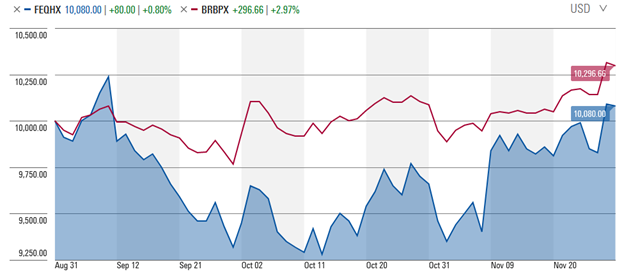

On December 31, 2019, Oelschlager Investments launched the Towpath Focus Fund (TOWFX). The fund invests in 25-40 domestic stocks regardless of market capitalization. The fund is managed by Mark Oelschlager.

On December 31, 2019, Oelschlager Investments launched the Towpath Focus Fund (TOWFX). The fund invests in 25-40 domestic stocks regardless of market capitalization. The fund is managed by Mark Oelschlager. Sometimes, people matter

Sometimes, people matter